SPX....what goes up, must go downThis is long overdue. SPX has just crossed 9SMA, next 50SMA then 200SMA. Won't be surprised if it knocks each very soon. This will be a big week and tariffs are going to start hitting; even though this was mostly artificial and Americans are paying 90% of it! When in doubt, sell and park in money market! The next dip will hit hard and deep. Don't let the small wins overshadow the deep issues in the economy. Overpriced market and many lagging indicators will soon hit and default rates that are coming out are scary! Stay safe and don't get emotional over any stock. If it dips, you can always buy it cheaper.

US500FU trade ideas

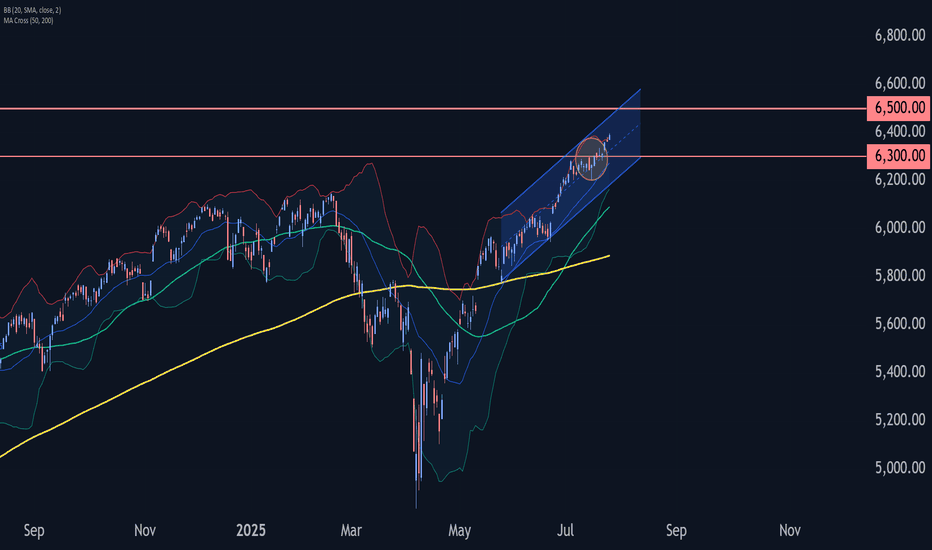

S&P 500 Index Wave Analysis – 25 July 2025

- S&P 500 Index broke key resistance level 6300.00

- Likely to rise to resistance level 6500.00

S&P 500 Index recently broke the key resistance level 6300.00 (which stopped the previous waves 5 and (B), as can be seen below).

The breakout of the resistance level 6300.00 continues the active intermediate impulse wave (5) from the middle of this month.

Given the strong daily uptrend, S&P 500 Index can be expected to rise to the next resistance level 6500.00 (coinciding with the daily up channel from May).

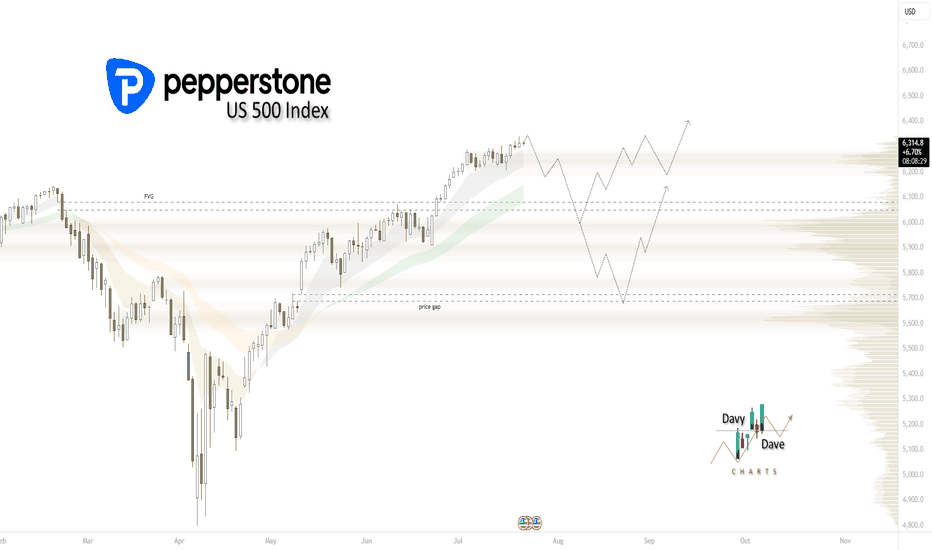

If we want a 2020-2021 style run, we need a seasonal pullbackUS 500 Index SP:SPX AMEX:SPY AMEX:VOO August seasonal scenario: institutional participation remains light, being outperformed by leveraged dip buying retail. How long can they remain on the sidelines, missing opportunities for their clients, before FOMO kicks in? Remember that institutions aren't emotionally driven, unlike their retail counter parts. That being said, they're itching to get in. What will compel them? IMO, a 5% pull back will incentivize them to buy. The August seasonal pull back may provide just that opportunity. If it comes, what happens in late Q3 and the rest of Q4 will likely be similar to 2020-2021. The deeper the pull back, the more impulsive it will likely be, as retail and institutions will be temporarily in tandem. SP:SPX PEPPERSTONE:US500 AMEX:SPY AMEX:VOO

