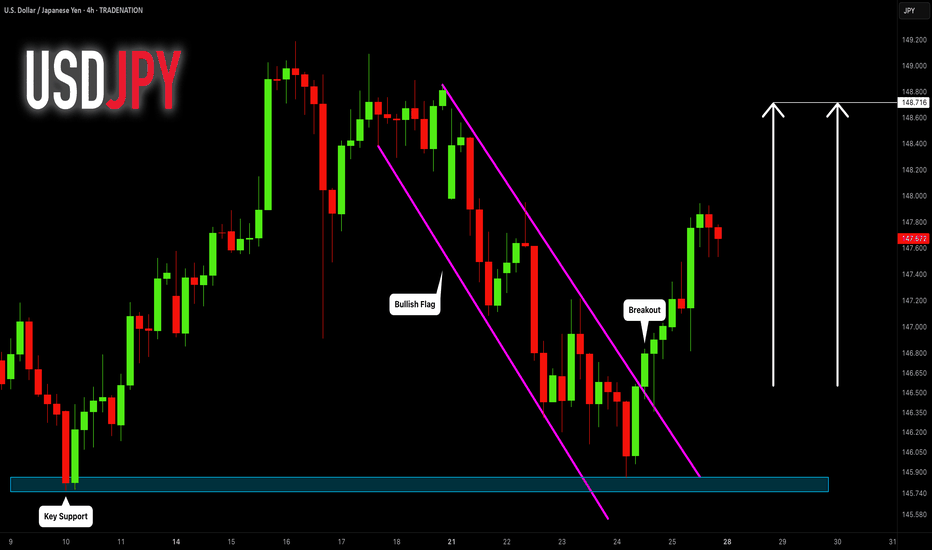

USDJPY: Bullish Move From Support Ahead! 🇺🇸🇯🇵

I think that there is a high chance that USDJPY will continue growing

next week.

A bullish breakout of a resistance line of a flag pattern that occurred

after a test of a key support provides a strong bullish signal.

Goal - 148.7

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY trade ideas

USD/JPY BEARS ARE STRONG HERE|SHORT

Hello, Friends!

We are targeting the 145.012 level area with our short trade on USD/JPY which is based on the fact that the pair is overbought on the BB band scale and is also approaching a resistance line above thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USDJPY - on the way to somewhere...USDJPY has always had a reputation of a very "technical" instrument. Certainly it is not anymore.

Somewhat weird policy of the BOJ during pandemic changed a lot.

Now it creates something like THAS (two heads and shoulders :) or Modified Wyckoff Distribution pattern :)

Anyway, what I can see is the following:

- price respected the Support level at FR 61.8 of the uptrend impulse (Jan '23 - Jul '24) and reverted there three times

- Now is approaching the Resistance cluster in between 148.68 and 151.52. Perhaps it will respect it - but who knows?

Just my humble opinion

Trade Idea: Aug 8 - London - Range breakHTF: 4H shows that the lower lower formation has changed with the last low being a higher low in the choppy downtrend.

MTF: 30m - Identified key levels of liquidity and aiming for a break above/below those key areas.

ETF: 5m - I am thinking the low will either be taken out and so I will target there or if there is a break of structure, aiming for a long trend.

USDJPY Possible Continuation Spotted a CHoCH (Change of Character) on the lower timeframe, confirming a BEARISH market structure shift as price broke the last low.

🟢 SUPPLY Zone has formed above — likely holding unfulfilled sell orders.

🔁 I’m watching for a retracement into this supply zone to enter a sell (short) position at a premium price, in line with the momentum.

🎯 Target: Next low below, where buying pressure may reappear.

🛑 Stop Loss: Just above the Supply Zone — if broken, the setup is invalidated.

✅ Quick Summary:

• CHoCH confirms trend change

• Supply Zone is key for entries

• Entry on pullback, SL above, TP at demand below

Fundamental Market Analysis for August 7, 2025 USDJPYEvent to watch today:

15:30 EET. USD - Unemployment Claims

USDJPY:

The yen is benefitting from falling Treasury yields and mounting expectations that the Bank of Japan could move to a token rate hike as early as this autumn. Minutes of the 30-31 July meeting revealed that two board members want tightening on the table should inflation stay above 2 %. In parallel, the Finance Ministry has expanded its FX-intervention envelope to ¥20 trn, signalling a readiness to cap USDJPY below 150.

The U-S dollar stays under pressure: weak labour data increases the odds of a September Fed cut, while a scandal over the dismissal of the Bureau of Labor Statistics head fuels doubts about data integrity. The 10-year U-S yield has slid to 3.95 %, narrowing the spread with JGBs and dulling the dollar’s carry appeal.

A restraining factor is caution within Japan’s ruling coalition, which warns against rapid tightening given the threat of new U-S tariffs. Even so, the overall risk balance still favours yen strength thanks to potential intervention and the likelihood of a BoJ policy pivot, keeping the pair biased lower.

Trade recommendation: SELL 147.550, SL 147.850, TP 146.500

"USDJPY Smart Money Play | Bullish Rejection at Key Demand ZoneUSDJPY showing textbook Smart Money behavior!

✅ Key Highlights:

Bullish ChoCH and Break of Structure (BOS)

Strong bounce from the Demand Zone near 145.86 (marked Strong Low)

Retest of the Bullish Trendline inside the Upward Channel

Expecting continuation to TARGET area (150.76)

Lower Timeframe Entry: Look for confirmation on M15/M30 near 147.23

🧠 Smart money concepts at play:

Mitigation of previous lows

Liquidity sweep followed by bullish intent

Market structure shifting back to bullish

📈 Bias: Bullish

🎯 Short-term Target: 150.76 (Resistance Area)

🛑 Invalid if clean break below 145.86

USD/JPY(20250807)Today's AnalysisMarket News:

Federal Reserve Chairman Kashkari: A rate cut may be appropriate in the short term, and two rate cuts this year are reasonable. Trump: The new Fed governor will likely be temporary, and the appointment will be announced within 2-3 days.

Technical Analysis:

Today's Buy/Sell Levels:

147.40

Support and Resistance Levels:

148.30

147.96

147.74

147.05

146.83

146.49

Trading Strategy:

If the market breaks above 147.40, consider a buy entry, with the first target price being 147.74. If the market breaks below 147.05, consider a sell entry, with the first target price being 146.83

USDJPY short on daily chartStop Loss = 152.065

Entry Order = 149.815

TP1 = 147.565

Two positions with the same stop loss and x1 target for the first position

The stop loss of the second position to breakeven when the first position hits the target1.

The second position has no target, only exit

Risk = 2% of account capital (1% each position)

USDJPY Swing Trade Plan – H1 Chart AnalysisA potential long setup is identified on USDJPY based on current price action and structure:

🔸 Entry (Buy Stop): 148.236

🔸 Stop Loss (SL): 146.980

🔸 Take Profit 1 (TP1): 149.441

🔸 Take Profit 2 (TP2): 150.559

📊 Price is currently consolidating below the 148.236 resistance zone. A break above this level would confirm bullish continuation, targeting previous supply zones.

📉 RSI is showing a slight bullish divergence and currently hovering around 42, signaling potential upside if momentum picks up.

🔍 Key zones are marked:

Buy Zone highlighted just above current consolidation

TP1 aligns with minor resistance and past liquidity grab

TP2 near the upper supply zone from the recent swing high

SL set safely below recent support and structure low

🛡️ Risk-managed plan with favorable RR if bullish breakout occurs. Wait for confirmation before entry. Stay sharp and trade safe!