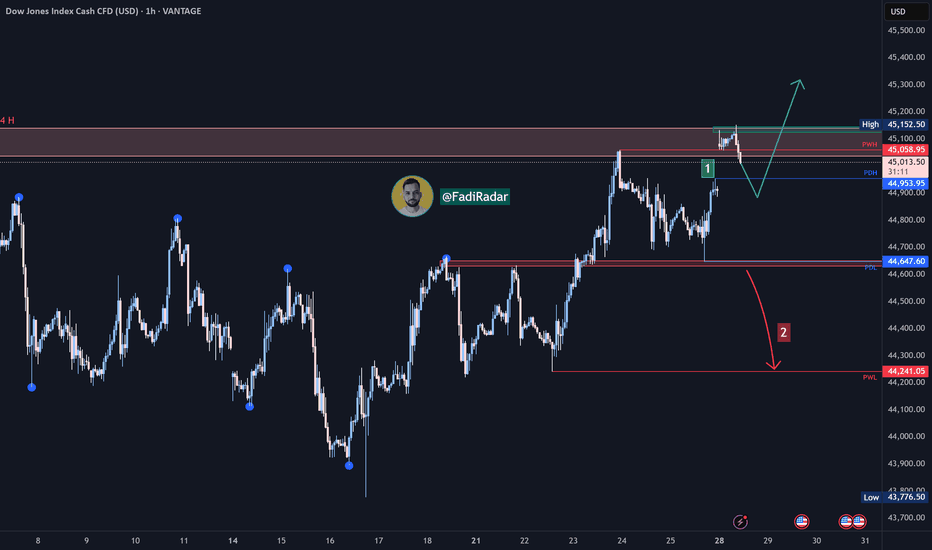

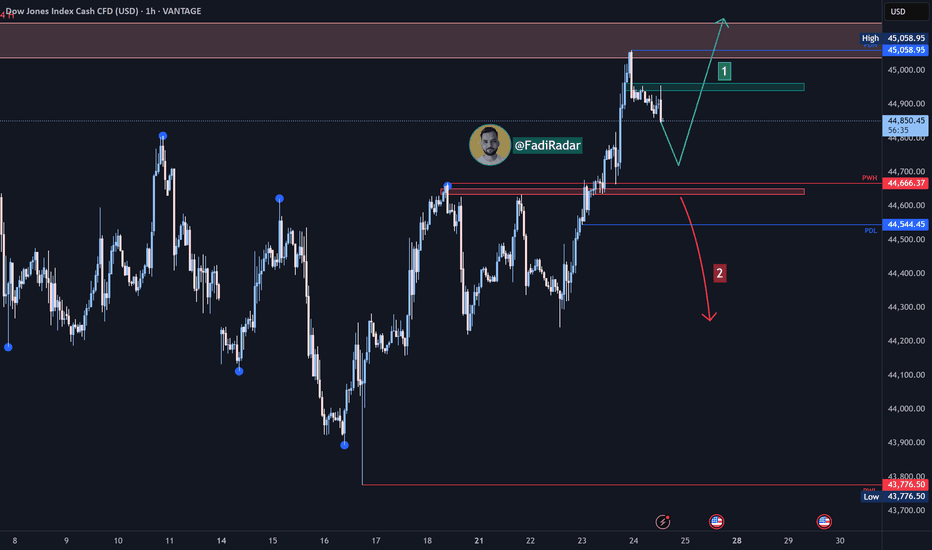

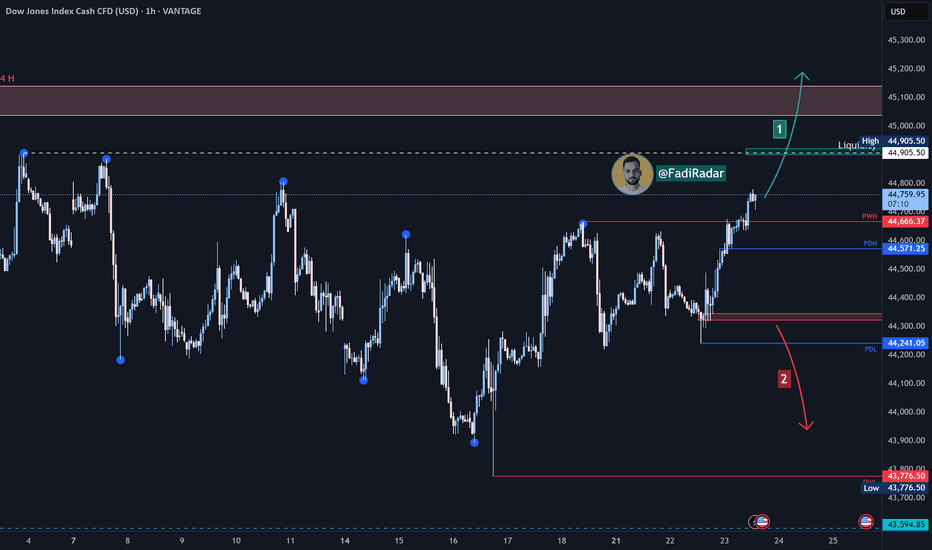

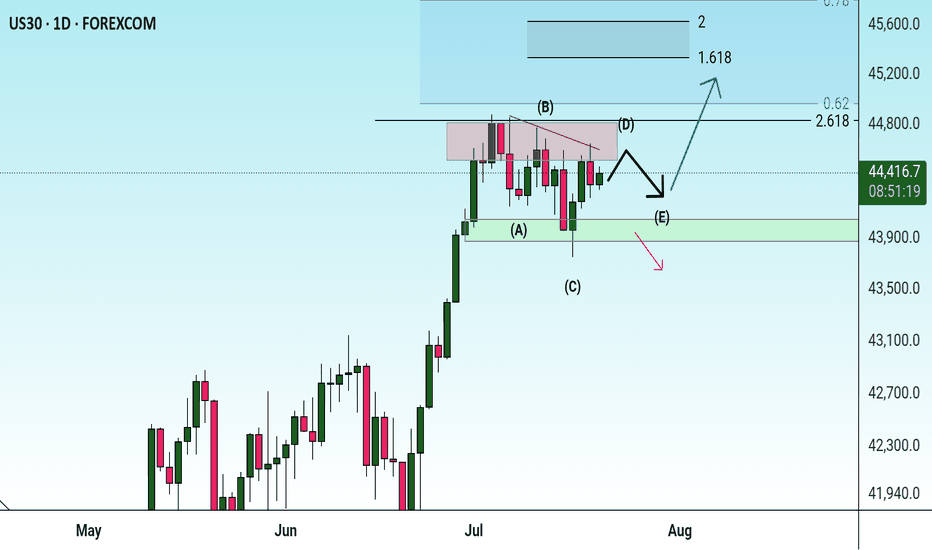

Dow Jones Index Analysis (US30 / Dow Jones):🔹 The index recently tested its all-time high at 45,152 USD, and a short-term correction may occur to retest the PDH level at 44,950 USD.

1️⃣ If strong bullish momentum leads to a break and close above 45,150 USD, the price is likely to push toward forming a new high.

2️⃣ However, a break and close below 44,620 USD could trigger a move toward 44,240 USD.

🔻 A confirmed break below this zone would resume the bearish trend and open the way toward 43,900 USD.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

DJ30 trade ideas

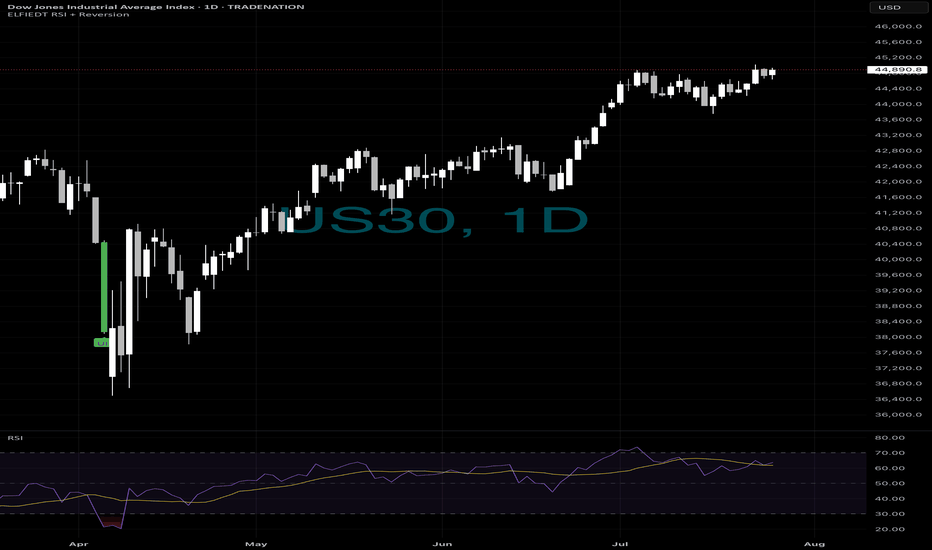

Retirement trading?🏦 LONG-TERM INVESTORS — This Was the Signal.

When fear hit the Dow in April,

most sold.

Our system?

🟢 It bought the dip — and never looked back.

That single green “UP” on the daily US30 chart caught the bottom of the move that led to 5,000+ points and counting.

⸻

This is what long-term confidence looks like:

✔️ Oversold RSI + deep structure

✔️ Clean mean reversion signal

✔️ Daily confirmation = strong foundation

✔️ No lag. No second guessing. Just one entry, held strong.

📈 From panic to new highs — all off one candle.

⸻

🧠 Here’s How Investors Can Use It:

1. Monitor daily charts on major indices

2. Wait for RSI exhaustion + reversion zone tag

3. Let ELFIEDT RSI + Reversion give the green light

4. Enter with size. Ride the trend.

This isn’t about day-trading.

This is about compound wealth with simple conviction.

⸻

💬 DM “DOW ENTRY” to get access

📲 Follow if you want less noise and more clarity

🔐 For investors who want an actual edge, not just advice

Because smart investors don’t time the market —

🚀 They follow signals with structure behind them.

