USD/CAD carving out a bottom?The USD/CAD is poking its head above a bearish trend line that has been in place since mid-May, in one of the first signs that suggests we may have seen a low in the Loonie. As well as the trend line, the 21-day exponential is also now below price, further suggesting that the tide is turning.

Key levels

Support levels off this daily chart are seen around 1.3695 then 1.3617

Resistance seen around 1.3750 next, followed by the next round handles like 1.38, 1.39 etc.

By Fawad Razaqzada, market analyst with FOREX.com

USDCAD trade ideas

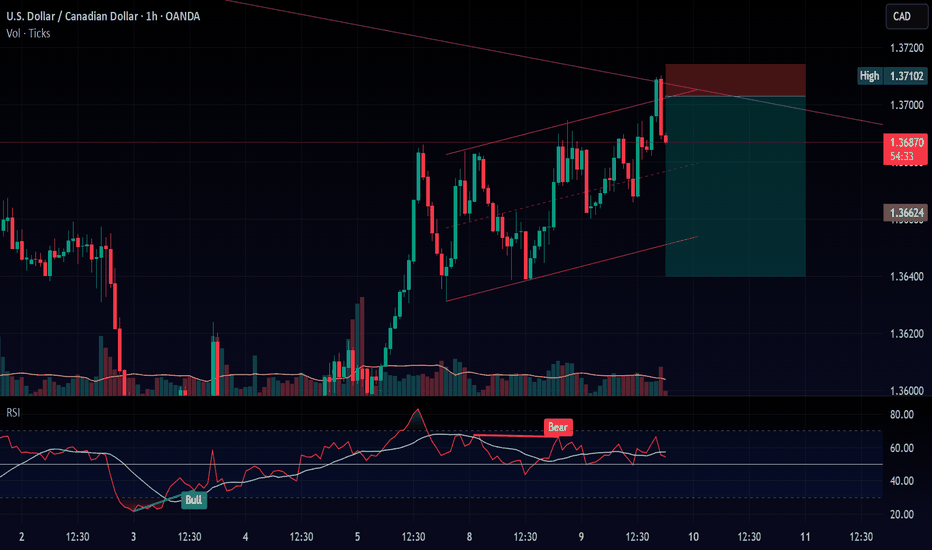

USDCAD: Bearish Continuation & Short Signal

USDCAD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short USDCAD

Entry Point - 1.3688

Stop Loss - 1.3717

Take Profit - 1.3634

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

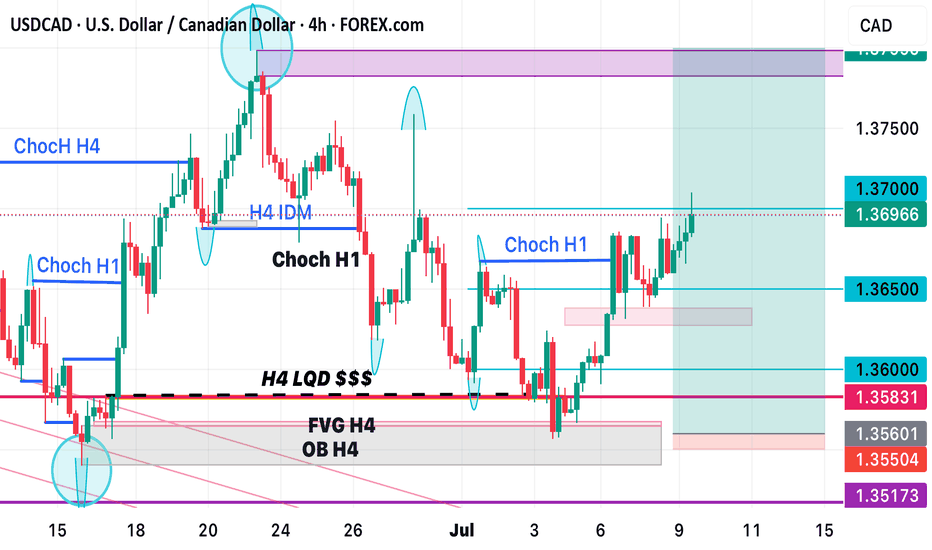

Bearish Reversal Zone Approaching🔹 Pair: USDCAD

🔹 Timeframe: H4

🔹 Price: 1.36806

🔹 Bias: Short/SELL Setup Pending

---

💡 Analysis Summary:

USDCAD is approaching a major resistance zone aligned with the 61.8% Fibonacci retracement level from the previous bearish leg.

