Bearish reversal off swing high resistance?USD/JPY is rising towards the pivot, which acts as a swing high resistance and could reverse to the pullback support.

Pivot: 149.20

1st Support: 146.36

1st Resistance: 151.18

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USDJPY trade ideas

USD/JPY Outlook: Bullish Target Set at 151.0 USD/JPY Weekly Forecast – July Week 4

Last week, USD/JPY retested a weekly Fair Value Gap and closed with strong bullish pressure, confirming demand. Now, the next key liquidity level sits around 151.00 — just above the previous major highs.

On the daily timeframe, we may see a bearish retest toward 147.00 early in the week. From there, supported by both Federal Reserve sentiment and a bullish dollar, price could launch a strong bullish move to sweep the 151.00 highs.

Bias: Bullish

Key Zones:

• Support / Retest: 147.00

• Target: 151.00

• FVG Reaction: Confirmed on weekly close

The setup aligns with dollar strength and clean bullish structure.

—

Weekly forecast by Sphinx Trading

Drop your view in the comments.

#USDJPY #ForexForecast #SmartMoney #LiquidityTargets #SphinxWeekly #DollarStrength #PriceAction #FVG

Could the price bounce from here?USD/JPY is falling towards the support level, which is an overlap support that aligns with the 38.2% Fibonacci retracement and could bounce from this level to our take-profit.

Entry: 147.06

Why we like it:

There is an overlap support that aligns with the 38.2% Fibonacci retracement.

Stop loss: 145.83

Why we like it:

There is a multi-swing low support.

Take profit: 148.95

Why we like it:

There is high swing resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDJPY 30Min Engaged ( BULLISH & Bearish Break Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Break- 148.750

🩸Bearish Break- 148.370

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

First Monthly Analysis – USDJPYThe USDJPY pair ends the month of July with a strong bullish impulse reaching 150.6, a price area that may signal the exhaustion of the uptrend that has dominated throughout the month.

An ongoing ABC harmonic structure is taking shape, with wave A likely completing between 151.36 and 152.00, which aligns with the 0.618 CD retracement — a confluence that reinforces the zone as a key resistance area.

From there, a potential bearish correction (wave B) may develop, targeting the 145.89 region. If this structure plays out correctly, a final bullish expansion (wave C) could aim for the 157.05 area.

Key Zones for the Week:

Projected exhaustion zone (wave A): 151.36 – 152.00

Expected pullback (wave B): 145.89

Final bullish target (wave C): 157.05

⚠️ Disclaimer

The correction of July’s bullish trend may begin before reaching the expected zone (151.36–152.00) due to liquidity buildup beneath current levels. A premature reversal is possible if institutional players decide to hunt that liquidity before continuing the larger move.

💬 “Sometimes it’s not about if it will get there, but when they let you in. If the party’s heating up above, check if they’re locking the door from below.”

Order Setup (Speculative Idea)

Sell Limit Order

Entry (Open): 151.362

Stop Loss (SL): 152.403

Take Profit (TP): 146.210

Risk–Reward Ratio : 4.79

Use this as a reference setup. Always manage your risk and adapt based on evolving price action

USD/JPY Analysis is Ready USD/JPY is showing a bullish setup. Price broke out of a rising channel and is expected to retest the 148.887 support level before moving higher toward the 150.600 and 151.568 resistance zones, targeting the 152.000 area. The demand zone adds strength to the potential upside.

USDJPY I Technical and Fundamental Analysis Welcome back! Let me know your thoughts in the comments!

** USDJPY Analysis - Listen to video!

We recommend that you keep this on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

Bearish - but first up then downBearish - but first up then down Bearish - We’re currently seeing a deceptive move: price is pushing upward into a supply zone or imbalance, likely to lure late buyers. The bigger picture remains bearish — structure is still respecting lower highs.

Play:

Expect a short-term move up to mitigate imbalances or tap supply (liquidity grab), followed by a strong rejection and continuation down in line with higher timeframe bearish structure.

Watching for a sharp CHoCH or bearish engulfing in key zones to reinforce the sell.

