Isp - one of the best ! I've been following Intesa Sanpaolo closely for years.

I started out as an observer, then became a dedicated analyst, and eventually it turned into an investment opportunity.

Between 2018 and 2020, I bought and sold the stock several times, always guided by objective analysis and medium-term strategies.

Over time, I’ve shared my research with more than 2,000 people, many of whom have purchased my studies and used them to inform their own financial decisions.

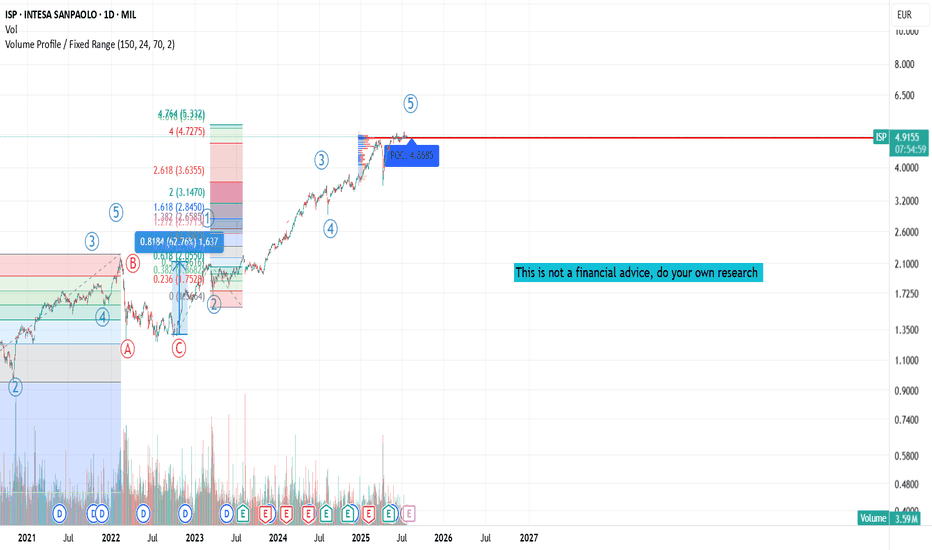

After nearly 18 years the stock could realistically return above €5. This wasn’t a personal wish, but rather the result of a rigorous analysis of financial statements, management strategy, and long-term technical market patterns.

Financial Performance 2022–2024: Solid and Consistent Growth

✦ 2022

Net profit: €4.35 billion

Despite the inflationary environment, the Group maintained a solid structure, supported by revenue diversification and the resilience of its core business.

✦ 2023

Net profit: €7.7 billion

Growth was driven by a sharp increase in net interest income and strong cost discipline. Dividend payouts increased, further boosting investor appeal.

✦ 2024

Record net profit: €8.7 billion

Net interest income grew by 6.9%, and the cost/income ratio remained around 52%. The bank confirmed its ability to deliver strong results even in complex market conditions.

Outlook for 2025 and Beyond: Sustainable Growth and Strong Shareholder Returns

Guidance for 2025 includes:

Expected net profit > €9 billion

Expansion in core sectors (wealth management, insurance, digital innovation)

Over €4 billion in technology investments

A strategy focused mainly on organic growth, with a cautious approach to extraordinary operations

In Q1 2025, the bank reported a net profit of €2.6 billion (+14% YoY), with an exceptionally low cost/income ratio of 38%.

In addition to operational growth, Intesa Sanpaolo continues to pursue a generous dividend and buyback policy, supported by one of the strongest capital positions among European banks.

This is a financial technical study and not a financial advise. Please do your own research before make any decision.

ISP trade ideas

ISP | Intesa SanpaoloScreener Buy Idea

Intesa Sanpaolo SpA engages in the provision of financial products and banking services. It operates through the following segments: Banca dei Territori, IMI Corporate and Investment Banking, International Subsidiary Banks, Private Banking, Asset Management, Insurance, and Corporate Centre. The Banca dei Territori segment oversees the traditional lending and deposit collection activities in Italy. The IMI Corporate and Investment Banking segment deals with corporate and investment banking; and acts as a partner for corporates, public administration, and financial institutions. The International Subsidiary Banks segment operates on international markets through subsidiary and associated banks. The Private Banking segment specializes in the asset management of private and high net worth individuals. The Asset Management segment develops solutions targeted at the firm's customers, commercial networks, and institutional clientele. The Insurance segment includes Intesa Sanpaolo Vita, Fideuram Vita, Intesa Sanpaolo Assicura, and Intesa Sanpaolo Assicura. The Corporate Centre segment comprises of the group's treasury and the Capital Light Bank. The company was founded in 1931 and is headquartered in Turin, Italy.

Intesa Sanpaolo SpA (ISP) | Chart & Forecast SummaryKey Indicators on Trade Set Up in General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Active Sessions on Relevant Range & Elemented Probabilities;

* Asian(Ranging) - London(Upwards) - NYC(Downwards)

* Weekend Crypto Session

# Trend | Time Frame Conductive | Weekly Time Frame

- General Trend

- Measurement on Session

* Support & Resistance

* Trade Area | Focus & Motion Ahead

# Position & Risk Reward | Daily Time Frame

- Measurement on Session

* Retracement | 0.5 & 0.618

* Extension | 0.786 & 1

Conclusion | Trade Plan Execution & Risk Management on Demand;

Overall Consensus | Buy

📉 Short ISP?

