Chart Patterns - How to read them like a ProChart patterns are visual formations on price charts that help traders anticipate potential market movements.

These patterns fall into three main categories: bullish , bearish , and indecisive .

---

1. Bullish Chart Patterns

Bullish patterns often signal that price is likely to move upward.

1.1 Bull Flag

* What it looks like: A sharp upward move followed by a small downward-sloping rectangle (the flag).

* Meaning: After a strong rally, the price consolidates briefly before continuing higher.

* Key insight: A breakout above the flag typically signals a continuation of the trend.

1.2 Pennant (Bullish)

* What it looks like: A strong upward move followed by a small symmetrical triangle.

* Meaning: Similar to the bull flag, but the consolidation takes a triangular form.

* Key insight: Once price breaks above the pennant, the uptrend often resumes.

1.3 Cup & Handle

* What it looks like: A “U”-shaped curve (the cup) followed by a small downward drift (the handle).

* Meaning: This pattern suggests a period of accumulation before price breaks higher.

* Key insight: A breakout above the handle signals the beginning of a new bullish leg.

1.4 Inverse Head & Shoulders

* What it looks like: Three low points, with the middle low being the deepest.

* Meaning: This reversal pattern appears after a downtrend and signals a potential change to an uptrend.

* Key insight: A breakout above the “neckline” confirms the reversal.

---

2. Indecisive Chart Patterns

These patterns show market hesitation, where neither bulls nor bears are clearly in control.

2.1 Consolidation Channel

* What it looks like: Price moves within a horizontal channel.

* Meaning: Market is moving sideways with no strong trend.

* Key insight: A breakout in either direction often leads to a significant move.

2.2 Symmetrical Triangle

* What it looks like: Two converging trend lines forming a triangle.

* Meaning: This is a neutral pattern that can break out in either direction.

* Key insight: Traders wait for a breakout before taking a position.

---

3. Bearish Chart Patterns

Bearish patterns signal a high probability of downward price movement.

3.1 Bear Flag

* What it looks like: A sharp decline followed by a small upward-sloping rectangle.

* Meaning: After a strong drop, price consolidates before continuing lower.

* Key insight: A breakout below the flag suggests a continuation of the downtrend.

3.2 Pennant (Bearish)

* What it looks like: A sharp downward move followed by a small symmetrical triangle.

* Meaning: Similar to the bear flag, but the consolidation takes a triangular form.

* Key insight: A breakout downward typically resumes the bearish trend.

3.3 Inverse Cup & Handle

* What it looks like: An upside-down cup with a small upward drift forming the handle.

* Meaning: Indicates weakness after an uptrend, often followed by a drop.

* Key insight: A break below the handle usually signals a strong bearish move.

3.4 Head & Shoulders

* What it looks like: Three peaks, with the middle one being the highest.

* Meaning: A classic reversal pattern that indicates a potential shift from an uptrend to a downtrend.

* Key insight: A break below the “neckline” confirms the bearish reversal.

---

How to Use These Patterns

* Combine pattern recognition with support/resistance, volume, and indicators for stronger confirmation.

* Always wait for breakouts and avoid acting too early.

* Manage risk with stop-loss orders.

USDTBTC trade ideas

BTC - Bulls vs Bears: who will win?Market Context

Bitcoin is trading in a tight consolidation just below its all-time high after a strong impulsive rally. This phase represents a balance of power between buyers and sellers, with neither side able to take control yet. Such a pause in momentum at this key level often builds pressure for a breakout move as liquidity pools accumulate above and below the range.

Consolidation Phase

The current range is clearly defined by a resistance area at the top and a support area at the bottom. Price has been oscillating within these boundaries without any sustained breakout attempts. This range-bound behavior is an essential part of the market cycle, as it allows larger players to build or distribute positions. The longer price stays in this box, the more significant the breakout that follows tends to be.

Bullish Breakout Scenario

If price breaks out decisively above resistance, it would indicate buyers have absorbed all the supply at these levels. Such a breakout opens the path to a new all-time high and could potentially extend far beyond as trapped shorts are forced to cover. For traders, a retest of the breakout level on lower timeframes could provide a low-risk entry point for continuation to the upside.

Bearish Breakout Scenario

On the flip side, if support fails, the market will likely gravitate toward the unfilled Fair Value Gap left behind during the previous rally. This inefficiency becomes a natural draw for price, offering a logical downside target for a corrective move. A clean break below the range followed by a retest from underneath could present shorting opportunities for those aiming to capture that move into the FVG.

Final Words

Patience and precision are key when dealing with setups like this. Let the market come to your level — and react with intent.

If you found this breakdown helpful, a like is much appreciated! Let me know in the comments what you think or if you’re watching the same zones.

Bitcoin Hits $40,000, It Will Recover —Name Your AltcoinSorry, there is a typo there on the title, I meant to say: Bitcoin hits $114,000, soon to recover.

As you can see from our trading range, Bitcoin just went beyond the lower boundary and hit a new low, the lowest since 10-July but there is good news. There isn't room for prices to move much lower, this is part of the consolidation phase.

The first low happened 25-July and notice the high (bear) volume. The second low happens today and we have lower volume compared to 25-July, but Bitcoin hit a lower low. This reveals that the bearish move is already weak and losing force. It also reveals the fact that Bitcoin is about to recover.

Also notice the RSI, 2H. It hit oversold recently and went the lowest in a long while. Reversals tend to happen when the RSI becomes oversold.

Bitcoin is testing the lower boundary of the trading range, when this happens, the action reverses and moves back up. Prepare to see Bitcoin back above $120,000. It is normal and it will happen... But it is wise to give the market a few days. 5-August was bad last year. It gets bad but it also marks the bottom. Once the bottom is hit, growth long-term.

— Name Your Altcoin

Leave a comment with the altcoins you are holding now and I will do an analysis for you. The altcoins will also recover and we are witnessing just a small retrace. Hold strong as this is the most important part. We will have a very strong new bullish wave develop within days.

As Bitcoin moves to test support, it will reverse to test resistance next. Which one is your top altcoins choice?

Thank you for reading.

Namaste.

Bitcoin & The Altcoins —Name Your AltcoinBitcoin is sideways right now and is moving in a very tight and narrow range. All the action has been happening between $117,000 and $120,000 based on candle close since 11-July. This is bullish, think about it.

Bitcoin hits a new all-time high and next thing you know it turns sideways very close to resistance. The only drop was short-lived and everything sold was quickly bought. Why is Bitcoin consolidating so close to resistance? It is preparing to move ahead.

What happens when Bitcoin moves forward after so much recovery? Everything experiences a positive cycle. This is a very strong signal.

