USD/RMB analysisThere has been much talk lately on the Chinese yuan (RMB) dethroning the US dollar as the world's main reserve currency within the next decade or so.

I have been analysing the chart of USD/RMB from an Elliot wave's perspective to assess the possibility of that occurring.

In my analysis, the pair USD/RMB has completed the running flat pattern (W) and is currently on the 'c' wave of the zigzag pattern (abc). The orange box, in the 8 region, is the target price of the (X) wave. This is followed by a retracement in the form of a triangle or flat (Y) and will bring the pair down to the low end of the 7 region as depicted in the chart.

The Y pattern can be viewed as a consolidation phase for the pair before rallying higher. It took 5 years to complete the W pattern. One would then expect a similar timeframe for the Y pattern.

I will label the corrective pattern (W) flat, (X) zigzag, (Y) flat or triangle, as a running double three pattern, with the possibility of the end of wave 2 higher than that of wave 1.

I reckon that USD will gain from strength to strength against the RMB in the years to come, though it will not be in a linear form. As such, it is highly unlikely that the Chinese yuan will replace the US dollar as the world's reserve currency in the next decade, let alone in the foreseeable future. IMHO.

USDCNY_TOD trade ideas

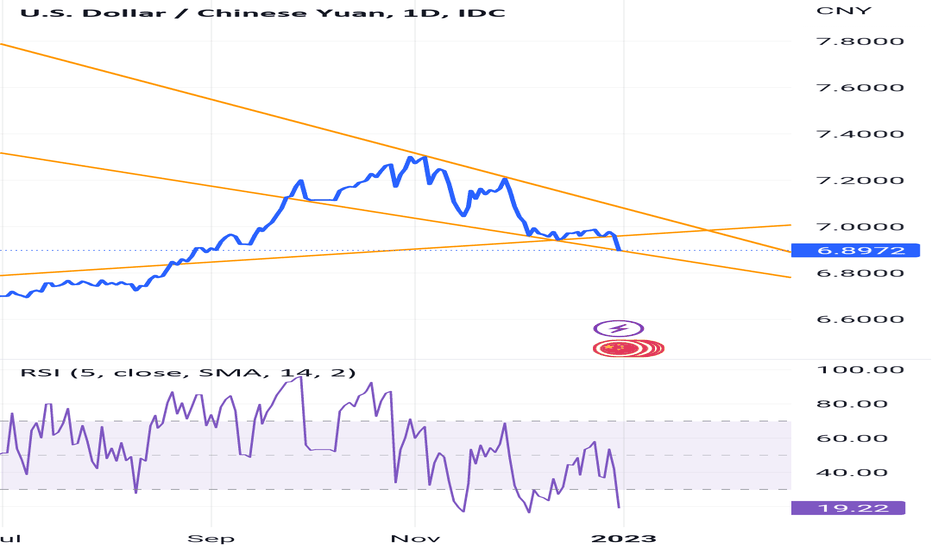

USDCNY Approaching a 2 month Resistance on overbought RSI.It's been a long time see we last traded the USDCNY pair (see chart below) but it was a long-term trade that very precisely hit the both the 1D MA200 (orange trend-line) and 1W MA100 (red trend-line) targets:

After the January 16 rebound, the pair former a Channel Up and currently the price is approaching the 6.9785 Resistance. The 1D RSI got overbought on Friday for the first time since February 24. If it closes a 1D candle above Resistance 1, we will buy and target the top (Higher Highs trend-line) of the Channel Up at 7.0500. Until then we will sell those overbought indicators and target the 1D MA50 on the short-term and if it closes below the Inner Higher Lows, then sell more towards the bottom of the Channel Up. If the price closes below Support 1, then long-term sell targeting Support 2 at 6.7000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USA vs. ChinaA new and dangerous phase of relations between China and America can bring a lot of problems for the world economy and not only.