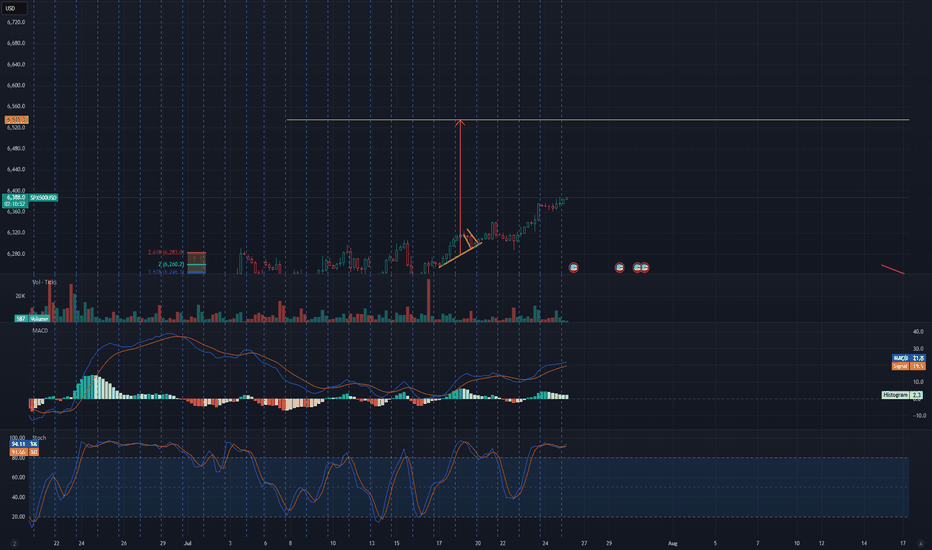

SPX500USD | Bulls Lose Steam at 6,424.5 ResistanceThe S&P 500 Index showed strong bullish momentum but is now pulling back after tagging resistance at 6,424.5. Price is currently hovering near 6,374.6, where previous structure may act as support.

Support at: 6,374.6 / 6,340.0 🔽

Resistance at: 6,424.5 🔼

🔎 Bias:

🔼 Bullish: Bounce from 6,374.6 and reclaim of 6,424.5 signals continuation.

🔽 Bearish: Break below 6,374.6 exposes 6,340.0 and lower zones.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

The Golden Age 7000 EOY SPXThe Golden Age (year) is here!

Have cash ready for May in April. Be heavy hedges going in to 26.

We're going to juice earnings with all the investments pouring in for just about every single industry. Once the injection is complete, we will reset while all the invested money completes projects.

GL!

Better Buy Bitcoin

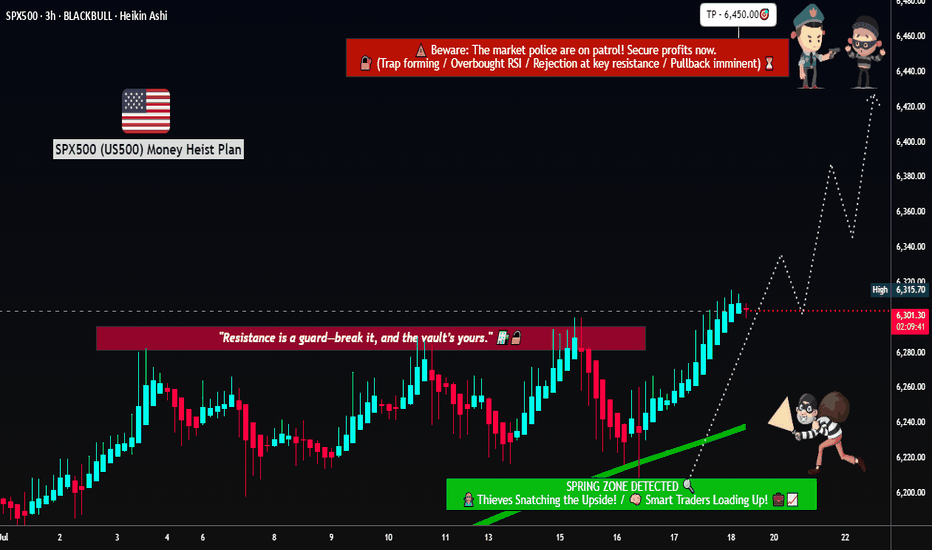

Rob the Rally SPX500: Enter Before Resistance Catches You🦹♂️💰**“SPX500 Street Heist” – Thief-Style Robbery Plan for Bulls!**📈💸

(Powered by Thief Trader's Market Robbing Tactics – Scalp | Swing | Day Trade Edition)

🌍Hello, Global Money Hunters!

