SPX 0DTE TRADE IDEA – JULY 25, 2025

⚠️ SPX 0DTE TRADE IDEA – JULY 25, 2025 ⚠️

🔻 Bearish Bias with Weak Volume – Max Pain Looming at 6325

⸻

📊 Quick Market Snapshot:

• 💥 Price below VWAP

• 🧊 Weak Volume

• 📉 Max Pain @ 6325 = downside pressure

• ⚖️ Mixed Options Flow = no clear bullish conviction

⸻

🤖 Model Breakdown:

• Grok/xAI: ❌ No trade – weak momentum

• Claude/Anthropic: ✅ Bearish lean, favors PUTS near highs

• Gemini: 🟡 Slightly bullish bias, BUT agrees on caution

• Llama: ⚪ Neutral → No action

• DeepSeek: ❌ Bearish → No trade

⸻

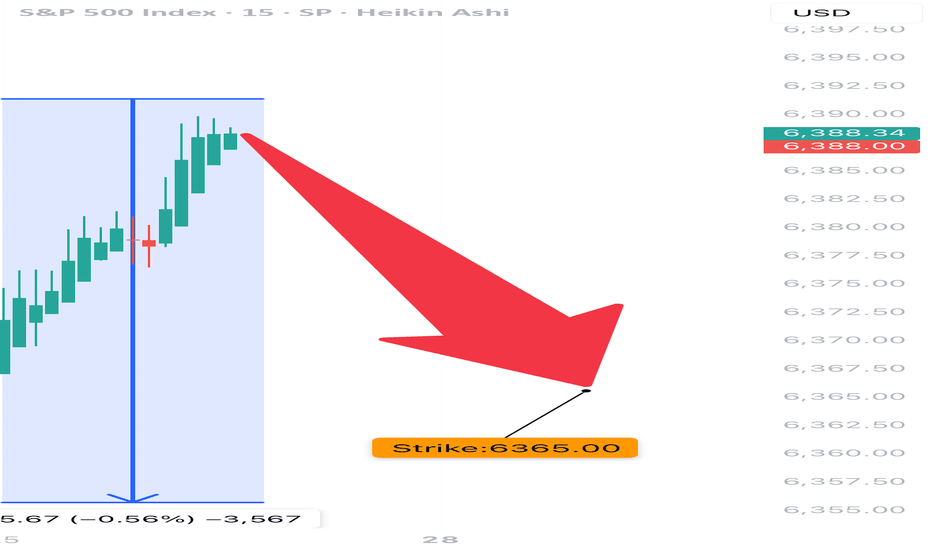

📌 TRADE IDEA:

🎯 SPX 6365 PUT (0DTE)

💵 Entry Price: $0.90

🎯 Profit Target: $1.80 (💥 2x return)

🛑 Stop Loss: $0.45

📆 Expires: Today

🕒 Exit by: 3:45 PM

📈 Confidence: 65%

⏰ Entry Timing: OPEN

⸻

⚠️ Risk Flags:

• Low volume = fragile conviction

• Possible reversal if SPX breaks above session highs

• Max pain magnet at 6325 could limit gains or induce a bounce

⸻

🧠 Strategy:

Scalp it quick. Get in early. Exit before the gamma games explode into close.

📈 Like this setup? Drop a 🔽 if you’re playing puts today!

#SPX #0DTE #PutOptions #OptionsTrading #MaxPain #SPY #MarketGamma #TradingSetup

US500AUD trade ideas

S&P 500: Bearish For The Short Term! Sell It!Welcome back to the Weekly Forex Forecast for the week of July 28 - Aug 1st.

In this video, we will analyze the following FX market for the week of Aug 4-8th:

S&P 500 (ES1!)

The S&P 500 rose Friday to fresh highs, following a busy week of tariff updates and earnings. The S&P ended the week with its fifth straight record close, its longest such streak in over a year.

No reason to consider selling. Wait for pullbacks to FVGs for high probability buys.

FOMC and NFP loom. Be careful to avoid new entries during news times.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Can the S&P 500's Ascent Continue?The S&P 500 recently achieved unprecedented highs, reflecting a multifaceted market surge. This remarkable performance stems primarily from a robust corporate earnings season. A significant majority of S&P 500 companies surpassed earnings expectations, indicating strong underlying financial health. The Communication Services and Information Technology sectors, in particular, demonstrated impressive growth, reinforcing investor confidence in the broader market's strength.