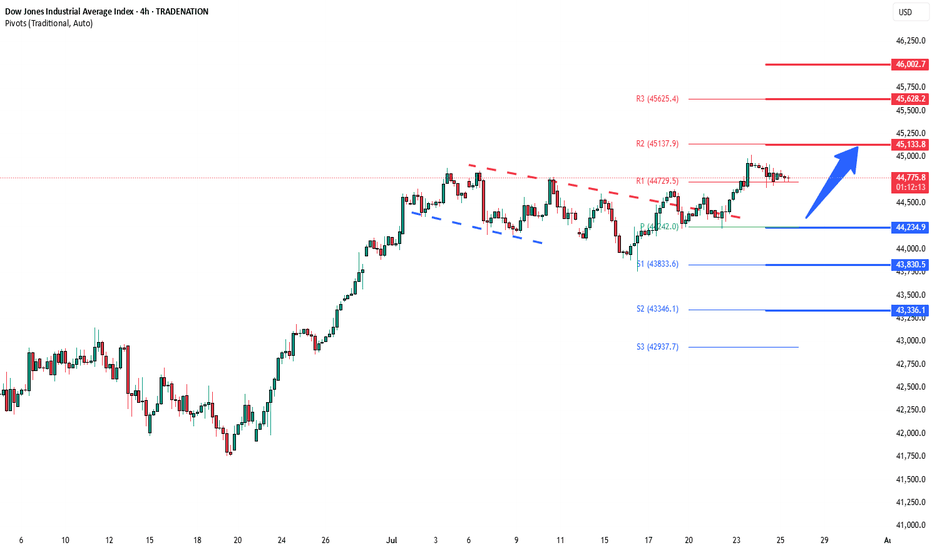

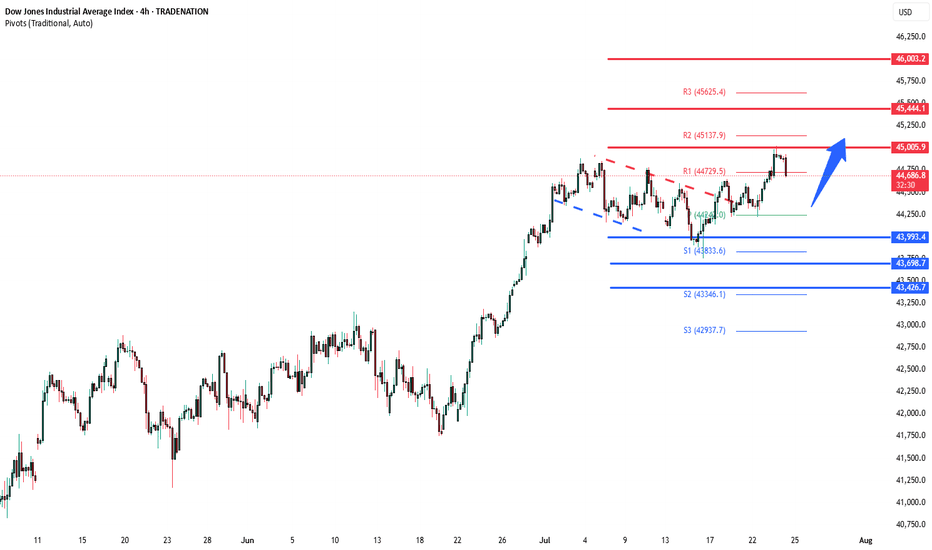

DowJones bullish breakout support at 44240Key Support and Resistance Levels

Resistance Level 1: 45135

Resistance Level 2: 45630

Resistance Level 3: 46000

Support Level 1: 44240

Support Level 2: 43830

Support Level 3: 43340

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

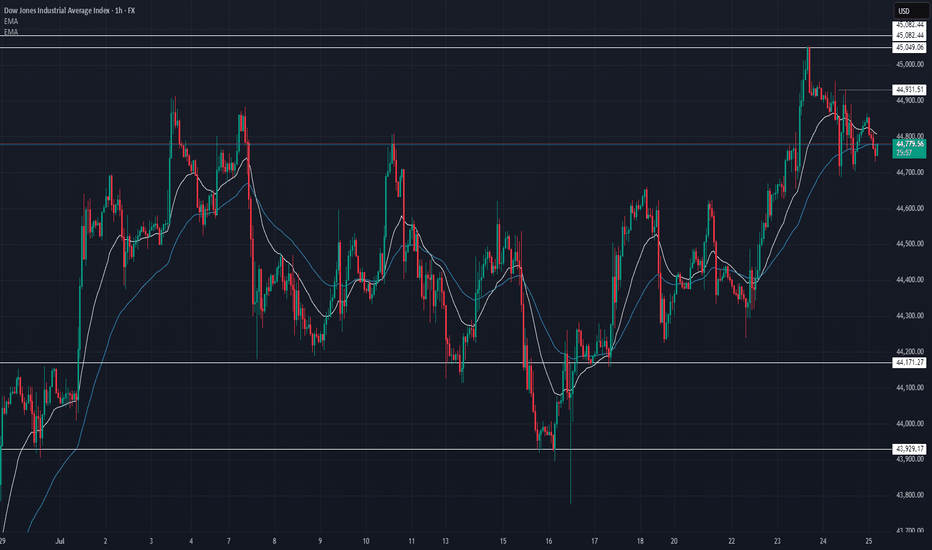

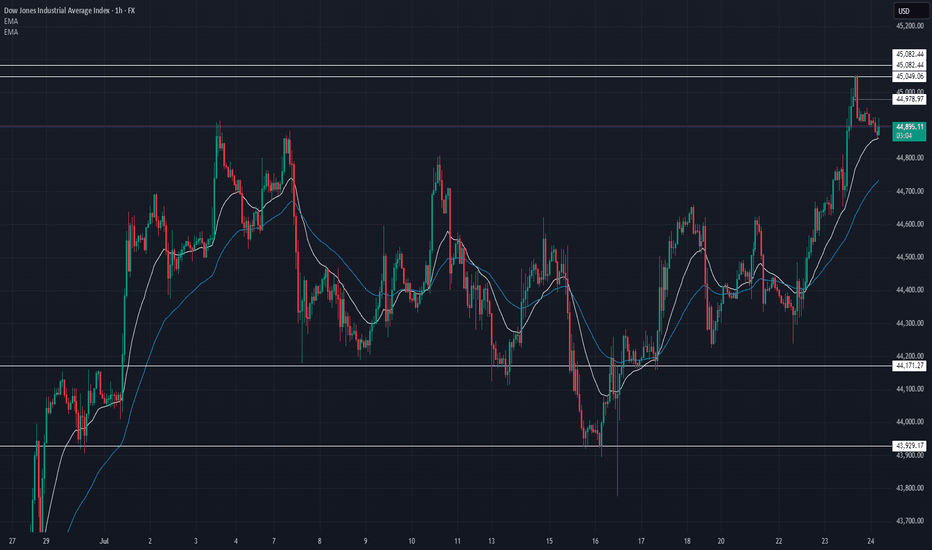

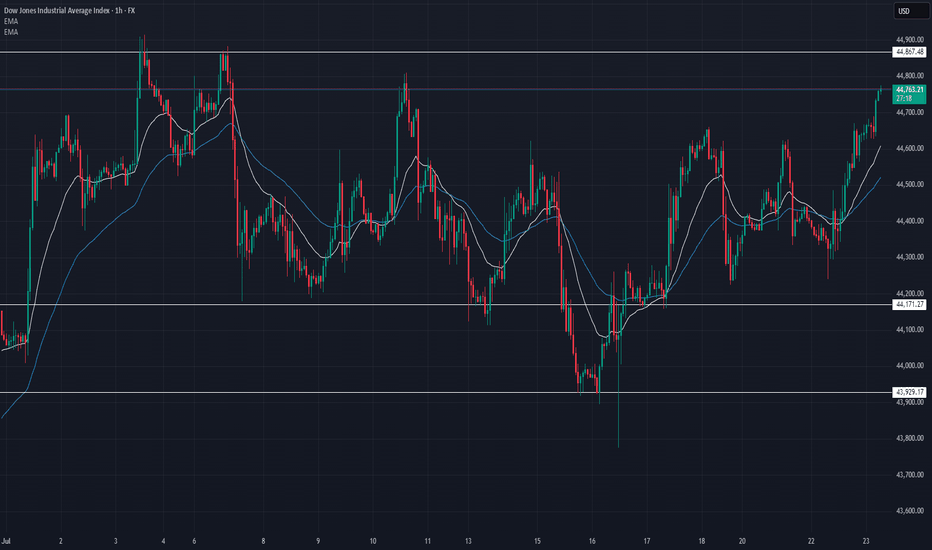

US30 Market Breakdown – 07/25/2025📍 US30 Market Breakdown – 07/25/2025

🕹️ After tagging the highs at 45,082, US30 has pulled back and is now hovering around 44,780. The market rejected the high and is consolidating below 44,931, forming a lower high — hinting at potential short-term weakness.

But don't get too bearish just yet. We’re still above the 9 & 21 EMAs on the 1H, and trend structure remains intact unless we lose key support.

Let’s break it down 👇

📊 Current Structure:

🔻 Rejection from 45,082

📉 Minor lower high forming

🔁 Consolidating between 44,700–44,900

📐 EMAs flattening = potential chop

🧱 Resistance Zones:

45,049 → 45,082 (double rejection)

44,931 (current ceiling)

📉 Support Zones:

44,750 (minor intraday demand)

44,700 = EMA confluence

44,600–44,500 (next strong base)

⚠️ If price breaks under 44,700, we could see a retest of 44,450 and even 44,171.

🧠 Bias:

🟡 Neutral to slightly bearish intraday

Below 44,900 = short setups favored

Watch for bounce at 44,700 or breakdown toward 44,600

Still in uptrend overall unless 44,171 breaks

#DJI - 5000 Pts already moved out of 8000 points..Date: 27-06-2025

#DJI - 5000 Pts already moved out of 8000 points as posted on 22nd April. Another 3000 points to cover. we have different pivot for the next level up and it will be shared soon.

Old levels are as follows.

#DJI Upside Targets: 41240.49, 43084.22, 45025.94 and 46967.67

#DJI Downside Targets: 34578.53, 32728.34, 30786.61 and 28844.88

