1.80 this week Posting this chart to show some obvious short term levels if your trading this is I was lucky enough to get Jan 26 1C for .21. I think TLRY could run to 2 pretty easily based on current momentum.

Trump said he was looking into declassification when asked today and has shown support before for rescheduling, decriminalization, and state rights to legalize cannabis.

"It could take a few weeks and is very complicated." he said

I grabbed safer calls to far out although 100% gain today. The closer dated 1.5 calls are cheap and ran 3x as hard ill be looking to load some tm if chart remains above daily MAs. IF weed actually somehow gets declassified $3 should be easy. Up at $1.09-1.16 overnight would be bullish to hold $1 for entry. 4hr RSI is at 90 so this meme like rally could end abruptly or maybe it wants 1.50 first.

Revenue has steadily been growing nothing crazy still not profitable and they have been diluting Gross margin is 29.49%, with operating and profit margins of -13.04% and -266.25%.

Plenty of risk 17% short float.

TLRY trade ideas

TLRY Earnings Play: Lotto-Style PUT Setup

📉 **TLRY Earnings Play: Lotto-Style PUT Setup**

*Tilray Brands (TLRY) - Earnings Due July 30 (AMC)*

🔻High risk. High reward. Possibly… nothing. But here's the setup:

---

### 🔬 Fundamental Breakdown:

* 💸 **TTM Revenue Growth**: -1.4% (🚩 declining)

* 📉 **Profit Margin**: -114.4%

* 🧾 **Operating Margin**: -16.8%

* 🧠 **EPS Surprise (avg 8Q)**: **-89.4%**, with only **12% beat rate**

* 🧯 **Sector Risk**: Cannabis = Over-regulated + Overcrowded

🧮 **Fundamental Score**: 2/10 → Broken business model.

---

### 📊 Technicals:

* 🔺 Above 20D MA (\$0.61) and 50D MA (\$0.49)

* 🔻 Well below 200D MA (\$0.91)

* 📉 Volume 0.72x = Weak institutional interest

* 📏 RSI: 57.69 (neutral drift)

**Technical Score**: 4/10 → Weak drift, low conviction.

---

### ⚠️ No Options Flow. No Big Bets Seen.

(But that’s exactly what makes this a clean lotto...)

---

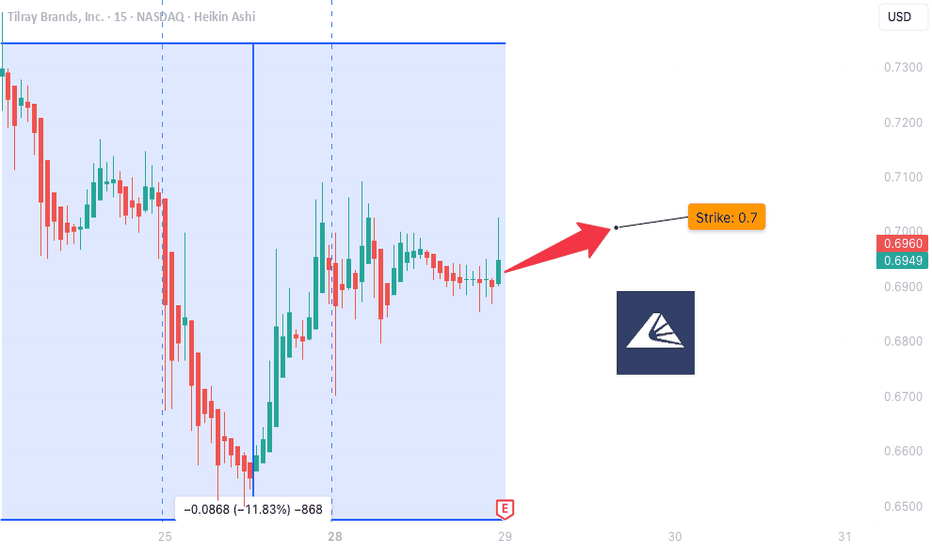

## 🎯 Lotto Trade Idea:

```json

{

"Type": "PUT",

"Strike": "$0.70",

"Expiry": "Aug 1, 2025",

"Entry": "$0.10",

"Profit Target": "$0.50",

"Stop Loss": "$0.035",

"Confidence": "30%",

"Size": "2% portfolio max",

"Timing": "Pre-earnings close"

}

```

---

### 🧠 Strategy:

This is not a trade based on strength. It’s based on **TLRY’s consistent failure to deliver** — and if it disappoints again, we ride the downside. If not? Risk tightly capped.