Geopolitical and geostrategic developments have also played a crucial role in bolstering market sentiment. Recent "massive" trade agreements, notably with Japan and a framework deal with Indonesia, have introduced greater predictability and positive economic exchanges. These deals, characterized by reciprocal tariffs and substantial investment commitments, have eased global trade tensions and fostered a more stable international economic environment, directly contributing to market optimism. Ongoing progress in trade discussions with the European Union further supports this positive trend.

Furthermore, resilient macroeconomic indicators underscore the market's upward trajectory. Despite a recent dip in existing home sales, key data points like stable interest rates, decreasing unemployment claims, and a rising manufacturing PMI collectively suggest an enduring economic strength. While technology and high-tech sectors, driven by AI advancements and strong earnings from industry leaders like Alphabet, remain primary growth engines, some segments, such as auto-related chipmakers, face challenges.

The S&P 500's climb is a testament to the powerful confluence of strong corporate performance, favorable geopolitical shifts, and a resilient economic backdrop. While the immediate rally wasn't directly driven by recent cybersecurity events, scientific breakthroughs, or patent analyses, these factors remain critical for long-term market stability and innovation. Investors continue to monitor these evolving dynamics to gauge the sustainability of the current market momentum.

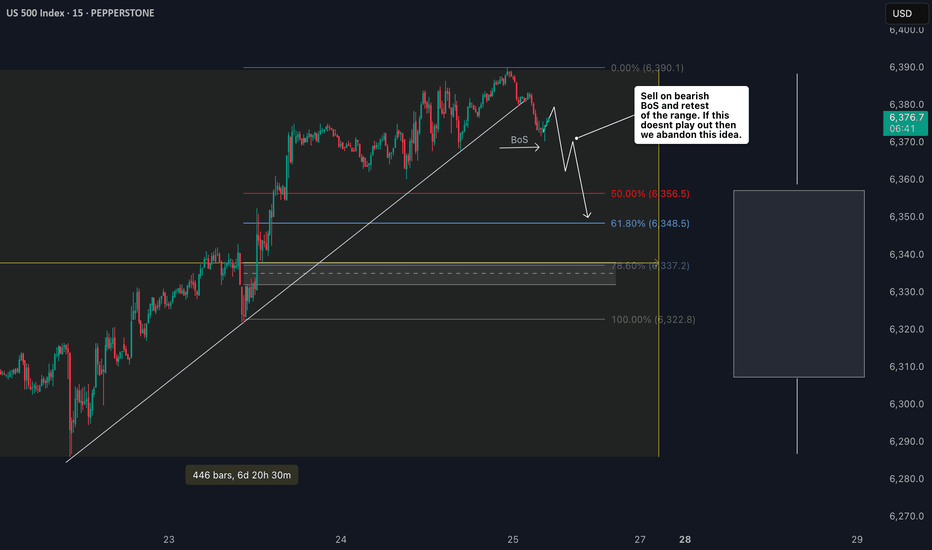

S&P 500 Counter-Trend Setup After Bullish Week US500Currently watching the S&P 500 (US500) closely 👀. The index has been in a strong bullish trend 📈, but I’m now evaluating a potential counter-trend opportunity.

Given the strength we’ve seen this week — possibly a “foolish rally” — there’s a chance we’ve either printed or are close to printing the high of the week 🧱. That opens the door for a retracement setup, particularly as we head into Monday’s open 🗓️.

🧠 Trade idea: If we get a bearish market structure break, I’ll be looking to enter short — targeting a 1R take profit initially, and holding a portion for a 2R–3R extension 🎯.

Friday sessions, especially after strong trends, often present clean intraday pullbacks — and when Monday’s low is set early, it can trap late buyers and fuel the move 📉.

⚠️ This is not financial advice — just sharing my thought process and trade plan.