Let me know if you want this in a more coded style just for your trading group.

USD/JPY Technical Analysis – Bearish Outlook from Key Supply ZonThe USD/JPY pair is currently presenting a strong bearish opportunity and price action structure. As of the latest 4H chart analysis, the price has reached a well-defined supply zone around the 148.80–149.70 area. This zone aligns with a previous institutional level where price showed significant reaction, marking it as a valid area of interest for sellers.

Liquidity Grab & Rejection

The market structure remains bearish overall. Recently, price took out a cluster of liquidity above the previous highs. This liquidity sweep suggests that smart money may have accumulated short positions, preparing for a move lower.

High-Probability Sell Zone

The price is currently reacting to a premium zone near the 0% Fibonacci retracement level, drawn from the recent swing high to swing low. This zone also coincides with a previous area of imbalance and supply, reinforcing the bearish setup.

Key Bearish Targets

First Target: 145.89 — this aligns with the 50% Fibonacci retracement level and a previous structural support.

Second Target: 142.56 — this deeper target sits near the 89% Fibonacci level, close to an old demand zone where price may look to rebalance.

Summary

With trend direction biased to the downside, the pair is showing strong signs of rejection from a key supply zone after sweeping liquidity. If momentum continues, we expect USD/JPY to drop toward 145.89 initially, with an extended move possibly reaching 142.56.

Traders should monitor price action closely for further confirmations and maintain proper risk management, especially with upcoming economic catalysts that may affect the JPY.

USDJPY Forming Bullish Reversal | MMC Analysis + Target🧠 Chart Overview (2H Timeframe)

🔸 1. Head and Shoulders Inverse Pattern – MMC Bullish Blueprint

The chart beautifully shows an Inverse Head & Shoulders pattern, one of the most powerful reversal signals under MMC logic:

Left Shoulder: Formed after the initial drop and quick recovery.

Head : Deep liquidity grab and reversal from the lowest point (demand zone).

Right Shoulder: Higher low structure, indicating reduced selling pressure and shift in momentum.

This pattern is forming around a previous liquidity zone, which makes it more valid and aligned with smart money behavior.

🔸 2. Retesting Zone – Critical MMC Demand Area

Price is now retesting a highlighted demand zone, which acted as the springboard for the previous bullish move:

Bullish Pattern marked aligns with MMC’s concept of “Return to Origin”.

This zone also sits just above the right shoulder, confirming that buyers are defending aggressively.

If this level holds, we may see a strong continuation move to the upside.

🔸 3. Previous Reversal Zone (Supply) – Next Target Area

Marked in light green, this area is the next critical resistance:

Acts as liquidity target for institutions if price rallies.

Historically acted as a major reversal point.

Price is likely to show reactions or profit-taking behavior here.

Once broken and retested, it becomes a new support for further upside continuation (as marked on the chart).

🔸 4. Dual Scenarios – Bullish vs Bearish Pathways

Your chart correctly outlines two strategic possibilities:

✅ Bullish Scenario:

Price respects demand zone.

Breaks above previous reversal zone (149.000+).

Bullish continuation toward 149.800–150.500 range.

MMC tip: “If it goes bullish, use previous demand or double it” = Add confluence or stack demand zones for scale-in entries.

❌ Bearish Scenario:

If price breaks below retesting zone, bullish invalidation triggers.

Look to the previous all supply zone (Zone Pattern Must) for next reaction.

This scenario reflects smart money rejection of upside continuation.

🗂️ MMC Structural Elements Identified:

Zone/Pattern Role in Analysis

Inverse H&S Trend reversal signal

Retesting Zone Demand/entry area

Previous Reversal Zone First key resistance / next liquidity pool

Supply Zone Below Target in case of downside breakdown

MMC Logic Follow price structure, fakeouts, demand/supply traps

📈 Summary Outlook:

USDJPY is showing a technical bullish structure backed by MMC-based price psychology. The current pullback into a demand zone gives traders an excellent R:R opportunity for long positions, targeting higher zones upon breakout confirmation.

