S&P500 INDEX (#US500): Intraday Bullish ConfirmationAfter a breakout of a key horizontal resistance,

📈US50P retested this level and then formed an ascending triangle pattern on a 4-hour time frame.

A bullish breach of the triangle's neckline is a key confirmation of buyer strength and suggests potential for a price increase to at least 5,500.

US500.F trade ideas

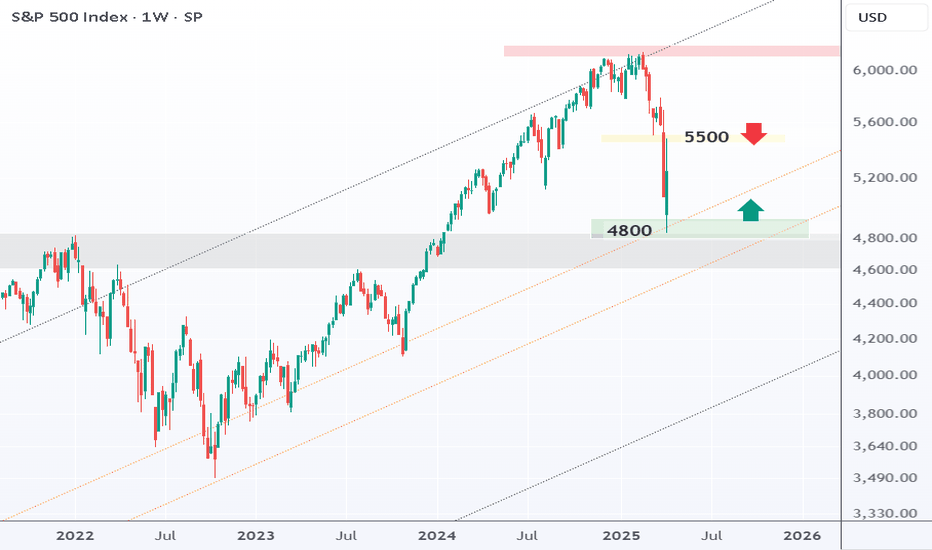

Market Outlook of S&P 500 This is a S&P 500 Weekly Chart and it’s on a perfect uptrend since the covid bottom, and on a shorter time frame, it has also broken the time frame. It has also touch the 2022 support which is around 4800.

I expect it to retest the recent bottom and maybe even a lower low, I think it can make a fib extension and retest 4250-4300.

SPX: the absurdity of tariffsTariffs-narrative continues to shape the sentiment of investors on the US equity markets. The high volatility continues to be the predominant way of price movements, ranging from deep pessimism to higher optimism. The reality is that no one is sure what to trade and in which direction. Markets are extremely unhappy in times of high uncertainty, like the tariff-time currently is. Another week with extreme moves is behind the market. The S&P 500 reached the lowest weekly level at 4.840, but soon realized that this might be too low for current conditions of the US economy. Then the news hit the market that US tariffs will be delayed for the majority of countries for up to 90 days, and the market suddenly entered into an optimistic mood, reaching the highest weekly level at 5.480. This occurred at Wednesday's trading session, where S&P 500 gained around 10% within one day. For the S&P 500 this could be treated as highly extreme movement, but it shows how much nervousness is within investors at this moment.

One of few reactions on the extreme volatility of US equity markets came from Susan Collins, head of the Boston Fed, who noted that “markets are continuing to function well” and that the Fed would be prepared to address chaotic conditions on the market, if needed. However, there is no indication that the Fed will react at this moment, and whether current developments will have any effect on their decision on rate cuts during the course of this year. The next FOMC meeting is scheduled for May 6-7th.

At this moment, the long term investors should not be worried, as this absurdity will come to pass one day, and US equities will continue to follow the growth of the US economy. Short term investors and traders will find this period of time as highly challenging. This sentiment will, unfortunately, continue for some time in the future, until the final tariffs-deal is set or dismissed.

SPX Elliott Wave Count AnalysisJust dropping a multi-timeframe breakdown of my current EW thesis for SPX, starting from the macro and drilling down to now.

Big Picture (3M View):

We’re still grinding through Grand Super Cycle Wave 3 (GSCW3) that I have starting in the 1932 low till now.

Scoped in look at Super Cycle W4(SCW4)

Super Cycle Wave 4 (SCW4) wrapped up around the ‘08-‘09 housing crash lows. Since then, we’ve been in SCW5, and based on current structure, I believe we’re still early or mid-stage, not near the end.

Zoom-In: SCW5 to Present (Cycle Degree Breakdown):

From the 2009 lows, price action carved out a textbook impulsive structure into what I’m labeling as Cycle Wave 1 (CW1), which likely topped out ~Dec 2024.

The correction that followed has the characteristics of an Expanded Flat:

A-B-C structure where Wave C just completed around April 7th.

This structure, in my view, forms Wave W of a potential WXY complex for CW2.

Now we’re either in:

The early stages of Wave X, targeting the 0.618 retracement zone of W (marked on the chart),

Or, X has already completed in a shorter move.

Alt (Low-Probability) Scenario:

There’s a slim case that the ABC (now W) correction was all of CW2 — given how it wicked into a deep, low-probability Fib zone (gray box).

