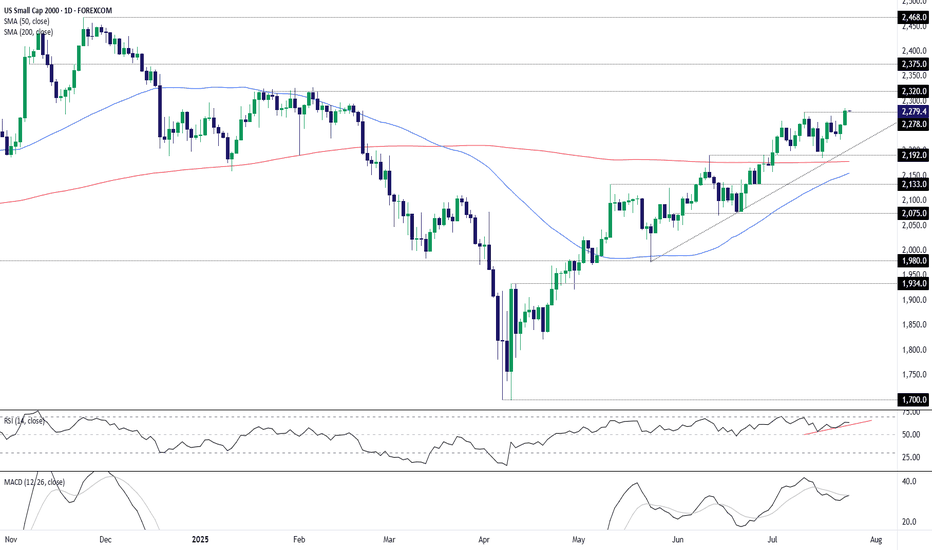

U.S. Small Caps Break Out: Dash for Trash Gathers SteamSitting in an obvious uptrend with momentum indicators skewing increasingly bullish, it looks like the U.S. small cap 2000 contract wants to go higher. The dash for trash is on!

Having just cleared the July 10 high of 2278, it’s provided a decent setup to initiate fresh longs, allowing for a stop b

Related indices

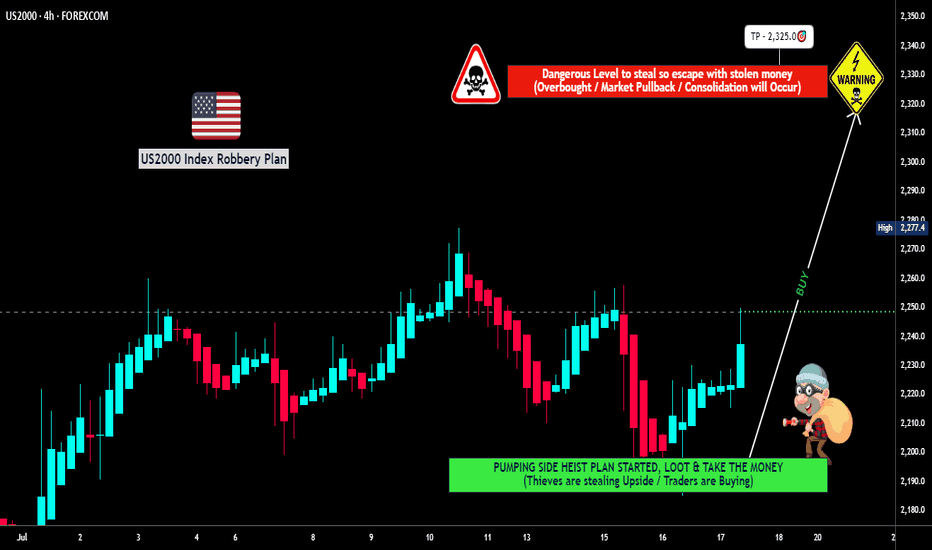

"US2000 THIEF TRADE: SWIPE & ESCAPE BEFORE BEARS!"🔥💰 "RUSSELL 2000 HEIST" – THIEF TRADING STYLE (BULLISH LOOTING IN PROGRESS!) 💰🔥

🚨 ATTENTION, MARKET ROBBERS & MONEY MAKERS! 🚨

(Thief Trading Strategy – High-Reward, Low-Risk Escape Plan!)

