USDJPY trade ideas

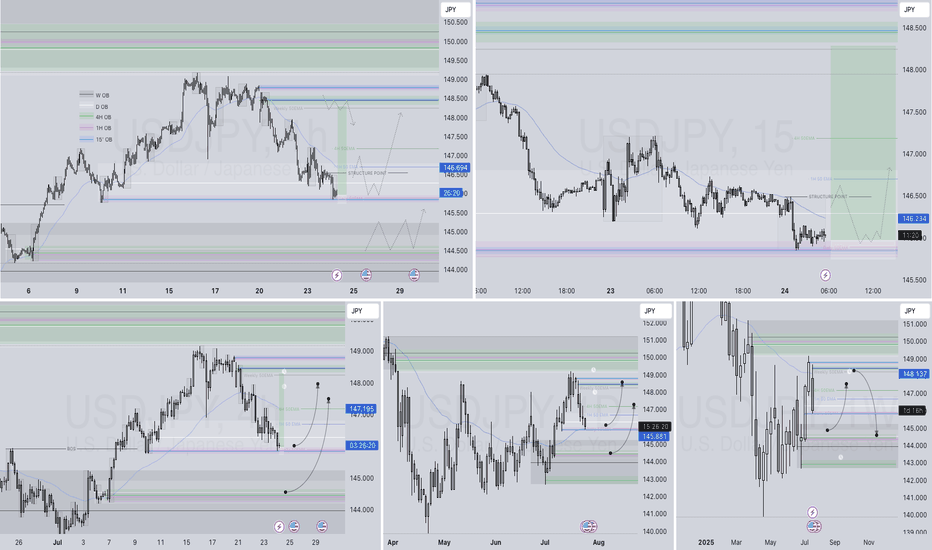

USDJPY Q3 | D24 | W30 | Y25📊USDJPY Q3 | D24 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

FX:USDJPY

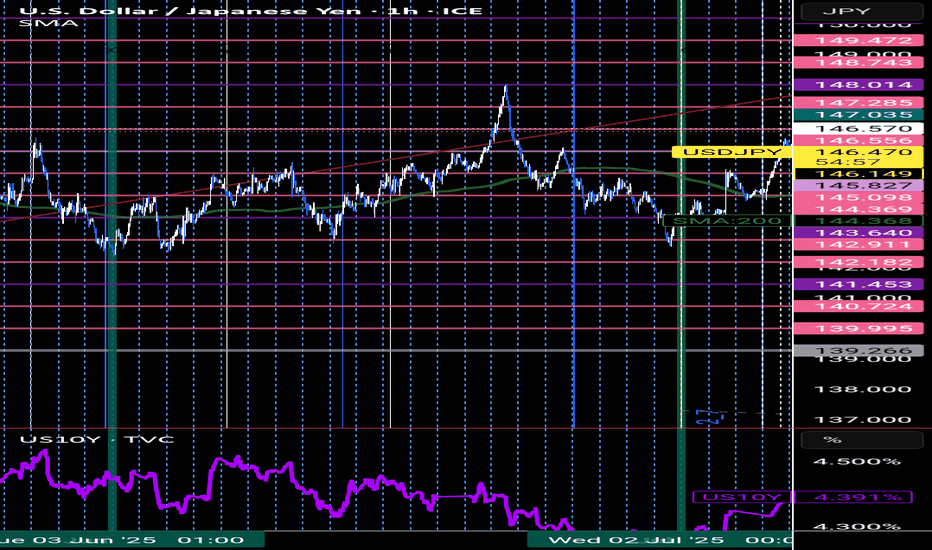

USDJPYUSDJPY continues to show solid bullish momentum, with price respecting higher lows and breaking through resistance zones cleanly. The market structure remains strong, supported by steady buying pressure and positive sentiment around the U.S. dollar. As long as support levels hold, the path of least resistance remains to the upside, with potential for continued gains in the short to medium term.

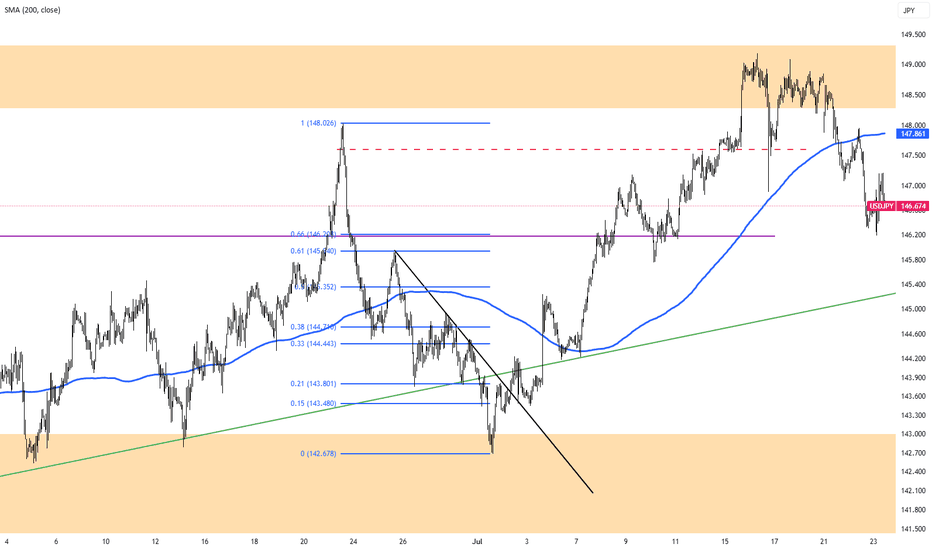

USD/JPY FORCAST 23-7📉 On the daily timeframe, price action confirms a potential start of a new bearish cycle.

