US100The US100 (Nasdaq 100) has shown a dramatic shift in trend, forming what appears to be a large-scale bearish harmonic pattern or potential M-top structure. After reaching its peak in mid-2025, the index has entered a sharp downward trajectory, shedding significant value in a short span.

This chart raises a critical question for long-term investors and traders:

Are we witnessing the early phase of a prolonged bear market that could stretch into 2026 and beyond?

🔻 Key Observations:

Bearish structure developing with aggressive selling pressure.

Potential breakdown from long-term support trendlines.

Momentum suggests institutional risk-off behavior.

Stay alert for macroeconomic cues, interest rate policy, and earnings season signals. A break below 13,000 could confirm a deeper bear cycle

USTECH100CFD trade ideas

Nasdaq 100 Analysis: Index Rebounds After Friday’s DeclineNasdaq 100 Analysis: Index Rebounds After Friday’s Decline

The release of disappointing US labour market data on Friday unsettled both stock market participants and the President of the United States:

→ Donald Trump promptly dismissed Erica McEntarfer, Commissioner of the Bureau of Labor Statistics, accusing her of falsifying employment data.

→ Stock indices accelerated their decline, with the Nasdaq 100 Index falling below its 16 June low.

However, US stock indices staged a strong recovery on Monday. According to Reuters, yesterday marked the largest daily percentage gain since 27 May.

Why Did Stock Indices Rise?

Possible reasons include:

→ Buyers were attracted by the falling share prices of companies that, for the most part, had delivered strong quarterly earnings;

→ Market participants are betting on a potential rate cut by the Federal Reserve in September (a move strongly advocated by Trump), which could support both the economy and the stock market.

Technical Analysis of the Nasdaq 100 Chart

In our earlier analysis of the Nasdaq 100 Index, we:

→ Identified a primary ascending channel (marked in blue);

→ Highlighted that the price had risen above the upper boundary of the channel (a sign of excessive optimism);

→ Anticipated a potential correction towards the 23,020 level.

However, the correction turned out to be more substantial than initially expected.

As a result of the price movements on Friday and Monday:

→ The blue channel was widened twofold;

→ The price found support at its new lower boundary and reversed upwards;

→ As of today, the Nasdaq 100 index is trading near the median line.

This can be interpreted as the market aggressively digesting recent corporate earnings reports and the prospects of a rate cut in light of a deteriorating labour market. Demand and supply may reach a new equilibrium, potentially leading to a consolidation phase around the median of the widened channel.

It is also possible that the area marked in orange—where the price previously rallied strongly, indicating a buyer-driven imbalance—may now act as support. Resistance levels might include:

→ Former support at 23,320;

→ 23,440 – the level at which bears broke through the purple channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Double Trap on USTEC: Sell Zones Locked In!Hey Guys,

I’ve prepared a NASDAQ 100 / USTEC 100 analysis for you. I’m planning to open sell positions from two key levels:

🔹 First entry: 23,290 or 23,164

🔹 Second entry: 23,397 – 23,450

🎯 Target levels:

TP1: 22,800

TP2: 22,666

Every single like from you is my biggest source of motivation to keep sharing these analyses. Huge thanks to everyone who supports with a like! 🙏

Nasdaq and S&P500 short: Update on wave counts and trade setupOver here, I update on the wave counts and explain why I think Nasdaq and S&P500 is once again, short opportunities. If you had try out my previous idea on 5th Aug, the maximum profit would be around 250 points on Nasdaq before the price reversed and went higher.

As traders, we are not so much concerned with being right but more on risk-reward and active trade and risk management. So I hope you would have taken your profit on that idea. The general macro and fundamental outlook remains the same as per previous video, which is why my recent ideas had been short ideas. In the near future, I foresee more short ideas too.

Anyway, I believe that the risk-reward is good this time for another short for Nasdaq and S&P500. Good luck!