📣 Salaam, Bonjour, Ola, Hola, Hallo, Marhaba & Welcome to the heist floor! 🎩💼

Thief Trader is back again with a loaded plan to rob the market clean — this time targeting the mighty SPX500 / US500 🎯. Based on a fusion of technical setups, macro sentiment, and the Thief Trading System, we’ve set our sights on the next breakout vault of Wall Street.

🎯 The Gameplan – Heist the Resistance Vault

The index is entering a high-risk resistance barricade — overbought, consolidated, and heavily guarded by bearish robbers (sellers). This is the zone where the market police lurk and trend reversals often get triggered. However, smart thieves always plan with precision.

Here’s the mission briefing:

🔓Entry Zone (Break-in Point)

💥 “The vault is open — grab the bullish loot!”

Enter Long anywhere close to market price or on pullbacks near recent swing lows/highs.

Preferred timeframes: 15-min to 30-min for sniper-level accuracy.

Deploy DCA-style limit orders (layered entries for maximum control).

🛑Stop Loss (Escape Hatch)

Base SL on recent swing low candle wicks on the 4H timeframe.

Suggested: ~6250.00 — but adapt based on your risk appetite, lot size, and position stacking.

📈Target / Loot Location

🎯 Primary Take-Profit: 6450.00

Or… pull out early if you spot resistance fighters guarding the vault.

Use trailing SL to secure gains and manage getaway.

⚡Scalper’s Notice

Only Long-side allowed!

Got big capital? Jump in now.

Running low? Tag along with swing traders and follow the robbery protocol.

Always protect your bag with dynamic trailing stops.

🧠Fundamental Fuel Behind the Plan

Bullish sentiment across major indices

Macro trends, COT positioning, sentiment outlook, and intermarket analysis all greenlit

Geopolitical and Fed tone supportive — tap into real data before entering

👉 Always analyze: News, Fundamentals, Sentiment, COT reports, and macro conditions.

🚨NEWS ZONE ALERT – No Loud Moves!

Avoid entry during major economic news drops

Use trailing SLs to guard profits

Don’t let your open trades get caught in the chaos of news releases!

💥Let’s Boost the Thief Army!

Smash the BOOST button 💖 to power up the robbery crew.

Support the strategy, share the love, and stay ahead of the game using Thief Trading Style. Every trade is a step closer to freedom from financial traps. 🚀💰🎉

📌Disclaimer: This is a general market analysis for educational purposes and should not be considered personal financial advice. Please evaluate your own risk management strategy before placing trades.

📌Markets shift fast — stay flexible, stay alert, and always rob smart.

🔥Stay locked in for the next heist plan — Thief Trader signing off for now…

💸💼📈 Trade smart. Rob harder. 🤑🦹♂️📊

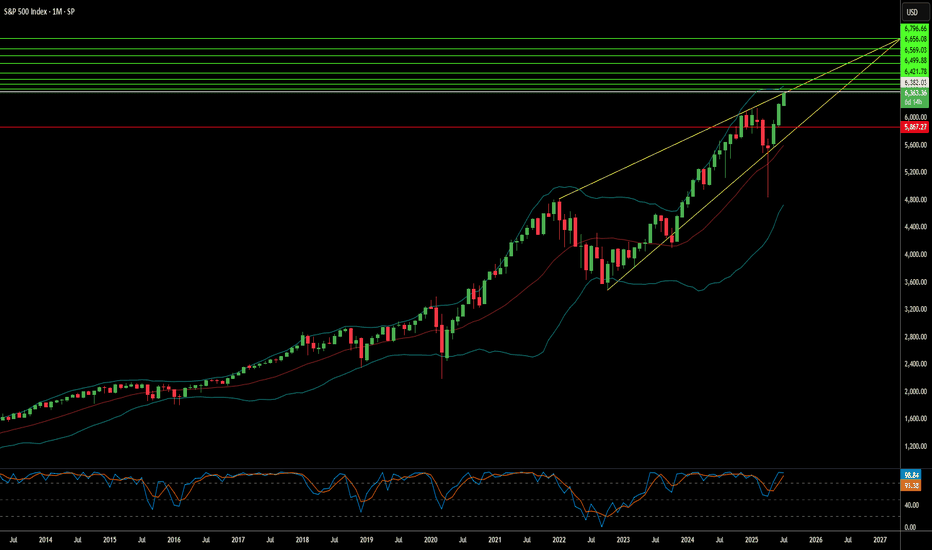

Can the S&P 500's Ascent Continue?The S&P 500 recently achieved unprecedented highs, reflecting a multifaceted market surge. This remarkable performance stems primarily from a robust corporate earnings season. A significant majority of S&P 500 companies surpassed earnings expectations, indicating strong underlying financial health. The Communication Services and Information Technology sectors, in particular, demonstrated impressive growth, reinforcing investor confidence in the broader market's strength.

