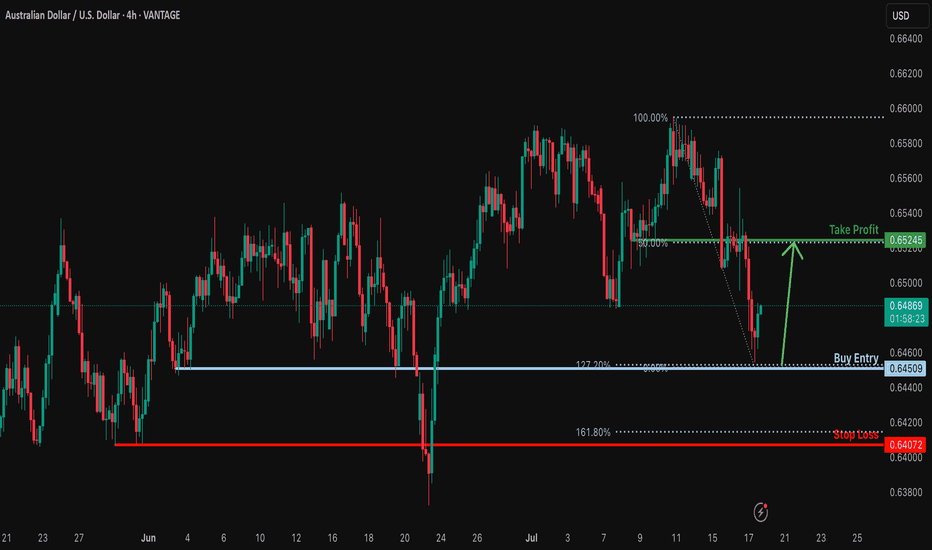

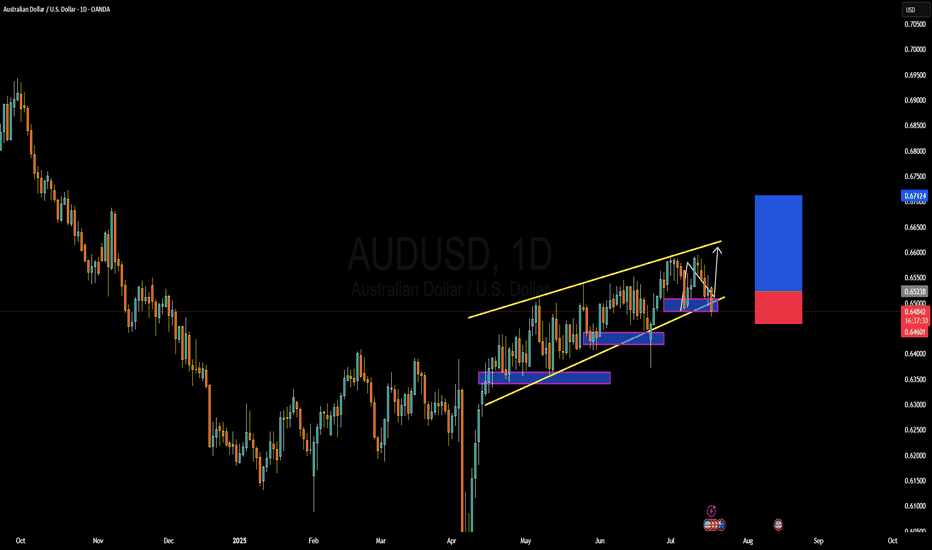

Bullish bounce off for the Aussie?The price has bounced off the support level which is a pullback support that aligns with the 127.2% Fibonacci extension and could potentially rise from this level to our take profit.

Entry: 0.6450

Why we like it:

There is a pullback support that aligns with the 127.2% Fibonacci extension.

Stop loss: 0.6407

Why we lik eit:

There is a pullback support that is slightly below the 161.8% Fibonacci extension.