This chart allows for more whipsaw as you know nothing else is possible in a trading range. We predict the pattern to resolve bullish, but there can be swings to either side. A swing down just as it happened 25-July. A swing up just as it happened 14-July. This is always possible but the end result won't change. Bitcoin will continue sideways but when the sideways period is over, you will not see a move toward $110,000 or $100,000. The break of the trading range will confirm the advance toward $135,000 next month. Bitcoin is likely to continue in the same mode. While Bitcoin consolidates the new advance, the altcoins grow. In this way the entire market continues to recover and grow month after month after month.

Name Your Altcoin

Leave a comment with your favorite altcoin trading pair and I will do an analysis for you. I will reply in the comments section. Make sure to include any questions you might have beforehand.

If you see a comment with a pair you like, boost and reply so these can be done first.

Thanks a lot for your continued support.

Namaste.

BTC - Short Setup at 0.702 Fibonacci & Fair Value GapMarket Context

Bitcoin recently rejected from a major resistance area and has since been retracing downward, finding temporary support inside a bullish Fair Value Gap. The market is currently in a corrective phase, with buyers attempting to defend lower levels while sellers look for optimal positions to reload shorts. This environment shows a classic tug-of-war between these two forces as price moves between supply and demand zones.

Consolidation and Current Phase

Although the prior consolidation has been broken, the current price action can still be described as corrective, with intraday structure forming lower highs. The bullish Fair Value Gap beneath price has been respected so far, creating a temporary base. However, the path remains complex, as the market has unfilled imbalances both above and below.

Bearish Retest Scenario

One key scenario involves a retracement toward the bearish Fair Value Gap near 117K, which also aligns with the 0.702 Fibonacci retracement level. This confluence makes it a high-probability area for sellers to step in again. A rejection from that zone would likely resume the downtrend, with the next logical target being the deeper unfilled bullish Fair Value Gap around 110K. This zone acts as a magnet for price due to the inefficiency left behind during the last rally.

Bullish Defense Scenario

For bulls to regain control, the current Fair Value Gap at 114K must hold, followed by a strong move that invalidates the lower-high structure. Such a move would need to break above the 117K bearish FVG with conviction. Only then could momentum shift back to the upside, opening the door for another challenge of the higher resistance zones.

Final Words

Patience and precision are key when dealing with setups like this. Let the market come to your level — and react with intent.

If you found this breakdown helpful, a like is much appreciated! Let me know in the comments what you think or if you’re watching the same zones.

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

After a strong rally, BTC is currently pulling back from the 124K resistance area, heading toward a major confluence support zone between 108,000– 110,000, which aligns with:

✅ Previous breakout zone

✅ 0.5–0.618 Fibonacci retracement

✅ Lower bound of the ascending channel

This level is expected to attract buyers and act as a base for a new bullish leg.

Scenario Ahead (Main Bias):

1. Price dips into the 108–110K support

2. Bullish reversal from the zone (watch for strong reaction candles or bullish divergence)

3. Target 1: 124K (retest resistance)

4. Target 2: 135K–140K (upper channel boundary upon breakout)

BTC remains in a healthy bullish structure. Current pullback is considered constructive, and the 107–110K zone offers a high-probability long setup. Watch for bullish signals before entering.

A confirmed daily close below 107K would invalidate this bullish structure and expose BTC to deeper correction levels.

What’s your take on this setup? Do you expect a bounce from support or a deeper correction? Share your thoughts below 👇

Don’t forget to like and share your thoughts in the comments! ❤️

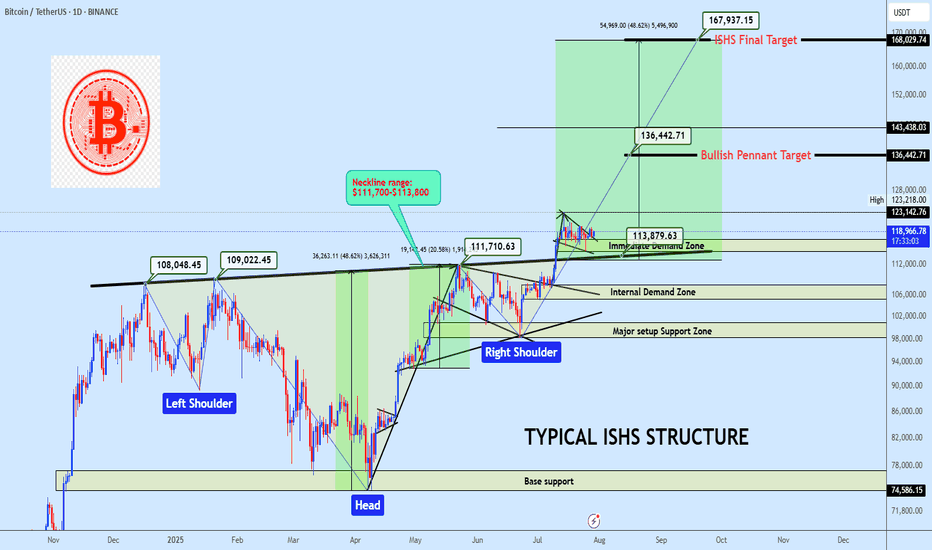

BTCUSDT ISHS Breakout with Bullish Pennant ContinuationBTC is holding above a clean neckline breakout from a inverse head and shoulders formation, currently consolidating inside a bullish pennant. A breakout from this range offers continuation potential to $136K and possibly to $168K. Bias remains bullish while price holds above the $114K region.

Market Structure

• Trend: Bullish continuation

• Pattern: Inverse Head & Shoulders + Bullish Pennant

• Price Action: Clean breakout and retest of neckline support, followed by tightening consolidation

Key Zones

• Immediate Demand Zone: $114,000 – $117,000

• Internal Demand Zone: $105,000 – $108,000

• Major Setup Support Zone: $98,000 – $101,000

• Base Support (ISHS Origin): $74,500 – $77,000

• Neckline: $111,700-$113,800 (Confirmed pivot level)

Technical Confluence

• Volume: Strong candle breakout through neckline, followed by low-volume bullish flag

• Price Geometry: ISHS measured move aligns with the final target at $168K

• Momentum: Bullish structure maintained with higher lows and reactive demand

Entry Plan

• Zone: $117,500 – $119,000

• Method: Limit buy on demand retest or breakout retest of $123K

• Execution: Swing entry with invalidation below demand base

Targets

• 🎯 TP1: $136,442 — Pennant measured move

• 🎯 TP2: $168,029 — Final ISHS target

Invalidation

• ❌ SL: Below $110,000

• Reason: Break below ISHS Neckline invalidates bullish thesis in the short term

• RRR: Estimated 1:4 depending on execution

If this structure aligns with your outlook, feel free to share your thoughts in the comments.