Structure shows a clear ABC corrective pattern with signs of exhaustion at current levels.

---

📌 Key Levels to Watch:

🔺 Resistance: 1.3720–1.3740 (Potential Reversal Zone)

🔻 Target Zone: 1.3450–1.3500

🔓 Invalidation Above: 1.3760

---

📉 Plan:

Watch for bearish confirmation (e.g., bearish engulfing, double top, divergence) at resistance before entry.

High RR setup expected if price rejects near 1.3740.

---

🔁 Wait. Confirm. Execute.

🧠 Trade smart, not fast.

📊 More updates coming daily.

USDCAD oversold rally The USDCAD currency pair remains in a bearish technical structure, consistent with the prevailing downtrend. Recent price action suggests sideways consolidation, indicating indecision as the pair pauses before its next directional move.

Key Technical Levels:

Resistance:

1.3700 – Key pivot zone; previously acted as intraday resistance.

1.3740 – Minor resistance.

1.3790 – Stronger resistance zone and potential reversal point.

Support:

1.3566 – Initial downside target on renewed selling pressure.

1.3544 – Intermediate support.

1.3520 – Long-term support and potential demand zone.

Scenario Analysis:

Bearish Case (Favored):

Price is consolidating below the key 1.3700 level. A failure to break above this resistance could trigger a renewed move lower. A bearish rejection from this level may open the path toward 1.3566, then 1.3544 and 1.3520 over a longer timeframe.

Bullish Case (Alternative):

A confirmed breakout and daily close above 1.3700 would invalidate the current bearish setup. This could shift sentiment to bullish and trigger a move toward the next resistance zones at 1.3740 and 1.3790.

Conclusion:

The technical bias for USDCAD remains bearish while price trades below the 1.3700 resistance zone. Traders should watch for a rejection from this level to confirm further downside potential. However, a sustained break above 1.3700 would neutralize the bearish setup and suggest scope for a short-term bullish reversal.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USDCAD Holds Rebound Above 1.36In parallel with the DXY’s rebound from the 96-level, USDCAD has bounced from its 1.35 support zone, coming off oversold conditions last seen in 2021. The pair is also respecting a breakout from the 2025 contracting downtrend pattern.

Key upside levels for the ongoing correction are 1.3830, 1.3860, and 1.40 — aligning with a significant support/resistance zone established in October 2022. However, if 1.36 and 1.3520 are breached to the downside, the bearish trend could resume, with downside levels at 1.34 and 1.32 in focus.

- Written by Razan Hilal, CMT

uptrendIt is expected that after some fluctuation and correction, the upward trend will continue. A break and consolidation above the resistance trend line will be a confirmation of the upward trend.

Otherwise, a continuation of the downward trend with a break of the green support range will be possible.

Why I’m Bullish on USD/CAD This Week | Forex Market OutlookIn this video, I break down a potential bullish setup on USD/CAD based purely on technical analysis using support and resistance zones on the 4H and Daily timeframes.

Key Highlights:

Strong price bounce off major support zone

Former resistance flipping into support

Bullish market structure with higher lows forming

My price target: 1.37400

Invalidation zone: 1.35334

A Return to 1:1?As spending heats up considerably with the 5 Trillion USD bill, in my opinion it looks like CAD is set to skyrocket vs the USD once again.

The main driving factors include greater industrialization (worlds biggest nuclear plant, more gold/platinum production than the USA, bigger oil reserves than USA), comparatively less spending, less tariffs, expanding to other countries via exports, and the most untapped resources/land with lowest population of any developed nation in the world.

Personally, for the next 10 years I'll be heavily focusing on Canadian companies if the CAD breaks the trend line

Bullish rise?USD/CAD has bounced off the support level which is a pullback support and could potentially rise from this level to our take profit.

Entry: 1.3660

Why we like it:

There is a a pullback support.

Stop loss: 1.3618

Why we like it:

There is a pullback support.

Take profit: 1.3780

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

The importance of trendlines in FOREXIn the world of currencies or FOREX, there are certain entry points that only happen a few times a year , but they’re incredibly powerful . These opportunities come after a trend breaks, a trend that has been touched and confirmed as a support or resistance zone over several years.