After the removal of restrictions on the coronavirus, China opened up and became accessible to the world economy again. Everyone was waiting for this event and hopefully expected that the global crisis would end and new growth would begin, but China is not so simple.

Tensions between China and the rest of the world are only growing , because China sees the weakness of America and Europe, in addition, China feels pressure from America, which does not want to put up with a new big rival and wants to destroy it.

America is not ready to just give away the title of economy No. 1.

President XI has won the election again and is hostile to America, which means a difficult future for the countries' economic relations.

Xi is starting to establish contacts with neighbors and with political allies. Xi's recent meeting with Putin confirmed the strength and cohesion of China and other countries.

In response, America is trying to restrain China by force, increasing military tension in the Asian region. America imposes strict restrictions on products from China, while not yet able to replace vital parts, America is trying to build new production in other countries.

In turn, China is increasing military spending and is not going to give up power in Asia, demanding to take its hands off Taiwan.

All this leads to possible conflicts and a downturn in the economy.

A drop in global GDP to an alarming 7% is possible.

Last year, America imposed a ban on the sale of some semiconductors and equipment that is manufactured in China. This event increases the gap in the economies of both countries, because now not only China will not receive money, but the United States will not receive important components.

In the US Congress, a complete ban on TikTok is on the agenda. This platform generates billions of dollars and its complete closure will lead to big problems.

As noted in a recent article by Alan Wolf, Robert Lawrence and Gary Hufbauer of the Peterson Institute for International Economics, the growing hostility to trade in the United States risks negating the achievements of the last nine decades of extremely successful policy.

A new World Bank book highlights that the long-term prospects for global economic growth are deteriorating. One of the reasons is the slowdown in global trade growth after the global financial crisis of 2007-09, exacerbated by the turmoil after the Covid pandemic and the rise of protectionism. Among other things, as noted in the book, trade “is one of the main channels for the dissemination of new technologies.” In addition, it should be noted that a more protectionist world will have a lower elasticity of supply and, consequently, a greater propensity to inflationary shocks.

From all sides, countries are trying to aggravate the situation. Chinese investment in the US economy is at a minimum, investments from the US are no longer directed to China.

China, in turn, wants to make the yuan the number one currency and create a union within which all payments will not be made in dollars.

All this can have a detrimental effect on the dollar.

The future is foggy as never before.

The US is printing more and more money, causing more and more problems.

China is a dangerous rival that is gaining strength.

What will happen next? What do you think?

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

USDCNY Chinese Yuan will strengthenOne significant challenge to the US dollar's dominance in the global economy is the growing trend of de-dollarization. Many countries are seeking to reduce their dependence on the US dollar for international trade, investment, and other financial transactions.

One reason for this trend is the use of economic sanctions by the US government to contain geopolitical threats. The US government has used economic sanctions as a tool of foreign policy, often targeting countries that pose a perceived threat to US national security interests. These sanctions can prevent countries from trading with sanctioned nations or accessing the US financial system, which can have a significant impact on their economies.

As a result, many countries are seeking to de-dollarize to avoid the systemic risk of being sanctioned or losing access to the US financial system. For example, nations like Saudi Arabia, Russia, India, and Iran have agreed to trade using the Chinese Yuan, especially in trading oil and gas. This move to alternative currencies like the Chinese Yuan could reduce the demand for the US dollar and weaken its value in the global economy.

Furthermore, the Chinese government has taken significant steps to strengthen the international role of the Chinese Yuan. For example, they have established currency swap agreements with over 30 countries, allowing for the direct exchange of currencies without the need for the US dollar as an intermediary. Additionally, China has established the Belt and Road Initiative, a massive infrastructure development project in Asia, Europe, and Africa. This initiative is expected to significantly increase the use of the Chinese Yuan in international trade and investment, further weakening the dominance of the US dollar.

