VFC trade ideas

$VFC on verge of massive Breakout Entry level $93.00 = Price Target $105 = Stop loss $90.00

On verge of multiyear breakout.

Ascending triangle closing in on apex.

Earnings approaching, may be stimulant.

Average analysts price target $100 | Overweight

Up 35% year to date.

Company profile

VF Corp. designs, produces, procures, markets and distributes lifestyle apparel, footwear and related products. It operates through the following segments: Outdoor, Active, Work and Jeans. The Outdoor segment refers to outdoor and activity-based lifestyle brands including performance-based apparel, footwear, equipment, backpacks, luggage and accessories. The Active segment is a group of activity-based lifestyle brands which offers active apparel, footwear and accessories. The Work segment consists of work and work-inspired lifestyle apparel and footwear and occupational apparel sold through direct-to-consumer, wholesale and business-to-business channels. The Jeans segment markets denim and related casual apparel products globally. The company was founded by John Barbey in October 1899 and headquartered in Greensboro, NC.

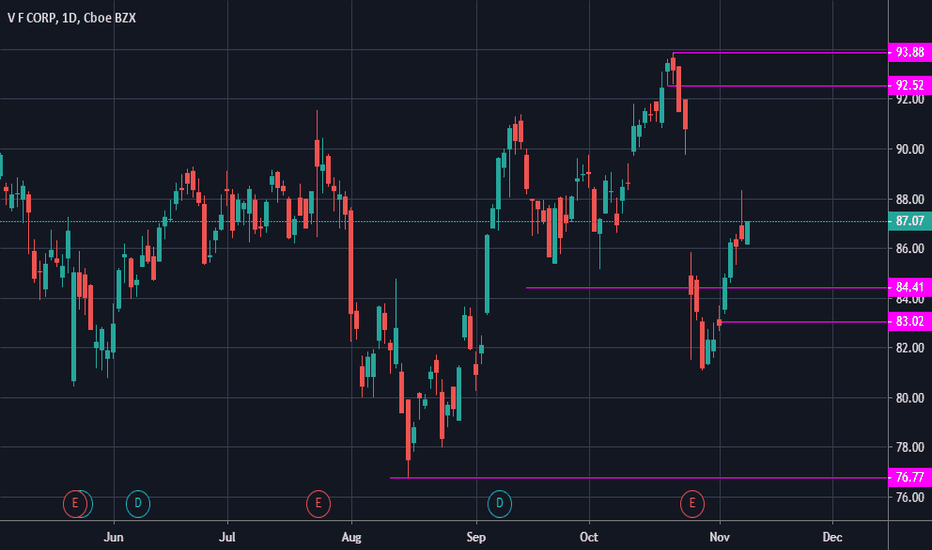

VF Corp back in buy zoneAfter the recent decline in VFC and indeed the mass majority of retail we believe that VFC is once again in the zone.

Strong brand appeal with the fashion hungry teenager has no signs of abating.

Technically the chart is quite bullish but will require some strong volume days to get past the strong resistance.

Alert set for break above $92 for possible entry

ANALYSTS PRICE TARGET $99.55

ANALYSTS RECOMMENDATION OVERWEIGHT

P/E RATIO 30

COMPANY PROFILE

VF Corp. designs, produces, procures, markets and distributes lifestyle apparel, footwear and related products. It operates through the following segments: Outdoor, Active, Work and Jeans. The Outdoor segment refers to outdoor and activity-based lifestyle brands including performance-based apparel, footwear, equipment, backpacks, luggage and accessories. The Active segment is a group of activity-based lifestyle brands which offers active apparel, footwear and accessories. The Work segment consists of work and work-inspired lifestyle apparel and footwear and occupational apparel sold through direct-to-consumer, wholesale and business-to-business channels. The Jeans segment markets denim and related casual apparel products globally. The company was founded by John Barbey in October 1899 and headquartered in Greensboro, NC.

