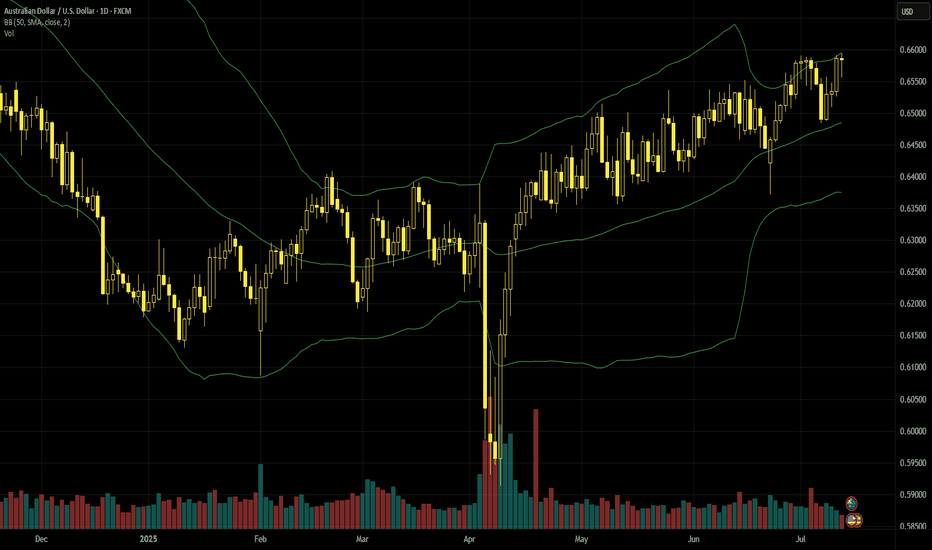

AUDUSD Cautiously Bullish As US PI Data Looms This is the Weekly FOREX Forecast for the week of July 14 - 18th.

In this video, we will analyze the following FX market: AUDUSD

The AUDUSD has been grinding higher for weeks. Only Friday closed with a hint of a pullback starting. The RBA is looking for the US CPI Data to post. If the inflation numbers are a bit hot, this will strengthen the USD against the AUD. A soft CPI should see the market pricing back in higher chances of a third cut by year-end and weigh on the US dollar.

We'll see how the market reacts on Tuesday.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

USDAUD trade ideas

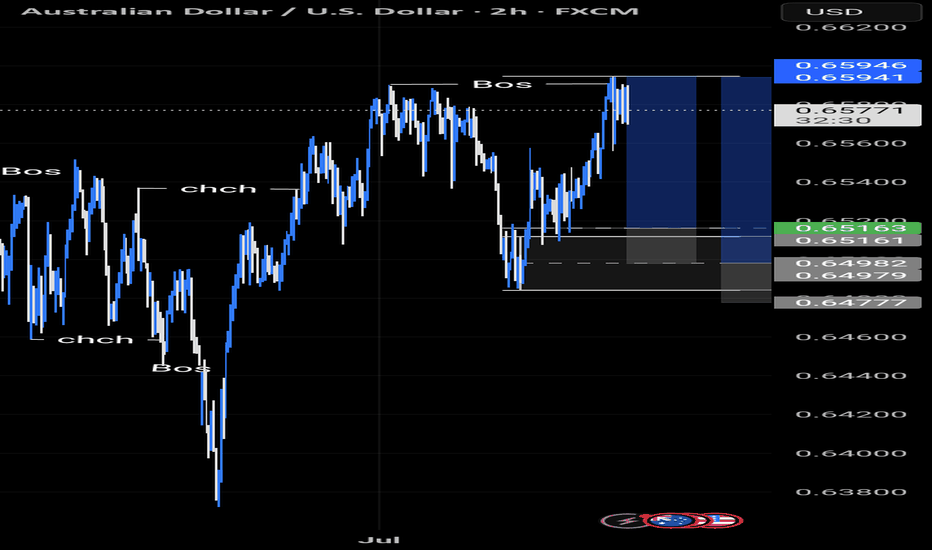

AUDUSD 4Hour TF - July 13th,2025AUDUSD 7/13/2025

AUDUSD 4hour Bullish idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bullish

4hour - Bullish

We’re looking like we’re back to bullish after last week. The 4Hour timeframe has been moving up nicely and as of last week we’re sitting just below 0.65800. Going into this week we’re looking mainly bullish but we are still going to mark up two potential scenarios:

Bullish Continuation - This is looking like the most likely scenario. Ideally, price action pushes above 0.65800 then retests as support and confirms the next higher low. I’d be interested in positions as the higher low is forming and as I can spot bullish conviction to enter long on.

