USDEUR trade ideas

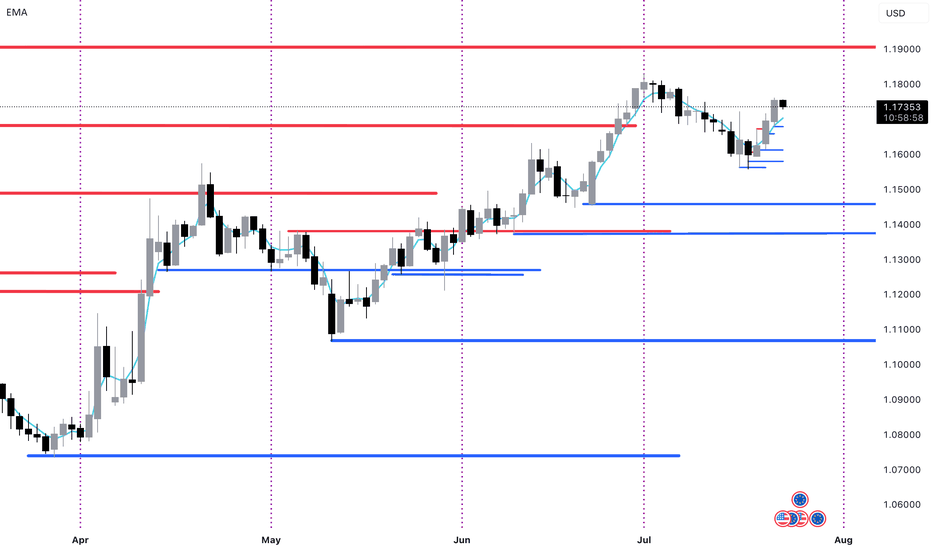

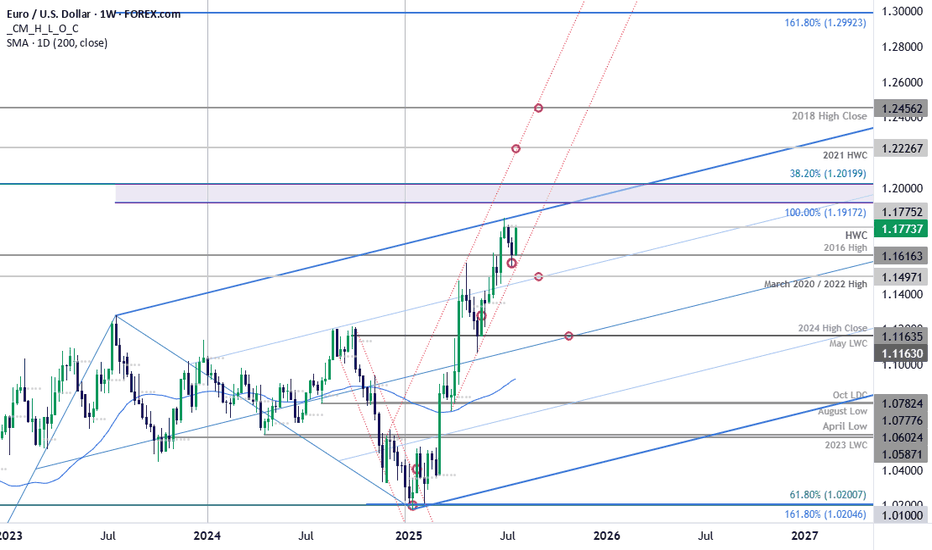

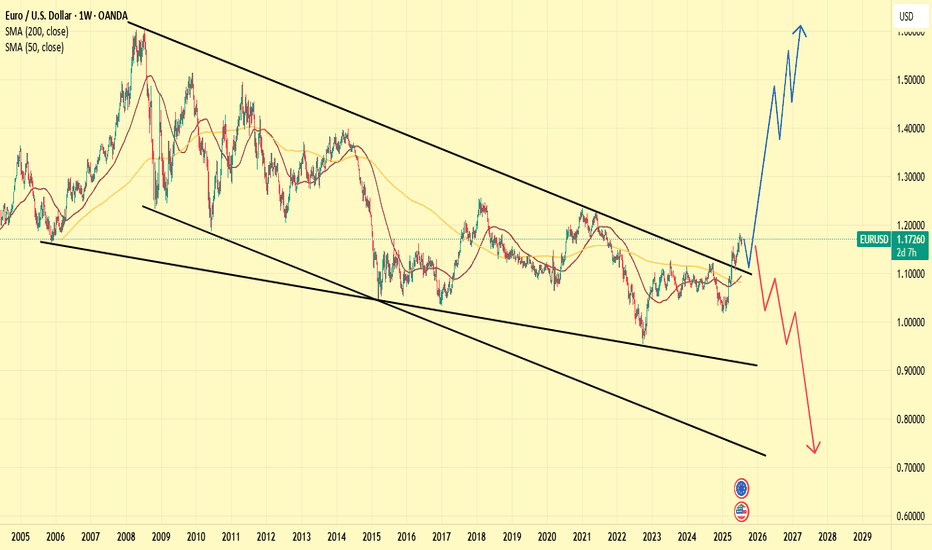

EUR/USD Surges into Resistance Ahead of ECBEuro is poised to snap a two-week losing streak with EUR/USD up more than 1.2% since the Sunday open. The advance takes price back into weekly resistance ahead of tomorrow’s European Central Bank rate decision and the focus now shifts to the weekly close for guidance.

