MRNA: Bullish Setup Ahead of Earnings & FOMCMRNA: Bullish Setup Ahead of Earnings & FOMC

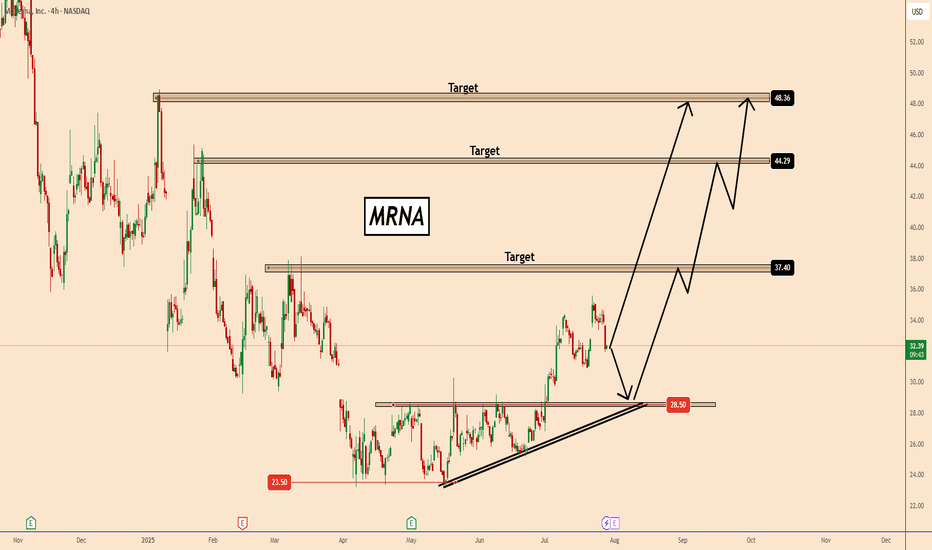

Moderna (MRNA) appears to have found a bottom near $23.50, based on recent price behavior. Following that level, the stock began accumulating, suggesting renewed buying interest. This was confirmed when MRNA decisively broke above $28.50, signaling a shift in momentum.

The company is scheduled to report earnings on 01 August 2025. While there is a chance the results could be positive, even a miss may not result in a significant downside move. The real market risk lies with the upcoming FOMC meeting and interest rate decision tomorrow.

Depending on the tone of the Fed and rate guidance, MRNA should take the price direction. I expect the price to remain supported above the $28.50 zone, even in a pullback scenario.

Bullish targets I’m watching: $37.50, $44.50, and $48.50.

PS: In my view, using Call Options with longer expiration dates offers better risk management. You don’t need to put your entire account at risk in one trade. Call Options let you control exposure in a better way.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