Another significant factor weakening the US dollar is QE infinity, which has resulted in the inflation of the dollar and the destabilization of the US economy, apparent in the series of bank failures. The US Federal Reserve's ability to print dollars ad infinitum, without causing significant inflation, has been supported by the Petro-dollar system. This system required nations wishing to buy oil or gas to purchase dollars in the past, which strengthened the dollar. However, as more countries de-dollarize, the demand for the US dollar in oil and gas transactions could decline, which could weaken the US dollar's value.

Moreover, the US dollar's value has also been supported by the notion that the US has a deep taxpayer base and the strongest military. Nations leaving the dollar could put pressure on the US to increase taxation to compensate for the loss of revenue from the Petro-dollar system. Additionally, any significant losses in US military conflicts could have a disastrous impact on the US dollar's value, as the US military is seen as a symbol of US strength and security.

In conclusion, de-dollarization is a growing trend in the global economy that poses a significant challenge to the dominance of the US dollar. Countries are seeking to reduce their dependence on the US dollar to avoid being sanctioned and to reduce their exposure to the risks of the US financial system. The trend towards de-dollarization is likely to continue, which could weaken the value of the US dollar in the global economy. The US dollar's value is also being challenged by factors such as QE infinity, the potential decline of the Petro-dollar system, and the risks to US military strength and taxation revenue. Meanwhile, the Chinese Yuan is expected to strengthen as China takes steps to increase its international role and influence, potentially weakening the dominance of the US dollar in the global economy even further.

In terms of technical analysis of USDCNY, it appears that the Yuan will strengthen, indicating that US efforts to support the dollar will fail. USDCNY has dropped below its range resistance and retested it, a pattern known as a "fakeout" above a key level. This pattern has previously resulted in USDCNY reaching a bottom of the range at 6.3. The clear pattern of a "fakeout" above a key level in USDCNY suggests that the dollar will fail to hold its range support, as previously predicted in the idea of the DXY dollar index.

The possibility of DXY bouncing off its support is less likely than breaking below its support, as DXY is in a descending channel. If DXY were to rise, so would USDCNY, but the range support for USDCNY has now turned into resistance, from which it has already been rejected. Furthermore, the descending channel of USDCNY provides additional resistance to an upward move.

If this analysis proves to be accurate, it would once again confirm the maxim that "all news is in the chart."

USD vs CNY US Dollar vs Chinese Yuan Q1 Currency War Thoughts!The Background & Info:

At the end of Q1 we have seen the usual crazy headline packed news cycle that we all have become accustomed to since 2020. Strange news, wars, meme realities and conspiracy vindication are now the new normal. You might have missed it in the news cycle, due to all the chaos, but the Chinese Yuan ( CNY ) has made some HUGE waves throughout the world by announcing the settlement of Saudi Arabia's purchase of gas from Russia. It appears that China is taking a page out of the USA playbook by being seen on the international stage trying to broker peace in a proxy war it appears to be funding in a foreign land, aggressively disrespecting nations borders with its airspace violations and spy equipment and, if all that was not enough of a copy cat move, they now have moved forward with courting Saudi Arabi into its BLOC countries that have agreed to swap their trade settlements from the USD to the CNY .

It appears Long gone are the days of China shouting threats from the confines of the Forbidden City ( not Forbidden Garden ) walls. They now seem to be taking center world stage and with the Ukraine war and the Saudi Arabia agreement. This will allow them to continue their campaign of world influence peddling and open the doors of Europe to them as a proxy negotiator for Russian Oil & Gas as well as alternative trade settlement base, military assistance, and other one off trade alliances. Truly a wolf in sheep's clothing is now knocking on the doors of Eastern Europe. Europe is one of the few areas of the globe that China currently does not have a good foot in the door. In Africa and the Middle East they own the majority of rare earth mineral rights & mines, In Asia and America they control the tech and manufacturing sectors. Now they are taking on Global Policing and Influence that will lead them into Europe in 2024.

Is this the END of the US Dollar being the currency of the world's economy? How is the Chinese Yuan stacking up against the US Dollar today? Well....