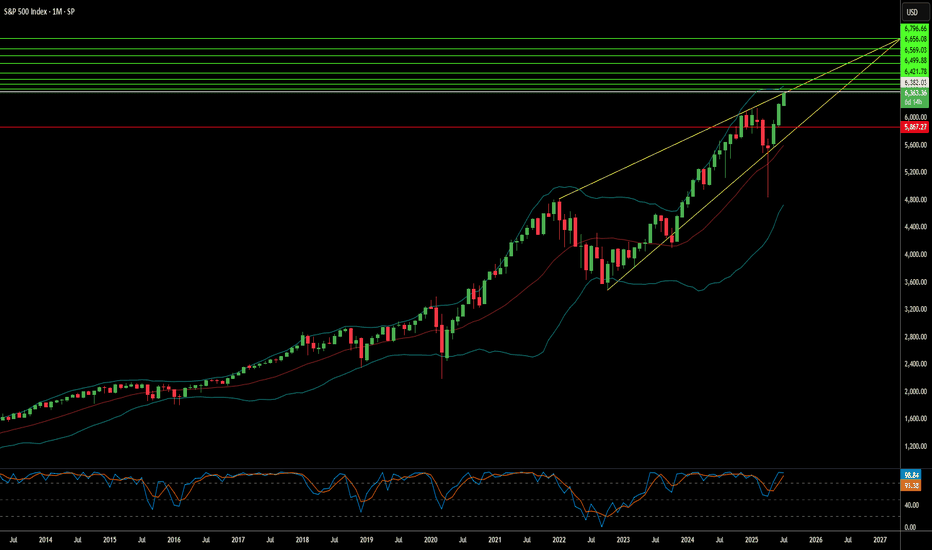

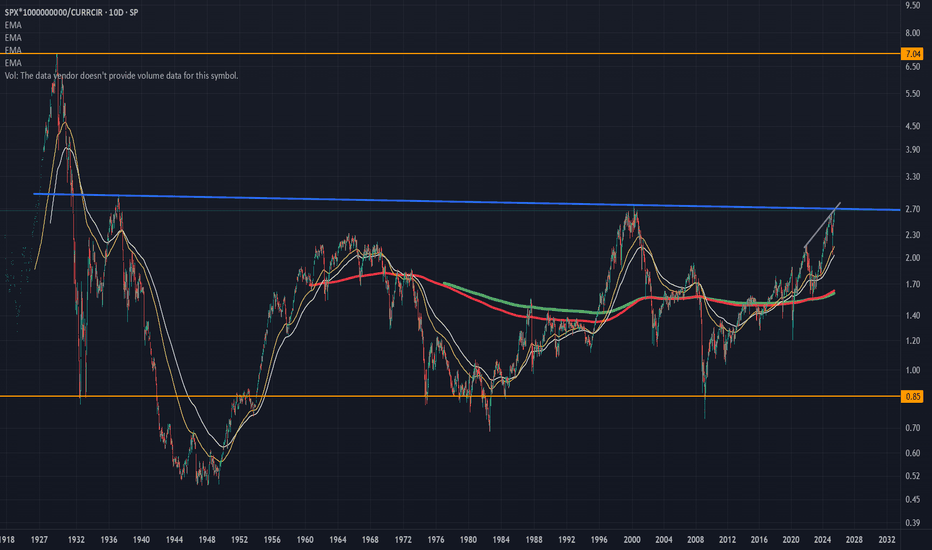

Entire S and P history in one chart. Approaching a neck-snapper!Here is a chart of the entire S and P history versus total currency in circulation.

This gives bubble periods (anytime the value is over 2) and times when the market crashed after being in a bubble.

If you notice we are fast approaching the line that broke the neck of the market in the 60s and 2000 dotcom bust.

If we clear that line, hold on to your hats because we are going into full blown speculative mania like just before the Great Depression!

In fact maybe the AI-crypto bubble will be exactly like the Great Depression, AI causing mass unemployment and global poverty.