Take profit: 0.6524

Why we like it:

There is an overlap resistance that lines up with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDAUD trade ideas

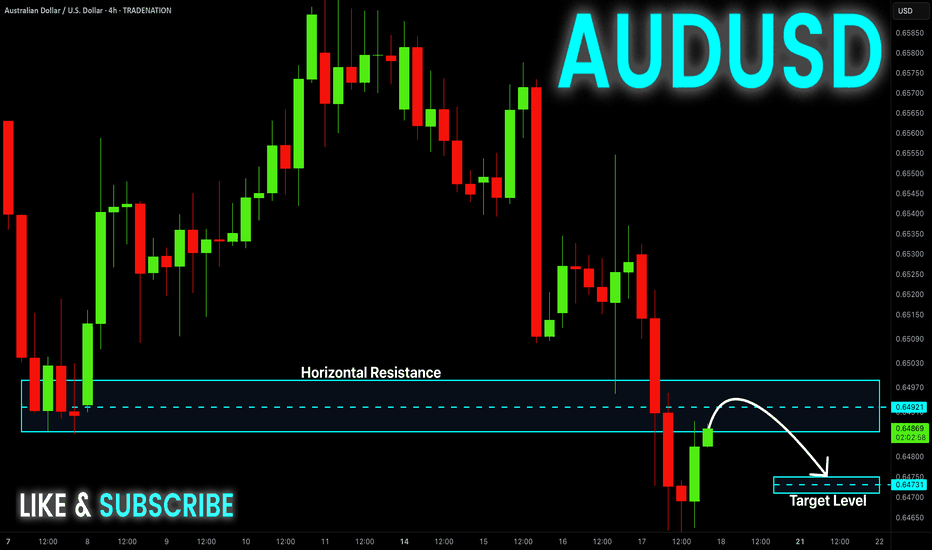

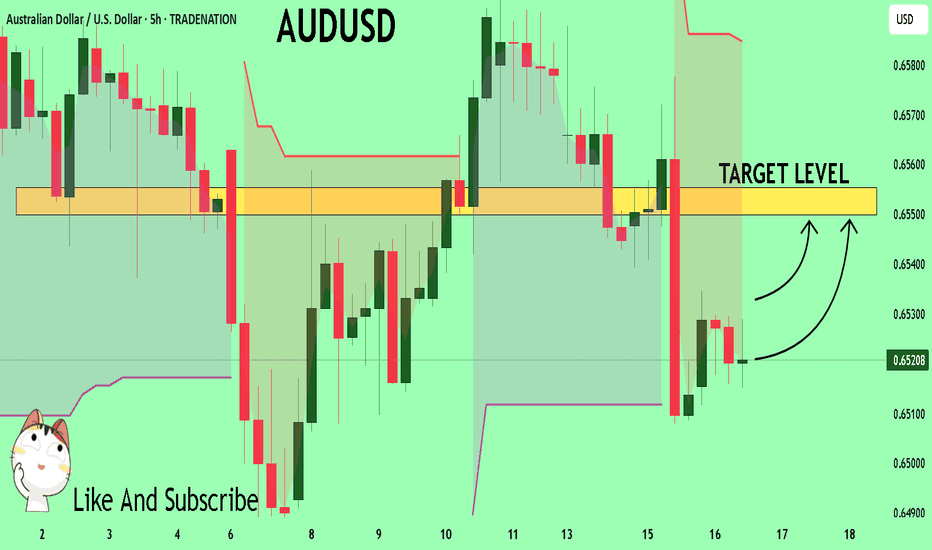

AUD-USD Local Short! Sell!

Hello,Traders!

AUD-JPY is making a bullish

Rebound and the pair is

Making a retest of the key

Horizontal resistance of 0.6497

From where we will be

Expecting a local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

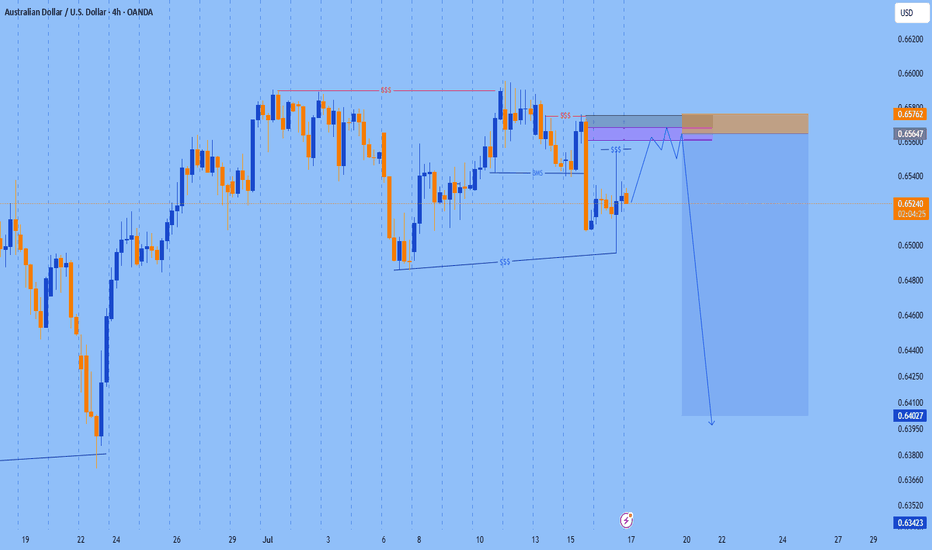

AUDUSD Bearish Breakout!