What does the Chart Say:

My charts are telling me that historically the USD is a powerhouse and has had MANY moments of retracement while maintaining a VERY bullish uptrend. Support is EVERYWHERE for the USD and the world economy understands better than we the citizens do, that USA policy and leadership change every 4-8 years. The recent gains of the Chinese CNY BLOC should have crippled the USD but instead it merely dipped it back to the mid range of its upward bullish trading channel.

SUMMARY:

I would refuse to bet against the USD and I don't see any significant trading opportunities arising from this over the short term. However, if the Chinese continue to play the world police and peace broker on the world stage then other countries and other settlements will strengthen the BLOC alliance and that WILL have a noticeable effect on how the USDCNY trades. I would suspect that IF more significant trade partners join the BLOC and China continues its mature world stage presence, that the USDCNY would end up looking to trade between 5.5-6.25 this time in 2024. But if the USA gets back to world leadership, makes a strong presence felt on the world stage, then I would look for USDCNY to continue is current trading channel and its bullish uptrend.

THIS is just me documenting my own thoughts on the matters at hand. Do your own Research.

USDCNY DAILY POTENTIAL BULLISH OPPORTUNITYFX_IDC:USDCNY

TRADE PLAN

INSTRUMENT: USDCNY

TIMEFRAME: DAILY

DESCRIPTION

While awaiting FED decision later today, there are potential bullish entries on Lower timeframe with stop loss at 6.830.

If price break the stop, we shall look for another bullish entry at the external trendline targeting 7.4900 level.

Fed rates hike will confirm the bullish bias.

Forex - $USD/$CNY trend status changed w/ 21yr backtesting, wk10

2023, week 10

- Trend Status Analysis by PresentTrading

USD index is fluctuating around 6.9.

The risk market is uncertain.

Keep moving. Keep watching.

Gluck. Please do risk control.

-- Summary --

Total Closed Trades 34

Winning rate 76.47%

'Use backtesting to evaluate and make objective trading decisions.'

by PresentTrading

#forex #USD #CNY #trading #backtesting

Forex - $USD/ $CNY trend status changed w/ 21yr backtesting, wk9FX_IDC:USDCNY

Up only? it seems DXY is going to dominate Forex again in short term.

Keep moving.

Keep watching.

-- Summary --

Total Closed Trades 34

Winning rate 76.47%

Use backtesting to evaluate and make objective trading decisions.

Gluck. Please do risk control.

PresentTrading

#forex #USD #CNY #trading #backtesting

230228 - USD/CNY as leading indicator - or not?I am investigating the extent to which USD/CNY is an indicator of future USD moves across the Majors.

First, notice on the chart how well Price-Action and Elliot Wave concepts apply to USD/CNY.

The levels of polarity chance sit right on the Fionacci retracements.

The Breakout Aug 2022, in (A), follows the description of a breakout (Pre-Breakout PA) to perfection.

The Breakdown Dec 2022 / resumption of trend, in (D) is beautiful in its simplicity.

The top reversal from Oct/Dec last year in (B) is a textbook example of a Head & Shoulders pattern.

The top itself (C) does also read as THE top: Long Candle up, Dark cloud Cover, Inside bar, Pin bar and a counter strike bar. Text book Dark Cloud Cover Reversal, in fact you’ll find a chart example in Steve Nison, 'Beyond Candlesticks’, p.80, that looks very similar to this one. (I checked, I did look familiar when I saw it)

Double bounce Jan 2023, in (D) respecting S/R levels from 6 months earlier.

LAST FRIDAY

You remember USD gained across all pairs. Bullish USD means Bearish Stocks. Friday should have been a good day for you guys. It was easy, no?

All I needed for Friday was USD/CNY, it’s what I based my decisions on.

THE BREAKOUT LAST FRIDAY WAS PRECEDED BY A BRKEAK OUT ON USD/CNY.

MEANING THAT (AT LEAST ON THAT OCCASSION) USD/CNY IS A LEADING INDICATOR, maybe just because it's the earliest market to trade on any given day.

