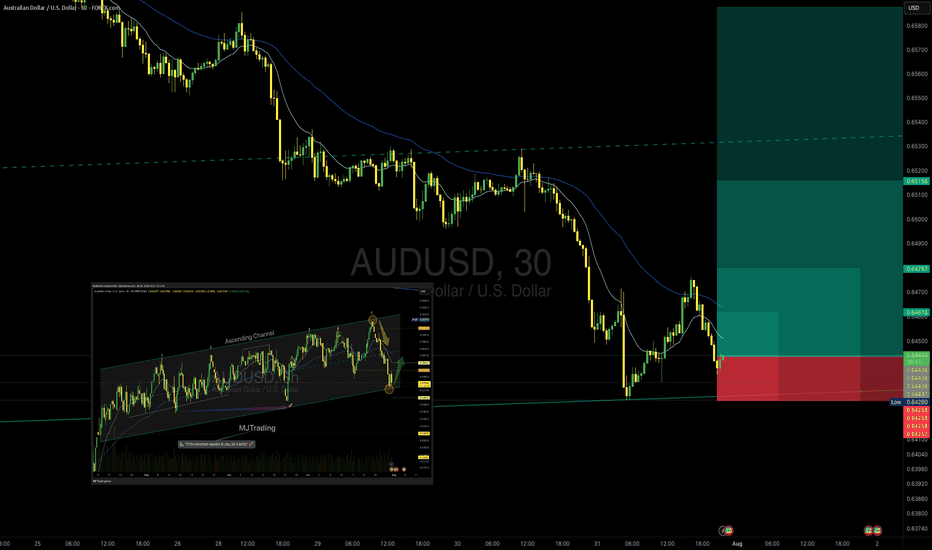

AUD/USD – Potential Bounce Buy SetupOANDA:AUDUSD

Timeframe: 30m

Type: Counter-trend / Bounce from Support

Risk Level: Medium to High

Possible Reward: 4+

🔹 Setup:

Price is testing the lower boundary of the recent support zone (0.6432 – 0.6420), aligning with the previous channel structure visible on the 8h chart. The descending move has shown initial signs of exhaustion, suggesting a potential bounce.

📈 Entry:

Current price zone 0.6432 – 0.6445

🎯 Targets (TP):

TP1: 0.64624

TP2: 0.64797

TP4: 0.65158

⛔ Stop Loss (SL):

0.64250 (below recent swing low and liquidity pool)

8H chart Overview:

Previous Position from top of Channel:

#AUDUSD #Forex #SmartMoney #PriceAction #MJTrading #ChartDesigner

Psychology Always Matters:

USDAUD trade ideas

AUD/USD BullishReversalConfirmed/TargetingKey Resistance0.06600+The AUD/USD 4H chart presents a textbook Smart Money Concept (SMC) setup:

✅ Change of Character (CHoCH) after a major bearish move

✅ Price entered a well-defined Demand Zone

✅ Formed a Bullish Reversal Pattern near the Support Level / Weak Low

✅ Clear Break of Structure (BOS) and upside momentum starting

📍 Key Targets:

Resistance Area: 0.6550 – 0.6600

Strong High: Potential liquidity grab zone.

📌 Confluence Areas:

Volume shift showing buyer strength

Liquidity sweep followed by bullish candle structure

RSI divergence confirmation (optional if mentioned)

This move aligns with institutional order flow theory and is supported by strong price action. As long as price holds above the Demand Zone, bullish continuation is likely.

AUDUSD BUY

AUD/USD rises to near 0.6480 as accelerating Fed dovish bets weigh on US Dollar

The AUD/USD pair moves higher to near 0.6480 during the European trading session on Monday. The Aussie pair gains as demand for risk-perceived assets has increased, following an increase in market expectations that the Fed could resume its monetary expansion cycle in the September meeting

The AUD/USD currency pair, commonly known as the “Aussie”, represents how many US dollars (the quote currency) are needed to purchase one Australian dollar (the base currency). Alongside the New Zealand Dollar (NZD) and the Canadian Dollar (CAD), the AUD is considered a commodity currency due to Australia’s significant exports of raw materials such as precious metals, Oil, and agricultural products.

The Reserve Bank of Australia (RBA) has historically maintained higher interest rates compared to other industrialized nations. Combined with the relatively high liquidity of the AUD, this has made the AUD attractive for carry traders looking for higher yields.

SUPPORT 0.64852

SUPPORT 0.65074

SUPPORT 0.65285

RESISTANCE 0.64498

AUDUSD- SMC Breakdown: Understanding Smart Money Moves📘 SMC Breakdown: Understanding Smart Money Moves

🔹 Buy-side liquidity was engineered to trap late buyers.

