USDCNY About to Test a Historic SupportUSDCNY's downtrend accelerated earlier today following the release of the surprising crunch in China's trade surplus, underpinning falling global demand.

The downtrend is taking the form of a 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory. Seeing as how the price action is currently in the process of developing the final impulse leg (4-5), a bullish pullback may be due soon.

On the other hand, the ADX indicator continues to thread above the 25-point mark, highlighting the strength of the downtrend.

USDCNY_TOD trade ideas

USDCNY Developing a 1-5 Elliott Impulse Wave PatternThe price action of the USDCNY continues to be developing a major 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory. Given the declining bearish momentum in the short term, as underpinned by the MACD indicator, a pullback to the 61.8 per cent Fibonacci retracement level at 6.4156 is likely to ensue next.

This would serve as the second retracement leg (3-4) of the Elliott pattern. A potential reversal there would then underpin the likely beginning of the third impulse leg (4-5).

Bears can look for an opportunity to sell there on the expectations for a subsequent dropdown to the previous swing low at 6.3570.

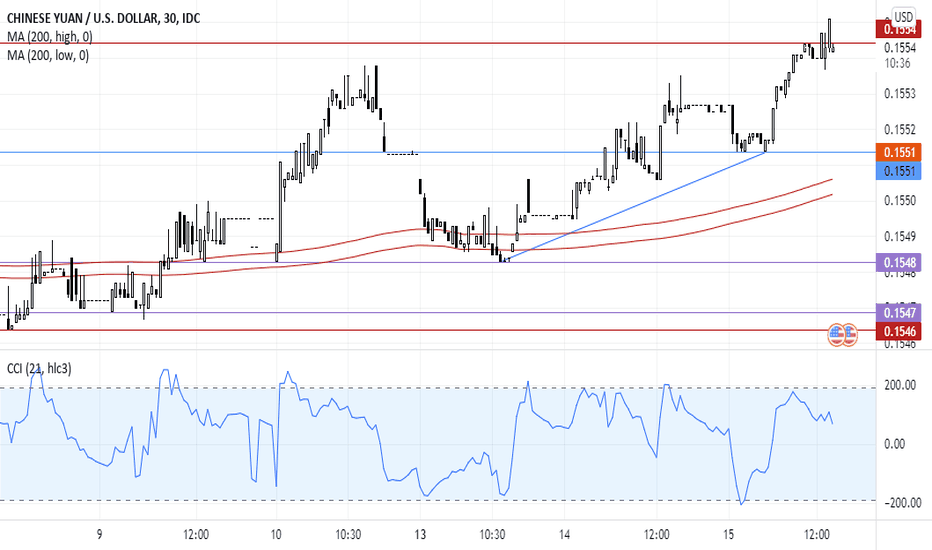

The Reversal Trend of The Chinese Yuan Against The US Dollar.The currency pair of the Chinese Yuan against the US Dollar has started to rise by 3 points between the support line 0.1551 and the resistance line 0.1554, and this is an identical reaction to the continuation pattern of the ascending triangle. On the other hand, the Chinese Yuan may reverse its trend and start decline against the rise of the US Dollar; due to the negative report issued by China's National Bureau of Statistics about annual retail sales, which came less than the expected percentage by 4.4% therefore, the currency pair can break the first support line 0.1551 to meet the second support line 0.1548, then the third support line 0.1547, and it is unlikely that the currency pair will breach the resistance line 0.1554

USDCNY Likely to Rebound From the 23.6% Fibonacci The price action of the USDCNY pair has been range-trading since the 16th of July, as underpinned by the ADX indicator. Bearish pressure has been slowly accumulating over the same period, which is illustrated by the current reading of the Stochastic RSI indicator.

The price action is likely to reach a new dip at the 23.6 per cent Fibonacci retracement level, which is the closest psychologically significant support level. A bullish rebound can be expected to occur there, given the current development of a Descending Wedge pattern. The latter represents a classic trend reversal pattern.

The first major target for the renewed uptrend would be the descending trend line (in red) just above the 38.2 per cent Fibonacci.

Don't Visit China for a bit.Won't be a pretty place for us Americans in the coming decade. They're getting serious about Taiwan after taking HK - also, looks to break below this line. For something so manipulated, there's finally some pattern & reason.

I've visited China twice; I absolutely love the country and her people to bits and pieces. Obviously don't agree with what the CCP is doing, and the people's dissent shows many think alike. We'll see how it goes.

USDCNY Testing a Triangle The price of USDCNY is establishing a new downtrend. It is structured as a 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory. After having broken down below the 38.2 per cent Fibonacci retracement level, the price action is currently testing the lower limit of the Triangle.

If it manages to break down below it as well, then the price action would be able to head towards the 61.8 per cent Fibonacci. However, a rebound from the lower limit of the Triangle would see the price action testing the 38.2 per cent Fibonacci from below. The latter is currently converging with the 50-day MA (in green), making it an even more powerful resistance level.

USDCNY to Fall Towards the Lower End of the Accumulation The USDCNY continues to find itself in a solid downtrend. This is illustrated by the ADX indicator, which has been threading above the 25-point benchmark since late September 2020.

