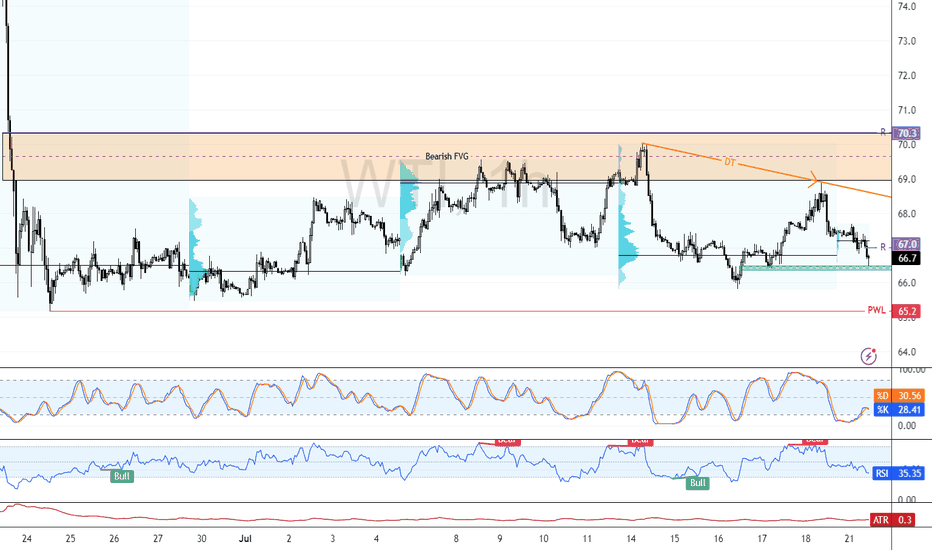

WTI Oil H4 | Rising into a pullback resistanceWTI oil (USOIL) is rising towards a pullback resistance and could potentially reverse off this level to drop lower.

Sell entry is at 70.04 which is a pullback resistance.

Stop loss is at 72.70 which is a level that sits above the 61.8% Fibonacci retracement and a pullback resistance.

Take profit is at 65.91 which is an overlap support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USDWTI trade ideas

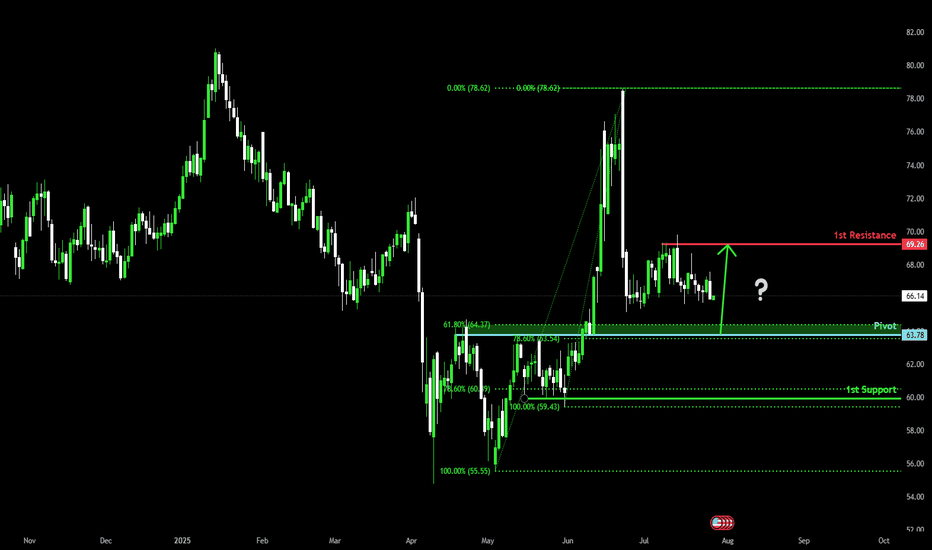

Bullish bounce off pullback support?WTI Oil (XTI/USD) is falling towards the pivot, which has been identified as a pullback support and could bounce to the 1st resistance.

