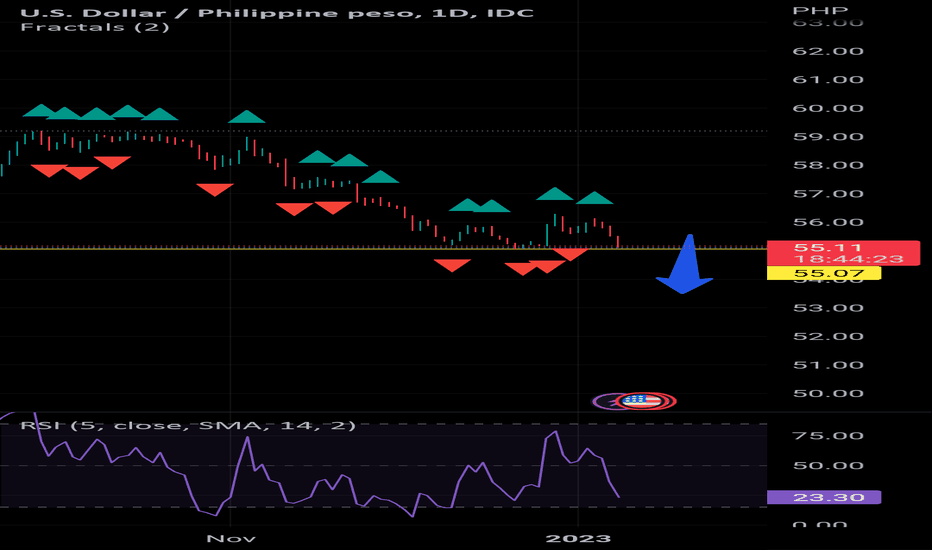

UP 200 MA RESISTALL INFO PRICED IN.

After previous trend break, price tried to rally but was halted by the 200 ma, and high were getting lower and low getting lower, only issue is, we're in phase 2, the shorter up phase before the longer down phase.

Wait for the setup, when daily closes as red, 4h closes as red, that's the time to find an entry.

USDPHP trade ideas

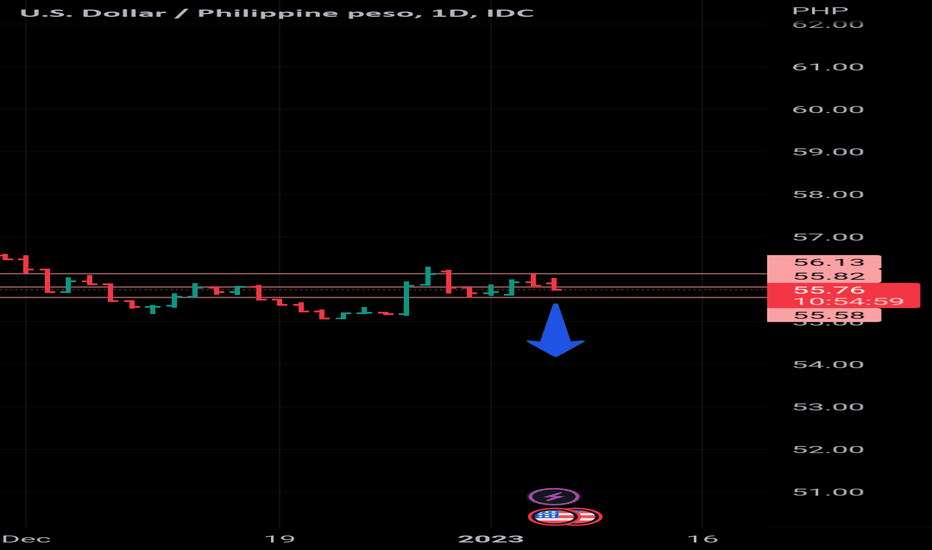

UP bounced for a short CEILING HELD for Usd Php making price breached a weaker floor. Only the last floor is left marked by a downward fractal as the last hurdle.

Text book short bouncing off the roof.

As Filipinos go back to work and students back to school; the machinery of business continue to function as normal.

Good signs for Philippines.

USD PHPAll is expressed in price action.

Price went on a strong bear run but went on a pull back. But not yet breaking the ceiling Price. It could be momentum to try and break the floor Price further mode. As the cycle goes, longer first phase, short pull back, longer phase again, short pull back.

But here we're only seeing one cycle. If things continue to go bearish, then we can establish a proper big trend.

W1 possible start of down trendW1 shows one cycle. But without another, we can't say for certain there's a down trend.

D1 shows a break of a previous high, but lacks enough information to establish if there is indeed a trend.

Let's wait a few more days and see what price action says and the news.

So far, Philippines has been a prime destination for tourism. Expats exchanging dollar to peso for their families. Filipinos spending for the holidays driving the economic machinery.

Is the Philippine Peso Inherently Weak?The Philippine peso is not the only currency that is losing its value in recent weeks. Every major currency in the world, including the Japanese yen, and the British pound, and the Euro had taken a beating. Unspeakably, the Euro and is now at parity with the USD.

The peso yesterday fell to another all-time low of 59 against the greenback.

