USDTBTC trade ideas

Bitcoin: Pennant - Bullish Continuation PatternI spotted a bullish continuation pattern called Pennant in Bitcoin chart

Support and resistance are marked with yellow trendlines

There is also a Flag Pole (white trendline)

The model is clean as we already see a bullish breakup and a textbook pullback

to the broken resistance.

The target is established at the height of the Flag Pole applied to the broken resistance

at $135k.

For final confirmation the price should overcome the top of breakout at $119,800

The invalidation point is located at the bottom of the Pennant at $114,700

From Euphoria to Exhaustion – BTC's Next Move?BTC Idea – Bearish Divergence + Key Level Watch ⚠️

Summary / Bias:

BTC has tapped 120K and is now showing early signs of weakness. A bearish divergence on the MACD Histogram (weekly) is flashing caution, while price has retraced back to the critical 112K zone. I'm leaning bearish short-term, expecting a move towards 100K, and possibly as low as 93K, if key confirmations unfold.

Technical Context:

Weekly MACD Histogram shows a clear bearish divergence, signaling potential exhaustion.

BTC rejected from 120K and has pulled back to 112K.

Price crossed below the Yearly Camarilla L#, but we need a weekly close below to confirm further downside.

112K remains the key pivot – failure to bounce strongly here could open the door for deeper retracement.

Scenarios to Watch:

🟥 Bearish Continuation (Primary Bias)

Breakdown and close below 112K

Downside targets:

TP1: 100K

TP2: 93K

🟨 Neutralizing Risk

Hold above 112K with strong bounce = neutral bias, reassess

Close back above 115K+ with strength = invalidate bearish lean

Caution & Patience:

Now is not the time for aggressive longs. Signs of exhaustion + major level retest call for defensive positioning and high-quality setups only. Let confirmation guide entries.

NFA. Risk management always.

Will update if structure shifts.

BITCOIN TRADING IS 100% PROBABILITY,ANY KEY LEVEL IN THIS CHART CAN FAIL,pls manage your risk and build a strong mindset.

bitcoin is showing a bullish drive. If i retest the 123k level again and gets rejected we are selling down ,the structure has given us a clue on 135k and above possible upswing on sentiment ,this level represents the ascending trendline and a supply roof.

#btc #bitcoin #crypto #eth #sol

Bitcoin Turned Down — It Was Only a Matter of TimeBitcoin Turned Down — It Was Only a Matter of Time

When the price gets stuck at the top and can’t move higher, it’s always a reason to stop and think. BTC got stuck around $118,000, started to form long upper wicks, and the volume started to decline. All of this pointed to a classic case of fading bullish momentum.

At this point, my indicator gave several key signals: weakening buying power, a change in momentum, and the formation of a potential reversal zone. I refrained from opening long positions — and this decision turned out to be the right one. The price went down and is now trading around $114,000.

Next, I will wait for a retest of the imbalance zone and work from the reaction from this zone.

It is important to understand: this correction is not something unusual. This is a technically sound phase after a strong rally. The market gets rid of speculative positions, gets rid of excessive leverage and prepares for either a reset or a deeper correction.

The market has weakened predictably, and that's actually a good thing. When the structure becomes clear, we can trade with a plan rather than just following our gut instinct.

BITCOIN PREDICTION - MASSIVE CANDLE INCOMING!!! (WARNING) Watch this Bitcoin Prediction video now, you will love it!

Yello, Paradisers! Big warning sign: #Bitcoin is about to liquidate more traders soon if we get these confirmations that I'm sharing with you in this video. Loads of people will get wrecked again. Be careful not to get trapped into fakeouts.

In this video, I'm describing exactly what I'm seeing on Bitcoin, what patterns I'm waiting to form, and what confirmations I want to see before being able to say with 100% accuracy guaranteed that MARKETSCOM:BITCOIN is moving in that direction.

I'm sharing with you all the important targets and also how professional trading works: how risk-reward proper ratio trading works, and how high-probability trading depends a lot on how you choose to create your trades.

Watch this Bitcoin prediction to understand what I'm seeing right now on the chart and how I'm acting and making my decisions.