🎯 MISSION: US2000 / RUSSELL 2000 INDEX

(Current Market Status: Bullish Heist in Progress!)

🔓 ENTRY POINT: "THE

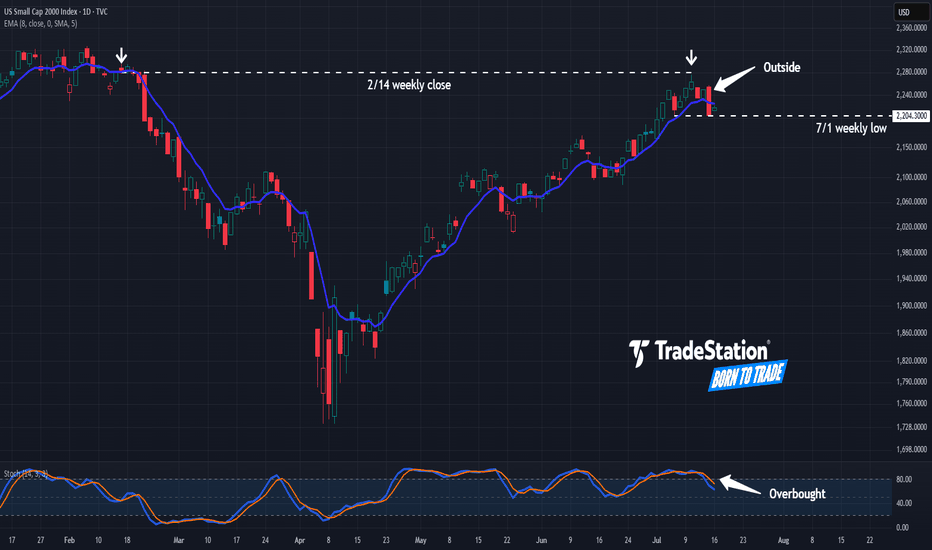

Have Small Caps Hit a Wall?The Russell 2000 has lagged the broader market for years, and now some traders may think it’s stalling again.

The first pattern on today’s chart is the February 14 weekly close of 2,280. The small cap index approached that level last Thursday but couldn’t hold. The resulting “shooting star” candles

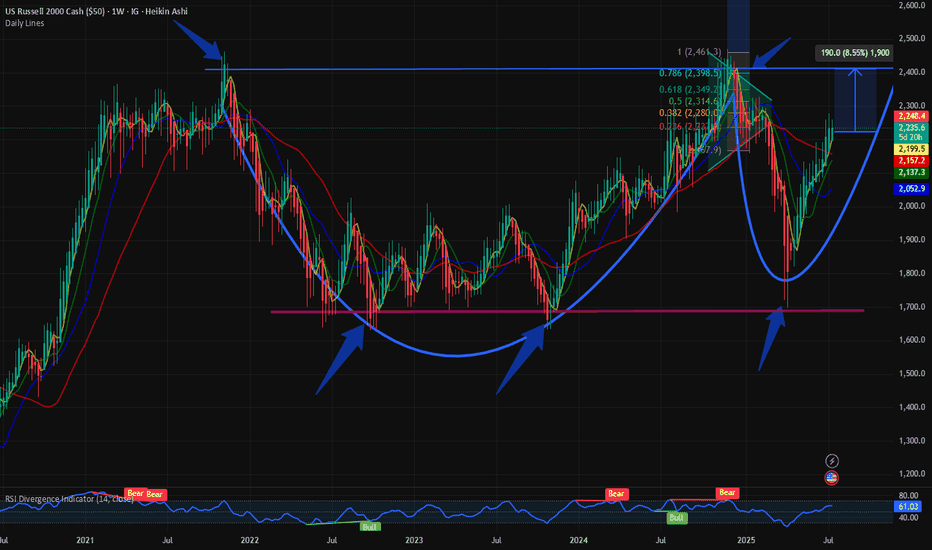

$RUSSEL: Completion of Cup and Handle formation or higher?The small cap index $RUSSEL has had a good past couple of months and has bounced back from its lows. We visited the small cap index on May 1st when we identified the trend reversal. The $RUSSEL was in the recovery mode after the Liberation Day capitulation.

