USDTBTC trade ideas

Bitcoin Turned Down — It Was Only a Matter of TimeBitcoin Turned Down — It Was Only a Matter of Time

When the price gets stuck at the top and can’t move higher, it’s always a reason to stop and think. BTC got stuck around $118,000, started to form long upper wicks, and the volume started to decline. All of this pointed to a classic case of fading bullish momentum.

At this point, my indicator gave several key signals: weakening buying power, a change in momentum, and the formation of a potential reversal zone. I refrained from opening long positions — and this decision turned out to be the right one. The price went down and is now trading around $114,000.

Next, I will wait for a retest of the imbalance zone and work from the reaction from this zone.

It is important to understand: this correction is not something unusual. This is a technically sound phase after a strong rally. The market gets rid of speculative positions, gets rid of excessive leverage and prepares for either a reset or a deeper correction.

The market has weakened predictably, and that's actually a good thing. When the structure becomes clear, we can trade with a plan rather than just following our gut instinct.

You don't know what's going on , 130K waiting for youI have shown in my previous post that Bitcoin is looking for a correction of wave 4 from wave 5 of the main wave 3 of Elliott waves, I said wait for 112k and then buy altcoins. It seems that the Elliott wave 4 micro-wave has completed its correction with the 50% Fibonacci percentage, I predict Bitcoin will touch the 128-130k levels at the end of Elliott wave 5. as I said before altcoins season is in the midway

Bitcoin Traps Bulls and Bears – Real Move Next?Bitcoin is trading in a descending channel on the 4H chart, with two recent fakeouts — one above resistance and one below support — trapping traders on both sides. After reclaiming support, BTC is pushing toward the upper boundary with rising volume, hinting at strong demand. A breakout above $119K could drive a rally toward $125K–$135K.

Cheers

Hexa

BINANCE:BTCUSDT BITSTAMP:BTCUSD

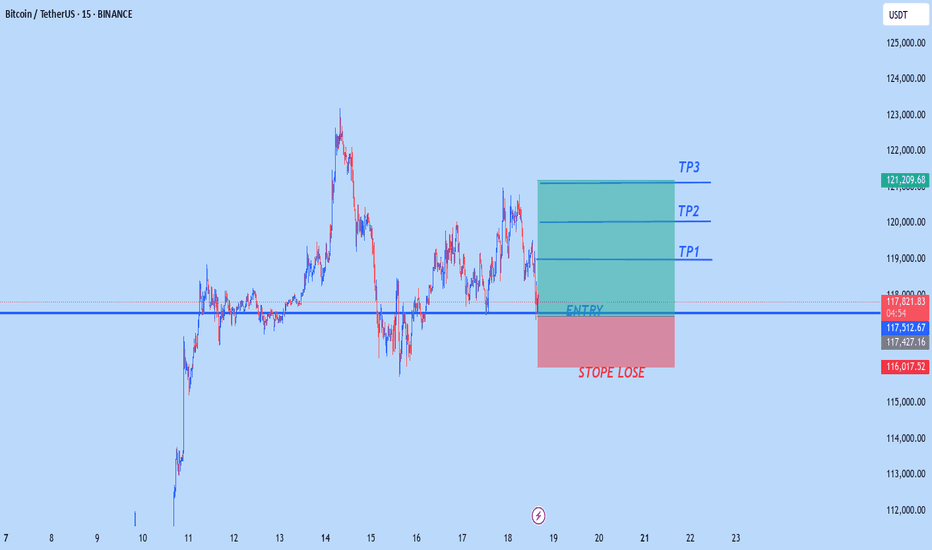

BTC retracement planDon’t chase breakouts above $115K without confirmation—false signals are common in volatile crypto conditions.

Watch for volume spikes at key levels like $115K or near $117,800 for validation.

Use tight stop-losses given intraday volatility—it’s easy for sharp 1–2% swings in crypto.

Note that technical sentiment (RSI, MACD) remains neutral to slightly bearish across intraday and daily indicators .

Weekly trading plan for BitcoinBINANCE:BTCUSDT Price has shown recovery over the past 24 hours, but now faces a critical test at the weekly reversal level ($115,300). The inability to establish sustained footing above this level may trigger a deeper correction

Key Scenarios:

Bullish: Hold above $108K maintains ATH potential

Bearish: Failure to consolidate above $115.3K opens downside risk to 110k

Let the market confirm its direction first

BTCUSDT Expanded Flat Correction may be overBear with me (pun intended). I know I'll probably get some slack from the 5 wave correction counting of wave C. Most people would place the 3rd wave in June instead of May, but a few things suggest me that the 3rd wave down was actually in May:

This C wave lies at the 123.6% extension of wave A which is a common area for the Expanded Flat correction.