$VFC return to trend lineNow I normally don't scout swings that extend this far out and prefer to stick into a 3-5 day range, however, the spur of the VFC split at least grabbed my attention enough to look at the chart and I noticed we were dealing with a double top on the weekly with a downward trend to the ~71-73$ area

Not really suggesting a huge plan of action here or get too much into the thick of it, but wanted to post the chart so I can see how it plays out into next earnings Jun 21

$VFC ***Kids are the key to continued growth*** Like most parents I usually say "no" but eventually give in for a easier life. Today that was one of those times, my child asked for a new pair of VANS for school, because that is what everyone wears, apparently. This sent the alarm bells going on Who makes Vans?. VF Corp is the answer and I have been astounded by the growth in this company. After quizzing my kids it has become apparent that every kid in their school wears van to school or after school, or both.I have now discovered that there is 3 (soon to be 4) pairs of vans in our household with 2 with kids, that is a powerful brand. My oldest daughter then shows me the variety of fashions and styles available, they have become somewhat of a collectors item for the fashion conscious teenagers. On my kids recommendations I suggest that VFC is a must have stock until this trend stops, we are long.

VFC offers an attractive r/r shortVFC - a low quality stock with earnings and revenues decreasing the last 3 years - currently offers a good risk/reward ratio short position.

Stoploss set right about previous high of $82, target set for $74.5 which is above an important resistance level of $72 and POC of $74.

"VFC": {

"info": {

"close ": 80.45,

"marketcap ($bil)": 32.08,

"name": "v.f. corporation",

"sector": "consumer non-durables",

"industry": "apparel",

"country": "united states"

},

"val": {

"peg_k": -1.23843739,

"fp2e_k": 23.25144509,

"p2e_k": 52.92763158,

"p2e": 52.58169935,

"p2bv": 8.65053763,

"p2sales": 2.74261596,

"p2fcf": 25.77163982,

"ev2ebitda": 20.93639381,

"ev2ebitda_k": 21.10270868

},

"val2_k": -4,

"val2_q": 0,

"qual2_k": 18,

"qual2_q": 15,

"qual3_k": 14

},

Rebound?VF Corporation, the long-standing parent company of some top name retail brands such as North Face, VANS, and Wrangler, lost 10.8% of its stock value on Friday. That being said here is the analysis and my thoughts:

Analysis: As the chart shows, a strong inverse head and shoulders pattern began to take shape around 31 Jan, with a completion of its pattern on the right shoulder around 12 Feb. With a very moderate volume increase the stock was on track for a breakout, remained semi-neutral throughout, and never reached it's 5 point expected climb. It fell short by approximately 2 points (Based on candle analysis). This remained the case until it sharply declined on the open Friday pushing it well below support levels.

Thoughts: If the theory holds true about the effect of the tax code change this sudden shift just pushed the stock back 2 months to previous support levels. However, with its long-standing reputation, I'm optimistic about a return on this stock after its full year and four quarter reports from last year. (For further detail visit: www.vfc.com)

What Next: I myself will place this on my watchlist for the coming week. Overall I believe, for myself, it will turn out as a solid medium to long-term investment.

Disclaimer: This analysis is solely meant for educational purposes, not financial advice. All trade considerations based on this chart are the sole responsibility of the individual.

$VFC #long #stock massive #bullflagThis one is going thru the roof! Wow is it a rare find to see a monthly bull flag like this. This one is going thru the roof. It will be joining my 2018 collection. You can scroll up and down the time frames. They all look good. I wish I could tell people there is more complexity to this stuff. Bull and Bear Flags are consistent winners.

VFC Gapping up after EarningsVFC Gapped up on Earnings. Inside Day candle, looking like a pennant pattern, Hourly shows a nice tweezer top - so would expect it to break bullish, although, if it pulls back, 67.20 is longstanding Resistance/Support, but more likely, will bounce off the 10 SMA at around 69.

Bullish entry - 70.52 (or higher depending on the next candle) x 69.00

Bearish - wait to see next day's close.

$VFC - VF Corporation - LongThesis:

Long VFC

The name has been trending higher across time frames and recently gapped higher on heavy volume and is heading towards all time highs.

Confirmations:

1. Higher highs on Day chart

2. Higher high on Week chart

3. Above 8 Day EMA

4. Above 21 Day EMA

5. Above 8 Week EMA

Contradictions:

1. The price is currently below resistance so this may be an obstacle to price moving higher and breaking out above all time highs.

Trade:

Long VFC

Related Trade:

None

Disclaimer: All charts are for informational purposes only and should not be considered recommendations to perform actions related to securities.