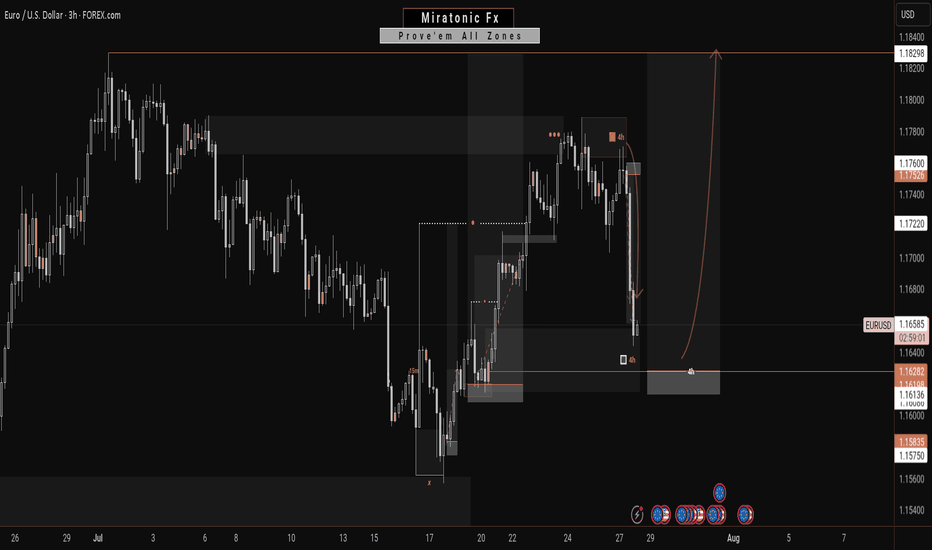

EUR/USD Analysis: Potential Reversal at Key Support📉 Day 3 of 100: EUR/USD Breaks Structure!

Today’s market gave us a lesson! 📚

✅ SL Hit due to news

✅ 61% order block broken

✅ NY session may go bullish after Asia+London trap

.

Are you seeing the pattern unfold?

👇 Comment “Wave Watcher 🌊” if you use Elliott Wave!

Day 3/100 - EUR/USD Breakdown! | Forex Analysis | Elliott Wave | Order Block Strategy

In today’s update: 📌 SL hit due to major fundamental shift

📌 Break of 61% order block; heading to 78% zone

📌 Similar pattern in Tokyo/London sessions—bullish setup possible for NY session

.

💬 Drop a comment if you're also using Elliott Wave price action!

👍 Like | 🔁 Share | 🔔 Subscribe for more daily updates!

🚀 Join the 100-Day EUR/USD Challenge — Let’s decode the market together!

#forex #eurusd #elliottwave #orderblock #forextrader #forexeducation #smartmoneyconcepts #priceaction #forexchallenge #newyorksession #technicalanalysis #forexstrategy

---

USDEUR trade ideas

$EURUSDTrade Idea: EUR/USD – Short Position Opportunity We are $EURUSDTrade Idea: EUR/USD – Short Position Opportunity

We are currently observing a EUR/USD selling opportunity.

📌 Entry Zone: 1.17539

This level presents a favorable point to initiate a short (sell) position, based on current market structure and momentum indicators.

🎯 Target 1: 1.17300

🎯 Target 2: 1.17200

🎯 Target 3: 1.17150

These targets are based on key support levels and recent price action. The pair is showing signs of downward pressure, which may push the price toward these levels.

🛑 Stop Loss: 1.17920

This stop loss is placed just above recent resistance to protect against unexpected reversals or volatility spikes.

