GOLDSILVER trade ideas

Gold/Silver Ratio to 72 Minimum - Imminent Silver BreakoutGoldSilver Ratio is following a clear pattern of behavior. We can expect a return to mean conservatively hitting 72 at a minimum. This puts silver at $46-58 if Gold doesn't move higher. I think we will see silver 5-10X over the next few years. Easy 25-50% in the short term (6-12 months).

GSR Update July 8th 2025I am expecting the GSR to return to the medium doted line in the near future with the divergence of the short term FIB time zone 3 coinciding with the long term FIB time zone 3. This will bring the silver chart at the bottom up closer to the medium dotted line. Fingers Crossed!

GOLD/SIlver Ratio Signals Risk On Gold/Silver ratio represents the appetite for risk

Stronger gold means risk off and vice versa

In spring, the ratio had hit the target for leg 2 (blue) within

large consolidation that took over 4 years to emerge

It travelled the equal distance of leg 1 (blue) and then reversed.

The next step might be the continuation to the downside for the ratio.

The minimum target is to hit the bottom of red leg 1 at 63.

The next target is located at the distance of the red leg 1 subtracted from the peak of blue leg 2. It was set at 43.

Both downside targets are within historical range.

Gold/Copper ratio shows same dynamics of "Risk-On" attitude on the market.

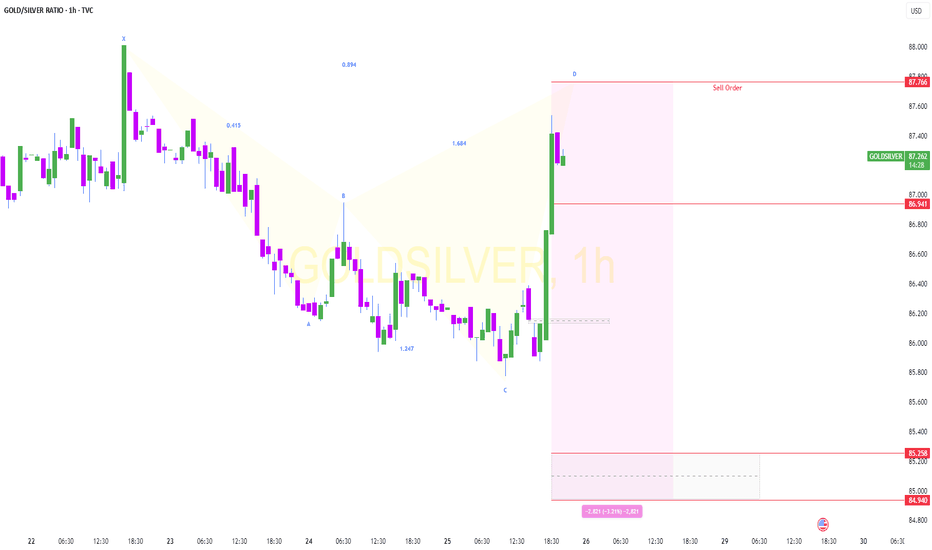

3-Year Range Broken — Gold/Silver Ratio Retesting Critical ZoneContext:

For more than three years, the Gold/Silver ratio traded within a predictable range between approximately 79 and 92. This provided consistent opportunities to rotate between metals: buying Gold when the ratio approached the bottom of the range, and favoring Silver when Gold became relatively expensive near the top.

Breakout and Failure:

In March 2025, the ratio broke out sharply above the 92 ceiling, reaching above 105 for the first time in years. This breakout was driven by macro uncertainty and a surge in demand for Gold as a safe haven. However, the move quickly lost momentum. As risk appetite returned and macro concerns faded, the ratio dropped aggressively, falling back below the former breakout zone.

Current Setup:

Price is now testing the 90–92 region — the same area that acted as resistance for years. This zone is now functioning as key structural support. Its behavior here could determine the next major leg.

Trading Outlook:

If the ratio holds above 90, Gold may continue to outperform Silver, possibly establishing a new higher range between 90 and 105. However, a decisive break below 90 would indicate a failed breakout and may favor Silver strength, with downside potential back toward the 80–85 area.

Conclusion:

This is a technically critical zone. A confirmed hold or breakdown from here could define the next multi-week trend in the precious metals space.

Gold Silver trade updateHello,

So, the case remains unchanged; buy silver when the gold to silver ratio is above 80:1. But, now silver is out-performing gold significantly and the ratio is strongly trending towards a lower gold to silver ratio.