You’re also welcome to drop your preferred altcoins for a quick technical review.

Mastering bullish candlestick patterns - How to use it!In this guide, we will explore some of the most important bullish candlestick patterns used in technical analysis. These patterns are essential tools for traders and investors who want to better understand market sentiment and identify potential reversal points where prices may start moving upward.

What will be explained:

- What are bullish candlestick patterns?

- What is the hammer?

- What is the inverted hammer?

- What is the dragonfly doji?

- What is the bullish engulfing?

- What is the morning star?

- What is the three white soldiers?

- How to use bullish candlestick patterns in trading?

What are bullish candlestick patterns?

Bullish candlestick patterns are specific formations on a candlestick chart that signal a potential reversal from a downtrend to an uptrend. These patterns are used by traders and investors to identify moments when the market sentiment may be shifting from bearish to bullish. Recognizing these patterns can help traders time their entries and make more informed decisions based on price action and market psychology. While no single pattern guarantees success, they can provide valuable clues when combined with other forms of analysis such as support and resistance, trendlines, and volume.

What is the Hammer?

The Hammer is a single-candle bullish reversal pattern that typically appears at the bottom of a downtrend. It has a small real body located at the upper end of the trading range, with a long lower shadow and little to no upper shadow. The long lower wick indicates that sellers drove the price lower during the session, but buyers stepped in strongly and pushed the price back up near the opening level by the close. This shift in momentum suggests that the downtrend could be coming to an end, and a bullish move might follow.

What is the Inverted Hammer?

The Inverted Hammer is another single-candle bullish pattern that also appears after a downtrend. It has a small body near the lower end of the candle, a long upper shadow, and little to no lower shadow. This pattern shows that buyers attempted to push the price higher, but sellers managed to bring it back down before the close. Despite the failure to hold higher levels, the buying pressure indicates a possible reversal in momentum. Traders usually look for confirmation in the next candle, such as a strong bullish candle, before acting on the signal.

What is the Dragonfly Doji?

The Dragonfly Doji is a special type of candlestick that often indicates a potential bullish reversal when it appears at the bottom of a downtrend. It forms when the open, high, and close prices are all roughly the same, and there is a long lower shadow. This pattern shows that sellers dominated early in the session, pushing prices significantly lower, but buyers regained control and drove the price back up by the end of the session. The strong recovery within a single period suggests that the selling pressure may be exhausted and a bullish reversal could be imminent.

What is the Bullish Engulfing?

The Bullish Engulfing pattern consists of two candles and is a strong indication of a reversal. The first candle is bearish, and the second is a larger bullish candle that completely engulfs the body of the first one. This pattern appears after a downtrend and reflects a shift in control from sellers to buyers. The bullish candle’s large body shows strong buying interest that overpowers the previous session’s selling. A Bullish Engulfing pattern is even more significant if it occurs near a key support level, and it often signals the beginning of a potential upward move.

What is the Morning Star?

The Morning Star is a three-candle bullish reversal pattern that occurs after a downtrend. The first candle is a long bearish one, followed by a small-bodied candle (which can be bullish, bearish, or a doji), indicating indecision in the market. The third candle is a strong bullish candle that closes well into the body of the first candle. This formation shows a transition from selling pressure to buying interest. The Morning Star is a reliable signal of a shift in momentum, especially when confirmed by high volume or a breakout from a resistance level.

What is the Three White Soldiers?

The Three White Soldiers pattern is a powerful bullish reversal signal made up of three consecutive long-bodied bullish candles. Each candle opens within the previous candle’s real body and closes near or at its high, showing consistent buying pressure. This pattern often appears after a prolonged downtrend or a period of consolidation and reflects strong and sustained buying interest. The Three White Soldiers suggest that buyers are firmly in control, and the market may continue moving upward in the near term.

How to use bullish candlestick patterns in trading?

To effectively use bullish candlestick patterns in trading, it’s important not to rely on them in isolation. While these patterns can signal potential reversals, they work best when combined with other technical tools such as support and resistance levels, moving averages, trendlines, and volume analysis. Traders should also wait for confirmation after the pattern forms, such as a strong follow-through candle or a break above a resistance level, before entering a trade. Risk management is crucial—always use stop-loss orders to protect against false signals, and consider the broader market trend to increase the probability of success. By integrating candlestick analysis into a comprehensive trading strategy, traders can improve their timing and increase their chances of making profitable decisions.

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like 👍 and leave a comment 💬, I’d love to hear your thoughts!

Deep Dive Into Relative Strength Index (RSI)The Relative Strength Index (RSI) is a momentum oscillator developed by J. Welles Wilder Jr. that measures the speed and magnitude of price changes.

Introduction

In the world of trading, timing is everything — and few indicators have stood the test of time like the Relative Strength Index (RSI). Introduced by J. Welles Wilder in 1978, the RSI is a momentum oscillator that helps traders evaluate the strength and speed of price movements. Whether you're trading stocks, forex, or crypto, understanding how RSI is calculated and how to interpret its signals can give you a critical edge.

In this article, we’ll break down exactly how the RSI works, explore its formula, and dive into practical ways you can incorporate it into your trading strategies. From spotting potential reversals to identifying overbought and oversold conditions, the RSI remains a cornerstone of technical analysis — but only if you know how to use it properly.

Let’s explore the mechanics and the mindset behind this powerful indicator.

What Is RSI and How Is It Calculated?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements over a defined period. It outputs a value between 0 and 100, which helps traders determine whether an asset is overbought or oversold.

The default RSI setting uses a 14-period lookback window and is calculated with the following steps:

🔷Calculate the average gain and loss over the last 14 periods:

Average Gain = Sum of all gains over the past 14 periods / 14

Average Loss = Sum of all losses over the past 14 periods / 14

🔷Compute the Relative Strength (RS):

RS = Average Gain / Average Loss

🔷Apply the RSI formula:

RSI=100−(100/(1+RS))

The result is a single number between 0 and 100 that indicates the asset's momentum.

How to Use RSI in Trading Strategies

⚡️Overbought and Oversold Conditions Strategy

RSI > 70 typically signals that an asset may be overbought and due for a pullback.

RSI < 30 suggests the asset might be oversold, potentially primed for a bounce.

However, these levels aren’t absolute sell or buy signals. In strong trends, RSI can stay overbought or oversold for extended periods.

📈Long Trading Strategy Example:

1. Identify the major trend, to find the long trades it shall be uptrend. On the screen below you can see 1D time frame for BITMART:BTCUSDT.P .

2. Move to lower time frame (in our case 4h) and find the moment when RSI falls below 30. This is our oversold condition and we are going to look for long trade.