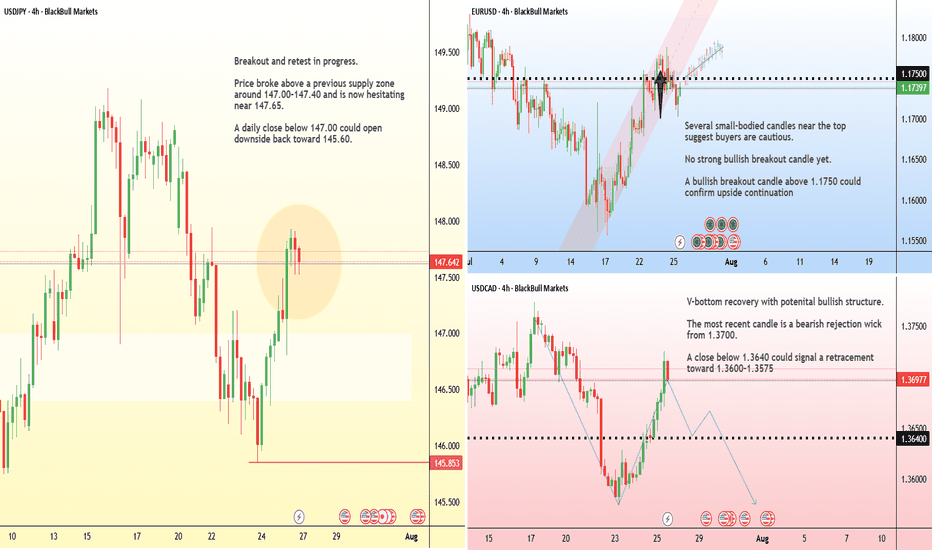

EURUSD – Smart Money Short Setup During NFP Friday | ICT Concept

EURUSD is trading inside a well-defined bearish structure after multiple internal liquidity sweeps during the London and Asia sessions.

As we enter the New York Killzone, price has returned to a bearish OB near the NY Midnight Open, with clear signs of exhaustion.

The pair failed to break above the Thursday OB zone, and the 15M chart shows consecutive MSS and BOS patterns, indicating supply is in control.

🧠 Trade Idea (Execution Plan):

Sell Limit: 1.14183

SL: 1.14422

TP1: 1.13877

TP2: 1.13608

TP3: 1.13351

📌 Confluence:

Bearish OB

NY Midnight Open rejection

MSS on LTF

RSI/Williams %R Overbought

📉 Structure: Bearish

🕒 Session: New York (NFP Volatility Expected)

💡 Context: USD is likely to strengthen after deep retracement into DXY OB, targeting 100.5–100.7

If price invalidates 1.14422 with bullish displacement, setup becomes void.

Patience is key during high-impact news – let Smart Money show their hand.

EUR/USD Analysis:🔹 Performance Overview:

The short-term trend is bearish after breaking the recent low. A temporary price correction is likely before the downtrend continues.

1️⃣ Holding above 1.151 USD may lead to a correction toward 1.160 USD.

2️⃣ However, a break and close below 1.145 USD could push the price down to retest 1.140 USD, followed by 1.135 USD.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

The euro extends sharp losses following the US-EU tariff deal

The euro weakened sharply against the dollar amid views that the US-EU tariff deal favors the US. European leaders voiced mixed reactions. Germany’s Chancellor Merz welcomed the agreement as a safeguard against economic damage, while Hungary’s PM Orbán criticized it as a one-sided win for the US. Meanwhile, the IMF raised its eurozone growth forecast from 0.8% to 1.0% in its July outlook, citing the lower-than-expected tariff levels as supportive of the region’s economy.

EURUSD broke below the ascending trendline and briefly tested the support at 1.1520. EMA21 has death-crossed EMA78, indicating the potential extension of bearish momentum.

If EURUSD fails to hold above the support at 1.1520, the price could decline further toward 1.1450. Conversely, if EURUSD breaches above the resistance at 1.1590, the price may gain upward momentum toward 1.1640.

EUR/USD Technical OutlookToday we’re focusing on the euro versus the US dollar, which has recently experienced a sharp sell-off. The move appears directional and is now approaching a key support zone, defined by:

• The April high at 1.1573

• The June low at 1.1556

• The 55-day moving average at 1.1536

A daily close below 1.1536 would be required to confirm further downside momentum.

At present, the pair looks technically vulnerable, having reversed from the top of a 3-year rising channel, with weekly RSI indicators suggesting potential exhaustion. Channel resistance stands around 1.1850.

🔽 Should support fail, we could be looking at a measured move toward the 1.1300 area as a minimum downside target.