Geopolitical and geostrategic developments have also played a crucial role in bolstering market sentiment. Recent "massive" trade agreements, notably with Japan and a framework deal with Indonesia, have introduced greater predictability and positive economic exchanges. These deals, characterized by reciprocal tariffs and substantial investment commitments, have eased global trade tensions and fostered a more stable international economic environment, directly contributing to market optimism. Ongoing progress in trade discussions with the European Union further supports this positive trend.

Furthermore, resilient macroeconomic indicators underscore the market's upward trajectory. Despite a recent dip in existing home sales, key data points like stable interest rates, decreasing unemployment claims, and a rising manufacturing PMI collectively suggest an enduring economic strength. While technology and high-tech sectors, driven by AI advancements and strong earnings from industry leaders like Alphabet, remain primary growth engines, some segments, such as auto-related chipmakers, face challenges.

The S&P 500's climb is a testament to the powerful confluence of strong corporate performance, favorable geopolitical shifts, and a resilient economic backdrop. While the immediate rally wasn't directly driven by recent cybersecurity events, scientific breakthroughs, or patent analyses, these factors remain critical for long-term market stability and innovation. Investors continue to monitor these evolving dynamics to gauge the sustainability of the current market momentum.

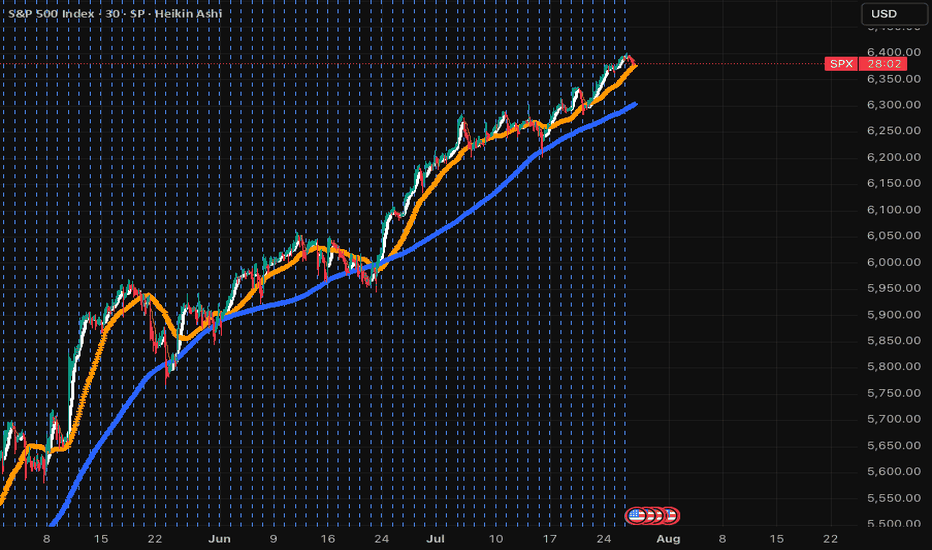

SPX chit chat... we're still up for nowAfter that crazy April 2025 crash, it feels like we should not be this high so fast... that's how I felt before too. But the rising channel is holding up right now. We are approaching the top. In previous times, the market grinded even higher (COVID pandemic was the last example).

Today we squeezed out new ATHs. The month ends next week and a new one begins. Less fear; more charts for the rest of the year.

See you in August!