MRNA trade ideas

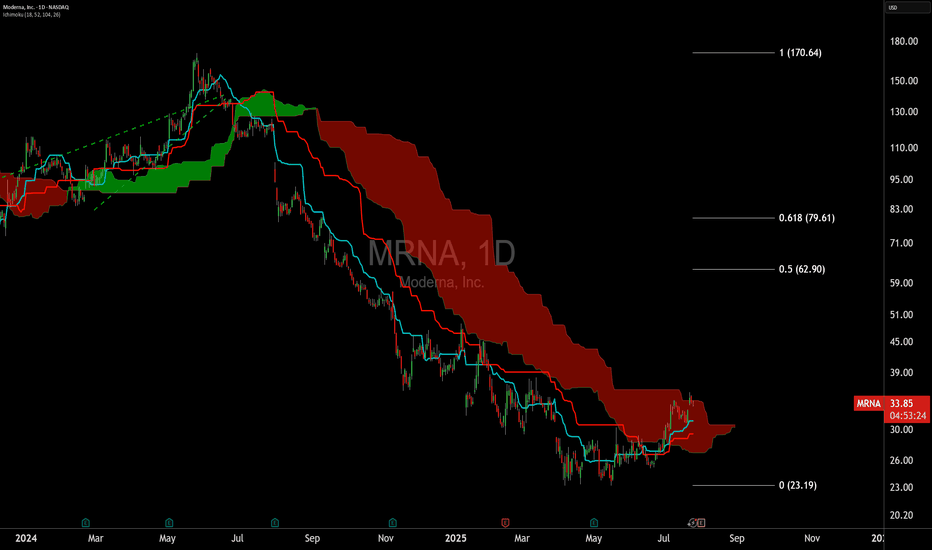

MRNA Approaching Trend Shift After Multi-Month DeclinePotential trend flip on the Moderna Chart for the first time since May 2024. I use a default doubled cloud on the daily timeframe 18/52/104/26. I find this to be superior to the default cloud on both backtesting and forward testing over the past decade on any chart.

Ideal bullish entry conditions occur on the cloud system when all four conditions are met:

Price above cloud

Bullish cloud

Bullish tenkan and kijun cross (TK)

Lagging span above price and above cloud (LS)

The doubled cloud settings are meant to decrease noise and increase signal, because of this I ignore the lagging span entirely and have never used the lagging span for entry criteria. We are approaching sufficient entry conditions with a bullish kumo breakout (price above cloud) and kumo twist (bullish cloud).

The target zone is merely based on the 50% retracement of high to low of the multi-month down trend, see: Dow Theory. Additional upside can be seen if the trend remains intact. Trailing stop losses via Williams Fractals and keeping an eye out for bearish divergences are both key to position management for this strategy.

Stop loss considerations for this idea is a combination of price below cloud and new lower lows. There is not a strongly defined level here at the moment but 31, 27 and 25 would all be considerations for reduction or closing of the position.

Interesting that this TA setup occurs in the setting of heavy anti-vaccine rhetoric from the current administration as well as severe weakness in the healthcare sector generally.

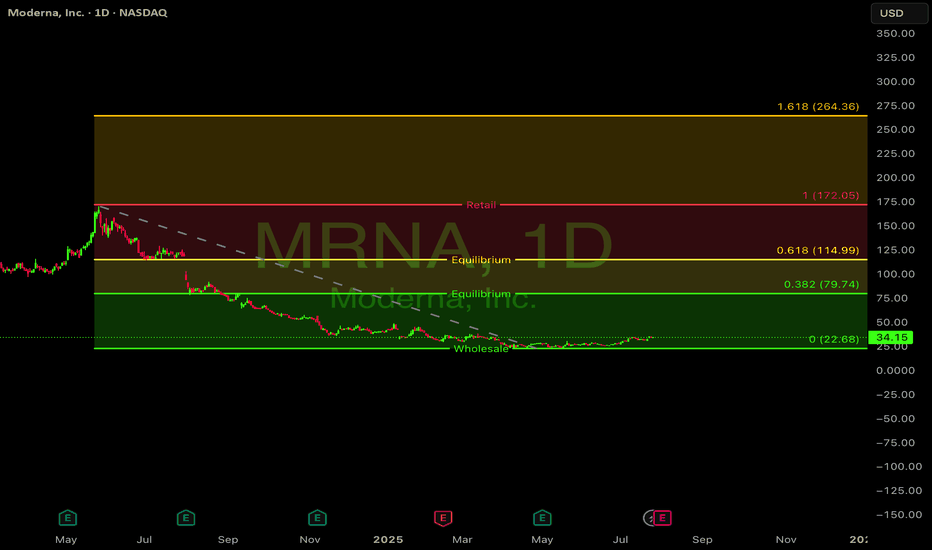

Bullish Analysis for Moderna (MRNA)Recent Price Action Shows Strength MRNA has shown significant bullish momentum since mid-May 2025, rising from around $24 to current levels above $34, representing a 40%+ gain. The stock has formed a series of higher lows and higher highs, establishing a clear uptrend.