Pivot: 63.78

1st Support: 59.94

1st Resistance: 69.26

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

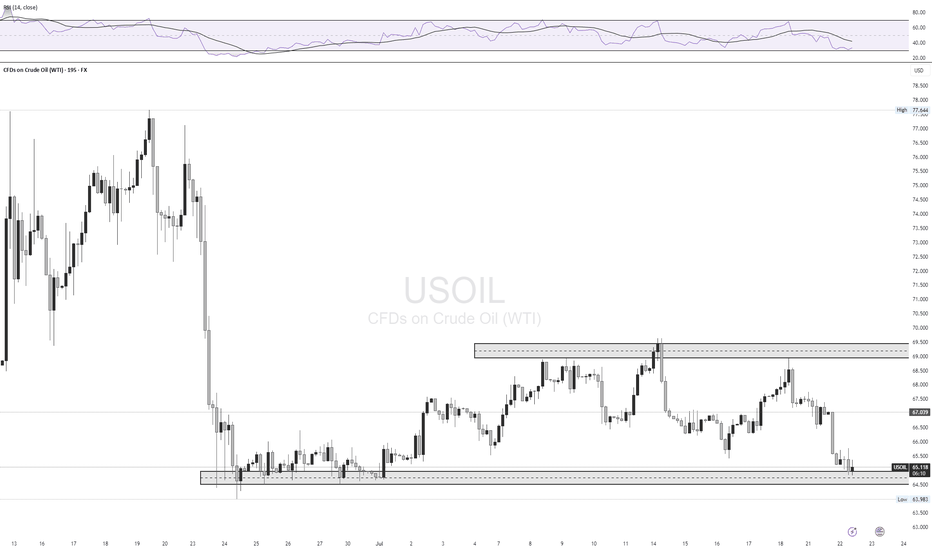

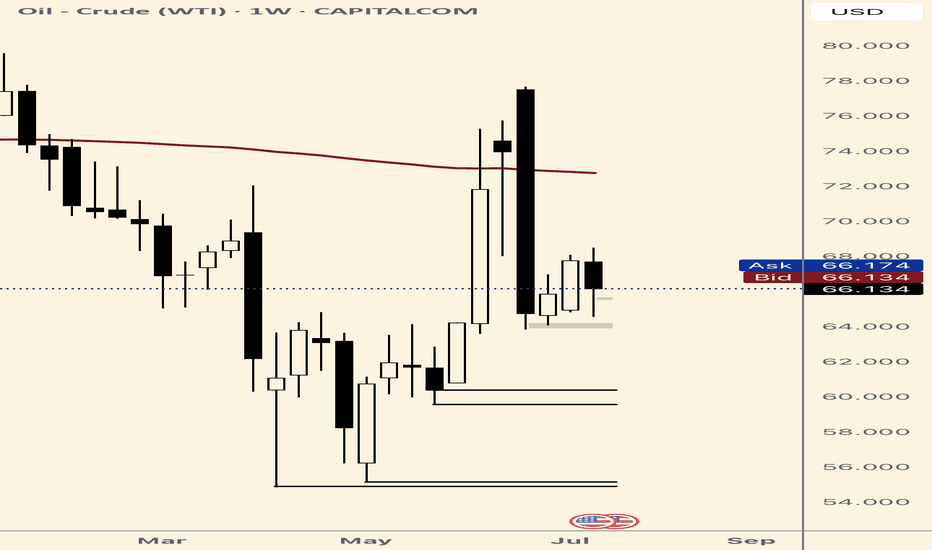

OILUSD Range Between 60–64.26 – Will Support Hold or Break?WTI Crude has been in a sideways range after the sharp drop in early April. Price recently tested resistance at 64.260 but failed to break higher, pulling back into the 60.000 support zone. This level has held multiple times, forming a key pivot.

Support at: 60.000 🔽, 55.931 🔽

Resistance at: 64.260 🔼, 67.000 🔼, 71.101 🔼

🔎 Bias:

🔼 Bullish: A strong rejection from the 60.000 zone followed by a breakout above 64.260.

🔽 Bearish: A daily/12H close below 60.000 opens the path to retest 55.931, and potentially lower.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