🟩 If bullish, breakout >149.000 will likely lead toward 150.000+

🟥 If bearish, breakdown <147.600 opens doors to deeper drop toward 146.000 zone (watch for reversal pattern).

🔑 Key Levels to Watch:

Type Level Range Notes

Support 147.600–147.800 Current retesting demand

Resistance 148.800–149.300 Previous Reversal Zone (Profit booking area)

Higher Resistance 150.500+ Final upside objective

Breakdown Zone <147.500 Flip to bearish scenario

USD_JPY RESISTANCE AHEAD|SHORT|

✅USD_JPY is going up now

But a strong resistance level is ahead at 151.232

Thus I am expecting a pullback

And a move down towards the target of 150.368

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY POTENTIAL CONTINUATION AFTER A PULLBACK Price has returned to a higher time frame supply zone after a change in structure and is now showing signs of rejection following a pullback (retracement). The mitigation of the supply zone suggests that institutions may have filled their sell orders and are now ready to push price lower.

📉 Execution Plan:

• Entry: On lower timeframe BOS/CHOCH or strong bearish reaction after mitigation.

• SL: Just above the supply zone (allow breathing room).

• TP: Next demand zone or based on structure (e.g., swing low, imbalance fill).

• RR: Minimum 1:3, ideally 1:5 depending on refinement and volatility.

USDJPY 30Min Engaged (Buy & Sell Reversal Entry's Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal - 148.350

