RANDOM THOUGHTS ON TETHER - WE REALLY NEED IT OR EXCHANGES DO?Hi everyone, I am exploiting this weekend of quarantene for listening to music and reasoning about markets. When they are closed it is perfect as I can focus on details and reason with cool mind.

"Make sure before you get in, you know the insurance won't cover this" as Marylin Manson says in one of his songs, is exactly what came to my mind when I think of tether, alts and exchanges that allow you excessive leverage.

We have 4billions of tether around, 600 millions printed in 2020 only. Currently #4 crypto by market cap. Fourth! Without entering the discussion on whether they are backed or not by real collateral in usd, where all this money goes? What is the point of having a crypto like this?

It is pegged to 1usd and controlled by a centralized entity, both of these features are the opposite of bitcoin vision and goal it was created for.

I understand that it allows to park liquidity in bad times (me personally I never used tether in my pluriennal crypto experience), but if you do not wanna risk to lose when bitco goes down, why not simply sell and keep the amount in usd or eur? There are plenty of exchanges that does it out there. They are centralized? So is tether, with the difference that exchanges like Kraken have much better security and they also have to comply with legislators.

USDT is part of a mechanism that exacerbates market fluctuations and allows intraday trading on nothing (because some alts are NOTHING for real), as well as excessive leverages do (remember that with a 10x leverage you just have a 10% market move against you allowed before getting rekt, just 5% with 20x and only 1% with 100x). You have money ready to use, to bet on another 50x bet. Some exchanges (you know which ones) want you to trade and provide you with things that have nothing to do with crypto. In the top 15 we find another stable coin (UNUS SED LEO) and a utility token of Binance BNB that is used for trading. We do not even talk about BCH which is a joke, XRP who is simply not a decentralized thing and EOS that got 8 billion in IPO but delivered NOTHING and is now worth less than 2 as I write.

My impression is that the alt market, beside the top 5, is completely kept alive by this thing called USDT, that in the end works against us: imagine if we all buy Bitco instead of dissipating our efforts and our money on 2000 cryptos.

What do you think? Let me know in the comment section below after a welcomed LIKE and FOLLOW to be updated on my ideas. Do not worry about spam as I am not an intraday trader!

USDT trade ideas

Bitfinex Completes Chainswap with EOSFinexBitfinex, a cryptocurrency exchange, in conjunction with EOSFinex, reported a complete chain swap. They successfully convert $5 million worth of Tether (USDT) stablecoins onto the EOS blockchain protocol.

Based on a press release on October 5, the firms want to give the EOS DApp ecosystem with a stable and liquid store of value. And they aim to diminish the risks of digital assets’ volatility.

CTO Paolo Ardoino stated, “Promising projects aren’t getting the light of the day with current congestion and volatility issues on other chains. And that is why there’s higher DApp usage on EOS.”

He also added that EOS lacked a stablecoin, which might support these projects to manage exposure to price volatility.

On the announcement, currently, peer-to-peer micropayment infrastructure of EOSIO powers 49% of the top 100 decentralized applications (DApps). And it is also of the top seven of the top 10 DApps with the highest 24-hour transaction activity.

EOS Blockchain Protocol

Meanwhile, in a report on October 4, users of EOS blockchain protocol have been experiencing recurring issues with network access. And this has been occurring for the past few weeks until now.

In addition to that, a pseudonymous smart contract developer and security engineer Dexaran wrote an article recently. And they described the probable root of the problem. It is an inexpensive technique that lets hackers congest the network. Also, it could set into a low-efficiency mode, with a few dollars worth of EOS.

Apparently, the said exploit gave the hacker a chance to steal over $110,000 in cryptocurrency. And it was from an EOS gambling application EOSPlay earlier in September. But EOS’s parent firm Block. one executive became unfazed. They even argued that the network is running properly.

Moreover, stablecoin firm Tether and its affiliate exchange Bitfinex recently said they foresee a lawsuit – alleging USDT token being involved in market manipulation – as the result of yet unpublished researched.

USDT - "May I stand unshaken Amid, amidst a crash of worlds."Say the chorus of the melody "Unshaken" of the singer D'Angelo, the crash of worlds that we can see between the concept of Fiat currency, Cryptocurrencies, and the Blockchain technology in our modern society. Where our today main character, found the middle ground and its name is Tether.

Tether (USDT) is a controversial cryptocurrency, created to be a stable coin, that is, it's designed to be worth $1.00 always, maintaining $1.00 in reserves for each Tether issued. However, the audit over these reserves has always been a controversial matter, simmered by the New York State Attorney General (NYSAG), that discovered while building the case against Tether and Bitfinex Exchange (affiliated company) a hole of $850 million in Tether funds allocated in unpaid loans and seized by foregein authorities.

Despite all this controversy, legal tangles with enforcement laws agencies. Tether has been gaining prominence, after becoming the fourth biggest cryptocurrency by market cap and the biggest one in daily volume, passing even the Bitcoin in this category.

One curious fact is that we tend to think that Bitcoin is the ultimate solution, for that dystopic situation were governments impose capital restrictions. However, that wasn't what happened. Recently was reported that Chinese importers in Russia are buying up to $30 million a day of Tether from Moscow over-the-counter trading desks. The use of the stable coin has the purpose of sending vast sums back to their home country, which has strict capital controls, a more significant concerning than know if the token is backed or no.