This is a critical juncture — we’ll be watching closely for confirmation in the coming sessions.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

EURUSDTrade Opportunity: EURUSD – Short Position Setup

We have identified a potential selling opportunity on the EURUSD pair, supported by current price structure, momentum shifts, and broader market dynamics. EURUSD is currently facing strong resistance near the 1.15850–1.15900 zone, which has rejected price multiple times in the recent past.

The pair appears to be forming a lower high on the 1H and 4H charts, indicating weakening bullish momentum and the potential start of a downward move.

Entering the trade at 1.15862 allows us to capitalize on early signs of bearish reversal before a possible larger drop unfolds.

The first target at 1.15610 captures a minor support level and could be reached swiftly if bearish pressure persists.

The second target at 1.15480 aligns with the base of a previous consolidation range, offering additional confirmation of downward structure.

The third target at 1.15320 reaches deeper into the last demand zone and could be hit if bearish sentiment intensifies.

The stop loss at 1.15950 is placed just above the recent swing high to protect the trade while keeping the risk tight and manageable.

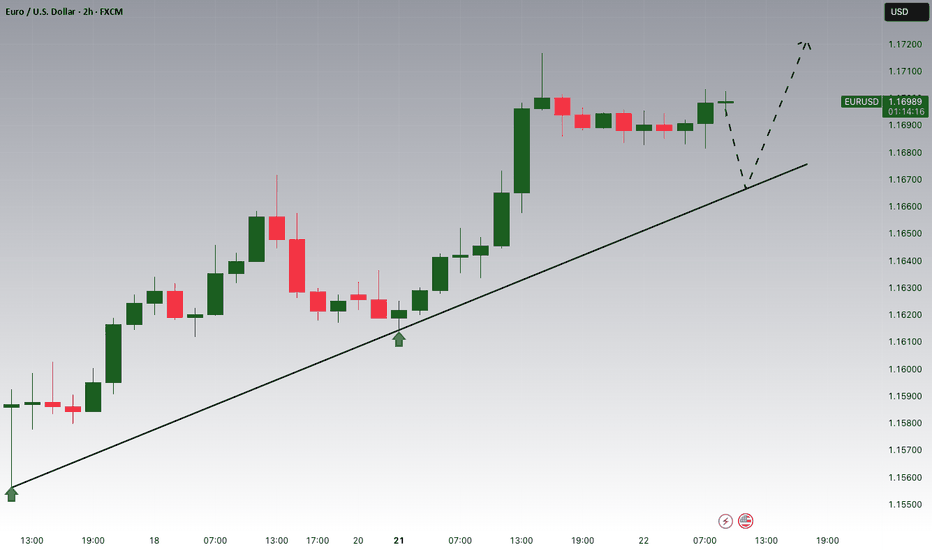

Awaiting for bullish signal - EURUSDSo my EURUSD pair was stopped out with a profit. Now, at this price level, it looks like the selling pressure is not finished so I will be waiting.......

As I want to LONG ONLY so I will not be shorting this pair for now.

Let's check back later to see how the price movement is

EUR/USD testing bull trend after 1% dropThere are multiple factors weighing on the EUR/USD today. We have seen a broad dollar rally, suggesting that the trade agreements are seen as net positive for the US economy, even it means rising inflation risks. With higher tariffs and Trump’s inflationary fiscal agenda, interest rates in the US are likely to remain elevated for longer.

As far as the euro itself is concerned, the single currency fell all major currencies, which suggests investors were not impressed by the EU’s negotiation tactics. Accepting a 15% tariff on most of its exports to the US while reducing levies on some American products to zero, means the deal will make companies in Europe less competitive. Still, it could have been a far worse situation had we seen a trade war similar to the US-China situation in April. It means that there is now some stability and businesses can get on with things. On balance, though, European leaders will feel that they may have compromised a little too much.

Technically, the EUR/USD is still not in a bearish trend despite today’s sizeable drop. But that could change if the bullish trend line breaks now. If that happens 1.15 could be the next stop. Resistance is now 1.1650 followed by 1.1700.

By Fawad Razaqzada, market analyst with FOREX.com

Next Move On EURUSD: A Bullish ContinuationWith this 4H bearish impulsive move, it’s easy to assume a reversal is underway to break the previous daily swing low. However, this appears more like a liquidity grab—fueling the next leg to the upside.