🔄 Previous Cycle Breakdown:

Phase 3 (Impulsive Downtrend):

📅 Jan 8 → Mar 6

⏱️ ~41 daily candles

Phase 6 (Correction):

📅 Mar 6 → Mar 30

⏱️ ~20 daily candles

Phase 9 (Distribution/Exhaustion):

📅 ~16 daily candles, ending Apr 21

This marked the completion of a full cycle, triggering a shift in behavior.

🔁 What happened next?

A Reaccumulation / Manipulation phase began immediately after the cycle ended — which is normal after full cycle completion.

This reaccumulation lasted around 62 daily candles, building up pressure and liquidity.

> 80% of market movement is corrective or consolidative.

Only 20% (or less) is pure trend.

If you’re only looking for trends, you’re missing the actual map.

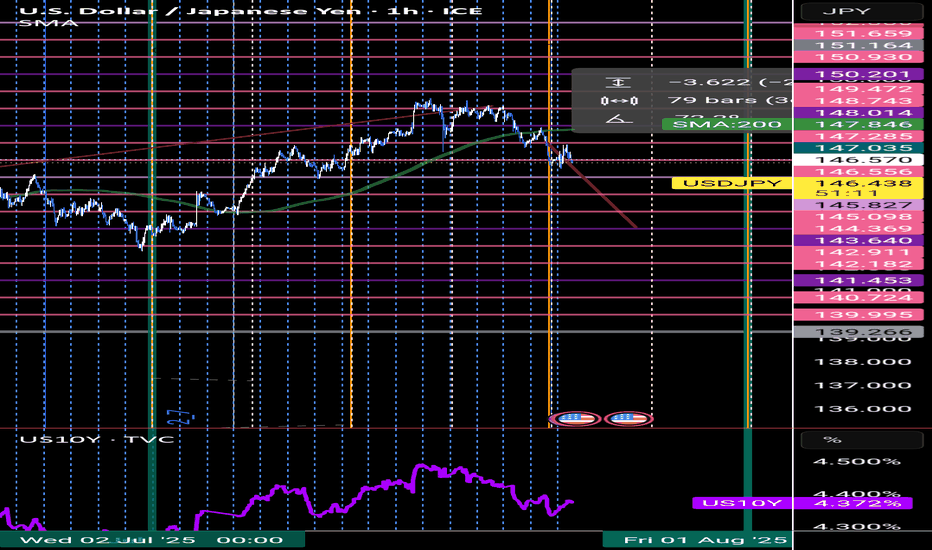

⚠️ Current Outlook: on the 1hr timeframe

As we now enter the final time pivot of the month — specifically beginning July 22 at 16:00 —

the market is signaling the start of a new Phase 3 (bearish impulsive wave).

usd/jpy may reach 141.453 before 1st of August.

I think this is the time to sell usd , or buy any other currencies or metal against usd

What’s your view? Are you trading with time or against it?

update : usd/jpy forcast 23th Jul📉 On the daily timeframe, price action confirms a potential start of a new bearish cycle.

🔄 Previous Cycle Breakdown:

Phase 3 (Impulsive Downtrend):

📅 Jan 8 → Mar 6

⏱️ ~41 daily candles

Phase 6 (Correction):

📅 Mar 6 → Mar 30

⏱️ ~20 daily candles

Phase 9 (Distribution/Exhaustion):

📅 ~16 daily candles, ending Apr 21

This marked the completion of a full cycle, triggering a shift in behavior.

🔁 What happened next?

A Reaccumulation / Manipulation phase began immediately after the cycle ended — which is normal after full cycle completion.

This reaccumulation lasted around 62 daily candles, building up pressure and liquidity.

> 80% of market movement is corrective or consolidative.

Only 20% (or less) is pure trend.

If you’re only looking for trends, you’re missing the actual map.

⚠️ Current Outlook: on the 1hr timeframe

As we now enter the final time pivot of the month — specifically beginning July 22 at 16:00 —

the market is signaling the start of a new Phase 3 (bearish impulsive wave).

usd/jpy may reach 141.453 before 1st of August.

I think this is the time to sell usd , or buy any other currencies or metal against usd

What’s your view? Are you trading with time or against it?

Pound Hits $1.35 on Weaker DollarThe pound climbed to $1.35, supported by a weaker dollar and cautious positioning ahead of the August 1 U.S. tariff deadline. Investors expect UK economic data to show improving momentum, while the Bank of England may scale back bond sales due to weak demand. Despite the optimism, markets still price in two BoE rate cuts in 2025.

