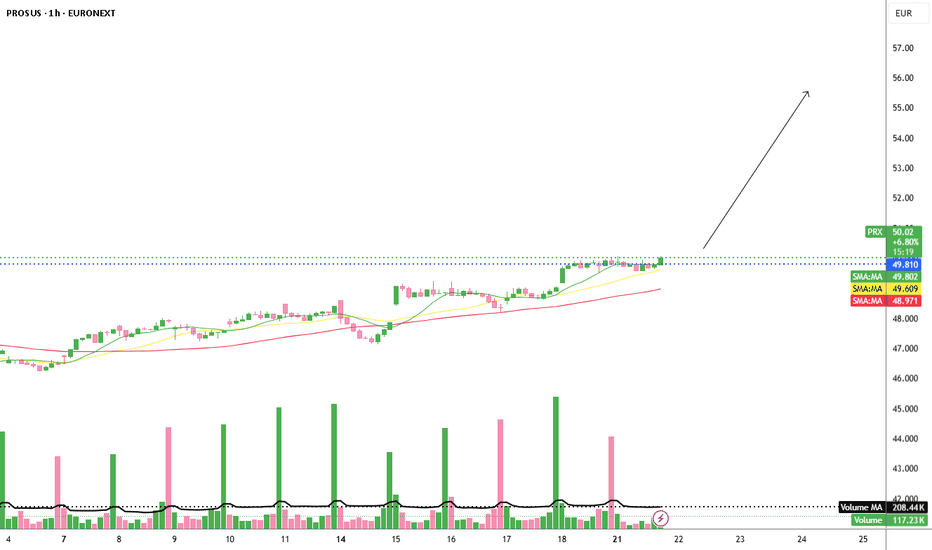

Prosus N.V. – Hidden Giant with Breakout PotentiaFollowing a strong bullish trend in July, Prosus N.V. is already up 8% month-to-date, and things are heating up. The company is reportedly in talks to acquire Just Eat Takeaway.

However, since Prosus already holds a 24% stake in Delivery Hero, the EU antitrust body has pushed back. Prosus has responded by offering to cut its Delivery Hero stake down to 10%, which could pave the way for regulatory approval.

But beyond the headlines, Prosus is a hidden champion in the European tech sector – with a market cap near €120 billion. The company is a global investor and operator in digital platforms, e-commerce, online classifieds, food delivery, fintech, and increasingly, artificial intelligence. With holdings across high-growth tech assets and a long-term strategy focused on unlocking value, Prosus has a positive, innovation-driven outlook, also constantly implementing AI-infrastructure.

From a technical perspective, the chart is clean and convincing: bullish continuation patterns forming repeatedly, always accompanied by decreasing volume during consolidations – a classic sign of strength. On the daily chart, Prosus is comfortably trading above its 10, 21, and 50 moving averages, indicating strong momentum and trend-following alignment. Especially in the last few sessions, we’ve seen a tight consolidation just beneath the 2021 all-time high, with volume drying up – often a precursor to an explosive move.

Should the Just Eat deal go through, Prosus could quickly push toward the €60 level, aligning with Wall Street targets and implying ~20% upside from current levels. Notably, the RSI remains below overbought, leaving room for a healthy push higher.

One cannot overlook the company’s strategic stake in Tencent, which remains a massive value anchor. Tencent not only provides financial muscle but also ongoing exposure to Asia’s tech innovation – something Prosus continues to leverage smartly.

With solid fundamentals, technical momentum, and a major catalyst on the table, Prosus looks well-positioned for Q3 and Q4 2025.

best, gqt

PRX trade ideas

PROSUS is one of the most interesting EU stocks (+30%)🟢 PROSUS is one of the most interesting EU stocks (+30%)

EURONEXT:PRX is one of the most interesting stocks in the EU, investing in small projects with large potential and also some consolidated projects like tencent.

✅ What pattern is unfolding in EURONEXT:PRX ?

PRX traded over a previous resistance level (big blue line) and now we are see a pullback to the previous resistance.

💰 How to trade this chart pattern?

Buying near the blue support is a very good idea because you can have a potential of up 6 times your risk (30% benefits vs 5% risk)

If not, buying over the next green resistance could be a nice option because is a signal of bullish sentiment and then we will not see the price near the blue line. If you buy there, adjust the stop!