Bearish Reversal - Even though it’s likely we will continue bullish, a reversal is still possible as nothing is definite. For us to consider bearish setups we would need to see a break below 0.65500 with a retest of that zone as new resistance. Look for a lower high to short on below 0.65500.

AUDUSD Selling Trading IdeaHello Traders

In This Chart AUDUSD HOURLY Forex Forecast By FOREX PLANET

today AUDUSD analysis 👆

🟢This Chart includes_ (AUDUSD market update)

🟢What is The Next Opportunity on AUDUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

Week of 7/13/25: AUDUSD AnalysisLast week pushed bullish and demand is still in control on all time frames, so we are going to follow bullish order flow.

Looking for bottom liquidity to be taken in the local range before getting in on a long.

Major News:

Tuesday - CPI

Wednesday - PPI

Thursday - Unemployment

AUDUSD SHORT & LONG – WEEKLY FORECAST Q3 | W 29 | Y25💼 AUDUSD SHORT & LONG – WEEKLY FORECAST

Q3 | W 29 | Y25

📊 MARKET STRUCTURE OVERVIEW

AUDUSD is currently trading around a previously mitigated Daily and 4H Order Block zone.

Price has shown signs of short-term bearish momentum on lower timeframes (1H & 15m), but the broader structure still allows for bullish re-entries from deeper discounted levels.

We’re entering a key decision zone with potential for both short and long opportunities, depending on intraday confirmation.

🔍 Confluences to Watch 📝

✅ Daily OB – Previously Mitigated

Larger structure still holds room for bullish continuation if key internal supports hold.

✅ 4H OB – Mitigated with Initial Rejection

✅ 1H & 15m OBs – Valid for Intraday Shorts

Clean bearish structure on intraday timeframes.

Potential shorts available

📈 Risk Management Protocols

🔑 Core Principles

Risk per trade: Max 1%

Only act at planned levels — never chase

RR minimum: 1:2

Use scaling techniques on intraday shorts, and hold conviction for swings when structure confirms

🧠 Your risk plan is your protection. Without it, your strategy is meaningless.

🧠 Weekly FRGNT Insight

“Bias is flexible. Discipline is not.”

Adapt to what price gives — but never abandon your risk framework.

🏁 Final Thoughts from FRGNT

📌 Both short and long opportunities are valid this week.

📌 Choose your bias based on structure + confirmation.

📌 Let the order flow lead and risk management guide.

❤️ Stay sharp, stay structured. I’ll see you at the very top.

🎯 Trade consistent. FRGNT X

AUSSIE BANK ROBBERY: AUD/USD Bullish Breakout Confirmed!🔥 AUD/USD BANK HEIST: The Ultimate Bullish Robbery Plan (Thief Trading Style) 🔥

🌟 ATTENTION, MONEY MAKERS & MARKET ROBBERS! 🌟

💸 MISSION BRIEF:

Based on Thief Trading Style (technical + fundamental analysis), we’re executing a bullish heist on AUD/USD ("The Aussie")—time to steal those pips like a pro!

📈 ENTRY STRATEGY (The Heist Begins!)

Long Entry Trigger: Wait for Dynamic Resistance MA crossover + candle close above 0.65300 (bullish confirmation).

Pro Tip: Use Buy Stop orders above MA or Buy Limit orders on pullbacks (15m/30m timeframe).

🔔 SET AN ALERT! Don’t miss the breakout—alert up, gloves on!

🛑 STOP LOSS (Protect Your Loot!)

"Yo, rookie! 🗣️ If you’re entering on breakout, DO NOT set SL before confirmation!

📍 Thief SL Placement: Nearest 4H swing low (0.64800)—adjust based on your risk, lot size, & trade multiples.

⚠️ Warning: Deviate at your own peril—your risk, your rules!

🎯 TARGET (Cash Out & Run!)

Take Profit Zone: 0.65800

Scalpers: Long-only plays! Use trailing SL to lock profits.

Swing Traders: Ride the wave—big money moves require patience!

📰 FUNDAMENTAL BACKUP (Know Why We Robbin’!)

Bullish momentum fueled by macro trends, COT data, sentiment shifts.

🚨 Breaking News Alert: Avoid high-impact news spikes—trail SL or stay out!

💥 BOOST THE HEIST!

Hit 👍 LIKE, 🔄 SHARE & 🚀 BOOST—strengthen the robbery squad! More heists = more profits!

🤑 NEXT HEIST COMING SOON… STAY TUNED! 🐱👤

AUDUSD holds bullish structureAUDUSD is currently trading around 0.6576, maintaining a clear uptrend with higher lows and strong respect for the ascending trendline. A consolidation pattern is forming just below the key resistance zone at 0.6600–0.6617, suggesting a potential breakout if price stays above the support at 0.6546.