Current price is around 43,870 at the time of this post.

DowJones uptrend support at 43990Key Support and Resistance Levels

Resistance Level 1: 45000

Resistance Level 2: 45444

Resistance Level 3: 46000

Support Level 1: 43990

Support Level 2: 43700

Support Level 3: 43426

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Dow Jones Index Analysis (US30 / Dow Jones):🔹 The index is trading near 44,900 USD and showing short-term bullish momentum, with a potential pullback to retest the 44,700 USD zone.

1️⃣ If strong buying momentum leads to a break and close above 44,960 USD, this could push the price toward the 45,200 USD resistance.

2️⃣ However, if the price breaks below the 44,630 USD support and closes beneath it, we may see a decline toward 44,350 USD.

🔻 A confirmed break below this level could resume the bearish trend and open the path toward 43,900 USD.

⚠️ Disclaimer:

This analysis is not financial advice. Please monitor the markets carefully before making any investment decisions.

US30 LONG US30 has recently broken out of a multi-session consolidation range and tapped into the 45,000 psychological resistance zone, forming a temporary high around 44,950. With this in mind, I’m seeing two opportunities based on the market structure:

Short-Term Sell Setup

Bias: Counter-trend (retracement)

Entry Zone: 44,850 – 44,950 (rejection at resistance / liquidity grab)

Target Zone:

TP1: 44,400

TP2: 43,950

Stop Loss: Above 45,050

Reason: Price is overextended; likely to pull back before continuing uptrend. This is a scalper/intraday short opportunity.

Long-Term Buy Setup

Bias: Trend continuation

Ideal Buy Zones (Fibonacci):

Zone 1: 44,400 (23.6%)

Zone 2: 43,775 – 43,550

Stop Loss: Below 43,400

Targets:

TP1: 45,250

TP2: 45,750

Reason: Market is in a bullish structure. A pullback to golden ratio (50%–61.8%) offers an ideal entry for a swing continuation. Watch for bullish confirmation at these zones.