🛡️ The risk management strategy

As we have done in so many previous ideas, remember you can split the position in 2.

- 50% of the position in a take profits, at least, as large as your stop loss (adapt SL and this 1st TP to local supports/resistance levels). In this case, a 7% TP for 5% SL (see the chart)

- 50% of the position to a price as large as the previous pattern, which would mean a profit of 30%.

✴️ ENJOY AND FOLLOW for more 😊

PROSUS showing upside to come to R1661.98 after W BreakW Formation formed after it's been in consolidation for a while now.

The previous trend was up, so the conditions have lined up as a high probability trade.

The price has broken above and looks to be heading up.

7>21>200

RSI >50

Target R1661.98

SMC Sell Side Liquidity Order Block just below the Second leg of the W Formation. This is where Smart Money has been buying the price up.

ABOUT:

Prosus is a global consumer internet group headquartered in the Netherlands, with a primary listing on Euronext Amsterdam and a secondary listing on the JSE.

It was established in 2019 as a spin-off of Naspers, a South African media and technology company.

Prosus is one of the largest technology investors in the world, focusing on sectors such as online classifieds, food delivery, payments and fintech, education technology, and more.

The company has a diverse portfolio of investments in leading technology companies globally, including significant stakes in Tencent Holdings, Delivery Hero, and Mail.ru Group.

Prosus is known for its strong presence in emerging markets, particularly in countries such as India, China, Russia, Brazil, and South Africa.

Its most notable investment is a 31% stake in Tencent, a Chinese multinational conglomerate and one of the world's largest internet companies.

As of its latest annual report in March 2023, Prosus had investments in over 200 companies across more than 90 countries.

Our opinion on the current state of PROSUS(PRX)Naspers (NPN) spun off Prosus (PRX) on 11th September 2019, listing it on the Euronext in Amsterdam to hold its international assets, including Tencent, Mail.Ru, and other internet brands. Naspers retains a 73% stake in Prosus, while 25% is free float. This listing mitigates rand risk, making Prosus a rand-hedge investment that benefits from rand weakness. As Europe’s largest consumer internet company, Prosus's primary asset is a 26% stake in Tencent, a Hong Kong-listed company with over 1.1 billion users across its top 10 mobile applications in China. Tencent, however, remains exposed to Chinese regulatory challenges, particularly in gaming.

Prosus operates across classifieds, payments, fintech, food delivery, e-tail, and travel, serving 1.5 billion people in 89 markets. The company has been diversifying its revenue streams while managing risks associated with its heavy reliance on Tencent.

Recent developments include:

- May 2022: Tencent announced a sharp decline in profits, adversely affecting Prosus shares.

- June 2022: Prosus launched an open-ended share buyback program, funded partly by selling Tencent shares. This move boosted the share price.

- October 2022: Prosus shares fell after Chinese President Xi Jinping’s re-election, raising concerns over regulatory pressures.

In its March 2024 results, Prosus reported an 11% increase in revenue and an 84% rise in core headline earnings, highlighting the impact of its share repurchase program, which reduced the free-float share count by 21% and generated $30 billion in value for shareholders.

In its September 2024 trading statement, Prosus estimated a 112% to 122% rise in headline earnings per share (HEPS), attributing the growth to improved profitability and lower impairment charges.

Technical Analysis: Since November 2023, the Prosus share has been trending upwards. It remains undervalued at current levels, with robust financial performance and a strong buyback program contributing to investor confidence. The share's rand-hedge characteristics and diverse portfolio further strengthen its appeal. However, investors should remain cautious of Chinese regulatory risks tied to Tencent.

Our opinion on the current state of PROSUS(PRX)Naspers (NPN) separately listed Prosus (PRX) on the Euronext in Amsterdam on 11th September 2019, consolidating its international assets, including its stake in Tencent, Mail.Ru, and various internet brands. Naspers retains a 73% ownership of Prosus, with a 25% free float. The Euronext listing provides a key advantage as it mitigates the currency risk associated with the South African rand, making Prosus a rand-hedge; its value tends to increase when the rand weakens and vice versa.

Today, Prosus is Europe's largest consumer internet company. Its primary asset remains its 26% stake in Tencent, a Hong Kong-listed leader in social media and gaming in China, reaching over 1.1 billion users across China’s top mobile applications. However, Tencent faces regulatory risk from Chinese authorities, particularly in the gaming sector.

