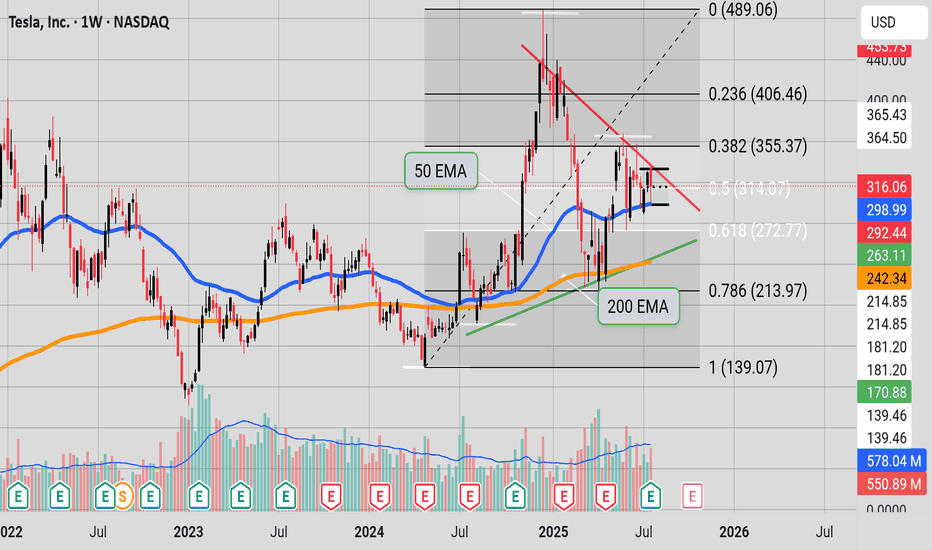

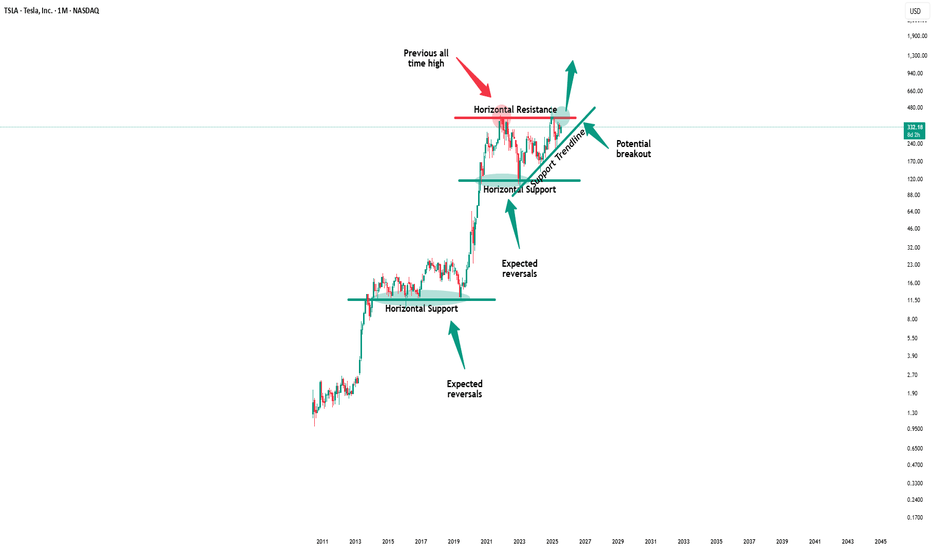

TSLA Long-Term Bold Projection (2025-2035)This is a long-term analysis of Tesla (TSLA) stock on the weekly timeframe, combining Elliott Wave Theory, Fibonacci extensions, and price structure (base formations) within a broad logarithmic trend channel.

Key Highlights:

🔹 Base Formations:

Base 1 (2010–2013): First consolidation before TSLA’s

Key facts today

Tesla (TSLA) shares dropped from $325 to $303 from July 28 to August 1, a 7% decline. Year-to-date, the stock is down 24%, starting the year near $379.

Tesla's retail sales in China fell to about 129,000 in Q2, a 12% drop from last year, likely due to rising U.S.-China trade tensions affecting consumer behavior.