Key Bullish Factors:

Positive FDA Developments

Full FDA approval for COVID-19 vaccine Spikevax for children 6 months through 11 years (July 10)

European Medicines Agency's positive opinion for updated COVID-19 vaccine formulation (July 25)

Technical Breakout

The stock broke above its resistance level around $30 in early July

Volume has increased on up days, particularly on July 8-9 (19.3M shares) and July 22-23 (12.5M shares), indicating strong buying interest

Cancer Vaccine Progress

Recent news (July 23) about researchers moving closer to a universal cancer vaccine, which aligns with Moderna's mRNA technology platform

Relative Value Opportunity

Market cap has decreased significantly from $44.4B in Q2 2024 to $10.9B in Q1 2025

Current price represents a potential value opportunity if the company can return to profitability

Price Structure Analysis:

08 Apr

15 Apr

22 Apr

29 Apr

06 May

13 May

20 May

27 May

03 Jun

10 Jun

17 Jun

24 Jun

01 Jul

08 Jul

15 Jul

22 Jul

25

30

35

MRNA Close Price

Support Levels

FDA Approval

EMA Positive Opinion

Entry Strategy:

Current price ($34.15) offers a potential entry point with strong support at the $32-33 level

Volume profile suggests accumulation phase may be underway

Risk can be managed with a stop loss below $32

Potential Catalysts:

Additional vaccine approvals or expanded indications

Progress in cancer vaccine development

Return to profitability in upcoming earnings reports

Potential for inclusion in seasonal vaccination programs

Risk Factors to Monitor:

Bank of America maintains a "sell" rating with a $25 price target

Negative PE ratio indicates the company is not currently profitable

News about Japan plant cancellation suggests demand challenges

Political uncertainty around vaccine policies

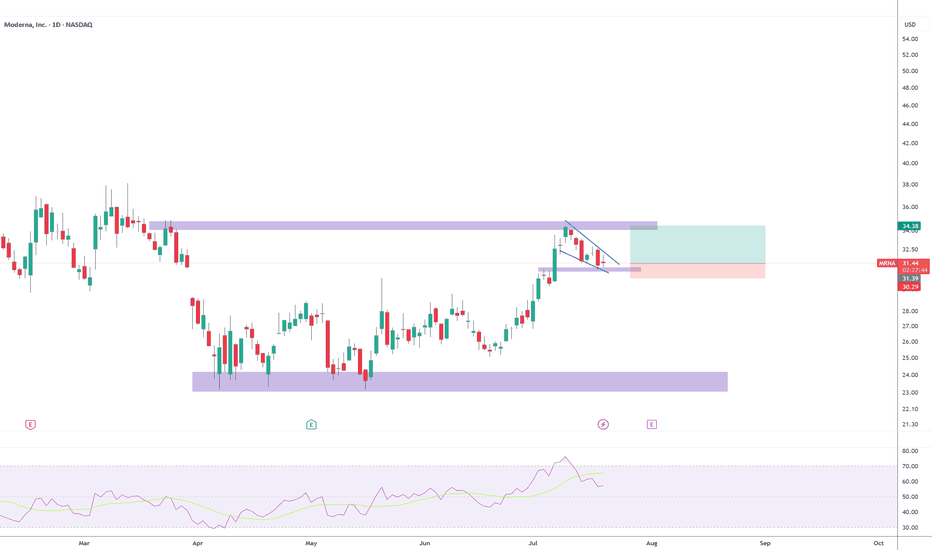

MRNA looking strong at cmpModerna remains in a precarious transition phase—from COVID-revenue dependency toward a diversified vaccine portfolio. Technically, momentum favors upside in the short-term, but fundamentals and macro-regulatory factors suggest caution. If its RSV and flu/COVID combo rollouts succeed and regulatory support stabilizes, it could rebound toward analyst targets near 60. Otherwise, expect choppier consolidation or downward pressure.

MRNA: The Wager No One Wants to Talk AboutModerna (MRNA) has become a pariah in many portfolios. Between reputational overhangs, political weaponization of its COVID success, and fresh regulatory pressures like the labeling requirement just triggered by Florida, the company has seemingly absorbed wave after wave of bad press.

But that’s the point.

1. The chart says it all: a long descent into pessimism, now basing near long-term support. A wedge of reversal is gradually taking shape.