Prosus is a global consumer internet group active in 89 markets and a leader in 77 of those. Its services include Classifieds, Payments and Fintech, Food Delivery, and other online sectors like Etail and Travel. On 18th May 2022, Tencent reported that its profit for Q1 2022 was half of that in 2021, which negatively impacted Prosus shares. Then, on 24th June 2022, Prosus announced plans to sell a portion of its Tencent shares to finance an open-ended share buy-back program, which led to a positive market response. The re-election of Xi Jinping on 24th October 2022 contributed to a steep fall in Prosus shares, as his policies advocate for regulation of “disorderly expansion of capital” in China.

For the year ending 31st March 2024, Prosus reported:

- Revenue up 11%

- Core headline earnings up 84%

Prosus highlighted its share repurchase program, launched in June 2022, which reduced the free-float share count by 21% and generated US$30 billion in shareholder value.

Technically, Prosus has been on an upward trend since November 2023. Despite gains, the share still appears undervalued. The company announced on 18th September 2023 that CEO Bob van Dijk would step down with immediate effect, and Fabricio Bloisi was appointed CEO of both Naspers and Prosus, effective 1st July 2024. This leadership change could signal strategic shifts as Prosus continues to navigate its substantial international portfolio and ongoing buy-back program.

Our opinion on the current state of PROSUS(PRX)On 11th September 2019, Naspers (NPN) separately listed Prosus (PRX) on the Euronext in Amsterdam to house all its international assets including its stake in Tencent, Mail.Ru, and other internet brands. Naspers holds 73% of Prosus and there is a 25% free float. One of the benefits of the Euronext listing is that it removes the risk inherent in the rand, so Prosus is a rand-hedge which rises when the rand weakens and vice versa. Prosus is now Europe's largest consumer internet company.

The main asset of Prosus is 26% of Tencent, a Hong Kong-listed company that provides social media services and gaming in China. Tencent has 10 of China's 20 top mobile applications reaching over 1.1 billion users. Tencent remains vulnerable to the authoritarian regulators in China and their involvement in the gaming industry.

Prosus describes itself as, "...a global consumer internet group operating across a variety of platforms and geographies and is one of the largest technology investors in the world. The Prosus Group's businesses and investments serve more than 1.5 billion people in 89 markets and are the market leaders in 77 of those markets. The Prosus Group's consumer internet services span the core focus segments of Classifieds, Payments and Fintech as well as Food Delivery, plus other online businesses including Etail and Travel."

On 18th May 2022, Tencent issued a statement saying that its profit in the March 2022 quarter was half of what it had been in 2021, leading to a negative impact on Prosus shares. On 24th June 2022, the company said that it intended to sell some of its Tencent shares to finance an extended open-ended share buy-back program. This caused the share price to jump up. On 24th October 2022, the re-election of Chinese leader Xi Jinping for a third term caused Prosus shares to fall heavily. Jinping is part of a faction in Chinese politics which aims to keep the "disorderly expansion of capital" under control.

In its results for the year to 31st March 2024, the company reported revenue up 11% and core headline earnings up 84%. The company said, "We have created additional value for our shareholders by continuing the open-ended share-repurchase programme. Since its inception in June 2022, this programme has reduced the free-float share count by 21% and generated US$30bn of value for shareholders."

Technically, the Prosus share has been trending up since November 2023. We still believe that the share is undervalued at current levels. On 18th September 2023, the company announced that CEO, Bob van Dijk, would resign with immediate effect. On 17th May 2024, the company announced that Fabricio Bloisi would take over as CEO of both Naspers and Prosus with effect from 1st July 2024.

Our opinion on the current state of PROSUS(PRX)On 11th September 2019, Naspers (NPN) separately listed Prosus (PRX) on the Euronext in Amsterdam to house all its international assets, including its stake in Tencent, Mail.Ru, and other internet brands. Naspers holds 73% of Prosus, and there is a 25% free float. One of the benefits of the Euronext listing is that it removes the risk inherent in the rand, so Prosus is a rand-hedge that rises when the rand weakens and vice versa. Prosus is now Europe's largest consumer internet company.

