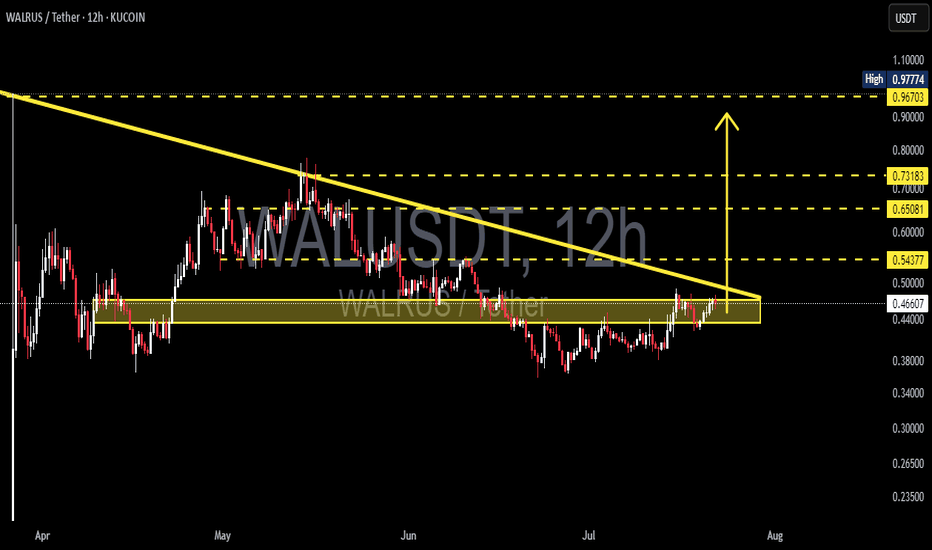

WAL/USDT – Major Breakout Unfolding! 70% Upside Potential?After weeks of compressed price action and relentless seller pressure, WAL is showing signs of a potential explosive move. Is this the breakout bulls have been waiting for?

🧩 Chart Pattern: Descending Triangle — With a Bullish Twist

Over the past 3 months, WAL has formed a descending triangle, typically known as a bearish continuation pattern.

But here’s the twist — WAL is breaking out upwards, signaling potential trend reversal instead.

The pattern shows higher lows meeting a horizontal resistance around $0.47–$0.48, a classic sign that buyers are gaining strength.

This setup suggests buyers are slowly overpowering the selling pressure, leading to a high-probability breakout scenario.

🟡 Strong Accumulation Zone: $0.42–$0.45

This range has consistently acted as a strong support base since mid-April.

Every dip into this zone has been met with strong buyback and increasing volume.

It likely represents a smart money accumulation zone before a larger markup phase.

🚀 Breakout Target: Where Could Price Go?

Measured move from the triangle's height projects a move of ~$0.25. From the breakout level at ~$0.48, this gives a technical target around $0.73.

🎯 Bullish Price Targets:

1. TP1: $0.543 — First breakout validation zone

2. TP2: $0.650 — Previous May resistance level

3. TP3: $0.731 — Measured move target from triangle

4. Extended Target: $0.967 – $0.977 — Prior liquidity and local high zone

With sustained volume, $1.00+ isn’t off the table.

---

🔻 Bearish Scenario:

If this breakout turns into a fakeout:

Price may revisit the support zone at $0.45–$0.42.

Breakdown below this zone opens risk toward:

🧨 $0.36 — Mid-range demand zone

Further breakdown could lead to $0.30–$0.28

Confirmation of a fakeout: A strong 12H close below the yellow box support with increasing sell volume.

🔍 Additional Bullish Confirmation Signals:

Volume should spike significantly above average to validate breakout.

RSI, MACD, or EMA crossover can help strengthen the bullish thesis if aligned.

✅ Summary

WAL/USDT is currently at a pivotal breakout moment. A confirmed move above the descending triangle could trigger a major trend reversal, with targets between $0.65 and $0.73 in sight. This setup could be one of the cleanest breakout opportunities on the charts right now.

#WALUSDT #CryptoBreakout #TechnicalAnalysis #BullishSetup #DescendingTriangle #AltcoinWatch

WALUSDT trade ideas

WALRUS 📈 WAL/USDT Mid-Term Outlook

Structure suggests a possible ABC corrective wave in progress.

▫️ (A) formed after bounce from key demand zone

▫️ (B) pullback is ongoing

▫️ (C) wave might target:

• $0.535

• $0.594

• $0.652

• Max extension: $0.95+

Invalidation / SL:

Break below $0.435 (daily close) would invalidate this scenario.