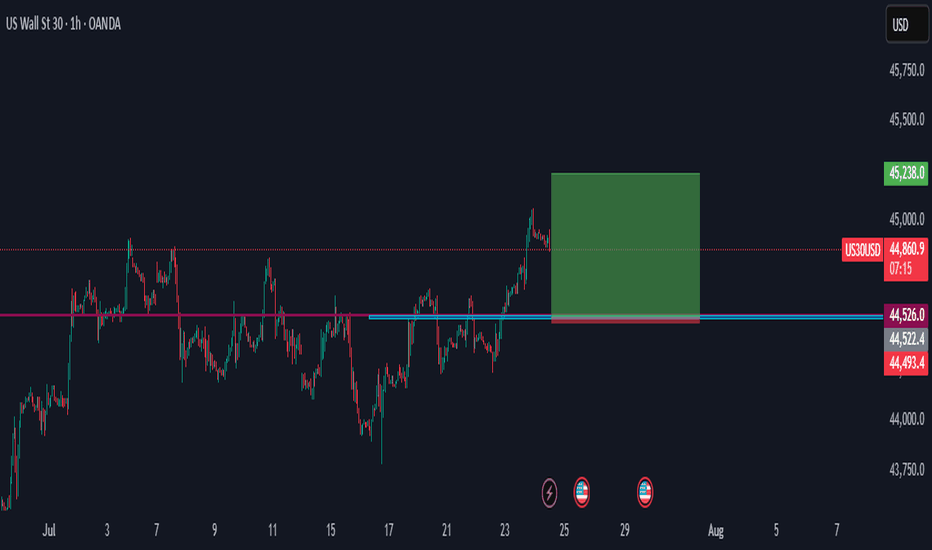

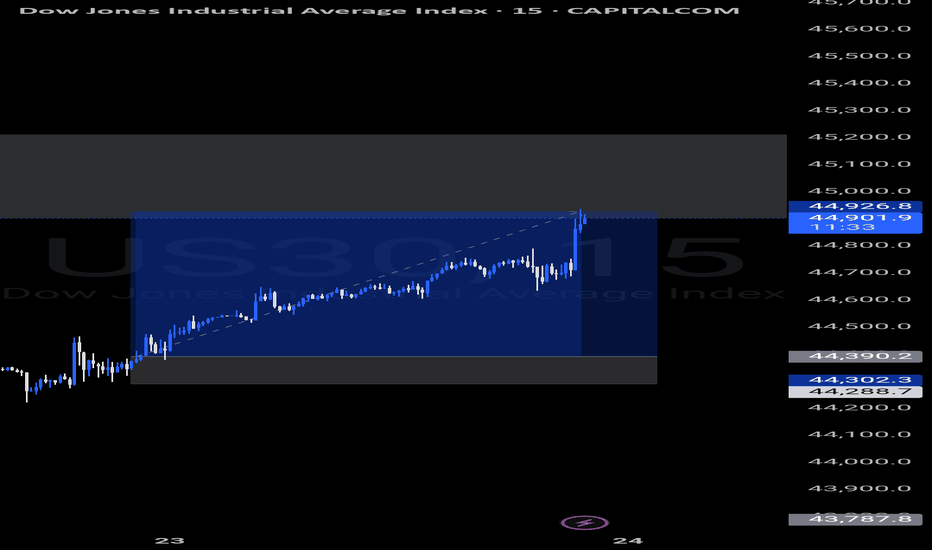

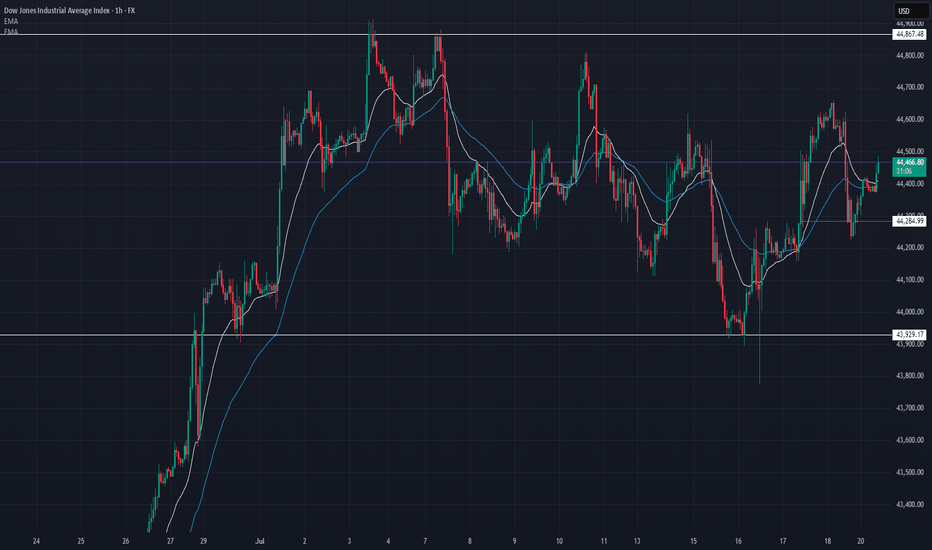

US30 Technical Breakdown – 07/24/2025📍 US30 Technical Breakdown – 07/24/2025

🔥 New highs achieved — bulls pushed straight through the 44,867 ceiling and tagged 45,082 before pulling back slightly. This is a key psychological level, and price is now consolidating just below.

We’ve officially shifted into breakout territory. Momentum is strong, and EMAs are fully bullish. But after such a run, we may be due for a retest or short-term correction. Let’s break it down 👇

📊 Current Market Structure:

✅ Series of higher highs & higher lows

✅ EMA 9 > EMA 21 > Price (bullish structure)

✅ Breakout from range: 44,867 → 45,082

🧱 Minor resistance at 45,050–45,082

⚠️ Watch for pullback to 44,750–44,800 zone

🔑 Key Levels:

🔼 Resistance:

45,050 → 45,082 (fresh supply zone)

45,200+ (blue sky if broken)

🔽 Support:

44,867 (former resistance turned support)

44,734 (EMA confluence)

44,450–44,600 (demand zone)

🧠 Market Bias:

📈 Still bullish, but extended.