---

⚖️ **Conviction**: 35%

💀 **Risk**: Total loss possible

🚀 **Reward**: 400%+ possible

---

📝 *Not financial advice — just one degenerate’s earnings notebook.*

💬 Drop your TLRY lotto plans below👇

TLRY Trade Update – Island Reversal in Play?🚨 TLRY Trade Update – Island Reversal in Play? 🚨

I’ve been tracking Tilray (TLRY) for a while now. While the company has struggled, it’s now trading well below book value and showing some life on the charts. Here’s what I’m seeing — and how I’m positioned.

My Position:

50 contracts Jan 2026 $0.50 Calls @ $0.11

50 contracts Jan 2027 $0.50 Calls @ $0.18

Defined risk, big potential. I’m playing both the short-term breakout and the long-term value thesis.

Why I Entered When I Did:

When I watch stocks, I’m always focused on the chart, not just the price. I zoom out — monthly, weekly, daily — then zoom in: hourly, even 5–10 min on high-volume names.

On June 25th, TLRY broke above the hourly trendline. That was a key technical shift. From there, it began forming a bullish flag-like pattern — right after hitting new lows. That setup caught my attention.

I debated buying shares or options. I chose long-dated calls to fully define my risk and selected a strike that I believed could end up in the money. Ultimately, I went out to 2026 and 2027 to give the pattern — and potential catalyst flow — time to work.

Because in the end:

👉 Time is more important than price.

📊 Technical Breakdown:

1-Hour Chart:

Clean breakout above $0.41–$0.44

Targeting a test of $0.64 (prior breakdown zone)

Solid momentum and volume

Daily Chart:

Potential island reversal forming

Gap fill potential to $1.34

Confluence with moving averages turning up

Fundamentals:

Trading at ~$0.48 with book value near $2.80

Market cap under $500M

Exposure to cannabis, beverages, CBD, and European growth

Possible M&A or policy tailwinds still on the table

🎯 TLRY Price Targets:

$0.64

Retest of breakdown zone

Short-term (1–2 weeks)

$0.80–$0.90

Previous consolidation/resistance

Medium-term (1–2 months)

$1.34

Gap fill zone

Long-term (3–6 months)

$2.80+

Return to book value

Tail event (6–18 months)

Risk is defined. Structure is forming. If price and fundamentals align, TLRY could have room to run. Keep an eye on volume at each level and how it handles the $0.64 test.

Let’s see if the reversal holds 🔄

P.S. Since writing this breakdown, TLRY has continued its move and closed strong. While short-term price action may vary, the core thesis remains intact: the structure, volume, and breakout levels are all part of the bigger setup I'm tracking. This is a long-term swing with defined risk, and I’ll continue to post updates as the trade unfolds.

TLRY BUYBUY TLRY at .10 to .06, riding it back up to 2.90 to 4.90 as Profit Targets, Stop Loss is at .01!

If anyone likes mumbo jumbo long useless analysis, than this is NOT for you.

Also, if you are afraid of risk, failure, and want only a 100% sure thing, than

run as fast as you can from here and from the markets,

because it is definitely NOT for you.

WARNING: This is just my opinion of the market and its only for journaling purpose. This information and any publication here are NOT meant to be, and do NOT constitute, financial, investment, trading, or other types of advice or recommendations. Trading any market instrument is a risky business, so do your own due diligence, and trade at your own risk. You can loose all of your money and much more.

$NASDAQ:TLRY Up in Smoke or Waiting for the Puff and Pump?NASDAQ:TLRY Up in Smoke or Waiting for the Puff and Pump?

