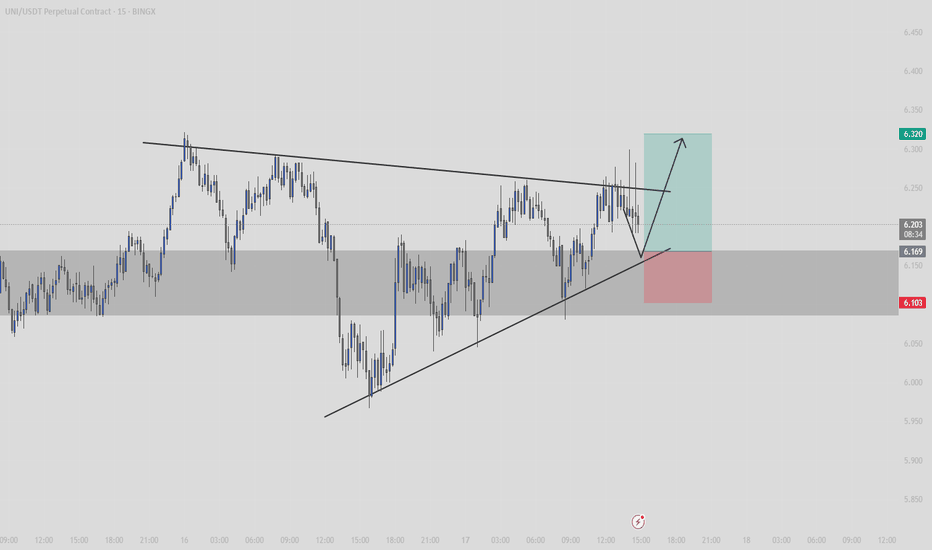

Short trade

5min TF overview

Trade Entry – UNIUSDT

📅 Date: Wednesday, 23rd April 2025

🕓 Time: 00:40 AM (NY to Tokyo Session – AM)

🗂 Structure: Daily

📈 Entry Timeframe: 1 Hour

🔻 Trade Direction: Sellside

Trade Details:

Entry: 6.089

🎯 Target (Profit Level): 5.788 (4.94%)

🛑 Stop Loss: 6.100 (0.18%)

💹 Risk-Reward Ratio: 27.36

Market Context:

Price showed signs of exhaustion at a key resistance level on the 1Hr structure, with the RSI aligning with the overall bearish sentiment during the NY to Tokyo transition.

1Hr TF

Structure & Confirmation:

Observed on the 1h timeframe, a clear sweep of NY High formed the direction bias, aligning with a significant daily structure point.

UNIUSDT trade ideas

UNIUSDTshort selling set up 📉

DISCLAIMER:

what I share here is just personal research, all based on my hobby and love of speculation intelligence.

The data I share does not come from financial advice.

Use controlled risk, not an invitation to buy and sell certain assets, because it all comes back to each individual.

Uniswap Coin (UNI): Possible Correction Incoming | (+30-40%)Uniswap coin has been on a rough path where price has dumped pretty hard since it's local highs.

As we have been monitoring this coin on different timeframes, we noticed how far the daily timeframe EMAs are from market price, which gave us the first sign of possible upcoming upward movement.

Now what we are seeing is the volume is building up on a 4-hour timeframe where we are mostly going to test the 100EMA and we are going to look for a break of that EMA as well. There are a lot of uncertainties on the markets right now so we are keeping the stops pretty tight!

Swallow Team

Uniswap Coin (UNI): 2 Ways To Go | Good Risk:Reward TradesUniswap coin is at a crucial zone where we are going to wait for further confirmations. We have spotted 2 good trades that can be taken on a daily timeframe so we are now going to wait for either a breakout in the form of BoS or a breakdown!

More in-depth info is in the video—enjoy!

Swallow Team

UNI — Time to Accumulate? A Clean Long-Term SetupUNI is the native token of the Uniswap DEX — and it's finally back in our interest zone.

After a brutal 70% correction from previous highs, price has retraced into a key accumulation range between $3.60 – $6.76.

This isn’t just another alt — UNI is a fundamental token that arguably deserves a place in every long-term portfolio.

Spot entry around $5.50 looks reasonable, with higher timeframe targets at $10.35, $17.03, and $19.47.