HI,Traders !

AUD-USD is trading in a sideways trend

and the pair

Made a breakout of the

Key horizontal level

Of 0.8149 which is now

A resistance and the pair

Is now making a retest

Of the level so as we are

Bearish biased we will

Be expecting a pullback

And a further bearish

Move down !

Comment and subscribe to help us grow !

AUDUSDWe're looking at a clean Break of Structure (BoS) followed by a textbook retest of the Area of Interest near 0.6530.

Price respected the demand zone perfectly after stop-hunt liquidity sweep below 0.6500, then surged upward.

Now consolidating back inside the zone with bullish momentum building.

Expecting a push toward 0.6575+ if we get continuation confirmation. 🎯

🟩 Area of Interest: 0.6525–0.6535

🟥 Stop: Below 0.6490

🎯 Target: 0.6575 and beyond

🔎 Confirmation via lower timeframe bullish engulfing

AUDUSD Forming Bullish MomentumAUDUSD is showing strong bullish momentum, and the current price structure confirms that the pair is gearing up for another potential rally. After building solid bullish pressure from key support zones, price has been making higher lows with clear buying interest stepping in on dips. I entered this setup earlier and am already in deep profit. With the momentum continuing to hold, I’m anticipating another wave to the upside in the coming sessions.

From a fundamental standpoint, the Australian dollar is currently benefiting from broad US dollar softness driven by expectations of a Fed rate cut later this year. As inflation cools in the US and the labor market shows signs of moderation, the Fed’s hawkish stance has softened, weakening the dollar across the board. At the same time, the Reserve Bank of Australia (RBA) has maintained a relatively firm tone, leaving the door open for further tightening if inflation pressures persist domestically. This divergence in central bank tone is favoring AUD strength.

Additionally, commodities like iron ore and copper—major Australian exports—have recently found renewed demand, particularly from China. With Chinese authorities signaling more fiscal and monetary stimulus to support their post-COVID recovery, the Australian economy stands to benefit, further supporting AUD upside. This commodity-backed strength adds another layer of support to the bullish AUDUSD narrative.

Technically, the pair has broken above a key resistance level and is now forming a bullish continuation pattern on the lower timeframes. Price action is supported by rising volume and moving averages starting to slope upward. The structure is clean, the fundamentals are supportive, and sentiment across TradingView shows increasing bullish interest in AUDUSD. I'm holding for higher levels as the bullish wave continues to develop.

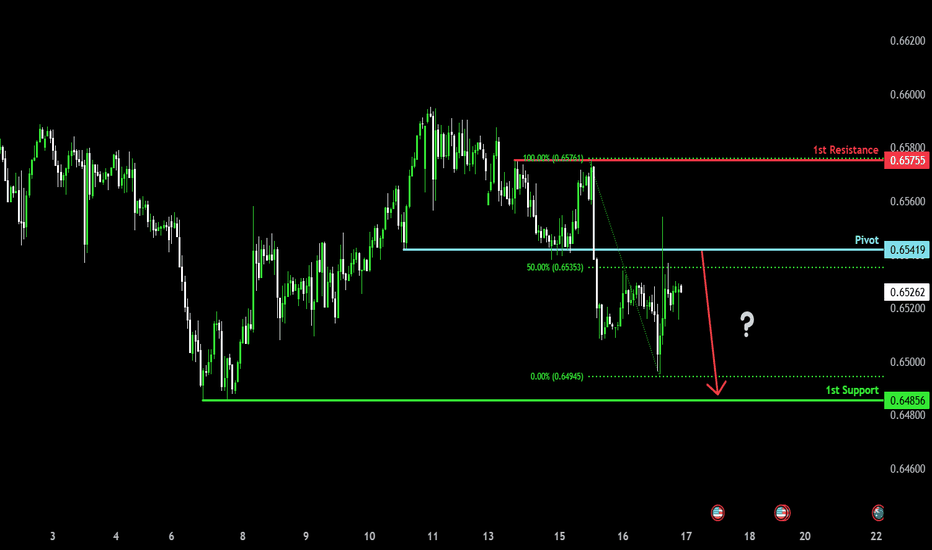

Bearish reversal?The Aussie (AUD/USD) is rising towards the pivot and could reverse to the 1st support.