Resistance stands at 1.3550, with support at 1.3380.

US-Japan Deal Supports YenThe yen held firm near 146.5 per dollar, its highest level in two weeks, after President Trump announced a trade agreement with Japan featuring 15% tariffs on exports. Japan, in turn, pledged $550 billion in U.S. investments and increased access for American goods. Prime Minister Ishiba’s lack of details and speculation about his possible resignation add further political uncertainty, especially after the coalition’s upper house defeat.

Resistance is at 147.75, with major support at 146.15.

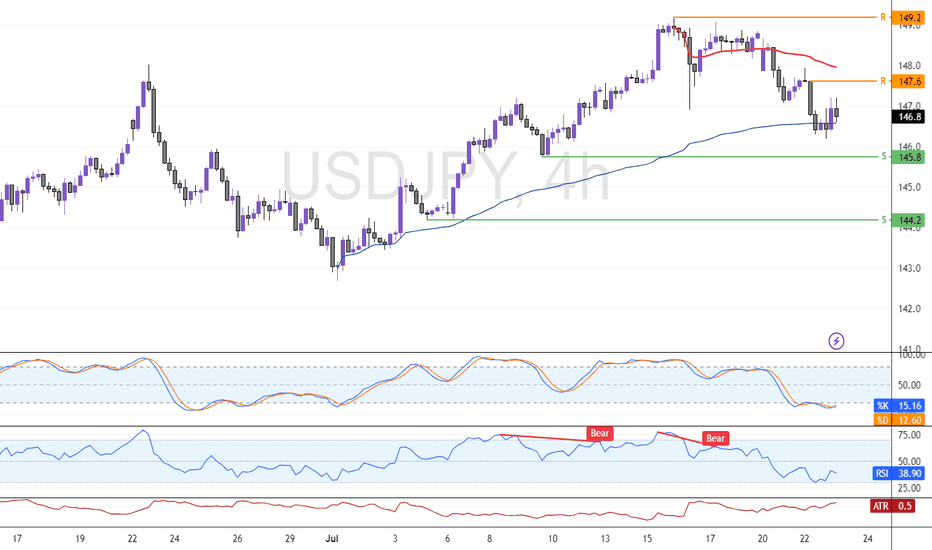

USD/JPY: Bearish Setup Looms Below VWAP ZoneUSD/JPY dipped as expected, currently testing the VWAP as support while Stochastic signals the Yen is overpriced in the short term.

Resistance is at 147.6, backed by the bearish VWAP. It is likely the pair will rise and test this level. Furthermore, a new bearish wave can potentially emerge if 147.6 holds. In this scenario, the next target could be the support at 145.8 followed by 144.2.

The Day Ahead Economic Data

US June Existing Home Sales (10:00 ET): Will gauge housing demand resilience amid high mortgage rates. A weaker print may support rate cut expectations.

Eurozone July Consumer Confidence (Flash): Important for sentiment around ECB rate policy. Any downside surprise could weigh on the euro.

Central Banks

BoJ’s Uchida Speaks: Watch for any shift in tone post-yield curve control tweak. A hawkish slant may support JPY and pressure Japanese equities.

Earnings – High-Impact Reports

Tech & Comms:

Alphabet (GOOGL), Tesla (TSLA), IBM, T-Mobile US (TMUS) – Key for Nasdaq sentiment and AI/cloud/EV momentum.

Industrial & Energy:

GE Vernova, Equinor, Freeport-McMoRan – Outlooks can move energy, copper, and renewables sectors.

Financials & Payments:

Fiserv, UniCredit – Insight into global payment volumes and eurozone banking resilience.

Consumer & Healthcare:

Chipotle, Hilton, Thermo Fisher, Boston Scientific – Consumption trends, travel recovery, and health sector resilience in focus.

Fixed Income

US 20-Year Bond Auction (13:00 ET): Watch for demand metrics (bid-to-cover, indirect bids). Weak take-up could push yields higher and pressure equities.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