The main asset of Prosus is 26% of Tencent, a Hong Kong-listed company that provides social media services and gaming in China. Tencent has 10 of China's 20 top mobile applications, reaching over 1.1 billion users. Tencent remains vulnerable to the authoritarian regulators in China and their involvement in the gaming industry. Prosus describes itself as, "...a global consumer internet group operating across a variety of platforms and geographies and is one of the largest technology investors in the world. The Prosus Group's businesses and investments serve more than 1.5 billion people in 89 markets and are the market leaders in 77 of those markets. The Prosus Group's consumer internet services span the core focus segments of Classifieds, Payments and Fintech as well as Food Delivery, plus other online businesses including Etail and Travel."

On 18th May 2022, Tencent issued a statement saying that its profit in the March 2022 quarter was half of what it had been in 2021, leading to a negative impact on Prosus shares. On 24th June 2022, the company said that it intended to sell some of its Tencent shares to finance an extended open-ended share buy-back program. This caused the share price to jump up. On 24th October 2022, the re-election of Chinese leader Xi Jinping for a third term caused Prosus shares to fall heavily. Jinping is part of a faction in Chinese politics that aims to keep the "disorderly expansion of capital" under control.

In its results for the six months to 30th September 2023, the company reported revenue up 13% and headline earnings up 85%, "...primarily due to improved profitability of our ecommerce consolidated businesses and equity-accounted investments, particularly Tencent, and higher net interest income during the period." Core headline earnings per share (HEPS) almost doubled to 76c per share. In a trading statement for the year to 31st March 2024, the company estimated that HEPS would increase to between 107c and 111c (US) compared with 23c in the previous period. The company said, "...headline earnings per share for the year are expected to increase driven by improved profitability of our ecommerce consolidated businesses and equity-accounted investments, in particular Tencent, and an increase in our net interest income."

Technically, the Prosus share has been trending up since November 2023. We still believe that the share is undervalued at current levels. On 18th September 2023, the company announced that CEO Bob van Dijk would resign with immediate effect. On 17th May 2024, the company announced that Fabricio Bloisi would take over as CEO of both Naspers and Prosus with effect from 1st July 2024.

Prosus appears to be in a strong position with its diversified internet assets and strategic moves to enhance profitability. However, investors should be aware of the regulatory risks in China and market volatility. The recent leadership change may also bring new strategic directions for the company.

Our opinion on the current state of PROSUS(PRX)On 11th September 2019, Naspers (NPN) separately listed Prosus (PRX) on the Euronext in Amsterdam to house all its international assets including its stake in Tencent, Mail.Ru, and other internet brands. Naspers holds 73% of Prosus, and there is a 25% free float. One of the benefits of the Euronext listing is that it removes the risk inherent in the rand, making Prosus a rand-hedge which rises when the rand weakens and vice versa. Prosus is now Europe's largest consumer internet company.

The main asset of Prosus is a 26% stake in Tencent - a Hong Kong-listed company that provides social media services and gaming in China. Tencent operates 10 of China's top 20 mobile applications, reaching over 1.1 billion users. However, Tencent remains vulnerable to the authoritarian regulators in China and their involvement in the gaming industry.

Prosus describes itself as, "...a global consumer internet group operating across a variety of platforms and geographies and is one of the largest technology investors in the world. The Prosus Group's businesses and investments serve more than 1.5 billion people in 89 markets and are the market leaders in 77 of those markets. The Prosus Group's consumer internet services span the core focus segments of Classifieds, Payments and Fintech as well as Food Delivery, plus other online businesses including Etail and Travel."

On 18th May 2022, Tencent issued a statement saying that its profit in the March 2022 quarter was half of what it had been in 2021, leading to a negative impact on Prosus shares. On 24th June 2022, the company said that it intended to sell some of its Tencent shares to finance an extended open-ended share buy-back program. This caused the share price to jump up. On 24th October 2022, the re-election of Chinese leader Xi Jinping for a third term caused Prosus shares to fall heavily, as Jinping is part of a faction in Chinese politics which aims to keep the "disorderly expansion of capital" under control.

In its results for the six months to 30th September 2023, the company reported revenue up 13% and headline earnings up 85%, "...primarily due to improved profitability of our e-commerce consolidated businesses and equity-accounted investments, particularly Tencent, and higher net interest income during the period." Core headline earnings per share (HEPS) almost doubled to 76c per share. Technically, the Prosus share has been trending up in November 2023. We still believe that the share is undervalued at current levels.