Tesla plans to appeal a jury's ruling on its Autopilot and Full Self-Driving systems, claiming the verdict is wrong and threatens safety. The company faces several lawsuits and NHTSA investigations.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.60 EUR

6.89 B EUR

94.37 B EUR

2.81 B

About Tesla

Sector

Industry

CEO

Elon Reeve Musk

Website

Headquarters

Austin

Founded

2003

FIGI

BBG00GQ6S9F6

Tesla, Inc. engages in the design, development, manufacture, and sale of electric vehicles and energy generation and storage systems. It operates through the Automotive and Energy Generation and Storage segments. The Automotive segment includes the design, development, manufacture, sale, and lease of electric vehicles as well as sales of automotive regulatory credits. The Energy Generation and Storage segment is involved in the design, manufacture, installation, sale, and lease of solar energy generation, energy storage products, and related services and sales of solar energy systems incentives. The company was founded by Jeffrey B. Straubel, Elon Reeve Musk, Martin Eberhard, and Marc Tarpenning on July 1, 2003 and is headquartered in Austin, TX.

Related stocks

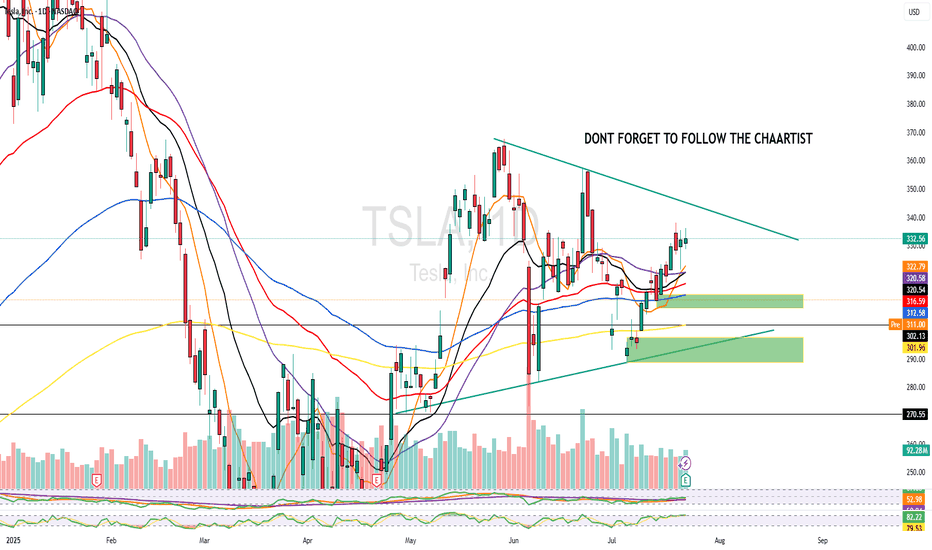

Inflection point"Tesla is at a binary point on the chart. The stock is wedged tightly between the red, downward-sloping resistance line (upper boundary) and the green, upward-sloping support line (lower boundary)—the classic apex of an asymmetrical triangle.

At this stage:

A breakout above the red resistance woul

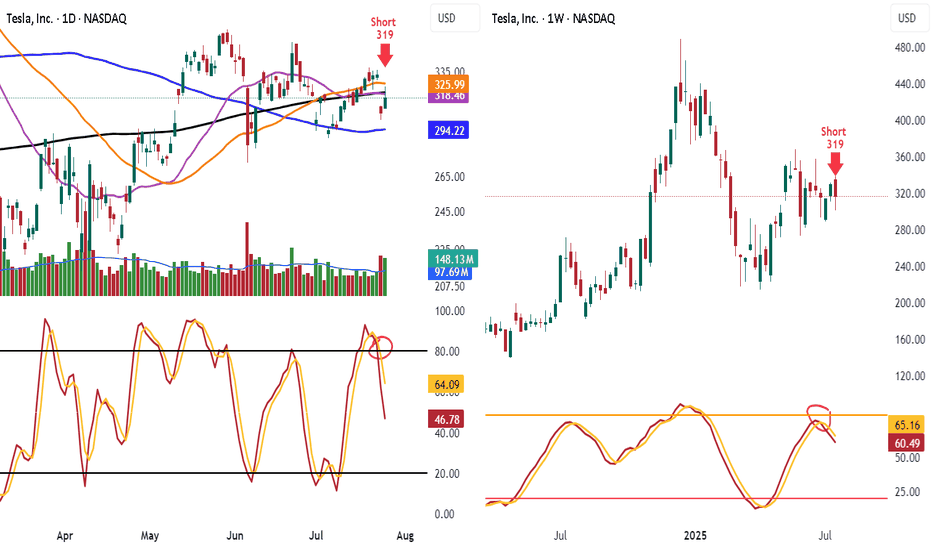

Shorted TSLA 319 Look at TSLA hit 50 day and 200 day MA and failed and know under them

Look at the lower highs and see the stoch heading down

Know lets look weekly stoch heading down and lower highs

Target is 100 day ma 294.22 take some off. When it breaks will add back on

Have trailing stop in place

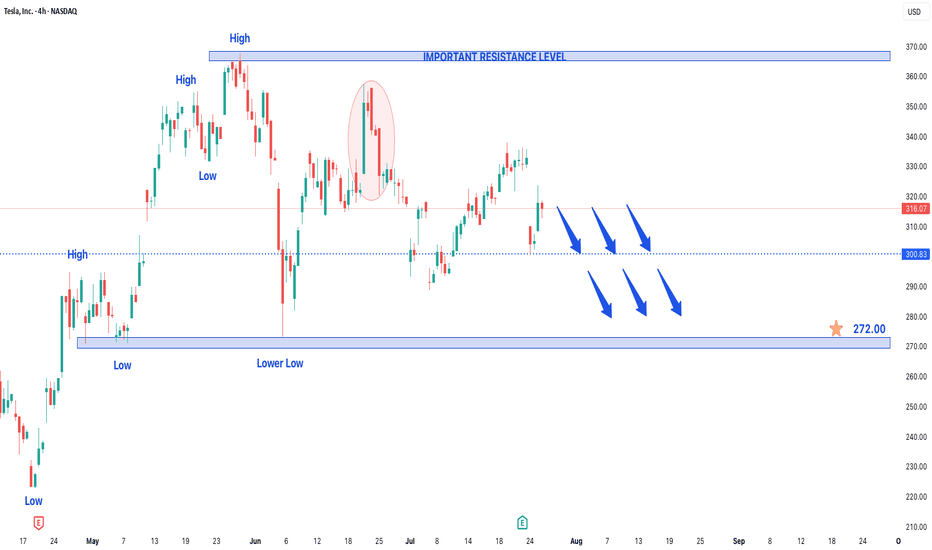

Tesla Stock in Bearish Trend - Further Downside ExpectedTesla Stock in Bearish Trend - Further Downside Expected

Tesla's (TSLA) stock price continues to display a clear bearish trend structure, characterized by the formation of consistent lower lows and lower highs on the price chart. This technical pattern suggests sustained selling pressure and indica

$TSLA is in an accumulation phase.A classic Wyckoff scenario is playing out, offering a prime opportunity if you have the nerve for it.

Support: The key support zone is $300 - $305. As long as this holds, the bullish thesis is intact.

Resistance: The primary target is the top of the multi-month accumulation range, around $370 - $38

Tesla (TSLA) Crash Ahead? $101.81 Retest in SightThe Tesla price chart appears to show a large flat correction labeled W-X-Y.

