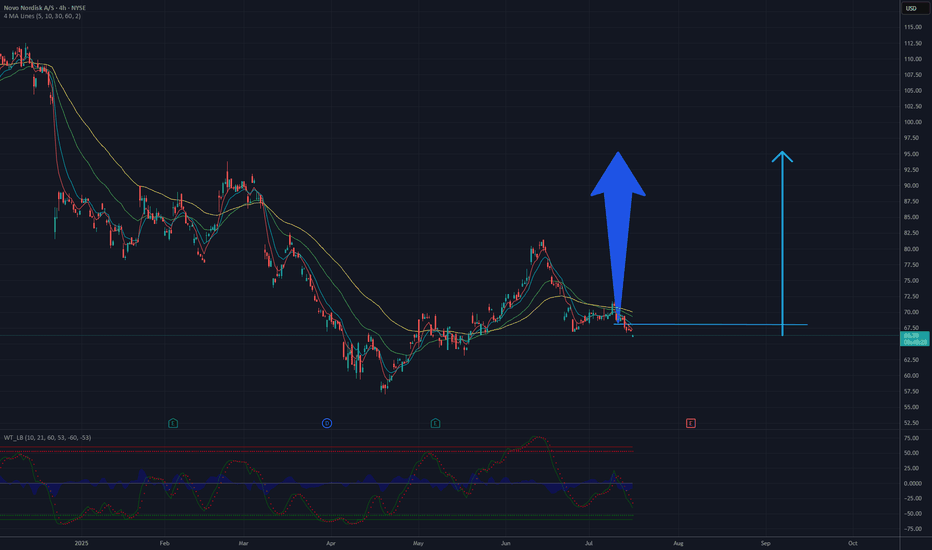

Potential Upside Move in Novo Nordisk Stock Toward the $90–$100 Based on the 4-hour chart of Novo Nordisk A/S (NYSE: NVO), the stock has undergone a strong downward correction from above $165, but is now showing signs of a potential technical bottom near the $65 level. Price action has stabilized, and oscillators indicate oversold conditions, suggesting a possible trend reversal.

The chart shows a short-term consolidation after a bounce, and the moving averages (MA 5/10/30/60) are converging — a setup that often precedes a bullish breakout. The $90–$100 area aligns with former support-turned-resistance zones, making it a natural target for a corrective upward move.

Conclusion: If the current momentum holds and the price breaks out of the local consolidation, a move toward the $90–$100 range appears likely as part of a broader rebound following the extended downtrend.

Potential TP : 90-95 USD

NNO2 trade ideas

NVO: Trend Continuation With 4.74 R/R SetupNovo Nordisk ( NYSE:NVO ) is showing classic strength — bouncing off the cloud, reclaiming structure, and flashing early signs of momentum rotation. This is how you catch continuation trades without chasing.

📊 Technical Breakdown

Ichimoku: Price reclaimed the top of the cloud and is now building above it. Kijun and Tenkan are aligned. This is the first real bullish structure since the March breakdown.

MACD: Histogram curling upward. We’re not fully bullish yet, but the pressure is shifting back to buyers.

R1 Pivot ($81.31) is the first big test. A clean break above that opens the path toward R2 and beyond.

🎯 Trade Specs

Entry: $71.58

Target: $93.33 (+30.44%)

Stop: $67.00 (–6.42%)

Risk/Reward: 4.74 — elite-level skew for a high-quality name

Cup & Handle to 81$ (and much more)Breakout successful from the red descending channel where we had left it in the previous idea.

The price is now completing the 'handle' of the pattern in question.

Resistance is around $81.5, and a close above it, accompanied by strong volume, could push the price back toward $100

NVO to 107 USDTechnical Analysis Summary – NVO

After a prolonged downtrend, the stock established a potential reversal structure:

Wave 1: Initial impulsive rally, marking the first significant move against the prevailing bearish trend.

Wave 2: Healthy corrective pullback that retraced precisely to the 61.8% Fibonacci level of Wave 1, which is a classic depth for a Wave 2 retracement in Elliott Wave Theory.

The price also tested and bounced off the 200-day Simple Moving Average (SMA) on the first attempt, confirming this zone as key technical support.

A hidden bullish divergence formed: while the price created a higher low, the momentum indicator (RSI) printed a lower low. This suggests that sellers exhausted their strength and the primary trend may resume.

Premarket action showed the stock trading about +2% higher, indicating early buying interest and potential momentum continuation.

The projected target for Wave 3, assuming the scenario unfolds, is approximately $107, derived from the 161.8% Fibonacci extension of Wave 1. This also coincides with historically important resistance.

Overall, this setup combines:

✅ A clear Elliott Wave structure (Wave 1-2-3),

✅ Confluence of major support levels (61.8% retracement and the 200-day SMA),

✅ A hidden bullish divergence signaling continuation,

✅ A strong premarket move suggesting institutional interest,

✅ And supportive fundamentals behind the price action.