2. Volume spikes not from hype, but from accumulation—stealth hands.

3. Meanwhile, the same narratives that depressed sentiment (public skepticism, regulatory scrutiny) have largely been priced in.

Here’s what the crowd is missing:

a) Moderna isn’t just a COVID trade. Its mRNA platform is still one of the most potent IP arsenals in biotech.

b) Obesity, flu, RSV, oncology—they're positioning for relevance beyond pandemics.

c) In markets driven by liquidity and narratives, the re-rating doesn’t require universal approval, maybe just less animosity.

I'm holding $50 LEAPS for 2027 just to be safe for $4.33 here.

I don't believe in fairy tales.

However, doubling a stock from a bombed-out base doesn't necessitate a miracle—just narrative fatigue, a favorable trial headline, and perhaps, just possibly, a market that rediscovers optionality.

$MRNA – Long-Term Setup Brewing | Major Move Incoming?Moderna ( NASDAQ:MRNA ) may be gearing up for a multi-month reversal after a prolonged downtrend. Price action is compressing in a tight base, suggesting a potential 6+ month breakout could be in the cards.

📊 Key Technical Notes:

Trading near long-term support with signs of accumulation

Bullish divergence forming on RSI and MACD

Volume contraction hints at a volatility expansion ahead

Overhead resistance sits between $60–$80, aligning with previous breakdown levels from 2023

⚠️ Breakout Trigger: Watch for a decisive move above $29.50–$30 on volume. A sustained breakout could initiate a powerful move toward the $60–$80 resistance zone.

📍 Levels to Watch:

Breakout zone: $29.50–$30

Resistance targets: $60, then $80

Key support: $25–$26

🧠 This is a longer-term swing trade idea — ideal for patient traders looking to front-run institutional rotation into beaten-down biotech names.

#MRNA #Moderna #SwingTrade #BiotechStocks #LongTermSetup #TechnicalAnalysis #StockMarket #BreakoutSetup #OptionsTrading #TradingView

Bullish wedge coiling up; bird flu incoming ?

1. Over the past year moderna is down 85% and from its pandemic highs, down 90%+ so simply that alone tells you the stock is quite cheap and beaten down. It is currently trading at 2020 levels as if a world changing pandemic never happened.

2. Moderna is currently trading around its book value once again highlighting how cheap it is.

3. From a trading perspective, a bullish wedge has formed over the past 7 months which looks ready to breakout and of course, if and when it breaks out, it'll be a one sided explosion.

4. Sentiment in the entire vaccine and biotech space is extremely pessimistic, but that is how bottoms form !

Most importantly, the stock market looks like its ready to start another leg lower, meanwhile moderna and other vax stocks look ripe for a breakout so maybe a bird flu catalyst could be coming very soon !

MODERNA $305 | Bidding at $220 and $150 Informed Players and speculators at Sub $100 levels are booking gains

we wait for additional drwadowns and re accomodation ACCUMULATION of designated Bankers for the next run up OR cycle

Vaccine COViD was intense HiV was the sell on News..

we await next Drama and Biden Policy on Healthcare etc..

for now Watch or Chrun at key leves (eyeball the box)

A Long-term Bullish Trend ?With an upcoming Earnings report we can observe rather uncertain future behavior.

But since the trend has been bearish for a longer period of time and the price is "nearly" at the same position which was achieved for the first time in early April in 2019, we can, mostly based only on the technical analysis and Earnings report, determine quite confidently that the price is ready to rise.

Important data:

EPS Estimate: -$3.12

Revenue Estimate: $106 million to $166.7 million

Notable developments:

Cost-cutting initiative = Targeting $1.1B in reductions by 2027

By the end of 2024 $9.5 billion allocated in investments

Moderna (MRNA) Shares Plunge Nearly 9%Moderna (MRNA) Shares Plunge Nearly 9%

Moderna (MRNA) shares tumbled by approximately 8.9%, falling below $29—marking their lowest level since April 2020, when global markets were shaken by the COVID-19 pandemic.

