AUDUSD corrective pullback supported at 0.6486Trend Overview:

The AUDUSD currency price remains in a bullish trend, characterised by higher highs and higher lows. The recent intraday price action is forming a continuation consolidation pattern, suggesting a potential pause before a renewed move higher.

Key Technical Levels:

Support: 0.6465 (primary pivot), followed by 0.6445 and 0.6400

Resistance: 0.6570 (initial), then 0.6590 and 0.6625

Technical Outlook:

A pullback to the 0.6465 level, which aligns with the previous consolidation zone, could act as a platform for renewed buying interest. A confirmed bounce from this support may trigger a continuation toward the next resistance levels at 0.6570, 0.6590, and ultimately 0.6625.

Conversely, a daily close below 0.6465 would suggest weakening bullish momentum. This scenario would shift the bias to bearish in the short term, potentially targeting 0.6445 and 0.6400 as downside levels.

Conclusion:

AUDUSD maintains a bullish structure while trading above the 0.6465 support. A bounce from this level would validate the consolidation as a continuation pattern, with upside potential toward the 0.6570 area. A breakdown below 0.6465, however, would invalidate this view and suggest deeper corrective risk.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USDAUD trade ideas

AUDUSD 4HOUR TIME FRAME ANALYSISOn the 4-hour chart, AUD USD has recently shifted into a shallow up-trend after carving out a higher low around 0.6480. From that support zone, price has rallied through a short-term descending channel, breaking its upper trendline just above 0.6500 and holding that breakout on the last two candles. The entry at 0.65231 sits just above a cluster of prior resistance–turned–support (0.6500–0.6520), giving the trade a solid foothold.

Momentum indicators confirm the bullish tilt: the 14-period RSI is riding around 60–65, neither overbought nor fatigued, suggesting room to run toward your target. Likewise, price is comfortably above both its 50-period and 200-period EMAs, with the shorter EMA crossing above the longer one roughly 12 bars ago, signalling that buyers are in control.

AUDUSD H4 I Bullish Bounce Off the 50% Fib Based on the H4 chart analysis, we can see that the price is falling toward our buy entry at 0.6542, which is a pullback support that aligns with the 50% Fib retracement.

Our take profit will be at 0.6581, an overlap resistance.

The stop loss will be placed at 0.6499, a swing low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

AUDUSD Will Go Higher From Support! Buy!

Please, check our technical outlook for AUDUSD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 0.656.

The above observations make me that the market will inevitably achieve 0.662 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUDUSD.JULY 29TH

Bureau of Labor Statistics will publish will JOLTS which measures the Number of job openings during the reported month, excluding the farming industry;

JOLTS Job Openings CB Consumer Confidence forecast 95.9 previous 93.0 .market will watch for data report for clear directional bias .

wednesday 30th

Australian Bureau of Statistics will publish the Consumer price index which Measures Change in the price of goods and services purchased by consumers

'Actual' greater than 'Forecast or below will be watched for clear directional bias .

this data are Frequency Released quarterly, about 25 days after the quarter ends;

and the next report will be on Oct 30, 2025

Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate of 2%

Aud CPI q/q forecast 0.8% previous 0.9%

AUD CPI y/y forecast 2.1% previous 2.1%

AUD Trimmed Mean CPI q/q forecast 0.7% previous 0.7%

USD 1:15pm

1:15pm USD ADP Non-Farm Employment Change forecast 82K previous -33K

Advance GDP q/q forecast 2.4% previous -0.5%

Advance GDP Price Index q/q forecst 2.3% previous 3.8%

Pending Home Sales m/m forecast 0.3% previous 1.8%

USD Crude Oil Inventories-3.2M

by 7pm USD Federal Funds Rate previous 4.50% 4.50%

FOMC Statement

7:30pm FOMC Press Conference.

watchout for federal fund rate data report and FOMC (federal open market committee)

NOTE;TRADING ANAY INSTRUMENT IS 100% PROBABILTY ,ANY KEY LEVEL CAN FAIL YOU,DONT EVER TRADE WITH ALL YOUR CAPITAL BECAUSE YOU MENTOR SAY BUY OR SELL.

TRADING IS 100% PROBABILTY AND NO STRATEGY IS PERFECT.

TRADE WITH CAUTION.

WISH A HAPPY NEW WEEK.

BYE.

AUD/USD Pullback or Trap? Key Level in FocusPrice has slipped below the rising channel and is now pulling back to retest the breakdown area. This retest could decide the next move.

If buyers fail to step in here, and price gets rejected again, it may signal the start of a deeper correction. However, reclaiming the channel could flip the bias back to bullish.