3. Find the local support zone and open long trade.

4. Take profit when price reaches resistance level next to the previous swing high

5. Don’t forget to put initial stop loss when enter position. The best stop loss which will give you 3:1 risk to reward ratio.

📉Short Trading Strategy Example

1. Identify the major trend, to find the short trades it shall be downtrend. On the screen below you can see 1D time frame for BITMART:ETHUSDT.P .

2. Move to lower time frame (in our case 4h) and find the moment when RSI grows above 70. This is our overbought condition and we are going to look for short trade.

3. Find the local resistance zone and open short trade.

4. Take profit when price reaches support level next to the previous swing low

5. Don’t forget to put initial stop loss when enter position. The best stop loss which will give you 3:1 risk to reward ratio.

⚡️RSI Breakout Strategy

RSI is breaking through 60 indicating bullish momentum shift if the long-term trend is bullish can be the potential long signal

RSI is breaking down 40 indicating bearish momentum shift if the long-term trend is bearish can be the potential short signal

This strategy works great only on the trending market, don’t use it on the range bounded market to avoid whiplashes.

📈Long trading strategy example:

1. Make sure that long-term trend is bullish. Use 200 period EMA as its approximation. If price remains above it we can look for potential long trade setup.

2. If RSI crossed above the level 60 open long trade.

3. Put the initial stop-loss under the signal candle’s low.

4. Take profit when price reached 3:1 risk-to-reward ratio.

📉Short trading strategy example

1. Make sure that long-term trend is bearish. Use 200 period EMA as it’s approximation. If price remains below it we can look for potential short trade setup.

2. If RSI crossed below the level 40 open short trade.

3. Put the initial stop-loss above the signal candle’s high.

4. Take profit when price reached 3:1 risk-to-reward ratio. In our case we received very fast and profitable trade

⚡️RSI Divergence Strategy

RSI can be used also as a trend reversal indicator if we are looking for divergences. This is very reliable sign of current trend weakness and great opportunity open trade against the trend. Usually it’s not recommended, but in case if divergence can be applicable.

Bullish divergence is the situation when price created the lower low, while RSI made the lower low. Usually, it indicates that current downtrend is weakening and we can look for long trades

Bearish divergence is the situation when price created the higher high, while RSI made the lower high. Usually, it indicates that current uptrend is weakening and we can look for short trades

😎Important hint: it’s rarely covered in textbooks about technical analysis, but in our opinion it’s better to used divergences when RSI was able to cross level 50 between two lows/highs.

📈Long trading strategy example

1. Find at the chart situation, when the price made the lower low

2. At the same time RSI shall set the higher low

3. RSI shall break level 50 between these lows indicating shift to the bullish momentum

4. If price failed to set the clean breakdown open long trade on the candle which set the lower low. Put stop loss under it’s low

5. Take profit at 3:1 RR. When you master this concept, you will be able to have much more RR trades, even 10:1. This is possible because when trend finish you have the highest potential upside

📉Short trading strategy example

1. Find at the chart situation, when the price made the higher high

2. At the same time RSI shall set the lower high

3. RSI shall break level 50 between these highs indicating shift to the bearish momentum

4. If price failed to set the clean breakout open short trade on the candle which set the higher high. Put stop loss above it’s high

5. Take profit at 3:1 RR. When you master this concept, you will be able to have much more RR trades, even 10:1. This is possible because when trend finish you have the highest potential upside

Conclusion

The Relative Strength Index (RSI) remains one of the most powerful and flexible tools in a trader’s technical arsenal — but its real value lies in how you use it.

We’ve explored three key RSI strategies:

✅ Overbought/Oversold setups offer simple entry signals in ranging markets, where price tends to revert to the mean.

✅ Breakout strategies unlock RSI’s momentum-tracking potential, helping you ride strong directional moves with confidence.

✅ Divergence detection reveals hidden shifts in market sentiment, giving you an early warning of possible reversals or trend continuations.

Each approach has its strengths — and its risks — but together, they offer a complete framework for using RSI across different market conditions

🔑 Key Takeaways:

RSI is not just a “buy low, sell high” tool — it’s a multi-dimensional indicator that adapts to trends, momentum, and market structure.

The best RSI signals come from confluence: combining RSI with price action, support/resistance, volume, or trend filters like moving averages.

Patience and discipline are essential — RSI signals are only effective when paired with proper risk management and confirmation.

By mastering RSI beyond the basics, you'll be better equipped to make timely, confident, and informed trading decisions — whether you're entering a pullback, chasing a breakout, or spotting the early signs of reversal.

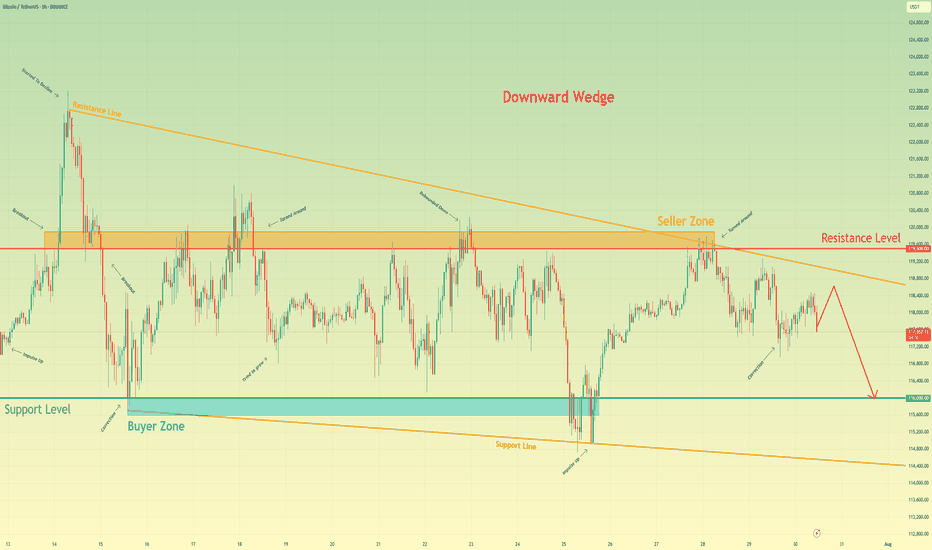

Bitcoin will continue to decline to support levelHello traders, I want share with you my opinion about Bitcoin. Following a period of a broad downward trend, bitcoin's price action has been channeled into a large downward wedge, a pattern that signifies converging volatility and a period of consolidation before an eventual decisive move. This market action is taking place between two critical, well-established zones: a major seller zone capping rallies around the 119500 resistance level and a significant buyer zone providing support near 116000. Recently, an upward rebound attempted to test the upper boundary of this wedge but was met with strong selling pressure from the seller zone, confirming its validity as a formidable barrier. The price is now correcting downwards after this rejection. The primary working hypothesis is a short scenario, anticipating that the bearish momentum from this recent failure will continue to drive the price lower. While a minor bounce or retest of local resistance is possible, the path of least resistance within the pattern's structure is now towards its lower boundary. Therefore, the TP is strategically set at the 116000 level. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Deep Dive Into Moving Average Convergence Divergence (MACD)🗓 The Moving Average Convergence Divergence (MACD) is one of the most popular momentum indicators in technical analysis. Whether you're a beginner or an experienced trader, understanding how the MACD works can significantly enhance your trading decisions.