This is a mid-term outlook (2–6 weeks), assuming bullish momentum is sustained.

📌This is my personal view,not financial advice.

Always DYOR and manage risk.

NYSE:WAL

WALUSDT - Change in the trend and let's capture itWAL is currently showing a change in the trend, after a continous downtrend finally we are seeing change in the trend.

Price has held the support strongly and now we are seeing the reversal.

We have decent trade opportunity here.

Entry Price: 0.4319

StopLoss: 0.3500

TP1: 0.4828

TP2: 0.5292

TP3: 0.6374

TP4: 0.7817

Cheers

GreenCrypto

WAL - Walrus amazing out of box pattern!

As we seen a positive and bull steady upward market, many alts are coming up.

Wal is an great example, where we can see a broken box from a 0.6 level!

Volumes are sustain the up trend thus we are following the trend as the price confirm the upward side.

We dont have a target because we can follow the price till a possibile exhaustion pattern.

Let's see how it evolve!

Good trading!

Buy Trade Strategy for WAL: Fueling Web3 Gaming and Engagement

Description:

This trading idea is centered on WAL (Wall Street Memes Token or Wallet Arena Labs, depending on project context), a cryptocurrency designed to empower Web3 gaming ecosystems and decentralized social engagement. WAL integrates reward systems, NFT utilities, and user-driven governance, aiming to provide players and content creators with new avenues for monetization and community involvement. As the demand for blockchain-based games and interactive metaverse platforms grows, WAL positions itself at the intersection of entertainment and decentralized technology, offering potential long-term value through utility, engagement, and partnerships.

Nonetheless, it is important to consider the inherent volatility of the crypto market. External factors such as regulation, investor sentiment, and project execution risks can heavily influence the asset’s price action. As with all digital assets, prudent risk management is essential when engaging with WAL.

Disclaimer:

This trading idea is for educational purposes only and does not constitute financial advice. Investing or trading in cryptocurrencies like WAL involves significant risks, including the potential for total capital loss. Always perform thorough research, understand your financial situation, and consult a licensed financial advisor before making any investment decisions. Past performance is not indicative of future results.

WALUSDT 12H#WAL has formed a rising wedge pattern on the 12H timeframe — typically a bearish setup. However, given the current hype around the token, it could still continue its bullish trend after a correction toward $0.6144.

📈 In case of a breakout above the pattern, the targets are:

🎯 $0.8722

🎯 $1.0101

🎯 $1.1858

📉 In case of a breakdown below the pattern, the downside targets are:

🛡 $0.5166

🛡 $0.4561

🛡 $0.4072

⚠️ Use a tight stop-loss and wait for confirmation of either a breakout or breakdown before entering.

Chat analysis for WAL/USDTCurrent Price: $0.6162

EMA Levels:

EMA 20: 0.5855

EMA 50: 0.5762

EMA 100: 0.5504

EMA 200: 0.5133

➤ Price is currently above all EMAs, indicating short-to-mid-term bullish momentum.

RSI (14): 60.93

RSI is below the overbought zone (70), suggesting room for more upside before a potential pullback.

Key Support & Resistance Levels:

Immediate Resistance: Around $0.70

Next Strong Resistance: $0.90 – $1.00 (psychological level)

Immediate Support: $0.58 – aligns with EMA20/50

Major Support Zone: $0.50 – $0.52 (close to EMA100/200)

Potential Trading Insight (Not Financial Advice):

The price action shows a bullish structure with higher lows.

If it breaks and holds above $0.70, WAL could potentially rally toward $0.90 or higher.

Watch for a rejection at $0.70 — it could lead to a retest of the $0.58–$0.60 zone.

#WALUSDT continues its bearish momentum 📢 As long as the price stays under $0.6000 — short BYBIT:WALUSDT.P bias remains valid.

📢 Watch for further weakness!

📉 SHORT BYBIT:WALUSDT.P from $0.5794

🛡 Stop loss: $0.6000

🕒 Timeframe: 1H

✅ Overview:

➡️ The chart shows a clearly formed and broken Bearish Rectangle, confirming a short setup after price exited the range to the downside.

➡️ The $0.6090 support level has turned into strong resistance.

➡️ Entry at $0.5794 follows a textbook breakdown and retest structure.

➡️ Target area aligns with the volume-based support near POC $0.515, offering solid R:R.