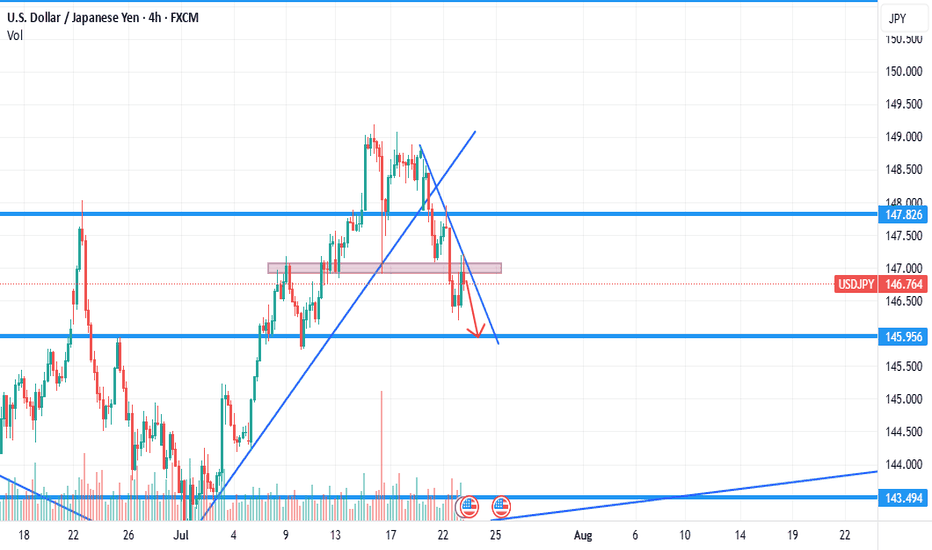

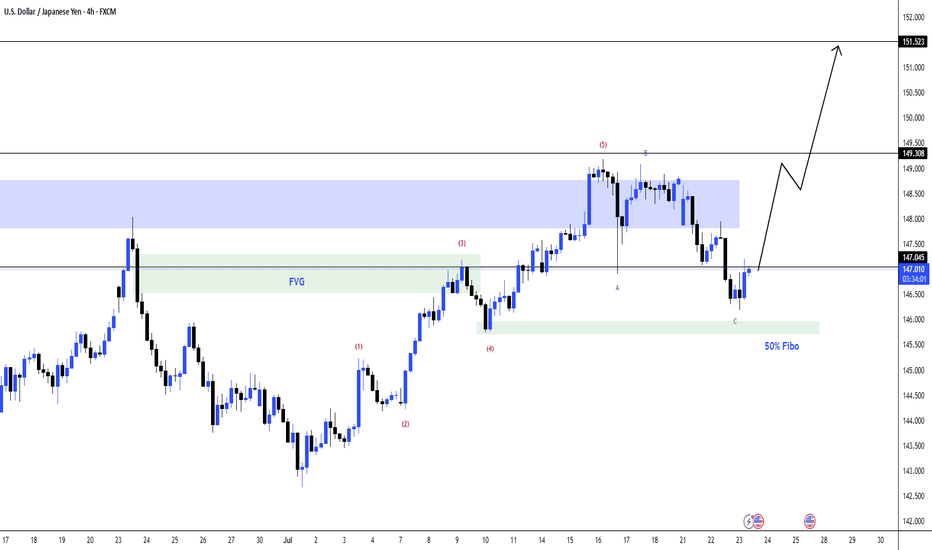

USDJPY 4H Chart Analysis – Bullish Setup in PlayThe USDJPY pair is currently showing signs of a bullish continuation after completing a corrective wave pattern (ABC) down into a strong confluence zone.

📌 Key Technical Insights:

✅ Wave Structure:

The market appears to have completed a 5-wave impulse up, followed by an ABC corrective pattern.

The final leg C has touched the 50% Fibonacci retracement level, aligning with a bullish reaction zone.

✅ Support & Confluence Zone:

Price retraced into the green demand zone marked around the 146.5 level.

This area also aligns with the Fair Value Gap (FVG) and the midpoint of the impulse leg, indicating strong demand interest.

✅ Fair Value Gap (FVG):

Price respected the FVG region twice – first as a breakout, now as a retest.

FVG acts as a dynamic support zone around 146.8–147.2.

✅ Key Resistance & Target Zones:

Immediate resistance lies at 149.30 (previous high and supply zone).

A breakout above this level can trigger a rally toward the 151.50 target, aligning with higher-timeframe resistance.

📈 Potential Bullish Pathway:

As shown on the projection path, price is expected to:

Hold above the 146.5–147.0 demand zone.

Retest 149.30 as resistance.

Continue to push higher toward 151.50, completing a larger bullish leg.

💬 Let me know your thoughts in the comments! Will USDJPY break 151 next?

#USDJPY #ForexAnalysis #ElliottWave #SmartMoney #PriceAction #FVG #TradingView #FX