Pivot: 0.6541

1st Support: 0.6485

1st Resistance: 0.6575

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

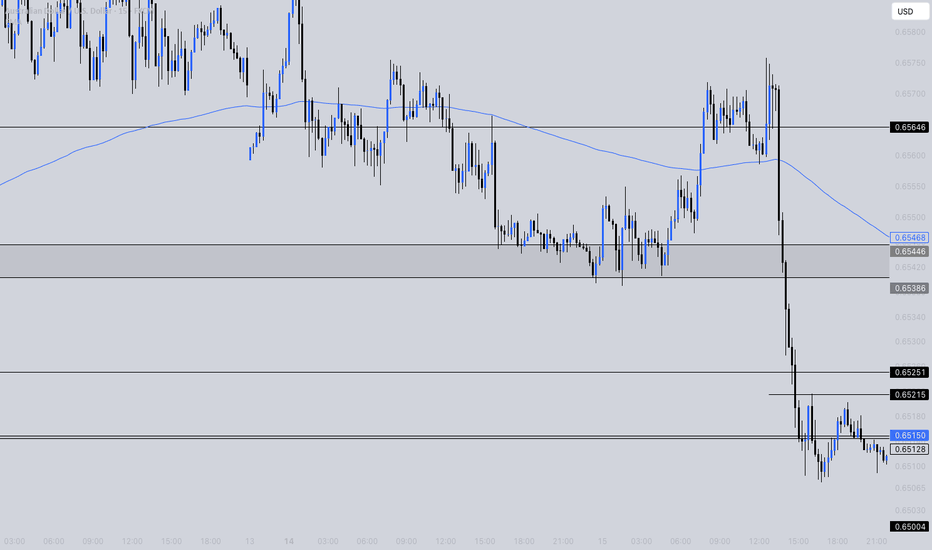

The only key levels you need - DITCH THE INDICATORS- Previous day high/Low

- Weekly high/low

- Session high/low

- Closing Price

In this specific example on OANDA:AUDUSD we have a day 3 Tuesday breakout fail reversal setup on the backside of a previous weeks expansion.

Fridays closing price was plotted going into Monday day 2 on the backside of a new week. Once the initial high low was set on day 2 below the previous weeks high and closing price we than look for short opportunities going into day 3 Tuesday.

In this case day 2 Ny session high acted as the reversal point staying below Friday closing price below the high of the previous week. The Asia/London session printed a beautiful high/low range reversing at near the midpoint of the previous days range (50% retrace.)

A great opportunity for a projected range expansion presented with confluence at a previous days low giving a solid set and forget trade with little to no stress or heat. This parabolic opportunity took place in the NY session below Fridays closing price to a previous weeks LOD level.

- Mondays High (Stop)

- NY session High, Fridays Close (Entry)

- Wed Low, Range expansion (Target)

KEY NOTES:

It is very important to keep your trading simple. As a newer trader I filled my chart with as many indicators as possible trying to find a "signal" because I lacked the patience for the market to give me a setup over multiple days. Now as a more experienced trader I sit back on higher time frames (1H/15M) TO WAIT FOR THE DAILY LEVELS TO PRINT. Avoiding trading inside a range on a low time frame. Lower time frames are only to decrease risk and increase position accuracy already derived from higher time frames. It is key to understand when higher time frame traders are triggered into a market and to understand there are only two main plays from key levels. Keep it simple, find the scalable setups, AND PUT THE SIZE ON WITH CONFIDENCE.