Since the start of 2025, MRNA’s share price has declined by around 32%.

Why Did MRNA Shares Drop?

On Monday, MRNA led the decline among US biotech stocks following the resignation of Peter Marks, director of the FDA’s Center for Biologics Evaluation and Research. Marks had held this position for over a decade.

During Trump’s first term, Marks oversaw the rollout of COVID-19 vaccines and established guidelines for emerging treatments such as cell and gene therapy.

However, in Trump’s second term, Robert F. Kennedy Jr. now serves as Health Secretary. According to The Wall Street Journal, Marks criticised Kennedy’s stance on vaccines in his resignation letter, calling it “misinformation and lies.”

The pharmaceutical industry was already under pressure amid speculation that Trump’s tariff plans could extend to prescription drugs, which are typically exempt from such measures. Marks' departure has further intensified uncertainty regarding regulatory decisions under the new administration.

Technical Analysis of MRNA Shares

The chart indicates that:

➝ The stock remains in a downtrend that began with a sharp drop in August last year (reinforced by the moving average).

➝ Over the past five months, it has been forming a descending channel (marked in red).

➝ The lower boundary of this channel acted as support yesterday.

The formation of higher lows and highs (marked in blue) had given bulls some hope in March 2025. However, yesterday’s bearish gap appears to have shattered that optimism.

It is possible that the lower blue trendline and the median of the red channel will act as resistance moving forward, further darkening the outlook for MRNA’s share price—especially given the ongoing negative news surrounding the stock.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Moderna. Why Anti-Covid19 Juggernaut Goes 'The Bloodmachine'It's gone 5 years or so... (Duh..? 5 years, really? 🥴) since everyone was talking about COVID-19 pandemic, vaccines, "world will never be the same again", and so on.

- And now?..

- It's gone. It's absolutely gone..! Since nothing last forever and no one should chase a feather, or dust in the wind.

This is why we at our 💖Super-Duper Beloved @PandorraResearch Team decided to build this idea, as a educational idea to learn, even this story is about single Moderna stock, and we have reasonable considerations about fundamental, technical and price movement perspectives.

Well.. Let's the story begin...

Over the past few years, Moderna's stock has experienced a significant decline, primarily due to several key factors.

Here's a detailed explanation of why Moderna's stock has been moving downward:

1. Declining Demand for COVID-19 Vaccine

The primary reason for Moderna's stock decline is the waning demand for COVID-19 vaccines. During the pandemic, Moderna's mRNA-based vaccine was one of the first and most widely used, leading to a surge in sales and profitability. However, as the pandemic transitioned into an endemic phase, demand for vaccines decreased substantially. This shift has resulted in declining sales for Moderna, impacting its revenue and profitability.

2. Sales Guidance and Performance

In recent years, Moderna has faced challenges in meeting sales expectations. For instance, in 2025, the company forecasted sales between $1.5 billion and $2.5 billion, which was significantly lower than analysts' expectations of around $2.9 billion. This discrepancy led to a sharp decline in stock prices as investors became increasingly pessimistic about the company's future growth prospects.

3. Cost-Cutting Measures

To mitigate the impact of declining sales, Moderna has implemented cost-cutting measures. The company plans to reduce its cash operating costs by $1 billion in 2025 and an additional $500 million in 2026. While these efforts aim to improve profitability, they also reflect the challenges Moderna faces in maintaining its financial health without strong vaccine sales.

4. Competition in New Market s

Moderna is expanding into new markets, such as the respiratory syncytial virus (RSV) vaccine space, with its product mResvia. However, this market is highly competitive, with established players like Pfizer and GSK already present. The competition and uncertainty about market share have contributed to investor skepticism about Moderna's ability to drive growth through new products.

5. Delayed Break-Even Point

Initially, Moderna aimed to break even on an operating cash cost basis by 2026. However, this goal has been pushed back to 2028, indicating a slower-than-expected transition to profitability. This delay has further eroded investor confidence in the company's ability to execute its strategic plans effectively.

