USDJPY trade ideas

ujThe dollar index (DXY00) on Monday added to last Friday’s losses and fell by -0.38%. The dollar moved lower Monday on negative carryover from last Friday’s weaker-than-expected US payroll and ISM manufacturing reports, which sent T-note yields lower and bolstered speculation that the Fed may cut interest rates as soon as next month.

UJ| Bullsih Bias | Professional Sweep Forming Off 30M OB (Refined & Structured):

• Pair: USDJPY

• Bias: Bullish

• 4H Overview: After breaking previous highs, price pulled back into a sell-side liquidity (SSL) zone. This move shows signs of exhaustion following the sweep, hinting at bullish continuation.

• 30M Structure: Price took out internal liquidity/SSL and is now reacting from a refined 30-minute order block. Looks like a professional sweep is in play, with refined structure holding.

• Entry Zone: Waiting for further confirmation on the lower timeframes once the market opens.

• Targets: 5M and 30M structural highs depending on how price delivers.

• Mindset Note: This setup is a prime example of letting price come to you. Trusting HTF structure and recognizing the sweep fuels the patience needed to strike on LTF intent.

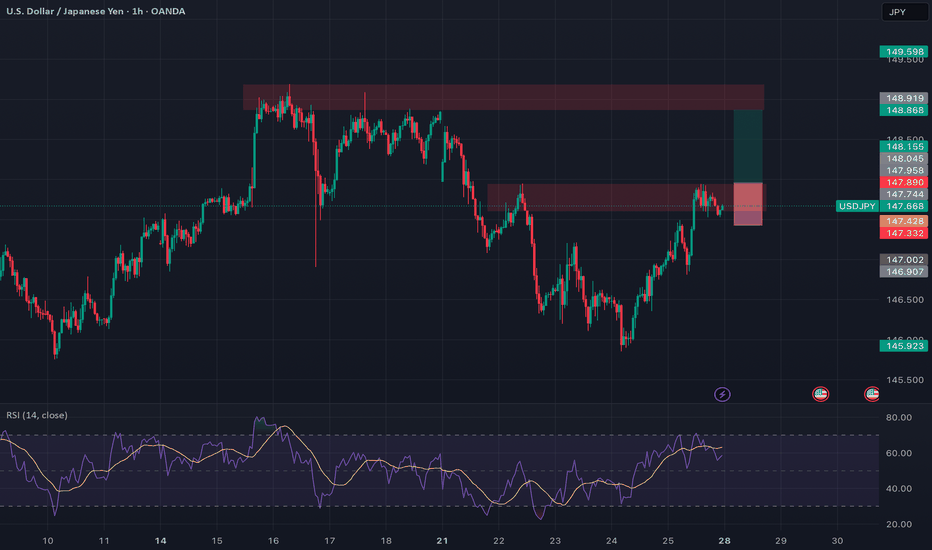

USDJPY: Breaking Out With Macro Backing 🟢 USDJPY | Breakout Opportunity Above Resistance

Timeframe: 1H

Bias: Bullish

Type: Break and Retest

📊 Technical Setup

USDJPY is currently consolidating at a key 4H resistance zone (147.75–147.90). A clean breakout and retest of this area will confirm bullish continuation.

• Entry: Above 147.90 (after confirmed candle close + retest)

• SL: Below 147.30

• TP: 148.90 / 149.60

• RR: ~1:2.5

• Indicators: RSI showing strong upside momentum, holding above 50

🧠 Fundamentals + Macro Confluence

• USD Strength: Strong macro & delayed rate cuts support USD upside

• JPY Weakness: BOJ remains dovish; risk-on sentiment weighing on JPY

• COT + Conditional Score: USD score increased to 17, JPY dropped to 8

• Risk Sentiment: VIX at 14.2 = RISK ON → bearish JPY bias

🧭 Gameplan

“Wait for confirmation above resistance before entering”

🔔 Set alerts around 147.90 and monitor lower timeframes for retest and bullish candle structure.

DeGRAM | USDJPY fixed above the descending channel📊 Technical Analysis

● Dollar-yen has punched through the 16-month descending channel top and twice retested it as support (false-break tags), carving a rising trend line that now guides price away from 144.90.