Above 44,867 = continuation zone

Below 44,734 = momentum shift likely

Rejection at 45,082 could give scalpers a play short 🔄

💡 Potential Trade Setups:

📈 Breakout Buy (Momentum Entry):

Entry: Above 45,100

TP1: 45,200

TP2: 45,300

SL: Below 45,040

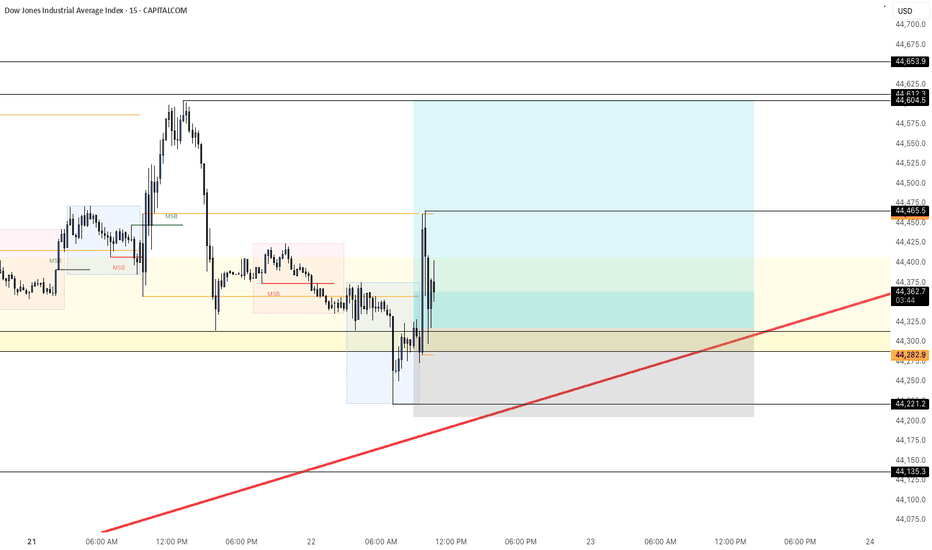

Dow Jones Index US30 Analysis:🔹 The index is approaching a key liquidity zone near 44,905 USD.

1️⃣ If price breaks and closes above 44,905, this could trigger a bullish continuation toward 45,100 USD.

2️⃣ However, if the price fails to break above and bearish momentum appears, a pullback is expected to test 44,570 and 44,320.

🔻 A confirmed break and close below 44,320 could resume the bearish trend and open the way toward 43,900 USD.

⚠️ Disclaimer:

This analysis is not financial advice. Please monitor the markets carefully before making any investment decisions.

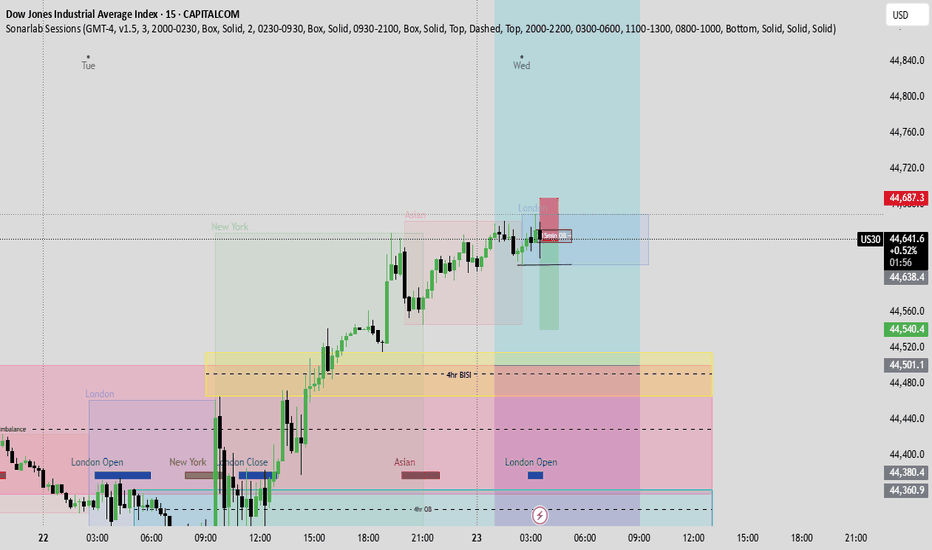

US30 Update – 07/23/2025📍 US30 Update – 07/23/2025

The bulls are back in control 🚀

After consolidating below 44,450, we finally saw a strong breakout above the mid-range and EMAs. Price surged straight into the 44,760–44,867 resistance zone with strength, riding the 9/21 EMA crossover 🟢

We're now testing a major supply zone, so momentum traders should watch for a reaction here.

📊 Market Structure:

✅ Clean higher lows

✅ Breakout above 44,600 resistance

✅ EMAs aligned bullish on 1H

✅ Bullish engulfing + follow-through

🔑 Key Levels:

🔼 Resistance: 44,764 → 44,867

🔽 Support: 44,450 → 44,171

🧠 Market Bias:

Short-term bullish ✅

➡️ Holding above 44,600 = bullish continuation

➡️ Rejection at 44,867 = possible pullback/retest

💡 Trade Scenarios:

📈 Breakout Continuation (Aggressive Long):

Entry: Above 44,780

TP1: 44,867

TP2: 44,950

SL: Below 44,700

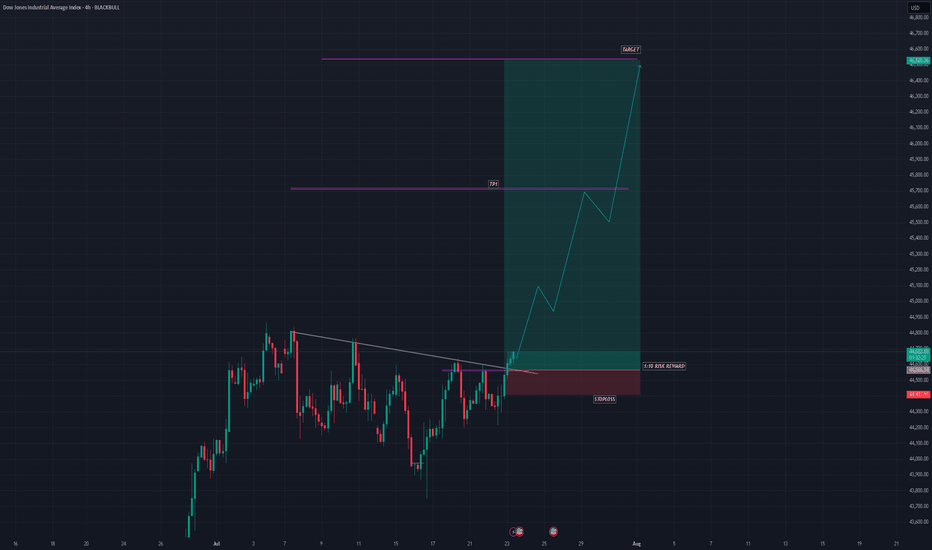

US30 SHOWING A GOOD UPWARD MOVE WITH 1:10 RISK REWARDUS30 SHOWING A GOOD UPWARD MOVE WITH 1:10 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follows good risk reward