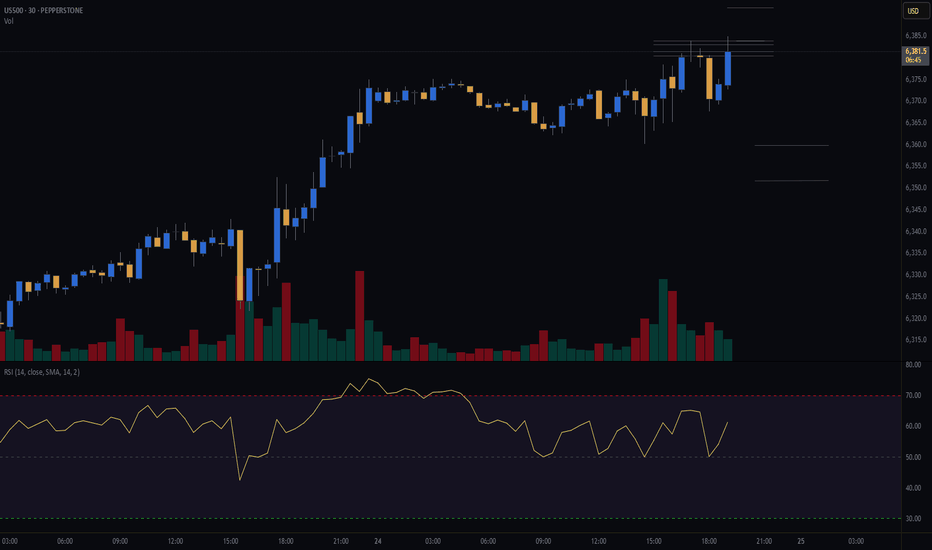

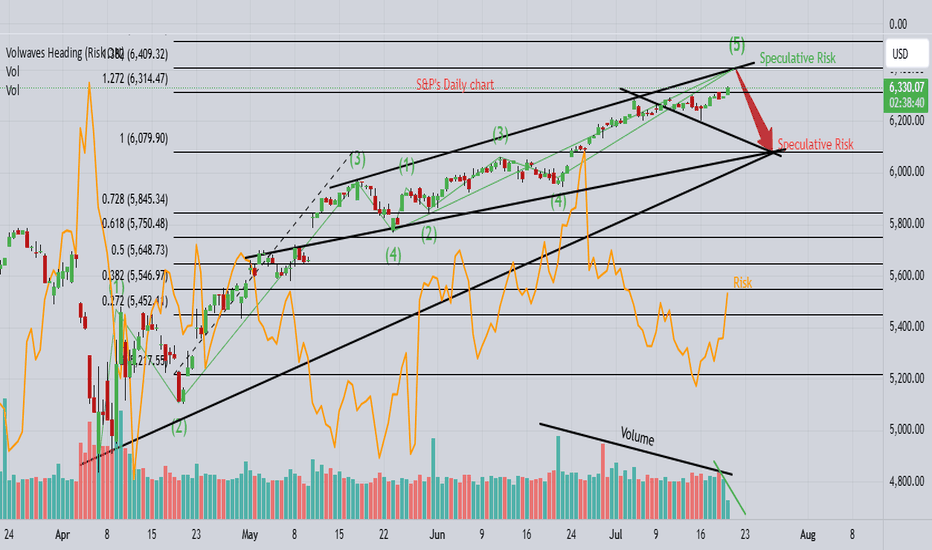

S&P's "hugely overbought" towards 6375!1). Position Volume dropping! 2). Big institutions (Banks & Insurance) have backed off on higher Risk positions! 3). Huge resistance at .728 fib & trend! 4). Trump tariff talk is likely adding to a fall as well! 5). We're looking for a "SELL" trade @ 6375, since buying is too risky at the moment...Good Luck!

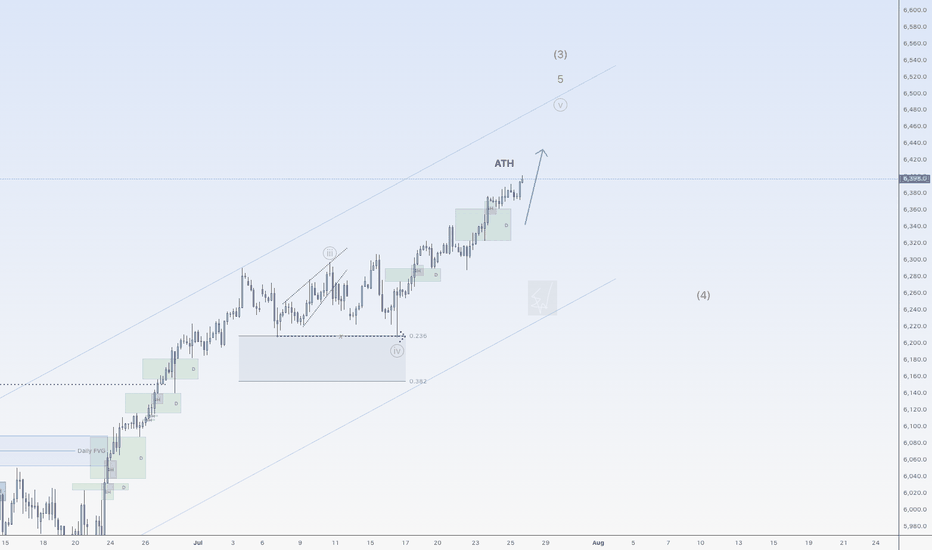

SPX500USD is on a riseHi traders,

Last week SPX500USD started the next impulse wave 5 (grey) as I've said in my outlook.

Next week we could see more upside for this pair.

Let's see what the market does and react.

Trade idea: Wait for a small pullback and a change in orderflow to bullish on a lower timeframe to trade longs.

NOTE: the next three weeks I'm on holiday so I will not post any outlook publicly.

If you want to learn more about trading FVG's & liquidity sweeps with Wave analysis, then please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

S&P500 sideways consolidation breakoutKey Developments:

Fed Politics: Treasury Secretary Scott Bessent called for a review of the Fed’s $2.5B HQ renovation, continuing political pressure on Jerome Powell. This adds to the uncertainty around Fed independence and rate path.

Meme Stock Surge:

Opendoor soared 121% amid a retail-driven frenzy.

Major institutional investors are also chasing the rally, pushing broader equities to record highs.

However, upcoming Alphabet and Tesla earnings could be a turning point for momentum.

Corporate News:

Hewlett Packard Enterprise suffered a $985M loss in the Autonomy case—corporate governance and M&A risks in spotlight.

Sarepta paused drug shipments amid backlash—biotech volatility rising.

LA Times plans IPO—media valuations may resurface.

