USD/JPY: Fifth Wave Target in SightUSD/JPY is painting a textbook five-wave impulse structure from the recent lows, and we're now positioned for what could be the final act of this motive sequence.

Current Wave Count

✅ Waves 1-3 Complete: Clean impulsive structure with wave 3 showing strong extension

✅ Wave 4 in Progress: Currently correcting from the 150.94 high

🎯 Wave 5 Setup: Targeting completion around 151.95 - 152.20

Key Levels to Watch

Support Zone: 150.00 area (ideal wave 4 retracement)

This aligns with wave principle fourth-wave correction parameters

Provides a healthy pullback without threatening wave 1 overlap

Target: 151.95 - 152.20 zone for wave 5 completion

Classic 5 vs 1+3 projection

Trade Strategy

Monitor for supportive price action near 150.00

Look for an impulsive price action to confirm wave 5 beginning

Structure suggests one more leg higher before a larger correction

The beauty of Elliott Wave: when the count is this clean, the roadmap becomes crystal clear. Let's see if USD/JPY delivers this final push to complete the sequence.

USDJPY trade ideas

USD/JPY USD/JPY – Bullish Setup in Line with the Prevailing Trend

As the overall trend remains bullish, we are considering a potential long setup on USD/JPY. The structure suggests continued upside momentum, and we aim to close the trade by the end of the European session.

📍 Entry: 149.400

🎯 Target: 150.600

🛑 Stop-loss: 148.600

This idea aligns with current market direction and intraday trend strength. Traders should watch for supportive price action to confirm the move.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk appropriately.

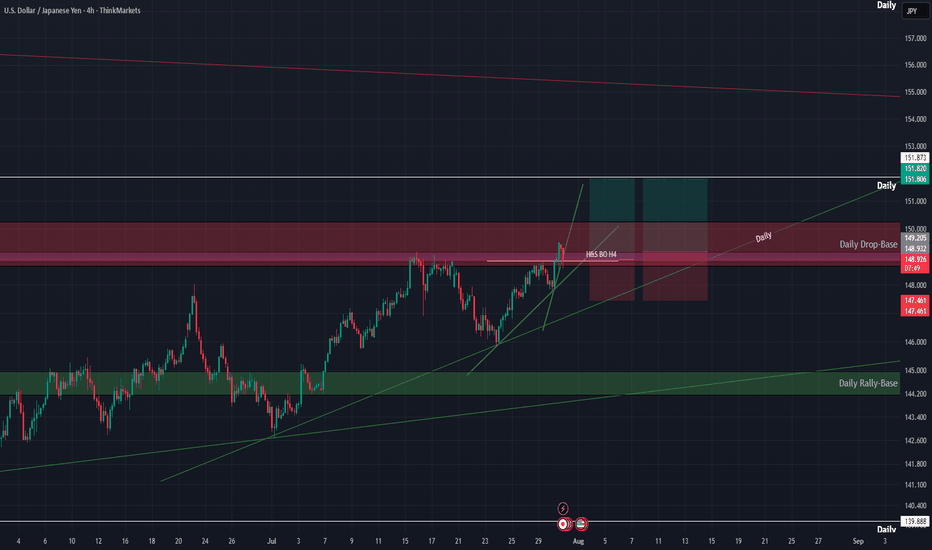

USDJPY Analysis : Key Reversal Zone After Parabolic Rally🧠 Market Psychology & Structure

The USDJPY 4-hour chart reveals a classic parabolic curve pattern signifying an acceleration phase in bullish momentum. This phase typically occurs during the final stages of a bullish move, where price action becomes increasingly steep due to aggressive buyer participation.

The rounded curve drawn on the chart reflects momentum compression—where pullbacks become shallower, and higher highs are formed rapidly. However, this pattern often ends in a blow-off top or a sharp correction, especially when approaching key supply zones.

🧩 Key Technical Highlights

Major Break Zone: The previous resistance around 148.80–149.00 (now flipped to support) was clearly broken with strong bullish candles, confirming trend continuation.

Break Out Demand : Price retested the breakout zone (around 149.80–150.00) before launching higher, validating this level as a new demand zone.

Current Price Action: The pair is currently hovering around 150.50 after a powerful rally, showing early signs of exhaustion with smaller bullish candles and slight upper wicks.

🔍 Target Area – Next Reversal Zone (151.80–152.30)

The green highlighted zone marks a strong supply area / reversal zone, identified from:

Previous price rejections in historical data.

Overbought conditions due to vertical rally.

Completion of the parabolic structure (climax zone).

We can expect price to reach this zone in the coming sessions, where it may:

Face strong selling pressure.

Trigger short positions from institutional sellers.

Lead to distribution or reversal back toward the demand area near 150.00.

🔄 Forecast & Trade Plan

Scenario 1 (High Probability): Price taps into 151.80–152.30, forms bearish engulfing or rejection wick, then pulls back to 150.00 or lower.

Scenario 2 (Invalidation): Strong breakout above 152.30 with momentum—bullish continuation towards 153.00+ possible.