On 18th September 2023, the company announced that CEO, Bob van Dijk, would resign with immediate effect. On 17th May 2024, the company announced that Fabricio Bloisi would take over as CEO of both Naspers and Prosus with effect from 1st July 2024.

Buy PRX - 5th wave pivot identifiedPrice reversal and pivot from the end of wave 4. It also also flagged DeMark Sequential buy #9. Buying today with 1% allocation. Open @ 28.23 TP @ 29.75 c.5.4%

‐--‐-----------

Strategy:

Based on Elliot wave theory, pivot points and classic chart patterns. The 5th wave pivot strategy identifies the last impulse of the Elliot wave sequence. The 5th wave can be equal to the 3rd wave or extend to the 1.618 Fibonacci level.

Entry: A position is taken when a pivot point is reached at the end of the 4th corrective wave and the price reverses. This position is also confirmed by bouncing from the lower bound of a chart pattern or from price support level.

Exit: TP is taken from top of wave 3 or the previous resistance level.

$JSEPRX - Prosus: Triangle Invalidated, 48240 Key Level To WatchSee link below for previous analysis.

*Prices updated to post-share split adjusted prices.

Price traded much lower and invalidated the triangle outlook.

The overall wave count for Prosus and Naspers is still tricky but I am still counting the advance as a zig zag.

I will maintain a bullish stance above 48240 and buy the dips.

Policies at playChina is looking at reducing spending on gaming and this news was priced in aggressively. Prosus was a stock I was looking into last week but the price was too high with signs of slowing momentum to the upside. The 52-week moving average was showing signs of not being able to sustain the price above it.

Today, we had the opportunity to jump into Prosus at a MASSIVE discount and our buy order was filled at $24.50. The news has already been priced into the stock unless another surprise is around the corner to make the stock tank again. If not, we are expecting the share price to hold above $24.00 moving forward.

Prosus Price Target Set at Channel's Bottom: Eyeing the 390 MarkProsus N.V

1. Price Formation: The price has broken out from an inverted Cup and Handle price formation on a daily chart within a rising channel.

2. Moving Averages: The 7-day moving average (MA) is below the 21-day MA, which is a sign indicating short-term bearish momentum.

3. 200-day Moving Average is above the Price.

4. Thus, Mas 7<21 < 200

5. Relative Strength Index (RSI): The RSI is <than 50, indicating bullish momentum and potential further upward movement.

6. Price Target: to the bottom of the channel at 390

The company

Prosus N.V. is a global consumer internet group and a technology investor. It operates various platforms and services in more than 90 countries. Prosus's investments focus on sectors such as online classifieds, food delivery, payments and fintech, e-tail, and others.

The company was created in 2019 as a result of Naspers, a South African multinational company, spinning off its international internet assets into a separate listed entity. Prosus is listed on the Euronext Amsterdam with a secondary, inward listing on the Johannesburg Stock Exchange (JSE) in South Africa.

The connection between Naspers and Prosus is significant. Naspers remains the majority shareholder in Prosus, which means that any major decisions or changes in strategy at Prosus will likely involve Naspers.

PRX Restricted in The Bearish WedgePRX has carved a nice broadening wedge that has forced price into lower highs and lower lows. Price is currently seeking a half cycle correction after which it must challenge resistance again.

If there is a rejection on the resistance we can expect a sharp move down (can go straight down also), ideally that should have an objective of the lower support line, however we must be paying attention first to the 200 day moving average that would be higher than the trendline as a point to take profits if short. If we get there end of May or early June we will be in the timing for a weekly low, a good point to go long.

If price close above the resistance, any shorts have to be closed as a short covering will drive price up faster.