DOLLAR INDEX (#DXY) vs USD/CNY AS INDICATOR.

I have added DXY (in orange) as an overlay. I few things I notice:

Most important takeaway;

USD/CNY tells you the start of the big move up or down within a day or 2max. USD/CNY is not useful in providing info in ranging DXY markets.

May-Aug 2022. DXY is frisky. Jumps down, up, up and down, arriving where it started, 3 months earlier. During this time USD/CNY remains stable. But the breakout is dead-easy to read from the USD/CNY, while DXY at that time was confusing and useless as indicator.

I have already explained the top-reversal on USD/CNY above. That is clear. On DXY however, the top is very frisky again, wild swings with a range, half the range of the entire wave down.

1 Feb 2023. Is the bottom of the down-move on DXY. 2 Feb 2023 on USD/CNY. But USD/CNY gives you confirmation with a double bottom, which can be read as being the bottom.

Conclusion

For now, I suggest you add USD/CNY to your watchlists, and look for USD-pairs that respond well. (JPY and CHF are two) For those USD/CNY will be a useful indicator for timing your USD-trades.

One last thing - the spread between the USD/CNY and DXY

When the spread becomes too large, USD drops, but DXY drops more. We know CNY is overvalued. Chinese Central Bank manipulates it, since 2015, when USD and CNY de-pegged. But I need to investigate the spreads further.

Forex - $USD / $CNY trend status changed w/ 21 yr backtestingFX_IDC:USDCNY

Keep moving.

As what the post told last week,

the downside trend has stopped,

USD is showing strength against CNY.

-- Summary --

Total Closed Trades 34

Winning rate 76.47%

Use backtesting to evaluate and make objective trading decisions.

Gluck. Please do risk control.

#forex #USD #CNY #trading #backtesting

CNY responds beautifully to Technical AnalysisSpot the 4 patterns. With Dollar Index (DXY) plotted below for comparison.

It's a shame the USD/CNY can't serve as a leading indicator for USD-pairs, but its analysis shows you WHEN to enter the USD-market, long or short, and catch the big waves.

The most notable are the periods of sideways trading. Looking at USD/CNY, those are really calm and composed, while DXY is shouting and screaming as it were.

Forex - $USD / $CNY trend status changed w/ 20 yr backtestingFX_IDC:USDCNY

USD is showing strength against CNY, and the downside trend has stopped.

-- Summary --

Total Closed Trades 34

Winning rate 76.47%

Use backtesting to evaluate and make objective trading decisions.

Gluck. Please do risk control.

#forex #USD #CNY #trading #backtesting

The Chinese yuan is the new world currency.The forecast that will probably come true not in 10 years, but this year, the yuan will begin to become the world's currency. Currently it only accounts for a few percent of world trade, but it will account for tens of percent.

In this scenario China must stop devaluing the currency to please its exporters and overseas partners. Create an infrastructure parallel to the SWIFT system. I assume that this will be a digital yuan for international transactions. Whether there will be a correlation with the current fully fiat yuan - I can't say yet.

The Black Swan Soars on Plague WindsWhat is the Environmental, Social, and Governance effect of 400,000+ excess deaths a day over a month? Internal Chinese government documents suggest over 250 million cases in the first three weeks, across the country in December after COVID-zero protocols were disbanded from increasing social unrest. Others suggest a sitting average across two weeks at 37 million cases a day. Extrapolating the US's statistics onto China, a ~1.1% mortality rate with 10-15% incidence of Long-COVID yields 400 thousand deaths and 30 to 45 million disabled, so far. The image of the dystopian brutality in previous COVID-Zero lockdowns emanating from social media channels that weren't blocked out from government censors revealed the extent a nation would go through in order to prevent what is currently happening. From a humanitarian standpoint, the pain and suffering of the Chinese people during this time is incalculable and irrefutable.