Price has retraced into a key zone that previously performed a strong liquidation. With significant liquidity already swept and clean inducements now resting above, this level becomes crucial.

This zone is the last stand: a break downward may target the daily swing low, while a hold and reaction could propel price toward the swing high.

Fingers crossed 🤞 as we watch price play out.

Have a great trading week, traders.

Catch you in the next one. 🫡

Markets face a PACKED schedule this weekThe tariff truce between the U.S. and several major trading partners is set to expire on August 1 . A deal with Japan has already been reached, but talks with the EU, Canada, and Mexico remain active.

In monetary policy, the Federal Reserve is widely expected to hold rates steady at 4.5% during its midweek meeting .

Across the border, the Bank of Canada is also expected to leave its interest rate unchanged at 2.75% . After cutting rates twice earlier this year, the BoC is seen as entering a wait-and-see phase.

In Asia, the Bank of Japan will announce its decision on Wednesday . While the BoJ isn’t expected to hike this month, recent U.S.–Japan trade progress has opened the door for policy tightening later this year.

Finally, the week concludes with the U.S. Non-Farm Payrolls report on Friday. Economists expect job gains of around 110,000 in July, down from 147,000 in June.

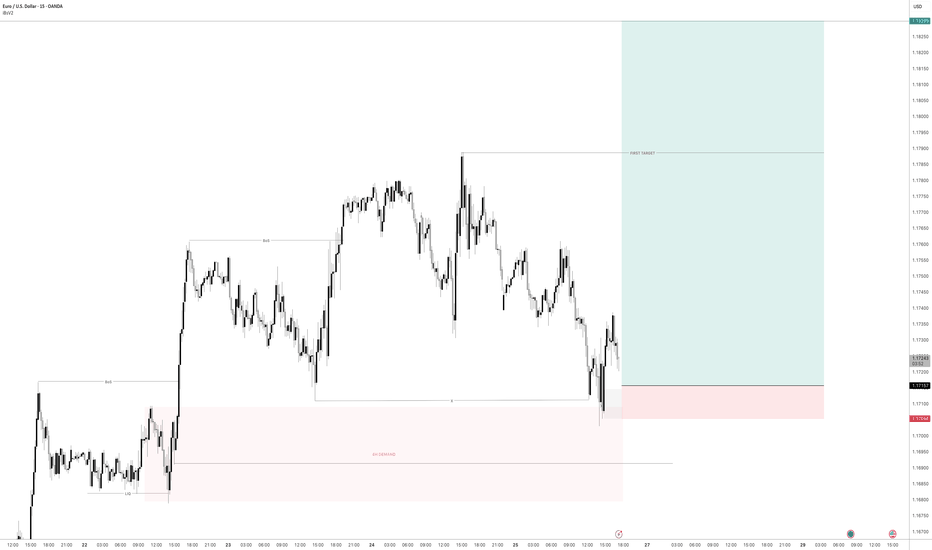

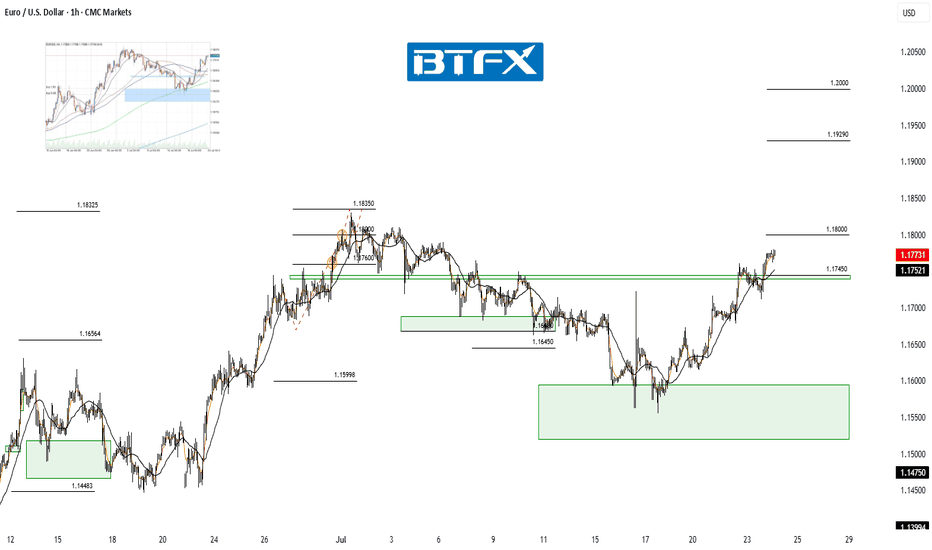

EUR/USD Recovery in Play — Eyes on ResistanceHi Everyone,

Since our last update, EUR/USD briefly dipped below the 1.16000 level but quickly reclaimed the key 1.16450 zone — a level that continues to serve as an important structural pivot.