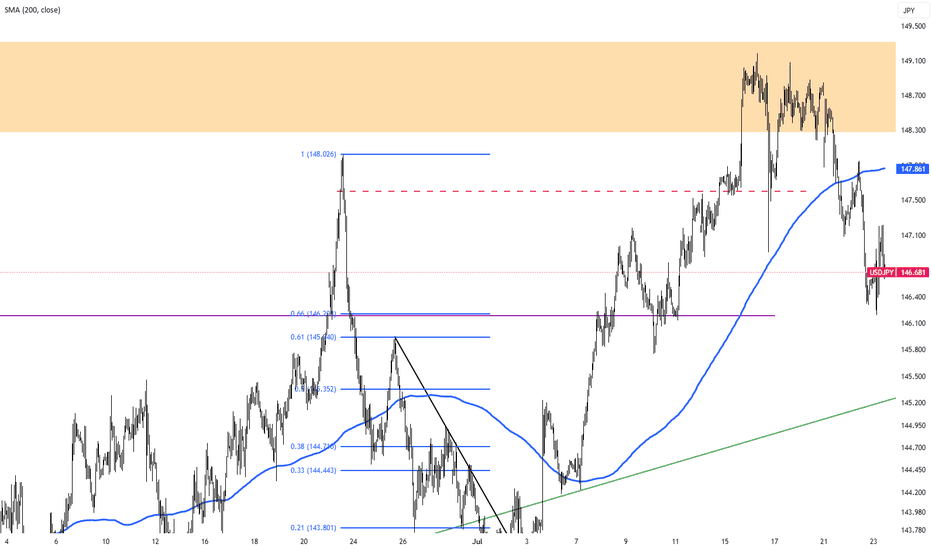

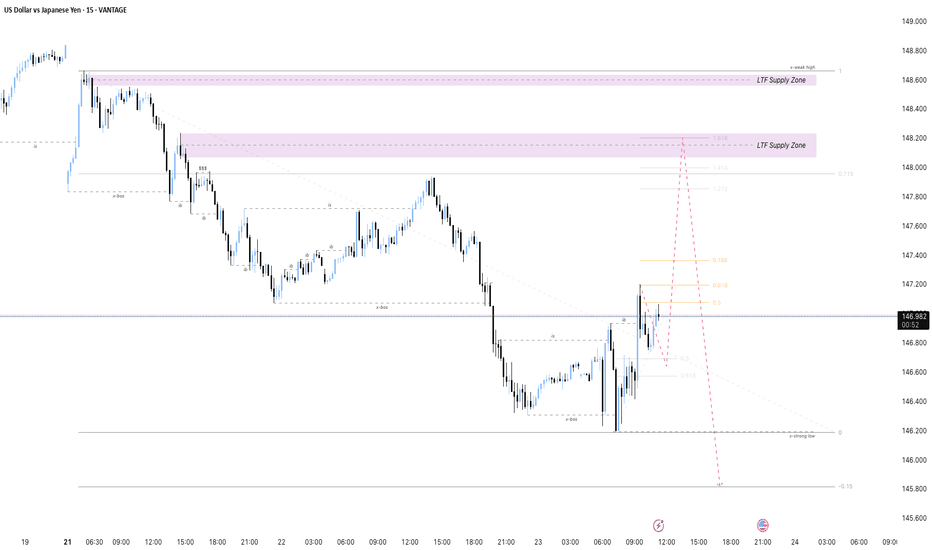

USDJPY - Bearish BiasThe USD/JPY market currently shows a clear downtrend, as indicated by the break of structure (x-bos) and lower lows formation. The price is expected to retrace upwards towards key smart money areas defined by Lower Time Frame (LTF) Supply Zones highlighted in purple.

Using Fibonacci retracement from the recent swing high to the swing low, key Fibonacci levels—especially around the 0.618 and 0.786 zones—align with these LTF Supply Zones, creating high-probability entry areas for short positions.

The trading plan anticipates a retracement into these supply zones, where bearish price action signals can confirm entries. The ultimate target is set near the previous strong low (around 145.821), aiming to ride the next leg down in alignment with the market structure.

Risk management should involve placing stop losses slightly above the upper boundary of the LTF Supply Zones to protect against false breakouts. Patience is emphasized by waiting for price to reach these confluence zones, combining Smart Money concepts and Fibonacci levels for optimal timing and risk-to-reward profile.

Trump’s 15% Tariff Move -Will It Trigger a USDJPY Trend ReversalThe dollar held firm after Trump announced a preliminary trade deal with Japan, setting a 15% tariff on Japanese imports and securing a 550 bln USD investment pledge. The agreement, which includes opening Japan's market to more US autos and agricultural goods, is part of Trump's broader push for "reciprocal tariffs" ahead of the Aug 1 deadline.

While details remain unclear, especially around potential exemptions for Japanese autos, the deal boosted sentiment in Japanese markets. Traders are watching for further specifics, as uncertainty around implementation and broader tariff risks linger.

From a technical perspective, USDJPY is approaching the support at 145.60, which aligns with an area of Fibonacci confluence. A rebound above 145.60 could prompt a further rise toward the following resistance at 148.80. Conversely, a break below the ascending trendline and support at 145.60 could prompt a further decline toward the following support at 142.80.

By Li Xing Gan, Financial Markets Strategist Consultant to Exness

JPY/USD 6J=F | SMC + LSTM Alignment | Target 0.006881 | VolanX P🚨 Bullish SMC Reversal Confirmed

After sweeping liquidity near 0.006804 equilibrium, price flipped BOS (break of structure) and is now pushing toward premium levels.

🔍 LSTM Model Forecast:

15-day trajectory aligns with upside bias. Short-term bearishness has likely completed.

🎯 Target: 0.006881 (2.414 fib extension)

🛡️ Smart entry was at the mitigation block between 0.006804–0.006820.

🔁 Price has returned to fair value and is now entering expansion.

🧠 VolanX DSS Signal:

SMC: BOS + mitigation + equilibrium tap

Fib cluster: 1.382–2.414 extensions favor bullish momentum

Volume profile confirms absorption

🪙 This may represent the continuation phase of JPY weakness or USD dominance. Monitor closely around 0.006862 (1.382 zone) for reaction.