Btc just hit the 1.618 golden fib no analysis keep posted Keep posted if interested, i just cant show it right now i want to have million of confirmation that it is accurate but i plotted it just right it really just hit it in red cherry just like in game of darts keep posted how i unfold it in coming months/years, it is still the same asset we know the only thing thats different is btc just trying hard to mimic the past moves but its clear as day that its shorthanded in terms of market capitalization. 🥏🐝✅✅..

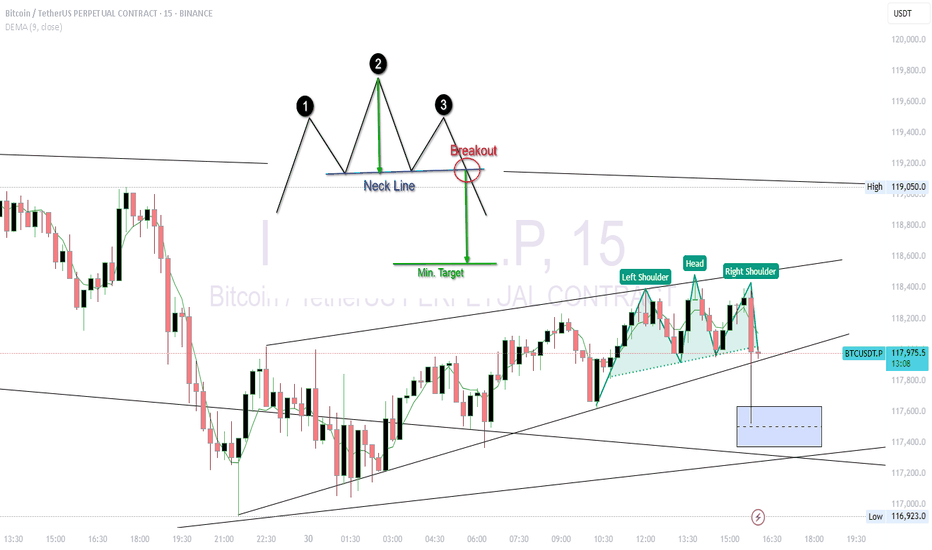

BTC USDT Forming Head and shoulder in 5 MinChart Breakdown

🟢 Pattern:

Left Shoulder: 118,450

Head: ~118,600

Right Shoulder: ~118,400

Neckline: Sloping slightly upward, around 118,050

📌 Bearish Breakdown Scenario

If BTC breaks below the neckline (~118,000) with volume, the expected drop (measured move) is:

Height of pattern:

Head (118,600) – Neckline (118,000) = 600 pts

Target on breakdown:

118,000 – 600 = ~117,400

🔻 Target: 117,400–117,300

🔒 Invalidation: Price closes above 118,300 with strong volume.

BTC Long Setup (Post-Liquidation Reclaim)Hey Candle Fam,

The weak hands just got flushed harder than a memecoin rug—perfect. While retail panicked on the dip, smart money was quietly filling bags near $114k. Now it’s our turn to strike with precision.

🔥 BTC Long Setup (Post-Liquidation Reclaim)

🎯 Entry: $114,390–$113,800

🛡️ Stop Loss: $111,900

💰 Targets: $121k / $130k / $140k

📊 Strategy: Liquidity Grab + Weekly Demand Tap

– HTF bias: Still bullish, above key $115k zone

– LTF confluence: Sweep of lows + CHoCH forming on 12H/1H

– Footprint data: Volume absorption + delta flip confirm buyer interest

⚠️ Caution:

Breakdown below $110k would invalidate this setup and likely trigger a strong bearish leg. This is not a “to the moon” YOLO.

Stick to your system, manage risk, and remove emotion.

🧠 Final Note:

We don’t chase dreams—we execute plans.

All the hours we spend studying this game? It’s not for fun. It’s for freedom.

Financial independence is the goal—this is the craft.

Candle Craft | Signal. Structure. Execution.

Possible run to 130 in the cardsEasily invalidated.