Hey guys, currently we have MIL:ISP with the following technical analysis which would indicate a higher probability of another bearish impulse.

1. Nice clear bearish impulse on larger degree

2. Corrective ABC pattern within range of 61.8 % retracement

3. Bearish impulse on lower degree breaking out of larger degree trend line

4. Healthy bearish correction on lower degree with the move breaking out

Typically I don't short the stock market much, I am mostly bullish with my positions, but this one looks really clean so I will be involved.

ISP - 9 months ASCENDING TRIANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

The content is The Art Of Charting's personal opinion and it is posted purely for educational purpose and therefore it must not be taken as a direct or indirect investing recommendations or advices. Any action taken upon these information is at your own risk.

Trading Idea - #Intesa #SanpaoloBUY

ENTRY: 2.34 EUR

TARGET: 2.65 EUR (+13%)

STOP: 2.19 EUR

1.) Intesa Sanpaolo is moving in a strong upward trend.

2.) Third rejection on the lower trend line indicates an entry and a trend continuation.

3.) Intesa Sanpaolo surprises with a jump in profit in the last quarter.

4.) Intesa Sanpaolo has a huge capital base

5.) After the dividend pause during the Corona crisis, dividends are to be paid out again in autumn. That is how long the upward trend could continue.

ISP Long TermHi guys, this is my POV on Intesa Sanpaolo, Italian bank that is rushing for the positive sentiment that is driving Italian markets these days, ISP is now breaking resistance so I will expect new highs.

I think a 20 % surge is very likely to happen in the next months, remember to set the stop loss.

DYOR and have a nice day

ISP ANALYSISHi traders :) I'm Guario, and here are some thoughts regarding ISP possible future price action. Although I prefer analyse forex, cryptocurrency or commodity markets, I've decided to bring this analysis to you traders because this title is giving pretty interesting signal. Infact ISP has just reached the volumetric level of 2.3425 along whit a very visible Stochastic divergence. ALso notice how price is perfectly reacting with the red up trendline which is now acting as support. I suggest to set your entry position just a little bit below the support level of 2.3215. Look at the chart for possible stop and targets levels. Write me in the comments for any question, thought or critic. Good luck :)

Selloff not over yet!The selloff is affecting Italian banks is not over yet.

The stock entered a bearish channel and is headed to 1.8-1.9

Of course the price is heavily drugged by political risk and next Italian government's steps might change the trend abruptly.

***As usual not a trading advice, merely my idea for informational and educational purposes only***

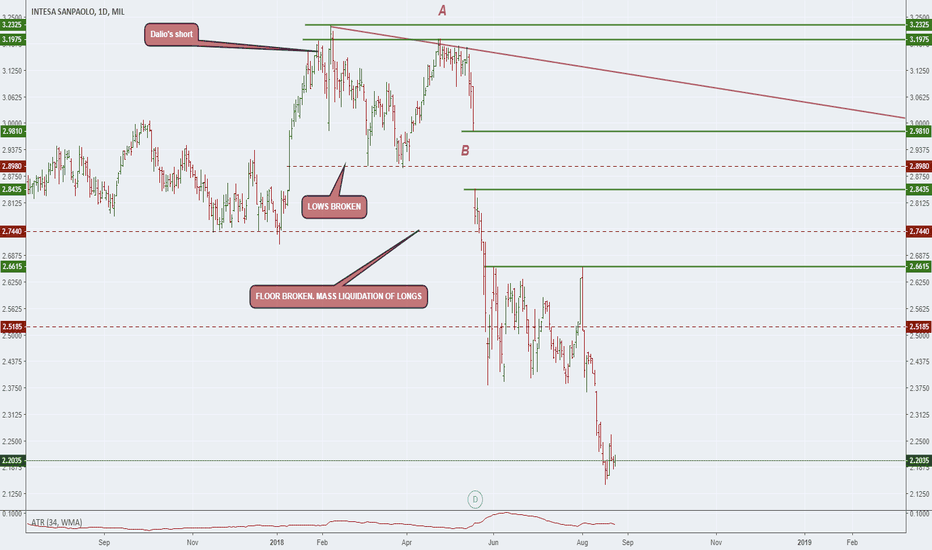

WHALE TRACKS !! A CASE STUDY. ISP is an Italian bank that has really taken a beating this year. Under all metrics it is a really weak institution.

What I wish to demonstrate today is how whales operate and hopefully how to take advantage of it.

Before I continue I'd Like to state two Axioms I take with me anytime I chart

1) A body in motion stays in motion unless an external force acts on it

2) Don't trade or look for the bottom , always wait for it and act on the weaker price action

Ray Dalio put a huge net short position on this bank , before the Italian fixed crisis and the Turkish mayhem that had a bleed over on the whole of the EU.

It is the actions of institutions that guide us , not our hypotheses. With that said are you willing to go long , short or wait? What are the positions in the market , who are in control of the market . Where and how does that change.

Those are the questions that I ask price , and I use its answer to give me a position.

HAPPY WEEKEND.

ISP correctingIntesa Sanpaolo Bank is, in my opinion, in a correction mode finding a support level at 2.70. Such a price was the one tested during last June "gap up" after the Italian Bank incorporated two smaller regional banks. Altough some analysts (www.thecerbatgem.com) forecasted a 3.20 target price, that level is quite difficult to reach in the short term. Much will depend on the updated business plan that will probably be disclosed together with 2017 consolidated financial results.