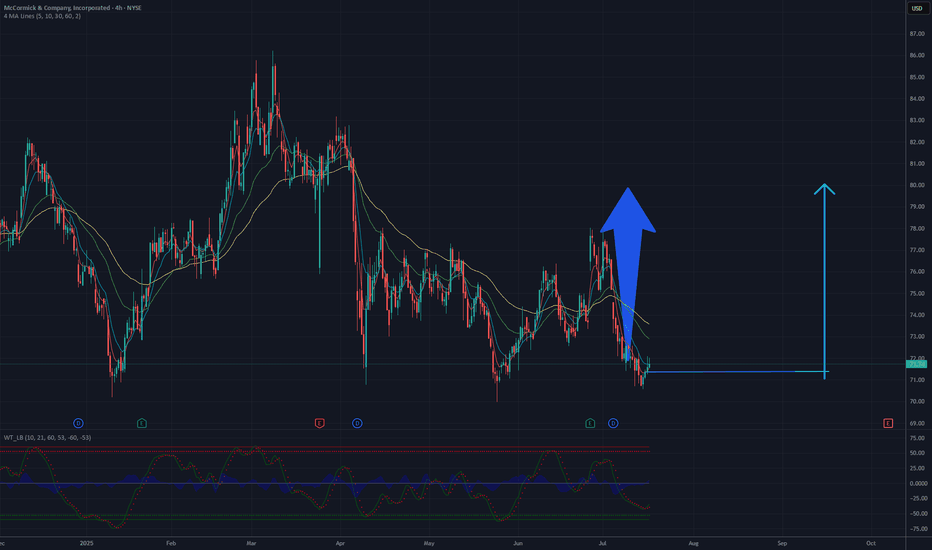

Ready for 80 USD? Time to grow for MKCThe chart analysis for this stock suggests a potential rise to 80 USD based on current technical patterns. The 4-hour chart shows a recent downtrend following a significant peak, with the price currently hovering around 71-72 USD. A key support level is evident near 70 USD, which could serve as a fo

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.54 EUR

745.62 M EUR

6.36 B EUR

252.52 M

About McCormick & Company, Incorporated

Sector

Industry

CEO

Brendan M. Foley

Website

Headquarters

Baltimore

Founded

1889

FIGI

BBG00P0PGKH8

McCormick & Co., Inc. engages in the manufacturing, marketing, and distribution of spices, seasoning mixes, condiments, and other flavorful products to retail outlets, food manufacturers, and foodservice businesses. It operates through the Consumer and Flavor Solutions segments. The Consumer segment sells spices, seasonings, condiments, and sauces. The Flavor Solutions segment includes seasoning blends, spices and herbs, condiments, coating systems, and compound flavors. The company was founded by Willoughby M. McCormick in 1889 and is headquartered in Baltimore, MD.

Related stocks

MKC🧩 Chart Structure & Trend

The chart shows a bullish breakout from a short-term consolidation pattern, confirmed by a recent bounce from the uptrend support line (red ascending trendline).

The price is currently hovering near the entry level at 76, suggesting a good risk-to-reward setup if momentum

MKC McCormick & Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MKC McCormick & Company prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $1.45.

If these options prove to be profitable prior to

Pantry Staples: Macro Fib SchematicsGeneral Mills, Kellogg, Campbell, Hershey, Smuckers, Sysco, McCormick & Company, and ConAgra are a handful of the largest American pantry/snack favorites.

These Fib Schematics look pretty good and are easy to decipher. This makes this a good idea other than the fact that I should have grouped my t

MKC McCormick & Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MKC McCormick & Company prior to the earnings report this week,

I would consider purchasing the 75usd strike price Calls with

an expiration date of 2023-10-20,

for a premium of approximately $2.53.