🩸Bearish Reversal - 148.370

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

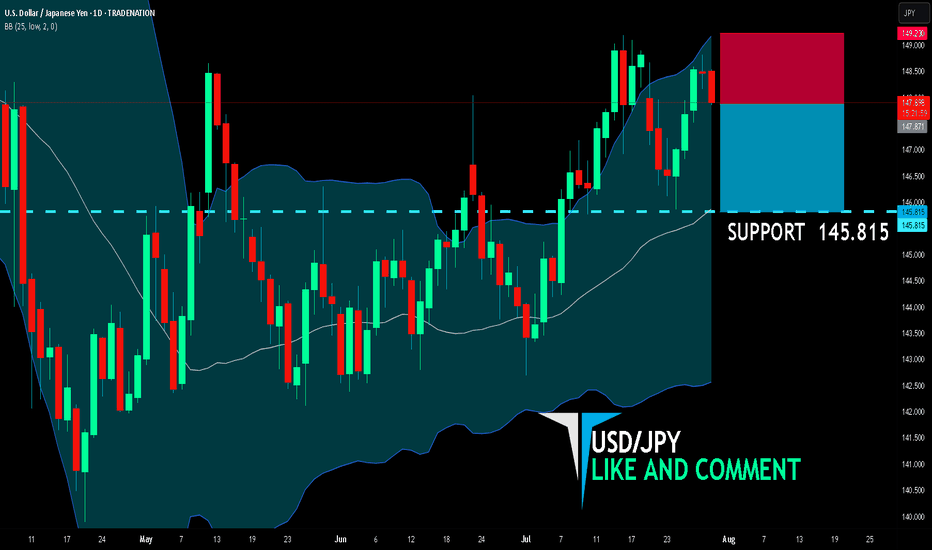

USD/JPY BEARS ARE GAINING STRENGTH|SHORT

USD/JPY SIGNAL

Trade Direction: short

Entry Level: 147.871

Target Level: 145.815

Stop Loss: 149.230

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

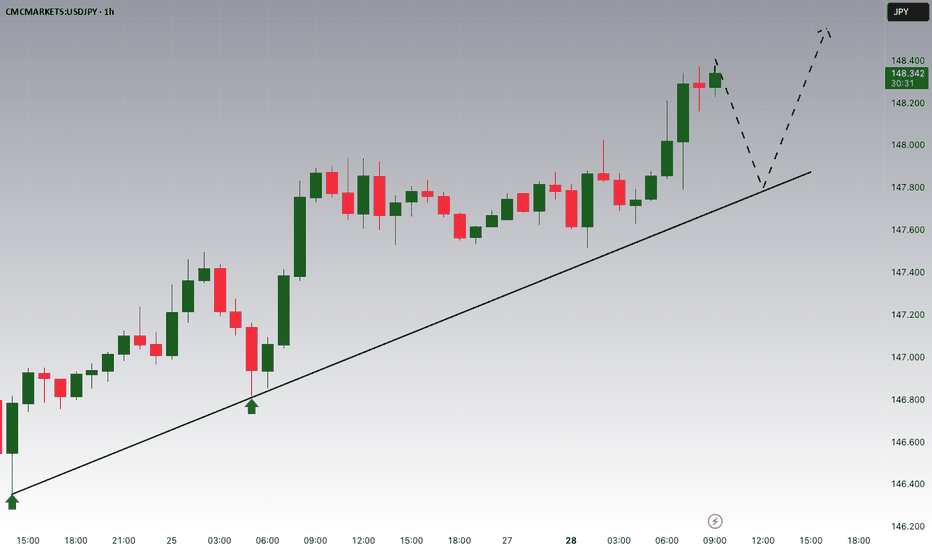

USD/JPY BreakoutUSD/JPY has had a big week already and the pair has shown a decisive breakout through a massive spot of resistance on the chart.

Coming into the week the 148.00 zone had been problematic for bulls in the pair since early-Q2 trade. But with the combined force of FOMC and the Bank of Japan, bulls have finally been able to prod a breakout and leave that zone behind. And the move has continued to press, with a breach of the 150.00 psychological level and price is now approaching the Fibonacci level at 150.77.

Chasing is a challenge at this point but given that prior resistance there's now multiple spots to track for support potential on pullbacks. The 150.00 level is an obvious one, but there's also the 200-day moving average which currently plots around 149.55 and there's the prior high of 149.19. Even the Fibonacci level at 148.13 could be of interest for that in prolonged pullback scenarios, given how it had played as support on Wednesday ahead of the FOMC announcement. The key for that level would be prices holding a higher-low, illustrating a degree of bullish defense at that price. - js

BoJ keep interest rate unchanged, yen weakeningFollowing the July meeting, the BoJ maintained its interest rate at 0.5%, citing prevailing uncertainties from trade tariffs. Concurrently, the BoJ revised its inflation forecast upward to 2.7% YoY from 2.2%. The central bank's language on economic uncertainty has become less pessimistic, downgrading trade policy risks from "extremely high" to "high uncertainties remain," which signals a growing, albeit cautious, confidence in the economic outlook.

In the US, the June PCE surged to 2.6% YoY, surpassing the 2.5% prev. cons. The increase was attributed to tariff impacts, with Goods prices rising 0.4% MoM, the fastest pace since January, while Services prices held steady at 0.2% MoM.

The higher-than-expected US PCE data and the BoJ's decision to hold interest rates have continued to drive further appreciation of the USDJPY.

USD/JPY Technical Analysis

The USD/JPY pair is trading above its EMAs extensions, signaling a continuation of the bullish momentum. The price has successfully breached the ascending resistance trendline. However, the RSI is in overbought territory, suggesting that the current rally may be extended, and a potential pullback could be imminent.

The pair could continue to test the resistance level at 151.367. Should it fail to break this level, a rebound could see the USD/JPY pair test the support at 149.65.

By Van Ha Trinh - Financial Market Strategist at Exness

USDJPY 4H Analysis : Curve Breakout & Retest Completed + Bullish"Momentum Building Above Retested Demand – Will Bulls Take Control?"

📊 Market Structure Overview:

USDJPY has shown a clean bullish structure in recent sessions, supported by a strong demand retest and a steady parabolic curve formation (Black Mind Curve Line). The pair has successfully broken above a major resistance, retested it, and is now holding higher ground—suggesting potential for continued upside if current structure holds.

🧱 Detailed Technical Breakdown:

🔹 1. Demand & Retesting Behavior

The chart highlights a key demand zone (green box) that was previously used after a bullish move.

Price recently returned to this zone for a clean retest, validating its role as a strong support.