📚 Introduction: What Is MACD and Why It Matters

The MACD (Moving Average Convergence Divergence) is one of the most powerful and widely used momentum indicators in technical analysis. It was developed by Gerald Appel in the late 1970s and has since become a staple in the toolkit of traders and investors across markets — from stocks and forex to cryptocurrencies.

At its core, MACD helps traders understand the relationship between two moving averages of an asset’s price, providing insight into both trend direction and momentum strength. By analyzing how these averages converge and diverge, the indicator offers valuable signals for entries, exits, and trend reversals.

What makes MACD especially popular is its versatility — it works well in trending markets, can be used across all timeframes, and combines both leading and lagging components. Whether you're a day trader or a long-term investor, understanding how MACD works gives you an edge in making timely and informed trading decisions.

📚 How the MACD Is Calculated: The Components Explained

The MACD is built from three core components: MACD line, Signal line and MACD histogram.

🔹 Calculating the MACD Line:

The MACD line is the difference between two Exponential Moving Averages (EMAs), typically 12-period EMA (fast) and 26-period EMA (slow). The formula is:

MACD Line = EMA(12) − EMA(26)

This line captures momentum by tracking how the shorter-term average diverges from the longer-term average. When the MACD line rises, the short-term momentum is increasing faster than the longer-term trend — a sign of bullish acceleration. The reverse implies bearish momentum.

🔹 Calculating the Signal Line:

To reduce noise and provide clearer signals, a 9-period EMA of the MACD line is plotted on top. This is the Signal Line, and it acts as a trigger:

When the MACD line crosses above the signal line → bullish signal (buy)

When the MACD line crosses below the signal line → bearish signal (sell)

Signal Line = EMA(9)(MACD Line)

🔹 Calculating the MACD Histogram:

The Histogram shows the difference between the MACD Line and the Signal Line:

Histogram = MACD Line − Signal Line

It provides a visual representation of momentum strength. The histogram bars expand when momentum strengthens and contract as it fades. It helps you spot shifts in momentum earlier than a basic crossover.

📚 How to Use MACD in Trading Strategies

⚡️MACD Signal Line Crossover

Buy Signal:

MACD Line crosses above the Signal Line from below (bullish crossover)

Preferably when both lines are below the zero line (early in the trend)

Price closes above the long-term trend approximation, in our case we use 200-period EMA

Sell Signal:

MACD Line crosses below the Signal Line from above (bearish crossover)

Preferably when both lines are above the zero line (early in the trend)

Price closes below the long-term trend approximation, in our case we use 200-period EMA

📈Long Trading Strategy Example

1. Wait until MACD line crosses over the Signal line from down to up. In our example we use 1D time frame for BITMART:BTCUSDT.P . Open long trade if point 2 will be completed.

2. Price candle shall be closed above the 200-period EMA. This is long-term trend filter to increase the probability that trades will be open only in the direction of the main trend.

3. Close the long trade when the MACD line crosses under the Signal line. This is an approximation that short-term impulse is over and correction is about to start.

In our case we have +20% return on this long trade, but, please, notice that we have not used initial stop-loss in this strategy. Trade was closed according to the technical condition, this approach can violate the risk management rules, but also can be applicable if you trade the amount ready to lose using this strategy. We will talk about stop-loss later.

📉Short trading strategy example

1. Wait until MACD line crosses under the Signal line from up to down. In our example we use 1D time frame for BITMART:ETHUSDT . Open short trade if point 2 will be completed.

2. Price candle shall be closed below the 200-period EMA. This is long-term trend filter to increase the probability that trades will be open only in the direction of the main trend.

3. Close the short trade when the MACD line crosses over the Signal line. This is an approximation that short-term impulse is over and correction is about to start.

In this case we have +15% return on the short trade. Again, strategy used the technical condition to close the trade and now let's cover how to place the stop-loss. There is no right answer how to use stop-losses. The first and the most obvious way to place stop-loss is using recent swing low/high, but the problem is that all traders are seeing them and do the same. Price tends to reach such levels to collect liquidity.

Another one way to place stop-loss is using the signal candle's high/low. This is so-called 1 candle stop-loss. Usually it's very tight and can allow to have the fantastic risk to reward ratio, but we are now recommend to use it if you are not a professional trader because win rate of such strategy decreases.

Third approach in placing stop-loss which we often use in our algorithmic strategies is the Average True Range (ATR). ATR is the volatility measurement, it allows to take into account the current volatility. Sometimes it helps to avoid the stop-loss hit when trade finally goes in your direction. You can just simply subtract (in case of long trade) or add (in case of short trade) ATR value to the entry price and obtain the dynamic stop loss based on current market condition. Also multiplier can be used for ATR. You shall choose the approach which is more comfortable for you, backtest all these approached to make your choice.

🧪Important: we used the long signals only below the zero-line and short signals above it in the attempt to catch the beginning of a trend and have large potential move. On the picture below you can see the same BITMART:BTCUSDT.P , but what will happen if we open long on the lines crossover above zero line? This trade will not be profitable because of restricted potential.

⚡️MACD Zero Line Crossover

Buy Signal:

MACD Histogram crosses above the zero line (momentum shifts from bearish to bullish)

Price closes above the long-term trend approximation, in our case we use 200-period EMA

Sell Signal:

MACD Histogram crosses below the zero line (momentum shifts from bullish to bearish)

Price closes below the long-term trend approximation, in our case we use 200-period EMA

📈Long Trading Strategy Example

1. Wait until MACD Histogram crosses over zero line. Open long trade if point 2 will be completed.

2. Price candle shall be closed above 200-period EMA. This is long-term trend filter to increase the probability that trades will be open only in the direction of the main trend.

3. Take profit when price reaches 3:1 risk to reward ratio according to the stop-loss from point 4.

4. Stop-loss shall be placed below recent swing low. This point can be discussed, you can use any stop-loss technique described earlier in this article. We demonstrate the simplest one, the key here is using at least 3:1 RR.