please dont use more than one percentage of your capital follow risk reward and tradeing rules

that will help you to to become a better trader

thank you

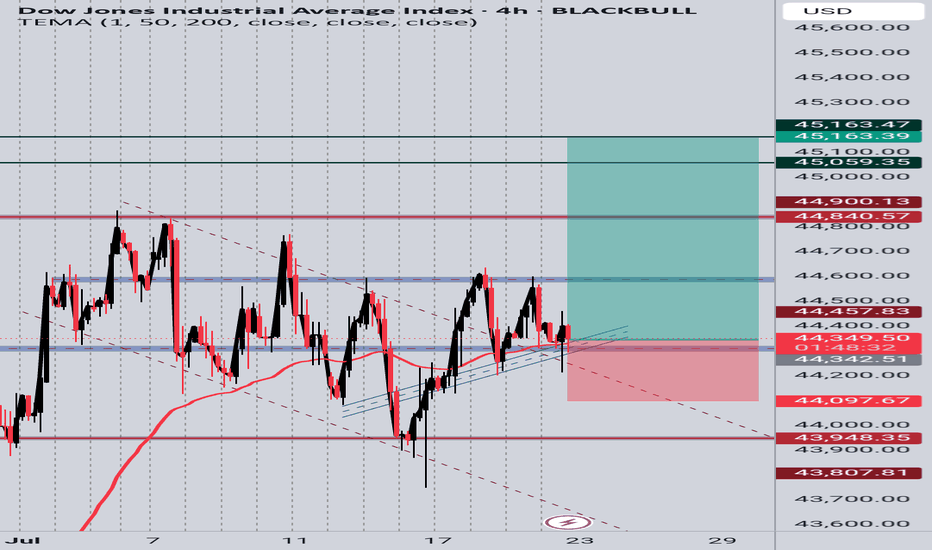

US30 4H Long SetupPrice is respecting a rising trendline and holding above a key support zone. After multiple rejections at the trendline and EMA bounce, current candle shows bullish intent. Targeting previous resistance zones around 45,059 and 45,163. SL placed below the trendline and recent structure low at 44,097. Setup based on structure support, EMA reaction, and potential bullish continuation.

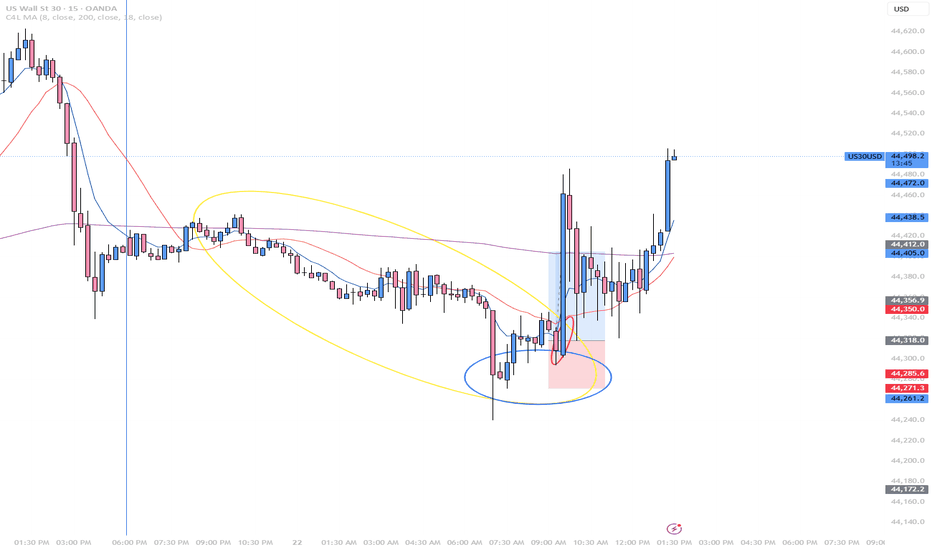

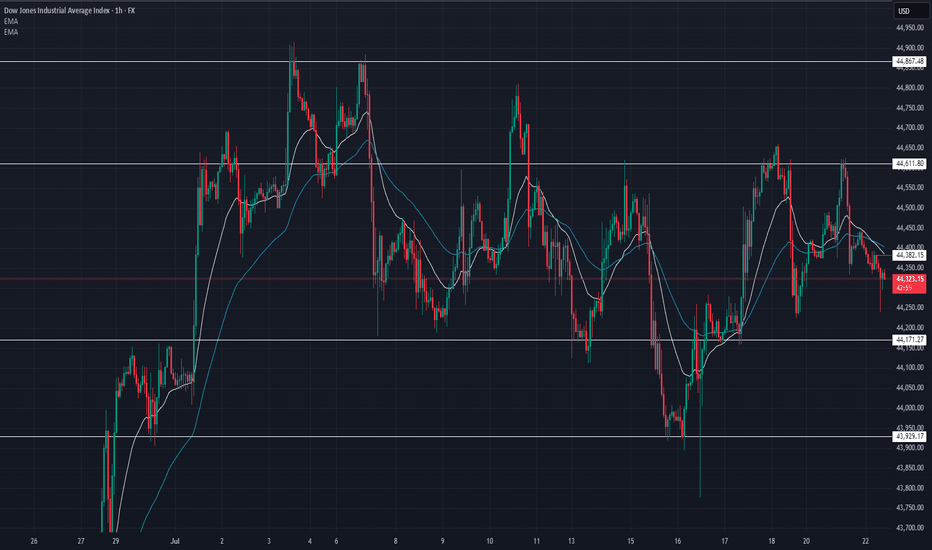

US30 Update – 07/22/2025📍 US30 Update – 07/22/2025

Still trapped in the range chop ⚠️

Price rejected off 44,611 again and is now pulling back toward mid-range. Structure continues to respect key zones, and we now see lower highs forming — early signs of bearish pressure building 🐻

EMA crossover is flipping bearish on the 1H — sellers gaining control short term.

