USDMYR trade ideas

Bilakah Waktu Terbaik Untuk Masuk Trade? 1USD=RM4.15Bilakah waktu yang sesuai untuk masuk trading?

Jawapan inilah yang membuntukan para pedagang Malaysia tentang bilakah waktu yang sesuai untuk saya memasuki trading.

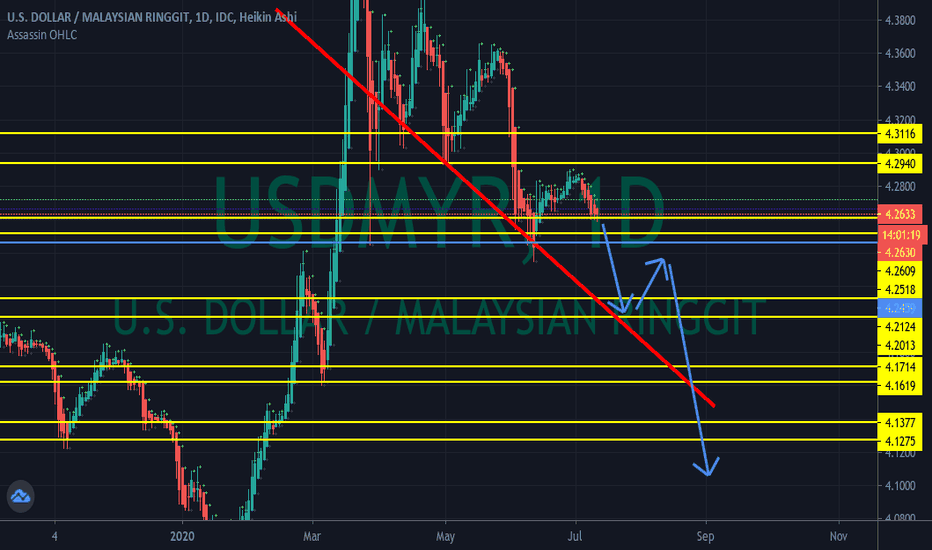

Pada hari ini 8th June 2020, Ringgit telah didagangkan pada USD1=RM4.26. Pada fasa ini, dollar telah lemah dan ringgit telah mengukuh.

Lantas membuatkan ringgit dari kedudukan RM4.40 mengukuh kepada RM4.26. Hal ini dapat saya bangkitkan pada waktu dasar webinar

saya yang menerangkan ringgit akan jatuh ke RM4.15.

Pada waktu inlah, ramai trader akan memasuki trade dagangan kerana nilainya amat murah untuk mendepositkan wang.

Menjangkakan berkemungkinan ringgit akan mengukuh kerana Malaysia akan membuka bisnes dagangan mereka pada minggu ini.

Walaupun PKPB telah tamat, digantikan dengan PKPP; 1/3 dari ekonomi akan terus terangsang menerusi skala kelonggaran bisnes antara bisnes.

Dengan pengukuhan ini, ekonomi akan terus mengukuh sehingga ke RM4.15.

Yang Benar,

Zezu Zaza

2048

MYRUSD Strengthen| The downturn of Dollar is begin| 3rd May 2020"When the steam is not there for the Dollar,

we buy our own currency Ringgit..especially KLSE"

-Zezu Zaza, Webinar 1st May 2020

The selling in Dollar last week is a one of example of mechanism of retracement.

As we can see, Ringgit is strengthen this week. This week is a bullish potential sign

has started.

Half of our sector industries will be open today 04th May 2020. The opening of the

sector will rise the Ringgit in the short term. It is a slow volatility but safe.

The subsidy or Bantuan Prihatin Nasional will be credited to your bank account by today

for the second phase. Please let me know if you want me as your financial advisor for

your Ringgit trading or Bursa Saham trading.

I am buying Ringgit for next whole week. Starting today Monday will open a buy position.

What is the target? I will tell the exact price on where the Ringgit will headed on my

web page subscription for the signal.