No overtrading here — just a clean long-term thesis. Accumulate, sit back, and let the narrative unfold.

More thoughts in my profile @93balaclava

Personally I trade on a platform that offers low fees and strong execution. DM me if you're interested.

Short-Term Short Position UNI/USDT🔥 UNI/USDT – Approaching Key Short Zone

Uniswap (UNI) has formed a rising wedge structure after rebounding from local lows. Price is now nearing a critical short zone around 5.762 – 5.804, where sellers could potentially step in if UNI fails to break above with conviction.

🟣 Zone to Watch

“Possible Short Zone” (in purple) — a high-probability entry area for short trades given the overhead resistance and wedge convergence.

🔴 Entry Points:

Entry 1: ~5.762 (initial level)

Entry 2: ~5.804 (upper boundary)

📉 Momentum & Setup

Chart Formation: The rising wedge often suggests bullish exhaustion; a decisive break below wedge support can signal a bearish shift.

Volume Consideration: Look for a sell-volume uptick or a clear rejection around 5.70 – 6.2 to confirm the short setup.

🟢 Take-Profit Zones

✅ TP1: ~5.549

✅ TP2: ~5.315

✅ TP3: ~4.957

✅ TP4: ~4.244 (Extended downside if momentum persists)

❌ Invalidation Level: 6.265+

(A strong close above this level indicates a bullish breakout from the short window.)

🧠 Narrative

This setup highlights a possible bearish retest, as UNI’s rebound has propelled price into a narrowing wedge near major resistance. Should buyers fail to push beyond 5.70, aggressive sellers may anticipate a correction. A volume-backed rejection here could see UNI retrace to lower support levels.

🎲 Market Context

Monitor broader crypto sentiment and Bitcoin’s performance; strong market momentum could negate the bearish bias, while a market-wide pullback may accelerate downside.

📌 Risk Management

Position Sizing: Adjust to your risk tolerance and never overexpose.

Stop-Loss: Place it above 6.265+ to avoid unexpected breakouts.

Remain flexible and reevaluate if price action shows continued strength above the wedge.

UNI Trade Setup - Strength After Liquidity SweepUNI has swept underside liquidity and is now holding strong. If price consolidates above $7, we’ll be looking for local lows to form, setting up a medium-term move higher as broader markets push into resistance.

🛠 Trade Details:

Entry: Around $7 zone

Take Profit Targets:

$10.50 – $11.00 (First Target)

$14.50 – $15.00 (Extended Target)

Stop Loss: Daily close below $5.5

Waiting for market confirmation before positioning for the next leg up! 📈🚀

#UNI/USDT#UNI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 5.50.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 6.20

First target: 6.75

Second target: 7.28

Third target: 7.92

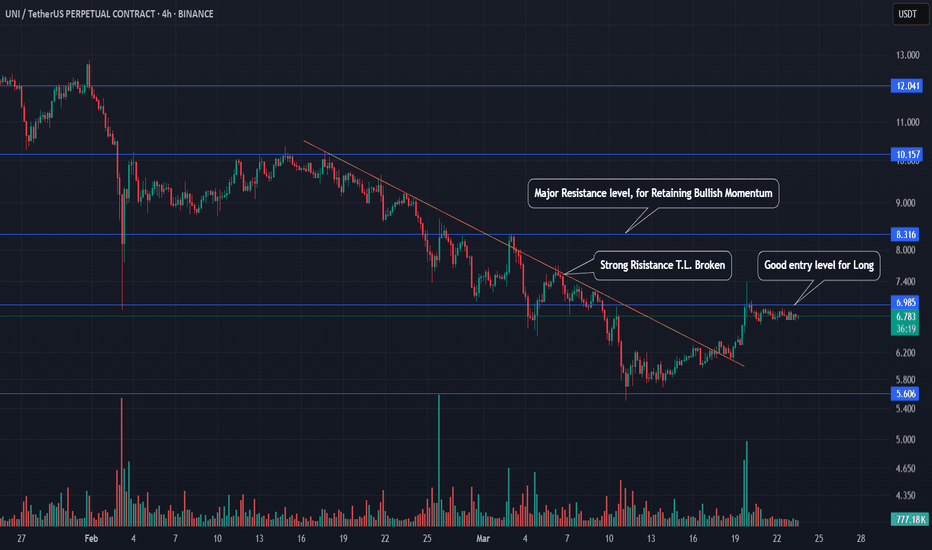

UNI/USDT 4H ANALYSISHi guys, today we want to analyze UNI/USDT in 4 hour time frame.