Euro plunged more than 2.3% off the June high with price briefly registering an intraweek low at 1.1557 before rebounding. The rally takes EUR/USD into resistance at the objective high-week close (HWC) / high-close at 1.1775- looking for a reaction off this mark with a weekly close above needed to keep the immediate advance viable into the close of the month.

Initial weekly support remains with the 2016 swing high at 1.1616 with the medium-term outlook still constructive while above the March trendline (red). Ultimately, a break below the 2020 / 2022 highs at 1.1497 would be needed to suggest a more significant high is in place / a larger correction is underway with subsequent support seen at the 2024 high close / May low-week close (LWC) at 1.1164.

A breach / close above this pivot zone exposes the upper parallel (blue), currently near 1.1840s, with the next major technical consideration eyed at 1.1917-1.2020- a region defined by the 100% extension of the 2022 advance and the 38.2% retracement of the 2008 decline (area of interest for possible top-side exhaustion / price inflection IF reached). Subsequent resistance objectives eyed at the 2021 HWC at 1.2227 and the 2018 high-close at 1.2456.

Bottom line: Euro rebounded just ahead of the March uptrend with the rally now testing the yearly high-close ahead of the ECB- watch the Friday close with respect to 1.1775. From a trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops- losses would need to be limited to this week’s low IF price is heading higher on this stretch with a close above the upper parallel still needed to fuel the next major leg of the advance.