Price has since stabilised above this support and is now moving back toward the highlighted resistance area around 1.17450. A sustained push toward 1.18000 in the coming sessions would further reinforce the presence of renewed buying interest.

Our broader outlook remains unchanged: we continue to anticipate the pair building momentum for another move higher. A decisive break above 1.18350 could open the path toward the 1.19290 area and ultimately the 1.20000 handle.

We’ll be watching closely to see whether this recovery gains traction and if buyers can sustain momentum through resistance. The longer-term view remains bullish, as long as price continues to hold above the key support zone.

We’ll continue to provide updates throughout the week as the structure develops and share how we’re managing our active positions.

Thanks again for all the likes, boosts, comments, and follows — we really appreciate the support!

All the best for the rest of the week.

Trade safe.

BluetonaFX

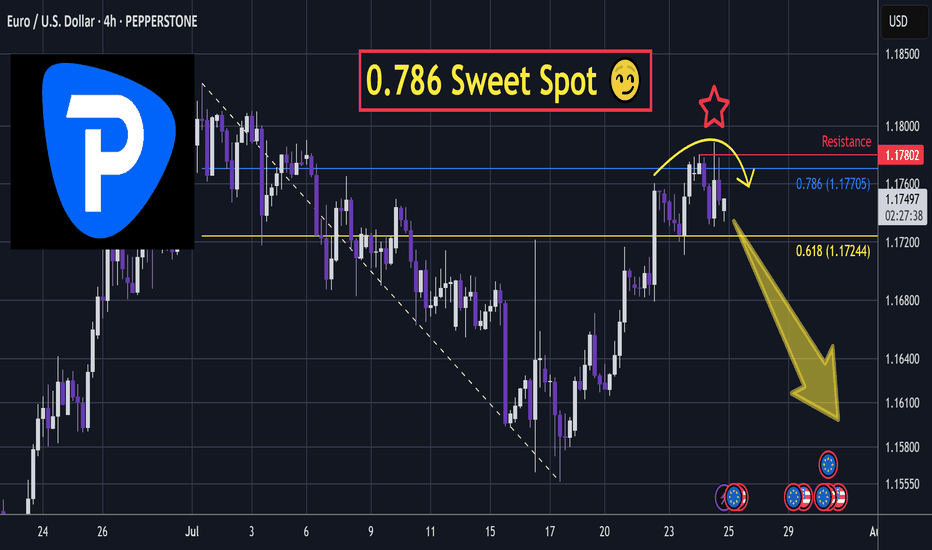

EURUSD - Short Term Setup Could Trigger MAJOR ReversalThis bounce is likely to be a connective wave into another wave down.

In the video I break down a classic algo driven liquidity sweep just above the 0.786 retracement.

This signals potential reversal.

Stop loss placement depends on how aggressive you want to be with margin.

Tighter risk gives more upside potential with defined exposure.

Invalidation of potential retracement failure swing @ $1.18.

If this unfolds on a higher timeframe, it could develop into a heavy-hitting move.

I'm layering shorts through this area, as discussed in the video.

Trade executed on Pepperstone CFD 👍.

This analysis is shared for educational purposes only and does not constitute financial advice. Please conduct your own research before making any trading decisions.