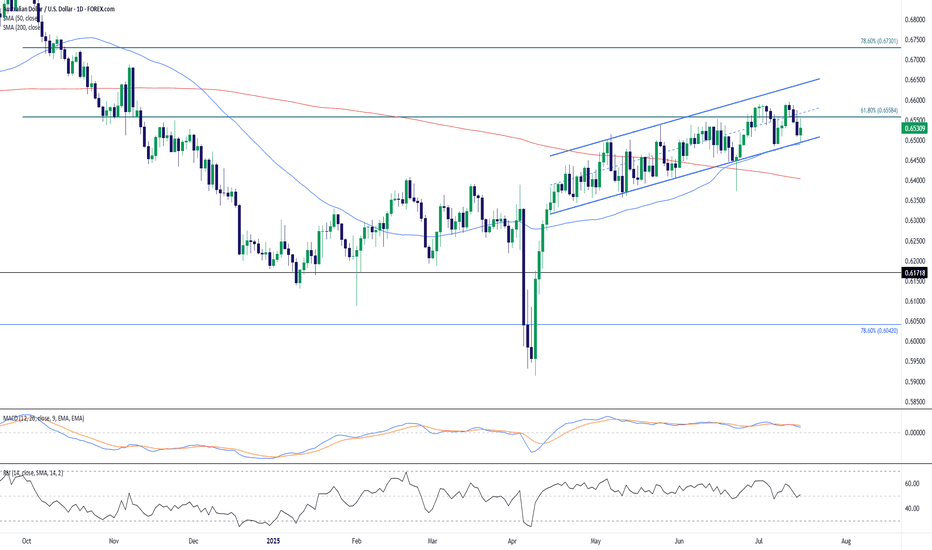

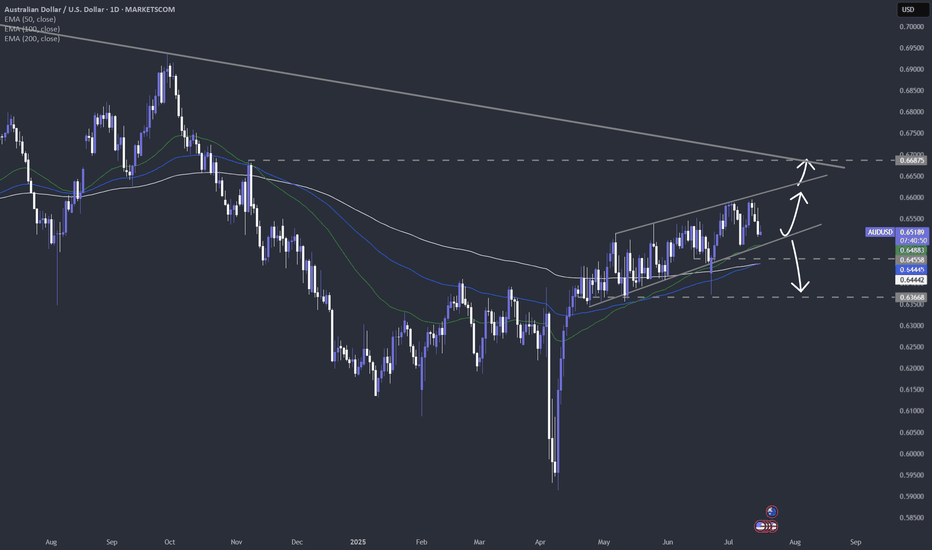

AUD/USD Technical Outlook: Rising Channel Faces Resistance Near The Australian Dollar remains in an upward-sloping channel against the U.S. Dollar on the daily timeframe. Price action has recently bounced from channel support near 0.6500, a key psychological and technical level, and is attempting to regain traction within the structure.

The 61.8% Fibonacci retracement of the July 2023 – April 2024 decline at 0.6558 is currently acting as resistance, coinciding with the upper half of the rising channel. A break above this could see momentum extend toward the 78.6% retracement zone near 0.6730.

The 50-day SMA is crossing above the 200-day SMA, forming a golden cross—typically a bullish continuation signal—though price is slightly below both moving averages, implying short-term indecision.

From an indicator perspective:

RSI hovers around 50, showing a neutral bias and confirming the consolidation phase.

MACD is flat and converging near the zero line, signaling weakening momentum and a possible pause or reversal.

A daily close below channel support could expose the 0.6450–0.6400 zone next, while sustained strength above 0.6558 could re-ignite bullish interest targeting the 0.6700–0.6730 region.

Overall, AUD/USD remains technically constructive as long as the channel holds, but traders should watch closely for a breakout or breakdown confirmation from current levels.

-MW

Australian job numbers and AUDWe are keeping a close eye on the Australian job numbers tonight. If you are trading AUD, then that's the data to watch. Let's dig in.

