USDCHF trade ideas

How to mark your charts Lightning fast!One of the things I didn't like was marking my charts. I would take so much time marking my charts and adding the prices on the side. My mentor showed me the fastest way. Just use the FIB tool and use "0" and "1". Now you can focus on other important things. I want to thank my mentor for showing me this. Good luck to everyone

Bullish bounce off 50% Fibonacci support?USD/CHF is falling towards the support level which is an overlap support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.7950

Why we like it:

There is an overlap support level that lines up with the 50% Fibonacci retracement.

Stop loss: 0.7924

Why we like it:

There is a pullback support.

Take profit: 0.7986

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Could the price bounce from here?The Swissie (USD/CHF) is falling towards the pivot, which is an overlap support and could bounce to the 50% Fibonacci resistance.

Pivot: 0.7933

1st Support: 0.7879

1st Resistance: 0.8052

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Could the Swissie bounce from here?The price is reacting off the pivot which acts as an overlap support and could bouncer to the 1st resistance which is slightly above the 37.2% Fibonacci retracement.

Pivot: 0.7933

1st Support: 0.7879

1st Resistance: 0.8016

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

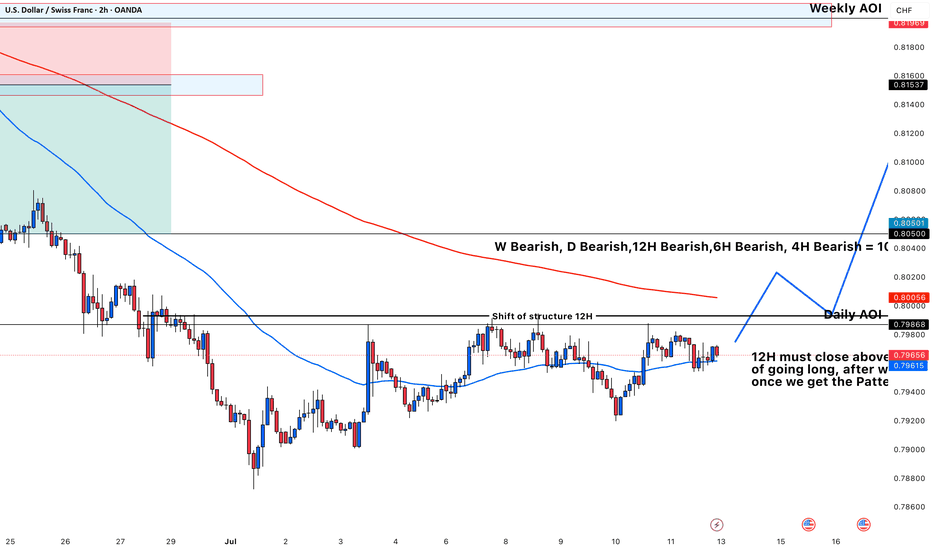

USDCHF Breaks Expansion, Aims For Next Support LevelOANDA:USDCHF has given us a Breakout of the Expanding Range it has been traveling in since the Low @ .78712 created on July 1st.

Now Price has already Retested the Breakout of the Rising Support of the Expansion and a Past Support Level, now turned Resistance @ .7960!

Hourly candles are continuing to close Lower signaling further potential to the downside!

Short Entry @ .7945

SL @ .7965 ( Above Retest of Breakout )

TP @ .7880

USDCHF: A Bullish Reversal Hinges on 0.7985USDCHF: A Bullish Reversal Hinges on 0.7985

USDCHF is currently testing a critical support zone near 0.7880—a level not seen since 2011.

The fact that price has returned to this area after more than a decade underscores the significance of this moment.

The pair remains under pressure for two key reasons:

Ongoing US tariff tensions have created big uncertainty and weighed on the dollar.

The Swiss National Bank continues to intervene in the FX market under the pretext of supporting the domestic economy and controlling inflation. While their reasoning may seem increasingly dubious, the impact on USDCHF is undeniable.

A decisive move above 0.7985 could signal the start of a bullish trend, with potential upside targets at 0.8060 and 0.8190.

A break of this resistance would not only shift short-term momentum but could also signal a broader trend reversal.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bullish rise?USD/CHF is reacting off the resistance level which is a pullback resistance and could rise from this level to our take profit.

Entry: 0.7975

Why we like it:

There is a pullback resistance.

Stop loss: 0.7934

Why we like it:

There is an overlap support.

Take profit: 0.8033

Why we like it:

There is a pullback resistance that aligns with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish rise?USD/CHF is reacting off the support level which is a pullback support and could potentially rise from this level too ur take profit.