If these options prove to be profitable prior to

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MKC4529789

McCormick & Company, Incorporated 4.2% 15-AUG-2047Yield to maturity

6.29%

Maturity date

Aug 15, 2047

MKC5910058

McCormick & Company, Incorporated 4.7% 15-OCT-2034Yield to maturity

5.30%

Maturity date

Oct 15, 2034

US579780AR8

MCCORMICK&CO 21/26Yield to maturity

5.23%

Maturity date

Feb 15, 2026

US579780AS6

MCCORMICK&CO 21/31Yield to maturity

5.06%

Maturity date

Feb 15, 2031

MKC5566709

McCormick & Company, Incorporated 4.95% 15-APR-2033Yield to maturity

4.90%

Maturity date

Apr 15, 2033

MKC4976295

McCormick & Company, Incorporated 2.5% 15-APR-2030Yield to maturity

4.73%

Maturity date

Apr 15, 2030

MKC4308076

McCormick & Company, Incorporated 3.25% 15-NOV-2025Yield to maturity

4.54%

Maturity date

Nov 15, 2025

MCXC

MCCORMICK & CO. 17/27Yield to maturity

4.46%

Maturity date

Aug 15, 2027

See all MKC bonds

Curated watchlists where MKC is featured.

Frequently Asked Questions

The current price of MKC is 60.40 EUR — it has decreased by −1.69% in the past 24 hours. Watch MCCORMICK & CO-NON VTG SHRS stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange MCCORMICK & CO-NON VTG SHRS stocks are traded under the ticker MKC.

MKC stock has fallen by −2.20% compared to the previous week, the month change is a −6.24% fall, over the last year MCCORMICK & CO-NON VTG SHRS has showed a −11.98% decrease.

We've gathered analysts' opinions on MCCORMICK & CO-NON VTG SHRS future price: according to them, MKC price has a max estimate of 86.63 EUR and a min estimate of 58.60 EUR. Watch MKC chart and read a more detailed MCCORMICK & CO-NON VTG SHRS stock forecast: see what analysts think of MCCORMICK & CO-NON VTG SHRS and suggest that you do with its stocks.

MKC stock is 1.72% volatile and has beta coefficient of 0.26. Track MCCORMICK & CO-NON VTG SHRS stock price on the chart and check out the list of the most volatile stocks — is MCCORMICK & CO-NON VTG SHRS there?

Today MCCORMICK & CO-NON VTG SHRS has the market capitalization of 16.35 B, it has decreased by −0.96% over the last week.

Yes, you can track MCCORMICK & CO-NON VTG SHRS financials in yearly and quarterly reports right on TradingView.

MCCORMICK & CO-NON VTG SHRS is going to release the next earnings report on Oct 7, 2025. Keep track of upcoming events with our Earnings Calendar.

MKC earnings for the last quarter are 0.61 EUR per share, whereas the estimation was 0.57 EUR resulting in a 6.11% surprise. The estimated earnings for the next quarter are 0.70 EUR per share. See more details about MCCORMICK & CO-NON VTG SHRS earnings.

MCCORMICK & CO-NON VTG SHRS revenue for the last quarter amounts to 1.46 B EUR, despite the estimated figure of 1.46 B EUR. In the next quarter, revenue is expected to reach 1.46 B EUR.

MKC net income for the last quarter is 154.25 M EUR, while the quarter before that showed 156.46 M EUR of net income which accounts for −1.41% change. Track more MCCORMICK & CO-NON VTG SHRS financial stats to get the full picture.

Yes, MKC dividends are paid quarterly. The last dividend per share was 0.38 EUR. As of today, Dividend Yield (TTM)% is 2.43%. Tracking MCCORMICK & CO-NON VTG SHRS dividends might help you take more informed decisions.

MCCORMICK & CO-NON VTG SHRS dividend yield was 2.14% in 2024, and payout ratio reached 57.44%. The year before the numbers were 2.41% and 61.84% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 14.1 K employees. See our rating of the largest employees — is MCCORMICK & CO-NON VTG SHRS on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MCCORMICK & CO-NON VTG SHRS EBITDA is 1.14 B EUR, and current EBITDA margin is 18.99%. See more stats in MCCORMICK & CO-NON VTG SHRS financial statements.

Like other stocks, MKC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MCCORMICK & CO-NON VTG SHRS stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MCCORMICK & CO-NON VTG SHRS technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MCCORMICK & CO-NON VTG SHRS stock shows the strong sell signal. See more of MCCORMICK & CO-NON VTG SHRS technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.