This is an example of a technically robust scenario with favorable risk/reward characteristics. Traders will watch for confirmation through volume expansion and a breakout above recent swing highs to validate the start of Wave 3.

$NVO Trade Idea – Potential Bullish Reversal Setup📊 Market Structure Insight

After a clear downtrend marked by consecutive Lower Highs (LH) and Lower Lows (LL), NYSE:NVO is beginning to show early signs of a trend reversal.

🔹 Recent price action has shifted into a Higher High (HH) and Higher Low (HL) formation – a classic sign of bullish momentum building.

🔹 Price is consolidating above a major demand zone (~$60–68), which previously acted as strong support. Buyers are showing interest here again.

🔹 The RSI is rebounding from oversold territory, indicating growing bullish pressure and a potential momentum shift.

📈 Upside Scenario (Projection)

If the current HL around $67 holds, we could see a continuation of the uptrend targeting key levels:

TP1: $90 – Initial resistance / possible gap fill

TP2: $120 – Mid-supply zone and structure resistance

TP3: $147 – Macro supply zone and previous all-time high

🎯 Trade Setup

Entry Zone: $67–70

Stop Loss: Below $60 (beneath key support)

Targets: $90 / $120 / $147

⚠️ Invalidation

Breakdown below $60 would invalidate this bullish setup and signal possible continuation of the previous downtrend.

💡 Watch for confirmation on the next HL / HH combo. A clean breakout above recent highs would further validate the bullish case.

NVO Soaring Towards TargetsOur NVO call debit spreads and LEAPS options soaring towards targets at the 233 EMA here.

Beautiful thing when fundamentals, valuations and technicals align.

Impulse move from the bottom gave us a hat trick - triple green tags (white circles) for bullish A+ momentum signals into a consolidation period in which we built our position and added on the consolidation breakout

NOVO is looking at a strong bullish bottoming outNYSE:NVO is looking at a strong bullish reversal and is likely to head higher after stochastic shows overbought AND long term stochastic shows clear confirmation of oversold crossover.

Price action shows a clear break out of the downtrend line and with the rounding bottom, the stock is likely to target 101 in near to mid-term.

Novo Nordisk: Massive buying opportunityNovo has been struggling big time, december and march hit especially hard.

American institutions have held large positions in Novo, and this was felt when they had to sell off due to risk management with the looming tariffs.

However, the sheer devaluation & importance of their export, is going to create a massive wave following a risk-on environment, which i firmly believe is coming.

One of the few large EU based firms worth investing heavy in.

nvo bullish long Long Setup Idea – Not Financial Advice - AH

This is a long trade setup based on my personal analysis.

The entry, stop-loss, and target levels are outlined for educational and illustrative purposes only.

📈 Entry:

🛑 Stop Loss:

🎯 Target(s):

Disclaimer:

I am not a financial advisor. This idea is shared for educational purposes only and should not be considered investment advice. Always do your own research and manage your risk accordingly. Trading involves significant risk and can result in the loss of your capital.

AH

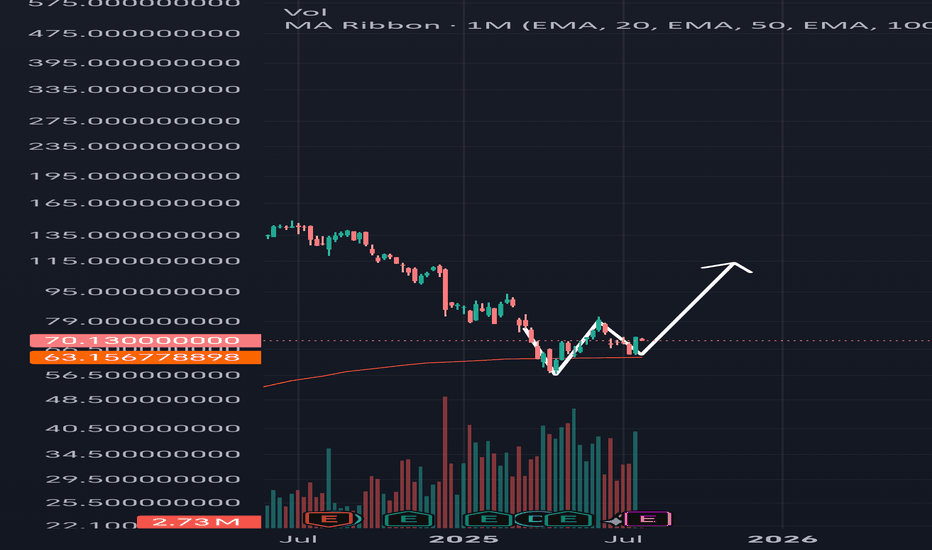

NVO Exhibits High Monthly Volume Amid Downtrend – SHortNVO Exhibits High Monthly Volume Amid Downtrend – Potential Accumulation Phase

📉 Post:

Novo Nordisk (NVO) has experienced a significant decline from its 52-week high of $148.15 to a recent low of $57.00. However, the monthly chart reveals an unusually high trading volume, which may indicate accumulation by institutional investors.