We are using the patterns from the price action post threshold break (redline in bottom pane)

These breaks are unseen on this time frame

The volume instabilities are between the 15 minute and the 1 hour. I would look for breaks under 15 minutes, too much noise at that level. Go ahead and test it yourself. See my script posted on trading view for details.

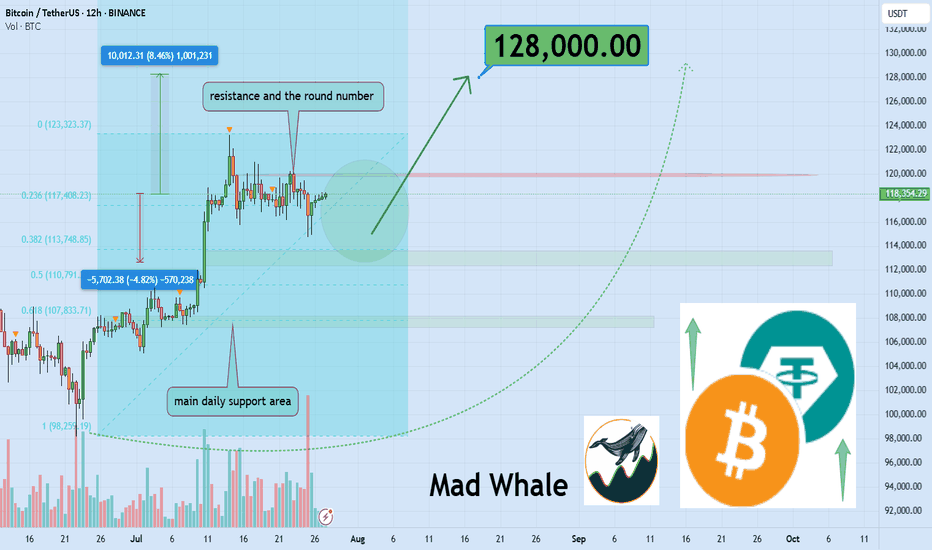

Bitcoin Price Outlook: Bull Flag Pattern Hints at Potential BreaBTC price Outlook: Bull Flag Pattern Hints at Potential Breakout Toward $129K

The local format of the corridor is interrupted by a wide, stronger one, based on which one can conclude about a rebound, and it is quite possible that this will happen tomorrow, during the opening of markets and trading

Also on the local BTC chart, this figure forms an incompletely formed "Bullish Flag" pattern, which also indicates growth

Also, this scenario does not contradict my previous analysis, where a global "Head and Shoulders" pattern is emerging on a 5-year time frame

Current price: $114.227

Expected according to the local scenario $123k and the price according to the global "Head and Shoulders" pattern remains within the same limits of $124k or $129k

Low probability of breaking through the $112k level, since this mark is the bottom of the ascending corridor

This analysis is based on the technical pattern and also incorporates AI to provide more accurate results.

BTCUSDT – Key Support Holding! Next Targets if 115,827 BreaksBitcoin is currently holding above a crucial support zone around 115,220. After a recent drop to the 114,979 area, buyers stepped in strongly, preventing further downside.

📊 If price stabilizes above 115,220 and successfully breaks through the resistance at 115,827, I expect bullish continuation towards the following targets:

🎯 Target 1: 117,900

🎯 Target 2: 119,076

These zones acted as strong resistances previously, and breaking through them could open the path to further upside.

⚠️ However, if BTC closes below 114,500, we may see a bearish breakdown with potential downside towards 108,000 – 106,000 range.

📌 Personally, I hope Bitcoin holds this support as it’s a key level to maintain bullish momentum.

Let’s see how the market reacts in the next few candles! BINANCE:BTCUSDT

BTC – Still looking heavy below key resistanceDespite a short-term relief bounce after Monday’s drop, BTC remains below the critical 1D MSS + S/R (red box). Structure is weak until this level is reclaimed. Bears remain in control as long as price can’t close above 115.7k.

Plan:

Maintain bearish bias while below the red box — expecting new lows, targeting the green demand/OB cluster around 108.3k.

Flip the red box (close above 115.7k) and the outlook shifts to neutral or bullish.