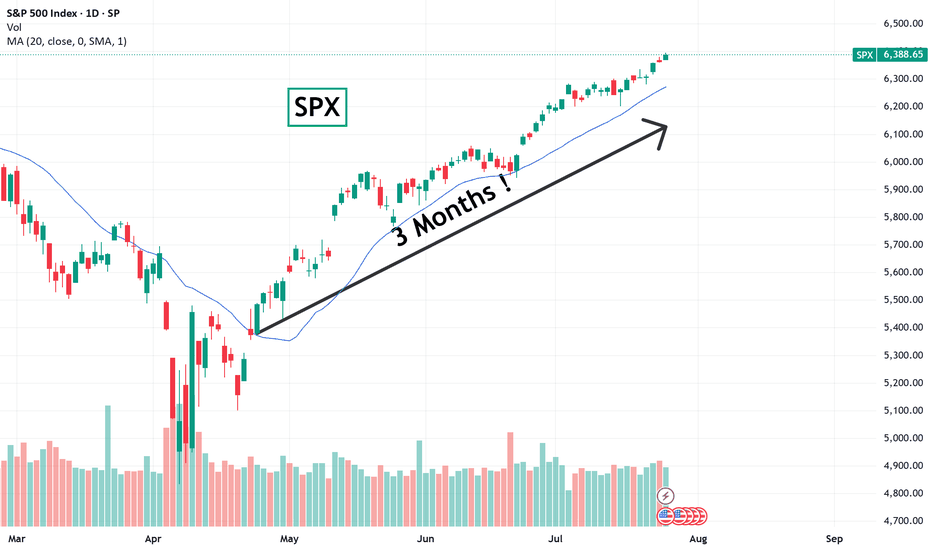

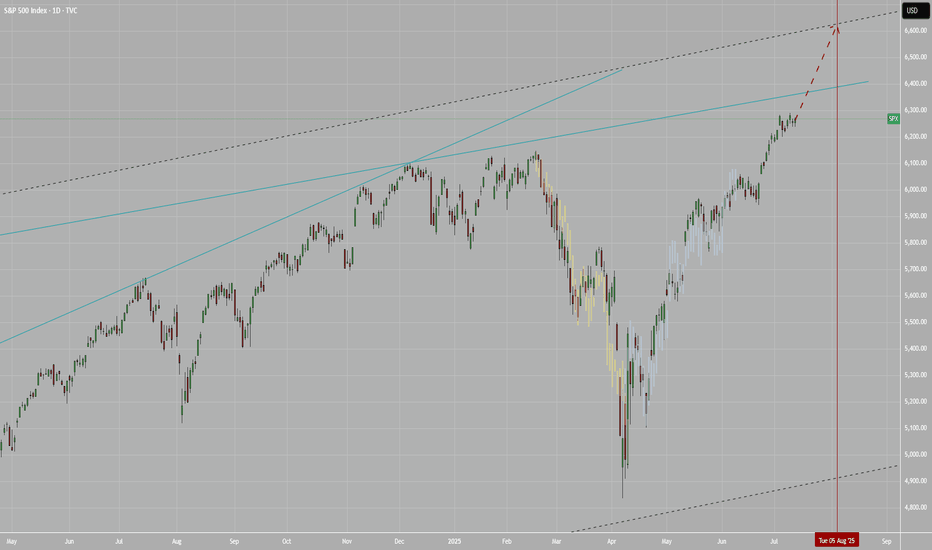

SPX chit chat... we're still up for nowAfter that crazy April 2025 crash, it feels like we should not be this high so fast... that's how I felt before too. But the rising channel is holding up right now. We are approaching the top. In previous times, the market grinded even higher (COVID pandemic was the last example).

Today we squeezed out new ATHs. The month ends next week and a new one begins. Less fear; more charts for the rest of the year.

See you in August!

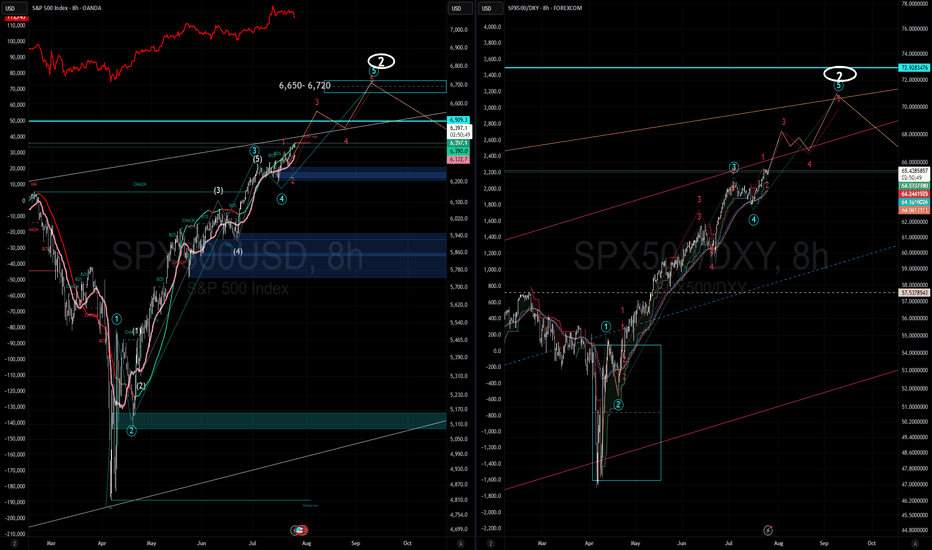

SPX More upside potentialI've revised my previous count based on recent price action. I now see a potential minor Wave 4 (of Intermediate Wave 5) forming around the 6,500 level. This could present a reasonable opportunity to take some % profits, (for the cautious or short term traders) though I recommend being prepared to re-enter, as I still believe we are ultimately headed toward the 6,650–6,720 range before a larger-scale correction sets in.