VolanX Decision Protocol | Forecast Engine: DSS + LSTM AI | Not financial advice.

JPYUSD – Liquidity Grab Complete? VolanX Smart Reversal in Play📈 JPYUSD – Liquidity Grab Complete? VolanX Smart Reversal in Play ⚔️

The Yen just triggered a textbook Smart Money setup.

After sweeping the Equilibrium zone at 0.006738, we saw:

Reversal from the 0.618 Fib confluence (0.006803)

Clear CHoCH + BOS structure confirming demand re-entry

Strong upside magnet: Premium zone near 0.00712

🔍 VolanX DSS Outlook

The system now confirms a bullish reversal scenario with high probability based on:

Demand reactivation off discount levels

USD softening (jobless claims + CPI pressures)

BOJ inching away from ultra-loose policy

Capital rotation favoring defensive pairs like JPY

🧠 Probability Map:

🎯 0.00705–0.00712 = High liquidity target zone

📉 Invalid below 0.006660

📊 Thesis:

JPYUSD appears to be front-running global risk moderation and macro recalibration. VolanX tracks strong confidence in a reversal toward premium.

🔒 Positioning: Long bias maintained

🔔 Alert zones: 0.00688 (breakout), 0.00712 (TP zone)

💡 Powered by VolanX Protocol – Institutional-grade signal engine for macro + AI alpha convergence.

#VolanX #JPYUSD #SmartMoney #FXTrading #LiquiditySweep #VolatilityHedge #MacroTrades #ForexAnalysis #TradingView #WaverVanir

USDJPYUSDJPY Update 🚨

Entered long at 146.370, price is now at 146.895 — currently up +52.5 pips ✅

🧠 Trade idea was based on:

• Clean tap into higher timeframe demand zone

• Strong rejection and bullish engulfing on the 1H

• Solid R:R setup with a clear upside target (149 area)

📌 SL was safely below 146.00

📌 Holding partials now or trailing stops to lock in profits

Let me know if you caught this move too 🔥

Patience + precision = results 💯

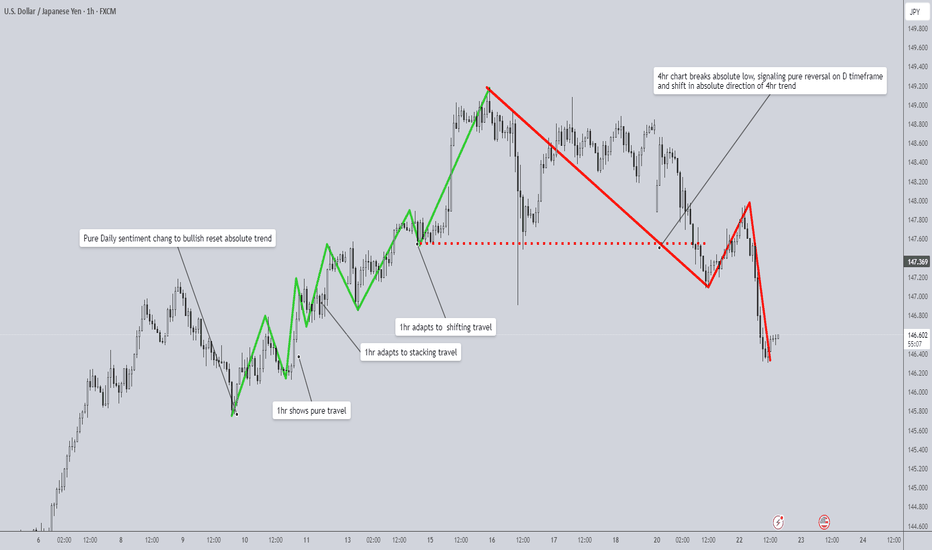

Market Travel: An Adaptive Framework for Tracking Structure🧭 Understanding Market Travel: An Adaptive Framework for Tracking Structure Manually

Market structure can be one of the most challenging patterns to read. There are tools and methods to help interpret it, but none are absolute. As market speed and volatility shift, so does its behavior. That’s why it’s important to move beyond rigid definitions and start understanding how price travels through the market.

What Is Travel?

“Travel” is a concept I developed through personal study and chart work. As price moves, it naturally forms pullbacks—temporary dips toward the weak side—and breaks—moves that close beyond the strong side. These are the two critical phases that form the backbone of market structure.

While most people focus on static patterns, I’ve found more value in learning how price travels through its pullbacks and breaks. These movements aren’t random—they follow clear behavioral patterns. Once you learn to identify these, structure becomes easier to read across timeframes.

The Three Modes of Travel

I've observed three types of travel that occur between the dip and the break:

1. Pure Sentiment Travel

This is the cleanest and most decisive form of travel. Price moves in one dominant direction with little to no opposing candles. For example, in a daily uptrend, the pullback might consist entirely of bearish 4H candles. As soon as a strong bullish candle appears, that typically signals the return toward the trend’s strong high.

