USDJPY trade ideas

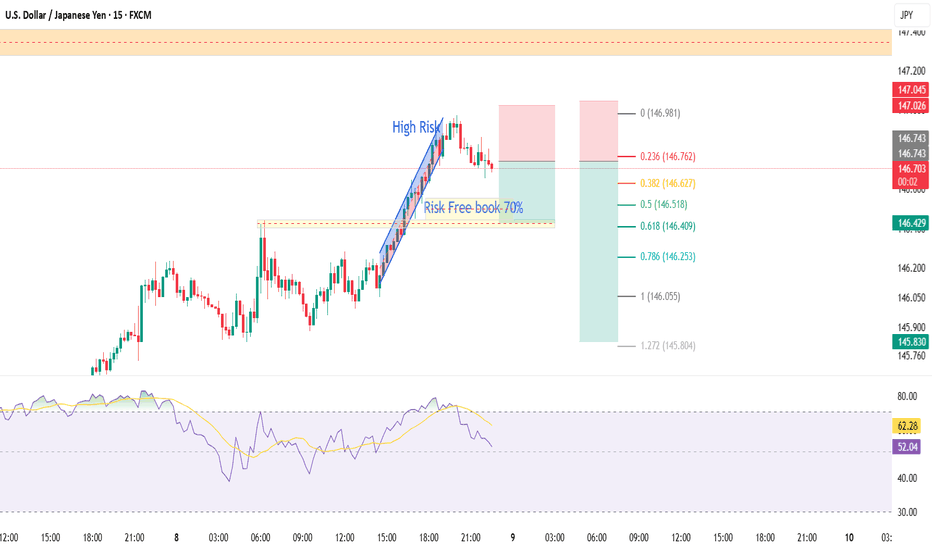

X1: USDJPY Short TradeFX:USDJPY Short swing trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Risking 1% to make 1.35%

Don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

Lingrid | USDJPY Pullback From the Key Resistance ZoneThe price perfectly fulfilled my previous idea . FX:USDJPY is moving inside an upward channel after reclaiming support near 145.25 and breaking out from its previous range. The pair printed a higher low and is now approaching resistance around 146.78, testing the upper boundary of the ascending channel. If it fails to break through the red resistance trendline, a retracement toward the 145.25–145.00 support is likely.

📈 Key Levels

Buy zone: 146.78 - 147.00

Sell trigger: rejection from 146.78 and lower high below resistance

Target: 145.25

Buy trigger: bullish breakout above 147.00 with momentum confirmation

💡 Risks

Price rejection near 146.78 may cause a sharp pullback

A surge above 147.00 breaks trendline structure

Market reaction to macro data could distort short-term pattern

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Yen Falls After Trump's 25% Tariff on JapanThe Japanese yen weakened beyond 146 per dollar on Tuesday, hitting a two-week low after President Trump confirmed a 25% tariff on Japanese imports starting August 1, lower than the earlier 35% threat but still above the standard 10%. Japan’s Prime Minister Ishiba pledged to keep negotiating for a favorable outcome. Although Japan’s May current account surplus came in stronger than expected, disappointing wage growth limited hopes for further Bank of Japan rate hikes, adding pressure on the yen.

Key resistance is at 146.20; major support at 144.85.

USDJPY Structural Analysis : Breakout Demand Play + Target🗺️ Market Structure & Key Technical Zones

On the USDJPY 4-hour timeframe, the market is clearly respecting smart money levels and giving us an ideal case study of institutional demand, trend continuation, and liquidity engineering.

🔰 1. Major Support Zone (142.500 – 143.200):

This zone acted as a high-value area where price consolidated previously before rallying. It has been tested multiple times and each touch has led to a strong bullish reaction, indicating accumulation by large players.

Think of this zone as the market’s base camp — when price visits it, big money steps in to reload longs.

🔰 2. Channel Formation & Breakout:

A clean bullish channel formed mid-June, with price respecting both bounds while gradually climbing. Once the channel was broken with strong volume (noted by the breakout candle), it suggested a shift from controlled bullish flow to an impulsive move — a change in pace that often indicates smart money is active.

🧱 Institutional Concepts in Action

🔵 QFL (Quick Flip Level):

This area marks a prior consolidation or sideways action that gets aggressively broken. In this chart, price dipped to a QFL zone then sharply reversed — suggesting a trap for early shorts and a liquidity grab before moving up. A classic “manipulation → accumulation → expansion” sequence.

🟦 Breaker Demand (BR Demand):

This is where previous resistance has flipped into new support. Breaker blocks are extremely important in identifying where institutions may re-enter positions. Price respected this area before continuing higher — confirming bullish control.