NAS100: Bullish Reversal from Key Support ZoneFirstly, our Algo-based indicators are used to create this analysis:

This 1-hour chart for NAS100 highlights a strong bullish reversal from a critical support level, suggesting a potential move back towards recent highs.

Analysis:

Support Bounce: The index experienced a sharp sell-off but found significant buying pressure within a key support zone marked between 22,677 and 22,829. This area, labeled "LSQB" (Liquidity Sweep Order Block) and including the "Daily Open," acted as a strong floor, triggering a V-shaped recovery.

Momentum Shift: The oscillator at the bottom of the chart confirms this shift in momentum. After dipping into the oversold "BUY" zone, the indicator has sharply reversed and is trending upwards with conviction, as indicated by the projected black arrow. This suggests that buyers have taken control in the short term.

Moving Averages: The price has decisively reclaimed the EMA 200 (the main green line), a key indicator often used to gauge the longer-term trend on a given timeframe. Holding above this level is a strong bullish sign.

Price Projection: The drawn black line illustrates the expected price path—a continued rally from the current level back towards the red resistance zone near the recent high of approximately 23,700.

Strategy:

Position: Long (Buy)

Entry: The bounce from the support zone has already been confirmed. Current levels could be seen as an entry, or traders might look for a minor pullback that holds above the EMA 200.

Target: The primary target is the red resistance zone around the 23,700 level.

Conclusion:

With the price reacting strongly to a key liquidity zone and momentum indicators confirming a bullish reversal, the path of least resistance for NAS100 appears to be upwards. The immediate target for this recovery is the recent high near 23,700.

Disclaimer: This analysis is for educational purposes only and should not be considered financial advice. Always conduct your own research and manage risk appropriately.

Behold the grand NAS100 short expeditionBehold the grand NAS100 short expedition, unleashed by my top-secret pyramidal formula (concealed in golden tombs and guarded by laser-eyed sphinxes):

Pharaoh’s Pivot Points

– We superimpose recent NAS100 peaks onto the Great Pyramid’s four secret chambers. When price breaches the “Upper Antechamber Zone” near 23,300, the ibis-headed guardian squawks—our signal to draw the short sword.

Oracular Sphinx Sentiment

– We feed Fed minutes hieroglyphs and mega-cap earnings scrolls into the Sphinx’s riddle engine. If the answer murmurs “overheating” or “tech fatigue,” it confirms our bearish quest.

Ra’s Wall-Street Candle Filter

– Only candles closing between 09:30–16:00 ET count as true “New York sun-blessed bars.” Any rogue moves in the witching hour? Mirage dust—ignored.

Anubis’ Volume Veil

– Volume spikes are weighed in pharaoh-ounces of pure gold. When daily turnover eclipses 30,000 pharaoh-ounces, the Underworld Flush ritual begins—time to tighten our longs… er, shorts.

Tomb-Run Trend Confirmation

– Trendlines aren’t drawn from ordinary swing highs; we connect the three sacred glyph-points carved into the sarcophagus walls. Once that “Tomb-Run Downtrend” appears, we descend into the dark.