2. Stacking Travel

Stacking is more nuanced. Price moves with alternating bullish and bearish candles, but the dominant sentiment stays in control.

Let’s say price is dipping in a daily uptrend. On the 1H chart, you may see a bearish sequence that includes a few bullish candles. These bullish candles don’t invalidate the bearish structure because they fail to close above the pivot high formed between the last bullish leg and the beginning of the bearish move. As long as that high is respected, the bearish stacking is valid.

Once price breaks that high (or, in a bullish stacking case, breaks the pivot low), the stacking order is broken, and that signals a reversal back toward the dominant direction.

3. Shifting Travel

Shifting travel looks similar to stacking but is constantly flipping between bullish and bearish stacking. Each shift creates a new high or low within the shifting structure. These micro-structures form lower lows or higher highs as sentiment switches back and forth.

Once price breaks its own shifting structure (e.g., breaks a bearish sequence with a bullish close), this typically signals the end of that leg of travel and a reversal toward the dominant higher timeframe trend.

How to Apply Travel Across Timeframes

These three types of travel operate in a hierarchy:

- Shifting travel (LTF) respects stacking travel (MTF)

- Stacking travel (MTF) respects pure travel (HTF)

- Pure sentiment travel (HTF) is the master mode that resets the others

When you identify a new pure sentiment shift on the higher timeframe, that becomes your reset point. From that candle forward, you should begin fresh stacking and shifting analysis on your lower timeframes.

Workflow example:

1. Spot a pure sentiment shift on the HTF (e.g., bullish daily candle after a clean bearish pullback)

2. From that pivot low, begin tracking stacking travel on the MTF

3. Use shifting travel on the LTF to navigate inside the stacking structure

If stacking or shifting behavior breaks unexpectedly, that usually means market speed is changing—and you may need to reassign which timeframes serve as HTF, MTF, and LTF.

Why This Works

This framework gives you a fixed point of structure—the dip and the break—but allows you to adapt to the behavior in between. Instead of just reacting to breakouts, you're learning how price moves to get there.

That’s what gives you the edge: not just reading where price is, but how it’s traveling to get there.

Final Thoughts

This adaptive travel model helps break down market structure into something both trackable and flexible. Try observing these travel types in real time and let me know how it works for you.

Tools & Resources

If you’d like to access my Pure Order Flow indicator and more exclusive tools, visit my TradingView profile:

@The_Forex_Steward

I’ve built an arsenal of indicators designed to support this framework across different markets and styles. If this breakdown helped, don’t forget to boost the post so others can benefit from it too!