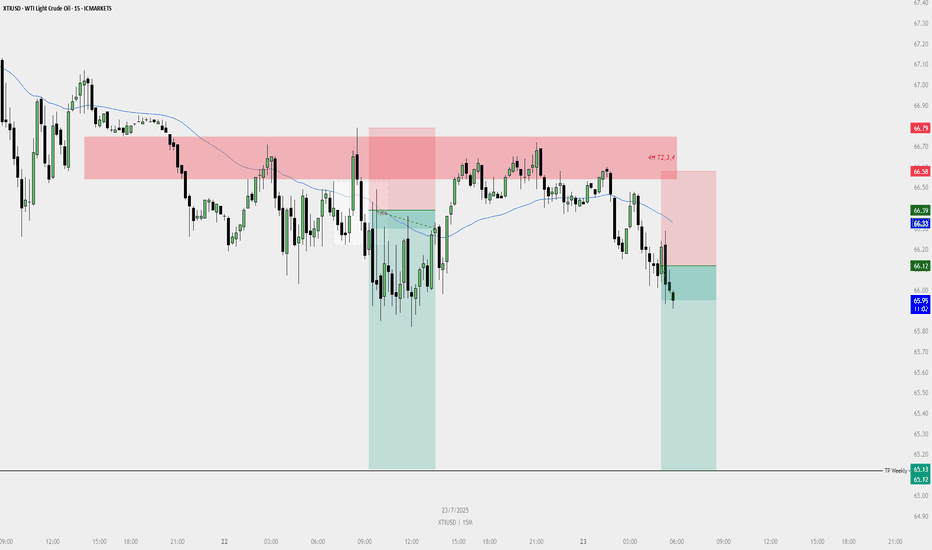

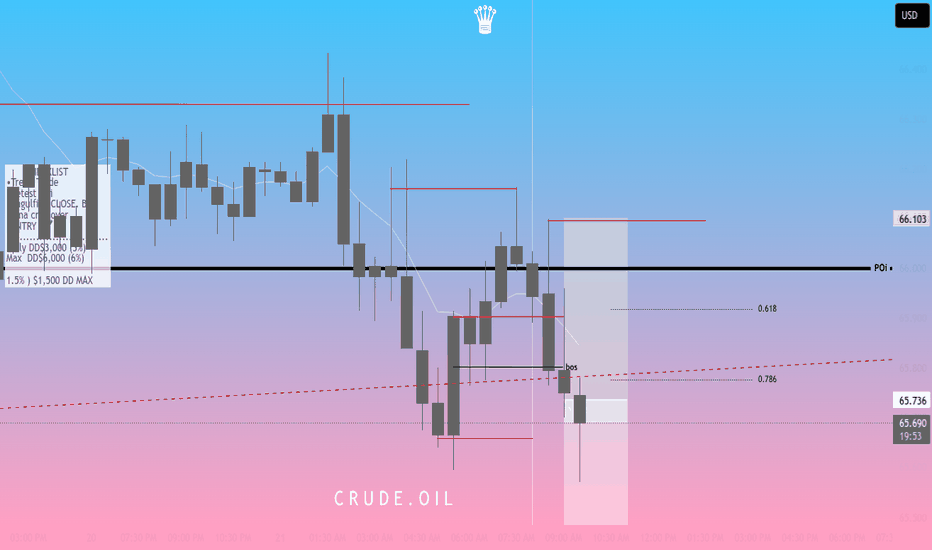

SELL PLAN – XTIUSD (15M)📉 SELL PLAN – XTIUSD (15M)

🗓️ Date: 23 July 2025

⏱️ Timeframe: 15-Minute

🔍 Context & Reasoning:

HTF Supply Zone (Red Zone)

Price entered the red HTF zone (noted as “4H T2,3,4”) and showed rejection.

This zone aligns with potential 4H Fair Value Gaps / Supply.

Sweep & Rejection

Liquidity sweep above previous highs followed by immediate bearish reaction.

Entry Confirmation

Bearish engulfing candle formed inside the HTF zone.

Price closed below 15M EMA (blue line) showing bearish momentum.

Dealing Range Valid

DR formed after rejection of the HTF zone.

Short-term bullish FVG created and violated.

Bearish FVG confirms continuation.

🎯 Entry Details:

Entry Price: ~66.12

Stop Loss: ~66.58 (Above HTF rejection zone)

Take Profit: ~65.12 (Near Weekly TP level)

🧠 Confluences:

Rejection from 4H Supply

Price closed below EMA

Clear swing failure / liquidity grab

DR confirmation on 15M

Multiple FVGs and breaker structure supporting the move

📌 Risk Management:

Risk-to-Reward: 1:2+

Risk per trade: Max 1%

If in drawdown: Use 0.5%

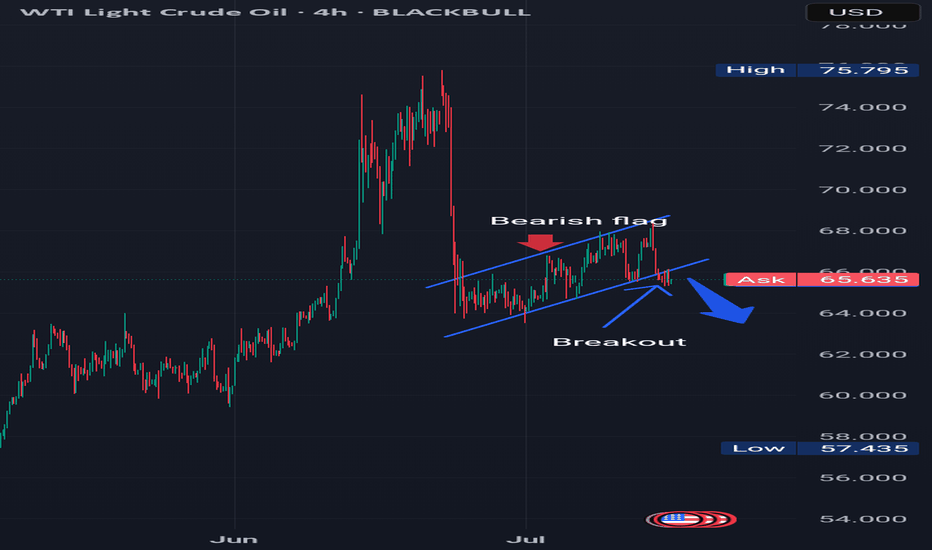

Oil Bulls Watch $67.0 for Breakout ConfirmationFenzoFx—Crude Oil trades slightly above the bullish FVG at $66.5, showing sideways momentum on the 1-hour chart. The $65.5 support is backed by volume interest and could drive prices higher.

If this level holds, bulls may target a retest of the descending trendline. For confirmation, a close above the $67.0 resistance is needed.

Please note that a close below $66.5 would invalidate the bullish outlook.

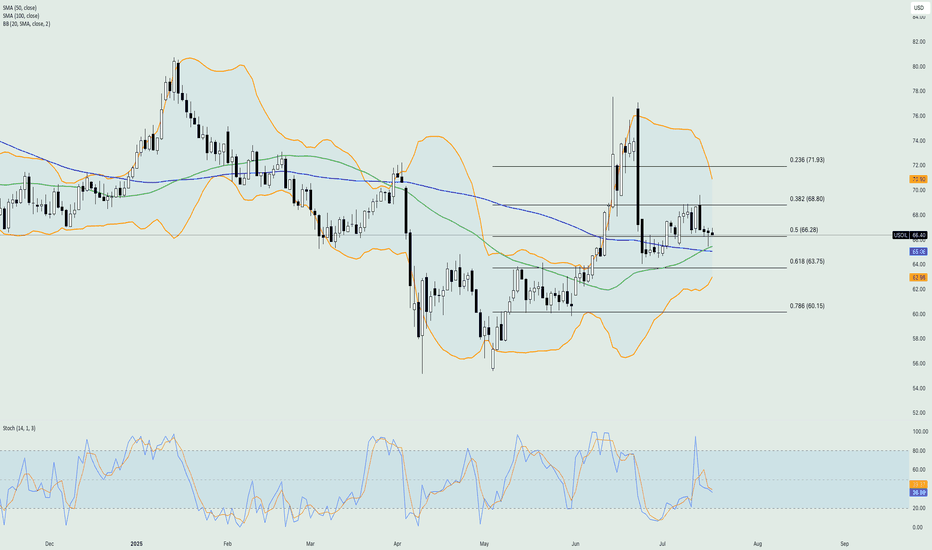

Crude Oil -DAILY- 21.07.2025Oil prices were steady after their first weekly decline this month, as attention shifted to U.S. trade negotiations and the European Union’s push to tighten restrictions on Russian energy exports. The EU is preparing new sanctions, including a lower price cap on Russian crude, limits on fuel refined from Russian oil, banking restrictions, and bans targeting an Indian refinery and Chinese firms. Despite western sanctions, Russian oil continues flowing to China and India. Meanwhile, diesel margins in Europe remain strong, signaling tight supply.

On the technical side, the price of crude oil has failed to break below the major technical support area, which consists of the 50-day simple moving average and the 50% of the weekly Fibonacci retracement level. The Stochastic oscillator has been in the neutral level since last week hinting that there is potential for the price to move to either direction in the near short term. On the other hand, the Bollinger bands have contracted rather massively showing that volatility has dried up therefore, the recent sideways movement might extend in the upcoming sessions.