As we can see that it had a strong downtrend followed by a resistant trend line which in the recent days it has broken the resistance trend line and also we have the huge volume in the two 4H candles for now we can have an opportunity of long after the price tag of $6.985.

Buy UNIUSDT: Weekly Support & golden Fib pocket!!Join our community and start your crypto journey today for:

In-depth market analysis

Accurate trade setups

Early access to trending altcoins

Life-changing profit potential

Let's analyze UNIUSDT:

UNIUSDT has plummeted nearly 70% in 90 days but now holds above crucial weekly support. Historically, rebounds from this level have been significant. Notably, a minor bounce is occurring at the weekly chart's golden Fibonacci pocket, suggesting strong potential for a reversal. This confluence of support and Fibonacci retracement indicates a likely, powerful recovery from this zone.

Closely accumulate here!!

Accumulation zone:

CMP to $5.50

Target levels:

$11.9

$19

$45.7

If you find this analysis helpful, please hit the like button to support my content! Share your thoughts in the comments and feel free to request any specific chart analysis you’d like to see.

Happy Trading!!

$UNI Accumulation Zone Between $6 to $4 – Bullish Outlook

🔸 Key Support Zone at $4 - $6:

UNI is consolidating in the $4 - $6 range, indicating a strong accumulation phase. This zone has historically acted as a demand area, making it a critical level for a potential reversal.

🔸 Upside Target: $12 - $17

Once UNI confirms a breakout from this accumulation range, the first major target would be $12, followed by $17 in a strong bullish scenario.

🔸 Risk Level at $3.50:

A drop below $3.50 would invalidate this bullish setup, potentially leading to further downside.

🔸 Action:

Watch for bullish confirmations above $6 with strong volume.

A retest of $5 - $4.50 could provide a high R:R entry opportunity.

Keep an eye on BTC and overall market sentiment to confirm trend direction.

#UNI 🚀

Technical Analysis for Uniswap (UNI/USDT)### Technical Analysis for Uniswap (UNI/USDT)

BINANCE:UNIUSDT

Current Price Level: $6.88

Time Frame: 1-day chart

#### Trend Analysis

Uniswap has been in a bearish trend since reaching a peak in the recent months, following a series of lower highs and lower lows. However, the price shows signs of potential reversal as it approaches crucial support levels, indicating a possible transition into a consolidation phase.

#### Key Levels

1. Support Levels:

- Primary Support: $5.00 (green line) – This level has been tested multiple times and serves as a solid floor.

- Invalidation Level: Below $4.63 – A daily close below this level would indicate a potential continuation of the bearish trend.

2. Resistance Levels:

- Short-Term Resistance: $8.00

- Targets for Swing Trade:

- 1st Target: $8.00

- 2nd Target: $10.00

- 3rd Target: $12.00

- 4th Target: $15.00

- Long-Term Target: $30.00+

#### Moving Averages

- The price is currently above the 50-day (yellow line) and 200-day moving averages, which suggests a bullish momentum. A crossover where the 50-day MA crosses above the 200-day MA may indicate a solid buying opportunity.

#### Chart Patterns

- The recent price action appears to be forming an ascending triangle or bullish flag pattern, which typically precedes upward breakouts. The market trajectory suggests that Uniswap may be preparing for a price increase.

#### Volume Analysis

- Recent trading volume has increased during upward price action, suggesting accumulation by buyers. Continued volume spikes on upward moves will confirm the bullish sentiment.

#### Technical Indicators

- RSI: (Relative Strength Index) is approaching the 50 mark, signaling that the market momentum is shifting. A breakout above the 50 level could indicate bullish momentum.

- MACD: The Moving Average Convergence Divergence indicator is showing signs of a bullish crossover. If this trend continues, it would suggest that upward momentum is gaining strength.

### Conclusion and Trade Strategy

Considering the current technical setup for Uniswap:

- Entry Point: $5.80 - $6.45 provides a high-risk reward ratio for traders looking to buy.