● Inside the break zone a smaller pennant is forming; a 4 h close above 147.18 completes the pattern and activates the channel-height target at 150.80 near the November swing cap.

💡 Fundamental Analysis

● US 2-yr yields pushed to a three-month high after hotter CPI core-services and Barkin’s “inflation progress has stalled”, while the BoJ July minutes flagged only “gradual” QT—widening the policy gap and reviving carry demand for yen shorts.

✨ Summary

Long 145.2-146.2; pennant break >147.18 targets 150.80. Bias void on a 4 h close below 142.80.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

USD/JPYThis is a trade setup for USD/JPY, based on volume and trend analysis.

Entry Price: 150.360

Stop-Loss (SL): 150.740

Take-Profit (TP): 149.963

The trade is intended to be executed instantly at the mentioned price, in alignment with both volume behavior and the current trend direction.

Disclaimer: This setup is shared purely for backtesting purposes and to document trade ideas. It is not financial advice. Always perform your own analysis before making any trading decisions.

Bearish reversal off overlap resistance?USD/JPY is rising towards the pivot, which has been identified as an overlap resistance and could drop to the 1st support.

Pivot: 151.17

1st Support: 149.03

1st Resistance: 154.51

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

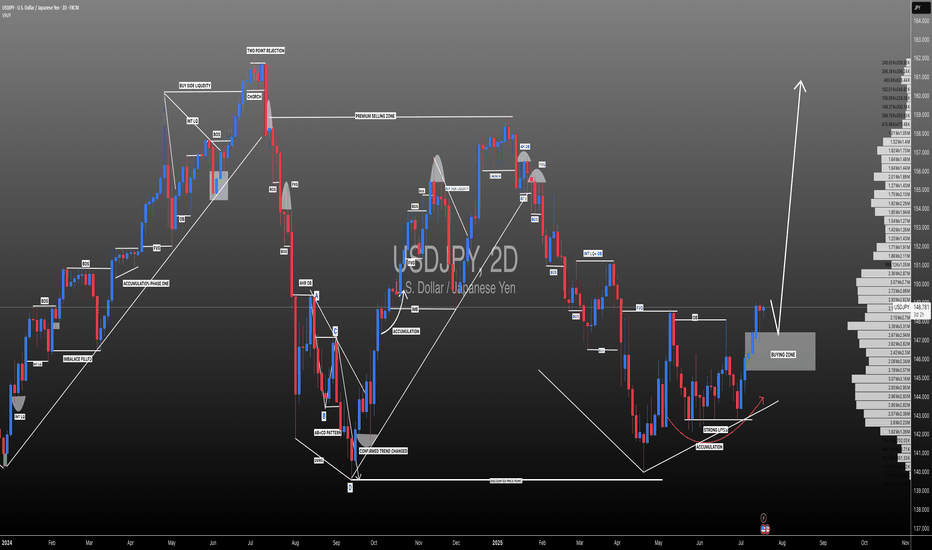

Increasing chances of bullish volatility in JPYThe fluctuations formed since May 2024 indicate a strengthening of the possibility of upward fluctuations in the currency pair, and in the long term, there is news of price targets in the range of 185 units!

Be careful, we will face numerous upward and downward fluctuations until the desired price target is reached!

Good luck

MJ.REZAEI

USDJPY Targets Completion of 7 Swing RallyThe USDJPY pair exhibits an incomplete bullish sequence originating from the April 22, 2025 low, signaling potential for further upside. We can project the extreme target area for this rally can be projected using using the 100% to 161.8% Fibonacci extension from the April 22 low. This places the target range between 150.88 and 156.33. The ongoing rally from the May 27, 2025 low is unfolding as a double three Elliott Wave structure. This structure has two zigzag corrective structure driving the upward momentum.

From the May 27 low, wave W concluded at 148.03. A corrective pullback in wave X then followed, which bottomed at 142.67. Currently, wave Y is in progress, with internal subdivision as a zigzag pattern. From the wave X low, wave ((a)) peaked at 149.18, followed by a corrective wave ((b)) that unfolded as a zigzag. Within this structure, wave (a) ended at 147.81 and wave (b) reached 149.08. Wave (c) completed at 145.87, finalizing wave ((b)) in the higher degree. The pair has since resumed its ascent in wave ((c)), developing as a five-wave impulse.