Taking some profits around 6,500 may be a prudent move, or alternatively, you can continue holding while adjusting your trailing stops accordingly.

Generally and in most cases its best to exhaust you bullish counts in Elliot .

On the right hand side i am showing SPX/ DXY which is typically a more accurate and discernable wave pattern then the SPX alone. FYI

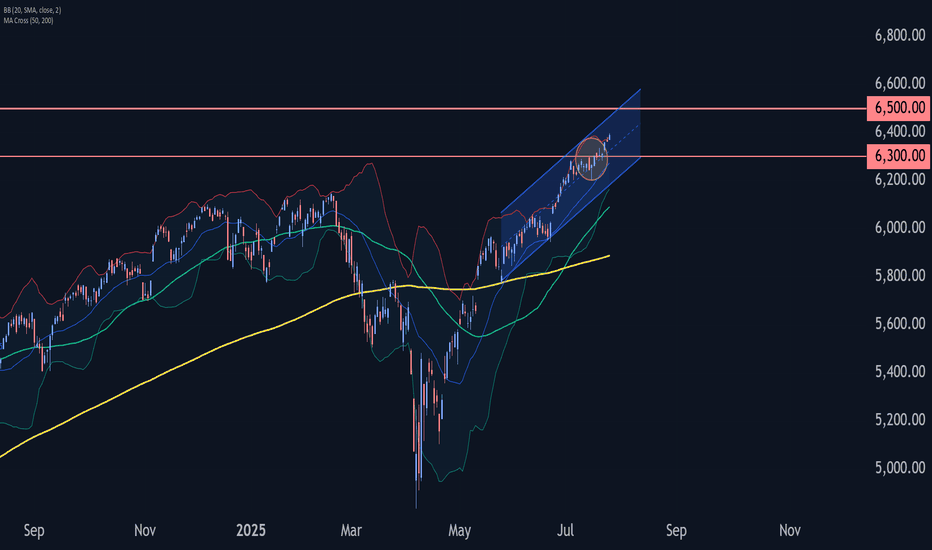

S&P 500 Index Wave Analysis – 25 July 2025

- S&P 500 Index broke key resistance level 6300.00

- Likely to rise to resistance level 6500.00

S&P 500 Index recently broke the key resistance level 6300.00 (which stopped the previous waves 5 and (B), as can be seen below).

The breakout of the resistance level 6300.00 continues the active intermediate impulse wave (5) from the middle of this month.

Given the strong daily uptrend, S&P 500 Index can be expected to rise to the next resistance level 6500.00 (coinciding with the daily up channel from May).

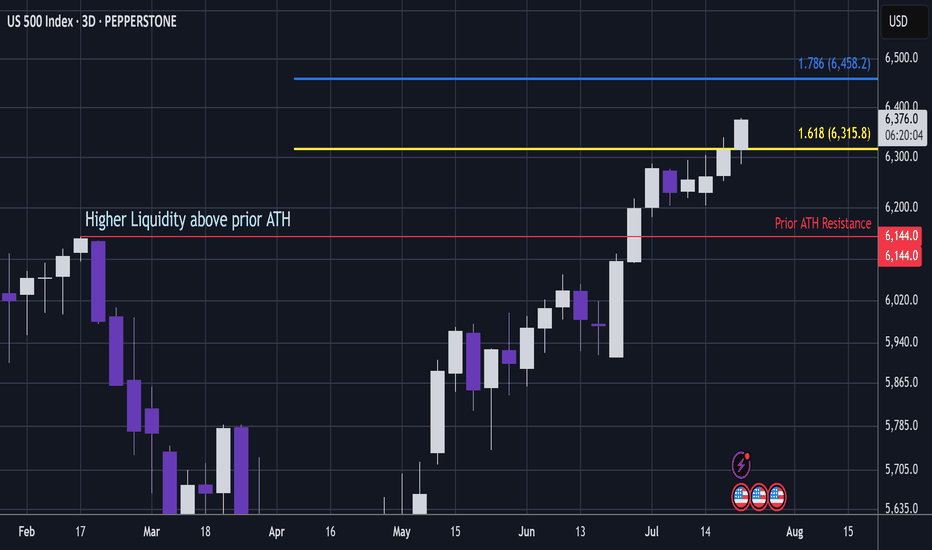

US500 - Can S&P Pass Critical Ratio / Liquidity ZoneS&P (Pepperstone CFD)

Price has popped above the 1.618 extension, which is a key ratio zone.

A bearish whipsaw in this area could be dangerous.

However, if price continues to push through this level, it signals that S&P is entering a very bullish phase.