Entry: 0.7936

Why we like it:

There is a pullback support level.

Stop loss: 0.7900

Why we like it:

There is a pullback support level.

Take profit: 0.8001

Why we like it:

There is a pullback resistance that aligns with the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USD CHF SHORT PLAY-TITAN SIGNAL🔻 USDCHF SHORT PLAY – TITAN SIGNAL 🔻

"Impulse Drain Line Breach – Initiate Tactical Short"

📍 PAIR: USDCHF

🎯 Play Type: Short

📈 Signal Code: Impulse Drain Line Activated

📌 Entry: Upon clean break + retest of the Impulse Drain Line (0.79436

🎯 Targets:

LZ1: 0.7909

LZ2: -0.7898

LZ3: 0.7886

🛡 Stop: 0.79522

USDCHF continues bullish recovery. Opportunity for BUY signal✏️#USDCHF is showing bullish recovery. The price is trading in a triangle pattern in the recovery phase. The 1.79500 area is an important support zone that is driving the pair's upside. 0.80700 is the immediate Target for a BUY signal.

📈Key Level

SUPPORT 0.79500

RESISTANCE 0.80700

BUY now at support 0.79500

Target: 0.80700

SELL Trigger: Break support 0.79500

Leave your comments on the idea. I am happy to read your views.

USD/CHF SWISSY Forex Heist Plan | Thief-Style Buy Setup🔥💰 "Forex Bank Heist: Thief Trading Blueprint for USD/CHF SWISSY 💵💸" 💣🚨

"Steal Pips, Not Dreams. Trade Like a Robber, Think Like a Mastermind." 🕶️💼

🌟 Hello World! Bonjour! Ola! Hallo! Marhaba! 🌟

Welcome, all Money Makers, Market Hustlers & Chart Robbers 🕵️♂️🤑🚁

Let’s gear up for our latest USD/CHF "Swissy" Forex Bank Heist, crafted using our high-level Thief Trading Style—a bold fusion of technical know-how, street-smart price action, and strategic risk maneuvers.

💎 HEIST PLAN SUMMARY

This trade is locked, loaded, and ready to target the vault using a Bullish Breakout / Pullback strategy.

We are eyeing the SWISSY with laser focus, watching closely for price action to retest key support zones, then blast through resistance to secure our escape route.

Let’s not get caught in the police trap zone (aka overbought resistance with fakeouts and bearish ambushes). Keep those trailing stops tight and your loot tighter. 🏃♂️💨

🎯 ENTRY STRATEGY — “The Vault is Open!” 📈

💰 Buy Limit Orders near recent swing low or pullback zone (15M–30M timeframe).

💣 Use DCA (Dollar-Cost Averaging) or Layered Entry strategy to spread risk and improve entry points.

🏹 Entry range: Monitor consolidation for the perfect dip-snatch setup.

🛑 STOP LOSS — “Fallback Safe House” 🚨

📍 Place SL just below recent swing low using 2H timeframe (e.g., 0.79200).

💡 Adjust based on position size, number of entries, and personal risk.

🏴☠️ TARGET ZONE — “The Getaway” 🎯

🎯 TP Level: 0.80700

🚁 Or escape early if momentum weakens—profit is profit.

💹 Scalpers: Ride only the bullish getaway car. Use Trailing SLs to ride and protect gains.

📊 MARKET STATUS — "SWISSY Watchtower" 🕵️

The market is currently neutral, but pressure is building. Expect a bullish breakout if macro & technicals align.

💡 Smart Robbers read the full blueprint:

→ Macro Outlook

→ COT Reports

→ Sentiment Analysis

→ Intermarket Trends

→ Seasonality & Institutional Flow

📰 TRADING ALERT — “Dodge the Sirens” 🚓

🚨 Avoid opening new trades during high-impact news events

💼 Use Trailing Stop-Loss to lock in profits

🧠 Plan your risk and exit BEFORE the bullets (candles) start flying

❤️ BOOST THE CREW! 💥

If this plan helps you pull clean profits, show love and Boost the chart 🔥📈

Your support fuels more strategies and keeps the crew funded 💼💵

Stay sharp, stay ruthless, and always trade like a Thief in the Charts 🎩🕶️

📌 Disclaimer

This strategy is educational and should not be considered investment advice.

Always trade based on your own analysis, risk profile, and market research.

🗓️ Stay tuned for the next Forex Heist Blueprint — we rob charts, not wallets.

📡 Tap follow. Boost the crew. Profit like a pro.