On the news front, the Australian dollar is supported by expectations that the RBA will keep interest rates high, while the USD is under slight pressure following weaker U.S. job data this week. Additionally, improving consumer data from China – Australia’s major trading partner – is further boosting AUD sentiment.

If the price breaks above 0.6617, AUDUSD could extend its rally into next week. Buyers are in control – have you planned your entry yet?

AUDUSD: Bearish Continuation is Expected! Here is Why:

The price of AUDUSD will most likely collapse soon enough, due to the supply beginning to exceed demand which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUDUSDAUD/USD is currently forming an impulsive Wave 3 — one of the strongest and most profitable phases in Elliott Wave theory. 🚀📊

The structure suggests strong bullish momentum is building.

We've already entered our first BUY position and are patiently waiting for a pullback to add more.

Wave 3 is typically the longest and most powerful wave, so we’re locking in early and planning to scale in on confirmation.

Stay sharp, manage your risk, and ride the trend.

#AUDUSD #ForexSignals #ElliottWave #Wave3 #BuyTheDip #ForexTradingStrategy

AUDUSD Long TradeOANDA:AUDUSD Long trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

AUDUSD - bullish market is in bull trend and have formed first HH and HL. bullish divergence and double bottom adds weight to the bull

we anticipate market to remain bullish, and entry is taken instantly and sl below the LH. take profits are with R:R of 1:1 and 1:2.

we can also trade on the break of neck line of flag cont. pattern.

AUDUSD reaches six-month highs8 July’s surprising hold by the RBA helped the Aussie dollar to recover lost ground against its American counterpart and push up to a new high. Sentiment seems to be mostly discounting the American governments announcements about upcoming tariffs while underlying data from Australia are somewhat positive or at least certainly not as negative as had been expected around the beginning of the year.

The 61.8% weekly Fibonacci retracement around 65.5c still seems to be a main technical reference because the price hasn’t decisively broken beyond this area yet. With extremely low volume compared to peaks in early April, ATR reaching new lows, the slow stochastic close to overbought and momentum from the chart seemingly lower, there’s a real possibility that the trend might change and the price try to push lower. The value area between the 20 and 50 SMA around 65c and particularly the 50 SMA itself look like possibly important supports in the short term.

If the uptrend continues, the next strong resistance isn’t obvious. 67c is the area of the 200 SMA on the weekly chart but that’s still quite a long way off. Equally, the price might consolidate in the runup to American inflation on Tuesday 15 July.

This is my personal opinion, not the opinion of Exness. This is not a recommendation to trade.

AUDUSD – The Spring Is Loading!AUDUSD has just pulled off an impressive rebound from the 0.6460 support zone, bouncing cleanly off the ascending trendline — like a compressed spring ready to launch. The repeated appearance of Fair Value Gaps after recent upward moves reveals a critical clue: smart money is stepping back in, and this time, they want control.

The price is now testing the familiar resistance at 0.6616 — a zone that has previously rejected several bullish attempts. But this time feels different. The US dollar is clearly losing steam after softer CPI data, pushing bond yields lower and giving AUD a tactical edge.

If the 0.6520 support holds strong, the next breakout won’t just be about overcoming resistance — it could be the spark for a new bullish wave. And when that wave hits... it won’t go unnoticed.

AUDUSD SHORT & LONG FORECAST Q3 D11 W28 Y25AUDUSD SHORT & LONG FORECAST Q3 D11 W28 Y25

It’s Fun Coupon Friday! 💸🔥

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDUSD H4 I Bullish Bounce Off Based on the H4 chart, the price could fall toward our buy entry level at 0.6554, a pullback resistance.

Our take profit is set at 0.6617, aligning with the 127.2% Fib extension.

The stop loss is set at 0.6508, an overlap support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

AUD/USD Long Setup – 1H Demand to 4H Supply 🧠 Trade Breakdown:

Price tapped into a clear 1H demand zone and showed bullish reaction. The setup is targeting a 4H supply zone above. This is a classic demand-to-supply flow with room for clean upside.

⸻

📍 Key Confluences:

• Strong 1H demand (reaction zone clearly respected)

• Clear bullish structure: Higher highs + higher lows

• 4H supply zone above as natural target zone

• Momentum supported by clean bullish candles on the way up

• Entry aligns with a pullback to demand zone wick rejection

⸻

📈 Trade Setup:

• Pair: AUD/USD

• Entry: 0.65881

• Stop Loss: 0.65570 (below demand wick)

• Take Profit: 0.66583 (4H supply zone)

• Risk-to-Reward (RR): ~1:6

⸻

🧠 Mindset:

Let this setup breathe — it’s demand into higher timeframe supply. No need to panic on minor retracements. Trust your bias. Let the setup develop. Protect your capital, but don’t micromanage the trade.

“Trade Simple. Live Lavish.”