USA500 trade ideas

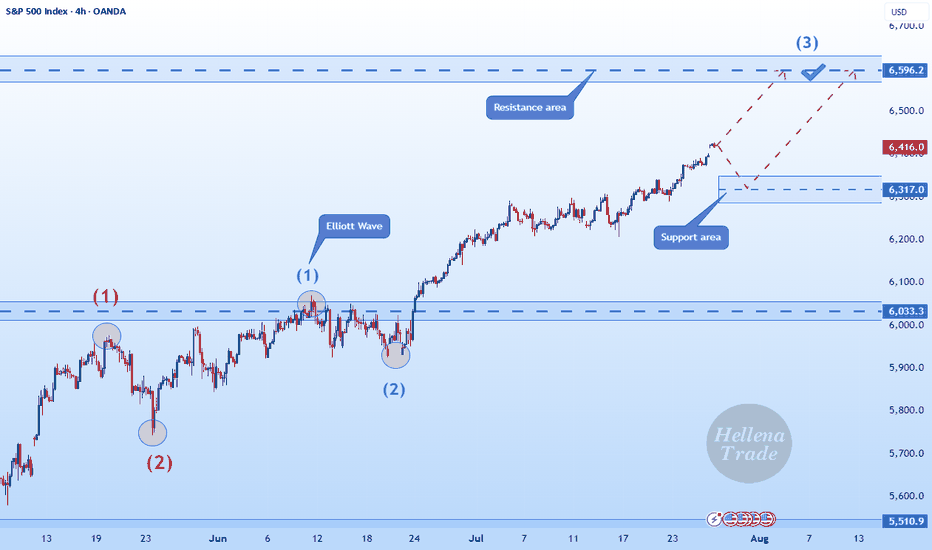

Hellena | SPX500 (4H): LONG to resistance area of 6596 .Dear colleagues, I haven't made a forecast for the SNP500 in a long time and was waiting for a correction, but it seems that a major correction is not yet close, and at the moment the price continues to be in an upward five-wave movement.

Therefore, I believe that we should expect to reach the 6596 area, which will mark the end of the medium-term wave “3.”

The corrections are not very deep at the moment, but the price may reach the 6317 area before continuing its upward movement.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

S&P 500 Bearish Pennant Signals Potential Downside MoveThe S&P 500 Index (SPX) is forming a bearish pennant pattern on the 30-minute chart, suggesting possible continuation of the recent downtrend. Price action is consolidating within converging trendlines after a sharp drop, with a breakdown below support near 6,360 potentially opening the door to further declines toward the 6,300 level. Traders should watch for confirmation with increased selling volume.

Pattern Structure: Price has made a steep drop, then entered a short consolidation bounded by converging trendlines (lower highs and higher lows).

Bias: This setup often signals a continuation of the prior trend — in this case, downward.

Trigger Level: A decisive break below the pennant’s lower support (around 6,360) could confirm the bearish signal.

Target Zone: If the breakdown occurs, the measured move could aim toward the 6,300–6,280 range, matching the height of the prior drop.

Risk Factor: A false breakout is possible, especially if broader market sentiment shifts bullish suddenly.

In short: The chart suggests sellers remain in control, and the next move hinges on whether support at ~6,360 holds or breaks.

US500 Bearish Idea: Waiting for Structure Break ConfirmationWatching the SPX US500 right now 📈 — it’s rallied hard with strong momentum and is pushing into a key resistance level ⚠️. Since price is overextended, I’m expecting a pullback towards equilibrium on the current move 🔄. My bias is bearish from this level 🔻, with entry dependent on a break in structure on the 30-min timeframe ⏳.

All is explained in the video 🎥 (not financial advice).

S&P500 Channel Up going straight to 6670.The S&P500 index (SPX) has been trading within a 3-month Channel Up since the May 12 candle. All of this time, it has been supported by the 1D MA50 (blue trend-line) and as long as it holds, the new Bullish Leg is expected.

The last two rose by +7.06%, and ahead of a new 1D MACD Bullish Cross, that gives us a medium-term Target of 6670.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Anticipating the market to go down this Thursday ....After my last BAD trade prediction, I just laid low for a little while, was very sick and visited some relatives for a little while. But I am jumping back on the horse, as they say.

I anticipate the market to go down this Thursday when jobless claims are reported.

I expect for whatever the news for it to be negative or not as good as expected.

I am using the Heikin Ashi candlesticks.

1) They show more of a directional movement within candlesticks.

2) They tend to filter out the market noise so you can see the market direction better.

3) It reduces false signals, allowing you to stay in the trade longer.

4) And, it also gives you a smoother appearance making it easier to see trends and reversals.

But I often switch between regular candlesticks as those are the candlesticks I started trading with and I still do get a little bit of information from the regular candlesticks.

I think we had an ascending triangle forming on the S&P with the tip forming on Friday, August 15th.

Usually, the chart can exit 2/3 before the tip. So it can start exiting the triangle before now and August 15, 2025 usually with some fundamental trigger. I suspect the trigger would be the jobless claims report on Thursday, August 14, 2025.

It can either exit up or down at the tip but I suspected that the market will exit down given the weekly indicators are suggesting a move down.

