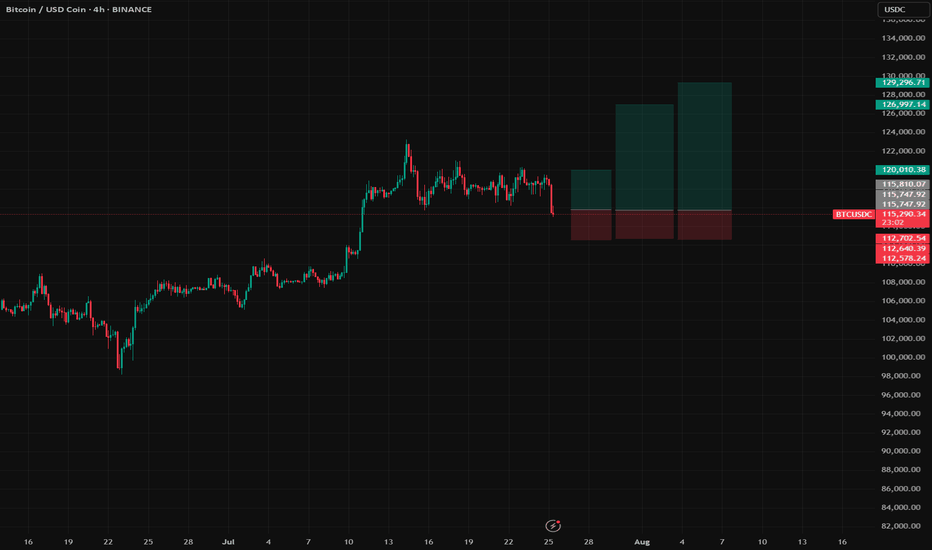

BTC Long Setup | Multi-target Swing Trade with Reasonable SL📝 Description:

Buy Bitcoin (BTC) based on continuation correction structure.

Entry: 115,800

Stop-Loss: 112,600

Risk: 1% per trade (position size adjusted accordingly, no leverage used trade spot only!)

🎯 Take-Profit Levels:

*Watch for a strong red candle at each TP zone.

If it happen, take full

Related coins

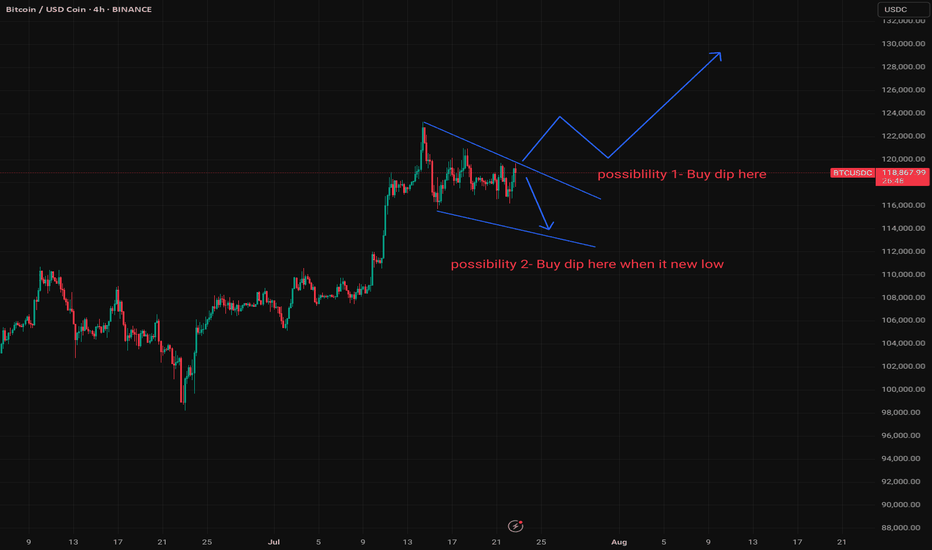

BTC Decision Point – Trade the Plan.BTCUSDC Outlook – Standby Mode Until Confirmation

BTC is currently forming a wedge on the 4H timeframe, typically a bullish continuation structure. However, now is NOT the time to enter. Patience is key — wait for price confirmation.

📌 First Plan (Possibility 1):

If price clearly breaks out to the

Long trade

15min TF

BTCUSD Perpetual – 15-Minute Chart Analysis

Key Trades Highlighted

Trade #1:

Type: Buyside trade

Entry: 114,171.5

Profit Level: 118,677.0 (+3.97%)

Stop Level: 113,635.5 (–0.47%)

Risk/Reward: 8.63

Entry Time: Thu 10th July 25, 5:15 pm (NY Session PM)

Target Reached: Fri 11th July 25, 5:3

Bitcoin - Levels of the Range On the hourly time frame it is clear that BTC is within a rangebound environment. Using key levels such as the weekly highs and lows with Mondays highs and lows to to paint a picture of where support and resistance may be.

In the "weekly outlook" post for this week I suggested a retest of the $108,

Bitcoin New ATH - Where now?After Bitcoin makes new all time highs, the next steps are very important. Where price goes now can be tricky to predict as there is the rare factor of price.

One of the only ways to predict where BTC may find resistance during price discovery is to use Fibonacci levels, using Fib extensions the fi

Btcusdt updateAnother scenario that can be imagined for Bitcoin is this. A head and shoulders pattern and a reversal from the $99,400 range and a rise to the $140,000 range, which could be the end of Bitcoin's celebration. In addition, we have a lot of news in these two weeks that may cause this 40% scenario to h

BTC will drop from here to around 100k **Bitcoin Analysis Update**

Bitcoin has printed a **bearish divergence**, suggesting a potential reversal from the current level. Based on the setup, a drop toward the **\$100,000–\$101,000** range is likely.

This presents a **low-risk, high-reward trade opportunity**, with a **risk-to-reward rati

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.