Buy DROPBOX [NASDAQ: $DBX] | 5.12.2020 | Eric ChoeMy name is Eric Choe.

I am a professional trader with over 7 years of equities and cryptocurrency experience.

I've worked at an energy trading company, a Fortune 500 company, and one of the top management consulting firms in the world.

I left my high-paying salary as a management consultant in early 2018 for a career in investing and trading.

I've been a full-time equities trader ever since.

I give detailed analysis on TradingView.

Over the past 7 years, I've dedicated my time and effort to helping others learn about the financial markets.

All my ideas are for education purposes. There is a high-degree of risks involving leverage trading. Trade at your own risk. This is not financial advice

DBX trade ideas

Drop Box Heading Higher on Positive Earning Surprise- 24% quarterly positive earning surprise pushes DropBox higher on the back of more people using Drop Box to support work from home.

- They added an additional $1m paid users YoY and it's ~20% YTD Performance.

- Technically the price has been pushing higher and zooming through the upsloping median line. We expect prices to head back to the support zone at $24

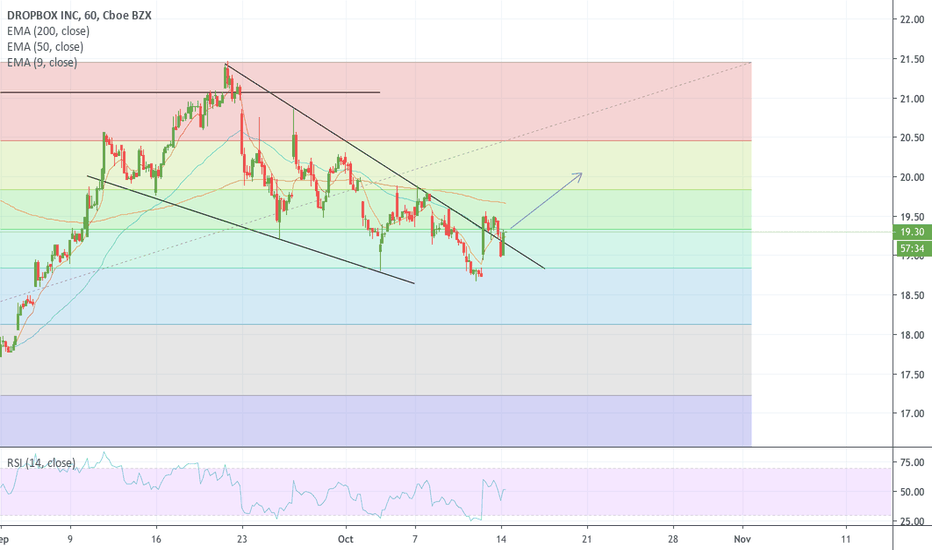

$DBX can rise in the next daysContextual immersion trading strategy idea.

Dropbox provides a collaboration platform worldwide.

The demand for shares of the company looks higher than the supply.

These and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $19,87;

stop-loss — $19,38.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

DBX - Gap closed and resumption of trendDBX retraced to close gap at 18.70 which is also a horizontal support level. The overal trend is still bullish after having formed a prior base. Got long on it at 19.67 with initial stop just slightly below 18.70 support. Looking to take partial profits around 21.20-21.80 but is expecting the long term uptrend to continue way higher eventually (trail the stops up).

Dropbox gap Filled, reversal Potential $dbx

Dropbox earnings could not have came at a worse stage in the bull-run,

On the eve of the greatest selloff we have seen in the markets, they company reported a great quarter and announced a buyback program.

If the market can stabilize next week the post earnings gap is now filled and the stock is ready for some very good gains, as its trading at a 20% discount of its 1 week high.

Dropbox Surges After-hours

Upside levels to watch

$22.57 = Fibonacci golden pocket & .286 overall retrace level

$23.53 = Point of control , critical level.

$26.53 = Overall .382 Fibonacci retrace level.

Earnings highlights

Dropbox (NASDAQ:DBX) +12.2% after Q4 beats with 19% Y/Y revenue growth.

Cash from operating activities totaled $446M with FCF of $161.3M.

ARR was up 19% Y/Y to $1.82B.

Paying users totaled 14.3M at the end of the year, up from 12.7M in the prior year. ARPU was $125 versus $119.61.

Non-GAAP gross margin was 77.6%, up from 75.7% in last year's quarter. Operating margin was 15.6% compared to 11%.

Buyback: The board authorizes a $600M repurchase program of Class A shares.