6. Valuation and Market Performance

Moderna's stock has underperformed both the industry and the broader market. The stock trades below its 200-day and 50-day moving averages, reflecting a lack of momentum. Additionally, Moderna's price-to-sales ratio is lower than the industry average, which might suggest undervaluation but also indicates a lack of investor enthusiasm for the stock.

7. Analyst Sentiment and Profitability Forecasts

Analysts have become increasingly pessimistic about Moderna's prospects, with many not expecting the company to turn profitable again until at least 2029. This negative outlook has contributed to the downward pressure on the stock. Furthermore, estimates for loss per share have increased, reinforcing the bearish sentiment among investors.

In summary, Moderna's stock decline is primarily driven by declining vaccine demand, missed sales expectations, increased competition in new markets, delayed profitability, and negative analyst sentiment. While the company is taking steps to adapt to these challenges, the path to recovery remains uncertain, contributing to ongoing investor skepticism.

--

Best 'No more Covid' wishes,

@PandorraResearch Team 😎

$MRNA: Moderna – mRNA Magic or Biotech Bubble?(1/9)

Good afternoon, folks! ☀️ NASDAQ:MRNA : Moderna – mRNA Magic or Biotech Bubble?

CEO drops $5M on shares, sparking a 9% surge—is this a biotech rocket or a hot air balloon ready to pop? Let’s crack the code! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Trend: Up 9% after CEO’s $5M buy on Mar 5, 2025 💰

• Context: Biotech’s a rollercoaster—posts on X show optimism 📈

• Sector Vibe: Volatile, but insider faith lifts spirits 🌈

It’s a wild climb—buckle up! ⚡

(3/9) – MARKET POSITION 📈

• Market Cap: Around $12B (based on 384M shares, est.) 🏅

• Operations: mRNA pioneer, vaccines to cancer therapies ⏳

• Trend: CEO’s move signals undervaluation hope 🎯

Solid player in the biotech jungle! 🌋

(4/9) – KEY DEVELOPMENTS 🔑

• Insider Buying: CEO’s $5M grab on Mar 5, 2025 🔄

• Buzz: Posts on X tie surge to leadership confidence 🌐

• Reaction: Market cheers, up 9% in a blink 📣

Risin’ like dough in a warm oven! 🔥

(5/9) – RISKS IN FOCUS ⚠️

• Volatility: Biotech swings wild amid macro uncertainty 🔎

• Policy: Healthcare shifts could sting 📉

• Pipeline: New products unproven, per X chatter 🌬️

High stakes, high drama! 🎭

(6/9) – SWOT: STRENGTHS 💪

• Innovation: mRNA tech reshapes medicine 🏆

• Confidence: CEO’s $5M bet screams belief 📊

• Legacy: COVID vaccine king, still swinging ⚒️

A biotech beast with bite! 🐺

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Volatility, macro jitters hit hard 📉

• Opportunities: New mRNA goodies, partnerships loom 📈

Can it brew more magic or fizzle out? 🧪

(8/9) – 📢 Stock up 9% after CEO’s $5M buy—your call? 🗳️

#

• Bullish: $50+ soon, biotech boom 🚀

• Neutral: Holding steady, risks weigh ⚖️

• Bearish: $25 looms, bubble bursts 🐻#

Drop your vote below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Moderna’s 9% pop on insider buying hints at hidden gems 📈, but biotech’s a stormy sea 🌊. Dips are our playground—DCA heaven 💸. Snag ‘em cheap, ride the wave! Winner or wild card?

MRNA'Ticker: MRNA

Direction: Up

Prognosis: Buy Calls (Author bought $40 and $41 calls expiring this week, considering rolling to later dates)

Reasoning: New Covid-like virus discovered, rising avian flu concerns, large institutional buying, bullish technical indicators (RSI divergence, MACD turning up), high call option volume and open interest. Author acknowledges that a drop below $30 could invalidate the thesis.

Disclaimer: This is not financial advice. MRNA is volatile; know your risk tolerance.

Bonus: Author also mentions potential plays on HD puts, LOW puts, and CLF calls.'