Our opinion on the current state of PRXOn 11th September 2019, Naspers (NPN) separately listed Prosus (PRX) on the Euronext in Amsterdam to house all its international assets including its stake in Tencent, Mail.Ru and other internet brands. Naspers holds 73% of Prosus and there is a 25% free float. One of the benefits of the Euronext listing is that it removes the risk inherent in the rand, so Prosus is a rand-hedge which rises when the rand weakens and vice versa. Prosus is now Europe's largest consumer internet company. The main asset of Prosus is 26% of Tencent - a Hong Kong-listed company that provides social media services and gaming in China. Tencent has 10 of China's 20 top mobile applications reaching over 1,1bn users. Tencent remains vulnerable to the authoritarian regulators in China and their involvement in the gaming industry. Prosus describes itself as, "a global consumer internet group operating across a variety of platforms and geographies and is one of the largest technology investors in the world. The Prosus Group's businesses and investments serve more than 1.5 billion people in 89 markets and are the market leaders in 77 of those markets. The Prosus Group's consumer internet services span the core focus segments of Classifieds, Payments and Fintech as well as Food Delivery, plus other online businesses including Etail and Travel." The share has benefitted from its inclusion in the Stoxx 50 index from September 2020. On 4th October 2021 Prosus announced that it had invested R1,3bn in Ula, a start-up e-commerce platform in Indonesia. On 7th March 2022 Prosus said that it had asked its board members of VK Group (previously known as Mail.ru) to resign after the CEO was added to a US sanctions list. Prosus owns 27% of VK worth about $769m or R12bn. In addition to VK, Prosus has about 4000 employees in Russia and a further 350 in Ukraine. On 14th March 2022, a report in the international media suggested that Tencent's "WeChat" service would face a substantial fine from the Chinese authorities for allowing money laundering. The share fell by more than 10%. On 18th May 2022 Tencent issued a statement saying that its profit in the March 2022 quarter was half of what it had been in 2021 - leading to a negative impact of Prosus shares. On 24th June 2022, the company said that it intended to sell some of its Tencent shares to finance an extended open-ended share buy-back program. This caused the share price to jump up. On 19th August 2022, the company announced that it had acquired the remaining 33,3% of iFood for R25,5bn. On 24th October 2022, the re-election of Chinese leader Xi Jinping for a third term caused Prosus shares to fall heavily. Jinping is part of a faction in Chinese politics which aims to keep the "disorderly expansion of capital" under control. In its results for the year to 31st March 2023 the company reported headline earnings per share (HEPS) of 46c down from the previous year's 201c. Core HEPS was 185c down from the previous year's 244c. Naspers announced on 27th June 2023 that it was going to unwind the cross shareholding between in at Prosus. The news was well-received by the market because it simplified the overall structure of both businesses making them easier to analyse. In a trading statement for the six months to 30th September 2023 the company estimated that HEPS would be between 46c and 48c compared with 7c in the previous period. Technically, the Prosus share price came off because of rand strength, the complexity of the share swap and then on 26th July 2021 the share fell 7% due to new Chinese regulations which impact on Tencent's music streaming business. The share, which was falling with the bear trend on international markets, then collapsed down to a new cycle low as a result of the re-election of Xi Jinping as Chinese premier. Since February 2023 the share has been moving sideways. We still believe that the share is undervalued at current levels. On 18th September 2023 the company announced that CEO, Bob van Dijk, would resign with immediate effect.

PRX.JSE Prosus recent Trend Cloud Study.Prosus has shown a nice Up Trend from the recent Lows and Double bottom.

This is an update from my recent Study.

Possible Key Resistance and Support levels are depicted.

Get Expert Advice when making any Trade or Investment decisions.

Smash that Rocket Boost Button to show your Appreciation for my Studies.

Regards Graham.

PRX.JSE Prosus Short Chart StudyProsus has been following the recent market trends.

My study shows R496 as critical level for support, otherwise, some more pain.

As with all Investing / Trading, get Expert advice. I am not one.

Smash the Rocket Boost Button if you appreciate my study.