Crypto Moves:

Trump Media bought $2B in Bitcoin and related assets, aiming to become a crypto treasury.

JPMorgan may lend against crypto, signaling broader institutional adoption.

Tech & AI:

MIT’s Andrew Lo predicts AI will make real investment decisions in 5 years.

OpenAI–Oracle to expand US data center capacity by 4.5 GW—significant tech infrastructure tailwind.

Conclusion for S&P 500 Trading:

The S&P 500 remains supported by strong risk appetite, AI optimism, and crypto momentum, but faces near-term tests from key tech earnings (Alphabet, Tesla). Political noise around the Fed and signs of speculative froth (meme stocks) could introduce volatility. Stay bullish with caution—watch earnings and Fed commentary closely for market direction.

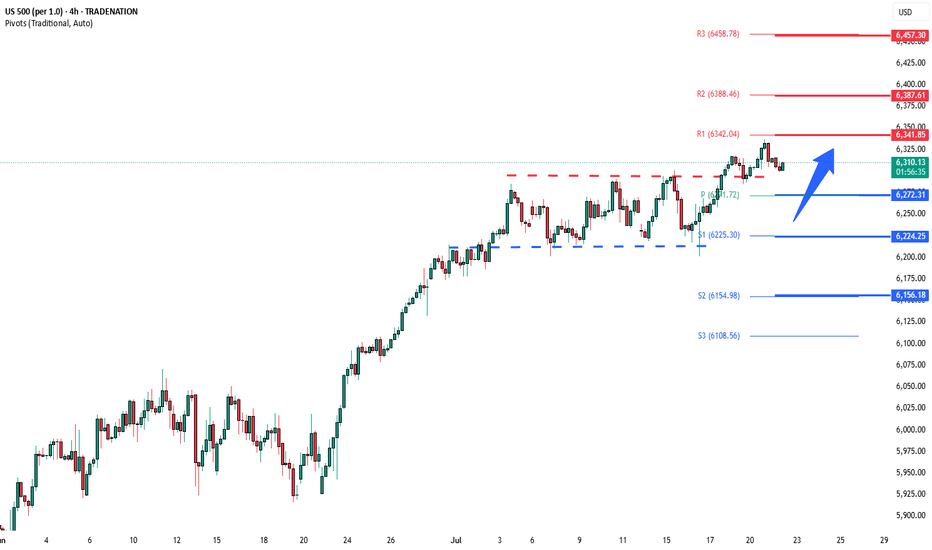

Key Support and Resistance Levels

Resistance Level 1: 6340

Resistance Level 2: 6390

Resistance Level 3: 6457

Support Level 1: 6270

Support Level 2: 6224

Support Level 3: 6156

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

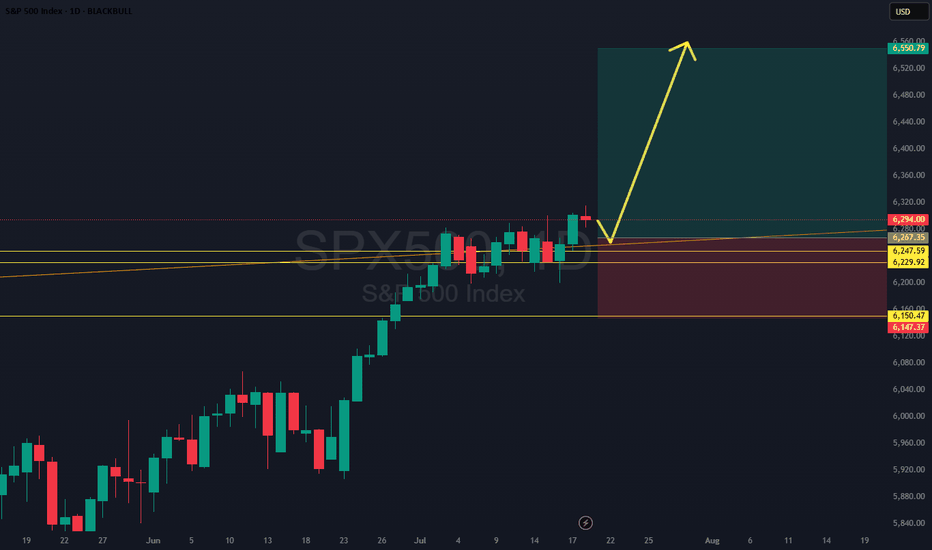

SPX500: Clean Breakout Setup - Trade of the Week?SPX500 just broke and closed above a key daily level, confirming strength after a bull flag formed off a skinny leg up. The plan? Wait for a retest of that flag structure, then ride momentum higher. We’ve got a conservative stop below solid support, making this one of the cleanest, most technically sound setups of the week. Only watch-out: price may not give the retest and could continue running. Either way, structure favors the bulls.