-MB

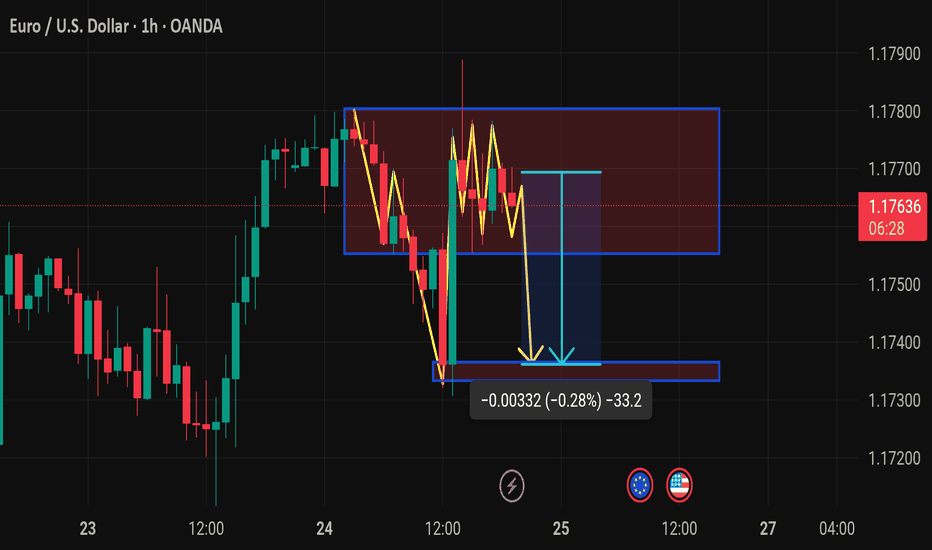

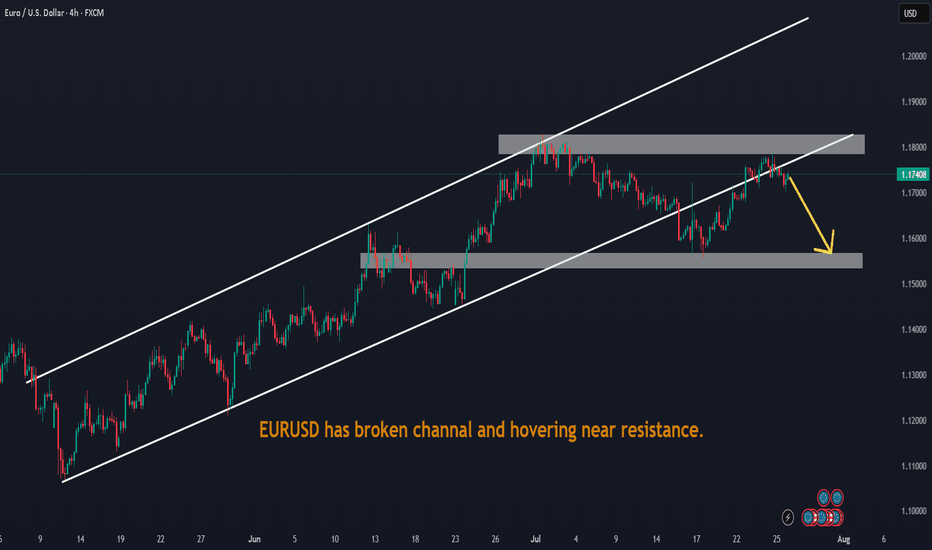

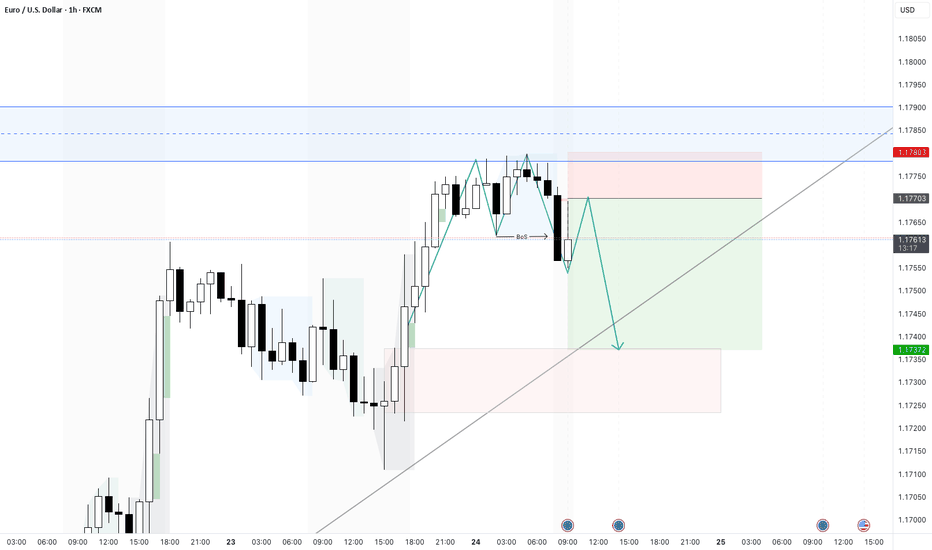

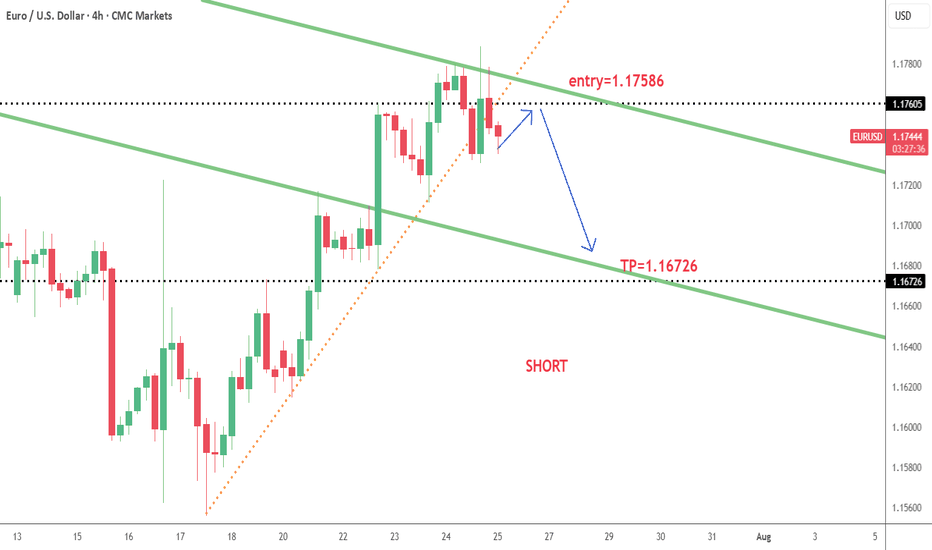

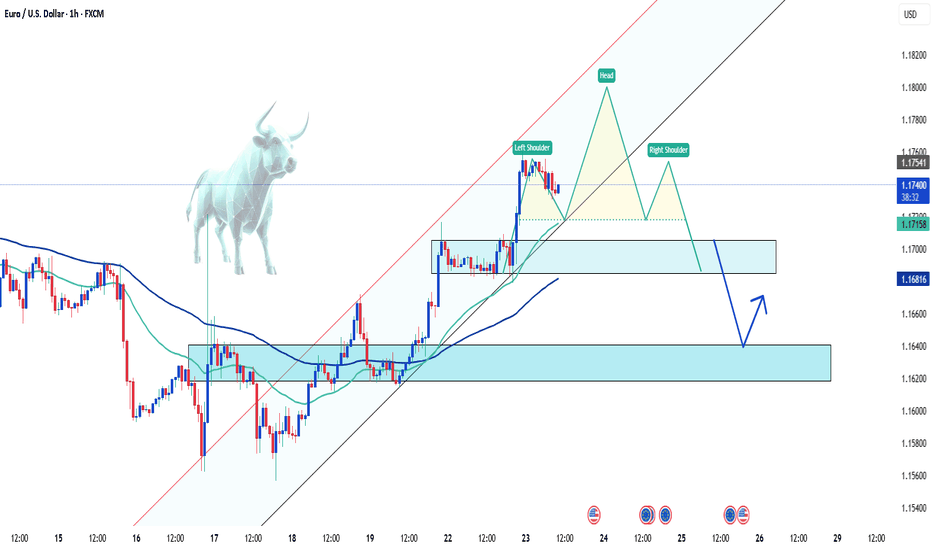

EUR/USD H4 DOWNWARD 🔄 Disrupted EUR/USD 4H Analysis

🟢 Current Context:

Price is currently at 1.17375, slightly below the resistance area (1.17400–1.17500).

Market shows a recent bullish impulse, followed by consolidation within the marked resistance zone.

Projection in the image suggests a double-top pattern forming at resistance, followed by a bearish reversal toward the target demand area (~1.15800–1.16000).

---

⚠️ Disruption Points:

1️⃣ Failed Double Top Scenario

Disruption Hypothesis: Instead of forming a clean double top and reversing, price may break above the resistance zone at 1.17500.