From wave ((b)), wave (i) concluded at 148.71, with a minor pullback in wave (ii) at 147.79. In the near term, as long as the pivot low at 145.87 holds, dips are expected to attract buyers in a 3, 7, or 11-swing corrective pattern, supporting further upside toward the Fibonacci extension targets.

USDJPY – DAILY FORECAST Q3 | W31 | D30 | Y25📊 USDJPY – DAILY FORECAST

Q3 | W31 | D30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:USDJPY

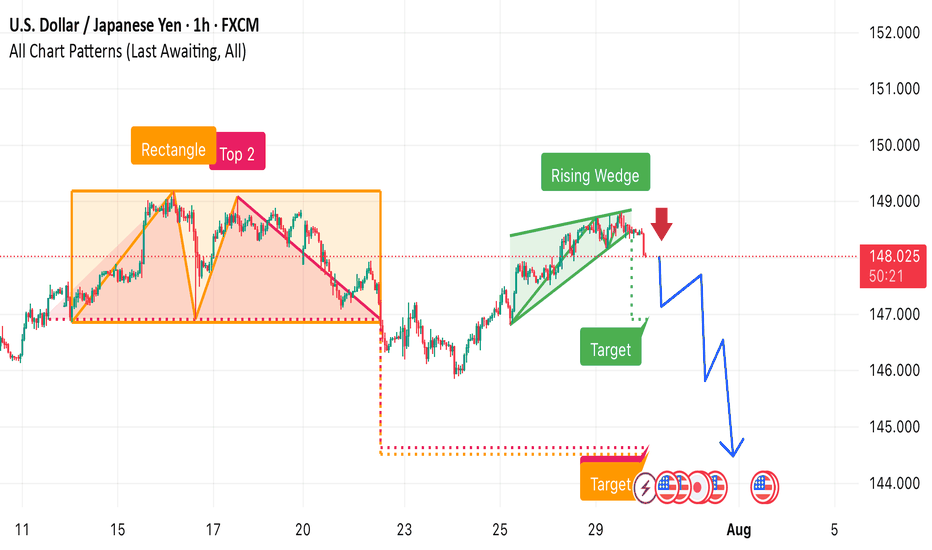

Key Observations 1. Rectangle + Double Top (“Top 2”) Formation (left side):

• Price ranged between ~147.5 and ~149.5.

• A double top inside the rectangle signaled resistance and potential reversal.

• Breakdown from the rectangle zone occurred, confirming bearish momentum.

2. Rising Wedge Pattern (right side, green zone):

• A bearish pattern forming higher highs and higher lows.

• The red arrow indicates an expected breakdown from the wedge.

3. Bearish Price Projection (blue arrows):

• The chart projects a sharp drop following the wedge breakdown.

• Multiple target levels are marked:

• First Target: ~147.0 zone.

• Final Target: Near 144.0, aligning with the measured move from previous breakdown.

4. Confluence of Bearish Signals:

• Rectangle breakdown + rising wedge.

• Bearish candle rejection near 149 resistance.

• Pattern-based technical targets drawn using past behavior.

Bullish bounce off an overlap support?USD/JPY is falling towards the pivot, which has been identified as an overlap support and could bounce to the 1st resistance, which acts as a swing high resistance.