IG:RUSSELL in a bounce back mode. But u

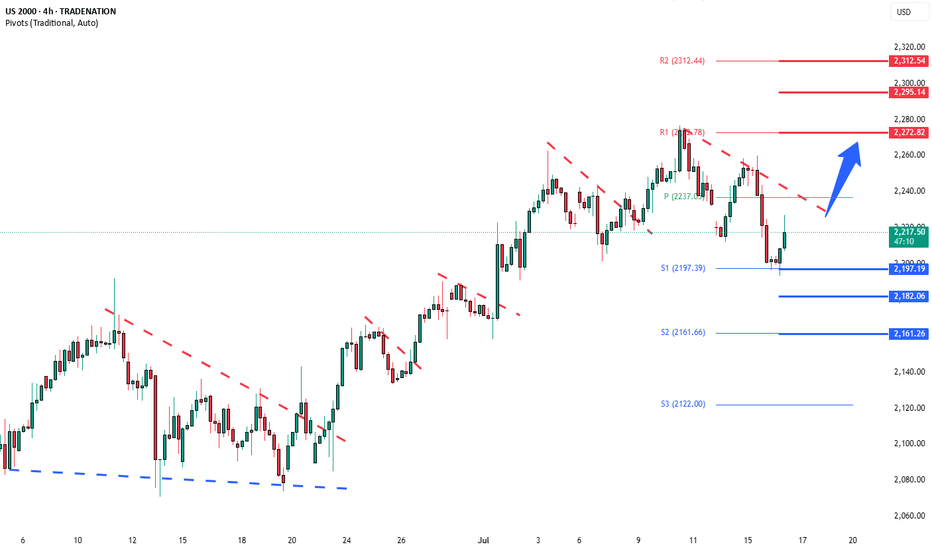

Russell2000 corrective pullback supported at 2197Key Support and Resistance Levels

Resistance Level 1: 2270

Resistance Level 2: 2295

Resistance Level 3: 2313

Support Level 1: 2197

Support Level 2: 2180

Support Level 3: 2160

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a p

US Small Caps: Evening star pattern flags reversal riskThe U.S. Small Cap contract often generates reliable reversal signals, meaning the three-candle evening star pattern completed Friday should be of interest to traders, especially with bullish price momentum also showing signs of rolling over.

Should the price push back towards Monday’s opening leve

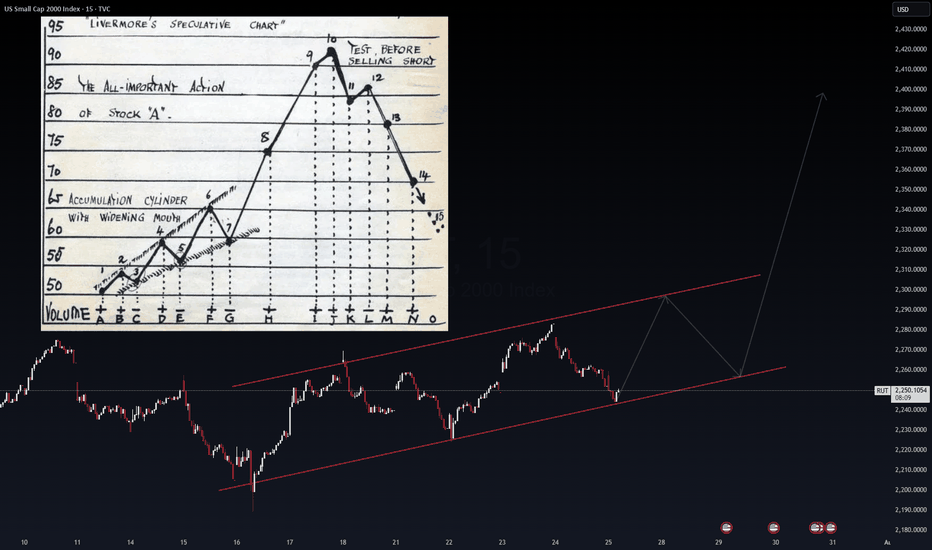

RUT Echoes IWM – The Livermore Playbook?The Russell 2000 (RUT) is painting a structure that mirrors the IWM ETF – a widening accumulation channel, setting up for a potential breakout. The VolanX protocol flags this as a classic Livermore Speculative Chart pattern, where phases of quiet accumulation lead to an explosive markup.