Reasoning: Strong bullish momentum and recent higher highs indicate potential for bullish continuation, invalidating the bearish target.

Disrupted Path: Price could break out → retest the resistance as new support → continue toward 1.18000–1.18300 zone.

2️⃣ Mid-Range Liquidity Trap

The current range may act as a liquidity trap:

Smart money could push the price slightly below support (fake breakdown), attract sellers, then reverse sharply upwards.

This would trap retail sellers targeting the 1.15800 zone.

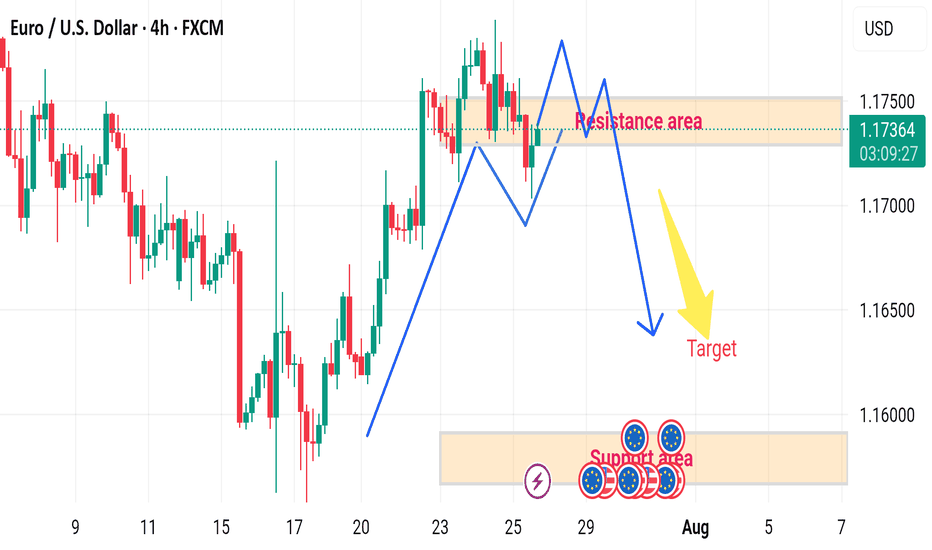

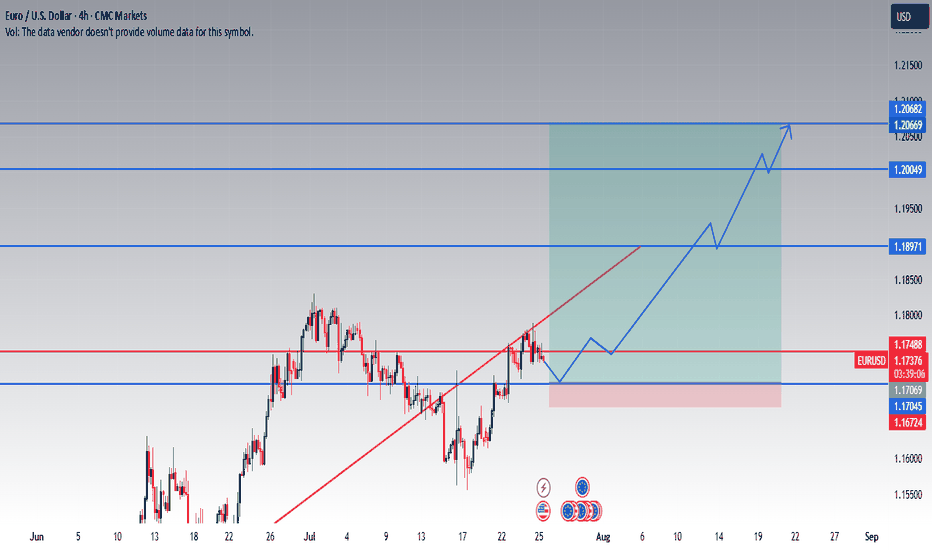

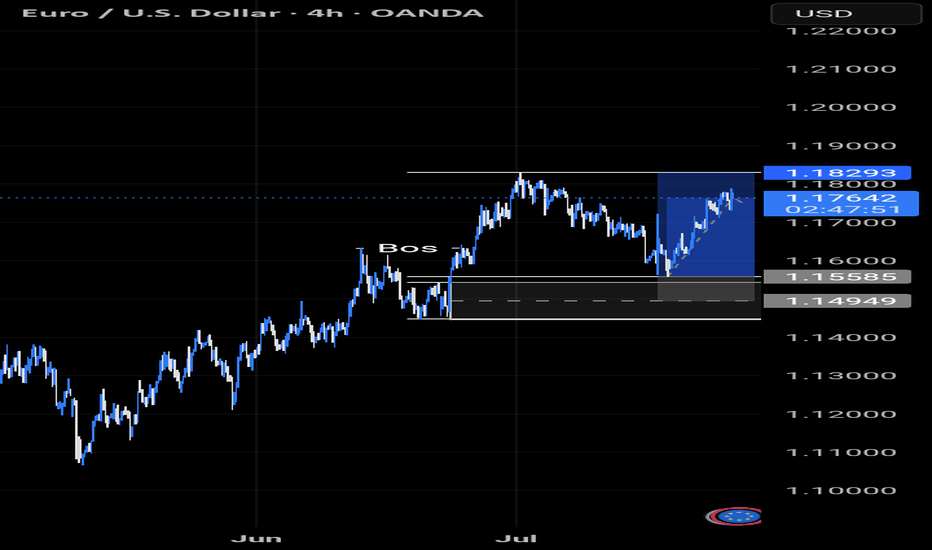

EURUSD Long Setup: Technically and Fundamentally Supported Push 📈 I'm expecting a climb of this pair due to weakening USD.