SPX 500 TO CONTINUE HIGHER Week of July 20, 2025 SPX500 will continue going higher as we don't have any reversal setup yet on the higher time frames, although there is a lot of hesitation on the chart as the past week's new high was not supported. The trend on 4 hours to weekly is still up and has no break of major moving averages yet. I am looking forward to either a capitulation new high candle or a bullish new high candle that breakout of the weekly consolidation zone as we enter another trading week. I hope my thought process and analysis is helpful for making your own trading or investment decisions.

Thank you for listening and wish everyone a great trading week.

Cheers

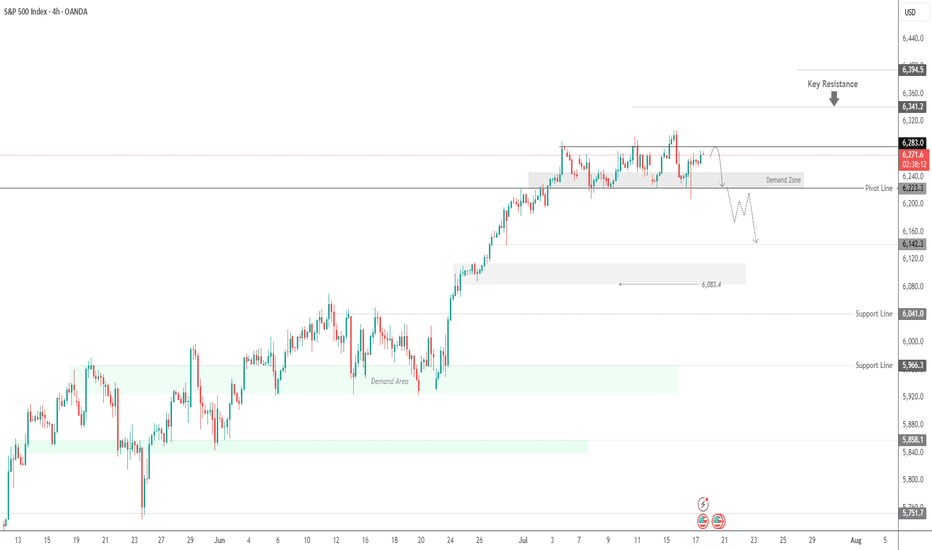

SPX500: Calm Returns, But Bearish Pressure Lingers Below 6283SPX500 OVERVIEW

Markets Calm After Powell Drama

Markets steadied Thursday following Wall Street's volatile reaction to uncertainty over Fed Chair Powell’s future. While President Trump denied plans to fire Powell, he admitted discussing the idea with lawmakers and hinted he'd prefer a resignation. For now, earnings and data are back in focus.

Technical View:

SPX500 is consolidating between 6283 and 6223.

A 1H close above 6283 may trigger a bullish move toward 6341.

Remaining below 6283 keeps bearish momentum intact toward 6223, and a break below that could start a deeper downtrend.

Key Levels:

Support: 6243, 6223, 6195

Resistance: 6305, 6341

3 month rally just not sustainable SPXThe economy is not doing horribly, but many are citing lagging indicators and there's signs of that this level is just not sustainable. Current levels abouve 9, 50, 200 SMAs! Seriously, what's great that isn't artificially propped up. Highest bankruptcies, highest level of housing unaffordability, dollar losing over 10% of value YTY, unemployment #s but that's bc people are giving up and it's a lagging indicator, hardship withdrawals up, defaults across the board up at over 10 year levels, banks with historic unrealized losses on their books (how much did Wells Fargo drop the other day!), yields going up up up. The Champage effect will end and many will get wiped out, unfortunately. Not being a dooms day person, but this economy is overheated and it's mostly driven by tech, which is over represented in the S&P. VIX is pretty low right now, would be an interesting play when it starts spiking (and it will!) when the deck starts falling apart.

Best of luck and always do your own due diligence.