This type of retesting behavior is critical in smart money analysis, confirming that accumulation has occurred and sellers have been absorbed.

🔹 2. Major Breakout Confirmation

The previous major structure level has been decisively broken to the upside.

This level now acts as support, increasing the probability that the bullish move will sustain.

🔹 3. Black Mind Curve Line (Parabolic Structure)

A parabolic curved trendline supports the current price action, showing how bulls are gradually gaining momentum.

This curve represents buyer interest increasing over time, which often leads to an aggressive breakout when paired with retest confirmation.

📍 Key Price Zones:

Type Price Level (Approx.) Description

🔹 Retesting Zone ~148.800 – 149.100 Support zone after major breakout

🔺 Resistance Target (1) ~150.500 Bullish breakout target (short-term)

🔻 Downside Risk (2) ~147.000 – 146.500 Bearish invalidation zone if demand fails

🔹 Full Supply Area ~145.000 – 145.500 Historical supply zone if price fails completely

🔮 Trade Scenarios:

✅ Scenario 1 – Bullish Continuation (Primary Bias)

Retest is complete, and price is holding above the curve and demand zone.

If bullish momentum continues:

📈 Target 1: 150.50 – Near-term resistance and liquidity area

📈 Target 2: 151.20+ – Extension target if buyers dominate

Bullish Confirmation:

Price must stay above ~149.00 and continue forming higher highs.

Entry ideas: Wait for minor consolidation above current price or bullish breakout from mini range.

⚠️ Scenario 2 – Bearish Rejection

If price rejects from current level and breaks below the curve and demand zone (~148.80):

📉 First downside target: 147.00 (minor support)

📉 Final bearish target: 145.50 (full supply zone)

Bearish Confirmation:

Breakdown of curve support and close below the retesting zone with momentum.

Such a move would suggest buyers failed, and market may rotate lower.

🧠 Market Sentiment & Psychology:

Smart Money Behavior: Demand was filled cleanly and retested, indicating possible institutional interest at that level.

Momentum Curve: As shown by the black curve, momentum is rising gradually—this reflects confidence building among buyers.

However, price is near psychological resistance (150.00–150.50 zone), where heavy sell orders might be placed.

The market is in a decision zone, where confirmation of strength or failure will dictate the next 200–300 pip move.

🎯 Summary:

USDJPY is showing a bullish structure supported by:

A valid retest of demand

A clean breakout of major resistance

An ascending parabolic curve

If bulls defend the current zone, we may see a powerful continuation toward 150.50+. If price fails to hold above the retest zone, downside risks open toward 147.00 and potentially the full supply at 145.00.

📌 Trade Smart: Wait for price confirmation, manage risk with stop placement below the demand zone or structure lows, and avoid chasing the move.

USDJPY POTENTIAL CONTINUATION AFTER A PULLBACKPrice has returned to the recent demand zone after a BOS and is now showing signs of rejection following a pullback (retracement). The mitigation of the DEMAND zone suggests that institutions may have filled their buy orders and are now ready to push price higher.

📉 Execution Plan:

• Entry: On the demand zone

• SL: Just below the demand zone (allow breathing room).

• TP: Next supply zone or based on structure (e.g., swing high, imbalance fill).

USD-JPY Will Keep Growing! Buy!

Hello,Traders!

USD-JPY keep growing and

The pair made a bullish breakout

Of the key horizontal level

Of 149.181 and the pair is

Already retesting the new

Support and we will be

Expecting a further

Bullish move up

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY Setup: Prime Buy Zone with a Clear Target!Good morning my friends,

I've prepared a fresh USDJPY analysis just for you.

Currently, the most logical buy zone sits at 147.170. If price reaches this level and performs a retest, it’s likely to target the 149.185 level.

I'll personally be entering at 147.170 and waiting for my target: 149.000.

This setup is based on the 4-hour timeframe, so it may take some time to reach the target.

Every single like you give is a major source of motivation for me to keep sharing these analyses.

Thanks so much to everyone supporting with a like!