Regards,

Zezu Zaza

2048

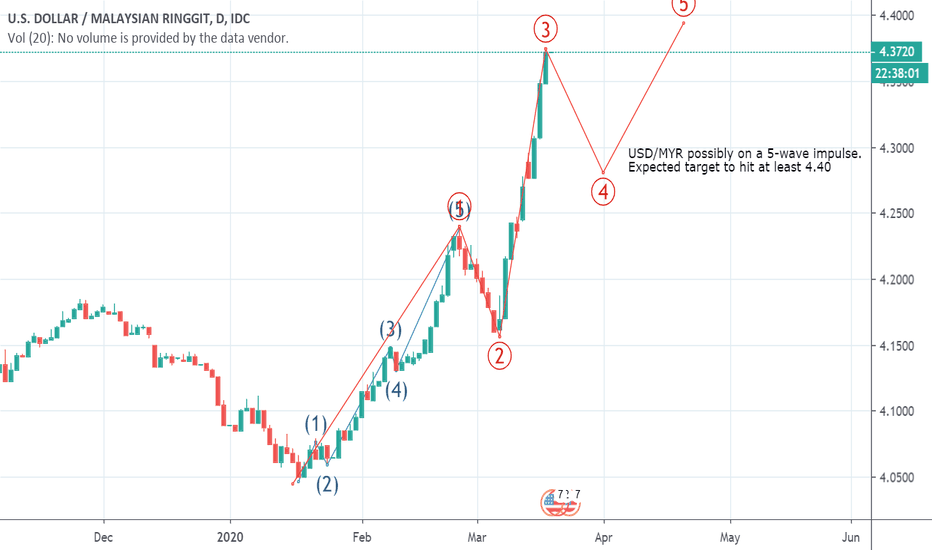

USDMYR on Wave 5 Final Leg ?

USDMYR has been respecting the daily trendline from the start of March.

USDMYR has been respecting the 50% and 61.8% fib retracement levels (from 2020 low to 2020 high)

Possible upward breakout of the triangle to complete Wave 5 final leg. Target just above Wave 3 high (4.4480)

Portier |USDMYR Macro Outlook, Analysis & Market CommentaryTraders & Investors!

We are now looking at potential opportunities across MYR crosses following the unexpected BNM easing yesterday when key rates were cut 0.25% in response to slowing domestic growth, trade uncertainty and continued geopolitical risks

Our view

- Markets to re price 0.25% rate cut, finding buyside liquidity on RM4.05xx floor

- Downside risks will remain in our view with domestic growth slowing, uncertainty from various trade negotiations, geopolitical risks, weaker-than-expected growth of major trade partners, heightened volatility in financial markets, domestic factors which include weakness in commodity-related sectors and delays in the implementation of projects to fuel a selloff in MYR.

- We see technical value in averaging into this trade from here down to the RM4.00xx buyside floor before any meaningful impulsive unwind in the MYR.

We have added buyside exposure across both our macro and directional portfolios in response to the recent BNM rate cut however remain aware of value lower closer to the RM4.00 buyside floor.

-------------------------

We look forward to continuing to provide market leading analysis to traders & investors alike across the TradingView platform.

Like, subscribe and leave your comments below!

Until next time,

Portier Capital

Macro Strategy & Portfolio Management

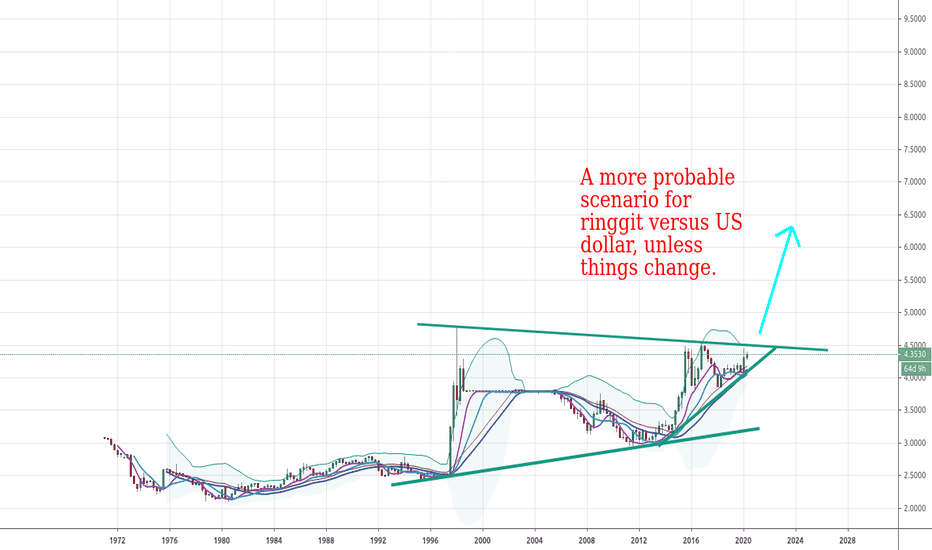

USD bearish against MYRIn a monthly time frame, it is clear that the pattern forming descending triangle and forming double top inside the major pattern. Although the major trend

still uptrend, but the price move near the support line with the RSI 40%.

After breakout double top pattern, the price might be pullback to the breakout point and wait for bearish price action to short, thus, set the 1st TP @ 3.8556, 2nd TP @ 3.7364, 3rd TP @ 3.5567.

In terms of fundamental, USD bearish due to few crisis such as US-IRAN war and US-China Trade War.

DISCLAIMER: THIS IS OPINION BASED ON MY PERSPECTIVE. FOLLOW AT YOUR OWN RISK.