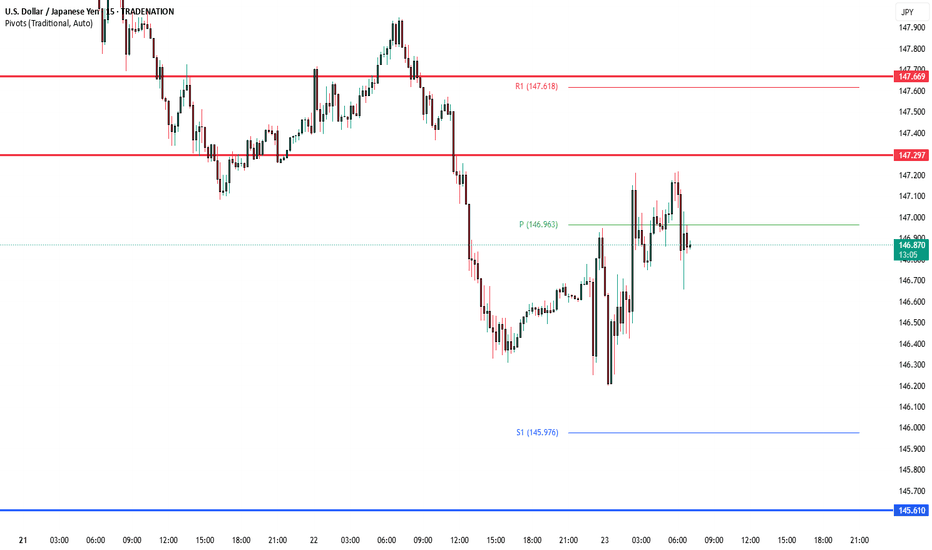

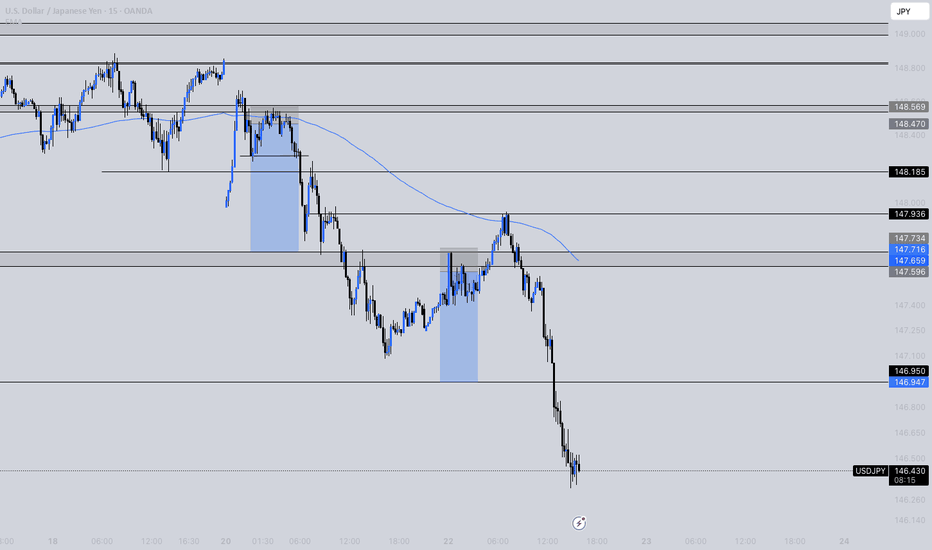

USD/JPY - Potential TargetsDear Friends in Trading,

How I see it,

KEY RESISTANCE AREA @ 147.000 - 147.150

1) 145.940 - Swing Area @ 50% Retracement of July rally

2) As long as price remains below key resistance, watch price reaction

at swing area.

3) If this swing area is decisively breached, 145.000 will be targeted next.

I sincerely hope my point of view offers a valued insight.

Thank you for taking the time study my analysis.

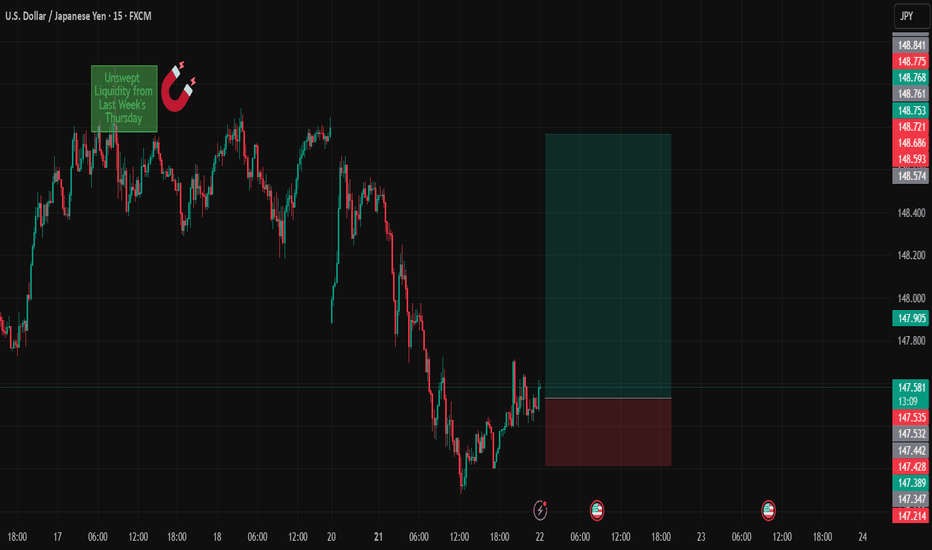

USDJPYDate:

July 22,2025

Session:

Tokyo and London session

Pair:

USDJPY

Bias:

Long

1. Clean liquidity pool left unswept from last week's NYC Open (Thursday).

Took this trade earlier today but looks like price wanted to consolidate in the liquid pool its currently in. I still hold the same idea and think the sweep will definitely take place sometime this week. Now looks like the perfect time to enter. If Asia session cant get it done its up to London and New York session.

Entry:147.534

Stop Loss:147.215

Target:148.768

RR:3.89

USDJPY Smart Money Analysis – Bearish OutlookAfter a confirmed 1-hour bearish divergence @149.202, price initiated a downward structure. We saw a bounce from a bearish 4H Order Block (OB) @147.356, but this bounce did not invalidate the initial bearish divergence structure.

Price then broke below that 4H OB slightly, before retracing back into the same OB zone, forming another 4H bearish OB at that level, indicating reinforced institutional interest. This was followed by a clean CHoCH @146.943, confirming further bearish pressure.

Price reacted next from a bullish 4H OB @146.496, initiating a short-term retracement.

📌 Expectations:

🔁 We expect price to retrace back into the newly created 4H bearish OB @147.626, which is a refined point of interest.

📉 If that level holds as expected, the bearish move is likely to continue towards the next bearish OB sitting around 145.148, which is a potential demand exhaustion zone.

🧠Summary of Key Zones:

1H Bearish Divergence: 149.202

Initial 4H Bearish OB: 147.356

CHoCH Confirmation Level: 146.943

Bullish OB Reaction: 146.496

Expected Retracement POI (4H OB): 147.626

Final Bearish Target OB: 145.148

⚠️Risk Management Note:

This analysis is based on Smart Money Concepts and market structure observation.

Always use proper risk management — risking no more than 1–2% of your capital per trade.

Ensure your stop-loss and lot sizes match your account equity.

News events and volatility can invalidate technical zones quickly.

Trade safe. 🧠💼📉