Left for Dead or a Sleeper Rocket in the Making? 🚀

Alright, let’s talk about Tilray (TLRY). I know what you’re thinking: this thing’s been taken behind the woodshed, beaten, and then fed through the wood chipper—twice. Technically speaking, it’s been in a brutal downtrend. But here's where it gets interesting...

Since December, I’ve been noticing signs of quiet accumulation. Volume patterns are showing life. This isn’t just random noise... it looks like smart money nibbling while the rest of the market sleeps.

Fundamentally, it's trading at 0.68x sales and a crazy 0.17x price to book. That’s deep value territory... basically priced like it’s going out of business, which it’s not. Cannabis isn’t going anywhere, and when this sector comes back (and it will), I want to already be on the launchpad.

Now imagine a scenario: Trump leans on Musk-style libertarian logic, and pushes for federal legalization to fill the coffers with tax revenue (and their pockets as they and their friends will be ahead of the trend as all politicians at that level are). Boom. You think this thing trades at 65 cents for long? Me neither.

I’m not saying we’re going to $5 next week....but the risk/reward here feels very asymmetrical. Worst case? We chop sideways or retest lows. Best case? We get a face-melter rally that TLRY has shown it's capable of in the past.

This is precisely the kind of chart I look for. Beaten up, forgotten, but technically setting up... and fundamentally undervalued.

Not financial advice. Just sharing my thinking as someone who loves deep contrarian setups.

54% move completed. here's why this is the bottom.MARKETSCOM:TILRAY

we have just completed the 54% move down after the breakdown. you are supposed to take the highest move in the pattern and put it at the point of breakdown. the expected move after breakdown was 54% and we just hit that around 79 cents. this should be the local bottom. i have an average of .86 and am buying more

TLRY - A Last Gasp of a Dying Industry, Or?.....Cannabis stocks have been nothing short of annihilated lately.

The last administration failed to deliver on their hot air promises and now the current one has done nothing to help the industry. Yet.

We're headed either toward mass bankruptcy or the beginning of a new cycle.

TLRY around 25 on the weekly RSI, as low as it's ever been. Getting hammered.

I'm optimistic, probably foolishly...

TLRY Tilray Brands Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TLRY Tilray Brands prior to the earnings report this week,

I would consider purchasing the 2usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $0.32.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TLRY | Time for MJ to POP! | LONGTilray Brands, Inc. is a global cannabis-lifestyle and consumer packaged goods company, which focuses on medical cannabis research and the cultivation, processing, and distribution of cannabis products worldwide. It operates through the followings segments: Cannabis Business, Distribution Business, Beverage Alcohol Business, and Wellness Business. The company was founded on January 24, 2018 and is headquartered in Leamington, Canada.

TLRY cannabis stocksHexo turned out to be a bummer pick

but TLRY is still remaining

Which leads me to believe that the only thing that could cause a price to drop this much and then project this high upwards, has got to be due to federal legalization THC drinks and possibly more.

Lots of legal hoops to jump through for states and cannabis and more, but there is good that comes from legalization, meaning research money, meaning jobs, meaning genetics, meaning new ways of grow cannabis and using it that could ultimately be safer to consume vs now, maybe leads to dosages being figured out and effects to be specifically altered per user or use or effect or whatever you want to imagine.

Maybe not every state is ready to allow it but it seems across the board, it's a favorable issue for a lot of members of both parties. I've heard trump say, he doesn't need or want to use it but he has seen it do amazing things to help other, I've heard Kamala can help undo damage done during the course of a long a difficult career, and allow people who were simply selling to get by vs selling to commit crime and harm others, which ultimately means, she could probably do some good with the current fentanyl issue. As clearly she is now thinking about it from some views other than her own and how it can be used as a net good.

On top of that, it's clear the big companies or execs maybe even pharma companies need a look and a whole lot of questions asked about why cannabis caused the inability to fund through loans, borrow money, pay with credit and more.