Disclaimer: The opinions in this article are personal to the writer and do not reflect those of Exness

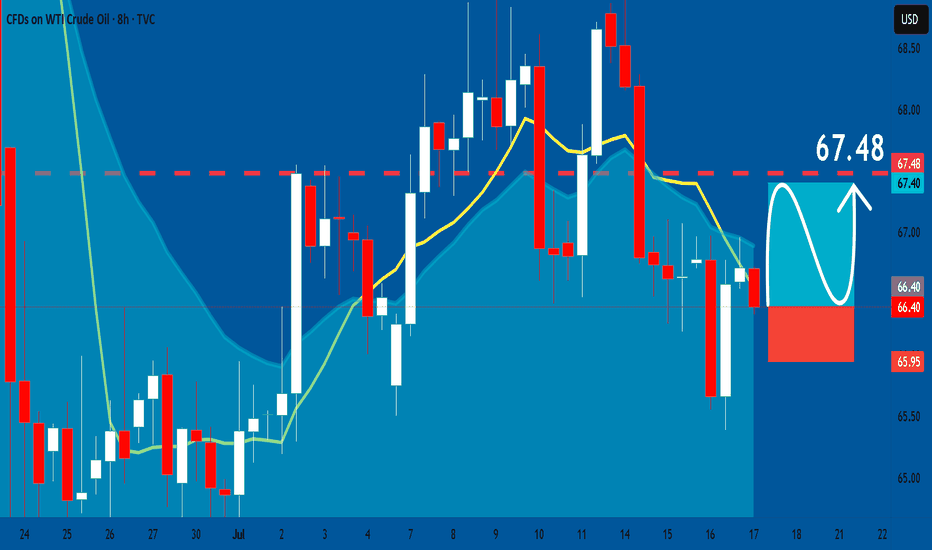

USOIL: Bullish Continuation & Long Trade

USOIL

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy USOIL

Entry - 66.40

Stop - 65.95

Take - 67.48

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Crude fall - short termI am anticipating crude to fall these marked levels because:

1. Strong Opening Gap which usually closes after some time

2. Liquidity levels are at the same place as the Opening Gap.

3. Oil price has to fallback a bit more and consolidate a bit more to have a healthy patterns to rise until potential 90.

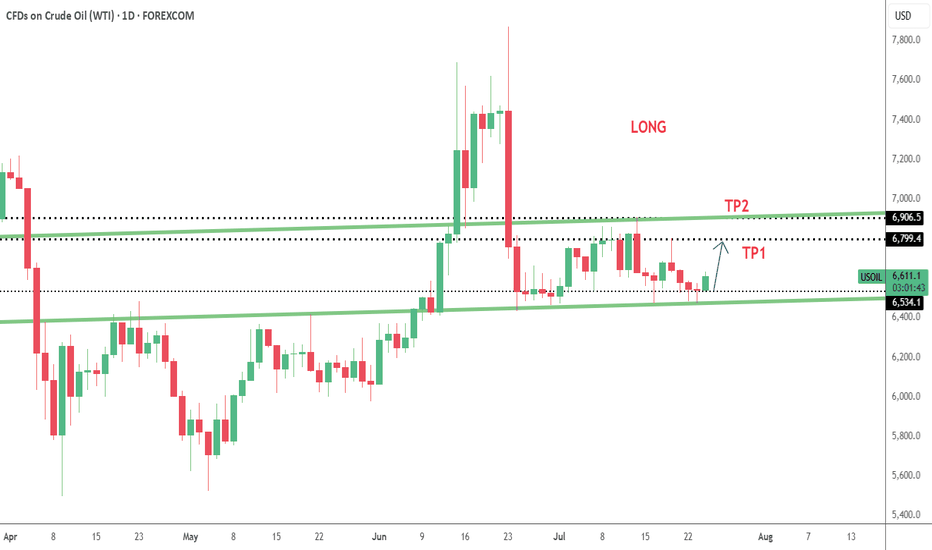

break above 6866.1 may push prices toward the second resistance break above 6866.1 may push prices toward the second resistance at 6911.3 (TP2).

Confirmation of bullish continuation would occur if price closes above 6981.0 on a 4H or daily chart.

Volume and momentum indicators should be monitored near 6866–6911 to assess breakout strength.