Pivot: 147.67

1st Support: 146.99

1st Resistance: 149.04

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

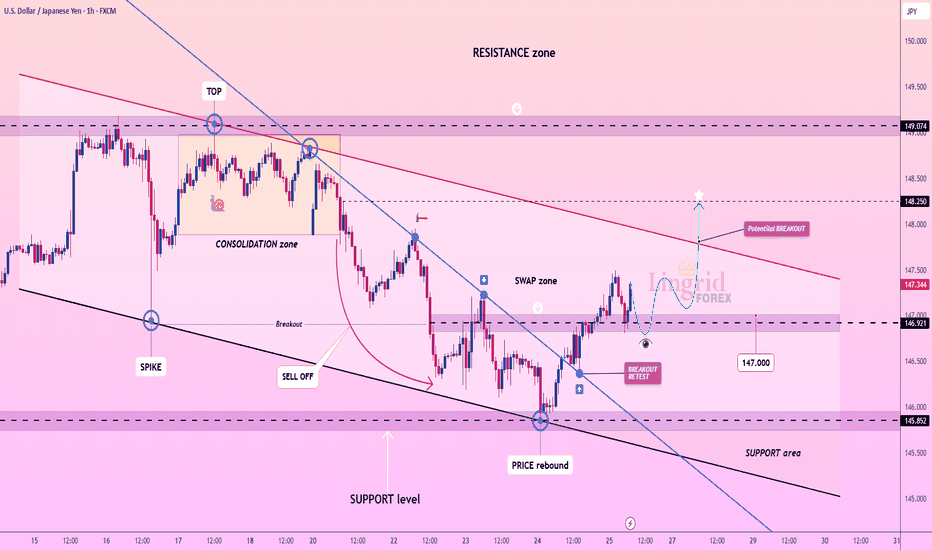

Lingrid | USDJPY Potential Channel Breakout. LongFX:USDJPY is retesting the breakout zone after reclaiming support from a prior swap area near 146.9. Price action has broken above a downward trendline and is forming a bullish retest structure. As long as USDJPY holds above 146.920 zone, the setup favors a continuation toward the resistance barrier. A breakout above the red descending trendline could accelerate upside momentum.

📉 Key Levels

Buy trigger: Break and hold above 147.500

Buy zone: 146.900 – 147.000

Target: 148.250

Invalidation: Break below 146.000

💡 Risks

Failure to break the descending red trendline may trigger renewed selling

Consolidation below resistance could signal buyer exhaustion

Break below 146.000 would invalidate bullish retest setup

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

July 29, Forex Outlook : High-Reward Setups You Shouldn’t Miss!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

USDJPY

AUDJPY

CADJPY

EURGBP

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

#USDJPY: Swing Buy Almost +2000 Pips! Dear Traders,

The USDJPY currency pair appears to be in an accumulation phase at the moment, as evidenced by the lack of significant price movement throughout the current week. Several factors contribute to this trend.

Firstly, several significant economic events are scheduled for this week, particularly tomorrow and Friday. These developments will have substantial implications for the future trajectory of the USDJPY pair. Consequently, there’s a possibility that the price may experience a decline before initiating a bullish trend. We’ve recently seen a strong bullish candle, which suggests a strong bullish move in the coming weeks. Additionally, the strong USD could continue rising, while the JPY is dropping.

Secondly, there are two primary areas where the price could reverse its course. The extent to which the USD reacts to the economic data will indicate potential reversal zones.

It’s crucial to conduct your own analysis before making any financial decisions. This chart should be used solely for educational purposes and does not guarantee any specific outcome.

Regarding the stop loss, as this is a swing trade, it’s advisable to employ a larger stop loss if the price reaches entry zones. The take profit level can be determined based on your entry type and analysis.

We wish you the best of luck in your trading endeavours and emphasise the importance of trading safely.

Please share this analysis with others through likes, comments, and social media platforms. If you have any questions or require further assistance, don’t hesitate to comment below. We’re here to provide support.

Team Setupsfx_

❤️🚀

USDJPY Short Setup: Trend Reversal Confirmation in ProgressAfter waiting patiently for nearly two weeks, price action on USDJPY is finally beginning to align with bearish expectations. The current setup shows signs of exhaustion in the bullish momentum, with a rejection near the 147.80–148.00 zone — a key area of interest.

🔍 Entry thesis:

Price is reacting below previous highs.

EMAs are starting to compress and slope downward.

Potential change of character (CHOCH) forming on lower timeframes.

🎯 Trade parameters:

Entry: 147.72

SL: 147.99

TP: 146.35

Risk/Reward: ~5:1

This move could unfold progressively throughout the week, especially as we approach the end-of-month flows and increased USD volatility. I’ll continue to monitor structure and volume for confirmation.