Have been warned multiple times....BTC will FALL on retailersBTC has been consolidating at the top for a while, which is not very common. Have a feeling that crypto bros have been getting the scratch for more profit taking, but no sensible person will keep buying at the top when the market is already WAY overheated. Picked up early UltraBear signal on this, don't be the person holding to the bag for years. This bubble will burst, just like every other time! Always do your own due diligence, stay safe and get out if you can....

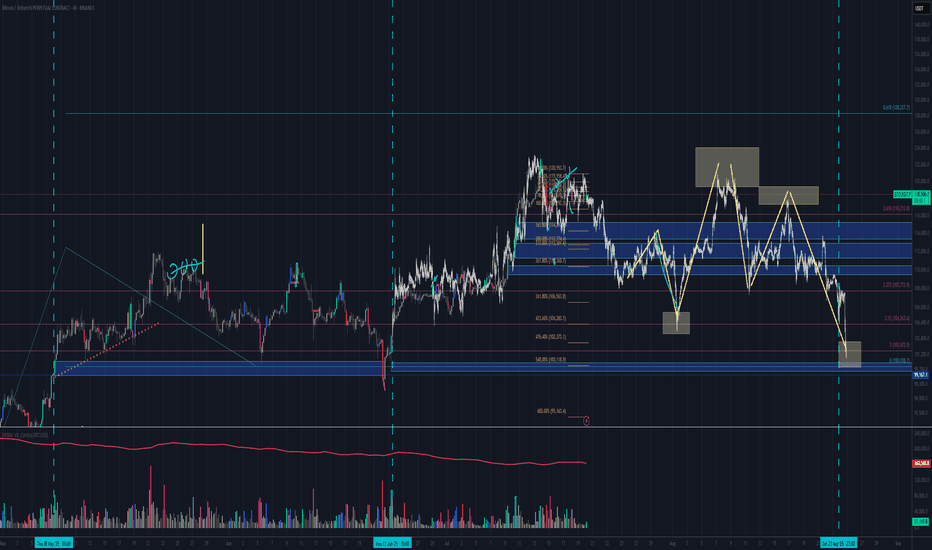

Bitcoin BTC price analysis by the end of 2025🕯 July is coming to an end, with 3 weeks of OKX:BTCUSDT consolidation between $117k–121k.

Tomorrow begins the last month of summer — and it promises to be "hot" as, according to our earlier published calendar Trump's administration plans to send letters with new, increased tariffs to "all countries" on 01.08.

💰 Also, take a look at Bitcoin Monthly Returns. In our view, 2025 resembles 2020 the most.

What do you think?

👉 According to this dynamic, the real "hot" may come not in summer, but late autumn.

💰 We've also tried to find a price fractal for #BTCUSD that fits the current structure — and for now, it looks plausible:

◆ In the coming days, CRYPTOCAP:BTC should not rise above $121k.

◆ A low of correction might hit mid-September around $93k.

◆ A cycle top for #BTC could arrive to the end of 2025, near $147k.

📄 Now that you've seen our version — share your forecasts on future #BTCUSDC price action in the comments 👇

Bitcoin Correction Maturing – Long Setup Brewing!Bitcoin ( BINANCE:BTCUSDT ) has fallen by more than -4% over the past day.

Let's take a look at the reasons for the decline.

One of the key reasons behind Bitcoin’s decline in the past 24 hours ( July 25 ) could be the reduced likelihood of Jerome Powell being replaced as Chair of the Federal Reserve.

In recent days, market participants were speculating that Donald Trump might replace Powell — a scenario that was considered bullish for risk assets like Bitcoin. However, recent reports of a meeting between Trump and Powell, and signs that Powell might not be dismissed, have weakened this fundamental narrative.

This meeting may signal a truce or reduced tension between Trump’s team and Powell , which could imply a continuation of current Fed policies. That’s bad news for Bitcoin, as it removes a potential psychological tailwind from the market and dampens speculative sentiment.

As a result:

Over $500 million in liquidations(Long Positions) occurred

Weak inflows into Bitcoin ETFs

A stronger U.S. Dollar Index ( TVC:DXY )

And declining Gold( OANDA:XAUUSD ) prices over the past two days

all added additional selling pressure on BTC. Now let's take a look at Bitcoin's conditions on the 4-hour time frame .