Mathematically, these numbers are ideal and optimistic; healthcare in China is as diverse as America's major hospitals vs rural community, except numbers far in excess. Staff, equipment, general education levels, ability to buffer and support - all at drastically reduced levels in a country that has failed to hit reasonable vaccination levels with an ineffective vaccine. Socially, 400 thousand homes a day losing at least someone, and millions more taking a hit to productive members and increasing in burden. Economically, whatever lockdowns shuttered commerce is just the start. Short-term consumerism will be chaotic as essential goods struggle to meet essential needs, on the back of behaviours befitting a scene of crumbling organization. Long-term will suffer as 1+% of the population exits stage right quickly, and the potential tens of millions dealing with a new disability preventing maximum economic output, or even any.

Environmentally, the Megatropolis has failed. Early COVID in America was centered on dense-Urban populations, with New York City facing some of the worst numbers resulting in National Guard being called in to medically treat the living and sanitarily remove the dead. China has ten cities bigger than NYC, and 40 more just under to 25+% of the size. High-density environments carry outsized risks in disease transmission, as a single cough reaches far more susceptible hosts for disease progression. Aside from the obvious, previous studies on China's COVID issues with urban environments has revealed serious regulatory failures in high-rise plumbing that enabled aerosolized-COVID from wastewater within apartments to spread across the building. The social unrest and riots in the streets that forced the CCP from COVID-zero saw millions congregating on the street in super-spreader events.

Governance, or rather Government, failed. Behaviours by the Chinese government to reduce the likelihood of this specific event, and to reduce total COVID levels across the nation, failed. The Chinese government has failed to prevent a catastrophic-COVID event, and the Chinese people are and will continue to suffer from it. No good deed goes unpunished, which says little for bad deeds done for "good" reasons. Unfavourable and unsupported lockdowns were a necessary evil to give the Chinese government more time to establish preventative measures, medicines, and environments to enable reduced-transmission without preventing social activity. Furthermore, the riots that led to the abandonment of the lockdowns were only stopped by government acquiescence, which means that whatever next step the government chooses to do will be done on the back of an angry populace. Balancing the economic and healthcare needs of the largest nation on Earth is hard enough, doing it on the back of a persistent tract of failures will be a dance.

Russia's continued attacks on Ukraine carries a risk of social unrest leading to dissolution of the nation; secluded and deprived regions being scoured for bodies and cannon fodder are increasingly rising up against Putin's regime. While these events carry more risks on the frontline, and reveal themselves with Russian-on-Russian violence in Ukraine, dissatisfaction and anger continues to build as graveyards fill up. China has been unified for millennia, and are made up of diverse regions and peoples that carry this patchwork engrained culturally. Despite moderate runs of anti-individualism, there is little to suggest a greater "falling apart" would happen - but that doesn't mean the Communist party gets to celebrate.

China's COVID-surge is just one facet of a nation struggling in the times. Tensions have been rising amid economic issues across the globe, naturally occuring as friction between sovereign's builds in a bipolar environment. An economy built on manufacturing everything else for everyone else is fragile as reshoring begins, and rising tensions between China and regional partners has only accelerated that. China winning an invasion on Taiwan isn't the same as Russia and Ukraine - China's military strength removes most of the guesswork on success, but that success itself would result in greater issues of international cooperation for a country so focused on being the economic center of the world. Bipolar to America's financial center of the world; and this distinction carries the greatest importance for the future. Economic sanctions on Russia elucidated the totality of the situation, China's large stockpiles of other sovereign's government debt and bills is only as good as the willingness of those other sovereign's to respect that debt. If China wants to continue to play any game on the world stage, it will need to continue to play by the greater game's rules. Russia believed it had the strength to break these, to which it failed and will continue to fail until the government ultimately fails.