🎯 TP Targets:

💎 TP 1: $0.5725

💎 TP 2: $0.5665

💎 TP 3: $0.5600

📢 Bearish structure confirmed with increased volume.

🚀 BYBIT:WALUSDT.P continues its bearish momentum — downside potential remains active!

Invalidated M pattern and a Tripple Bottom with W pa to finish. Invalidated M pattern and a Tripple Bottom with W pattern to finish.

Looks bullish to me,

144 million raised at 0.40 cents give or take in the bull with sui on a run I would say the likely hood for an impulse breakout of W is high because the price has already reached above the neckline for a 4th break to the downside, I would say the triple bottom is confirmed by ending in a double bottom.

CRYPTOCAP:SUI NYSE:WAL

TradeCityPro | WAL: Squeezing Tight Before the Breakout👋 Welcome to TradeCity Pro!

In this analysis, I want to review the WAL coin for you. This coin belongs to the Walrus project, which is part of the SUI ecosystem and falls under the DePIN and Storage categories.

⚡️ After its airdrop, this project’s token has managed to maintain its hype and, with a market cap of $589 million, is currently ranked 97th on CoinMarketCap. Since this token has just recently launched, the analysis will be done on the 4-hour time frame.

⏳ 4-Hour Time Frame

As you can see in the 4-hour time frame, after this token’s launch on March 27, the price has formed a low and a high at the 0.3899 and 0.5903 zones respectively. It is still trading between these two levels and has yet to start a clear trend.

✔️ Currently, a descending triangle has formed. The price is forming lower highs, while maintaining equal lows, and each time the price touches these lows, the probability of a breakdown from the triangle increases.

📉 So, for a short position, I suggest definitely having a position open if the 0.3899 zone breaks. You can open this position earlier by entering on a rejection from the descending trendline or the break of 0.4101, but keep in mind that these are not the main triggers—they're just early entries in anticipation of a breakdown, so you’ll have a position ready if the zone breaks.

🔼 For a long position, the first high formed was at 0.4362. The price is currently above this level, but the breakout candle isn’t very strong, and the price hasn’t confirmed stabilization above this level yet. Also, this zone is very close to the descending trendline, so it’s not logical to enter a long position while this trendline remains unbroken.

📈 Therefore, for a long, wait for the break of the descending trendline and a pullback to this dynamic level before entering. The next triggers for upward movement are the 0.5167 and 0.5903 zones.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

WAL/USDT Long SignalLIMIT ORDER - #WAL/USDT

Direction: #Long 🟢

Entry Price: 0.4393

Stop Loss: 0.38132

Target 1: 0.48490

Target 2: 0.53050

Target 3: 0.57611

Target 4: 0.62171

Target 5: 0.66731

1. Technical Setup & Entry Logic

Entry at 0.4393: The price is approaching a key support/resistance flip zone, indicating a potential reversal or continuation of an uptrend.

Stop Loss at 0.38132 (~13.2% risk): Placed below a recent swing low or a critical support level to avoid premature stop-outs while maintaining a favorable risk-reward ratio.

Targets Set with Measured Moves:

T1 (0.48490): Near a previous resistance level (10.4% profit).

T2 (0.53050): Next liquidity zone (20.8% profit).

T3-T5 (0.57611 - 0.66731): Extended Fibonacci extensions or swing high projections (31.1% - 51.9% profit).

2. Risk-Reward Ratio (RRR) & Position Sizing

1:1 RRR at T1, 1:2 at T2, scaling up to 1:4+ at T5.

Conservative traders can take partial profits at T1/T2, while letting the rest run.

3. Market Structure & Trend Confirmation

Higher timeframe (HTF) trend is bullish (e.g., EMA 50 > 200, or price above key moving averages).

Break of a recent swing high or consolidation suggests accumulation before continuation.

4. Liquidity & Order Flow Analysis

Stop loss placed below a liquidity pool (mitigating stop hunts).

Targets align with untapped liquidity zones where take-profit orders may cluster.

5. Volatility & Volume Considerations

USDT pairs often have stable liquidity, reducing slippage risk.

Rising volume on upward moves supports bullish momentum.

Final Verdict:

This trade offers a high-probability entry with clearly defined risk management and a scalable profit-taking strategy. The structured approach ensures flexibility—whether the market delivers a quick 10% gain or extends into a 50%+ runner.

Execution Tip: Monitor Bitcoin’s movement (as it affects altcoins) and adjust if macro conditions shift.