Key Observations:

High monthly trading volume, suggesting potential accumulation.

Current price: $71.50.

52-week range: $57.00 – $148.15.

Trading below the 209-day EMA, indicating a bearish long-term trend.

While the increased volume could signify a shift in sentiment, it's essential to wait for confirmation through a break above key resistance levels before considering a bullish position.

Not financial advice – just sharing my technical perspective.

#NVO #NovoNordisk #StockAnalysis #TechnicalAnalysis #EMA200 #VolumeAnalysis #PotentialReversal

NVO buyThis downturn has been influenced by several factors:

Leadership Changes: CEO Lars Fruergaard Jørgensen is stepping down after eight years, following a sharp decline in the company's stock price.

STAT

+8

MarketWatch

+8

WSJ

+8

Increased Competition: Eli Lilly's weight-loss drugs, Mounjaro and Zepbound, have gained market share, intensifying competition in the diabetes and obesity drug markets.

Barron's

+3

Investor's Business Daily

+3

WSJ

+3

Product Challenges: Novo Nordisk's next-generation obesity drug, CagriSema, showed underwhelming performance in late-stage trials, and the company has faced supply issues with its popular weight-loss products.

Reuters

+2

MarketWatch

+2

Barron's

+2

Despite these challenges, Novo Nordisk remains a significant player in the pharmaceutical industry, with a market capitalization of approximately $284.69 billion. The company continues to focus on its core strategies and is actively seeking new leadership to navigate the evolving market landscape.

晨星

MarketWatch

+1

纳斯达克

+1

For real-time updates and detailed financial information, you can visit Yahoo Finance or Google Finance.

NOV - CONTINUATION OF A DOWNTREND OR START OF A NEWGood Morning,

Hope all is well. NVO has been in a down trend since Feb 26 2025, like most stocks. NVO tried to move past the 70$ price point however it was rejected and is now seeking lower support. Currently for trend there is an ascending channel. A break above the mid-line is bullish, a failure to break could result in lower lows.

ENJOY!

Novo Nordisk Stock Chart Fibonacci Analysis 050925Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 411/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

NVO - looking for move upMy MVP system

M: rsi bottoming, rounded w a higher low

V: solid increase in vol

P: steep downward channel; could have nice pop to the upside; I would like the price better if it were forming a base instead of a steep down path, though price did hit a prior support/resistance zone

*Im wondering if NVO pops on earnings & then moves into a sideways range to form a new base

*If NVO drops on earnings, I’m even more interested for a lower entry as an investment

Bias: I don’t get into the weeds of fundamentals. However, I have a significant bias towards the GLP1 (and other peptides) industry. My background is in medicine.

Thank you.

Novo Nordisk (NVO) – Oversold Reversal + Earnings CatalystNovo Nordisk (NVO) has declined 61.13% from its all-time high of $148 (June 2024), finding support at $57.55. Over the past two weeks, the stock has rebounded over 15%, currently trading around $66.30, with strong reversal signals just ahead of earnings.

This setup presents a compelling opportunity, both technically and fundamentally, for a tactical trade or a longer-term position.

Simply Wall St

🔍 Technical Highlights:

✅ Rebound from long-term ascending trendline (~$57–58 zone)

✅ RSI rising from oversold levels (28 → 32 and climbing)

✅ MACD approaching a bullish crossover, indicating momentum shift

✅ Two consecutive green weekly Heikin Ashi candles post-bottom

✅ Defined risk with invalidation below $57 support

📈 Trade Setup:

🟢 Entry Zone: $66–68 (current price range)

🔴 Stop Loss: Below $57.00 (break of structure and breakout base)

MarketWatch

+6

StockAnalysis

+6

Simply Wall St

+6

✅ TP1: $78 – previous support zone

✅ TP2: $90 – February 2025 high before the selloff

✅ TP3: $110 – around December 2024’s local top

🗓️ Earnings – May 7, 2025

🔹 Analysts project ~19.7% YoY revenue growth

🔹 Continued strong demand for Ozempic and Wegovy

🔹 Forward P/E ratio at 16.33, below industry average

🔹 Robust margins and high institutional ownership

🔹 Significant free cash flow and a promising innovation pipeline

StockAnalysis

📌 This appears to be a high-quality oversold bounce with a well-defined risk/reward structure ahead of a significant earnings catalyst. Whether you're considering a swing trade or building a core position, this setup aligns both technical and fundamental factors.

Let’s monitor how this unfolds. 📊🔬

Disclaimer: This is not financial advice – just sharing my perspective. Please conduct your own research before making investment decisions.