This idea is based on both technical and fundamental parameters:

🔍 Fundamentals

ECB kept rates unchanged, signaling stability and reluctance to tighten policy further.

FED is expected to cut rates in 5 days, as inflation eases and growth concerns rise in the US.

A weaker dollar is likely to support EURUSD strength.

1.20 is a psychological and political level – above that, European exporters begin to suffer, and ECB might intervene verbally or with policy action.

🧠 Technical Setup

Price has reclaimed a key support zone around 1.17069 – 1.17488, with consolidation signaling accumulation.

Break of the descending trendline shows bullish intent.

Next major resistance lies at 1.18971, followed by 1.20049 – a strong historical level and likely ECB reaction zone.

Final target at 1.20669 – 1.20682 marked by previous highs.

Entry Zone: 1.17045–1.17488 (current area of interest)

Stop Loss: Below 1.16724

Targets: 1.18971 / 1.20049 / 1.20669

💬 Feel free to monitor price action at key zones. Entry should be based on reaction at support or a confirmed breakout. This is not a blind entry setup.

📅 If the FED cuts rates as expected, USD weakness could accelerate the move.

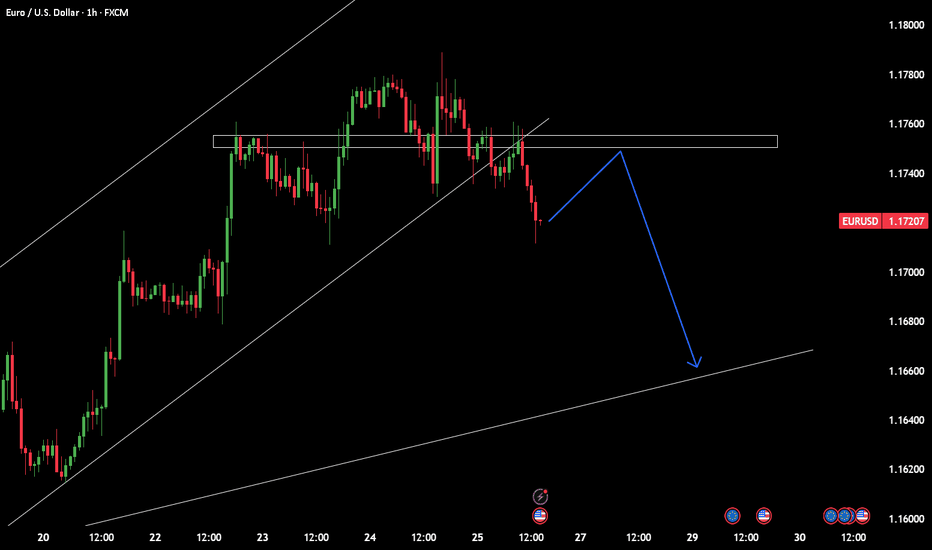

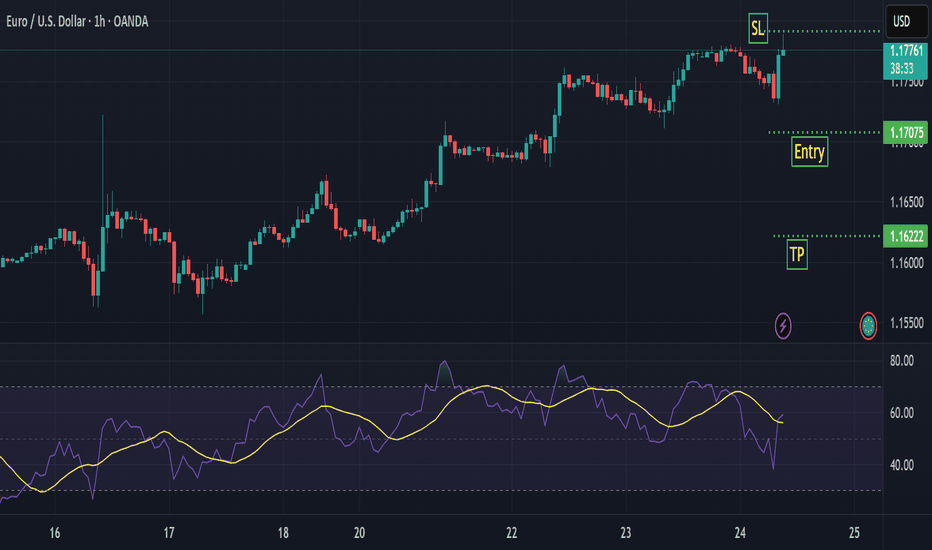

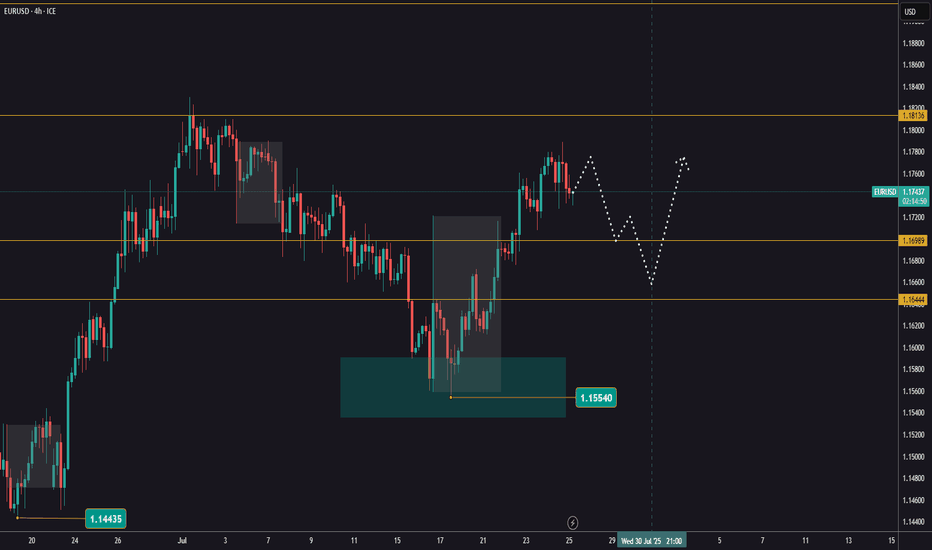

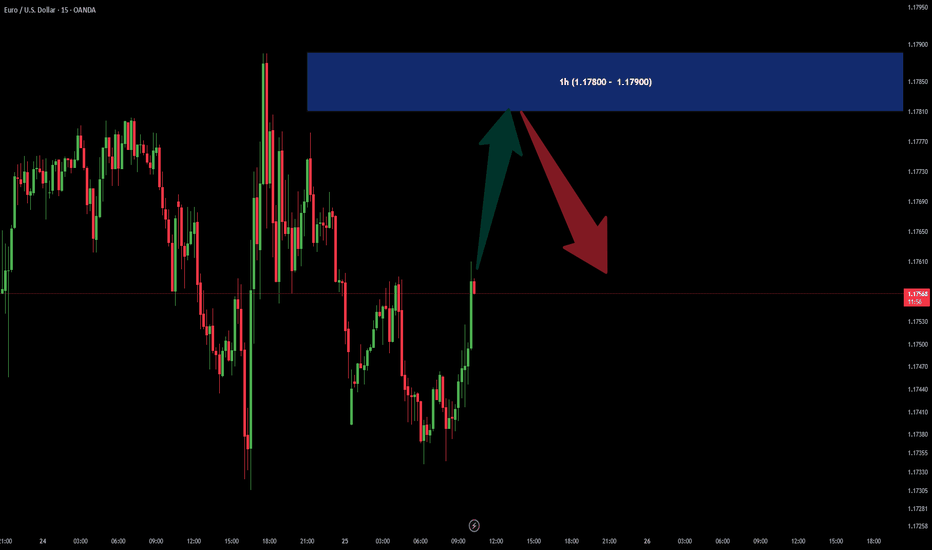

EURUSD pullbackYesterday, EURUSD attempted to continue its bullish move but was rejected at 1,1788.

Keep an eye on whether it has the strength for another push higher. If it fails again, a correction is more likely to follow.

The first support levels to watch are 1,1699 and 1,1644.

Next week, the FED’s interest rate decision is due.

That news will likely determine both the direction and timing for entry.

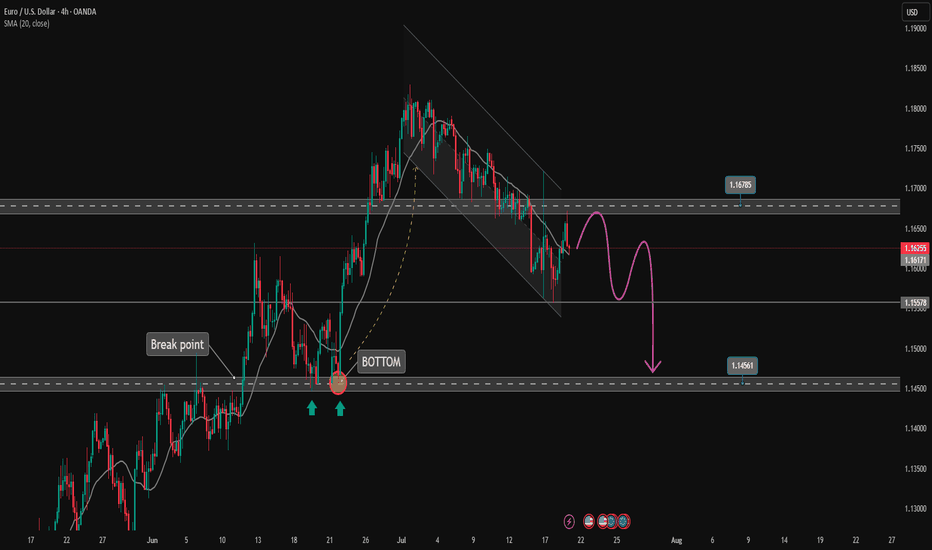

EURUSD Trading Price Channel, SELL Strategy✏️ OANDA:EURUSD H4 Timeframe EURUSD is trading in a bearish channel. This bearish channel may extend to the important support at 1.145. A break of this important support will form a Downtrend. Further upside recovery will remain limited by the channel, with the notable upper boundary at 1.16800.