📉Short trading strategy example

1. Wait until MACD Histogram crosses under zero line. Open short trade if point 2 will be completed.

2. Price candle shall be closed below 200-period EMA. This is long-term trend filter to increase the probability that trades will be open only in the direction of the main trend.

3. Take profit when price reaches 3:1 risk to reward ratio according to the stop-loss from point 4.

4. Stop-loss shall be placed above recent swing high. This point can be discussed, you can use any stop-loss technique described earlier in this article. We demonstrate the simplest one, the key here is using at least 3:1 RR.

⚡️MACD Divergence Strategy

MACD Divergence is a strategy that helps traders identify potential reversals in market direction before they become obvious on the price chart. This makes it a favorite tool among swing traders and crypto enthusiasts looking to catch major moves early.

But what exactly is a divergence? In simple terms, divergence occurs when price and momentum (MACD) are moving in opposite directions — signaling that the current trend may be losing strength and preparing for a reversal. There are two main types of divergence.

🐂 Bullish Divergence

Price makes a lower low

MACD Histogram makes a higher low

This suggests that while price is still falling, downward momentum is weakening. The bears are losing control, and a bullish reversal may be near. Trading signal is very simple, when bullish divergence happens wait for the first increasing column on MACD histogram and open long trade. Place stop-loss under recent swing low and take profit at 3:1 RR.

🐻Bearish Divergence

Price makes a higher high

MACD makes a lower high

This suggests that while price is still falling, downward momentum is weakening. The bears are losing control, and a bullish reversal may be near. Trading signal is very simple, when bearish divergence happens wait for the first decreasing column on MACD histogram and open short trade. Place stop-loss above recent swing high and take profit at 3:1 RR.

🧪 Important hint: MACD histogram shall cross the zero line between two lows/high to create the most reliable divergence signals. We are not recommend to use it without zero-line crossover to decrease number of false signals.

📈Long Trading Strategy Example

1. MACD Histogram shall create higher low.

2. Price shall create lower low.

3. MACD Histogram shall cross the zero line between lows.

4. MACD Histogram shall show the first increasing column.

5. Put stop-loss under the recent swing low.

6. Put take profit at 3:1.

🧪 You can enhance the long signal with the MACD Line divergence. In our case we have both divergences: with MACD Histogram and MACD Line.

📉Short trading strategy example

1. MACD Histogram shall create lower high.

2. Price shall create higher high.

3. MACD Histogram shall cross the zero line between lows.

4. MACD Histogram shall show the first decreasing column.

5. Put stop-loss above the recent swing high.

6. Put take profit at 3:1.

🧪Divergence is extremely strong signal, but when price continue it's move in the direction of a trend and it's not reversing it can also be the signal for the trend continuation. This situation is called "Baskerville Hound" signal, this name was given by famous trader Alexander Elder. We don't recommend to use it for novice traders, but it's useful to know about it.

📚 Conclusion

The Moving Average Convergence Divergence (MACD) is more than just a crossover tool — it's a powerful momentum indicator that offers deep insight into the strength, direction, and timing of market trends. By understanding how the MACD line, Signal line, and Histogram interact, traders can uncover early trend shifts, spot momentum divergences, and time entries and exits with greater confidence.

Whether you're a short-term trader using fast crossovers for scalping or a long-term investor watching for weekly divergences, MACD can adapt to your style when used thoughtfully. Like all indicators, it works best when combined with price action, support/resistance levels, and other indicators — not in isolation.

Ultimately, mastering MACD is not about memorizing patterns, but about learning to read the story of momentum that unfolds beneath the surface of price. With disciplined application and practice, MACD can become a reliable compass in your trading strategy.

Bitcoin - Will the liquidity at $122K be the next target?Bitcoin is currently trading within a defined corrective channel, which has been developing over the past few weeks. Price action within this structure has been characterized by a sequence of lower highs and lower lows, suggesting a mild downtrend. However, these movements lack strong momentum, indicating that the market is consolidating rather than entering a deeper correction. This kind of structure often precedes a significant breakout, and given the nature of the current price action, a retest of previous highs remains a realistic possibility.

Bullish Scenario

Looking at the overall structure of the channel, a bullish breakout seems increasingly likely. For this scenario to unfold, BTC needs to hold the midline of the channel as support. If this level is respected, it could pave the way for a push towards the upper boundary of the channel and a potential break above the lower high structure near $120,000. A successful breach of that level could trigger a move toward the $122,000 liquidity zone, with the potential to challenge the all-time high (ATH) in the near future. Holding the midline and breaking above key resistance would provide confirmation of strength and continuation to the upside.

Bearish Scenario

On the flip side, if BTC fails to hold the midline as support and starts closing below it on the 4H timeframe, we could see a renewed move toward the lower boundary of the corrective channel. This could lead to a test of the unfilled 4H fair value gap (FVG) highlighted in the chart, located around the $112,000 – $113,000 area. This zone also coincides with a strong historical support level, making it a logical area where buyers might step in and provide the momentum needed for a more sustainable bullish reversal.

Final Thoughts

While both scenarios remain valid, the price structure within the corrective channel currently leans slightly more toward a bullish outcome. The lack of aggressive selling and the potential for liquidity above the previous highs support this view. However, trading is never about certainty but about preparing for various possibilities. Being aware of both bullish and bearish setups allows traders to react with flexibility and discipline depending on how the market unfolds in the coming sessions.

-------------------------

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like 👍 and leave a comment 💬, I’d love to hear your thoughts!

Bitcoin stop loss hunting end, entry for Long is now!!Hi on this chart that may happen with more than 70% possibility we have one of the easy setups and strategy which i call it FAKEOUT&LIQUIDTY this happen usually near trendline support or range zone support or even resistance and after a possible fakeout usually market kick sellers or Buyers and then with high volume market reverse.

I saw High volume and Fake breakout in my mind and i think it can be one of those times so we open long and lets now wait for this 1:2(Risk:Reward) signal to play.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

Bitcoin Rejected Near $120K – Bears Wake Up!First of all, I have to say that Bitcoin’s movements over the last 12 days have been a bit difficult to trade , generally, the hardest market to make a profit in is the range market with a swing movement .