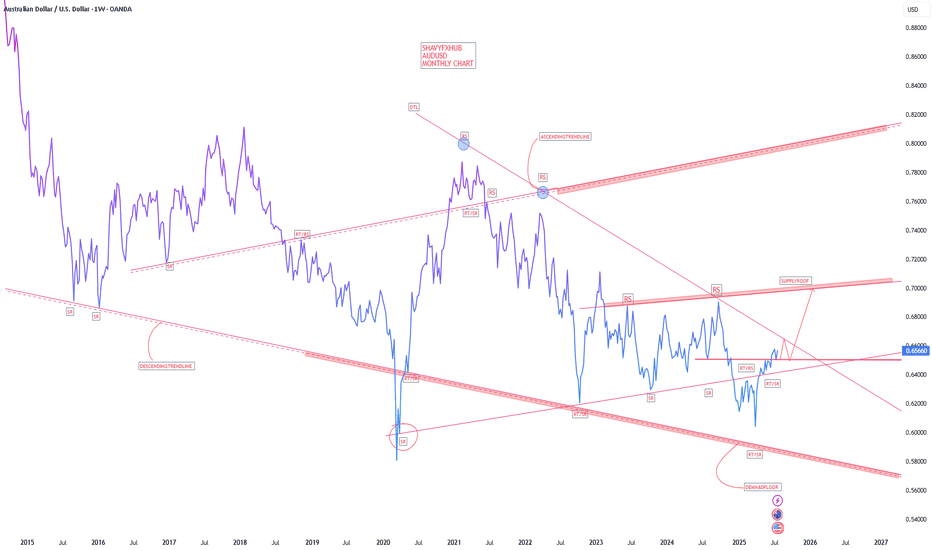

AUD/USD - Full in depth breakdown (MUST READ) 📉 AUD/USD Multi-Timeframe Sell Setup – High Confidence Reversal

Pair: AUD/USD

Timeframes: Weekly / Daily / 1H

Bias: Bearish

Entry Zone: Supply Zone around 0.6700 - 0.6730

Target Zones:

🔹 TP1: 0.6520 (Mid-Range)

🔹 TP2: 0.6360 (Channel Support)

🔹 TP3: 0.6250 (Long-Term Demand Zone)

🧠 Technical Breakdown:

🔸 WEEKLY TIMEFRAME

✅ Long-Term Bearish Channel

Price is respecting a clearly defined descending channel.

This week’s price action has reacted perfectly from the upper boundary of that channel – rejecting continuation of bullish moves.

✅ Major Supply Zone Reaction

The most recent rejection aligns with a historically respected weekly supply zone.

Volume was introduced here in the past, suggesting institutional presence and high sell interest.

🔸 DAILY TIMEFRAME

✅ Daily Market Structure Shift

A confirmed daily break of structure (D-BOS) shows the bullish wave has lost steam.

Most recent rally into Supply 2 has been rejected, forming a lower high within the macro downtrend.

✅ Volume Profile Confluence

Volume is heaviest below current price, suggesting there’s little interest or imbalance left to fill above.

Current price sits in a low volume node, often leading to quick rejections and sell-offs.

✅ Supply Zone + 71% Premium Level

Price has tapped into the 71% Fib retracement level, aligning perfectly with:

Prior supply zones

EMA resistance

Volume-based rejections

🔸 1H TIMEFRAME

✅ CHoCH & i-BOS Confirming Reversal

Clear Change of Character (CHoCH) followed by internal Break of Structure (i-BOS) confirms lower timeframe bearish intent.

Price is currently forming a retracement leg, likely to pull back into supply for another sell.

✅ Bearish Schematic Playing Out

Expecting minor bullish pullback to retest broken structure before continuation into deeper targets.

Clean distribution phase completing before markdown.

📌 Sell Plan:

Sell Zone: 0.6700 – 0.6730 (supply + 71%)

Stop Loss: Above supply zone / channel high

Take Profits:

TP1: 0.6520 (fair value gap zone)

TP2: 0.6360 (channel low)

TP3: 0.6250 (major demand)

⚠️ Risk Management

Enter on lower timeframe confirmation (1H / 15M engulfing or BOS)

Trail stops as each BOS forms

Maintain R:R ≥ 1:3 for higher timeframes

🗓️ Market Outlook:

AUD/USD is aligning across all major timeframes for a high-probability bearish continuation. With structure shifted, supply respected, and volume confirming rejection, sellers are in clear control.

🔔 Follow for more SMC-based setups, clean structure trades, and multi-timeframe confluence strategies.

AUDUSD(20250807)Today's AnalysisMarket News:

Federal Reserve Chairman Neel Kashkari: A rate cut may be appropriate in the short term, and two rate cuts this year are reasonable. Trump: The new Fed governor will likely be temporary, and the appointment will be announced within 2-3 days.