📉 Key Levels

Sell trigger: rejection from 1.168 with bearish confirmation

Sell DCA: Break 1.155

Target: 1.145

Leave your comments on the idea. I am happy to read your views.

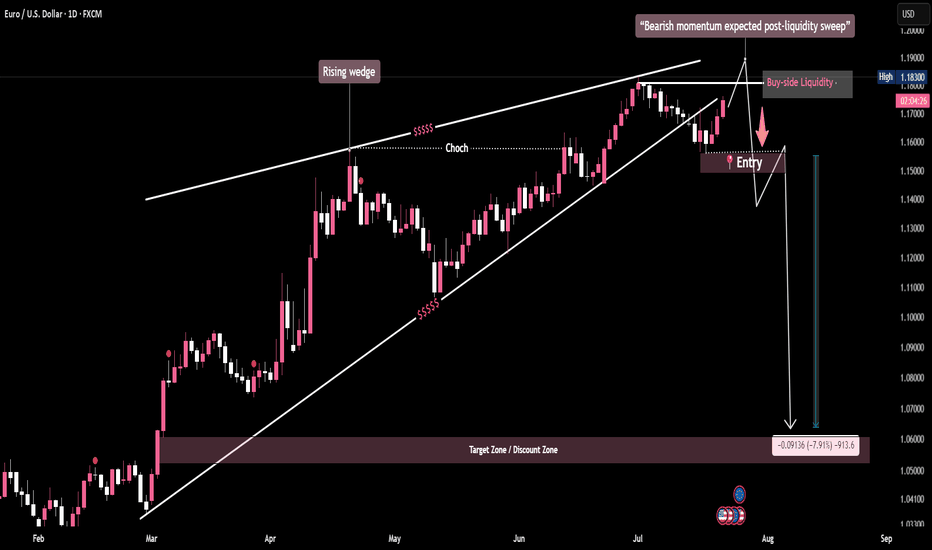

EUR/USD - Final Push Before Collapse?This EUR/USD daily chart highlights a bearish setup within a weakening rising wedge.

A Change of Character (CHoCH) confirms a potential shift in structure as price pushes toward buy-side liquidity above previous highs—where retail stops are likely resting.

Once this liquidity is swept, smart money is expected to reverse price sharply, breaking wedge support. The projected move targets the 1.03 zone, representing a 7% drop, aligning with internal liquidity and a return to the discount zone.

This setup illustrates classic SMC behavior: liquidity grabs, structural shifts, and institutional unloading before a major move.

EUR/USD – Final Push Before Collapse?