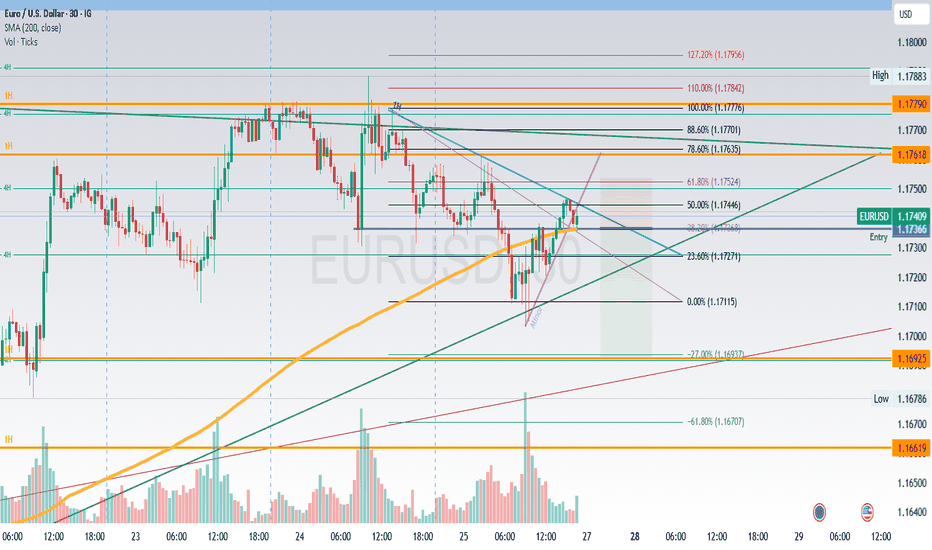

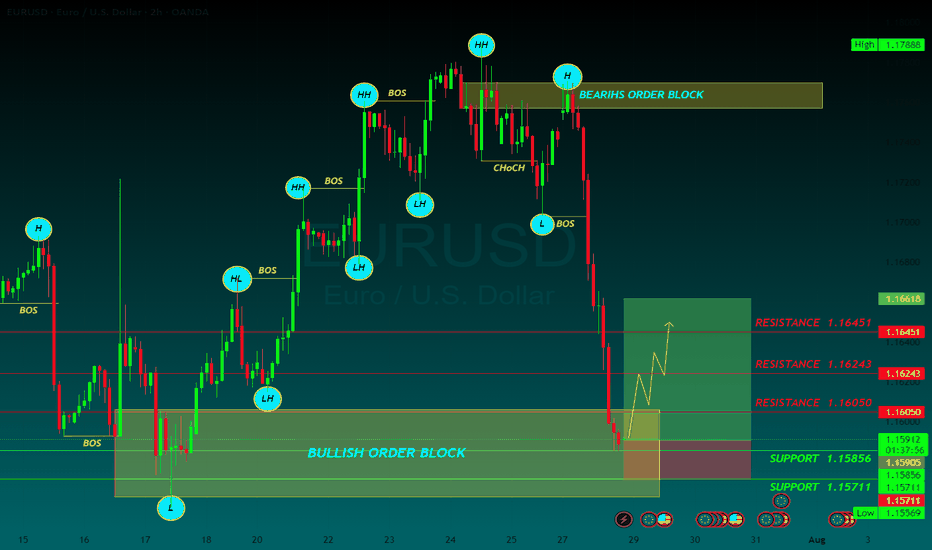

EURUSD Supply Rejection – Bearish Move ExpectedOn the 1-hour chart, EURUSD tapped into the 4hr Supply + OB zone 🟧 and failed to hold above previous structure.

- BoS (Break of Structure) shows weakness at highs

- ChoCh (Change of Character) confirms bearish shift

- Price rejected from 0.236 Fib level (1.17400) and is moving lower

Plan:

- Expecting price to move toward 1.16200 (≈ 120 pips from current level) 🎯

- Bearish momentum remains valid as long as price stays below supply zone

- Confirmation candles & retests strengthen short bias

Reasoning:

- Supply zone rejection + failed breakout

- Clear structure shift (ChoCh) toward lower lows

- Fib retracement confluence (0.5 – 0.618 zone) aligning with sell pressure

(Not financial advice – only a personal observation)

EURUSD BUYThe US Dollar (USD) gapped lower at the weekly opening amid optimism fueling demand for high-yielding assets, following news that the United States (US) and the European Union (EU) reached a trade deal.