🔹 Price created a fakeout above the highs — classic liquidity grab.

🔹 Entry followed right after the FVG (Fair Value Gap) fill.

🔹 Sharp reversal marked by CHOCH (Change of Character), confirming shift in structure.

🔹 Market swept sell-side liquidity, triggering BOS (Break of Structure) — ideal exit or next entry zone.

AUDUSD: Great Trading Opportunity

AUDUSD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell AUDUSD

Entry - 0.6475

Stop - 0.6480

Take - 0.6464

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️Please, support our work with like & comment!❤️

AUDUSD – Plan Ready for Both ScenariosWe're patiently waiting for price to reach our key zone. If we get a valid sell signal, we’ll take the short.

But if the market breaks above this level with strength and gives us a clean pullback, we’re ready to go long.

No guessing. No hoping. Just reacting to what the market shows us.

📌 Discipline over prediction.

AUDUSD – DAILY FORECAST Q3 | W32 | D6 | Y25📊 AUDUSD – DAILY FORECAST

Q3 | W32 | D6 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:AUDUSD

Australia inflation gauge hits 20-month high, Aussie gains grounThe Australian dollar has extended its gains on Monday. In the North American session, AUD/USD is trading at 0.6483 up 0.22% on the day. The US dollar made inroads last week against all the major currencies except the yen and gained 1.5% against the Australian dollar.

Australia's Melbourne Institute inflation guage soared 0.9% m/m in July, up sharply from 0.1% in June and marking the highest rise since Dec. 2023. The MI gauge, which provides a monthly guide to consumer inflation (official CPI is published quarterly), will no doubt raise concerns at the Reserve Bank of Australia, which has been cautious about cutting rates due to inflation worries.

Last week, CPI for the second quarter eased to 1.9%, down from 2.2% in Q1 and just below the central bank's target of 2%-3%. This cements a rate cut at the Aug. 12 meeting, after the RBA shocked the markets last month when it held rates. The markets had widely priced in a rate cut but the RBA defended its non-move, saying it wanted to see additional inflation data.

The week ended with a softer-than-expected US employment report. Nonfarm payrolls for July rose by only 73 thousand, missing the market estimate of 110 thousand. Adding to the bad news, the June and May reports were both revised sharply lower, down by a combined 258 thousand. The unemployment rate ticked higher to 4.2%, up from 4.1%.

The weak July reading and the downward revisions indicate that the labor market may be cooling more quickly than initially anticipated. The weak numbers support the case for the Fed to lower interest rates at the next rate meeting in September. The likelihood of a cut has climbed to 75%, compared to 63% on Thursday.

The soft jobs report should serve as a wake-up call regarding the effect of US tariffs on the economy, as the employment picture is worse than previously thought.

AUDUSD – DAILY FORECAST Q3 | W32 | D5 | Y25📊 AUDUSD – DAILY FORECAST

Q3 | W32 | D5 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:AUDUSD

AUDUSD(20250805)Today's AnalysisMarket News:

Goldman Sachs: The Federal Reserve is expected to cut interest rates by 25 basis points three times starting in September; a 50 basis point cut is possible if the unemployment rate rises further.

Technical Analysis:

Today's Buy/Sell Levels:

0.6470

Support and Resistance Levels:

0.6500

0.6489

0.6482

0.6459

0.6451

0.6440

Trading Strategy:

If the price breaks above 0.6470, consider buying, with the first target price at 0.6489. If the price breaks below 0.6459, consider selling, with the first target price at 0.6440.

AUD eyes yield advantage over USD UBS strategists view the Australian dollar as a compelling long opportunity at current levels, supported by expectations that the Reserve Bank of Australia will ease policy more gradually than the U.S. Federal Reserve.

The bank forecasts 75 basis points of rate cuts from the RBA through Q1 2026, compared to 100 basis points from the Fed—helping to preserve a relative yield advantage for the Aussie.

On the daily chart, AUD/USD remains within a well-defined ascending channel that began in late 2024. The pair recently bounced off the lower boundary of the channel near 0.6450, with long lower wicks potentially indicating dip-buying interest.

Immediate resistance could sit at 0.6600, followed by a major zone near 0.6670. A break above these levels could confirm bullish continuation.

AUDUSD Will Keep Falling!

HI,Traders !

#AUDUSD keeps falling down

And the pair made a strong

Bearish breakout of the key

Horizontal key level of 0.64796

And the breakout is confirmed

So we are bearish biased and

We will be expecting a further

Bearish move down !

Comment and subscribe to help us grow !

AUDUSD FORECASTLooking into the AUDUSD today, the market is really looking Nice. Waiting for the market to reach at the area of focus. Looking to take as a sell limit order waiting for the price to Liquidate then taking after gaining volume and power to push to the downside, it gives me the high probability to looking into this pair.