The dollar just the other day touched a 37-year high against the pound sterling of the UK.

HENCE: Peso- Weak because the dollar is strong? Or inherently weak?

Graduate school economics teaches that a currency loses its value against the US dollar for any of the following reasons:

1 Domestic political turmoil that results in a capital flight and loss of investor confidence.

2. Economy is close to collapsing because of dubious policies. Think Argentina or Zimbabwe's rapid inflation where values eroded by the day.

3. The US Federal Reserve Board, or the US central bank, continues raising interest rates and executes quantitative tightening to stop inflation in the US

Arguably, #2 and #3 apply for the Philippines' financial woes. Wealth fund managers gravitate toward the US dollar because of higher returns than those offered by other currencies. Global and local Businesses had either closed down or pulled out of the nation dude to a persistent lack of infrastructure or hostile business registration policies that make operations difficult. Notice how Citibank, Ministop and luxury car brands have shuttered? The recent government drive to implement Return to Office was intended to jump start real estate lease and acquisition. However this placed a toll on workers and industries incapable of supporting the influx of a commuting public.

RATES RATES RATES

The interest rates in the US may increase to above 5 % next year and persist till inflation ends. Locally, the Bangko Sentral ng Pilipinas has raised the local interest rate to 3.75 percent in its own fight against rising inflation.

The US dollar, via mechanisms such as US Treasury Bills, will draw foreign money because of better yields. The peso and Asian currencies will remain weak unless their interest rates are priced higher than those offered by dollar-based financial instruments.

SOLUTIONS?

The local Central Bank does not predetermine a price of Peso maintained. Rates moves dynamically with respect to economic developments. To maintain growth, the Philippines has raised imports since its productive capacity is still lagging due to COVID-19’s shocks. This weakened the Peso

Crushing pressure on the peso came from increased speculation on commodity prices; these prevailing conditions have further depreciated the peso.

There is upside. A weak peso implies that demand for PH exports may increase. OFWs, paid in dollars, will find that their salaries are now worth more in Philippine pesos. GNP will increase.

Domestic constraints limit the gains. The Philippines is not a producer and is remains an importer. The increase in foreign remittances received by OFWs’ families are offset by rising prices of imported basic goods such as rice (?!) and oil.

The clobbered peso implies foreign debt more difficult to repay. As of last year, the Philippines’ foreign obligations stood at $106.43 billion, 55.4% of which is denominated in the US dollar. Our gross national reserves had been depleted.

Given the mixed consequences of the peso’s weakening, the BSP’s response is vital in effectively mitigating the negative effects. Furthermore, revitalizating industries with tax perks and enhanced infrastructure may stem the bleed.

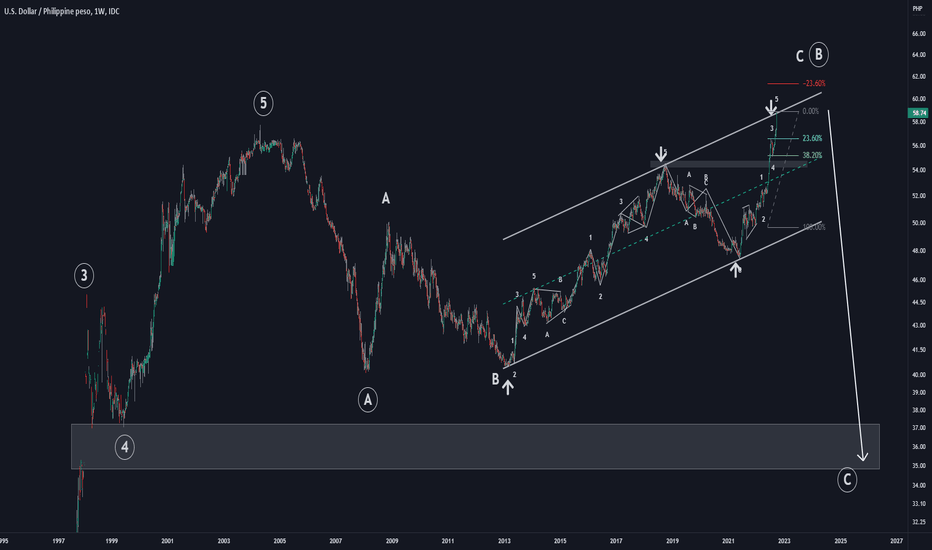

#USD is the next #bubble | $USDPHP | Elliott Wave in weekly TF$USDPHP | Elliott Wave Principle in Weekly Timeframe | Forecast

This week marks the hit of our parallel channel Zigzag correction for WaveB SUPERCYCLE. This tell's us that USDPHP is currently at parallel resistance. once the rejection starts, we can see that USDPHP will go around 55-54php per US dollar as alternation of correction suggested a Zigzag correction within its degree as sub-rule of Elliott Wave Theory.

After the correction to 55-54php, It's projected to continue it's uptrend up to 61php per dollar. It will also show exhaustion of the market and complete its WaveB Expanding flat correction on a SUPERCYCLE degree. If my SUPERCYCLE count is correct, we can expect a great deflation of the US dollar in the next 6-10 years. and exchange rate around 36-34php per dollar also as to FILL the GAP on 1998.