Strength on MRNADespite negative news, Moderna, Inc. stock is in a good position to rally. Its price has been falling since August 2021, but relatively big buys have begun to emerge since August 2024.

It has to be noted that on every bar with buying, volume is increasing, which is usually a sign of accumulation on a down move.

If the price breaks the $40.83 level (the high of the bar with the largest volume), then tests it on low volume later, and supply does not re-emerge in the $49.94 - $56.70 zone, this would signal the end of accumulation. In such a case, we could expect the move towards $102.90 - $118.10, and if shares would not be sold off there, it might go even higher to $156.94 - $163.19.

At the same time, if accumulation has not been finished yet, we may still see another leg down for more buying.

Moderna Faces Another Quarterly Loss, Yet Shares Show ResilienceModerna Inc. (NASDAQ: NASDAQ:MRNA ) has once again reported a quarterly loss, reflecting the continued decline in COVID-19 vaccine sales and an unexpected charge related to a canceled manufacturing contract. Despite this, shares of the biotech giant saw a 3.35% uptick, signaling a mixed sentiment among investors.

Weighing the Challenges and Opportunities

On Friday, Moderna disclosed a Q4 2024 revenue of $966 million, marking a sharp 65% year-over-year decline. The loss per share stood at $2.91, exceeding the analyst projection of $2.73 per share. More concerning for investors was the company’s forecast for 2025 sales, estimated between $1.5 billion and $2.5 billion—significantly below the $3.26 billion consensus estimate.

CEO Stéphane Bancel reaffirmed Moderna’s focus on cutting costs and streamlining its research and development (R&D) efforts. The company plans to reduce R&D expenses by up to $1.1 billion by 2027, primarily by halting early-stage projects and prioritizing late-stage drug approvals. Moderna has already trimmed $1 billion in costs, positioning itself for leaner operations in the coming years.

Technical Analysis: Key Levels to Watch

From a technical perspective, NASDAQ:MRNA shares closed Friday’s session down 0.38%, showing hesitation despite the broader market’s strength. The stock is currently hovering near a critical support zone—the one-month low. Should this level fail to hold, a further decline towards the $25 region could be the next stop.

On the upside, a breakout above the 38.2% Fibonacci retracement level could alter the trajectory for Moderna’s stock, potentially signaling a bullish reversal. However, with the Relative Strength Index (RSI) at 41.46, the stock remains in weak momentum territory, suggesting that bullish conviction is still lacking.

Outlook: Can Moderna Reignite Investor Confidence?

Moderna’s near-term outlook remains uncertain, as the company grapples with declining COVID vaccine sales, weaker-than-expected 2025 revenue projections, and an ongoing shift in its R&D strategy. However, its pipeline of combination vaccines and upcoming approvals may offer a longer-term upside if execution is successful.

Technically, NASDAQ:MRNA needs to hold its key support zone and break above the 38.2% Fibonacci retracement to shift market sentiment positively. Until then, investors should watch for further signals of strength, particularly in trading volume and RSI movement, before confirming a potential bullish turnaround.

In the coming months, all eyes will be on Moderna’s next earnings report and the market’s reaction to its cost-cutting measures and pipeline advancements. The stock’s ability to sustain recent gains—or break lower—will depend on whether the company can deliver on its strategic shifts and stabilize its revenue trajectory.

MRNA Moderna Options Ahead of EarningsIf you haven`t bought MRNA before the previous earnings:

Now analyzing the options chain and the chart patterns of MRNA Moderna prior to the earnings report this week,

I would consider purchasing the 45usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $3.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

$MRNA yieahhhrough day for some, good day for my DCA friends.

NASDAQ:MRNA on a rough down trend since covid days. Looking for a wild bounce here.

1. MACD curving to the upside

2. RSI Curving to the upside

3. Price is at the bottom of the parallel channel.

My bets are on seeing $60-$70 which is middle of the channel by the summer. Of course I bought some time.

Would be insane to see this going to $120 top of channel by eoy right? Maybe too insane?

Yieaahhh