Price tapped into this BR demand, showed low-wick rejections, and moved strongly, signaling confidence from large orders.

📊 Volume Burst Zone (~147.2–147.7):

This zone has historically seen high volume and sudden price acceleration. Price is re-approaching it now. This is where a lot of pending orders and take-profits are likely clustered — expect strong reactions here.

📈 Current Price Action

Price is climbing along a clean bullish trendline, reinforcing current momentum.

Price has broken previous structure highs and is now making higher highs and higher lows — a textbook bullish trend.

Buyers are in control as long as the price continues to respect:

The bullish trendline

The BR demand zone (~145.5)

🔮 Projection & Potential Scenarios

🟢 Bullish Continuation Case:

If current momentum holds, the price is likely to push toward the Next Reversal Zone (148.500–149.000).

This zone aligns with multiple confluences:

Fibonacci extension targets

Previous high liquidity trap zone

Potential institutional profit-taking level

Expect this zone to cause a reversal or deep pullback.

🔴 Bearish Breakdown Case:

If price breaks below the BR Demand Zone and closes under the trendline, expect a drop back toward the Central Zone (~144.8–145.0), or even deeper into the Major Support Zone.

This would shift market structure back to neutral or bearish depending on volume and rejection patterns.

📌 Summary:

✅ Bias: Bullish

🎯 Short-Term Target: 147.5 (volume burst area)

🧱 Key Support: 145.50 (breaker demand)

❗ Trendline Break = Red Flag

🏁 Final Reversal Zone: 148.500–149.000

💬 Final Thoughts

This chart is a brilliant example of smart money accumulation and market engineering. USDJPY continues to respect well-defined zones, presenting high-probability opportunities for traders who understand structure and patience.

This setup is NOT about chasing price — it's about following the footprints of volume, breakout structure, and institutional intent. Stick to the plan and manage risk around key invalidation zones.

DeGRAM | USDJPY formed the triangle📊 Technical Analysis

● Price defended the 142.80 confluence (triangle base + channel median), printing a bullish hammer and reclaiming the short-term trendline; structure now forms an ascending triangle inside the broader consolidation.

● Momentum is rising toward 146.50 – the pattern’s 1:1 swing and prior supply – with the next objective the upper triangle wall at 148.10. Invalid if candles fall back under 142.80.

💡 Fundamental Analysis

● Rebound in US ISM manufacturing and Fed minutes hinting “no near-term cuts” lifted 2-yr yields, while weak Japanese wage growth keeps the BoJ patient. The widening policy gap revives USD/JPY bid.

✨ Summary

Long 143.4-144.1; targets 146.5 then 148.1. Exit on a 4 h close below 142.8.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

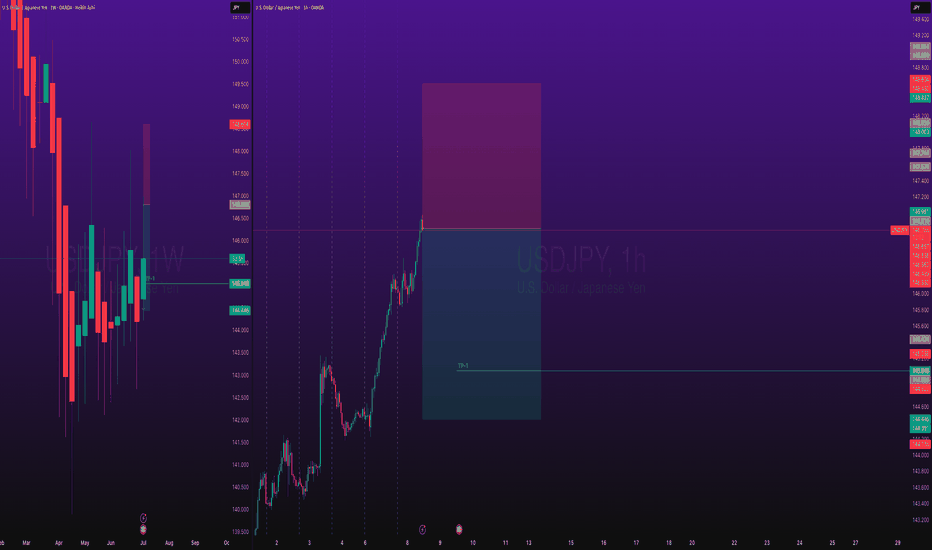

USDJPY h4 strongly downBearish Expectation Disruption / Bullish Counterpoint

Resistance (147.5) Rejection and drop Breakout and continuation toward 148.5+

Breakout FVG Fakeout and reversal True breakout — bullish trend continues

Bullish Zone (~144) Clean break below Accumulation zone, strong buying interest may emerge

Target (~143) Next leg down May not be reached if price stabilizes above 145

Support (~142.5) Final drop destination Could become irrelevant if trend flips decisively bullish Original Assumption: Market is behaving in isolation from fundamentals.