Regards Graham

Our opinion on the current state of PRXOn 11th September 2019, Naspers (NPN) separately listed Prosus (PRX) on the Euronext in Amsterdam to house all its international assets including its stake in Tencent, Mail.Ru and other internet brands. Naspers holds 73% of Prosus and there is a 25% free float. One of the benefits of the Euronext listing is that it removes the risk inherent in the rand, so Prosus is a rand-hedge which rises when the rand weakens and vice versa. Prosus is now Europe's largest consumer internet company. The main asset of Prosus is 26% of Tencent - a Hong Kong-listed company that provides social media services and gaming in China. Tencent has 10 of China's 20 top mobile applications reaching over 1,1bn users. Tencent remains vulnerable to the authoritarian regulators in China and their involvement in the gaming industry. Prosus describes itself as, "a global consumer internet group operating across a variety of platforms and geographies and is one of the largest technology investors in the world. The Prosus Group's businesses and investments serve more than 1.5 billion people in 89 markets and are the market leaders in 77 of those markets. The Prosus Group's consumer internet services span the core focus segments of Classifieds, Payments and Fintech as well as Food Delivery, plus other online businesses including Etail and Travel." The share has benefitted from its inclusion in the Stoxx 50 index from September 2020. On 4th October 2021 Prosus announced that it had invested R1,3bn in Ula, a start-up e-commerce platform in Indonesia. On 7th March 2022 Prosus said that it had asked its board members of VK Group (previously known as Mail.ru) to resign after the CEO was added to a US sanctions list. Prosus owns 27% of VK worth about $769m or R12bn. In addition to VK, Prosus has about 4000 employees in Russia and a further 350 in Ukraine. On 14th March 2022, a report in the international media suggested that Tencent's "WeChat" service would face a substantial fine from the Chinese authorities for allowing money laundering. The share fell by more than 10%. On 18th May 2022 Tencent issued a statement saying that its profit in the March 2022 quarter was half of what it had been in 2021 - leading to a negative impact of Prosus shares. On 24th June 2022, the company said that it intended to sell some of its Tencent shares to finance an extended open-ended share buy-back program. This caused the share price to jump up. On 19th August 2022, the company announced that it had acquired the remaining 33,3% of iFood for R25,5bn. On 24th October 2022, the re-election of Chinese leader Xi Jinping for a third term caused Prosus shares to fall heavily. Jinping is part of a faction in Chinese politics which aims to keep the "disorderly expansion of capital" under control. In its results for the year to 31st March 2023 the company reported headline earnings per share (HEPS) of 46c down from the previous year's 201c. Core HEPS was 185c down from the previous year's 244c. Naspers announced on 27th June 2023 that it was going to unwind the cross shareholding between in at Prosus. The news was well-received by the market because it simplified the overall structure of both businesses making them easier to analyse. Technically, the Prosus share price came off because of rand strength, the complexity of the share swap and then on 26th July 2021 the share fell 7% due to new Chinese regulations which impact on Tencent's music streaming business. The share, which was falling with the bear trend on international markets, then collapsed down to a new cycle low as a result of the re-election of Xi Jinping as Chinese premier. Since February 2023 the share has been moving sideways. We still believe that the share is undervalued at current levels. On 18th September 2023 the company announced that CEO, Bob van Dijk, would resign with immediate effect.

$JSEPRX - Prosus: Contracting Triangle ConsolidationProsus stock has has an interesting trading history since listing in September 2019.

The stock made an all time high in January 2021 and and had a strong sell-off in a three wave zigzag to an all time low in March 2022.

The recovery from the all time low can be labeled in numerous ways but in the short-term, it does not really matter.

What catches my eye is the consolidation pattern from the 148820 peak.

This consolidation has been sideways after a strong rally from 73201 to 148820.

This sideways consolidation fits a contracting triangle which can be found in wave 4 of an impulse of wave B of a corrective pattern.

Triangles are tricky to forecast as complete but as long as 127025 holds, the focus is on the upside.

A break below 127025 invalidates the current count and a break below 122869 invalidates the entire triangle outlook.

To buy Naspers when we buy Prosus - The answer isThere is a super strong correlation with Naspers and Prosus.

So yes, it would make sense to buy both. But with such a strong correlation one could just double on the investment on one of their trades to avoid extra costs?

That's just me thinking out loud.

Naspers and Prosus are closely correlated in price chart because of the relationship between the two companies.

Naspers is the parent company of Prosus and holds a significant stake in Prosus.

In fact, Naspers owns a majority of the voting rights in Prosus due to the dual-class share structure.

As a result, changes in the share price of Naspers often have a direct impact on the share price of Prosus.

This correlation occurs because investors and traders consider the value and performance of Naspers when assessing the value and performance of Prosus.

Since Naspers is the majority shareholder and has significant control over Prosus, any significant news, events, or market sentiment affecting Naspers can influence the perception and valuation of Prosus as well.

This correlation is further reinforced by the fact that both Naspers and Prosus have overlapping investments in prominent technology companies, such as Tencent.

It's important to note that while there is a strong correlation between Naspers and Prosus in terms of their share prices, there can still be slight differences due to factors such as market demand, liquidity, and investor sentiment.

Additionally, external market conditions and broader economic factors can also impact the share prices of both Naspers and Prosus, further reinforcing the correlation between the two.