USDNZD trade ideas

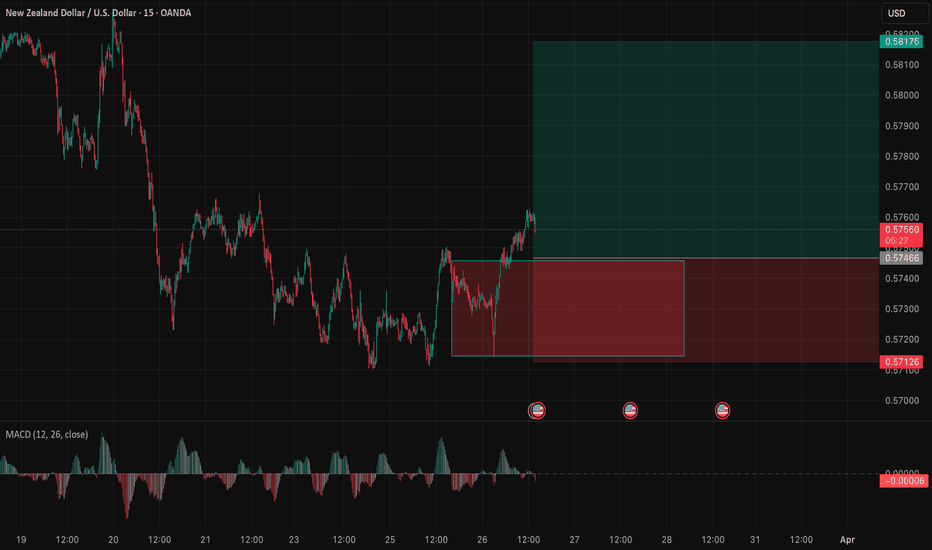

NZDUSD Short BiasThe New Zealand Dollar is consolidating, lacking clear directional momentum. However, the short-term outlook appears bearish following a confirmed closure below a key structure zone. A break below the 0.5710 level could serve as confirmation for further downside continuation, signaling potential bearish momentum ahead.

NZD/USD NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

NZDUSD - H4, H1 Forecast - Technical Analysis & Trading IdeasTechnical analysis is on the chart!

No description needed!

OANDA:NZDUSD

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

NZDUSD Continues to Develop A Large Channel PatternNZDUSD Continues to Develop A Large Channel Pattern

NZDUSD began a bullish movement at the beginning of February and the price is in a bullish movement taking the shape of a large channel pattern.

Price is already near to a strong support zone and it can resume the bullish movement between 0.5720 - 0.5660 zone

Given that the price is also holding strong the chances are growing that it may rise again as shown on the chart

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDUSD to find buyers at market price?NZDUSD - 24h expiry

Price action has stalled at good support levels and currently trades just above here (0.5725).

We expect a reversal in this move.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.5775 will confirm the bullish momentum.

The measured move target is 0.5800.

We look to Buy at 0.5725 (stop at 0.5690)

Our profit targets will be 0.5795 and 0.5800

Resistance: 0.5775 / 0.5795 / 0.5800

Support: 0.5725 / 0.5700 / 0.5690

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Falling towards 50% Fibonacci support?NZD/USD is falling towards the support level which is a pullback support that lines up with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.5728

Why we like it:

There is a pullback support level that lines up with the 50% Fibonacci retracement.

Stop loss: 0.5708

Why we like it:

There is a pullback support level.

Take profit: 0.5762

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

NZD/USD Bullish Reversal – Key Levels & Trade PlanThe 4H chart shows NZD/USD forming a bullish structure with an ascending trendline support.

A breakout from the descending wedge pattern signals potential upside momentum.

The price is currently testing a key support zone near 0.5740, aligning with the 23.6% Fibonacci retracement level.

Trade Setup & Levels:

Entry Zone: Above 0.5740 (support holding)

Target 1 (TP1): 0.5817 – previous resistance

Target 2 (TP2): 0.6050 – Fibonacci 61.8% level

Stop Loss (SL): Below 0.5620 (previous support structure)

Bullish Confirmation Factors:

✅ Trendline support remains intact, preventing further downside.

✅ Breakout from wedge pattern, indicating buying pressure.

✅ Higher lows formation, showing gradual accumulation of demand.

Conclusion:

A confirmed breakout above 0.5817 will validate the bullish move toward 0.6050. If price sustains above the resistance, we expect further upside momentum in the coming sessions. 📈

NZDUSD 4hNZD/USD 4H Analysis – Bullish Channel Holding Support

Market Structure & Trend Analysis:

The price is moving within a well-defined ascending channel, with multiple touches on both support and resistance.

Recent bounce from the lower trendline suggests the bullish structure is still valid.

The blue arrow indicates a potential upside move toward the channel’s upper boundary.

Key Levels to Watch:

Support: 0.5700 (lower trendline and historical reaction zone).

Resistance: 0.5850 - 0.5900 (upper trendline & previous rejection area).

RSI & Volume Analysis:

RSI is at 43.21, showing a weak momentum but near oversold levels, suggesting possible bullish reversal.

Volume is moderate, meaning we may need a stronger confirmation before a breakout.

Trade Considerations:

📈 Bullish Scenario: If price holds above 0.5700, we could see a push towards 0.5850 - 0.5900.

📉 Bearish Scenario: A breakdown below the channel could trigger a decline toward 0.5600.

⚠️ Confirmation Needed: Look for bullish candlestick patterns before entering long trades.

POTENTIAL SHORT TRADE SET UP FOR NZDUSDAnalysis: Utilizing chart patterns, highs & lows, and impulses & corrections, the focus is on identifying a continuation corrective structure following a breakout.

Entry: The price has reached the upper boundary of a higher time frame (HTF) expanding structure, approaching this zone with an ascending channel on the mid time frame (MTF). On the lower time frame (LTF), a bearish impulse has developed, and we will be watching for a continuation pattern to pinpoint a potential entry point for the trade.

Expectation: A downward move is anticipated, targeting the lower boundary of the HTF expanding structure.

⚠️ Reminder: Always conduct your own analysis and apply proper risk management, as forex trading involves no guarantees. This is a high-risk activity, and past performance is not indicative of future results. Trade responsibly!

NZD_USD SUPPORT AHEAD|LONG|

✅NZD_USD is set to retest a

Strong support level below at 0.5690

After trading in a local downtrend from some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above at 0.5750

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDUSD INTRADAY Bullish Breakout support retest at 0.5720The NZDUSD currency pair is displaying bullish sentiment, underpinned by the prevailing uptrend. The recent intraday price action indicates a corrective pullback toward a previous resistance zone, which has now formed new support. This pattern suggests that the pair is consolidating before potentially resuming its upward momentum.

Key Trading Levels:

Support Level: The critical support level to watch is 0.5720, marking the previous consolidation price range.

Upside Targets: A corrective pullback from current levels, followed by a bullish bounce from the 0.5720 level, could lead to a rally targeting the resistance levels at 0.5800, followed by 0.5830 and 0.5870 over a longer timeframe.

Alternative Bearish Scenario:

A decisive break below the 0.5720 support level, accompanied by a daily close below this point, would invalidate the bullish outlook. This scenario could trigger further retracement, targeting the lower support levels at 0.5690, 0.5650, and 0.5585.

Conclusion:

The current sentiment remains bullish, with the 0.5720 level serving as a critical pivot point. A successful bounce from this support could reinforce the uptrend and prompt bullish continuation. Conversely, a breakdown and close below this level would signal a potential shift to a bearish outlook, warranting caution.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.