Is it time for the buyers to step in?Double bottom forming at this key area on the pair. There's a huge abnormal sell volume candle printed in April, If really there are players positioned there a hard push up could mean a short squeeze propelling the price to go up further and quicker as sellers will have to run for cover.

6S1! Futures Divergence Signals USD/CHF Long OpportunityI'm anticipating a bullish USD/CHF move. We're seeing a retest of a key daily demand zone, which is reinforced by a weekly supply area from the futures market (6S1! contract). Futures data suggests significant retail investor bullishness, contrasting with bearish positioning from commercial and hedge funds. This divergence suggests a potential long opportunity. I've also highlighted the next key demand area on the CFD USD/CHF chart.

✅ Please share your thoughts about 6S1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

USD-CHF Bearish Flag! Sell!

Hello,Traders!

USD-CHF is trading in a

Downtrend and the pair broke

Out of the bearish flag so

We are bearish biased

And we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCHF – Sell Into Resistance in Bearish ChannelTrade Idea

Type: Sell Limit

Entry: 0.7989

Target: 0.7905

Stop Loss: 0.8018

Duration: Intraday

Expires: 09/07/2025 06:00

Technical Overview

The primary trend remains bearish, and price is currently trading within a corrective channel formation, suggesting further downside potential.

Trendline resistance at 0.7995 aligns closely with the entry point of 0.7989, providing a strong technical barrier to cap gains.

The recent weakness in the US dollar supports a continued bearish outlook for USDCHF.

A break below support zones could accelerate a move toward the target at 0.7905.

No significant events are scheduled in the next 24 hours, allowing technical patterns to dominate intraday trading.

Key Technical Levels

Resistance: 0.7991 / 0.8020 / 0.8050

Support: 0.7958 / 0.7922 / 0.7900

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

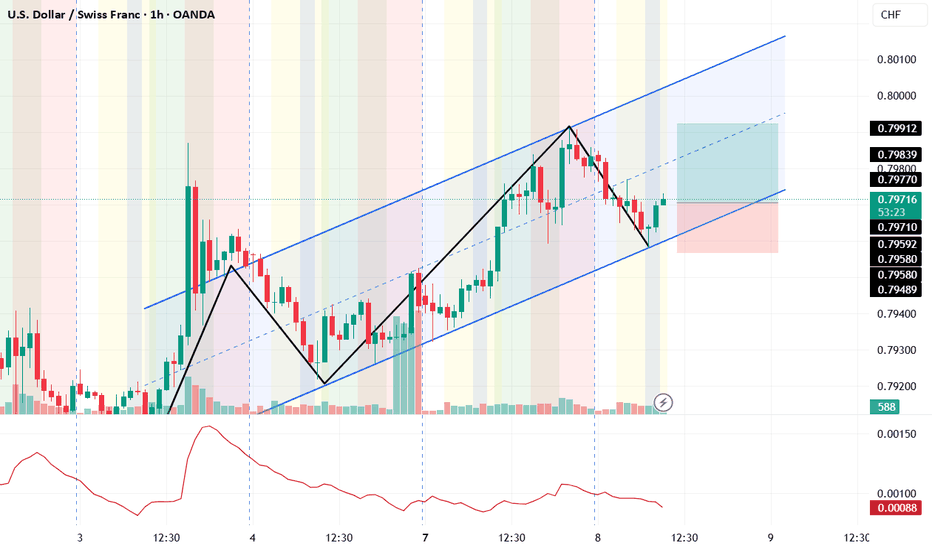

USDCHF – Trendline Break Signals Bearish Shift (1H Analysis)USDCHF has broken beneath a key ascending trendline that’s been supporting price since July 3rd. This drop comes after multiple failed attempts to break the 0.7986–0.8000 resistance zone — a level that continues to reject bullish pressure.

Now, price is retesting the broken trendline and the 50 EMA from below, creating a potential bearish continuation setup if this retest holds.

⸻

Bias: 🔻 Short

This is now a bearish structure unless price reclaims and closes above 0.7985 with strength.

⸻

Trade Idea:

• Entry Zone: 0.7960–0.7970 (trendline/EMA retest)

• TP1: 0.7930 (previous low / structure support)

• TP2: 0.7900 (psychological + demand zone)

• Invalidation: Clean break and hold above 0.7986

⸻

📌 Structure shift + EMA + trendline confluence

📌 Clean rejection from resistance

📌 Lower highs forming

⸻

#USDCHF #Forex #TrendlineBreak #BearishSetup #BuiltNotBegged #AutoMarkets #PriceAction #ForexAnalysis #TradingViewCommunity