Please see my SUPERCYCLE count in the comment 👇

#elliottician #fillthegap #USD is the next #bubble

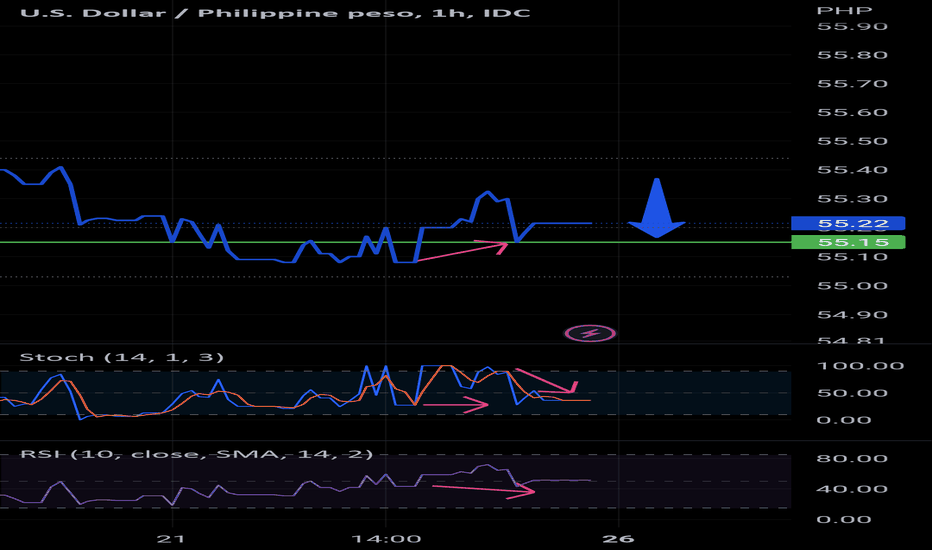

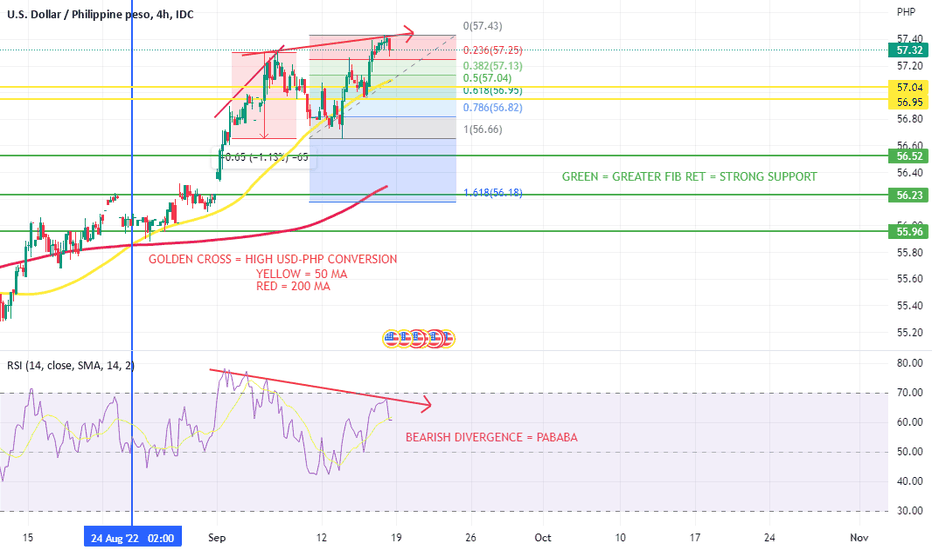

USD PHP MASSIVE BEARISH DIVERGENCEA bearish divergence is a pattern that occurs when the price reaches higher highs, while the technical indicator makes lower highs. Although there is a bullish attitude on the market, the discrepancy means that the momentum is slowing. Therefore it is likely that there will be a rapid decline in price (google copy paste).

USD-PHP 4H CHARTUSD - PHP CHART

DECREASING RSI + INCREASING PRICE = BEARISH DIVERGENCE

A bearish divergence is a pattern that occurs when the price reaches higher highs, while the technical indicator makes lower highs. Although there is a bullish attitude on the market, the discrepancy means that the momentum is slowing. Therefore it is likely that there will be a rapid decline in price. (GOOGLE COPY PASTE)

USDPHP - 29Apr2022USDPHP - 29Apr2022

On the H4, USDPHP is facing bearish pressure from the H4 & H1 trendlines. H1 h&s still intact and we could expect further downside to target at around 51.92. If price bounce above both trendlines, h&s will be invalidated.

Disclaimer: This is for personal work record purposes only, not trade / financial advise or solicitation of trade.

USDPHP - 26Apr2022USDPHP - 26Apr2022

On the H4, USDPHP is pulling back after all the price action and indicators are siding towards short-term top. The price is current at H1 200MA + trendline support. We could expect a short-term bounce based on H1 price action. Noting Daily Stochastic is still at resistance and we could expect deeper pullback.

Disclaimer: This is for personal work record purposes only, not trade / financial advise or solicitation of trade.