Usd/Mxn Buy IdeaThe Trend is up...

We have a pullback... We have a double bottom on the day chart...

If you buy Usd/Mxn you are buying in a uptrend...

But there is one thing!! This is a exotic pair and you need to use extreme risk management because it can shoot up and down in gigantic waves...

So please trade this one at your own risk..

Good Luck

USDMXN trade ideas

USDMXN :BUY DAY HIGH MADE FIRST-TAYLOR TRADING11 Months: First close below sma with Pin ball Buys

3days: Made 1-2 Pin ball Buys

Intraday divergence and expecting test of previous Low and continuation during US session

Look for Entry Pattern on Small Time frame:

15minutes already showing Divergence, Further 5 Minutes should Follow suit with range and then divergence, currently on strong bearish.

PATIENCE.................

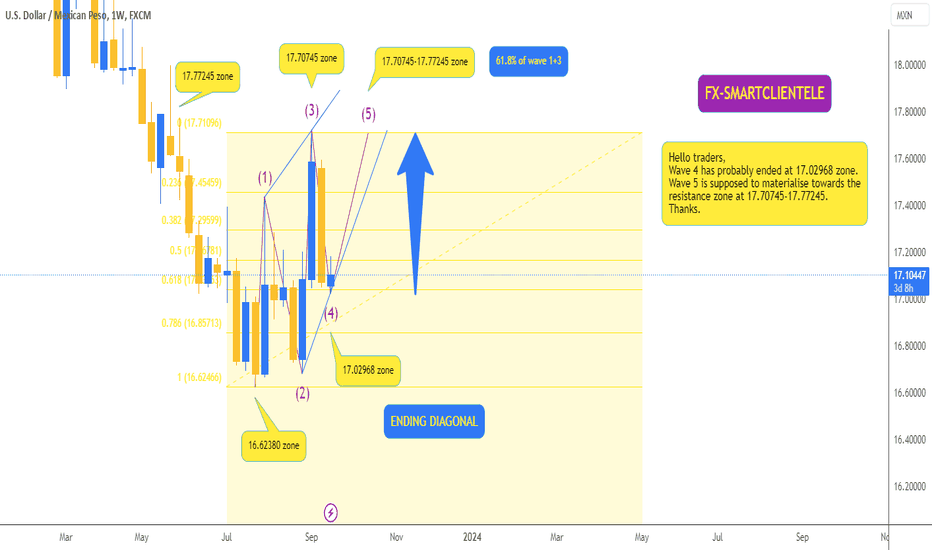

MXNUSD ready to dumpHi traders

We can see an on-boing classic distribution on MXNUSD daily chart.

RSI is in a downtrend which shows that there's less and less strength in the market.

When it comes to the price action, lower highs and lower lows suggests that we are about to get a mark-down and it may happen pretty soon.

3 targets (take profit levels) for shorts are shown on the chart.

Good luck

USDMXN: Channel Up calling for pullback buy.USDMXN has converted the 1D MA200 to support and is rising steadily inside a Channel Up. The 1D technical outlook is neutral (RSI = 54.479, MACD = 0.196, ADX = 35.456) so once the current pullback towards the 1D MA50 and the bottom of the Channel Up, is completed, we will buy again and target a new +5.93% rise (TP = 18.8000). A 1D candle close under the 1D MA50, will be bearish, aiming at the S1 level (TP = 17.000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

The 18.5000 level is more important than you think!The USDMXN 18.5000 level has capped the rally in recent weeks. And you can see the strong descending trend line capping the market. Even the rally this week has tried to keep a "lower high" but we think this is just a byproduct of the descending trend line. A break of the 18.5000 level would target 18.8700, but 20.2100 would be more likely. While above the 200dma we expect a break of resistance.

You should keep a close eye on the RSI (lower panel) on a breakout. If price moves higher, the RSI could be a good gauge to see if the trend will continue with a confirming move higher, or potential divergence which could signal we hit a near term top between 18.8700 to 20.2100.

Looks like it wants to close under the trend line. Looks like we want to break the trend line. 1 hr candle looks like it wants to close on the other side. Could be a good scalp down. If it plays out and you missed it, there is always a retest where the candles closed below. You should have a 2nd opportunity there too.

Good luck out there. Hopefully in the next half hour, we should know if were staying up or down. Protect your bag, set your sl.

Oct 22th, 2023 - USDMXN to 17.77?Last week USDMXN traded between 17.85 and 18.46. Given Banxico's decision to maintain its benchmark policy rate at a record high of 11.25% at its September 2023 meeting, as widely expected, and FED's expectation to hike rates if the economy remains hot... Short term, (weekly) my bias is for dollar weakness. I am looking for dollar strength around the 105.917 DXY handle....

This move could possibly lead to MXN nearing the 17.77 handle for this week.

This is not financial advice by any means, I am not a licenced financial advisor and these are just my points of view of the market.

FX:USDMXN

USD/MXN - Buy Idea 💡🎯The price of the dollar has fallen significantly until the beginning of August, showing a decline with considerable bullish strength.

- We hope that the price of the dollar reaches at least 19.5000.

- We have to wait at least for the price to fall since it has taken a target this week, we expect the price to fall back to the 17,000 -17,300 area

Mexican inflation is dropping but not fast enoughToday we saw the Mexican inflation come out lower than expected but it is not where the Mexican central bank wants it to be yet. For that reason, the work to slow inflation down is not done yet and they will have to at least keep the rates high... On the technical side, we see price failing to create a new higher high and we just broke below the structure for a potential short term bearish movement.

USDMXN Prime short position as it approaches a 2-year ResistanceThe USDMXN pair has been on a strong rise since July 28th, which was a Lower Low at the bottom of a 2-year Bearish Megaphone pattern. The rally has extended to a point where the price is about to test that 2-year top (Lower Highs) Resistance. The previous Lower High was priced exactly on the 0.786 Fibonacci retracement level and the new one is only a fraction away at 18.6900. We consider that current level already good enough to short, as the 1D RSI has also been on the overbought barrier (70.00) since October 03.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Short in USDMXNToday, I opened a short position on the USDMXN due to the strong bearish trend in recent months. This trend has been driven by the attractiveness of Mexican bonds with their high interest rates. However, today's release of the CB Consumer Confidence (Aug) data in the United States was significantly lower than expected. The actual value was 106.1, while the forecast was 116 and the previous value was 110. This reinforces my belief that the bearish trend will continue, at least until reaching 16.65.

It is worth mentioning that my perspective may change if tomorrow's Core PCE data in the United States is higher than 3.9%. In that case, I will close the position as it would strengthen the dollar.

Remember that the financial market is volatile and subject to constant changes. It is always advisable to assess the data and adjust strategies accordingly.