Potential bullish reversal?The Aussie (AUD/USD) has bounced off the pivot, which is a swing low support, and could rise to the 1st resistance, which acts as a pullback resistance.

Pivot: 0.6502

1st Support: 0.6468

1st Resistance: 0.6558

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Ready for the Aussie Heist? Is This the Perfect Entry?🚨💰 - "The Aussie Vault Raid: Bullish Robbery in Progress!" 💰🚨

AUD/USD Forex Trade Idea (Thief Style Swing/Day Plan)

📈🔥 Designed for Thief Traders, Market Robbers & Money Makers Worldwide 🤑🐱👤💸

🌍 Hello Global Robbers!

🌟 Hola! Ola! Bonjour! Hallo! Salaam! Konnichiwa! 🌟

Welcome to another bold heist plan from the Thief Trading Crew. This one’s a high-stakes raid on the AUD/USD — "The Aussie" — using our signature Thief Trading Style, combining raw technical setups with real macro/fundamental edge. We're eyeing the Bullish Vault Breakout, so tighten up your gloves — it’s time to rob smart, not hard.

🔓💸 ENTRY PLAN – “The Vault is Unlocked!”

Grab the bullish loot at any valid price zone — but here’s how real thieves move:

📍 Recommended Entry Style:

Use Buy Limit Orders near local swing lows, demand zones, or key pullback entries on the 15m to 30m chart.

Execute DCA (Dollar Cost Averaging) / Layered Orders for more precision.

Align with your MA lines & candle structures for max confirmation.

🛑 STOP LOSS – “Escape Route Secured”

📍 SL hidden beneath recent swing lows below MA (on 4H):

🎯 Suggested Level: 0.64170

💡 Custom-fit your SL based on:

Trade size

Number of active positions

Account risk strategy

🎯 PROFIT TARGET – “Cash Out Before the Cops Show!”

🏴☠️ Take-Profit Zone: 0.66400

This is our bullish breakout reward zone — a high-value zone where profit meets safety.

🔍 MARKET OUTLOOK – "Cops Are Watching, but We're Ahead..."

📈 The AUD/USD market is flashing bullish momentum, supported by:

✅ Risk sentiment flow

✅ US Dollar weakness and rate expectations

✅ Intermarket signals from commodities (Gold/Iron)

✅ Positive macro positioning from smart money (via COT)

✅ Technical demand forming reversal patterns from oversold zones

📎 For a deeper breakdown —

📰 Fundamentals | COT Reports | Sentiment | Intermarket Analysis — Check Klick 🔗

⚠️ THIEF ALERT – “Avoid Sirens. Watch the News.”

Stay out of trouble by following these protocols during major news events:

🚫 Don’t enter trades blindly before/after big news

📍 Use trailing stops to protect gains

🔄 Adjust SL/TP if price nears breakout points during volatility

💥 SUPPORT THE CREW – “Smash That Boost Button!”

Love the plan? Then Boost this chart to show love for the Thief Trading Movement.

Every like, comment, and boost adds power to our robbery network across the globe. 🌍❤️💰

⚖️ DISCLAIMER – “Not Financial Advice, Just Thief Vibes”

📌 This analysis is for educational and entertainment purposes only.

📌 Trade at your own risk and always do your own analysis.

📌 Market moves fast — stay sharp, stay stealthy.

**🎭 See you at the next heist.

Until then, trade rich. Rob wise.

Thief Trader out. 🐱👤💰📉📈**

AUDUSD Clear Short opportunityWe have been over extended on multiple oscillators. We are going to start layering sells at now and keep layering new sells every 1 to two candles. Keep risk light per candle. we are going to targe the VWAP for TP. We have pulled far enough away that we can expect a retest.

AUD/USD Analysis Based on Volume, Fibonacci & Stochastic

This AUD/USD setup is based on:

Volume Profile zones to detect institutional interest

Fibonacci levels for structural confirmation

Stochastic oscillator to time the entry more accurately

🔹 Entry: 0.6460

🔹 Stop-Loss: 0.6476

🔹 Take-Profit: 0.6441

🔹 Risk-to-Reward Ratio: 1.19

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own due diligence and manage risk appropriately.

AUDUSD Technical & Order Flow AnalysisOur analysis is based on a multi-timeframe top-down approach and fundamental analysis.

Based on our assessment, the price is expected to return to the monthly level.

DISCLAIMER: This analysis may change at any time without notice and is solely intended to assist traders in making independent investment decisions. Please note that this is a prediction, and I have no obligation to act on it, nor should you.

Please support our analysis with a boost or comment!