The area above prior ATH resistance holds high liquidity.

If price moves beyond this ratio band, it will signal that a reversal in this zone is unlikely.

That said, if it’s still in this band when Trump tariffs are reinstated potentially on 1 August, then this is looking dangerous 🧐.

(Fib trendlines lower in the chart).

This analysis is shared for educational purposes only and does not constitute financial advice. Please conduct your own research before making any trading decisions.

US500 Pulls Back from 6,400– Correction or Trend Shift?The index has rejected the 6,400 🔼 resistance zone with a strong bearish candle, pulling back toward the 6,200 🔽 support region. Price is still trading within a bullish structure, but this drop may signal early signs of exhaustion.

Support Levels: 6,200 🔽, 6,100 🔽, 6,000 🔽

Resistance Levels: 6,300 🔼, 6,400 🔼

Bias:

🔼 Bullish: If price holds above 6,200 and reclaims 6,300, the uptrend remains intact and bulls may reattempt a push toward 6,400.

🔽 Bearish: A daily close below 6,200 could open a deeper retracement toward 6,100 or even 6,000.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

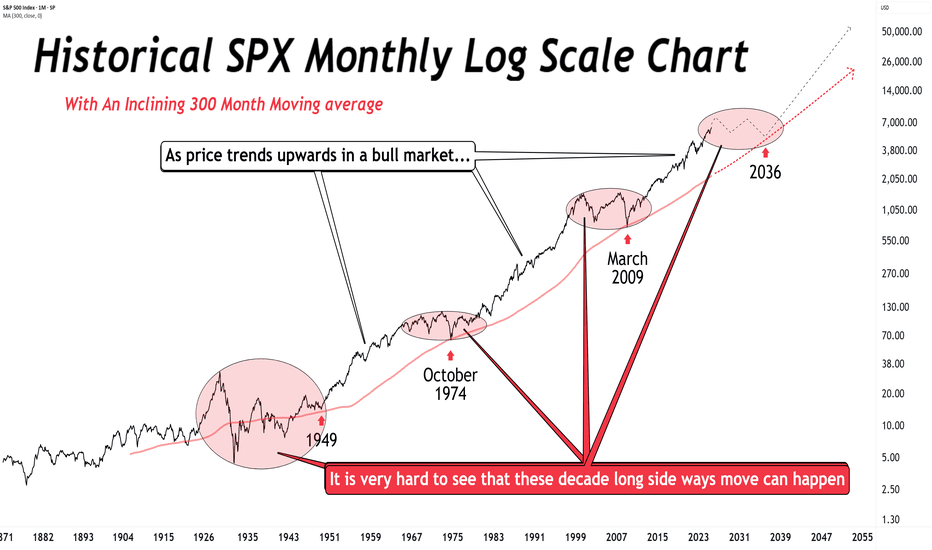

Before the perma-bulls go bonkers… Before the perma-bulls go bonkers… no, I’m not calling for a crash or bear market (yet).

But longer this bull runs, greater the odds of mean reversion.

Further we drift from 2009 without tagging the 300-month MA, more likely a sideways decade begins.

This will happen again.

You can't say we are "early" in the bull market. That simply is not true. Early is in the few years after the 2009 retouch of that very long term moving average. Can the indices still go up? Of course. But understand where you are in the cycle.

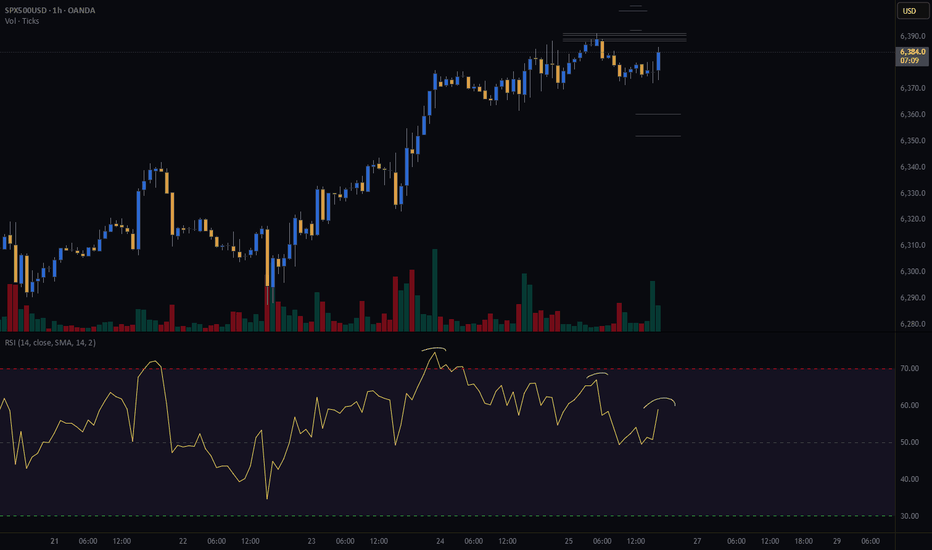

S&P Market Update – Signs of a Short-Term Correction?Although the S&P remains in an uptrend, recent price action suggests that momentum may be fading.