Another matter regarding the Tether tokens it’s the dependency relationship created by the Bitcoin that has its daily inflow majority coming from Tether tokens. Studies have been correlating the Bitcoin upward movements with the Tether issuance. According to TokenAnlyst Bitcoin increased in price in 70% of the days that Tethers tokens were minted, in details, the upward movement happened in 70% of the days were the issuance happened in Ethereum Blockchain and 50% of the days when created on Omni. The discrepancy's likely to be related to the first form of issuance (Ethereum Blockchain) be easier and faster than the Bitcoin Blockchain (Omni). This type of information can help us to understand better or have a broader view when speculating about the Bitcoin movements.

So as Bitcoin and Fiat currencies brawl for the nobility of being the trustable and used currency by the people. The Tether that ironically has all unreliable and suspicious characteristics, that currency and institution could hold still thriving amidst a crash of worlds.

Thank you for reading and leave your comments if you like.

Join the Traders Heaven today, for more exclusive contents!

Link bellow!

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should use it as financial advice

How to anticipate a BTC move....It’s as easy as setting alarms just above and below tether market cap. If Tether MC goes up I will leverage my short position going long on December futures, if it goes down and you are already in a short.... sit back and enjoy. Another one of my mental masturbation series.

FYI:still holding a short position at $12,120

BTC: 1PzgZ79Lc6PHdXz4RZcbPuvwXLmT8RzowW

R.I.P. TAI know I'm not the first person to point out this relationship but I think it warrants another mention following the price action that we've been seeing. Following our breakdown from 8500 USD, we entered a downtrend. 7500 USD acted strong support and we went on to bounce off it ~3 times. Now, I think the fourth bounce would have been fatal for the bulls as it would completed a double top continuation and the big mutant H&S that we've been making for some time now. Further more, we were below both a big Ichi Cloud and the 200MA on the 4H.

This fourth bounce never happened because - at seemingly tactical points - after the third bounce, mysterious pumps would arrive out of nowhere and buoy the price up just as it was eyeing another bearish attack on support. Looking at the upper wicks on the hourly, this resembled a price being dragged higher without regard for consensus. Upon breaking out of the downward channel, there was no volume confirmation and the mysterious pumps continued to procrastinate the bearish downturn into never happening.

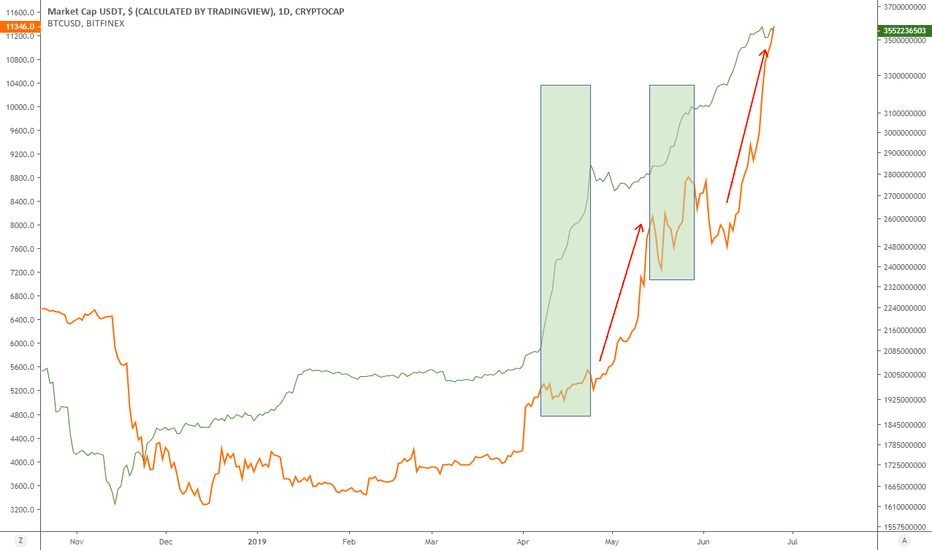

Anyway, to my point: I think this rally (like the 20k rally) is a Tether bubble. This chart highlights the correlation and the (roughly) month long delay that changes in Tether's market cap have on BTC's price. Anecdotally, look at the price action that we've been seeing and the charts that people have been posting: I found that both of these pointed to a healthy correction to ~$6.2k being on the cards and my analysis aligned with that too. Instead, what we have is a rally that can't correct. We breezed through the resistance at $6k having spent months leaning on it as support and now we're not even going to correct and retest it. This isn't the irrational exuberance of FOMO - I believe this is inflation by Tether and - if I'm correct - we should see a pretty steep rally to 10k soon; you've got to dance while the music's playing.

Best of luck on this crazy, one-way escalator and don't forget to keep an eye on the news re. Bitfinex, Tether, and the DoJ. If the Tether market cap starts shrinking or it gets canned all together, hold on to your hats.

P.S.: For those that think the correlation between BTC's price and Tether's market cap comes about due to demand for BTC producing demand for Tether, please check out the statistical analysis at Tether Report dotcom that debunks this and points much more strongly to tether being used to inflate BTC's price when it stagnates. For more on the 20k rally, look up Griffin and Shams.