📊 Market Structure:

📉 Lower highs forming below 44,611

📈 Still above demand at 44,171

📉 EMA 9/21 crossover down — bearish tilt

📉 Momentum weak under 44,385

🔑 Key Levels:

🔼 Resistance: 44,611 → 44,867

🔽 Support: 44,171 → 43,929

🧠 Market Bias:

Short-term bearish 🧨

➡️ Clean breakdown of 44,171 = bearish momentum

➡️ Buyers must reclaim 44,385 to shift bias

💡 Trade Scenarios:

📉 Bearish Rejection Play:

Entry: 44,380–44,400

TP1: 44,200

TP2: 44,000

SL: Above 44,430

📈 Demand Bounce (Low-Risk Buy):

Entry: 44,180–44,150

TP1: 44,385

TP2: 44,600

SL: Below 44,100

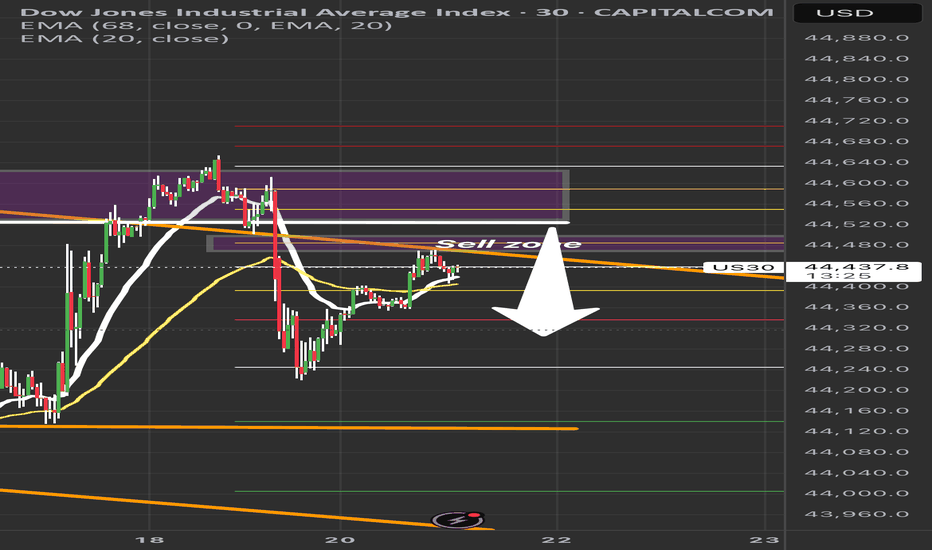

US30 Sell Setup – Watching Key Retracement ZonePrice is pulling back into a key sell zone (44,480–44,550) after a strong bearish move.

✅ Confluences:

• Previous liquidity zone

• 50–61.8% Fib retracement

• EMA rejection overhead

Plan: Waiting for bearish confirmation before short entry.

🎯 Targets:

TP1: 44,300

TP2: 44,150

TP3: 44,000

❌ Invalidation: Break above 44,600.

Patience = Precision. No confirmation, no trade.

#US30 #DowJones #TradingSetup #SmartMoneyConcepts #PriceAction #LiquidityZones #ForexTrading #DayTrading #IndicesTrading #SupplyAndDemand #TechnicalAnalysis #Fibonacci #MarketStructure #ScalpSetup #SwingTrade #RiskManagement #TradingEducation

US30 Update – 07/21/2025📍 US30 Update – 07/21/2025

Sideways chop continues on US30 🌀

We’re still range-bound between 44,285 and 44,867, with price currently hovering mid-range around 44,470. Structure remains indecisive — buyers tried to push higher but got faded near the 44,600 level again.

EMA structure is flat on the 1H — confirmation that we’re consolidating.

📊 Market Structure:

🔄 Consolidation Zone: 44,285 → 44,867

📉 Failed to hold above 44,600

📈 Bulls defending 44,285 zone (demand still active)

📊 1H EMAs flat — neutral/slightly bullish

🔑 Key Levels:

🔼 Resistance: 44,600 → 44,867

🔽 Support: 44,285 → 43,929

🧠 Market Bias:

Neutral short term ⚖️

➡️ Clear breakout above 44,867 = trend continuation

⬇️ Breakdown below 44,285 = bearish structure confirmed

💡 Trade Scenarios:

📈 Range Buy (Support Play):

Entry: 44,300–44,285

TP1: 44,500

TP2: 44,700

SL: Below 44,200

📉 Range Sell (Resistance Fade):

Entry: 44,600–44,650

TP1: 44,400

TP2: 44,300

SL: Above 44,700

⚔️ Breakout Setup:

Long above 44,870 (confirmation)

Short below 44,280 with volume

📵 No trade in the middle of the range unless scalp — wait for edges to act.

Dow Jones -> A breakout rally of +40%!🐂Dow Jones ( TVC:DJI ) will create new highs:

🔎Analysis summary:

Since the April lows, the Dow Jones already rallied about +25%. This was simply the expected rejection away from a strong confluence of support. Now, the Dow Jones is sitting at the previous all time highs and about to break out, leading to a massive rally.

📝Levels to watch:

$45.000, $60.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader