USDTRY trade ideas

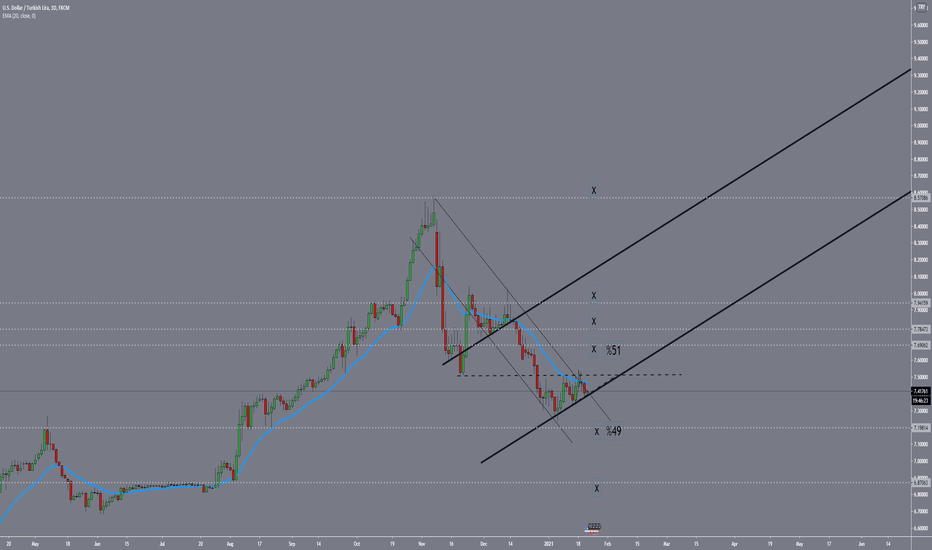

Turkish lira to break long term depreciation trendIt is pretty debatable but lira may hit an ATH or at least lira had a local top. The fundamentals are bleak or against the lira but US dollar's depreciation has a limited impact on the trend.

Moreover, Wyckoff's schematics, in particular distribution, supports the idea.

7.15 will be a quite important support. 6.07 and 5.12 will then be important levels to follow.

USDTRY Gearing Up For Another Impulsive Move?USDTRY has not been shy when it comes to showing off its linear trends as we witnessed staggering

growth of 89% in 2018 and 44% in one month alone in August 2018 reaching a high of 7.0831.

Price consolidated for 2 years after that and broke out in August 2020 and went on to trend to a

high of 8.5777. Price then went on a decline and is currently sitting at a cluster of support in the

form of a previous resistance level turned support at 7.2682 and the daily 200 simple moving average.

Price is currently walking up the 200sma and if this level continues to hold as support then we should

eventually see the bulls force price back up to continue the trend.

USDTRY does reward investors that have patience as the trends, once they come, usually arrives with

force and delivers fast and healthy profits.

We will continue to monitor this forex pair to see how price reacts to its current support base.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

Stable Central Banks, Turkish Lira and US Data

Yesterday can be called the day of the Central Banks: Bank of Japan, ECB and even the Bank of Turkey. Since all the above-listed central banks left their monetary policy parameters unchanged (as the markets expected), we did not see any serious price movements yesterday.

In general, oddly enough, the main intrigue was around the Bank of Turkey. The fact is that Erdogan is very dissatisfied with the current high rates of the Central Bank (17%) and has repeatedly stated the need to reduce them. But the Bank of Turkey demonstrated de facto independence and left 17% in the game. This means that the Turkish lira continues to remain extremely attractive from the position of carry trade. So sell USDTRY looks like a potentially very attractive trade.

A bunch of data were published yesterday related to the US labor and housing markets. Initial jobless claims were slightly better than forecasts and the previous value. But in general, 900K is a lot. More than three times higher than pre-pandemic levels: a quick economic recovery and V-shape as they are.

Meanwhile, Biden's optimism in the financial markets has subsided somewhat. The fuse lasted just a couple of days.

The oil market is also consolidating on the top. The data on oil stocks from the API showed unexpected growth, which puzzled buyers. However, who cares now about the real situation in the oil market, when $1.9 trillion are looming on the horizon.