Our opinion on the current state of APHAlphamin (APH) is a tin mining and exploration company operating out of Mauritius. Its primary asset is just over 80% of Alphamin Bisie Mining which has a tin mine in the DRC. The company claims that it is the best tin ore body in the world. In a report for the year to 31st December 2022 the company reported record tin production up 14% on the previous year with earnings before interest taxation depreciation and amortisation (EBITDA) of $222m with an average tine price of $30363 per ton. In the 4th quarter the average price dropped to $21436 which still gave a 41% EBITDA margin. The company said, "Mpama South project development advancing well, targeting commissioning by December 2023. Exploration activities yielded significant new resources at Mpama South and Mpama North." In an update on the 4th quarter to 31st December 2023 the company reported tin production up 1% and the average tin price down 5%. The company said, "Q4 tin sales of 2,046 tonnes impacted by poor road conditions, which have subsequently improved." This is clearly a highly risky and volatile commodity share - not only because of the volatility of the tin price, but also because of the location of the mine in the DRC. The company has about R64 000 worth of shares changing hands on average day on the JSE which shows that it has not yet attracted institutional interest, but it is viable for a small investment by private investors. The dividend yield (DY) of over 5% is attractive.

AFM trade ideas

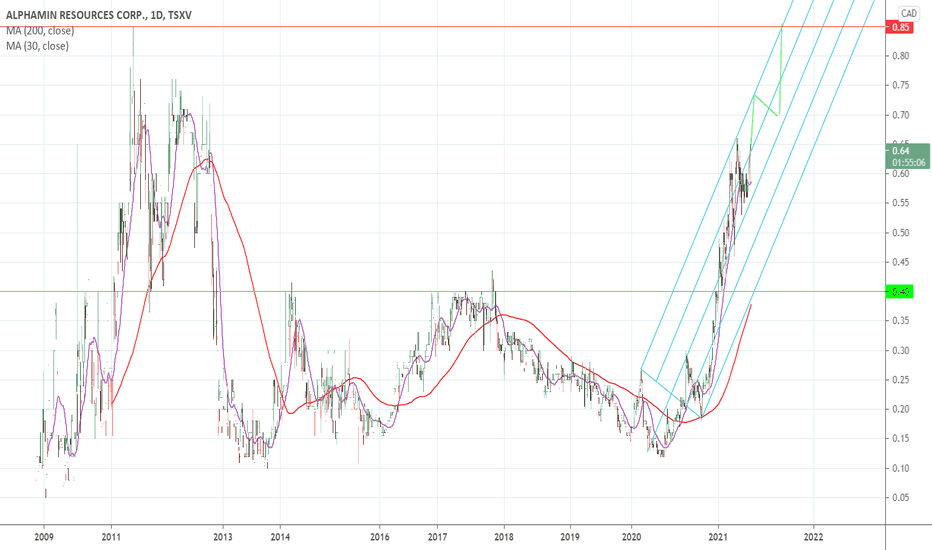

Alphamin Resources C&H and waiting for a brim break to R18.78 Cup and Handle is forming with Alphamin Resources.

We need the price to break above the Brim level before we action this.

21> 7 Price >200 - Mixed

RSI>50 - Bull divergence

Target R18.78

CONCERNS:

Price action shows an unhealthy chart - Volatile candles.

Sideways consolidation for extended periods of time

Low liquidity (Volume).

Not what I use to trade but I guess for investment purposes it is a good stock to have in a portfolio.

Alphamin: China risk on tradeLower volume than when it made its run (peeking out sometime when tin reached 50k

Cup & Handle maybe forming

50ma crossed the 200 day

tin price gone from 17k-(in the november to 32k as of today) with talk of china re-opening! One of the most profitable mines on earth

youtu.be

When will someone take it out? Hopefully not before it as reached its true potential

Congo DRC