This trade setup offers a favorable risk-reward ratio with a tight SL at 6522 and layered targets.

Ideal buy entries can be placed between 6630–6660, as this range shows price stability and potential reversal signs.

Traders should stay alert for fundamental news (inventory reports, geopolitical events) that could accelerate momentum past resistance levels

is currently trading at 6648.3, positioning itself within an attractive short-term buy zone.

This level sits just above strong support at 6522, which acts as the logical stop-loss (SL) zone.

The price action suggests bullish potential as it forms a base near the support level.

Immediate resistance lies at 6866.1, which could be the first profit target (TP1).

Crude oil awaits upward breakthrough

💡Message Strategy

Inventory data provides short-term support, but it is difficult to change the trend

Although oil prices are under pressure overall, inventory data released by the U.S. Energy Information Administration (EIA) show that as of last week, U.S. gasoline and distillate inventories have dropped significantly, while gasoline consumption has increased by 6% month-on-month to 9.2 million barrels per day, indicating that the summer driving peak has brought short-term positive factors.

In addition, global aviation demand has also become an important variable to boost market sentiment. JPMorgan Chase pointed out in a client report: "In the first eight days of July, the global daily number of flights reached an average of 107,600, a record high, among which aviation activities in Asian countries have recovered to the peak in nearly five months."

The bank also expects that the average daily global crude oil demand growth this year will be 970,000 barrels, which is basically consistent with its forecast of 1 million barrels at the beginning of the year, indicating that although the consumption end is under pressure, it has not yet experienced a cliff-like decline.

📊Technical aspects

The short-term (4H) trend of crude oil breaks through the upper resistance of the range and runs in an upward trend. The moving average system is arranged in a bullish pattern, and the short-term objective trend direction is upward. The MACD indicator opens upward above the zero axis, and the bullish momentum is sufficient. The oil price fluctuates in a narrow range, and it is expected that the crude oil will continue to rise.

In terms of operation, crude oil is mainly long at a low level. If it rises to the target point, the direction will be selected according to the pattern and continued attention will be paid.

💰Strategy Package

Long Position:65.50-66.50,SL:64.00,Target:69.00-70.00

Heading into 50% Fibonacci resitance?WTI Oil (XTI/USD) is rising towards the pivot and could reverse to the 1st support.

Pivot: 71.43

1st Support: 65.55

1st Resistance: 76.08

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USOIL RISKY LONG|

✅CRUDE OIL is trading along

The rising support line

And as the price is going up now

After the retest of the line

I am expecting the price to keep growing

To retest the supply levels above at 70.20$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WTI Support & Resistance Levels🚀 Here are some key zones I've identified on the 15m timeframe.

These zones are based on real-time data analysis performed by a custom software I personally developed.

The tool is designed to scan the market continuously and highlight potential areas of interest based on price action behavior and volume dynamics.

Your feedback is welcome!

USOIL: Bearish Continuation & Short Trade

USOIL

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short USOI

Entry Point - 68.66

Stop Loss - 69.40

Take Profit - 67.23

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

(2-hour timeframe for WTI Crude Oil (USOIL).(2-hour timeframe for WTI Crude Oil (USOIL)), here’s the technical analysis and target zones:

🟦 Key Observations:

Price is trading in an ascending channel.

I'm using the Ichimoku Cloud for trend confirmation.

There are two clear target zones marked with arrows.

---

🎯 Target Levels (as shown on chart):

1. First Target Zone: ~$74.50

This is the intermediate resistance level.

Price is expected to break above ~$69, then head toward this zone.

2. Final Target Zone: ~$76.50–77.00

This is the major resistance area, possibly the upper end of a swing move.

Could be reached if momentum remains strong and no major reversal occurs.

---

📌 Current Price:

$68.66 (Sell) / $68.76 (Buy) — as of the screenshot.

📈 Suggested Strategy (based on the chart setup):

Entry: On breakout above ~$69.00 with volume confirmation.

First TP: ~$74.50

Second TP: ~$76.50–77.00

Stop-Loss: Below the lower channel support (~$66 or tighter, depending on your risk tolerance).

WTI USOIL WTI oil ,watch oil inventory and opec data report for clear directional bias . if the monthly candle closes above the supply roof,it will be a long confirmation if demand holds .the probability of rejection is high, because the current candle is coming as a retest candle to broken demand floor that served as bench mark oil price level 65$-68$ zone for long time .

#oil #opec #usoil #wti