🧠 Trader’s Mindset (MMC Insight)

This chart suggests a matured bullish trend nearing exhaustion. As smart traders, we anticipate rather than react. Wait for the price to reach the supply zone, then observe for confirmation (bearish structure, divergence, candlestick pattern) before shorting.

Avoid chasing longs at these highs—risk-to-reward is no longer favorable. Patience will offer a much cleaner entry if the reversal unfolds as expected.

#USDPJPY BUY#USDJPY currently facing this rejection on the Daily.

Our Expectation; we expect price to a lower level after this week’s rally, gather momentum and break this ceiling. From here, we will have a free run 🏃 to 154 and money will be made. Wait for our next sniper to swing signal next @tspsignals

USD/JPY - Potential TargetsDear Friends in Trading,

How I see it,

Let me know if anything is unclear.

NFP TODAY - BE SAFE

1) 151.150 holds the key to broader upside at this time.

2) 1st resistance @ 150.730

3) Key support/Strong Demand @ 148.850

Keynote:

In case of a short correction of the previous day candle-

If price can hold above 149.500, potential for more upside remains high.

I sincerely hope my point of view offers a valued insight.

Thank you for taking the time study my analysis.

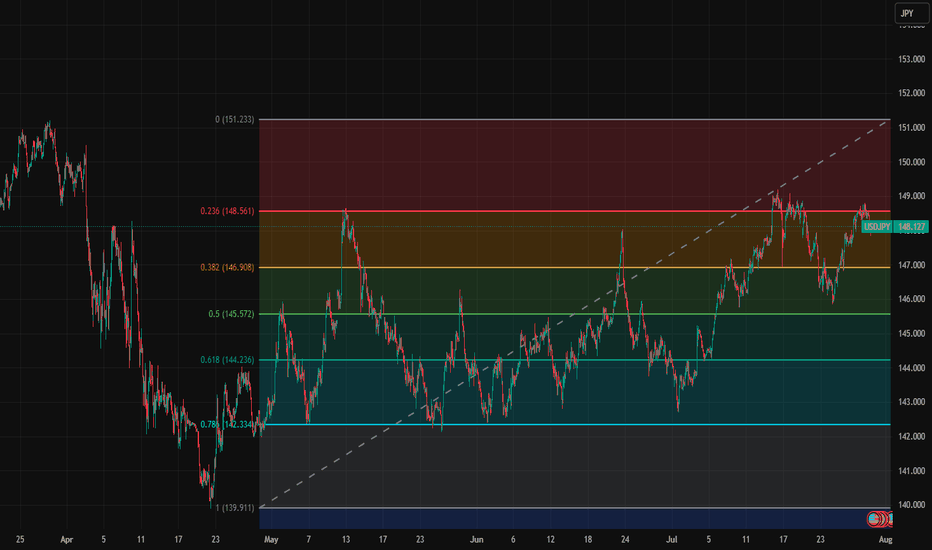

USDJPY Wave Analysis – 31 July 2025- USDJPY broke resistance zone

- Likely rise to resistance level 152.00

USDJPY currency pair recently broke the resistance zone located between the resistance level 148.85 (which stopped earlier waves A and i) and the 50% Fibonacci correction of the downward impulse from January.

The breakout of this resistance zone accelerated the active impulse wave c, which belongs to medium-term ABC correction (2) from April.

USDJPY currency pair can be expected to rise further to the next resistance level 152.00 (target price for the completion of the active impulse wave C).

JPY/USD — Long-Term Technical Setup & Market Outlook💱 JPY/USD — Long-Term Technical Setup & Market Outlook

1. 🧭 Market Context & Catalysts

US-Japan monetary divergence: The Fed remains rate-tight while the BoJ maintains ultra-loose policy, putting persistent downside pressure on the yen.

Economic drivers: Strong US economic data (growth, labor, inflation) supports USD strength; Japan’s macro data remains soft.

Sentiment signals: Hawkish Fed tone continues; safe-haven flows may limit further USD gains in geopolitical risk shifts.

2. 🧱 Technical Structure (Daily Timeframe)

Break of structure (BOS) below 0.00700 signaled the dominant bearish regime.

The price retraced into the 0.786–0.886 Fibonacci zone (~0.00676–0.00679), then resumed selling—textbook re-entry into areas of liquidity (Equilibrium).

Current price sits near 0.006631, just below BOS and equilibrium zone—suggesting continuation of bearish order flow.

Fibonacci extensions show projected targets at 0.006632 (1.236), 0.006588 (1.382), 0.006517 (1.618), and potential support area at ~0.006400.

A stronger support zone exists near 0.006276 (Weak low / domain demand zone).

3. 📝 Trade Plan & Risk Controls

Continuation Setup: Look to enter on a clean bearish candle close near ~0.00665. Target the Fibonacci extensions at 1.236, 1.382, and 1.618—approximately 0.006632, 0.006588, and 0.006517 respectively. A deeper extension into the 0.006400 zone is also possible. Place the stop-loss just above 0.00670, as this level invalidates the recent break of structure and implies rejection of downside continuation.