Channel Su

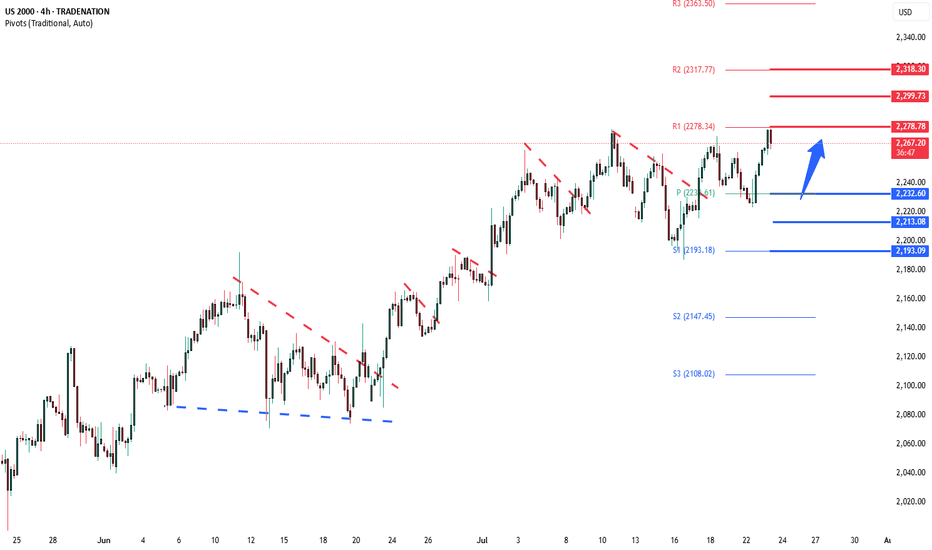

Russell2000 Bullish continuation supported at 2232.60Key Support and Resistance Levels

Resistance Level 1: 2278.80

Resistance Level 2: 2299.70

Resistance Level 3: 2318.30

Support Level 1: 2232.60

Support Level 2: 2213.00

Support Level 3: 2193.00

This communication is for informational purposes only and should not be viewed as any form of recomm

Russell2000 bullish continuation breakoutKey Support and Resistance Levels

Resistance Level 1: 2278.80

Resistance Level 2: 2299.70

Resistance Level 3: 2318.30

Support Level 1: 2232.60

Support Level 2: 2213.00

Support Level 3: 2193.00

This communication is for informational purposes only and should not be viewed as any form of recomm

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of US Small Cap 2000 Index is 2,261.0679 USD — it has risen by 0.40% in the past 24 hours. Track the index more closely on the US Small Cap 2000 Index chart.

US Small Cap 2000 Index reached its highest quote on Nov 25, 2024 — 2,466.4853 USD. See more data on the US Small Cap 2000 Index chart.

The lowest ever quote of US Small Cap 2000 Index is 106.0700 USD. It was reached on Oct 28, 1987. See more data on the US Small Cap 2000 Index chart.

US Small Cap 2000 Index value has decreased by −0.18% in the past week, since last month it has shown a 4.53% increase, and over the year it's increased by 2.70%. Keep track of all changes on the US Small Cap 2000 Index chart.

The top companies of US Small Cap 2000 Index are NASDAQ:RKLB, NASDAQ:SMMT, and NASDAQ:INSM — they can boast market cap of 22.74 B USD, 21.29 B USD, and 19.75 B USD accordingly.

The highest-priced instruments on US Small Cap 2000 Index are NYSE:GHC, NYSE:GPI, and NASDAQ:CVCO — they'll cost you 918.76 USD, 436.52 USD, and 417.47 USD accordingly.

The champion of US Small Cap 2000 Index is NYSE:QBTS — it's gained 1.80 K% over the year.

The weakest component of US Small Cap 2000 Index is NASDAQ:JBIO — it's lost −99.64% over the year.

US Small Cap 2000 Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy US Small Cap 2000 Index futures or funds or invest in its components.

The US Small Cap 2000 Index is comprised of 1896 instruments including NASDAQ:RKLB, NASDAQ:SMMT, NASDAQ:INSM and others. See the full list of US Small Cap 2000 Index components to find more opportunities.