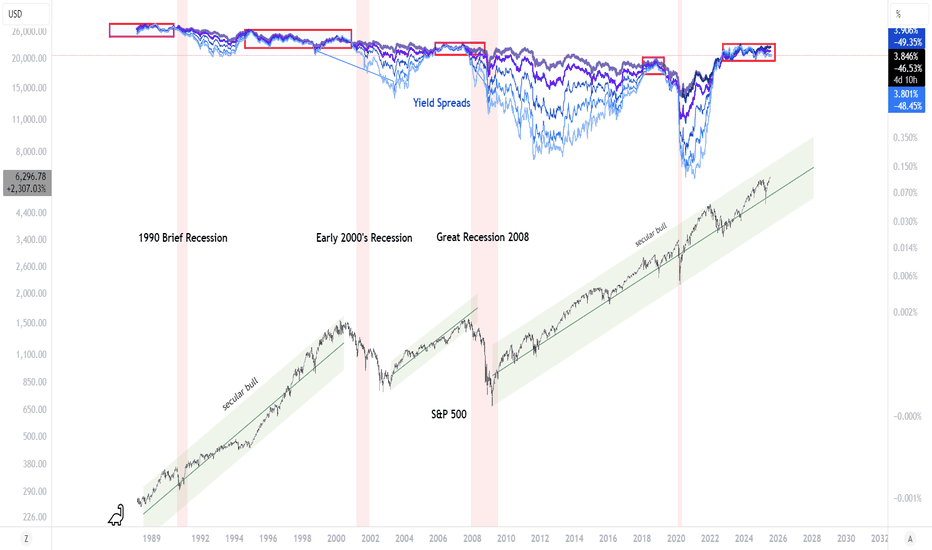

Yield Spreads Warning About the Secular Bull MarketAre we in the final innings of the current secular bull market that emerged from the robust injection of liquidity in response to the 2008 Financial Crisis? Yield spreads are giving us a warning and one that should not be dismissed. Yield spreads show (shorter to longer in lighter blue to darker b

Related bonds

See all ideas

A graphical representation of the interest rates on debt for a range of maturities.

Frequently Asked Questions

The current yield rate is 3.921% — it's increased by 0.75% over the past week.

The current yield of United States 2 Year Government Bonds is 3.921%, whereas at the moment of issuance it was 7.193%, which means −45.49% change. Over the week the yield has increased by 0.75%, the month performance has showed a 3.43% increase, and it has fallen by −11.55% over the year.

Maturity date is when a debt comes due and all principal and/or interest must be repaid to creditors. For example, the United States 2 Year Government Bonds maturity date is Jun 30, 2027.

You can buy United States 2 Year Government Bonds through brokers — choose the one that suits your needs and go ahead. You can also purchase bonds directly from the issuing organization. Closely track the price dynamics and market news before making any decision.

A bond is a debt security issued by a corporation or a government. By buying bonds, investors loan the issuer money in return for an interest rate. By issuing bonds, the state receives funds that can then be injected into the economy, and corporations raise funds for new research or other operational activities. The alphanumeric code of government bonds represents the abbreviated name of the issuing state, as well as its time to maturity. For example, United States 2 Year Government Bonds is the US government bonds with the maturity of 2 years.

Bonds can be of various maturities, e.g. short-term (less than three years), medium-term (four to 10 years), or long-term ones (more than 10 years). So United States 2 Year Government Bonds are short-term bonds — they have the maturity of 2 years.