Bitcoin currently appears to have broken the Support zone($116,900-$115,730) , Support lines , 100_SMA(4-hour TF) , and the lower line of the Symmetrical Triangle Pattern with a bearish Marubozu candle .

Note : In general, trading was difficult when Bitcoin was inside a symmetrical triangle (about 10 days).

It also seems that the pullback to these zones has ended and Bitcoin is waiting for the next decline .

In terms of Elliott Wave theory , Bitcoin appears to be completing microwave 5 of microwave C of major wave 4 . There is a possibility that main wave 4 will create a descending channel and complete at the bottom of the descending channel (at Potential Reversal Zone(PRZ) ).

I expect Bitcoin to start rising again after completing the CME Gap($115,060-$114,947) from Cumulative Long Liquidation Leverage($114,480-$114,000) or Cumulative Long Liquidation Leverage($113,284-$112,603) near the PRZ and Heavy Support zone($111,980-$105,820) .

Cumulative Short Liquidation Leverage: $117,904-$116,665

Cumulative Short Liquidation Leverage: $121,046-$119,761

Do you think Bitcoin has entered a major correction, or does it still have a chance to create a new ATH?

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Why Everyone’s Stop Loss Gets Liquidated?!!...Why does your stop loss always get hit first?

Is it possible that everyone else placed theirs exactly where you did?

Maybe it's time to face an uncomfortable truth about the market and crowd psychology.

Hello✌️

Spend 3 minutes ⏰ reading this educational material.

🎯 Analytical Insight on Bitcoin:

BINANCE:BTCUSDT has established a well-defined range in this zone, triggering multiple stop hunts and now approaching a fresh daily resistance. A confirmed breakout above this level could open the door for an 8% upside move toward the 128,000 area. 📈🧠

Now , let's dive into the educational section,

🎯 Crowd Psychology: The Fixed Target of the Market

In crypto markets, when everyone thinks the same, they tend to lose the same way. One of the clearest signs of this is where stop losses are placed. When a level becomes too obvious to too many traders, it becomes a magnet for liquidity hunters.

Public stop losses are usually placed right below obvious lows or above clear highs. These are areas that everyone has mentally marked as strong support or resistance. Ironically, that’s exactly where a sudden wick appears, takes out stops, and then the market goes right back in the original direction.

🧠 Your Brain Wants Safety, The Market Wants Liquidity

New traders search for “safe” places to hide their stops. That very logic makes those places unsafe. The market needs liquidity to move, and the most liquidity sits right where people feel safe placing their stops.

Remember: stop losses are actual market orders, buy or sell triggers. When yours gets hit, someone else enters a position. Your loss is their entry. This is a zero-sum game.

🐋 Whale Activity Before the Trap

Ever noticed how, just before your stop gets hit, there’s a small move in the opposite direction? That’s bait. Right after, a strong wick sweeps through, takes out public stops, then reverses. It’s not an accident. It’s planned.

If you observe these small shifts with suspicion rather than trust, you’ll often catch the trap before it happens.

💡 Your Trigger Shouldn't Be Where Everyone Else Sets It

There’s a smarter way to manage your stops, ways that avoid the obvious traps:

Use ATR to dynamically calculate distance

Place stops based on candle structure, not just price levels

Wait for confirmed reversal patterns before setting stops

Consider mental stops based on invalidation logic, not fixed price points

⛔️ Blind Trust in Repeated Zones

When a support or resistance level holds multiple times, people begin to trust it blindly. That collective trust becomes a weakness. The market doesn’t respect obvious levels, it exploits them.

If you see it, everyone else sees it. And so does the market. But the market plays a different game. You seek safety, it seeks liquidity.

🎲 Is It Really Your Fault?

Many traders blame themselves when their stop gets hit. The truth? You’re not the problem, your thinking pattern is. Most traders make the same decisions because they learned the same textbook strategies. That’s what makes their stops predictable.

It’s not always about poor analysis. Sometimes, it’s just about being part of the herd.