FX_IDC:AUDUSD

FX_IDC:AUDJPY

FX_IDC:AUDNZD

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

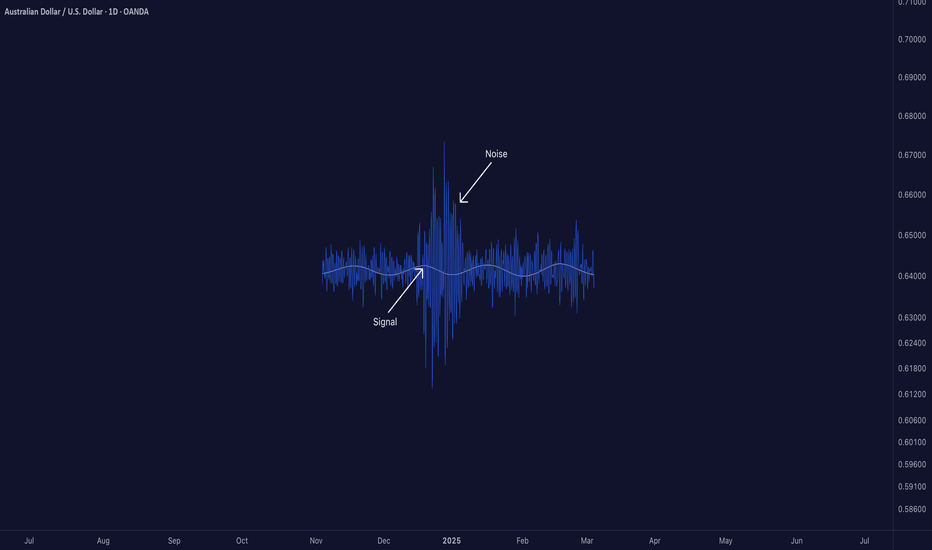

Signal-to-Noise Ratio: The Most Misunderstood Truth in Trading█ Signal-to-Noise Ratio: The Most Misunderstood Truth in Quant Trading

Most traders obsess over indicators, signals, models, and strategies.

But few ask the one question that defines whether any of it actually works:

❝ How strong is the signal — compared to the noise? ❞

Welcome to the concept of Signal-to-Noise Ratio (SNR) — the invisible force behind why some strategies succeed and most fail.

█ What Is Signal-to-Noise Ratio (SNR)?

⚪ In simple terms:

Signal = the real, meaningful, repeatable part of a price move

Noise = random fluctuations, market chaos, irrelevant variation

SNR = Signal Strength / Noise Level

If your signal is weak and noise is high, your edge gets buried.

If your signal is strong and noise is low, you can extract alpha with confidence.

In trading, SNR is like trying to hear a whisper in a hurricane. The whisper is your alpha. The hurricane is the market.

█ Why SNR Matters (More Than Sharpe, More Than Accuracy)

Most strategies die not because they’re logically flawed — but because they’re trying to extract signal in a low SNR environment.

Financial markets are dominated by noise.

The real edge (if it exists) is usually tiny and fleeting.

Even strong-looking backtests can be false positives created by fitting noise.

Every quant failure story you’ve ever heard — overfitting, false discoveries, bad AI models — starts with misunderstanding the signal-to-noise ratio.

█ SNR in the Age of AI

Machine learning struggles in markets because:

Most market data has very low SNR

The signal changes over time (nonstationarity)

AI is powerful enough to learn anything — including pure noise

This means unless you’re careful, your AI will confidently “discover” patterns that have no predictive value whatsoever.

Smart quants don’t just train models. They fight for SNR — every input, feature, and label is scrutinized through this lens.

█ How to Measure It (Sharpe, t-stat, IC)

You can estimate a strategy’s SNR with:

Sharpe Ratio: Signal = mean return, Noise = volatility

t-Statistic: Measures how confident you are that signal ≠ 0

Information Coefficient (IC): Correlation between forecast and realized return

👉 A high Sharpe or t-stat suggests strong signal vs noise

👉 A low value means your “edge” might just be noise in disguise

█ Real-World SNR: Why It's So Low in Markets

The average daily return of SPX is ~0.03%

The daily standard deviation is ~1%

That's signal-to-noise of 1:30 — and that's for the entire market, not a niche alpha.

Now imagine what it looks like for your scalping strategy, your RSI tweak, or your AI momentum model.

This is why most trading signals don’t survive live markets — the noise is just too loud.