Right now, with OANDA:USDCAD , we’re seeing a break and pullback to one of these long-term trends. That makes this a great moment to go short on this pair.

Let me share a couple of examples with USDBRL and USDMXN. In both cases, after similar long-term trends were broken, the price moved strongly in one direction, these are the kinds of moves that can really grow your account.

There are other pairs showing similar breakouts.

Have you spotted them? If not, leave a comment and I’ll share the other pairs with you!

USDCAD obeying Elliott Wave Principles.Our D1 chart is a continuation of a wave that started earlier and had a Flat correction for its Wave 2(Red), hence a Zigzag should be expected for our Wave 4(Red). When Wave 3(Red) completes, an aggressive selling move is triggered this is our Wave A(Black). A correction of this move occurs in the form of a Flat and this is now our Wave B(Black) of the major Zigzag correction that started when Wave 3(Red) completed. When Wave B(Black) is done, we should expect a Wave C(Black) to complete the Zigzag. Our Wave C(Black) unfolds in a 5 wave move and this is very normal. This 5 wave move is marked in Green. When Wave 1(Green) completes, our Wave 2(Green) unfolds in a Flat correction, meaning our Wave 4(Green) should be a Zigzag correction. After Wave 2(Green) completes, Wave 3(Green) is a strong downward move that reaches the 261.8% Fib. level. On reaching this level, we see a retest and a confirmation occurring. This is is to signal the end of Wave 3(Green) and the start of Wave 4(Green). As mentioned earlier, we should expect a Zigzag correction for Wave (Green) and we can see a shallow pullback and retest. The pullback is our first wave of the three wave Zigzag and is marked as Wave A(Blue). The retest as noted, does not go beyond Wave 3(Green) and this confirms it is a Zigzag. This retest is marked as Wave B(Blue). Next would be a Wave C(Blue) to complete Wave 4(Green). A retest and confirmation gives us an entry for the Wave C(Blue) which is also Wave 4(Green).

USDCAD My Opinion! SELL!

My dear friends,

Please, find my technical outlook for USDCAD below:

The price is coiling around a solid key level - 1.3669

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.3621

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USD/CAD) Down Trand Read The captionSMC trading point update

Technical analysis of USD/CAD (U.S. Dollar / Canadian Dollar) on the 1-hour timeframe, with a focus on a potential double-top formation at strong resistance, followed by a drop toward support:

---

Analysis Overview

Trend Structure: Downward-sloping channel with lower highs and lower lows.

Confluence Area: The current rally is approaching both the upper channel boundary and a significant horizontal resistance zone (~1.3660–1.3700).

---

Key Technical Elements

1. Resistance & Double-Top Setup

The price nears the resistance zone (yellow) where it previously reversed (noted by red arrows).

A cap-and-float pattern (double/top-like structure) is projected: price pushes higher, hesitates, tests resistance again, then fails—a sign of weakening bullish momentum.

2. EMA 200 Interaction

The 1-hour EMA 200 (blue line at ~1.3635) sits just below current price.

A failure to sustain above this level reinforces the bearish case.

3. RSI Overextension

RSI (14) is around 64–69, indicating near-overbought conditions on this timeframe, suggesting a potential pullback.

4. Price Targets

Initial target: Lower channel boundary near 1.3556 (highlighted support).

Extended target: Beneath to 1.3540, aligning with the broader Demand zone.

---

Proposed Trade Setup

Step Action Level

Entry Short near top of resistance/channel (after double-top confirmation) 1.3680–1.3700

Stop-Loss Above recent high and channel resistance ~1.3720

Take Profit 1 Near EMA 200/lower channel bounce ~1.3556

Take Profit 2 Extended move to demand zone ~1.3540

Estimated Move ~1.15% drop from midday highs –

---

Risk & Event Factors

Scheduled Canadian or U.S. data releases (icons shown) could introduce volatility and disrupt technical patterns.

A breakout above ~1.3720 would invalidate this bearish thesis and shift bias bullish.

Mr SMC Trading point

---

Summary

Expecting a cap-and-float double-top formation at key resistance near 1.3660–1.3700, followed by a trend continuation drop toward 1.3556–1.3540. The bearish setup is supported by a down-channel structure, EMA 200 failure, and overbought RSI conditions.

Please support boost 🚀 this analysis)