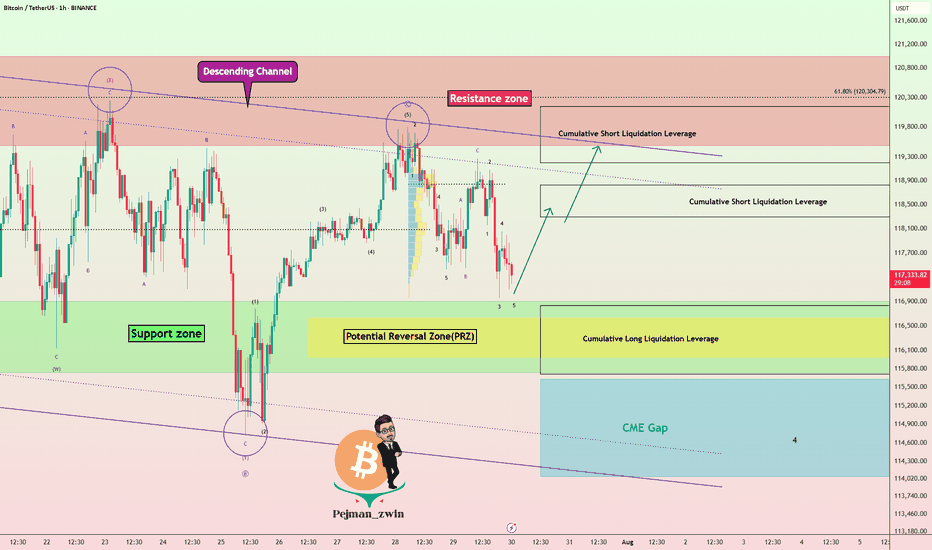

Bitcoin( BINANCE:BTCUSDT ) is currently trading near the Resistance zone($121,000-$119,500) , Cumulative Short Liquidation Leverage($121,336-$120,000) , and the upper line of the descending channel .

Since Bitcoin has lost support lines , we can consider this increase in Bitcoin over the last two days as a pullback to the support lines(broken) . Do you agree with me!?

In terms of Elliott Wave theory , it appears that Bitcoin is still completing the main wave B. The main wave B is a Regular Flat(ABC/3-3-5) . The structure of the microwave B of the main wave B was a Double Three Correction(WXY) .

Additionally, the SPX 500 index ( SP:SPX ), which Bitcoin is correlated with , is poised for a correction in my opinion, which could also impact Bitcoin .

Also, unlike previous Mondays, MicroStrategy has NOT purchased Bitcoin , and the company currently holds 607,770 BTC .

Old Bitcoin wallets also seem to be waking up to the fact that they can create movements in the crypto market . " In recent days, 471,867.8 BTC worth $56.39 million have been transferred from old wallets from 2012 to 2017 . ".

I expect Bitcoin to decline to at least the Support zone($116,900-$115,730) and fill the CME Gaps in the coming hours .

New CME Gap: $119,500-$118,295

CME Gap: $115,060-$114,947

Cumulative Long Liquidation Leverage: $117,401-$116,615

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

A lose Cycle! Sell The Bottom, Buy The Hype!? Why Do You Buy When Everyone Else Is Terrified?

What drives us to make the exact opposite of a rational decision?

Is a crashing market truly a buying opportunity or just a trap?

Hello✌️

Spend 2 minutes ⏰ reading this educational material.

🎯 Analytical Insight on Bitcoin :

BINANCE:BTCUSDT has created strong liquidity with this recent pullback 📉 and is now testing a key daily support level. I’m looking for a potential bounce of at least 5%, targeting around $119,000, near a significant daily resistance 🚀.

Now , let's dive into the educational section,

🌀 Retail Traders: Victims of Hype, Fear, and Noise

Most casual traders sell during a dip, not because of a plan but because of panic. As soon as they see red candles flooding the chart, they react emotionally, not logically. Then, when prices rally and social media is buzzing, they jump back in, usually at the worst possible time. This cycle of buying tops and selling bottoms isn’t random. It is driven by crowd psychology, and unless you recognize it, you’ll keep falling for the same trap again and again.

🧭 No Strategy or Stop Loss Means You’re Gambling

If you enter a trade without knowing where you'll exit, you’re not trading. You’re guessing. A strategy is not optional. It is your foundation. Proper take-profit and stop-loss levels are what keep emotions out of the equation. Traders without a plan either take profits too early or hold onto losses too long, hoping they’ll bounce back. This isn’t trading. This is gambling with extra steps.

🔍 Technical and Fundamental Analysis Work Best Together

Only reading charts without understanding the asset means you're blind to context. Only studying the fundamentals without watching price action means you’re missing timing. Technical analysis helps you pinpoint when to act. Fundamental analysis tells you why to act. The best traders blend both. You find the "what" through fundamentals, and the "when" and "how" through technicals.

⚠️ Buying the Hype and Selling the Panic Hurts

Markets swing between extremes. When your favorite coin is pumping and influencers are screaming 🚀🚀 it might be too late. That is often when smart money exits and retail rushes in. On the flip side, when everyone is doom-posting and charts are dripping red, that is when opportunity quietly appears. But only if you’ve done your homework. It’s not about being a contrarian. It’s about being informed.

🛠 Useful TradingView Tools to Avoid Getting Tricked

To avoid emotional decisions, there are a few essential tools in TradingView that every trader should get familiar with:

Volume Profile

Shows you where the highest buying and selling activity has occurred. It helps reveal the zones where whales might have entered the market.

Fear & Greed Indicator

Gives you a quick sense of the market’s emotional state. When everyone’s afraid, it might just be the right time to start thinking about buying.

Divergence Scanner

Helps you spot potential price reversals before they happen by detecting divergences between price and momentum.

Alerts

Stop checking the charts 24/7. Set alerts on key resistance and support levels so you only react when it actually matters.

Multi-Timeframe Analysis

Don’t stay locked into the 15-minute chart. Use daily and weekly timeframes to understand the bigger picture and avoid short-term noise.

🎯 Final Thought and Recommendation

In this market, the winners aren’t the fastest. They are the most prepared. Build your strategy, manage risk with stop losses, blend technical with fundamentals, and most importantly, don’t let the crowd think for you.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

BTC Breaks Down: Retest Could Lead to More LossesHello guys!

Bitcoin has officially broken below the descending channel it was stuck in for weeks. Right now, price is pulling back to retest the broken channel, which is now acting as resistance around the 114,700 zone.

What I'm watching:

Broken channel = bearish signal

Retest zone around 114,700

Downside target near 110,400

So far, it looks like a clean setup for further downside, unless bulls manage to reclaim that broken trendline. Until then, the pressure remains to the downside.

Let’s see how price reacts here... Rejection = short opportunity.

BITCOIN → From consolidation to distribution. Market weaknessBINANCE:BTCUSDT.P is moving from consolidation to a correction phase. The price broke through the support zone of 114.5–115.5, closing within the Friday trading session in the sell zone...

Previous idea from July 22: BITCOIN → Consolidation and compression to 116K. Correction?

The fundamental background is shifting to neutral, the hype has temporarily ended, and there are no bullish drivers yet. And for the health of the market, a correction is needed. Bitcoin is breaking the neutral consolidation structure. The previous trading session closed below the support range, which generally indicates market weakness. Despite the global bullish trend, Bitcoin is moving from consolidation to a correction phase, with 112K - 110.5K serving as points of interest in this case. Before the fall, liquidity may be captured in the 114K - 114.800 zone.