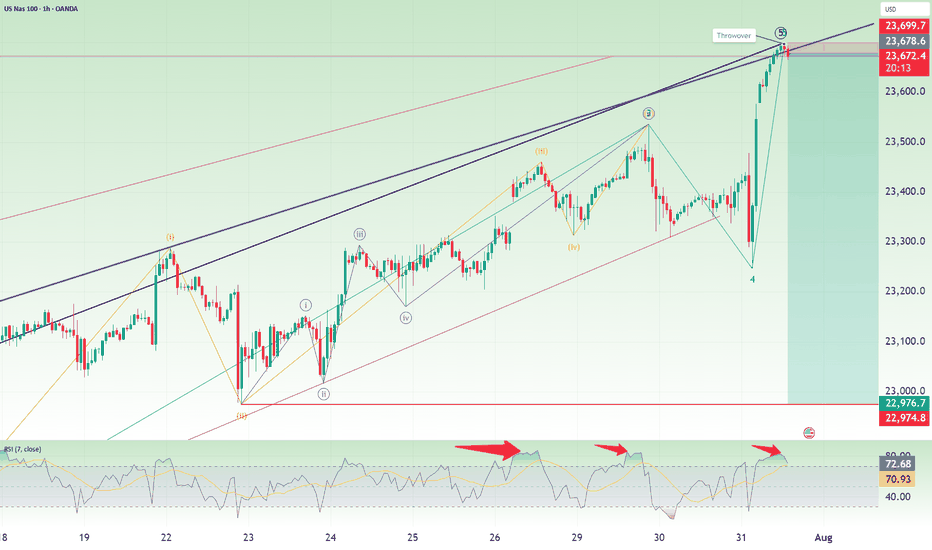

Nasdaq Short: multiple reasonsOver here, I present to you the Nasdaq short idea again. For my previous idea, it was stopped out at 23500. This time, I changed the wave counts again, mainly merging the previous wave 5 into wave 3, allowing for the new high to be a wave 5.

On top of that, here are the few other reasons for the short:

1. Fibonacci extension levels: Wave 5 is slightly more than Wave 1.

2. RSI overbought for the 3rd time on the hourly timeframe.

3. Rising wedge false breakout.

4. Head-and-shoulders on the 1-min timeframe.

As usual, the stop for this idea is slightly above the recent high, around 23700.

Thank you.

Nasdaq US100 Wave 3 Expansion Toward 31,606 in PlayNasdaq US100 has completed a significant wave cycle with a confirmed wave 1 in the broader Elliott Wave structure. Following this, price underwent a corrective wave 2 that extended from the $22,237 supply zone down to $16,334, marking the conclusion of the previous cycle’s correction. This structure now signals the initiation of a fresh upward impulse, setting the stage for a powerful wave 3 advance.

The emergence of wave 3 will gain full confirmation once price successfully breaks above the external supply zone, reclaiming $22,237. If this breakout occurs with sustained momentum, the wave 3 projection targets an expansion toward $31,606, which aligns with the 161.8% Fibonacci extension from the prior cycle. This forthcoming rally is anticipated to unfold in a five-subwave format, indicative of a high-momentum bullish leg.

As long as price action remains above the key support at $16,334, the bullish cycle remains valid. All eyes should now be on the breakout structure and volume profile around $22,237, as it represents the gateway to a much broader impulsive move.

NDX – Double Top & Divergence (H4, D FRL Setup)Hello friends! It's time for our beloved Nasdaq index to cool down. I expect a correction amid the strengthening of the dollar.

H4: clear Double Top forming near 23,000.

Daily: bearish MACD divergence confirms momentum shift.

📐 FRL (H4): neckline at 23,000, perfectly aligned with 100 SMA on H4.

🎯 Target: 0.618 Fib retracement at 20,500 – confluence with 100 & 200 SMA on Daily and strong horizontal support.

Nasdaq| Bullish Intent Maintained| Refined OB Reaction In Motion(Refined & Structured):

• Pair: Nasdaq (US100)

• Bias: Bullish / Buy

• 4H Overview: Bullish structure remains intact. Despite the congestion and noise, price maintained its upward trajectory. I refined the drop to mid timeframes for precision and clarity.

• 30M Structure: Refined bullish structure with clear intent. Price has mitigated a clean OB, setting the stage for further continuation.

• Entry Zone: Watching lower timeframes for confirmation to ride the wave higher.

• Targets: 5M to 30M structural highs depending on how price delivers.

• Mindset Note: Noise is just noise until structure filters it out. Precision comes from refining—this setup proves that. Stay focused, stay clean, let intent guide you.