█ How to Build Strategies With Higher SNR

To survive as a trader, you must engineer around low SNR. Here's how:

1. Combine signals

One weak signal = low SNR

100 uncorrelated weak signals = high aggregate SNR

2. Filter noise before acting

Use volatility filters, regime detection, thresholds

Trade only when signal strength exceeds noise level

3. Test over longer horizons

Short-term = more noise

Long-term = signal has more time to emerge

4. Avoid excessive optimization

Every parameter you tweak risks modeling noise

Simpler systems = less overfit = better SNR integrity

5. Validate rigorously

Walk-forward, OOS testing, bootstrapping — treat your model like it’s guilty until proven innocent

█ Low SNR = High Uncertainty

In low-SNR environments:

Alpha takes years to confirm (t-stat grows slowly)

Backtests are unreliable (lucky noise often looks like skill)

Drawdowns happen randomly (even good strategies get wrecked short-term)

This is why experience, skepticism, and humility matter more than flashy charts.

If your signal isn’t strong enough to consistently rise above noise, it doesn’t matter how elegant it looks.

█ Overfitting Is What Happens When You Fit the Noise

If you’ve read Why Your Backtest Lies , you already know the dangers of overfitting — when a strategy is tuned too perfectly to historical data and fails the moment it meets reality.

⚪ Here’s the deeper truth:

Overfitting is the natural consequence of working in a low signal-to-noise environment.

When markets are 95% noise and you optimize until everything looks perfect?

You're not discovering a signal. You're just fitting past randomness — noise that will never repeat the same way again.

❝ The more you optimize in a low-SNR environment, the more confident you become in something that isn’t real. ❞

This is why so many “flawless” backtests collapse in live trading. Because they never captured signal — they captured noise.

█ Final Word

Quant trading isn’t about who can code the most indicators or build the deepest neural nets.

It’s about who truly understands this:

❝ In a world full of noise, only the most disciplined signal survives. ❞

Before you build your next model, launch your next strategy, or chase your next setup…

Ask this:

❝ Am I trading signal — or am I trading noise? ❞

If you don’t know the answer, you're probably doing the latter.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

AUDUSD Set To Grow! BUY!

My dear subscribers,

AUDUSD looks like it will make a good move, and here are the details:

The market is trading on 0.6521 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.6550

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUD/USD BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are now examining the AUD/USD pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 0.652 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

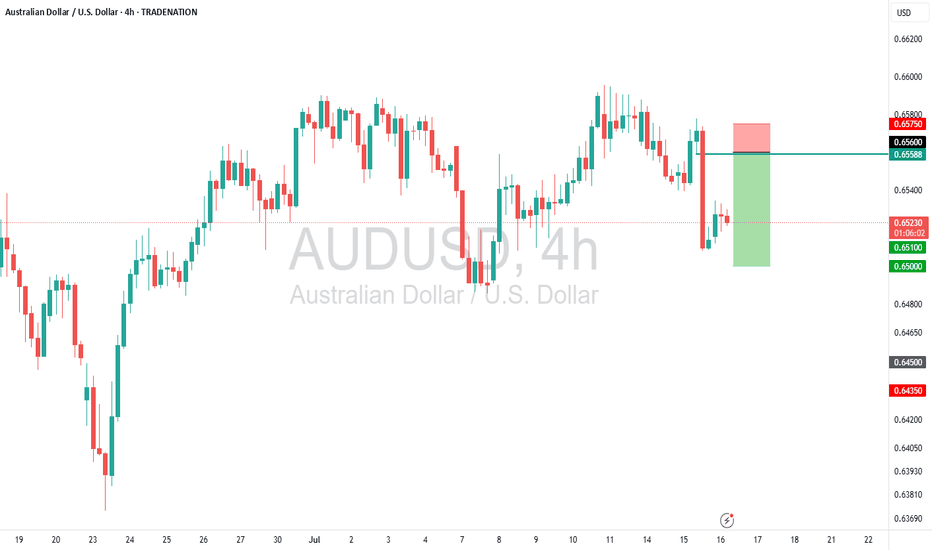

AUDUSD – Sell Into Rally as Top Formation DevelopsTrade Idea

Type: Sell Limit

Entry: 0.6560

Target: 0.6500

Stop Loss: 0.6575

Duration: Intraday

Expires: 17/07/2025 06:00

Technical Overview

Recent price action has been mixed and volatile, with signs that a top is forming.