The ADX reached a peak around the time the price action fell to the upper boundary of the last Accumulation range at 6.4700. Afterwards, the price went on to establish a false bullish rebound.

The latter materialised in a Dead Cat Bounce pattern, which typically represents a temporary break in the development of a broader downtrend. The pattern failed to strengthen above the 20-day MA (in red), which is why the USDCNY was then able to break down within the Accumulation range.

That is why the strength of the underlying Markdown - an essential component of the Wyckoff Cycle - appears to be waning down, as underpinned by the ADX indicator after February 2021.

This represents an early signal that the USDCNY is once again getting ready to consolidate in a new range. Before this can happen, however, the price action looks poised to fall to the Accumulation range's lower boundary at 6.2650 once again.

USDCNH went half way of my initial 1000bps target!Hello everyone. I've published 'USDCNH testing previous low with potential 1000bps drop!' 17 days later, price dropped by 500bps, hitting key level of 6.38 mentioned in the post.

I'm posting this not trying to say how accurate I am. What I care is what's next? Will the Chinese yuan keep appreciate against dollar until say, 6.33, or even 6.25?

Technically, the pair has to violated the red downtrend line on the daily for reversal. Until then, I'm bearish on dollar.

What's the impact of rising CNH?

1. Support Chinese stock market to go higher, especially for listed companies which rely heavily on import.

2. More funds will be attracted to China onshore market via HK. I can see the huge amount of money flows into China A share market via the stock Connect scheme.

3. Rising too much will hurt Chinese economy, e.g. export business. I talked to some trade merchants whose profit dropped a lot as they receive dollar from overseas.

So, Chinese government is likely to halt the speed of CNH appreciation against dollar.

CNY breaking major trendlineCNY has broken a major long term trendline against the US dollar. I believe there is more upside ahead for the Chinese Yuan.

The Chinese gov will try to talk down the Yuan to dollar but that will not work without some major government intervention. Just today, they announced a hike in reserve ratio requirements for the first time since May 2007. This move didn't work then and it probably won't work now. It may slow the acceleration though.

I would be looking for the Yuan to test its all time high of 16.66 area. Watch out for a throwback to .1558 area first.

USDCNH testing previous low with potential 1000bps drop! Hello everyone. I know the title looks too exaggerated. Would the dollar be so weak? Possible.

I remembered a friend seek my view on USDCNH 1 month ago when the pair was around 6.56. I was confident about the dollar index and told my friend that it might go to 6.68 level.

But I was wrong. Why? Because something important happened on April 1st. If you check the dollar index , it started to fall from that date. Without the events, I would be confident to be bullish on the index because of momentum, my dual-moving average system.

So, what was the event that triggered the weak dollar since then?

President Biden to unveil 2 trillion dollar infrastructure plan .

Look at that number! 2 trillion dollars plan. The massive stimulus plan would weaken the dollar index with no doubt similar to momentary easing policy. It smashed supply & demand, momentum and dual-moving average system combined.

So, my point is that do check the news or big numbers released on top of your technical analysis to increase your winner ratio . Be mindful of your confirmation bias and overconfidence.

The recent low is around 6.42. Once that level couldn't hold, the next key levels are 6.38 and 6.33. So, technically, it might drop by 1000 bps from the current level.

What might change the situation? Better-than-expected key US economic data and rate hike . Until then, dollar would be weak with downtrend continuation patterns.

USDCNY Dollar May Rally to 8 Yuan before RMB Further AppreciatesAfter China set the value of the Yuan at over 8 per dollar in the early 90s, it gained in relative value in a 5-wave impulsive sequence that ended at about 6.0 in early 2014, which was the 0.382 retracement of the rise from 1981 to 1991. Since then, it has been in an upward correction (declining in value). By our count, this 3-wave sequence has completed its waves A and B and appears to be ready to begin its 3rd and final wave C up of a larger wave A or 2, depending on one's perspective*.

We're inclined to view the small upward notch between January 25th and March 29th as a wave "E" of wave B's triangle. Triangles (i.e. the sentiment that they record), whether or not noticeably, essentially propel all market movement. In this pair, as the configuration looks right now, it suggests a thrust upward to near 8 kuai per dollar in a fairly straight rally before turning down again toward a lower target that further strengthens the RMB.

*With all of the artificial rate setting that occurred early on in the history of the yuan before it was allowed to float freely, we have some difficulty deciding whether its true destined direction is up or down. Although we have an apparent 5-wave sequence up since the 1980s, we also have a 5-wave sequence down after that. At this point, we'll assume the downward impulse was a wave A of an ABC correction. Either way, after this high, more downside action should be expected.

We see a similar juncture in GBPUSD, EURUSD and EURGBP, all suggesting a rather imminent reversal in favor of the dollar. From the price patterns alone, we suspect something may happen particularly involving the U.K. that has a global domino effect that leaves people scrambling for dollar liquidity. Whether that might be the cry for Scottish independence or the fact that Charles is actually in league with the "You will own nothing and be happy" psychos, it's anyone's guess.