The US and the EU agreed a 15% tariff on most European goods entering the US, much higher than the average 4.8% exporters face these days. No rates will apply to EU exports in important sectors, including aircraft parts, some chemicals, semiconductor equipment and some agricultural products.

The EU response to the headline was uneven. European Central Bank (ECB) policymaker Peter Kazimir said on Monday that the trade deal reduces uncertainty, but it is unclear for now how it impacts inflation. However, the French prime minister, François Bayrou, said the EU has capitulated to Donald Trump’s threats, adding it is a “dark day” for the EU. The trade focus now shifts to the US-China as officials from both countries resume talks in Stockholm.

The EUR/USD pair peaked at 1.1771 during Asian trading hours, but changed course early in Europe, with the USD surging across the FX board, resulting in the pair shedding over 100 pips.

The macroeconomic calendar had nothing relevant to offer at the beginning of the week, but will be flooded with first-tier releases, including US employment-related data ahead of the Nonfarm Payrolls report on Friday, the preliminary estimates of the Q2 Gross Domestic Product (GDP) for the US and the EU, and inflation updates. On top of that, the Federal Reserve (Fed) will announce its decision on monetary policy on Wednesday.

RESISTANCE 1.16050

RESISTANCE 1.16243

RESISTANCE 1.16451

SUPPORT 1.15856

SUPPORT 1.15711

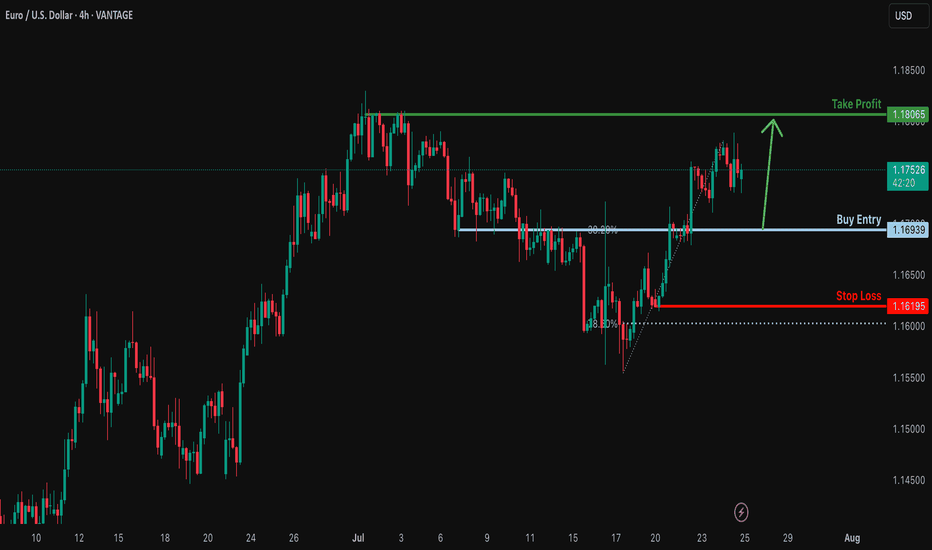

Bullish bounce off overlap support?EUR/USD is falling towards the support level, which is an overlap support that aligns with the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.1693

Why we like it:

There is an overlap support that lines up with the 38.2% Fibonacci retracement.

Stop loss: 1.1619

Why we like it:

There is a pullback support that is slightly above the 78.6% Fibonacci retracement.

Take profit: 1.1806

Why we like it:

There is a swing high resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURUSD – German GDP boosts EUR, but USD still holds the reins Germany’s recently released GDP data exceeded expectations, acting as a catalyst for EURUSD to rebound after a steep decline. However, this upward move remains fragile, as the USD continues to dominate the market—especially with several key U.S. economic reports set to be released later this week.

On the chart, EURUSD has just bounced from the 1.15000 support zone, which has historically served as a strong floor. If the price holds above this level and breaks the downtrend line, the short-term target could move toward the 1.15700 resistance zone.

Still, the path ahead won’t be easy. The market is closely watching upcoming U.S. data, such as the jobs report and the Core PCE index—the Fed’s preferred inflation gauge. If these figures come in strong, the USD could regain strength and put pressure back on EURUSD.