If we get a clear impulsive move above that 0.618 area, I’ll pay closer attention to this alt — but for now, I’m leaning toward more downside after this X-wave finishes (if it hasn't already).

EW interpretations evolve, but this is my current working roadmap

One more wave down for SPX500USDHi traders,

SPX500USD went straight into the target last week. From there it rejected and made a bigger correction (orange) wave X (updated wavecount).

Next week we could see the last impulse wave down to finish the bigger (red) WXY correction.

Let's see what the market does and react.

Trade idea: Wait for a change in orderflow to bearish and a small correction up on a lower timeframe to trade shorts.

If you want to learn more about trading FVG's & liquidity sweeps with Wave analysis, then please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

Is SP500 / US M2 Money Supply telling us a story?Historically this ratio has inflected from key levels. Last week the upper boundary of what 8 would call a normal range has acted as support. If history rhymes to dot com bubble, this AI bubble can bounce from these levels and see an increase until Q4 2026, then a sharp fall will follow. To the lower boundary of that normal range.

SPY, More pain to come? SPY / 1D

Hello Traders, welcome back to another market breakdown.

SPY is showing strong bearish momentum, breaking below resistance. However, the price is in the oversold zone for now. Hence, instead of jumping in at current levels, I recommend waiting for a pullback into the middle of the range zone for a more strategic entry.

If the pullback holds and sell mode confirms, the third leg lower could target new lows.

Stay disciplined, wait for the market to come to you, and trade with confidence!

Trade safely,

Trader Leo.

SPX 500 >>> Trade Idea FOR CALL FRAME 75

If price reaches $5,300 after a clear rejection from the current level, consider a long position with a stop loss at $5,250 (below the identified order block). Take Profit at $5,500 (previous high level). This setup aims to capture a mean reversion move following the liquidity sweep.

Long Term TrendlineA long term trend line on the SPX

Great place to buy if you are speculative of the current price movement

Price from this line will most likely move up

If not up from this trend line, very bearish.

Great time within a bear market to buy oversold stock regardless. Just have to HODL.

If bearish HODL .

S&P 500 Daily Chart Analysis For Week of April 11, 2025Technical Analysis and Outlook:

During the current trading session, the Index has recorded lower opening prices, thereby completing our key Outer Index Dip levels at 5026 and 4893, as previously highlighted in last week's Daily Chart analysis. This development establishes a foundation for a continuous upward trend, targeting the Outer Index Rally at 5550, with an interim resistance identified at 5455. Should this upward momentum persist, further extension may reach the subsequent resistance levels of 5672 and 5778, respectively. However, it is essential to note that a downward momentum may occur at the very significant completion target level of the Outer Index Rally at 5550, with the primary objective being a Mean Sup 5140 and retest of the completed Outer Index Dip at 4890.

Yes i predicted the stock market crashnot many people can say they predicted the stock market crash, no one believed me but you can see in my previous ideas i saw it over 6 months in advance, though i wished it crashed a whole lot more, i do believe it has bottomed out and is a great long term buying opportunity.

S&P500 Still a Short: Be mindful of Alternate CountI discuss how the additional wave up could have a larger implication on the entire outlook of S&P500 and could cause a re-labelling of the entire wave structure. What we want to see in order to keep our primary count, is a breakdown below the low of where I plotted wave 1 of C. That is, below 5119.8.

But no matter the primary count or the alternate count, it is still a short opportunity. But there is an implication on the Take Profit target.

TP 3300 Long term projectionsS&P we have seen the blow off TOP this early beginning of bearish trend , sell will continue almost 15 months set your target 🎯 3300 get this trend profit taking

as mentioned below

TP1. 5100

TP2. 46500

TP3. 3900

TP4. 3300

Long term projections those who invest sell side for longer term

Trump Tariffs - Trade War - High Volatility - Key LevelsEasy trading for 2025, right? Haha

We are seeing some of the wildest swings ever in the markets

Extreme intraday swings and volatility is getting everybody's attention

This video discusses all key levels and current seasonality

Hoping for the best and preparing for the worst

"SPX500/US500" Index Market Money Heist Plan (Day / Scalping)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "SPX500/US500" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Blue MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (5400) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (5100) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 5800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"SPX500/US500" Index Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets & Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

We are not in a bear marketIt´s amazing how social media is trying to provoke fear. We are not in a bear market. Even if there has been a more than a 20% drop. This is only an idea of a person: Donald Trump. Everything has been orquested by him and his team.

The real bear market will trigger when the 50MMA is broken down or the 200WMA. Until then, be ready for a blow off top to 7000 in the next 12 months.

Trading with Liquidity Sentiment IndicatorsJust a short introduction to trading with our indicators. I can't emphasise enough that you need to have at least 6 securities/tickers to click through to find the liquidity that fits the price action. At different times of day, different tickers are used by market makers to lay off deltas for hedging, this makes up the largest volumes in the markets, as well as the securities/tickers that you and others are trading. All these securities prices are moved around by the index they are a component of and the VIX which is made up of 30 day(dte) put IV. I will post more regularly this week reading live trading using the indicators.