So TLRY has overseas connections, favorable politics swinging their way through years of work, and drinks infused with THC, which as more research comes out, there might be ways to safely allow bars to serve drinks without someone being unable to get home within a reasonable amount of time. Would this ever occur, maybe, but the important key to take away is open research and money into science and then obviously trying to work with Mexico to literally end cartels (I have deep core ties to Columbia) and Escobar from stories I've heard personally and have no idea if they are true, really took care of the area he controlled, but yeah, he also probably was doing some awful stuff to others.

Lesson to learn here is that maybe some evil can be treated with a new direction, but some evil needs two major governments and police/technology and security that both keeps each place within their areas trying to solve a common goal and allowing each other to assist when a task is too difficult to handle on their own or ours. And clearly show the world that Mexico won't allow groups of evil to thrive and America can secure the border by doing it all in Mexico which could then theoretically lead to a an open border discussion, but say what you want. There is a major issue with cocaine usage and literally and knowingly killing other humans to profit, which is maybe evil, and something we could easily do which defense stocks getting obviously so much money pretty much all the time.

Again, why can't we help our vets to the point where it's not a issue? And they can seek help without losing status, rank, pay, benefits and more.

again, political views aside, America has a bad ass military that runs one hell of task, why aren't we using them to flush out corruption and evil and still find a way to maintain being an ideal view of how the military used to stand up to bad, and maybe we should have listened better should a former president suggest that money can cause an issue where oversight is gone, paraphrasing of course, as it's quite obvious this president have some serious foresight and tried to express that concern.

finally, cut anything out of this that you want to make it make sense in your world, but to make short a sweet, legalization allows the states more power, gives institutions power to direct lots of money towards meaningful research, gives avenues where we can actually start to work on the drugs that are laced with awful stuff coming into the country so frequently. And then you figure out who funds it and destroy whatever is left of that system, maybe dismantle is a better term, and start to setup some form of life that means someone in south america shouldn't feel the need to risk their life to leave their home, or why so many innocent people die for "drugs" which is probably a way better start a securing the border. A big wall can still have value in metal, and value can lead to an even better wall for cyber crimes, especially as we head to space. The space force is no joke, It was some well done prep work from former presidents and a realization of how much valuable stuff will be in a space making it targets for "evil"

Why do I say all of this, probably because a big first step is exactly the one I mention, legalization, and then locking up or whatever the leader decides is needed at that time. Ideally with a new lens of money being used to manipulate others at will. but my view is just one, I can't say my way is best, right or even possible, but again, legal leads to open freedom in safe environments. In fact, maybe the best person to handle an issue like that is someone who is potentially willing to legalize something that her decisions in the past have led to jail or worse.

TLRY Tilray Brands Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TLRY Tilray Brands prior to the earnings report this week,

I would consider purchasing the 1usd strike price in the money Calls with

an expiration date of 2024-10-11,

for a premium of approximately $0.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Tilray Brands (TLRY) to Report Q1 FY2025 Results October 10thTilray Brands Inc. (NASDAQ: NASDAQ:TLRY ), a global lifestyle and consumer packaged goods giant, is set to announce its Q1 Fiscal Year 2025 financial results on October 10, 2024. As the market eagerly anticipates the latest earnings report, let's dive into the company's recent performance, its strategic acquisition moves, and the stock's technical outlook, which offer both opportunities and potential risks for investors.

Overview

Tilray (NASDAQ: NASDAQ:TLRY ) has been making waves in both the cannabis and beverage industries, diversifying its portfolio and expanding its reach globally. Most notably, Tilray has completed the acquisition of Atwater Brewery from Molson Coors Beverage Company, further cementing its position in the craft beer industry. The acquisition adds Atwater Brewery, a historic Michigan-based craft brewery, to Tilray's growing list of premium brands, which includes SweetWater Brewing Company, Montauk Brewing Company, and more.

According to Tilray’s CEO, Irwin D. Simon, this acquisition enhances the company's presence in the Great Lakes region and strengthens its distribution channels. Tilray aims to leverage its resources to grow Atwater’s brand and introduce its signature brews to more beer enthusiasts across the U.S.