The global property market is popping, with very different effects among the parties. If America's housing crisis can be summarized as too little housing at too high prices, China's is too much housing at too high prices. Recent publications reveal over 90% of Chinese households own a home, with over 20% owning multiple homes. Various sources cite different numbers, but recent data suggests a greater than 40% ownership of 2, and 25% ownership of 3+ homes. Stories of China's "Ghost cities" have been circulating for decades, with several documentaries showcasing intimate portrayals of a government utilizing construction for GDP inflation. This obsession with numbers over reality is one of the greatest strengths China has, because the government does have the ability to create economic realities with those numbers. While most economists might cite wasteful spending on building regional transportation, high speed rail, and decentralized infrastructure across the gigantic nation - this infrastructure will enable diversified and de-localized population spreads with integrated and co-dependent economies. China's surplus on making everything for everyone else underpins a need for external demand. As that demand decays, China needs to build a system that benefits from intranational trade and internal demand. The government fully acknowledges this, CCP economists and strategists have been working on this for some time, but COVID belies the issues interpreting.

Medically, the mRNA vaccines provide significant protection against valid-COVID strains, and were made almost immediately post-genomic sequencing of the virus was made public. Peptide vaccines were slower to develop due to technological limitations, but are currently on the market. China failed to produce a nationalized version with similar efficacy, and failed to establish the mRNA technology to enable vaccine production. Scientifically, China relies on knowledge and technology transfer from others; as America and other nations continue their attempts to limit access to next-generation technologies, China's ability to create current-generation goods and services decreases. This is nearly two years of failure in securing and utilizing nascent technologies to prevent catastrophic COVID-surges, amid a top-down directive against foreign vaccines.

The ability to accurately forecast in China is done. The Black Swan among black swans has landed, and there are no longer guarantees of specific outcomes. 2022 saw Xi Jinping consolidate power into a blackhole, with the gravity of the times bringing extra pressure to a nation struggling to find a new path forward. Whether the government escapes the pull from their own failures isn't for current debate, as it is the action of the people that give the nation it's power, it's drive, it's ability to move forward. Whatever comes, may 2023 bring peace and health to the world, and to the Chinese people.

Selected References:

www.ncbi.nlm.nih.gov

www.scmp.com

www.cnn.com

www.bloomberg.com

Author's Note

Strain mutation will be extremely high given close-proximity of hosts across diverse immunological and pathological backgrounds; i.e. strains will mutate as they attempt to spread across people who have gotten various strains in the past with variable antibody levels and response. It is impossible to guess how various facets of COVID modulate, such as symptoms, but the virus has made significant modifications in RNA stability, replication levels, immune-stealth, evasion, etc. Many nations will and should institute travel bans to limit viral spread across large geographical distances, which will seriously afflict global markets.

USDCNY Bearish below the 1D MA50A month ago we called the top on the USDCNY:

With the price breaking below Fibonacci 4.0, the pair has basically called for an extension of November's downtrend. This will be confirmed if the price fails to close the week above the 1D MA50 (blue trend-line).

As you see, on a sample dating back to January 2017, every time the price failed to close above the 1D MA50 (four events), it extended its losses and broke below the 1D MA200 (orange trend-line), approaching the 1W MA100 (red trend-line) and on two occasions breaking (much) lower. A slightly different case is March 2017, when the price did break above the 1D MA50, but eventually collapsed below it a few weeks later.

Perhaps the best confirmation for a long-term sell would be when the RSI on the 1W time-frame breaks below its Support level. This happened on all of those cases since 2017.

As a result, we have a medium-term target for USDCNY on the 1D MA200.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCNY Next week will probably top and turn sidewaysThe USDCNY pair has been on a very strong rise since it got detached from the 1D MA50 (blue trend-line) on August 11. The bullish channel resembles that of mid April - mid May, which topped on its 6.0 Fibonacci extension from its previous Support. The RSI is printing a similar sequence that was just before that top.

As a result it is a possibility that the pair tops next week around 7.300 and then pulls back to the 4.0 Fib, turning sideways until it tests the 1D MA50 again, where the next long-term trend will be revealed: either a bullish continuation or a closing below it and a new bearish pattern will be introduced.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