US100The US100, also known as the Nasdaq 100 Index, tracks the performance of the 100 largest non-financial companies listed on the Nasdaq Stock Exchange, primarily in the technology, consumer services, and healthcare sectors. It is a market-capitalization-weighted index and includes major corporations such as Apple, Microsoft, Amazon, NVIDIA, Meta, and Alphabet. As a tech-heavy index, the US100 is highly sensitive to changes in interest rates, innovation cycles, investor sentiment, and macroeconomic indicators, especially those related to inflation, employment, and monetary policy.

Over the past two decades, the Nasdaq 100 has experienced strong long-term growth, driven by the expansion of the digital economy, cloud computing, artificial intelligence, and e-commerce. After a steep correction in 2022 caused by inflation concerns and aggressive rate hikes by the Federal Reserve, the index rebounded in 2023 and 2024, supported by improving macroeconomic conditions, a stabilization in interest rates, and renewed investor confidence in tech and growth stocks. AI-driven investments, semiconductor breakthroughs, and tech-led productivity gains have further fueled its momentum.

As of August 2025, the US100 is trading at 22,747, marking a new historical high. This reflects strong earnings performance from major tech companies, continued innovation in AI and automation, and a more dovish outlook from the Federal Reserve, which has helped reduce pressure on growth equities. Despite its gains, the index remains vulnerable to volatility stemming from inflation surprises, geopolitical risks, and shifts in central bank policy. The Nasdaq 100 continues to be a key benchmark for growth-oriented investors and a barometer for the health of the global tech sector.

Is the NASDAQ Vault Open for a Full Bullish Heist?🧠 NASDAQ Heist Masterplan: Thieves Eye on 24,500 🎯💰

🚨 Asset: NASDAQ100 / US100 / NDX

📊 Plan: Bullish | 🔁 Layering Strategy

🎯 Target: 24,500

🛑 Stop Loss: 22,600

📍 Entry: Any level – the vault’s wide open!

💼 Thief Trader's NASDAQ High-Stakes Robbery Is LIVE! 🤑📈

Welcome, money bandits & market looters! 💼💰

The time has come to launch a full-scale bullish raid on the NASDAQ fortress. We’re not just taking entries — we’re stacking them like a pro with our layered limit order strategy across swing zones. 🔫📉➡️📈

🔓 Entry:

Pick any price! We break in anytime, anywhere.

🔁 Stack your buy limits on 15m–30m swing lows.

🔔 Set your alerts – don’t let the opportunity slip.

🛑 Stop Loss:

Guard your loot at 22,600.

Risk management is the bulletproof vest in this raid. 🎯

Adjust your SL based on lot size and order volume. 📏🔐

🎯 Profit Target:

Thieves retreat at 24,500.

But hey – smart robbers use trailing SL to squeeze every last drop of gold! 🏆💸

💡 Scalpers & Swingers:

Stick to the long side only.

If your pockets are deep – full-send mode ON.

If not, tag along with swing entries. Patience pays big! 💎⏳

📢 Heads Up, Heist Crew:

News drops = landmines. Step carefully.

🚷 No new entries during major announcements.

🛡️ Use trailing SL to defend your profit bags.

🚨 Daily Reminder:

This market isn’t a playground. It’s a battlefield.

Use COT data, macro reports, sentiment scans, and index-specific triggers to fortify your robbery blueprint. Stay smart, stay updated! 📊🧠

💥 Boost Our Loot Crew 💥

Hit that LIKE ❤️ to support the Thief Army!

Stronger visibility = Bigger Loots = More Victory Runs.

See you at the next robbery – we move in silence, but the market hears us loud! 🐱👤💸🔥🚀

USNAS100Preferably suitable for scalping and accurate as long as you watch carefully the price action with the drawn areas.

With your likes and comments, you give me enough energy to provide the best analysis on an ongoing basis.

And if you needed any analysis that was not on the page, you can ask me with a comment or a personal message.

Enjoy Trading ;)