If the previous steep drop is extended from the recent high, then it could imply a G:S ratio of around 45:1, which is;

- right in my buy-zone (that would be a dream come true),

- looking more and more likely.

Luckily, I made a significant silver purchase in late May. I was going to buy gold, but with a gold to silver ratio at around 102:1 then, I just couldn't do it. I had to buy silver instead. I have physical silver ETFs and silver miners.

Actually, HYMC Hycroft Gold also did really well last night +14% (I was watching it spike up at market open). I have a position in HYMC. Because;

- It has almost 20Moz in gold equivalent ounces,

- Seems likely to start mining shortly (6 months or a year maybe commencing heap-leach operations while they seek finance for a processing plant),

- They are extremely under-valued. When I bought in I was only paying $4.40 per gold equivalent ounce,

- They have debt issued, but the bulk falls due 1st Dec 2027 - so there is a bit of time to seek additional funding or re-financing,

- It is in a reliable mining-friendly jurisdiction - Nevada,

- They had some ridiculous drill results recently... over 80,000g/ton Ag (yes only 0.2m of that but still) plus other strikes at 20,000, 15,000, and 10,000g/t Ag.

- The large component of silver was a positive for me, because silver is leverage on gold. I want more silver so I can buy more gold in the future.

For me HYMC was a clear "buy" despite discussing it with someone at Sprott, and they weren't positive about it. I hope it doesn't go up too much, because I see HYMC in the tens of dollars in a couple of years time, not in the single digits.

Dive into the Wild Waves of Gold and Silver!treasure hunters! Ever feel like the gold and silver markets are like surfing big waves?

The fluctuations in precious metal prices are often likened to the contrasting behaviors of wild crabs; gold prices soar upward, akin to a crab climbing, while silver prices plunge into the depths, reminiscent of a crab diving beneath the waves.

Such dynamics illustrate the volatility and unpredictable nature of the commodities market, where various factors can influence the trajectory of these valuable resources.

Understanding these movements is essential for investors aiming to navigate the complexities of financial markets effectively.

This is the Gold Silver Ratio, FIB Time ZonesThis is my comparison tracking the divergence in the gold and silver prices since 2006 prior to the Global Financial Crisis.

I noticed that both prices in USD and tracking in the same upward channel. I have inserted two FIB time zones that seem to be playing out with a move about to play out here on the 20th April 2025.

Important breakdown in the Gold & Silver ratio !!!This is a heads up that concerns the PM sector as well as all other assets.

An important breakdown just happened in the Gold & Silver ratio. This means precious metals bull resumes and SILVER will now overperform gold !! We are now in back test mode !

For the other asset classses this is good news also, because this breakdown in the ratio signifies the return of (asset) inflation. So this is good for stocks and crypto also.

It remains to be seen whether PM's will outperform stocks. My guess is YES.

Silver still under-valued vs GOLDBased on history, The relative value of gold and silver reverts between the 40:1 ratio and 80:1. Silver is still above 80:1, so IMO is a good buying opportunity, to leverage against gold.

The idea is; hold gold and buy silver above 80:1 ratio and sell silver and buy gold at or below 40:1 ratio. After a cycle, you will end up having twice as much gold as if you just bought gold outright.

If you think that silver cannot make major and quick advances relative to gold... look at 2020. We are just in a holding pattern, if you want confirmation, look for the 80:1 ratio level - that is currently acting as support to give way and for silver (smaller less liquid market) to make quick progress.

G&S ratio rising could be bearish on metals medium termThe G&S ratio is back above resistance (now support) and wants to break out of the bullish wedge in dark rose color.

If that happens, an inverse H&S formation could play out and shoot us up (blue line) to the extension of the rising resistance of the (yellow) bearish rising wedge. This would mean a last hurray spike of the ratio, to touch the apex a last time before falling again.

The final fall of the G&S ratio would then signal the risumption of the bull market and the further collapse in the G&S ratio would signifie a raging bull market for precious metale (both silver and gold - but especially silver).

The bull market in metals is unavoidable with the current macro sitauation. However its resumption could be delaid if this set up plays out.

Metals bull run has legs - Silver is gaining momentum!The gold-to-silver ratio is a key signal—a roadmap, if you will—showing us where we are in the cycle of precious metals. Gold typically takes the lead, but then, like clockwork, silver catches up, and fast. In recent months, we’re seeing that exact shift—silver is gaining momentum.