📉 Key Observations:

A Key Day Reversal occurred at 6409 – a potential warning signal.

We're seeing RSI divergence: price made a new high, but RSI didn’t follow suit.

The market is grinding higher, but without conviction.

📊 What to Watch:

The 15-day EMA, currently at 6317, is acting as near-term support. A close below this level could trigger a short-term correction.

Initial downside targets: 6147–6100, the previous highs from late 2024 and early 2025.

✅ To negate this bearish bias, the market would need to break above 6409 and continue higher with stronger momentum.

Stay alert — the technicals are flashing red flags. Always manage risk accordingly.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

Unlocking the Power of ORB (Opening Range Breakout)Unlocking the Power of ORB (Opening Range Breakout): A Proven Strategy for Intraday Traders

In the fast-paced world of intraday trading, simplicity and structure can often outperform complexity. One such time-tested strategy is the Opening Range Breakout (ORB) — a method favored by both discretionary and system traders for its clarity and adaptability.

📌 What is ORB (Opening Range Breakout)?

ORB refers to the price range (high and low) formed during the first few minutes (typically 5, 15, or 30) after the market opens. Traders look for a breakout above or below this range, anticipating strong momentum in that direction.

🧠 Why ORB Works

Volume Surge: The opening minutes see high institutional activity, creating genuine demand/supply signals.

Market Psychology: ORB captures trader sentiment as news digests overnight and is priced in at the open.

Defined Risk: The high/low of the range becomes a natural stop-loss area, allowing clean setups.

✅ Entry and Exit Rules for the ORB Strategy

Having a consistent framework helps you avoid emotional decisions. Here’s how you can structure your trades using ORB:

🔹 Entry Criteria:

Timeframe: Define your ORB window — e.g., first 15-minute candle.

Bullish Breakout Entry:

Enter long when price closes above the ORB high with volume confirmation.

Bearish Breakdown Entry:

Enter short when price closes below the ORB low with volume confirmation.

⚠️ Avoid entering on the first breakout candle. Wait for a close and retest, or a strong momentum candle for higher confidence.

🔹 Stop-Loss Placement:

For Long Trades: Place SL just below ORB low

For Short Trades: Place SL just above ORB high

🔹 Target/Exit Options:

Fixed RR Target: Aim for 1.5–2x your risk as initial target.

Mid/Outer Bands: Use indicator-drawn breakout bands (like those in LuxAlgo script) as profit zones.

Time-based Exit: Close position by end of session if price stalls or consolidates.

Trailing Exit: Trail your stop behind higher lows (long) or lower highs (short) after breakout.

📊 ORB in Action

You can explore this ready-to-use TradingView indicator to visualize ORB levels in real-time:

🔍 Indicator: Opening Range with Breakouts & Targets (by @LuxAlgo) Thanks to @LuxAlgo team to make this indicator available.

🛠️ Highlights:

Automatically marks the opening range

Plots breakout zones and targets

Ideal for intraday strategies

Works across indices, forex, and crypto

📓 Integrating ORB into Your Trading Journal App

If you're journaling ORB trades, consider logging:

✅ Symbol & timeframe

✅ ORB range (high/low)

✅ Breakout direction (long/short)

✅ Entry time & price

✅ Exit reason (target hit, SL hit, time-based exit)

✅ Notes: market sentiment, news drivers, volume confirmation

Over time, this data will help you:

🔍 Identify which assets respect ORB best

📈 Tune your RR ratio and stop placements

🧠 Reduce decision fatigue by automating setups

🧪 Want to Automate It?

Our trading journal app is ready with 🧠 AI-based journaling for feedback and refinement

🎯 Final Thoughts

ORB is a classic — not because it’s flashy, but because it offers structure, risk control, and repeatability. Whether you're a price action purist or using smart indicators, ORB can provide a disciplined edge — especially when integrated into a journaling and feedback loop.

📌 Start small. Track results. Tune your edge.