The preferred strategy is to sell into rallies, capturing potential exhaustion near resistance.

Bespoke resistance at 0.6560 aligns perfectly with the entry, offering a high-probability area for reversal.

A move lower to 0.6500 would confirm bearish momentum and complete the expected corrective move.

Watch for upcoming key data events:

US PPI data (16/07 at 13:30 UTC), and

Australian Employment data (17/07 at 02:30 UTC), both of which could increase volatility and provide catalysts.

Key Technical Levels

Resistance: 0.6570 / 0.6590 / 0.6600

Support: 0.6520 / 0.6500 / 0.6480

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

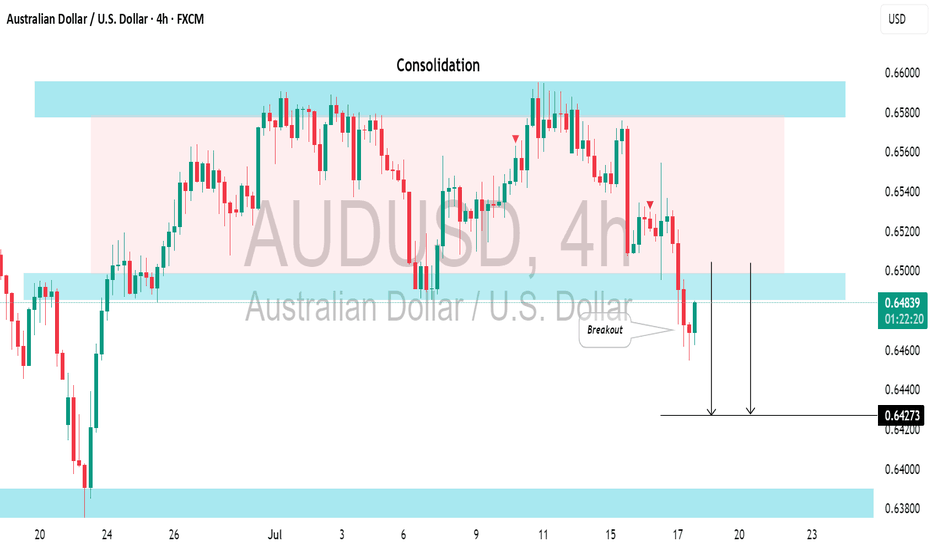

AUDUSD: Consolidation ContinuesThe AUDUSD is currently consolidating within a broad horizontal channel.

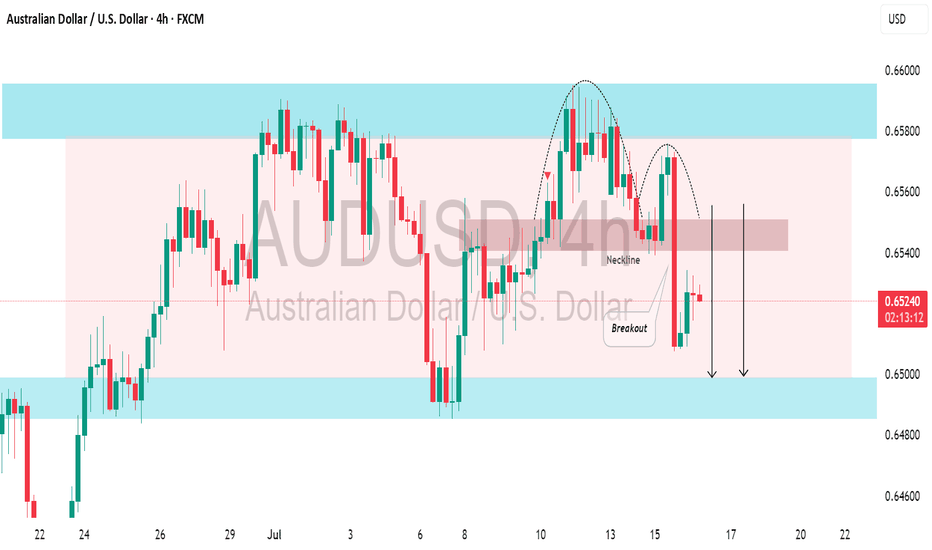

A notable bearish response to resistance has occurred, with the formation of a cup and handle pattern leading to a decline.

There is a strong likelihood that the price will soon hit the 0.6500 level.