Resistance levels: 114.05, 114.85, 115.67

Support levels: 112.03, 110.48

After a strong movement, the market may enter a correction or local consolidation, during which it may test the specified resistance zones before continuing its downward movement to the zone of interest and liquidity at 112 - 110.5.

Best regards, R. Linda!

TradeCityPro | Bitcoin Daily Analysis #142👋 Welcome to TradeCity Pro!

Let's get into the Bitcoin analysis. Yesterday, Bitcoin continued its correction and we need to see what is going to happen in the market today.

📅 Daily Timeframe

First, let’s take a look at the higher timeframe. On the daily chart, that curved upward trendline we had was broken by yesterday's candle, and the breakout candle had high volume.

✔️ For now, I don’t consider this trendline as broken and I’m waiting to get confirmation of the break.

🔍 Currently, the price is in a correction phase, and this correction is quite natural since the price had very low volatility for a long time and was stuck below the 120000 zone.

💥 But no trend reversal has occurred yet. In my opinion, as long as the price is above the 110000 zone, the trend is bullish, and I will consider the trend reversal confirmed only if a lower high and a lower low below 110000 are formed.

⏳ 4-Hour Timeframe

Yesterday, the corrective movement of the price continued, and after a pause at the 0.5 Fibonacci level, another bearish leg formed down to the 0.618 zone.

🔔 The RSI oscillator also entered the oversold area and then exited it again. I believe there’s a high possibility that until the end of the week, Bitcoin will range in these areas and the probability of a bullish or bearish move is much lower.

🔽 However, if the 0.618 Fibonacci level breaks, the price can move to lower areas like the 111000 zone. I think the likelihood of this happening in the future is high because that zone is a strong PRZ, and at the same time, it counts as a pullback to the 110000 zone.

📈 In the bullish scenario, if the price is supported from this area and starts to move upward, since we currently have no highs below the 116000 zone, we need to wait until the first bullish leg is formed and then enter on the second leg after the new high is broken.

⚡️ For now, I’m not opening any short or long positions. I prefer the price to form more structure so I can make a more comfortable decision.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Bullish Channel Intact: BTC Poised for Next Leg Toward 152KBitcoin continues to coil within a bullish consolidation zone above the critical $114.5k–$117.5k Immediate Demand Zone, firmly riding the ascending channel structure that has guided price since the March swing low. The prior wave structure confirms a clean ABC correction, followed by a powerful breakout and a structured range indicative of accumulation, not exhaustion.

The RSI shows persistent bullish divergence, confirming hidden strength, with multiple support bounces confirming demand. The current tight consolidation above former resistance now flipped demand presents a launchpad scenario for a breakout towards major projected upside targets.

Targets to Watch:

🟢 $123,053 – Range breakout threshold, aligns with channel midline and prior local high.

🟢 $134,428 – Measured move from current range and top channel boundary intersection.

🟢 $152,174 – Final leg projection based on macro channel trajectory and bullish wave extension potential.

On the downside, failure to hold $114.5k opens the door to a test of the $105k Strong Support Zone, which aligns with prior structural demand and broader trendline confluence.

💬 Drop your favorite altcoins in the comments for quick analysis , let's catch the next movers before they fly!

#BTCUSDT: Minor Correction In Price Then $150,000?Hi everyone,

Hope you are doing great we are witnessing some minor bearish correction in the price and think this might be a sellers trap. We think $110,000 can be a good area to buy. Our target is at $150,000 area which look possible after looking at how price recently behaved.

White House Crypto Report Incoming: Will BTC Pump from Support? One of the important news for Bitcoin ( BINANCE:BTCUSDT ) that was released today was that " White House confirms first Bitcoin and crypto report will be released TOMORROW ". Bitcoin is likely to rise with the release of the White House report .

What do you think? At least a temporary pump may be in store for Bitcoin.

Bitcoin fell to the Support zone($116,900-$115,730) and filled the New CME Gap( $119,500-$118,295) as I expected in the previous idea .

Bitcoin is currently moving near the Support zone($116,900-$115,730) , Cumulative Long Liquidation Leverage($116,828-$115,710) and Potential Reversal Zone(PRZ) .

I expect Bitcoin to rise from the Support zone($116,900-$115,730) to at least $118,680(First Taregt) .

Second target: Upper line of the descending channel

Note: Stop Loss: $114,680 = Worst Stop Loss(SL)

CME Gap: $115,060-$114,947

Cumulative Short Liquidation Leverage: $118,827-$118,298

Cumulative Short Liquidation Leverage: $120,144-$119,200

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

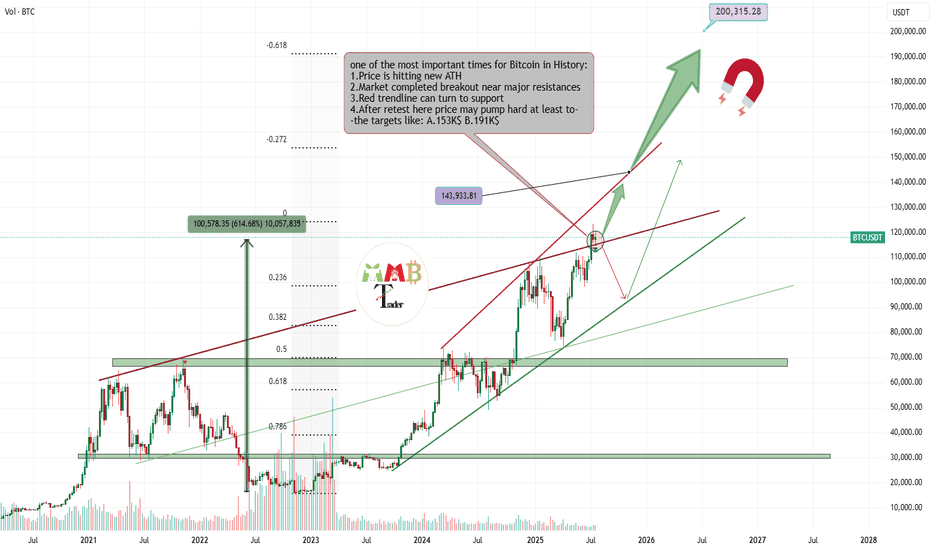

Bitcoin is getting Ready for 143K$ nowMajor red resistance trendline is now broken also last week the retest is completed now price is range for a while for new week to start and fresh volume and buys that make path easier to reach above 140K$.

Get ready and take a look at important zones at chart and possible scenarios which are all mentioned.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