- Targets: Use multi-tiered profit-taking strategies with the specified targets: $8.00, $10.00, $12.00, and $15.00 based on the progression of the price.

- Stop Loss: Set a stop-loss order at $4.63 to minimize loss in case of a downward reversal.

Final Note: Always consider external market factors and news that may impact crypto prices. Ensure risk management measures are in place when entering trades.

UNIUSDT UPDATEUNIUSDT is a cryptocurrency trading at $6.780. Its target price is $10.000, indicating a potential 50%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about UNIUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. UNIUSDT is poised for a potential breakout and substantial gains.

TradeCityPro | UNIUSDT Ready to Break the Trend Line👋 Welcome to TradeCityPro Channel!

Let's analyze and review one of the best crypto DeFi projects and projects that have good income in the crypto space!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

In the weekly time frame, we are witnessing a deep correction of this coin and the situation is not very good and these events are also due to the recent negative news in the market, but we experienced a 68 percent drop!

We have now reached an important support which is 5.599 and in terms of price it is really a good price for the yoni but I don't have any suggestions to buy it right now because it is a very strong downtrend and we need to form a structure!

Even if we need to lose a percentage of the movement, we will lose it so that we can enter with the momentum and we do not need to buy a step like the others and for now we will watch for a purchase, but to exit after the level of 4.051, I will exit myself

📈 Daily Timeframe

The same thing is happening on the daily time frame and after being rejected from 18.664 and not reaching this price ceiling, we went for a price correction and formed a box between 12.830 and 15.264

After breaking the bottom of this box, we started a downward movement and I had a bounce to this support and I went to continue the fall and now we have reached the important support of 5.617 and we are probably going to go for a time range and form a box

Currently, it is expected that we will go for a range and form a price structure and we must consider that sellers are no longer willing to sell and have been on it for a few days This is the support level and it is not a good level to buy at the moment, but if we form a box after it breaks, we can buy.

⏱ 4-Hour Timeframe

On the four-hour time frame, this recent decline is also clearly visible on the chart and has even caused us to form a downward trend line of the retracement type.

I should mention that trend lines are divided into two categories: retracement and continuation. Continuing trend lines are those that continue our main trend after the trend line breaks and usually we do not need a trigger to trade it, but retracement trend lines are trend lines that change our main trend and to open a position with them, I myself wait for the trend line to break and a confirmation trigger!

📈 Long Position Trigger

with the above explanation, after the trend line and trigger 6.287 break, we can open a risky long position, but if this happens, by forming a higher bottom and top after breaking that top, we will have a much better trigger and we are more confident that the trend will continue

📉 Short Position Trigger

our task is completely specific, and after breaking 5.721, we can open our position, and we can also continue to do the same with each rejection from this trend line and get confirmation for the position if the volume increases, but our main trigger will still be 5.721

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

UNI/USDT Daily AnalysisFollowing UNI analysis in Daily time frame we notice that the price has reached a vital support.

As we see in the chart that the bearish momentum on UNI is coupled with a strong resistance trend line. that for UNI to reclaim the bullish momentum it has to stabilize 4H or Daily candle above the resistance trend line and $6.793 and later the $8.39 area, which is a key PRZ.

Uniswap (UNI): Need To Find Proper Support / Break of StructureUniswap coin has a nice break of 200EMA, where after a proper correction we see a further weakening on the markets where we recently formed BoS on Uniswap.

With such a pressure, we are in need of finding a proper support zone where we might see some kind of bounce, so we are looking for another 30% drop, which then would give us a potential bounce zone.

Swallow Team

Idea No. 3 for the spotUniswap, the first significant DEX in the ETH network, where liquidity pools were created and all onchain transactions took place. Uni was the first, after it forks for different networks were based on it.

What do we have?

Active growth phase, the structure is not broken and remains upward. A sharp, but still divergence on the daily TF.

A bullish MACD crossover, the reversal can be seen on the chart itself.

In terms of tokenomics, there are only 13% more coins in circulation compared to May '21, and that was ATH. Plus the SEC recently closed the case against Uniswap, so more reasons to see positive dynamics.

My stop loss is at $6.6.

Consider your risks.

DYOR