SPPP trade ideas

SPPP bottoming for multi year retrace

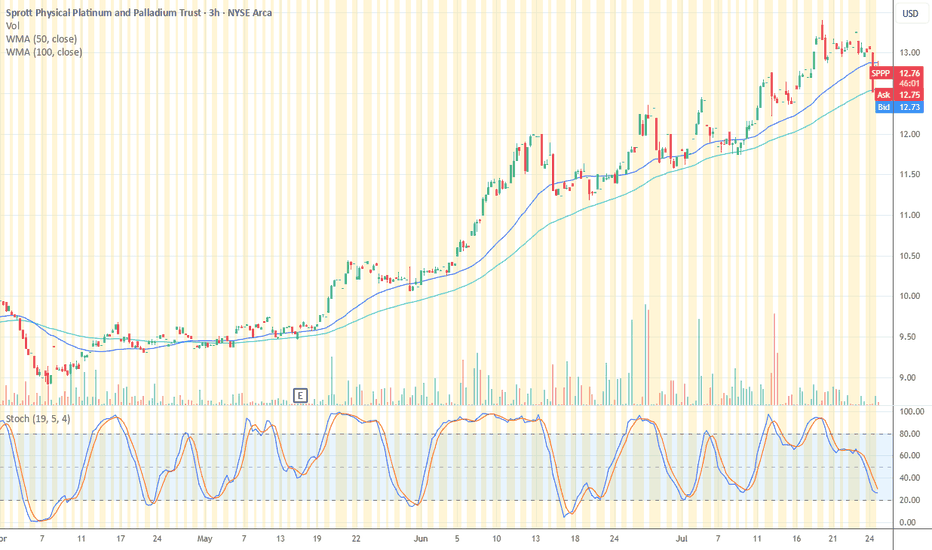

Several fundamental drivers backing the physical market of platinum and palladium such as institutional positioning, supply constraints, new deposit discoveries declining and misunderstood demand drivers across industrial market. Technicala offer a fairly simple setup based on a multi-year trendline starting from 2016 and a fib retrace to pull the price inline with established trend offering an initial target in coming years between 14 and 16. Additionally we can observe the RSI over the monthly chart turning up above the previous pre2020 lows.

Platinum having a new bull run?I have been buying SPPP for several years now and have been cost averaging down. Platinum has been in a down trend for years. Finally, it looks like Platinum has bottomed and is in a new uptrend. SPPP has broken a long time downtrend line, popped above it and is now retesting. With gold, silver, copper popping higher and higher, it is only a matter of time till Platinum catches a bid. I bought another bunch of shares looking for a continuation of the uptrend. If it fails, we might retest the bottom trendline in the wedge pattern.

Platinum Thesis is quite strong:

-Due to EV and Energy savings, more money is starting to move into commodities

-Many commodities are starting to outperform the broad market

-ICE Vehicles are not going away anytime soon, where Platinum and Palladium are used.

-As Hybrid vehicles are being more widely adopted, they use 3x the Platinum as ICE vehicles

-Platinum is 30x more rare than Gold.

-The miners that produce the metal are mostly in unstable jurisdictions.

-Demand for the metal is up, but we are currently in a deficit and material is difficult to get.

-As deficit increases, price should eventually rise to meet demand

-There are no real replacement for Platinum and Palladium.

SPPP-SPROTT PHYSICAL PALLADIUM AND PLATINUM PROFITSI made good profits with this in a short time swing trading this etf. I loved it. Why mess with bitcoin crypto or even gold when I can make money with this.. Anyway. Now its in a bear trend and looking to get back into this etf if it shows some promise. As you know the prices for Palladium and Platinum have skyrockted and have done even better than gold . Catalytic convertors are being stolen from cars at record numbers everywhere thorugh out the nation. Watch this video for details. Give me a thumbs up and feel free to subscribe to show support for my TA videos.

Disclaimer

I’m not a certified financial planner/advisor, a certified financial analyst, an economist, a CPA, an accountant, or a lawyer. I’m not a finance professional through formal education. The contents on this TA,(Technical Analysis) are for informational and educational purposes only and do not constitute financial, investment, trading, accounting, or legal advice. I can’t promise that the information shared on my posts is appropriate for you or anyone else. By using or reading this technical analysis or site, you agree to hold me harmless from any ramifications, financial or otherwise, that occur to you as a result of acting on information found on this analysis, or post.

SPPP boom on the horizon? Here's a potential catalyst...Thesis: Russia/Ukraine tensions threaten to disrupt the global supply of Palladium- a precious metal used to produce semiconductor chips. Small chip producers, particularly in smaller countries like Taiwan, companies may not be able to get their hands on enough supply. Palladium prices may increase if that happens....Plus, from a TA perspective...check out the perfect inverse head-and-shoulders. This looks like a strong buy, and I'm hunting for a few more diversified bets to (hopefully) seize this opportunity.

May the profits be with us all.

Palladium, It's Going to Be Fine...AMEX:SPPP gave me a scare this week when the stock plummetted, but it seems it will likely make a full recovery and continue its bull run, at least in the short term.

The price of palladium and platinum are based on two things: supply & demand. However, it is more complicated than that. There is also market speculation on supply and demand which is often seen as directly linked to overall market performance. Overall market performance seems to dictate the swings of AMEX:SPPP so much so that the price of palladium has not caught up to the demand. It's almost like a lagging indicator - like the price is stubborn to move despite the demand.

The result is that there are periods of recovery despite market movement. This is where we are now. Despite the SP:SPX and NASDAQ:IXIC having trouble today, palladium and platinum have regained their momentum, as investors saw this downswing as a time to buy, knowing the price was not matching supply/demand.

Historically, AMEX:SPPP appears to favor the 89 EMA on the 30min candles for support in a downtrend and resistance in an uptrend, with the price frequently bouncing off this line. Similarly, spikes that surpass 80 on the RSI-21 have shattered that line of resistance on the main chart with a slow and angry tumble. This has not happened, and therefore, is new territory where the outlook is still strong.

Palladium prices went up 0.85% today, while platinum was down.

I suspect there will be a 50% recovery (seems to be typical for these types of dramatic short swings before a consolidation pattern and upswing) from the latest drop by the end of the week, end of tomorrow if we are lucky. That puts it around an $11.75 price target to sell high.