We’re entering a phase where silver is primed to outperform over the next several months. The first conservative target? $44.3. But here’s the thing—if BRICS nations decide to step in, if they start stacking silver too, I believe we could be looking at a price much, much higher by the time this move plays out. Buckle up—this could be big.

GOLD is going to start getting much cheaper in SILVER terms.Gold has been on an absolute tear lately as the de facto U.S. corporate government has been printing and spending FRNs (Federal Reserve Notes) into oblivion. As a result, real money is gaining value against the Federal Reserve's monopoly money. Naturally, those who saw the money devaluation coming have been buying gold to preserve their purchasing power, but silver has been lagging behind, even though it has also been appreciating. Although the price of precious metals is, and will continue to be, on the rise, the price of gold is about to get much cheaper in terms of silver. Instead of buying gold, I believe the best move right now is to buy silver, hold it, and once the exchange rate drops to the 35/45 to 1 area, then exchange your silver for gold.

I believe that in the next year to a year and a half, we will see the price of gold cut in half in silver terms, which means it will take half the silver to buy the same amount of gold, effectively doubling the purchasing power of silver versus gold.

Good luck!

What does gold-silver ratio tell us about precious metals?The gold-silver ratio has reached a key area of resistance between 80.30 to 80. 55 area and has reacted. This comes on the back of a major breakdown below a multi-year bullish trend line back in early May. So far, the ratio has held resistance here, which suggests that silver might be able to outperform gold again. However, it could also mean that both precious metals may be in a correction phase, with gold falling faster than silver

But given the bullish price action we have seen so far this year, I'm leaning more towards the bullish argument for precious metals than bearish. For that reason, the breakdown in the gold-silver ratio makes me remain bullish on silver.

Meanwhile, the grey metal itself has been testing a major area of support around $28.00 to $29.00 in the last few weeks. So far there have not been any major bullish breakthrough with the metal holding inside what appears to be a bull flag pattern or bearish channel.

By Fawad Razaqzada, market analyst at FOREX.com

Why longer term charts are importantI took a look at the weekly gold/silver ratio and noticed a few significant patterns. For example, there was a notable acceleration downward following the break of a 3-year uptrend a couple of weeks ago. Additionally, there is support at the 74.65/63 level, which has been in place since January 2022.

This observation reminded me of the importance of examining long-term charts, regardless of your trading time frame. Longer-term charts provide essential context and clarity that short-term charts often lack.

Why everyone should be looking at longer term charts:

1. Identifying Trends

Long-term charts help in identifying significant trends that might not be visible in short-term data.

2. Smoothing Out Volatility

Short-term data is often noisy, with frequent fluctuations that can obscure the underlying pattern. Long-term charts smooth out this volatility, providing a clearer picture of the fundamental movement and reducing the influence of random, short-term events.

3. Contextualizing Current Movements

Long-term charts place current price or economic movements in a broader context. This helps investors and analysts understand whether a recent change is part of a larger trend or not.

4. Historical Comparisons

These charts allow for comparisons with past periods, making it possible to identify cycles, recurring patterns, and historical precedents. This historical perspective can be invaluable for forecasting future movements and making informed predictions.

5. Assessing Risk and Reward

By examining long-term performance, investors can better assess the potential risks and rewards of an investment. Understanding how an asset has performed over various market cycles helps in evaluating its stability and growth potential.

6. Avoiding Emotional Bias

Short-term market movements can evoke strong emotional responses, leading to impulsive decisions. Long-term charts provide a more detached view, helping investors stay focused on long-term objectives and avoid reacting to short-term market noise.

Conclusion

In summary, long-term charts offer a comprehensive view that is critical for understanding trends, reducing noise, contextualizing current events, making historical comparisons, assessing risk, avoiding emotional decisions, developing strategies, and analysing economic cycles. They are an indispensable tool for anyone involved in financial markets or economic analysis, providing the clarity and perspective necessary for informed decision-making.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

Gold SIlver ration 51724Huge event as GSR finally capitulates. It has broken down and targeting the floor of 30 oz silver to 1 oz gold.

Ive told ppl I was accumulating all major crashes in silver since it dumped into the teens in the RONA crash. I was laughed at. But just like Bitcoin it was a game of patience.

Long term will we see Silver return to its historical average of around 10 to 1? No one knows but imo Silver has been manipulated so low for so long. That now it could blow and completely destroy all shorts and rip to levels. THat you would likely scoff and laugh at.

The silver stackers will have the last laugh