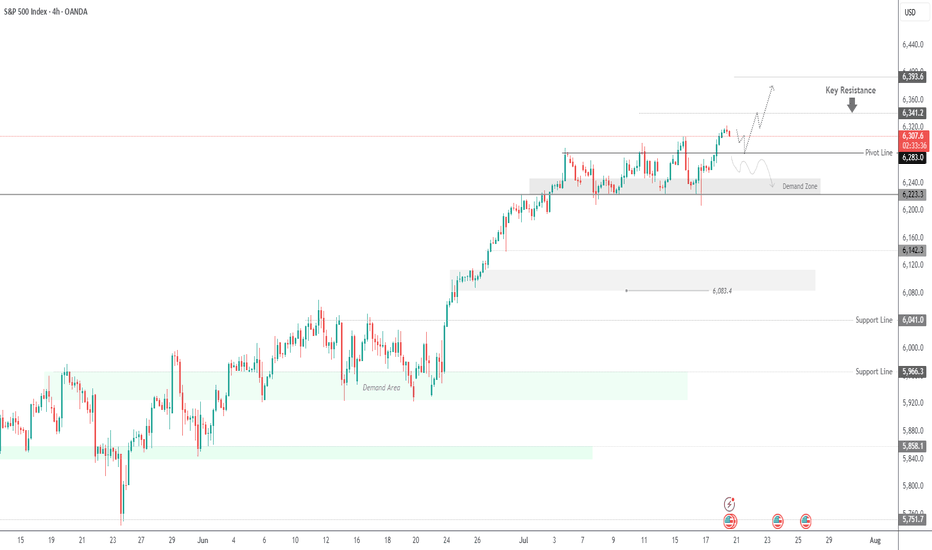

SPX500 Eyes Further Upside After Breaking to New HighSPX500 | Technical Overview

The price continued its bullish momentum after stabilizing above the 6283 support level, as anticipated. It has since posted a new all-time high (ATH) and is currently aiming for the next key resistance at 6341. A confirmed breakout above this level may open the path toward 6393.

On the downside, a break and sustained close below 6283 would shift the structure bearish in the short term, potentially targeting 6223.

Pivot line: 6283

Resistance: 6341 – 6393

Support: 6247 – 6223

previous idea:

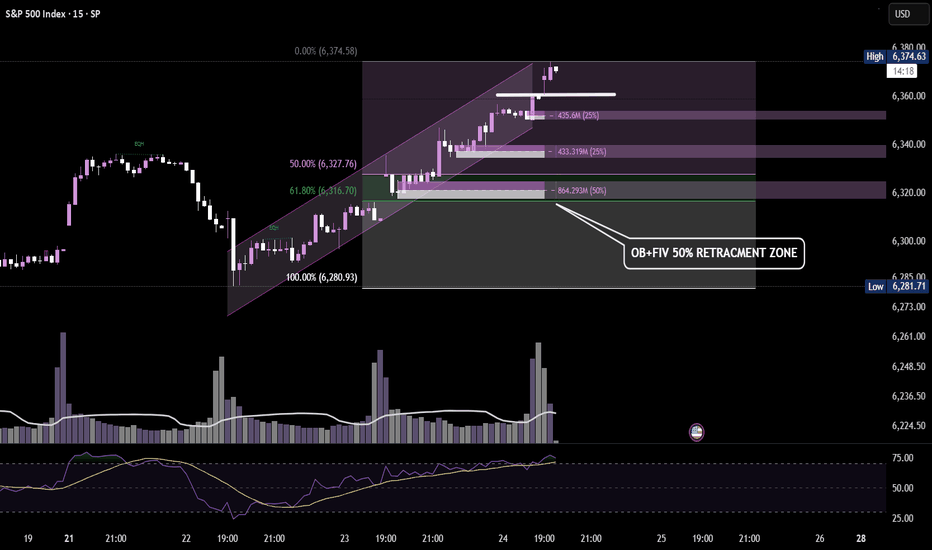

15_MinThis is a 15-minute timeframe chart, where each candlestick represents 15 minutes of trading activity. It is primarily used by intraday traders and scalpers to identify short-term trends, breakout zones, and momentum plays.

This chart of the S&P 500 (SPX) reflects intraday movements with real-time tracking of support/resistance zones, volume spikes, and short-term patterns.

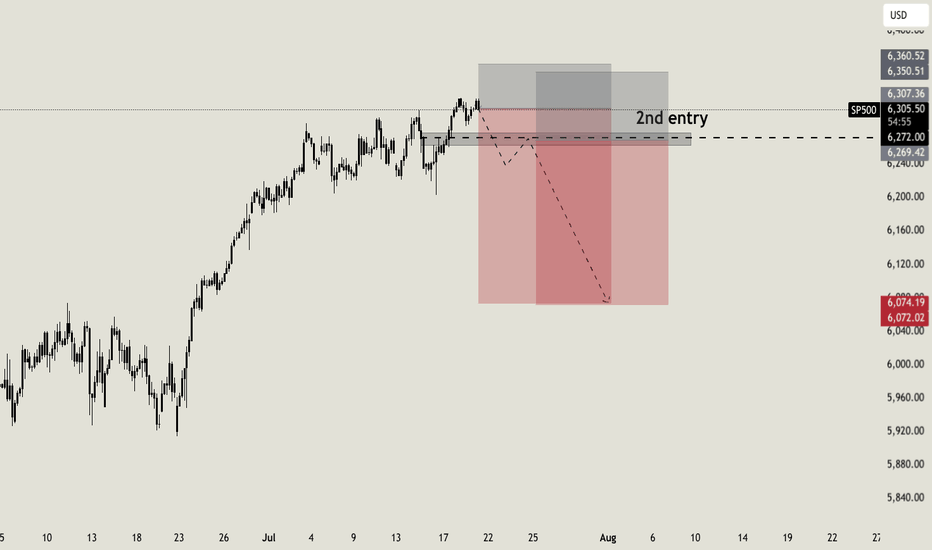

US500 Swing short tradeUS500 index is on the verge of major drop. I expect the price to sink in the coming weeks, that's why this will be a swing trade. I expect to reach my main target of $6000 around mid/end of August, with a second short entry once we will start to drop and retrace till my key level.