Technical Analysis:

Today's Buy/Sell Levels:

0.6489

Support and Resistance Levels:

0.6538

0.6520

0.6508

0.6470

0.6458

0.6440

Trading Strategy:

If the price breaks above 0.6508, consider a buy entry, with the first target at 0.6520. If the price breaks below 0.6489, consider a sell entry, with the first target at 0.6470

AUDUSD Swing Trade Plan – 1H Time FrameThe pair is showing early signs of bullish structure with a clean higher low (HL) to higher high (HH) transition. An instant buy entry is considered valid based on the breakout above a key resistance zone.

🔹 Entry: Market Buy (Current Price ≈ 0.65038)

🔹 Stop Loss (SL): 0.64496

🔹 Take Profit (TP): 0.65523

📌 Structure Shift Noted

The break above prior highs confirms a market structure reversal with HL → HH → HH sequence. The bullish RSI divergence and sustained move above the EMA cluster further support upside momentum.

📍 Trade Rationale:

Price broke out of prior resistance and retested it as new support

RSI currently around 63, indicating strength without being overbought

Favorable risk-reward from current levels, targeting previous imbalance area at TP1

🧠 Plan: Monitor candle close above minor intraday range for continued bullish pressure. SL is placed below recent demand and last swing low for structural protection.

💡 Patience and discipline are key — watch how price behaves around the 0.652 zone before scaling in.

AUD/USD Long SetupMarket structure just flipped bullish after sweeping liquidity around the 0.64200 zone.

Entry triggered on bullish break & retest, aiming for 0.65290.

SL well-protected below recent low.

🧠 Smart money move or trap?

Let the market prove you right, not your emotions.

No PAIN | no GAIN. Let the market DECIDE.

AUDUSD: Short entry triggerGood morning everyone,

today I am sharing a Short signal received now via alert from the LuBot Ultimate indicator.

Entry made on correction (approximately 50% of the trigger candle).

In this case I will follow the levels suggested by the indicator regarding both the TP and SL. Levels that will update as the trade progresses.

The signal is confirmed by the negative structure (red candles) that has just started on the 4H and a bearish trend confirmed by the signal a few candles back (Bear Trend signal).

The predictum also shows a bearish signal, therefore predicting a negative situation for the current month.

👍 If you want to see other similar posts, like/boost

🙋♂️ Remember to follow me so you don't miss my future analyses

⚠️ Disclaimer: This post is for informational purposes only and does not constitute financial advice. Always do your research before making investment decisions.

AUD/USDThis analysis is based on a combination of volume analysis, Fibonacci retracement levels, and Stochastic oscillator signals to find an optimal entry point. The trade setup suggests a potential bullish move after confirming support and momentum alignment.

Entry: 0.6475 area

Stop-Loss: 0.6465 area

Take-Profit: 0.6498 area

This setup aims to capitalize on a high-probability bounce within a key Fibonacci zone, confirmed by volume strength and oversold readings on the Stochastic indicator.

⚠️ Disclaimer:

This is not financial advice. Trading involves risk and may not be suitable for all investors. Always do your own research and use proper risk management.

AUD/USDAUD/USD – Possible Correction Scenario Based on Volume Analysis

This idea presents a potential correction in AUD/USD, based on recent volume behavior suggesting a shift in market sentiment.

Following a strong move, volume has started to decline near the recent lows, hinting at possible seller exhaustion. This may open the path for a short-term bullish correction toward higher value areas.

📍 Entry: 0.64681

🎯 Target: 0.65050

🛑 Stop-loss: 0.64428

This is a possible scenario, not a guaranteed outcome. Always monitor price action and volume for confirmation.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk appropriately.

Ask ChatGPT

AUD-USD Will Go Down! Sell!

Hello,Traders!

AUD-USD is trading in a

Downtrend and the pair

Broke the key horizontal

Level of 0.6470 which is

Now a resistance then

Made a retest and a

Confident pullback which

Reinforces our bearish

Bias and makes us expect

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDUSD - Sell Setup market is in bear trend with a series of LH and LL. currently market has retraced to a fib level of 0.5% which and continuing bear trend. there is no divergence and market is making a bearish channel with a bearish flag pattern intact.

we instantly enter into the market with our SL level above last LH and TPs as projected.

AU ASIA SESSIONI'm currently watching the sell-side liquidity to see if price makes a move in that direction. Given the current structure and momentum, this setup looks like a relatively low-risk opportunity heading into the Asia session. It’s not a guaranteed play, but the risk-to-reward looks favorable if we get confirmation. Let me know what you think about this one — always keen to hear a second perspective.

AUD_USD BEARISH BREAKOUT|SHORT|

✅AUD_USD broke the key

Structure level of 0.6460

While trading in an local downtrend

Which makes me bearish

And I think that after the retest of

The broken level is complete

A bearish continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.