Pullback Re-entry Setup: If price retraces higher, consider a re-entry short near ~0.00680. Use the same Fibonacci targets as above. Invalidate the setup if price breaks above 0.00680, which would suggest a shift toward bullish structure or absorption of the prior supply zone.

4. ⚠️ Watch Key Risks & Signals

If price breaks above the 0.786 zone or creates a higher high above equilibrium, bearish thesis fails.

Monitor US data releases: FOMC minutes, inflation or jobs data—shifts could accelerate USD momentum.

Geopolitical shocks or risk-off flows could trigger yen strength reversal.

✅ Summary Outlook

JPYUSD remains firmly bearish with technical integrity intact.

Valid corrective levels now become sell zones toward continuation targets.

Extended downside toward 0.00640 area is plausible, with further drop to 0.006276 zone if trend continues strongly.

USD/JPY - Bearish Idea on H1USD / JPY sell idea on H1.

Price broke out of the ascending channel after a divergence was formed.

Price also starting making Lower Lows & Lower Highs.

We will wait for the price to retrace back to the 0.5 - 0.618 Fib retracement to take the entry.

Stop loss above the last high formed

July 30 2025 USDJPY Buy Limit ActivatedGood day, folks!

Another trade today! This is a continuation trade before the USD fundamental news. I've got some useful schematics on my chart for trading continuation momentum patterns with positive confluence in your fundamentals. You can see a swing structure BOS with validity of an internal structure: another BOS. I waited for the price to tap again into that valid order block, which also had validity of internal structure - BOS. The risk-reward (RR) is 1:4. Check the chart for detailed annotations.

I hope you find value in this trade today. Until next time!

#proptrader

#wyckoff

#supplyanddemand

#riskmanagement

USDJPY UPSIDE The dollar index (DXY00) on Tuesday rose by +0.22% and posted a 5-week high. The dollar has carryover support from Monday following the EU-US trade deal that is seen as favoring the US. Also, expectations for the Fed to keep interest rates unchanged at the end of Wednesday's 2-day FOMC meeting are supportive of the dollar. The dollar extended its gains after the US Jun advance goods trade deficit unexpectedly shrank, a supportive factor for Q2 GDP, and after July consumer confidence rose more than expected.

USDJPY Confirmed that the currency pair has been dominatedConfirmed that the currency pair has been dominated by the short side in the short term through high-frequency aggregated reasoning on the time-sharing K-line pattern, capital turnover bias, and short-cycle public opinion winds, especially suggests that under the current market conditions, investors need to be wary of what appears to be a mild rebound but is actually a long-drawn-out trap.

The trading spectrum chart tracked by the system shows that short high-frequency accounts have continued to maintain a steady increase in positions in recent trading cycles, while long transactions have shrunk significantly, with an obvious structural imbalance. Words like "conservative", "position reduction" and "trend risk" have proliferated in the public opinion platform, and the dominant market sentiment has shifted to defense.

What's more, multiple signals have formed a "negative resonance", including: macro pressure, net outflow of capital, weakening of technical rebound, and investors' mentality turning cold.

BIASOne thing i will tell you for free is that, you should stop worrying about entries, and always focus on the market direction, of the current leg of price that you find yourself paired with the HTF perspective, that way even if your entry is wrong, you can always find another entry and join in the given direction.

#USDJPYDate: 29-07-2025

#USDJPY Current Price: 148.53

Pivot Point: 148.049 Support: 146.177 Resistance: 149.932

Upside Targets:

Target 1: 151.264

Target 2: 152.597

Target 3: 154.303

Target 4: 156.008

Downside Targets:

Target 1: 144.839

Target 2: 143.501

Target 3: 141.796

Target 4: 140.090

#TradingView #Stocks #Equities #StockMarket #Investing #Trading #Forex

#TechnicalAnalysis #StockCharts #Currency

Eyes on the Break USDJPY Approaches Key Resistance with Bullish.USDJPY Technical Outlook Bullish Momentum Gaining Strength

USDJPY is currently displaying a strong bullish structure, having taken a clean bounce from the ascending trendline support. This upward movement was further validated as the pair successfully broke through a significant resistance level, triggering a Market Structure Shift (MSS) a clear signal that the prior trend has potentially reversed or evolved.

Following the MSS, a Break of Structure (BoS) to the upside has confirmed the continuation of this bullish momentum. The price action is now navigating above the previous demand zone, indicating strong buying interest in that area.

Notably, the market retraced slightly to retest the bullish engulfing zone, reinforcing the strength of buyers at that level. After this healthy retest, price action is once again pushing upward.

Now, all eyes are on the next key resistance zone. If USDJPY manages to decisively break above this level and prints a valid bullish confirmation (such as another structure break, strong candlestick pattern, or liquidity sweep followed by a reversal), it would open the door for an extended upside move, potentially targeting higher time frame liquidity pools.

Traders should closely monitor price behavior around this resistance zone. A confirmed breakout with volume or institutional candle formations could provide an excellent opportunity for continuation buys, in alignment with the prevailing bullish sentiment.