Source Seeking Alpha

THE WEEK AHEAD: DBX, TECK EARNINGS; USO, GDXJ; VIX, VXX, UVXYEARNINGS:

The earnings that are best metrically for earnings-related volatility contraction plays are DISH (87/59), TECK (87/52), and DBX (82/57). Unfortunately, strike availability in DISH is limited to two-and-a-half wides, making it an unattractive play given its stock price (39.97 as of Friday close).

Pictured here is a DBX (82/57) skinny short strangle in the March cycle paying 1.98 on a buying power effect of about 3.25 (60.9%), break evens wide of the expected move, and delta/theta of 3.32/-7.44. Given its near-straddle narrowness, I would look to take profit at 25% max. Announcing on Thursday after market close, look to put on something in the waning hours of Thursday's session.

The other one of interest is also small: TECK (87/52), which finished the week at 13.46. A play similar to that in DBX -- a March 20th 13/14 skinny short strangle -- pays 1.15 at the mid price on a buying power effect of about 2.25 (51.1%) with break evens greater than the expected move and delta/theta metrics of -4.21/2.17. As with the DBX skinny, look to take profit at 25% max.

EXCHANGE-TRADED FUNDS WITH EXPIRY IN WHICH AT-THE-MONEY SHORT STRADDLE IS PAYING GREATER THAN 10% OF STOCK PRICE:

XLE (46/20), July

USO (42/35), April

FXI (35/21), August

XOP (34/34), June

XBI (34/27), June

SMH (30/25), June

EWZ (14/25), June

GDXJ (5/28), May

GDX (4/23), June

The paying plays of shortest duration are in USO (April) and GDXJ (May). Take your pick in June between XOP, XBI, SMH, and EWZ.

BROAD MARKET FUNDS WITH EXPIRY IN WHICH THE AT-THE-MONEY SHORT STRADDLE IS PAYING GREATER THAN 10% OF STOCK PRICE:

EEM (38/12), December

QQQ (26/18), September

EEM (23/18), September

IWM (19/16), October

SPY (16/13), November

FUTURES (EXCLUDING CURRENCY/TREASURIES):

/NG (52/39)

/CL (41/35)

/GC (26/11)

/ZS (23/17)

/ZW (20/21)

/ZC (16/14)

/ES (16/14)

/SI (5/24)

VIX/VIX DERIVATIVES:

VIX finished the week at 13.68, so there are probably some happy campers out there who shorted the January-end volatility pop to nearly 20. The March, April, and May /VX contracts are trading at 15.40, 16.11, and 16.30, respectively. I could see going small with an April term structure trade if you haven't already got one on, but May isn't going for a ginormous premium over April, so there probably isn't much benefit to going out farther in time: the April 16/18 is paying .60 at the mid with a break even of 16.60 versus the /VX contract of 16.11; the May 16/20, virtually the same price.

With the VXX short call verticals I already have on, I'm basically looking for a VIX low (it was around 12) to consider pulling some units off in profit. On the other end of the stick, I'm waiting for another pop in VIX to potentially add. VIX at 20 is a nice place to look to do that ... .

$26 UPSIDE TARGET IN DROPBOX.Option traders and investors seem to see some upside potential in DBX.

Indicators and volume have turned bullish.

Maybe the sell off in this sector has bottomed.

Dropbox, Inc. is a collaboration platform that's transforming the way people and teams work together. It offers following products: Dropbox Basic, Plus, Professional and Business. The Dropbox Basic is the simple, powerful home for photos, videos, docs, and other files. Its users also get access to new product Dropbox Paper, a collaborative workspace that helps teams create and share early ideas, and work with any type of content, in one centralized place. The Dropbox Plus provides unrivalled sync along with 1 TB of space, powerful sharing features, and increased control. The Dropbox Professional allows independent workers to store, share, and track their work from one place. The Dropbox Business is designed for small to enterprise level businesses, which users get full visibility and control over how critical work files are accessed and shared while letting team members continue to use the products. Dropbox was founded by Andrew W. Houston and Arash Ferdowsi in June 2007 and is headquartered in San Francisco, CA.

DROPBOX on the verge of massive downside drop. Having just listened to the CEO on CNBC try and quantify the markets reaction to disappointing results, the stock looks more like a short than a long. The stock has multiple competitors, some of which have recently completed IPO's that are taking market share and investor interests.

Long term holders of DBX must be ready to throw in the towel as the stock is no at its all time low levels, a break below that should open the floodgates.

The RSI is oversold but that does not mean it can drop further, any bounce could be short lived ans a very risky strategy.