Volume and RSI printing a divergence

2M RSI just broke out of its falling wedge

BTCUSDT resiliance at the 19k level, in contrast with the current equity price action & general sentiment, which goes against the previous sell offs of April and June

All of the above considered, there's still something missing : that the C wave should hold RSI divergence between wave 3 and 5 at completion, which did not happen with this counting. Also BTC would not only have be above the 19.3k resistance of the 123.6% extension of wave A (which is being rejected @ the moment) as it would also need to break & retest that yellow trendline (hands tied with the faster EMA's) that is holding its price down. But where is the fun in posting ideas when all of the cards are on the table? =D

All I'm saying is that this correction is closer to its ending than the other way around, and what I'm suggesting is that I wouldn't be surprised if it would be already over.

DYOR. Not advice

#BTC enters neckline resistance zone📊#BTC enters neckline resistance zone⚠️

🧠From a structural perspective, we hit the daily neckline support and began to rebound. Unfortunately, it's about $170 away from the overlapping support zone I'm focused on, and the rebound didn't establish a 1-hour bullish structure. This suggests a high probability of encountering resistance and a pullback after this rebound. Therefore, don't chase the rally at the neckline resistance zone! Only if we can break through the neckline resistance zone and stabilize for a day or so should we actively consider a bullish move.

➡️Support is clearly around 120,000. Even if it falls below this level, as long as the 4-hour closing price is above it, this support level will remain valid. Extreme support is still around 110,000!

🤜If you like my analysis, please like 💖 and share 💬

BITGET:BTCUSDT.P

$BINANCE:BTCUSDT Needs a Clean Break Above $117,000The BINANCE:BTCUSDT pair has shown a mild bounce over the past 24 hours, now trading around $114,000. But zoom out, and the weekly performance still shows a nearly 4% dip, raising the question of whether this bounce has real legs or is just noise.

From a long-term holder perspective, on-chain selling pressure has been easing. Data from spent output bands shows that older wallets, particularly those holding BTC for 7–10 years, were active between July 23 and August 1.

However, the extent of selling was notably lower compared to the earlier July 10–19 stretch, when BINANCE:BTCUSDT dropped from $ 123,000 to $ 117,000. Even during this recent distribution phase, BTC managed to hold above $113,000, indicating strong market absorption and reduced overhead pressure.

Valuation-wise, the MVRV (Market Value to Realized Value) ratio currently sits at 2.19. Historically, this zone has acted as a reliable launchpad for Bitcoin rallies. Back in June, a similar reading of 2.16 preceded a move from $101,000 to $110,000. And in April, a 2.12 print led to a surge toward $119000. Right now, BINANCE:BTCUSDT sits in the same zone, supported by a quiet shift in trader sentiment. The long/short ratio flipped from a bearish 0.89 to 1.02, indicating more traders are finally betting on the upside.

From a price action standpoint, BINANCE:BTCUSDT needs to make a decisive move. It is currently holding above the 0.382 Fibonacci retracement level at $113,600. This level is derived from the June low of $ 98,000 to the all-time high of $ 123,000.

The next visible support levels sit at $111,900 and $110,000, while $107,000 remains the invalidation zone for any bullish thesis. However, the true pivot remains $ 117,000; a level marked by historical significance, volume clusters, and failed breakouts. Unless BINANCE:BTCUSDT clears and holds above $117,000, the broader uptrend remains vulnerable to yet another failed rally attempt.

04/08/25 Weekly OutlookLast weeks high: $119,809.82

Last weeks low: $111,917.76

Midpoint: $115,863.79

First net outflow for BTC in seven weeks (-$643m) following the FOMC data release and also month end. Yet again no change by the FED but the chances of Septembers FOMC giving us a rate cut has drastically increased, currently at a 78.5% chance of a 25Bps cut.

Month end usually gives us a pullback/sell-off as larger institutions window dress which often includes de-risking somewhat. We saw this last Thursday combined with the weekends typical lower volume has resulted in quite a significant correction for BTC. Altcoins have down the same as many assets reject from HTF resistance areas, the correction has been on the cards and isn't too worrying on the face of it.

What I would say is August seasonality is generally not a bullish month and so expecting price to rebound and extend the rally would go against historical trends. I could see more of a ranging environment taking place for several weeks before any next leg up is possible.

This week I would like to see where altcoins find support and establish a trading range where some rotational setups tend to present themselves.

BTC Long Setup (Post-Liquidation Reclaim)Hey Candle Fam,

The weak hands just got flushed harder than a memecoin rug—perfect. While retail panicked on the dip, smart money was quietly filling bags near $114k. Now it’s our turn to strike with precision.

🔥 BTC Long Setup (Post-Liquidation Reclaim)

🎯 Entry: $114,390–$113,800

🛡️ Stop Loss: $111,900

💰 Targets: $121k / $130k / $140k

📊 Strategy: Liquidity Grab + Weekly Demand Tap

– HTF bias: Still bullish, above key $115k zone

– LTF confluence: Sweep of lows + CHoCH forming on 12H/1H

– Footprint data: Volume absorption + delta flip confirm buyer interest

⚠️ Caution:

Breakdown below $110k would invalidate this setup and likely trigger a strong bearish leg. This is not a “to the moon” YOLO.

Stick to your system, manage risk, and remove emotion.

🧠 Final Note:

We don’t chase dreams—we execute plans.

All the hours we spend studying this game? It’s not for fun. It’s for freedom.

Financial independence is the goal—this is the craft.

Candle Craft | Signal. Structure. Execution.

Analytics: Market Outlook and Predictions

📈 WHAT HAPPENED?

Last week, US President Donald Trump once again "shook up" the financial markets.

The report published by the White House was received positively and contributed to the recovery of the Bitcoin price. But soon after, new import duties were introduced, which changed the short-term trend of the first cryptocurrency to a downward one. Unfortunately, no one is immune to FUD.

The local minimum was recorded at $112,000, after which the price rebounded slightly, but didn’t reach the key zone of $110,000-$107,000 (accumulated volumes).

💼 WHAT WILL HAPPEN: OR NOT?

Currently, buyer activity remains weak, with significant volumes concentrated above the current price, and no active demand at the local lows. Another wave of sales is likely from the $115,000-$116,300 zone to the formed low of $112,000.

On the other hand, wave analysis shows the weakening of sellers. The market has already absorbed the last wave of sales, and there was a break on the hourly timeframe. With the growth of buying volumes, a rebound to the nearest volume resistance is possible. However, we’ll most likely not be able to do without strong sales, and we’re highly likely to see Bitcoin at $110,000.

Buy Zones:

$110,000–$107,000 (accumulated volume)

Sell Zones:

$117,600–$118,600 (accumulated volume)

$115,000–$116,300 (mirror volume zone)

📰 IMPORTANT DATES

Macroeconomic events that we’re following this week:

• Tuesday, August 5, 13:45 (UTC) — publication of the business activity index (PMI) in the US services sector for July;

• Tuesday, August 5, 14:00 (UTC) — publication of the US Non-Manufacturing Purchasing Managers' Index (ISM) for July;

• Thursday, August 7, 11:00 (UTC) — announcement of the UK interest rate decision for August;

• August 7, Thursday, 11:30 (UTC) — publication of the Bank of England's letter on UK inflation;

• August 7, Thursday, 12:30 (UTC) — publication of the number of initial jobless claims in the United States for August.

*This post is not a financial recommendation. Make decisions based on your own experience.

#analytics

BTC | Bitcoin - Weekly Recap & Gameplan - 03/08/25📈 Market Context:

Traders are currently anticipating a potential 0.25% rate cut at the September FOMC meeting, which continues to support the broader bullish outlook.

While the market pulled back following weaker-than-expected Non-Farm Payroll data, overall sentiment remains optimistic.

Greed has cooled off into a more neutral stance. Historically, August often brings some consolidation or pullbacks — but the structural bias for Bitcoin remains bullish.

🧾 Weekly Recap:

• After printing new all-time highs, BTC began a healthy retracement.

• Price action closely mirrored the Nasdaq's (NQ) pullback during the week.

• We saw a small bounce mid-week, but no strong reversal confirmation yet.

📌 Technical Outlook & Game Plan:

→ I’m watching for price to revisit the long-term bullish trendline.

→ A slight deviation into the HTF demand zone would be ideal for long entries.

→ Bonus confluence: This area also aligns with the 0.5 Fibonacci retracement (Equilibrium level), providing a key discount zone.

🎯 Setup Trigger:

I’ll be watching for a confirmed bullish break of structure (BOS) on the 1H–4H timeframes to signal a reversal.

On confirmation, I’ll look to enter a swing long position.

📋 Trade Management:

• Stoploss: Below the 1H–4H demand swing low

• Take Profit:

→ I’ll trail stops and lock in profits aggressively

→ Main target: $119,820

💬 Like, follow, and comment if this breakdown supports your trading! More setups and market insights coming soon — stay connected!

Smart Money Watching This Line — Are You?Bitcoin is holding strong above a key trendline that has acted as dynamic support since March. Every time price touched this line, buyers stepped in, and once again, it’s doing its job.

What was once resistance has now flipped into solid support. The recent pullback seems healthy, and the price is trying to bounce from the trendline area again.

As long as CRYPTOCAP:BTC respects this structure, the bullish momentum remains intact. If it holds, we could see another leg up from here.

DYOR, NFA

Thanks for reading!