📉 Practical TradingView Tools to Track Public Stop Zones

Here are a few powerful TradingView tools and indicators you can use to figure out where stop loss clusters are likely hiding. Use them together for better accuracy:

Session Volume (Fixed Range)

Apply this tool to recent ranges or high-volatility zones. Peaks in volume often reveal where most traders are entering or exiting, which means stops are likely nearby.

Liquidity Pools Finder

This indicator estimates areas with potential liquidity pools. These are often the next targets for large moves.

Horizontal Ray or Box Tool

Use these to mark the areas just above highs and below lows. These zones are where most public stops typically sit.

Fair Value Gap (FVG)

Gaps in price action can act as magnets. It's no coincidence that public stops often get hit in these areas during fakeouts or trap moves.

📌 Final Thoughts

When everyone looks at the same level, the market attacks it. Public stop losses are a primary fuel source for liquidity-based moves. Use TradingView tools, train your eye, and place your stops where no one else dares. That’s how you stay out of the trap.

✅ Wrap-Up

If your stop always gets hit right before the big move, it’s not a coincidence, it’s a mindset issue. Stop thinking like the crowd, and the market will stop treating you like one.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

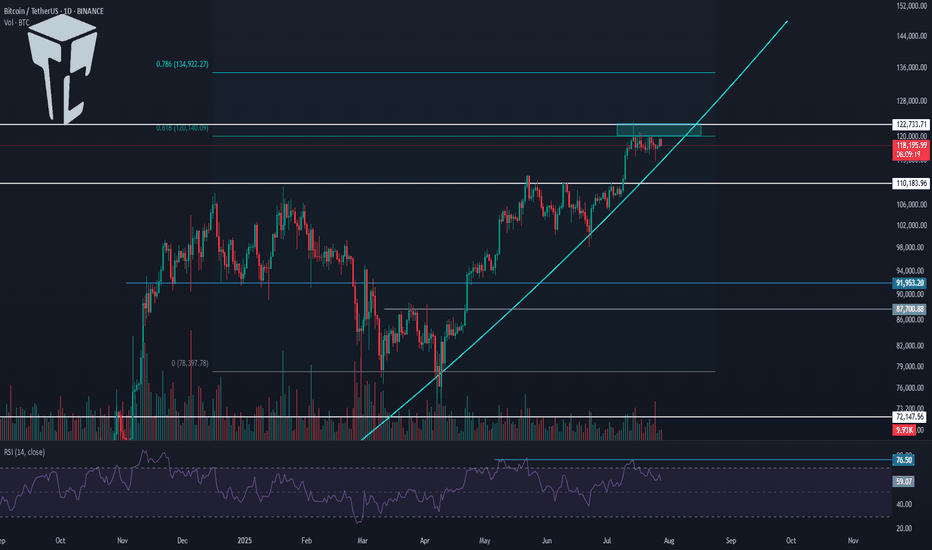

TradeCityPro | Bitcoin Daily Analysis #138👋 Welcome to TradeCity Pro!

Let’s get into the Bitcoin analysis. Today is the start of the week, and it’s very important to begin our trading week with the right analysis and outlook.

📅 Daily Timeframe

On the daily timeframe, as you can see, not much has changed compared to the previous analysis, and the price is still ranging near the supply zone.

✔️ The fact that no price correction has occurred so far shows the strength of the buyers, and even if a correction does happen, as long as the price stays above 110183, the trend will still be considered bullish.

🧩 The main trigger for trend continuation is either the price reaction to the curved trendline or the break of 122733. We can find more optimal triggers in the lower timeframes.

⏳ 4-Hour Timeframe

In this 4-hour timeframe, after a fakeout below 116829, the price corrected down to the 0.5 Fibonacci level and now has returned again to the box between 116829 and 120041.

🔍 The fakeout trigger is 120041, and I’ll try to have at least two positions open in the market when this level breaks — whether on Bitcoin or altcoins.

📈 The main trigger for the next bullish leg is 122733.

If RSI also breaks the 61.67 resistance alongside 120041, the likelihood of the move continuing will increase.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.