USDTHB trade ideas

USD/THB 1H Chart: Bears expected to prevailThe US Dollar has been trading in an ascending channel against the Thai Baht for the last two months. This has guided the pair from its 2014/2018 low of 31.10 towards the 61.80% Fibonacci retracement at 32.20.

From theoretical point of view, the pair has failed to form a new high this week which might be an early indication of a new wave down. In case the senior channel and the 200-hour SMA are breached at 31.97, the Greenback is likely to depreciate even further down to the 38.20% Fibo.

Given that these retracement lines have worked effectively at reversing the pair during the last week, it is likely that the pair continues respecting this junior channel and therefore reverses back to the upside. The general direction should nevertheless remain south.

Meanwhile, there is still some upside potential in the market that could result in a test of the monthly R3 at 32.30 within the remaining part of this week.

USD/THB Breaks long term SMAsThere is something about the USD/THB pair that you can observe only by changing the time frames of the charts while having set up them to show the 200-period simple moving average.

Namely, the most important is the fact that the currency exchange rate has passed the 200-day SMA, which has kept the pair lower since the start of 2017. In addition, the four hour time frame 200-period simple moving average has recently been broken.

As a result of these moves in a combination with the passing of the weekly R1, the rate began a surge. The surge is set to be paused by a monthly pivot point at 31.30. However, above that there is almost nothing until 31.40.

USD/THB: Recovery coming...The near term chart shows all signs of a bullish breakout. Clearing 31.303 triggers a new (intraday) uptrend towards 31.54, 31.81 and perhaps a tat higher. Such a rally is nevertheless classified as a counter trend rally within the longer term down trend. moreover, it will be the first noteworthy recovery since the down trend commenced in Q4-2016<>Q1-2017. Weekly resistance levels come in at 31.58, 31.91 up to 32.30.

So despite the significant upside potential the overall trend remains negative for the USD. Buying is justifiable but with elevated risk; no certainty that the projections will me reached and trading against the main trend. So much needs to be done to change the long term trend that we won't go into that now.

Near term trend: neutral (positive > 31.303

Long term trend: negative

Outlook: recovery likely

Strategy: exit-short and/or trading-buy

Support: 31.107 / 30.858*

Resistance: 31.303 / 31.54 / 31.58 / 31.91 / 32.30+

Outlook cancelled/neutralized: below 31.107

Short opportunity on the Thai.Price has tested Weekly supply, Over exceeded demand, Producing Daily supply,

Price coming up to Daily supply, I'm looking to short here.

Limit order placed based on 3 timeframe analysis. If it hits my SL, I can always re entry as long as there is sign of sellers.

If you are applying Supply & Demand methodology in your trading plan, or mere interest,

Be sure to follow me on Tradingview and share your views.

USD/THB 4H Chart: Breakout form triangle USD/THB 4H Chart: Breakout form triangle

The American Dollar was trading against the Thai Baht in a two-week long symmetrical triangle. In result of the previous trading session the currency rate made a breakout to the bottom. The bearish movement is not evident yet. Nevertheless, the slipping 55- and 100-period SMAs together with the weekly PP suggest that sudden surge is unlikely.

However, in larger perspective the soar is expected to continue, as in the end of November the pair made a rebound from the lower trend-line of a four-month long descending channel. An upcoming decision on the US interest rate hike as well as growing economy also point out in favour of further appreciation of the buck.

To certain extent, market sentiment confirms this assumption, as 72% of traders are bullish on pair. However, such common view might be also a signal of the upcoming turnaround.

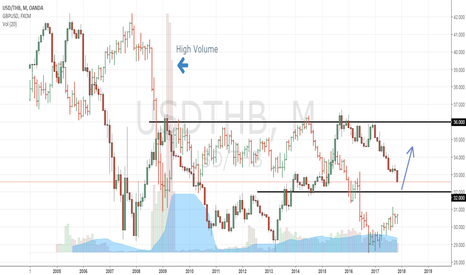

Sawadee Khrup - USDTHBThai baht has been very strong against the USD. It has appreciated more than 11% to its current price. Now it sits at the 50% FIB level and possibly there might be a retracement or it could heads further south to 61.8 FIB level before rebound.

Watch the wedge pattern breakout and be careful of false breakout. Take a small position and accumulate slowly if unsure, always use SL and manage your trade. Best of luck !

The best trading time for each pair of currenciesThe foreign exchange market operates around the clock, so it is impossible for a trader to track every market and seize every opportunity.

In forex trading, time is everything.

In order to design an efficient and timely investment strategy, it is necessary to record the market for 24 consecutive hours of trading, so that traders in their own trading hours, to seize the maximum trading opportunities.

If you know a certain currency in which time period will be the largest or smallest amplitude, there is no doubt that the trader will help to better allocation of capital, improve investment efficiency.

Asia‘s foreign exchange transactions are carried out in the central financial district.

Tokyo is the most important trading center, it is the first opening of the Asian market, many large participants often its trading volume as a benchmark to evaluate the dynamic change of the market, and to develop the corresponding trading strategies.

For investors who can withstand greater risk, G/J, U/J is a very good choice, because they are more volatility , short-term traders can get more profitable opportunities.

Day traders in Asia market position, waiting for the European market opening