I am undecided on the targets as of yet. For some reason I think it will be a shallow move due to the slop of the weekly Stoch RSI.

STOPS:

1) the low of the previous Heikin Ashi candlestick,

2) 2 red Heikin Ashi candlesticks,

3) a specific dollar amount for a total loss for my trade or

4) a specific dollar amount per contract.

**If it hits one of those stops, I am out of my trade.

My trading plan only entails me to use 10% of my total account. If I am wrong on this trade, I will not implode my account.

Trade at your own risk, make sure you have stops in place, a trading plan and only use 10% or less of your account.

Happy Trading Everyone!

$SPX All Time High’s in view // Last Friday review

Ok, this is a review of last Friday’s price action from the setup provided in the member video. We opened with a gap up and a rally to the top of the implied move. We actually took it to the top of the 30 day average volatility, which rounded out was 6390

So 6390/6400 bear call spreads paid.

ATH’s not to far away here.

S&P 500 Bullish Rounding Bottom in PlayS&P 500 continues its upward trajectory, supported by a clearly defined rounding bottom formation. Price has successfully broken above the neckline resistance, followed by a technical pullback which was met with a strong buy reaction, validating this zone as a key demand area.

This pullback area now acts as a critical structural base and the current bounce reinforces bullish continuation bias. The active plan is to accumulate within the buy-back zone and follow the path laid out in the chart towards the projected upside targets.

Drop your stock requests in the comments for a quick analysis, only US-listed stocks will be reviewed under this post.

Watching July 31 High and August 1 Low - Key LevelsUS Inflation Next Week (CPI and PPI)

Will August re-test highs with momentum? Or test and fade?

MAGS back to highs.

AAPL has one of the best weeks since 2020's post covid crash recovery (WILD).

I still like long assets, but playing the game with discipline and patience.

Enjoy the weekend. Looking forward to the grind next week.

Thanks for watching!!!

-Chris

SPX500 in Focus – Breakout Needed Above 6346SPX500 – Technical Overview

The price is currently showing bearish momentum as long as it remains below 6341 and 6323, with a downside target at 6283.

🔻 As long as the price trades below 6341, the bearish bias remains intact.

🔼 For the trend to shift bullish, we need a confirmed 1H close above 6346, which could open the path toward 6365 and higher.

🔹 Resistance: 6341, 6365, 6389

🔹 Support: 6298, 6283, 6247

SPX500 at Key Pivot – Bearish Below 6365, Bullish AboveSPX500 – Market Overview

U.S. stock index futures rose on Friday after President Donald Trump’s temporary pick for a Federal Reserve governor boosted expectations for a more dovish central bank board.

Technical Outlook

Stability below 6365, we expect a move down toward 6341.

A 1H close below 6321 would likely extend the bearish trend toward 6301.

A 1H close above 6365 could trigger a push toward 6389.

A confirmed break above 6389 would shift the bias to bullish, targeting 6425 and 6453.

Pivot Line: 6365

Resistance: 6389 – 6425 – 6453

Support: 6341 – 6321 – 6301

S&P500 at pivot zone Stocks are climbing higher, with S&P 500 futures up on hopes for interest rate cuts and solid company earnings. The outlook is positive, especially in the finance world—bankers, hedge funds, and asset managers are expected to get higher bonuses this year, reflecting stronger market conditions.

On the global front, the US is looking to tighten control over chip exports to China by adding better tracking in semiconductors. At the same time, Taiwan’s TSMC reported a possible leak of trade secrets, which led to arrests.

Trade talks are also heating up. Japan and Switzerland are sending officials to the US to push for lower tariffs, while India’s government is heading to Moscow just after criticism from the US over its Russian oil purchases.

Conclusion for S&P 500:

The rally has strong backing from earnings and rate-cut hopes, but investors should be alert. Rotation into small-cap stocks could continue, while tech and chip sectors may face headwinds from new trade and security pressures.

Key Support and Resistance Levels

Resistance Level 1: 6380

Resistance Level 2: 6400

Resistance Level 3: 6436

Support Level 1: 6295

Support Level 2: 6256

Support Level 3: 6214

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Dot Com Crash CorrelationThe following is a fractal of the lead up to the Dot Com crash, and the aftermath. It correlates extremely well with the current landscape. The TLDR is that if history repeats and we break the trendline, we'll form a blow off top in 2026 and crash spectacularly in 2027 (I'm guessing around May, a common dump month). If everyone is calling for the crash now, it means it's not over yet.

It's time to face the music. AI isn't profitable, it's an excuse to fire workers with high salaries. When there is no one left to fire and productivity/quality drops the answer will be clear: A program that is wrong 20% of the time is completely useless. The errors are a feature, not a bug, the AI can not work without hallucinating and hallucinating causes errors. Look it up if you don't believe me

Fundamentals:

-Rate cuts will keep this alive long enough to form a blow off top

-Extreme uncertainty from tariffs to manufacturing can account for that mid term drop

-AI Companies holding up the market make 0 net profit and have no realistic plans to make ROI

-The vast majority of AI companies have not made ROI

-Generative AI costs more to run than it makes. By their own very flawed estimate, OpenAI will take over 10 years to break even. In related news, snapchat just made ROI and they were founded in 2011, their stock is down 90%.