Disruption: If U.S. data (e.g., strong NFP, CPI, or Fed commentary) supports rate hikes, USD/JPY may remain bid and breakout to 148+ instead of reversing.

Watch For: Strong dollar narrative or dovish BOJ language.

Fundamental Market Analysis for July 8, 2025 USDJPYThe yen remains under pressure from trade frictions. President Donald Trump has confirmed 25 percent tariffs on Japanese goods effective 1 August, fuelling U.S.-inflation expectations and reducing the odds of a near-term Fed rate cut. Ten-year Treasury yields have climbed above 4.45 percent, while the spread over equivalent JGBs hovers near 380 basis points—supportive for the dollar.

Japan’s domestic backdrop offers little relief. Nominal wage growth has slowed for a third straight month, and real household incomes have posted their deepest decline in twenty months. The weak earnings momentum complicates the Bank of Japan’s exit strategy and keeps ultra-loose policy firmly in place, encouraging further capital outflows from the yen.

Against this backdrop, USD/JPY is consolidating above its 100-day moving average around 146.40–146.50. Absent a sudden flight to safe-haven assets, the pair could break 147.00 in the coming sessions, while the 145.950–146.000 zone is widely viewed as an attractive area to add to long positions.

Trading recommendation: BUY 146.250, SL 145.950, TP 147.000

Bearish reversal?USD/JPY is reacting off the pivot and could drop to the 1st support which has been identified as a pullback support.

Pivot: 146.18

1st Support: 145.01

1st Resistance: 147.62

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USDJPY Pre-Breakout Setup – Eyes on 145.310 for Bullish EntryThe recent structure on USDJPY (4H chart) shows a bullish shift supported by a strong double bottom formation within a defined demand zone. After a clean impulse from the bottom, price is now consolidating below the key resistance.

🔹 Trade Idea:

I am patiently waiting for the price to break and close above 145.310 to confirm bullish continuation. Entry is valid only above this level to avoid false breakouts.

🔹 Technical Highlights:

- Price rebounded from a strong demand zone with a double bottom.

- A new bullish leg formed, approaching the 0.786 Fibonacci retracement level.

- A clear impulse-correction structure signals potential for further upside if resistance is broken.

🔹 Trade Plan:

- Buy Above: 145.310 (confirmation breakout)

- Stop Loss: 144.40 (below structure and 0.382 Fib)

- Target: 146.900 (aligned with 1.618–2.0 Fibonacci extension)

⚠️ Note: No trade if price fails to break and hold above the entry trigger. Patience is key.

USDJPY H4 I Bullish Bounce Off Based on the H4 chart analysis, the price is falling toward our buy entry level at 145.21, a pullback support.

Our take profit is set at 146.70, aligning with the 100% Fibo projection.

The stop loss is placed at 144.01, a pullback support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USDJPY InsightHello to all our subscribers!

Please feel free to share your personal opinions in the comments.

Don't forget to like and subscribe!

Key Points

- U.S. President Trump has officially announced that he will sign an executive order extending the reciprocal tariff suspension deadline to August 1st.

- Through a post on Truth Social, President Trump revealed that he had first sent tariff letters to allies South Korea and Japan, addressed directly to their heads of state, stating that a 25% tariff would be imposed on both countries starting August 1st.

- Hajime Takata, a member of Japan’s Monetary Policy Board, hinted at the possibility of additional rate hikes, stating: “If solid capital investment, wage increases, and the sustainability of price pass-through can be confirmed, we will need to shift gears one step at a time.”

This Week's Major Economic Events

+ July 8: Reserve Bank of Australia (RBA) Interest Rate Decision

+ July 9: Release of FOMC Meeting Minutes

+ July 10: Germany’s June Consumer Price Index (CPI)

+ July 11: UK May GDP Report

USDJPY Chart Analysis

The pair rebounded near the 142 level, showing upward momentum. This appears to reflect the impact of Trump’s announcement of high tariffs on Japan.

If negotiations proceed, the upward trend may stall. In such a scenario, a potential high around 148 is likely.

However, if the 148 level is breached, there could be an additional rally toward the 151 level.