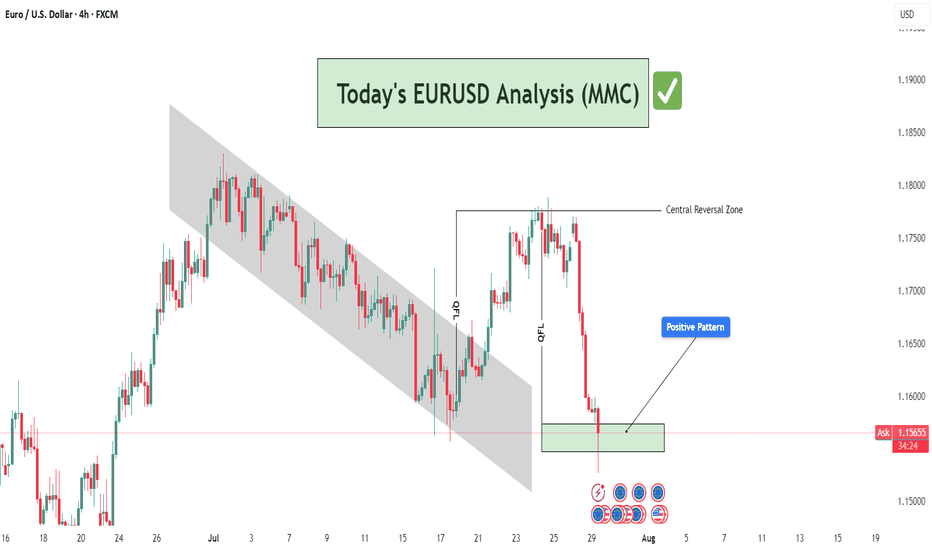

EURUSD Analysis : Rejection at Demand – Institutional Buy Setup🔍 Technical Storyline – What the Chart Tells Us:

🔸 1. Previous Bearish Structure – Descending Channel:

Price has been moving within a well-respected bearish channel, signifying structured sell-side liquidity control.

This channel served as a trap zone, where retail sellers were induced while institutions accumulated buy-side positions below the range.

The controlled movement inside the channel ended with a breakout to the upside, signaling a disruption in bearish control.

🔸 2. QFL Zone Formation – Manipulation & Liquidity Grab:

QFL (Quasimodo Failure Level) is evident in two phases here:

The first QFL acts as a reaction point where the market dropped to test demand and rallied aggressively.

The second QFL near the highs shows price swept previous liquidity before dumping, hinting at institutional profit-taking and possible redistribution into discount areas.

🔸 3. Central Reversal Zone (CRZ):

Price reversed sharply from this CRZ, which acted as a major supply level. The CRZ marks the top of the manipulation range.

This was a liquidity sweep targeting trapped long positions that entered too late at the highs.

🔸 4. Demand Revisit + Positive Rejection Pattern (Current Phase):

Price has now reached the MMC-validated demand zone, which previously launched a strong bullish move.

The long lower wick in the latest candle shows buyer absorption, suggesting early signs of a Positive Reversal Pattern.

This area is marked with high probability for bullish continuation, as it aligns with both technical support and smart money logic.

💡 Trading Plan & Market Mindset:

🔸 📈 Bullish Scenario (High-Probability Play):

Wait for bullish confirmation, such as:

Bullish engulfing on 1H/4H

Break of minor intraday structure (e.g., break of internal LH)

Strong volume surge from the zone

Entry zone: Within the demand block – 1.15500 to 1.15750

Stop-loss: Just below the demand zone (1.15250)

Target 1 (TP1): 1.16500 – minor intraday resistance

Target 2 (TP2): 1.17500–1.18000 – retest of QFL high and Central Reversal Zone

🔸 ❌ Bearish Invalidator:

A 4H candle close below 1.15250 would break the demand zone structure.

Invalidation of MMC reversal – move toward deeper liquidity (1.14500–1.14800)

🧠 Trader’s Psychology & Institutional Mindset:

Institutions often induce price spikes to trap both buyers and sellers.

This entire structure reflects classic accumulation → manipulation → distribution → reaccumulation.

The retest of the original demand zone allows institutions to re-enter at discount before pushing price back toward the highs.

“In MMC, patterns are not just shapes – they are footprints of institutional intent.”