Financially, Tilray has shown strong revenue growth, reporting a 25.80% increase in revenue for FY2024, bringing in $788.94 million compared to $627.12 million the previous year. However, challenges persist on the profitability front, as the company posted losses of -$244.98 million, which, while substantial, are an 83.14% improvement compared to its previous year’s loss. This signals Tilray is making efforts to reduce its financial burden, though it has not yet reached profitability.

Analyst Sentiment and Stock Price Forecast

The average analyst sentiment for Tilray Brands’ stock is “Hold,” with a 12-month price target of $2.00. Currently trading at $1.70, this represents an expected 17.65% upside, a modest gain but potentially compelling for those seeking short- to medium-term investment opportunities.

It’s worth noting that Tilray (NASDAQ: NASDAQ:TLRY ) operates in an industry marked by volatility, as it juggles both the cannabis and consumer packaged goods markets. This makes its future growth trajectory dependent on various regulatory developments and the company’s ability to continue expanding into new markets and sectors.

Technical Analysis: Key Levels to Watch

From a technical perspective, NASDAQ:TLRY has seen a modest recovery, trading up 1.18% in premarket trading on Friday. The stock had previously been in a downward trend, but recent price action signals a potential shift.

Relative Strength Index (RSI) Currently sits at 45.58, the RSI indicates that the stock is neither overbought nor oversold. This suggests that while there’s some weakness, it also provides an opportunity for investors to capitalize on potential upside if a breakout occurs.

Support and Resistance Levels: Tilray's stock finds support at $1.50. Should the stock dip below this level, we may see a return to bearish momentum. Conversely, resistance at $2.00 serves as the next key level to break. If the stock can break through this resistance, it may attract new momentum traders and long-term investors, pushing it higher.

While the stock has recently bounced off support, the overall trend remains weak. Investors should closely monitor the stock’s movement approaching its Q1 results, as a move above or below the critical $1.50 support could signal further action.

Upcoming Earnings & Potential Catalysts

With the Q1 FY2025 earnings release scheduled for October 10, 2024, investors will be watching for several key metrics:

Revenue growth, particularly how the Atwater Brewery acquisition has impacted the top line.

Cost reduction efforts, as Tilray continues to narrow its losses.

Any updates on expansion plans, particularly in the cannabis market, which could provide a catalyst for stock price appreciation.

Additionally, Tilray’s diverse portfolio in cannabis, beverages, and consumer packaged goods offers multiple streams of revenue, which provides a level of insulation against market-specific headwinds. However, its success in achieving profitability and growing margins will remain critical for future stock price appreciation.

Conclusion: Opportunity With Caution

Tilray Brands (NASDAQ: NASDAQ:TLRY ) presents an interesting investment case with its significant growth potential driven by acquisitions and a diversified product line. However, the company is still facing financial hurdles, and its stock reflects ongoing volatility in the broader cannabis and consumer goods sectors.

For short-term traders, the current technical setup offers an opportunity to capitalize on a breakout above $2.00 or a potential pullback to the $1.50 support level. Long-term investors should focus on the company’s Q1 earnings and any signals that point toward sustained revenue growth and eventual profitability.

While Tilray’s stock is currently rated a Hold by analysts, its acquisition strategy and diversified portfolio position it as a potential turnaround candidate, making it a stock worth watching closely as Q1 results are unveiled.

Headed Higher Through 2.15 and 2.97The corrective pattern developing in wave (2) has been stubbornly pervasive for nearly an entire year but recent price action would suggest the end of wave (2) has finally come.

It appears that wave C of (2) developed as a neat and textbook ending diagonal with a perfect reversal from our downside limit of 1.50 (the wave (1) origin). Ending diagonals typically imply swift and sizable reversals and price should now begin to develop higher in an impulsive manner through 2.15 and 2.97 in wave 3 of (3) against the 1.50 low. A violation of 1.50 voids the bullish forecast.

TILRAY RETRACEMENT A retracement does not imply a change in the trend, but rather a temporary pause or pullback. A retracement does not invalidate the previous trend. It confirms the trend, as the price resumes its original direction after the retracement.

Lower prices are an estimate but do not mean there has to be a retracement. They do reject many times depending on volume.