Wave W consists of three downward waves from 2021 to 2023. (white)

Wave X shows a three-wave upward retracement from 2023 to 2024, which even overshot the start of wave W. (blue)

Now, we seem to be in the final leg of th

Tesla - The all time high breakout!🚗Tesla ( NASDAQ:TSLA ) will break out soon:

🔎Analysis summary:

For the past five years Tesla has overall been consolidating between support and resistance. But following the recent bullish break and retest, bulls are slowly taking over control. It is actually quite likely that Tesla will soon

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TSLA4317805

Tesla Energy Operations, Inc. 5.45% 17-DEC-2030Yield to maturity

11.26%

Maturity date

Dec 17, 2030

TSLA4296328

Tesla Energy Operations, Inc. 5.45% 16-OCT-2030Yield to maturity

10.51%

Maturity date

Oct 16, 2030

TSLA4290558

Tesla Energy Operations, Inc. 5.45% 01-OCT-2030Yield to maturity

9.82%

Maturity date

Oct 1, 2030

TSLA4247202

Tesla Energy Operations, Inc. 5.45% 21-MAY-2030Yield to maturity

9.30%

Maturity date

May 21, 2030

TSLA4286421

Tesla Energy Operations, Inc. 5.45% 17-SEP-2030Yield to maturity

8.52%

Maturity date

Sep 17, 2030

TSLA4324758

Tesla Energy Operations, Inc. 4.7% 14-JAN-2026Yield to maturity

8.01%

Maturity date

Jan 14, 2026

TSLA4231716

Tesla Energy Operations, Inc. 5.45% 23-APR-2030Yield to maturity

7.89%

Maturity date

Apr 23, 2030

TSLA4250220

Tesla Energy Operations, Inc. 5.45% 29-MAY-2030Yield to maturity

7.67%

Maturity date

May 29, 2030

TSLA4313161

Tesla Energy Operations, Inc. 5.45% 03-DEC-2030Yield to maturity

7.43%

Maturity date

Dec 3, 2030

TSLA4222068

Tesla Energy Operations, Inc. 5.45% 19-MAR-2030Yield to maturity

7.39%

Maturity date

Mar 19, 2030

TSLA4265473

Tesla Energy Operations, Inc. 5.45% 16-JUL-2030Yield to maturity

7.00%

Maturity date

Jul 16, 2030

See all TSLA bonds

Curated watchlists where TSLA is featured.

Frequently Asked Questions

The current price of TSLA is 264.50 EUR — it has decreased by −3.27% in the past 24 hours. Watch TESLA INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange TESLA INC stocks are traded under the ticker TSLA.

TSLA stock has risen by 1.56% compared to the previous week, the month change is a 2.34% rise, over the last year TESLA INC has showed a 22.77% increase.

We've gathered analysts' opinions on TESLA INC future price: according to them, TSLA price has a max estimate of 437.98 EUR and a min estimate of 100.73 EUR. Watch TSLA chart and read a more detailed TESLA INC stock forecast: see what analysts think of TESLA INC and suggest that you do with its stocks.

TSLA reached its all-time high on Dec 18, 2024 with the price of 461.20 EUR, and its all-time low was 10.60 EUR and was reached on Jun 4, 2019. View more price dynamics on TSLA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TSLA stock is 5.34% volatile and has beta coefficient of 1.71. Track TESLA INC stock price on the chart and check out the list of the most volatile stocks — is TESLA INC there?

Today TESLA INC has the market capitalization of 855.04 B, it has increased by 4.27% over the last week.

Yes, you can track TESLA INC financials in yearly and quarterly reports right on TradingView.

TESLA INC is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

TSLA earnings for the last quarter are 0.34 EUR per share, whereas the estimation was 0.34 EUR resulting in a 0.70% surprise. The estimated earnings for the next quarter are 0.43 EUR per share. See more details about TESLA INC earnings.

TESLA INC revenue for the last quarter amounts to 19.10 B EUR, despite the estimated figure of 18.91 B EUR. In the next quarter, revenue is expected to reach 21.53 B EUR.

TSLA net income for the last quarter is 994.92 M EUR, while the quarter before that showed 378.06 M EUR of net income which accounts for 163.17% change. Track more TESLA INC financial stats to get the full picture.

No, TSLA doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 125.67 K employees. See our rating of the largest employees — is TESLA INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TESLA INC EBITDA is 9.76 B EUR, and current EBITDA margin is 13.44%. See more stats in TESLA INC financial statements.

Like other stocks, TSLA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TESLA INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So TESLA INC technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating TESLA INC stock shows the buy signal. See more of TESLA INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.