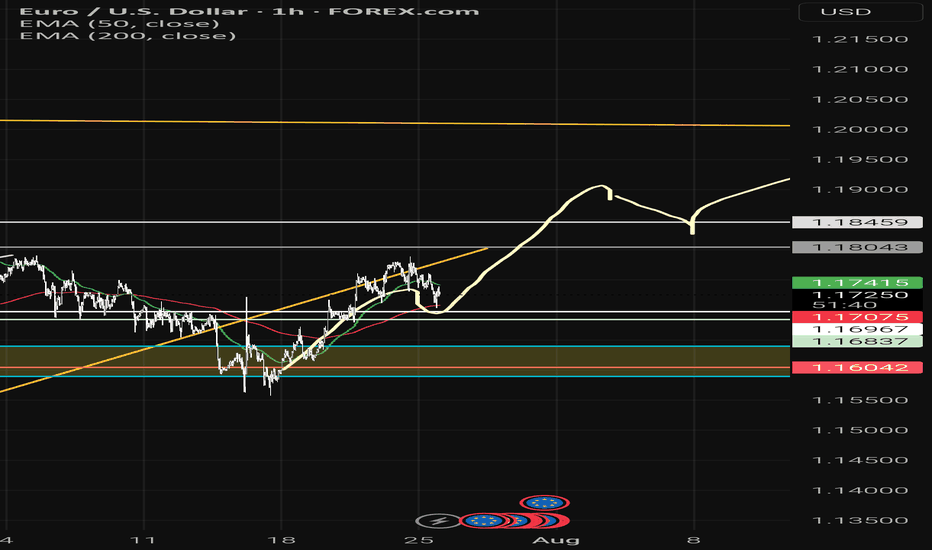

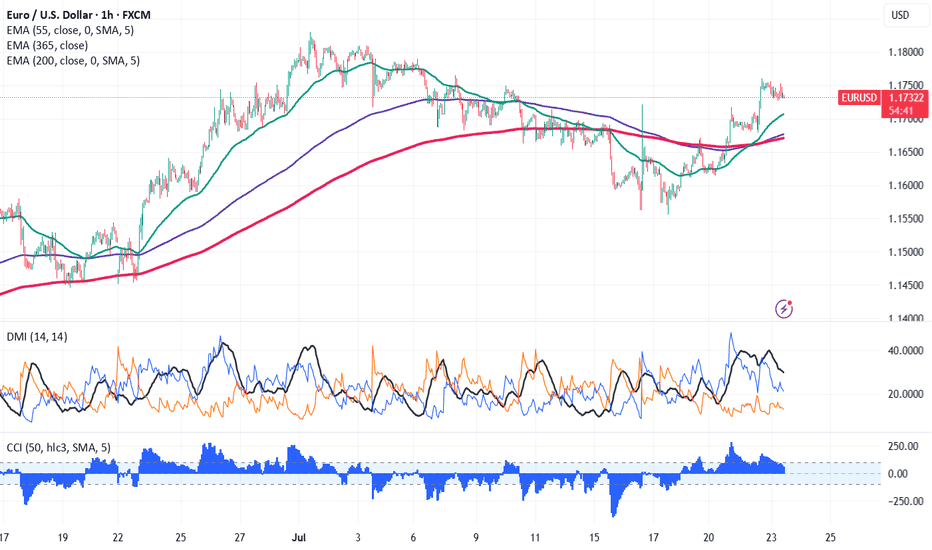

Euro Rallies Past 1.1750—Can the Uptrend Continue? EUR/USD surged above 1.1750 on easing trade tension. It hit an intraday low of 1.17604 and is currently trading around 1.117428. Overall trend remains bullish as long as support 1.1670 holds.

The pair is holding above the 55 EMA,above 200 EMA, and 365 EMA in the 1 -hour chart. Near-term resistance is seen at 1.1765, a break above this may push the pair to targets of 1.1800/1.1835/1.19090/1.1956/1.200. On the downside, support is seen at 1.1700; any violation below will drag the pair to 1.1670/1.1600/1.155.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bullish

Average Directional Movement Index (ADX) - Neutral

It is good to buy on dips around 1.1720 with a stop-loss at 1.1665 for a target price of 1.1835.

ECB holds rates as expected, Euro steadyThe euro is showing limited movement on Thursday. In the North American session, EUR/USD is trading at 1.1763, down 0.03% on the day. Earlier, the euro climbed to a high of 1.1788, its highest level since July 7.

The European Central Bank's decision to maintain the key deposit rate at 2.0% was significant but not a surprise. With the hold, the ECB ended a streak of lowering rates at seven consecutive meetings. The ECB has been aggressive, chopping 250 basis points in just over a year.

The ECB statement said that inflation was falling in line with the Bank's forecasts and that future rate decisions would be data dependent. President Lagarde has said that the easing cycle is almost down, but the markets are expecting at least one more rate cut before the end of the year.

The European Union and the United States are locked in negotiations over tariffs, with hopes that an agreement can be reached, on the heels of the US-Japan deal earlier this week. US President Trump has threatened to hit the EU with 30% tariffs if a deal is not made by August 1, but there are signals that the sides will agree to 15% tariffs on European imports, as was the case in the US-Japan agreement.

If an agreement is reached, it will greatly reduce the uncertainty around tariffs and will make it easier for the ECB to lower rates and make more accurate forecasts for inflation and growth.

In the US, Services PMI rose to 55.2 in July, up from 52.9 in June and above the market estimate of 53.0. This pointed to strong expansion and marked the fastest pace of growth in seven months. Manufacturing headed the opposite direction, falling from 52.6 in June, a 37-month high, to 49.5. This was the first contraction since December, with new orders and employment falling.

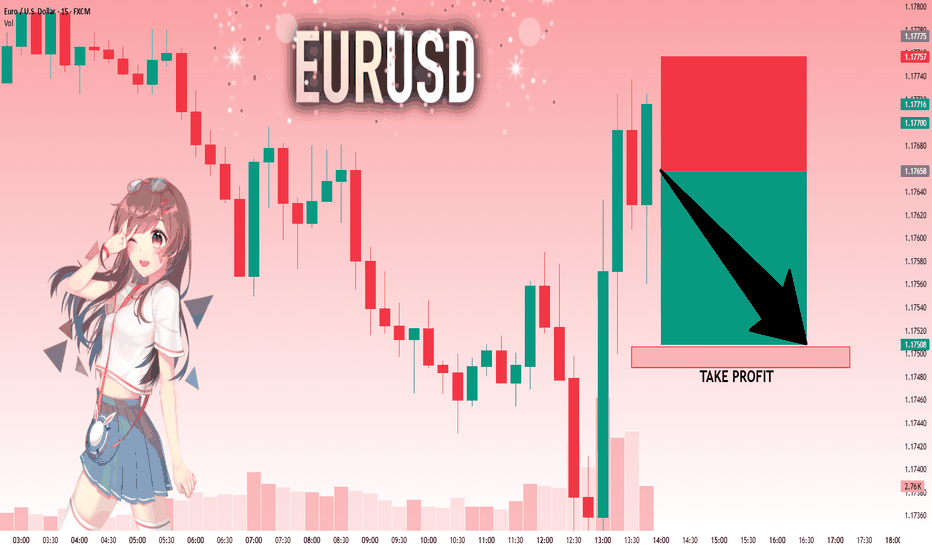

EURUSD: Next Move Is Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.17658 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 1.17506..Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

Euro Surges as Dollar Falters Amid Political TensionsThe EUR/USD pair is experiencing a strong rally, breaking above the 1.1760 level — its highest point in two weeks as of Tuesday. This sharp move not only signals the Euro’s recovery strength but also highlights the impact of heavy selling pressure on the US dollar.

The driving force? Ongoing trade tensions, coupled with rising uncertainty surrounding the escalating feud between President Trump and Fed Chair Jerome Powell, are shaking investor confidence in the stability of US monetary policy.

As a result, the dollar is losing its safe-haven appeal, paving the way for EUR/USD to climb higher. If this bullish momentum holds, the next key target for the pair could be around 1.1800.