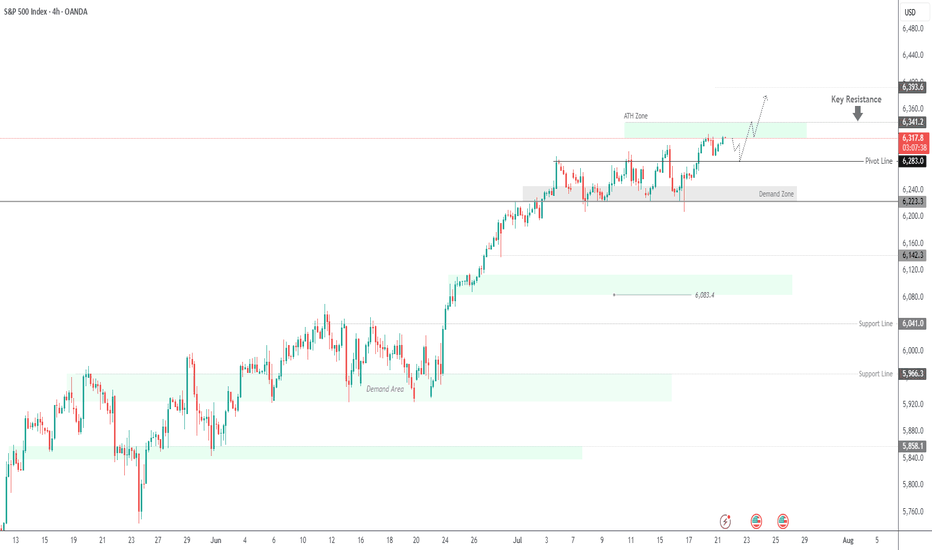

SPX500 Near ATH | Earnings Week Could Fuel Next MoveSPX500 | Weekly Outlook

The S&P 500 continues its bullish run, trading at record highs as investors await a critical week of tech earnings. Reports from Alphabet and Tesla could be key in justifying the lofty valuations driven by the AI boom.

Technical Outlook:

The price is expected to consolidate between 6341 and 6283 before any decisive move. A short-term bearish correction may occur initially, but if the price holds above the support zone, a push toward a new ATH at 6341 is likely. A breakout above this level could extend gains toward 6375 and 6393.

However, a break below 6283 would indicate weakness, potentially driving the price toward the demand zone near 6250 and 6224.

Support: 6283 · 6250 · 6224

Resistance: 6341 · 6375 · 6393

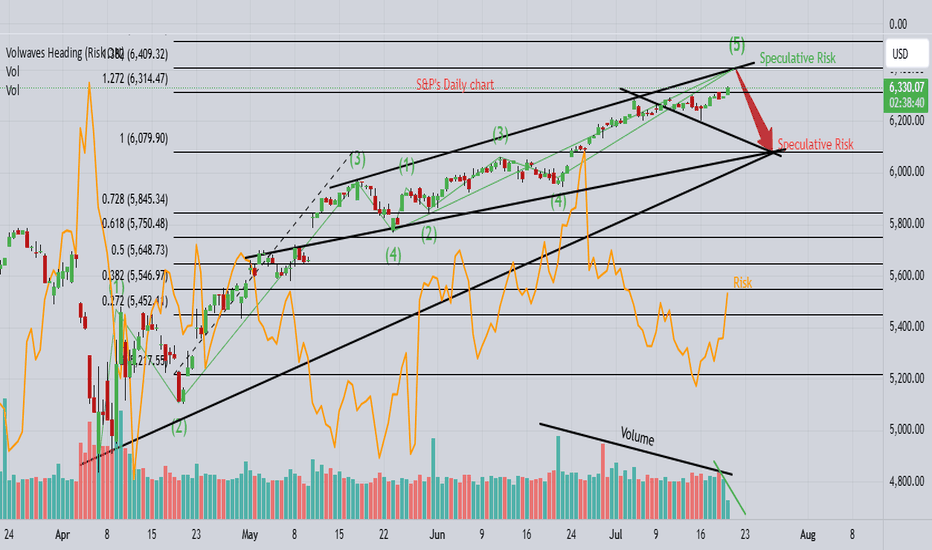

S&P's "hugely overbought" towards 6375!1). Position Volume dropping! 2). Big institutions (Banks & Insurance) have backed off on higher Risk positions! 3). Huge resistance at .728 fib & trend! 4). Trump tariff talk is likely adding to a fall as well! 5). We're looking for a "SELL" trade @ 6375, since buying is too risky at the moment...Good Luck!